Global Goat Polyclonal Antibody Market By Product(Primary, Secondary), By Source(Rabbits, Goats, Sheep, Others), By Application(Research, Diagnostics, Therapy), By End-User(Academic & Research Center, Pharmaceutical & Biotechnology Companies, Diagnostic Centers, Hospitals), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

45684

-

May 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

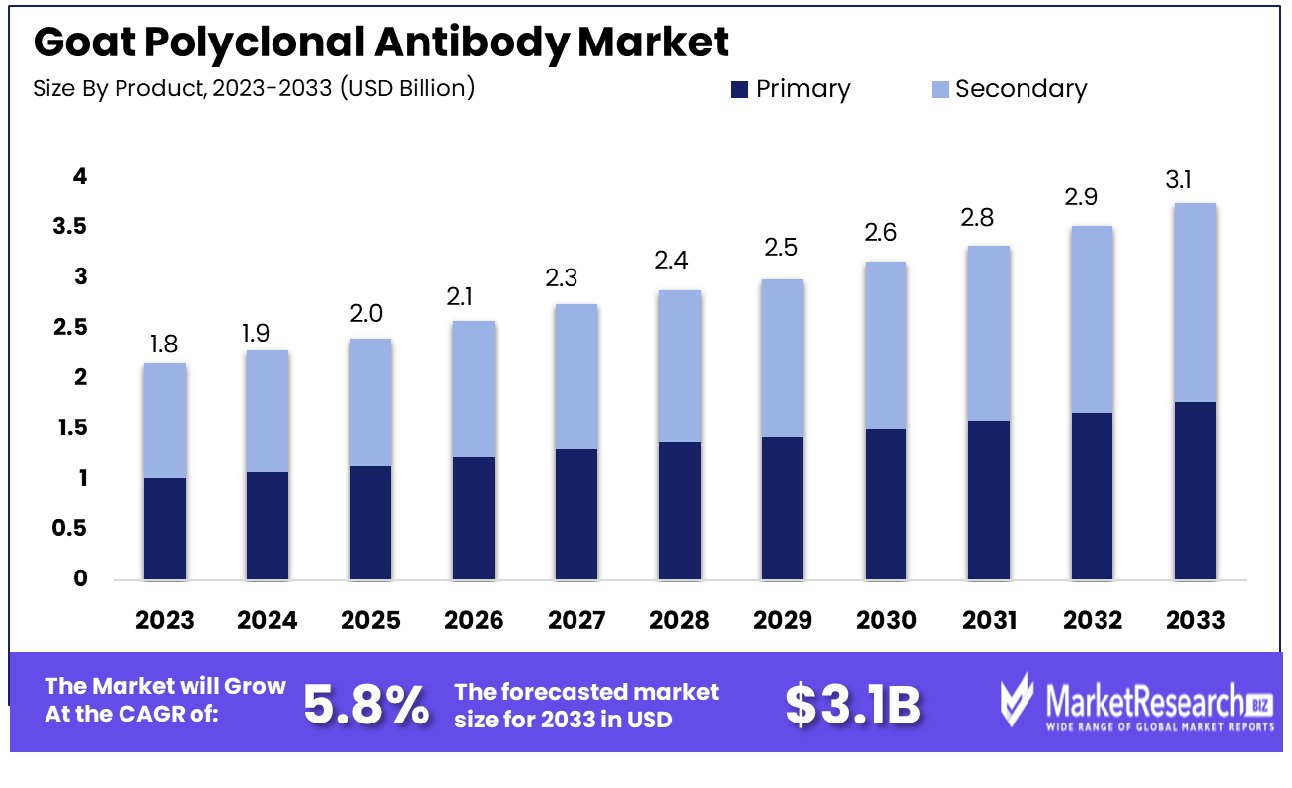

The Global Goat Polyclonal Antibody Market was valued at USD 1.8 billion in 2023. It is expected to reach USD 3.1 billion by 2033, with a CAGR of 5.8% during the forecast period from 2024 to 2033.

