Gluten-Free Pasta Market By Raw Material (Chickpea Pasta, Multigrain Pasta, Brown Rice pasta, Quinoa Pasta, Lentil Pasta, Others), By Category (Fresh, Dried), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience/Grocery Stores, E-commerce), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48320

-

July 2024

-

136

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

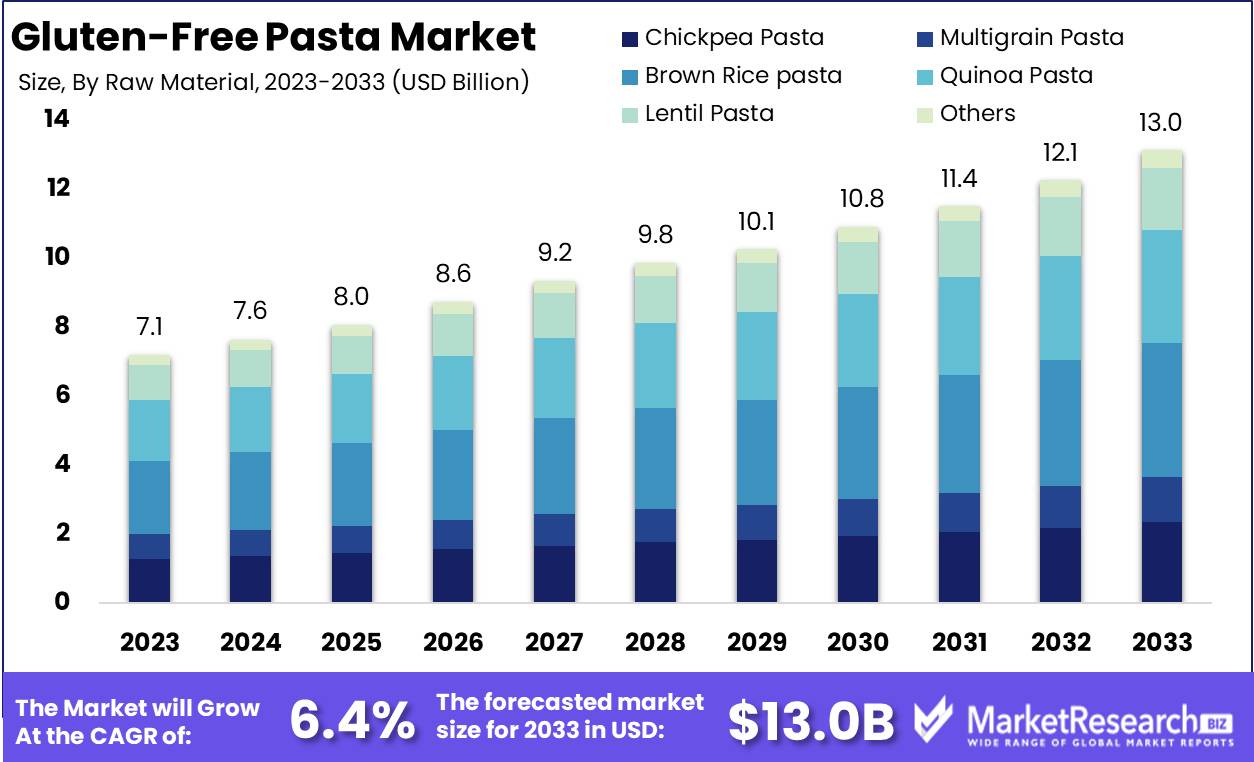

The Global Gluten-Free Pasta Market was valued at USD 7.1 Bn in 2023. It is expected to reach USD 13.0 Bn by 2033, with a CAGR of 6.4% during the forecast period from 2024 to 2033.

The gluten-free pasta market encompasses the production, distribution, and consumption of pasta products made without gluten, catering to