The Goat Polyclonal Antibody Market refers to a specialized segment within the biotechnology industry focused on producing and distributing polyclonal antibodies derived from goat immune systems. These antibodies are essential for various applications, including diagnostic assays, research tools, and therapeutic agents. The market's significance stems from goat-derived antibodies' unique advantages, such as high sensitivity and specificity, which are crucial for effective biomarker detection and disease diagnosis.

This sector is witnessing growth driven by advancements in immunological research and an increasing demand for precise diagnostic techniques, making it a critical area for investment and development for companies aiming to lead in biotechnological innovations.

The Goat Polyclonal Antibody Market is poised for nuanced growth, driven by a complex interplay of factors influencing demand and usage in both research and clinical settings. As the market adapts to evolving scientific needs, a noteworthy trend is the geographical variation in the seroprevalence of antibodies against Coxiella burnetii, an essential pathogen in veterinary and zoonotic contexts.

Recent studies indicate a seroprevalence of 16.05% in suburban Algerian goat herds compared to 7.33% in rural areas, highlighting distinct market dynamics that could influence the demand for diagnostic and research antibodies in these regions. Additionally, isolated findings, such as a 3.85% strong positivity rate for C. burnetii antibodies in goats from the El-Taref province, further underscore the potential for targeted regional market strategies.

The entry of Beyotime Biotechnology’s HRP-labeled Goat Anti-Rabbit IgG(H+L) antibody into the top 100 most cited research antibodies in 2022 exemplifies the competitive landscape and the opportunity for innovation in the sector. This milestone reflects the increasing relevance of goat polyclonal antibodies in high-impact scientific research, underpinning their market significance.

Collectively, these data points underscore the critical role of geographic and research-driven demand and suggest that suppliers and manufacturers must consider local epidemiological data and scientific usage trends to strategically position their offerings. Strategic investments in research and development, aligned with regional health data and evolving scientific requirements, will be crucial for stakeholders aiming to capitalize on growth opportunities within this specialized market.

Key Takeaways

- Market Growth: The Global Goat Polyclonal Antibody Market was valued at USD 1.8 billion in 2023. It is expected to reach USD 3.1 billion by 2033, with a CAGR of 5.8% during the forecast period from 2024 to 2033.

- By Product: Secondary products dominate market share, indicating broad-based utility.

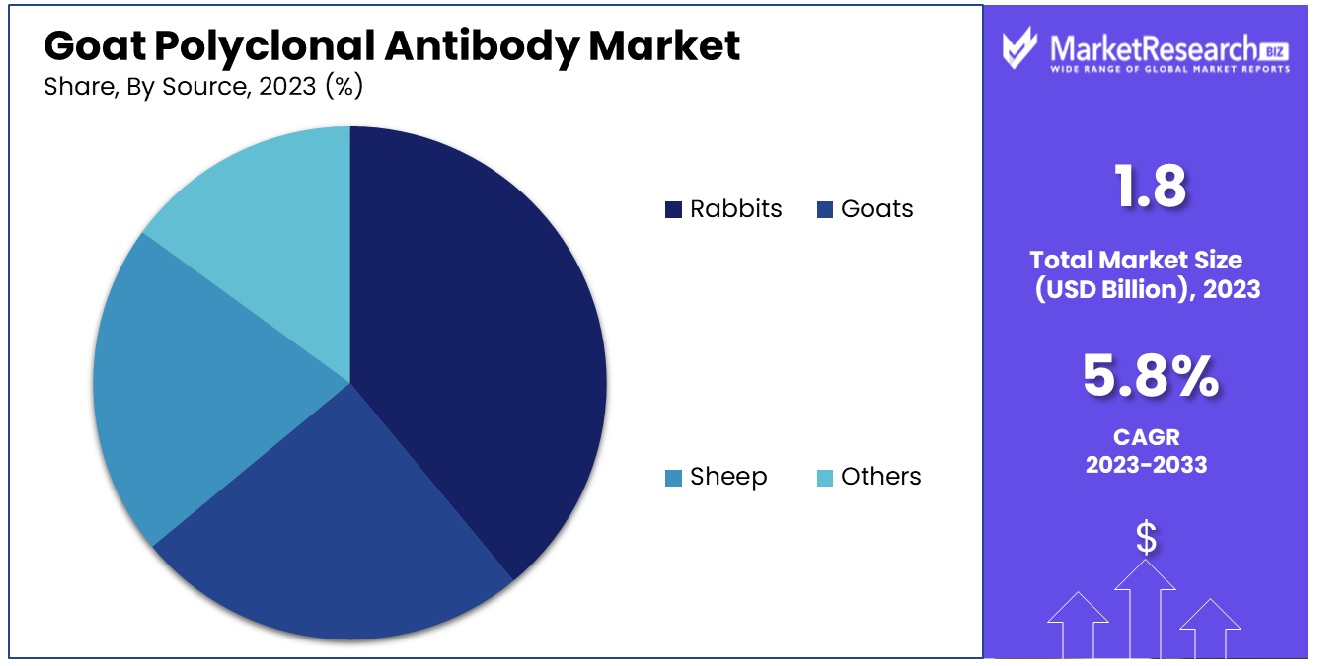

- By Source: Rabbit-sourced products lead, reflecting niche demands and specialty uses.

- By Application: Diagnostics applications dominate, driving innovations in accurate disease detection.

- By End-User: Pharmaceutical and biotechnology companies are major end-users, fueling market growth.

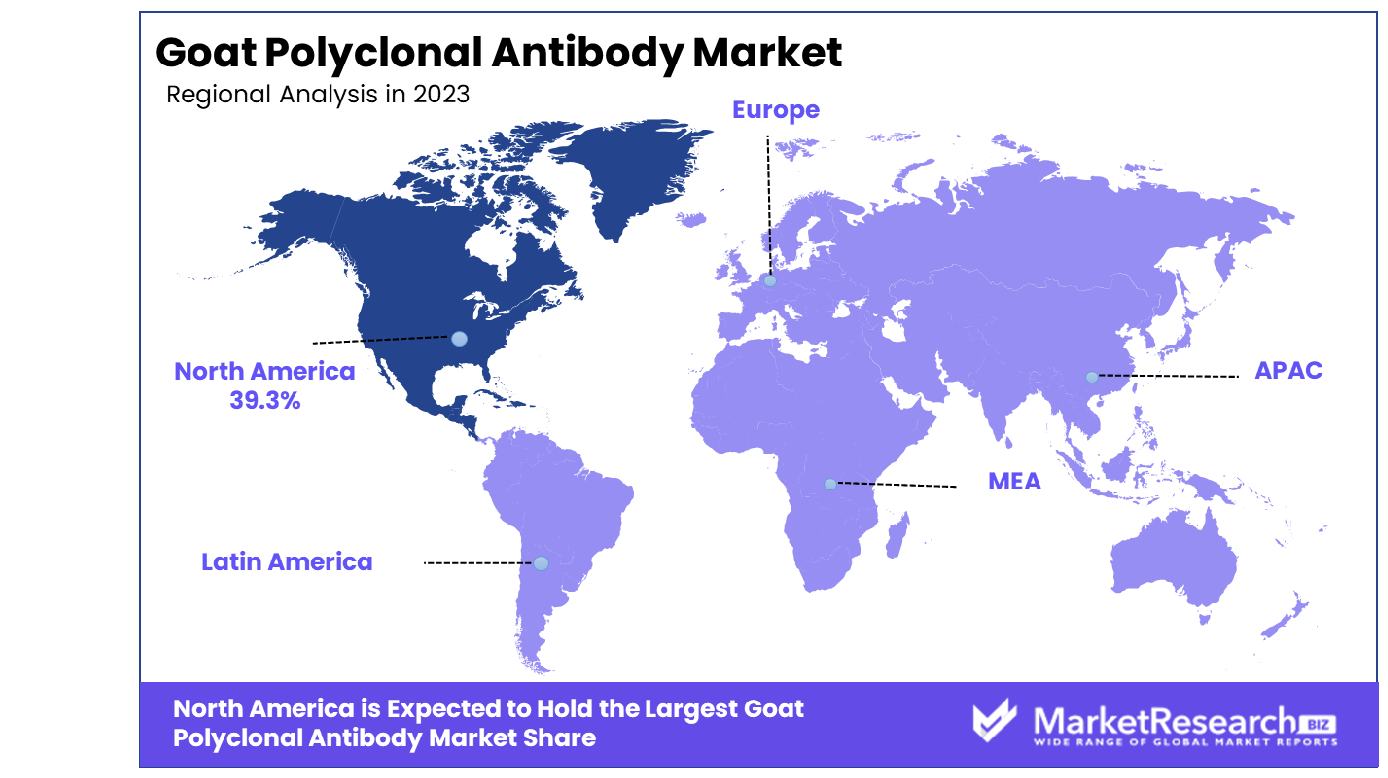

- Regional Dominance: North America holds a 39.3% share of the global goat polyclonal antibody market.

- Growth Opportunity: The global goat polyclonal antibody market is growing due to rising demand for high-sensitivity reagents and strategic mergers that enhance production efficiencies and innovation in antibody development.

Driving factors

Increasing Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases is a primary driver of growth in the Goat Polyclonal Antibody Market. Chronic diseases often require specific biomarkers for their detection and monitoring, which are frequently targeted using polyclonal antibodies due to their high sensitivity and specificity. As the global burden of chronic conditions such as cancer, diabetes, and autoimmune diseases rises, the demand for precise diagnostic and therapeutic tools also increases.

This uptick in chronic disease prevalence necessitates enhanced research into biomarkers and therapeutic targets, directly influencing the demand for goat polyclonal antibodies. The enhanced need for these antibodies in diagnostic assays and therapeutic applications contributes significantly to market expansion.

Rising Demand for Targeted Therapy

Targeted therapy represents a shift towards more personalized medicine, where treatments are specifically designed to interact with unique biomarkers associated with certain diseases. Goat polyclonal antibodies are integral to this approach due to their ability to bind to specific antigens, which can be exploited to deliver therapeutic agents directly to diseased cells.

This capability not only improves the efficacy of treatments but also minimizes side effects associated with broader-spectrum therapies. As healthcare moves increasingly towards targeted therapies, the demand for highly specific polyclonal antibodies is expected to rise, thereby driving market growth.

Growing Research and Development Activities

The expansion in research and development activities within the biotechnology and pharmaceutical sectors fuels the growth of the Goat Polyclonal Antibody Market. Increased funding and investment in R&D are pivotal, as they enhance the development of new antibodies and their applications in various fields such as infectious diseases, oncology, and immunology.

Additionally, academic and commercial research institutions are focusing on developing novel polyclonal antibodies that can provide more accurate results in both diagnostic and therapeutic applications. This surge in R&D efforts not only broadens the application range of goat polyclonal antibodies but also ensures continuous improvements in their quality and efficacy, further propelling the market's growth.

Restraining Factors

High Cost of Polyclonal Antibodies

The high cost of polyclonal antibody production is a significant restraining factor in the Goat Polyclonal Antibody Market. The process of generating these antibodies, involving the immunization of goats and subsequent purification of antibodies, is both time-intensive and resource-heavy. This results in higher production costs, which are often passed down to the end-users in the healthcare and research sectors.

High costs can limit accessibility and affordability for academic institutions and smaller research entities, potentially reducing market penetration and growth. The financial burden associated with these antibodies can deter widespread adoption, particularly in cost-sensitive markets, thereby impeding the overall expansion of the market.

Stringent Regulations

Stringent regulations surrounding the production and use of polyclonal antibodies also pose challenges to market growth. Regulatory frameworks designed to ensure the safety and efficacy of biologics, including polyclonal antibodies, often require extensive documentation, rigorous testing, and compliance with ethical standards, particularly those concerning animal welfare. These regulations can delay the entry of new products into the market and increase the cost and complexity of antibody production.

While these measures are crucial for maintaining high standards, they can also act as a barrier to innovation and slow down the research and development process, thereby restraining the market’s potential for growth. Together, the high costs and stringent regulations create a challenging environment for the expansion of the Goat Polyclonal Antibody Market, necessitating strategies to mitigate these effects and sustain market development.

By Product Analysis

The secondary antibodies segment overwhelmingly leads the market in terms of product dominance.

In 2023, Secondary held a dominant market position in the by-product segment of the Goat Polyclonal Antibody Market. The segment's prominence can be attributed to its crucial role in various diagnostic and research applications. Secondary antibodies are engineered to bind with the primary antibodies, thereby amplifying signal detection and enhancing the sensitivity of immunoassays. This feature is especially vital in the fields of proteomics and targeted therapy research, where accurate detection and quantification of antigens are paramount.

The growth of the market is driven by the increasing demand for personalized medicine and the rising prevalence of chronic diseases, which necessitate advanced diagnostic techniques. Moreover, the expansion of biotechnological and pharmaceutical industries globally has led to a surge in research activities, further bolstering the demand for secondary goat polyclonal antibodies. These antibodies are favored for their cross-reactivity with multiple species and ability to bind to different subclasses of primary antibodies, making them versatile tools in both clinical and laboratory settings.

Investments in healthcare infrastructure, coupled with advancements in antibody engineering and production techniques, are expected to sustain the growth of this segment. Furthermore, the development of more specific and high-affinity antibodies is likely to open new avenues for the application of secondary goat polyclonal antibodies, thereby supporting market expansion.

However, the market faces challenges such as the high cost of production and stringent regulatory requirements for antibody validation. To navigate these challenges, companies in the sector are focusing on strategic collaborations and technological innovations to enhance the efficacy and cost-effectiveness of their offerings. As a result, the secondary goat polyclonal antibody segment is poised for sustained growth, driven by continuous advancements and increasing applications in biomedical research.

By Source Analysis

Rabbit-derived antibodies are the predominant source, commanding a major share of the market.

In 2023, Rabbits held a dominant market position in the By Source segment of the Goat Polyclonal Antibody Market. This leadership is primarily due to the superior immune response of rabbits, which typically generate antibodies with higher affinity and specificity compared to those produced by other sources such as goats, sheep, or other animals. Rabbits are particularly effective in producing antibodies against small or poorly immunogenic antigens, making them highly valuable in complex immunoassays and diagnostic applications.

The robust growth in this segment is propelled by the expanding scope of immunology research and the increasing use of polyclonal antibodies in therapeutic applications. The pharmaceutical and biotechnological sectors are intensifying their reliance on high-quality antibodies for drug discovery processes and disease pathogenesis studies, thereby driving demand for rabbit-sourced polyclonal antibodies.

Additionally, advancements in genetic engineering and animal husbandry have improved the efficiency and output of antibody production in rabbits, further cementing their position as the preferred source in the polyclonal antibody market. These advancements not only enhance the quality of antibodies but also address ethical concerns by reducing the number of animals required for production.

Despite facing competition from other sources, the segment is anticipated to maintain its lead due to continuous innovations in antibody production technologies and the growing need for highly specific antibodies in research. Companies in the market are increasingly investing in R&D to develop novel antibodies that can provide more precise and reproducible results, ensuring the ongoing dominance of rabbits in the polyclonal antibody market.

By Application Analysis

In the application category, diagnostics emerge as the most dominant segment in utilization.

In 2023, Diagnostics held a dominant market position in the By Application segment of the Goat Polyclonal Antibody Market. The prominence of diagnostics can be attributed to the escalating global demand for precise and rapid diagnostic tests across various medical fields, including infectious diseases, oncology, and autoimmune disorders. Goat polyclonal antibodies are integral to these tests due to their ability to bind specifically to antigens, enabling accurate disease identification and monitoring.

The expansion of the diagnostics segment is further supported by technological advancements in immunoassay platforms and the growing accessibility of diagnostic services in emerging markets. These developments enhance the sensitivity and throughput of diagnostic tests, making goat polyclonal antibodies more appealing for clinical applications. The ongoing COVID-19 pandemic has also underscored the critical role of effective diagnostic tools in managing public health, thus driving significant investments into this area.

Moreover, regulatory approvals for new diagnostic methodologies involving polyclonal antibodies are facilitating their adoption in clinical settings, thereby fostering segment growth. The increasing prevalence of chronic conditions, which require continuous monitoring, contributes to the sustained demand for diagnostic solutions equipped with these antibodies.

Despite the strong position of diagnostics, the research and therapy segments also continue to evolve. However, the direct impact on patient care and the immediate need for accurate diagnostics sustain the leading status of this segment. Companies within the goat polyclonal antibody market are expected to continue innovating and improving their diagnostic products to meet the rising global health challenges, ensuring robust growth in this segment.

By End-User Analysis

Pharmaceutical and biotechnology companies are the leading end-users, heavily influencing market dynamics.

In 2023, Pharmaceutical & Biotechnology Companies held a dominant market position in the By End-User segment of the Goat Polyclonal Antibody Market. This segment's leadership is primarily driven by the intensive use of polyclonal antibodies in drug discovery and development processes, therapeutic protein validation, and preclinical research. The unique ability of goat polyclonal antibodies to recognize multiple epitopes on an antigen makes them invaluable in these applications, where high specificity and binding affinity are crucial.

The pharmaceutical and biotechnology industries are increasingly relying on advanced diagnostic tools and biological therapeutics, which require the use of diverse antibodies. The growth in personalized medicine and targeted therapy approaches has further amplified the demand for these antibodies. As a result, companies are investing significantly in R&D activities that incorporate goat polyclonal antibodies to expedite the development of novel drugs and improve the efficacy and safety of existing therapies.

Moreover, the expansion of this segment is supported by the ongoing advancements in genetic engineering and antibody production technologies. These advancements enhance the scalability and cost-effectiveness of producing polyclonal antibodies, making them more accessible for large-scale applications.

While pharmaceutical and biotechnology companies continue to dominate, other end-users such as academic & research centers, diagnostic centers, and hospitals also contribute to the market dynamics by adopting these antibodies for basic research and clinical diagnostics. However, the high stakes involved in drug development and the stringent regulatory requirements for therapeutic approval keep pharmaceutical and biotechnology companies at the forefront of the goat polyclonal antibody market.

Key Market Segments

By Product

- Primary

- Secondary

By Source

- Rabbits

- Goats

- Sheep

- Others

By Application

- Research

- Diagnostics

- Therapy

By End-User

- Academic & Research Center

- Pharmaceutical & Biotechnology Companies

- Diagnostic Centers

- Hospitals

Growth Opportunity

Increased Demand for High-Sensitivity Reagents

The global goat polyclonal antibody market has experienced significant growth due to the escalating demand for high-sensitivity reagents in various diagnostic and therapeutic applications. Goat polyclonal antibodies are increasingly preferred in research and clinical settings owing to their high specificity and sensitivity, which are essential for detecting low-abundance targets in complex biological samples.

This demand is driven by the expanding fields of proteomics and molecular diagnostics, where precise antigen detection is critical. Furthermore, the versatility of these antibodies in different immunoassay formats, including ELISA, western blot, and immunohistochemistry, underlines their growing utility. Consequently, the surge in demand for high-sensitivity reagents can be attributed to their pivotal role in advancing biomedical research and facilitating early disease detection, thereby propelling the growth of the goat polyclonal antibody market.

Strategic Mergers & Acquisitions

Strategic mergers and acquisitions have emerged as a key growth strategy within the goat polyclonal antibody market, allowing companies to expand their product portfolios and enhance their technological capabilities. By integrating operations and resources, firms can leverage synergies to improve production efficiencies and reduce costs, thereby enhancing their competitive positions in the market.

These strategic moves not only provide access to new markets and customer bases but also enable the sharing of expertise and innovation, leading to the development of more effective and innovative antibody products. This trend of consolidation is expected to continue, driven by the need to meet increasing demands and overcome challenges related to production scalability and regulatory complexities. Consequently, strategic mergers and acquisitions are vital for companies aiming to capitalize on the growth opportunities in the dynamic goat polyclonal antibody market.

Latest Trends

Rising Investments in Life Sciences Research

In 2023, the global goat polyclonal antibody market will be significantly influenced by rising investments in life sciences research. Increased funding from both governmental and private sectors is supporting advanced research in biotechnology and pharmaceuticals, where goat polyclonal antibodies are crucial due to their high sensitivity and specificity. These investments are not only enhancing the capabilities for disease diagnosis and therapeutic monitoring but also driving innovations in vaccine development and personalized medicine.

As research institutions and companies intensify their focus on exploring complex biological pathways and disease mechanisms, the demand for these specialized antibodies is expected to continue its upward trajectory. This trend underscores the integral role of robust financial backing in sustaining the growth and development of the goat polyclonal antibody market.

Shift towards Animal-Free Antibody Production Methods

A significant trend in the goat polyclonal antibody market is the shift towards animal-free antibody production methods. This movement is driven by ethical concerns, regulatory pressures, and the scientific need for more reproducible and sustainable antibody sources. Technologies such as recombinant antibody production are gaining traction, offering a humane alternative to traditional methods by eliminating the need for animal hosts.

These advancements not only address ethical issues but also improve batch consistency and reduce the risk of cross-reactivity and contamination. As more researchers and organizations adopt these innovative techniques, the market is witnessing a paradigm shift that could redefine production standards and significantly impact market dynamics in the years ahead.

Regional Analysis

The North American market holds a 39.3% share in the global goat polyclonal antibody industry.

In the Goat Polyclonal Antibody market, North America emerges as a dominant force, accounting for a significant share of approximately 39.3%. This region's prominence is propelled by several factors including robust healthcare infrastructure, substantial investment in research and development, and a high prevalence of chronic diseases necessitating advanced medical interventions. Furthermore, the presence of key market players and favorable regulatory frameworks contribute to the flourishing antibody market in North America.

In the United States, for instance, the increasing incidence of cancer and autoimmune disorders has fueled the demand for innovative antibody-based therapies, driving market growth. Moreover, strategic collaborations between pharmaceutical companies and research institutions accelerate the development and commercialization of goat polyclonal antibodies, bolstering market expansion.

Europe stands as another pivotal region in the Goat Polyclonal Antibody market landscape. With a mature healthcare system and growing emphasis on personalized medicine, Europe commands a substantial market share. Countries like Germany, France, and the United Kingdom are at the forefront of research and development activities, fostering innovation in antibody therapeutics. Additionally, the rising geriatric population, coupled with the increasing prevalence of infectious diseases, sustains demand for goat polyclonal antibodies across the region.

The Asia Pacific region presents lucrative opportunities for market players, fueled by rapid urbanization, improving healthcare infrastructure, and a burgeoning biotechnology sector. Countries such as China, India, and Japan are witnessing significant investments in biopharmaceutical research, driving the adoption of antibody-based therapies. Furthermore, the escalating burden of chronic diseases and infectious ailments propels the demand for goat polyclonal antibodies in the region.

While relatively smaller in market share compared to North America, Europe, and Asia Pacific, the Middle East & Africa, and Latin America regions demonstrate notable growth potential. Factors such as increasing healthcare expenditure, expanding pharmaceutical industry, and rising awareness about antibody therapeutics contribute to market development in these regions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2023, the global Goat Polyclonal Antibody Market showcased a competitive landscape marked by a myriad of key players, each contributing significantly to the market dynamics. Among these prominent entities, Thermo Fisher Scientific Inc., headquartered in the United States, emerged as a pivotal force shaping the market trajectory. Renowned for its cutting-edge technologies and comprehensive portfolio, Thermo Fisher Scientific Inc. played a crucial role in driving advancements in antibody research and development, thereby fostering market growth.

Merck KGaA, based in Germany, stood out as another influential player, leveraging its extensive expertise in biopharmaceuticals to bolster the Goat Polyclonal Antibody Market. The company's commitment to innovation and strategic collaborations fortified its position, enabling it to cater effectively to diverse market demands.

Abcam plc, headquartered in the United Kingdom, contributed significantly to the market landscape with its robust product offerings and unwavering focus on quality. By delivering high-performance antibodies and innovative solutions, Abcam plc cemented its reputation as a trusted partner for researchers worldwide.

These key players, along with BD, Bio-Rad Laboratories Inc., F. Hoffmann-La Roche Ltd., and others, collectively shaped the competitive dynamics of the Goat Polyclonal Antibody Market in 2023. Their relentless pursuit of excellence, coupled with strategic initiatives and technological advancements, underscored their pivotal role in driving market expansion and fostering innovation within the industry.

Market Key Players

- Thermo Fisher Scientific Inc., (U.S.)

- Merck KGaA (Germany)

- Abcam plc (UK)

- BD (U.S.)

- Bio-Rad Laboratories Inc., (U.S.)

- Cell Signaling Technology Inc., (U.S.)

- F. Hoffmann-La Roche Ltd., (Switzerland)

- Danaher (U.S.)

- Agilent Technologies (U.S.)

- PerkinElmer Inc., (U.S.)

- Lonza (Switzerland)

- GenScript (China)

- BioLegend, Inc. (U.S.)

- Illumia Inc., (U.S.)

- ImmonoPresice Antibodies Ltd (Canada)

- Fujirebio (Sweden)

- Analytik Jena GmbH (Germany)

- Omega BioTek Inc., (U.S.)

- Dovetail Genomics (U.S.)

- Atlas Antibodies (Sweden)

Recent Development

- In January 2024, Rockland Immunochemicals developed custom anti-HCP antibodies for bioprocessing, employing diverse immunization methods for broad coverage. Validated through Western blot and ELISA, these antibodies ensure purity in therapeutic biologics.

- In October 2022, Absolute Biotech will launch, merging leading antibody-centric brands to provide comprehensive antibody solutions worldwide. Offering a wide range of antibody-related products and services for research, diagnostics, and therapeutics.

Report Scope

Report Features Description Market Value (2023) USD 1.8 Billion Forecast Revenue (2033) USD 3.1 Billion CAGR (2024-2032) 5.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Primary, Secondary), By Source(Rabbits, Goats, Sheep, Others), By Application(Research, Diagnostics, Therapy), By End-User(Academic & Research Center, Pharmaceutical & Biotechnology Companies, Diagnostic Centers, Hospitals) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Thermo Fisher Scientific Inc., (U.S.), Merck KGaA (Germany), Abcam plc (UK), BD (U.S.), Bio-Rad Laboratories Inc., (U.S.), Cell Signaling Technology Inc., (U.S.), F. Hoffmann-La Roche Ltd., (Switzerland), Danaher (U.S.), Agilent Technologies (U.S.), PerkinElmer Inc., (U.S.), Lonza (Switzerland), GenScript (China), BioLegend, Inc. (U.S.), Illumia Inc., (U.S.), ImmonoPresice Antibodies Ltd (Canada), Fujirebio (Sweden), Analytik Jena GmbH (Germany), Omega BioTek Inc., (U.S.), Dovetail Genomics (U.S.), Atlas Antibodies (Sweden) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Thermo Fisher Scientific Inc., (U.S.)

- Merck KGaA (Germany)

- Abcam plc (UK)

- BD (U.S.)

- Bio-Rad Laboratories Inc., (U.S.)

- Cell Signaling Technology Inc., (U.S.)

- F. Hoffmann-La Roche Ltd., (Switzerland)

- Danaher (U.S.)

- Agilent Technologies (U.S.)

- PerkinElmer Inc., (U.S.)

- Lonza (Switzerland)

- GenScript (China)

- BioLegend, Inc. (U.S.)

- Illumia Inc., (U.S.)

- ImmonoPresice Antibodies Ltd (Canada)

- Fujirebio (Sweden)

- Analytik Jena GmbH (Germany)

- Omega BioTek Inc., (U.S.)

- Dovetail Genomics (U.S.)

- Atlas Antibodies (Sweden)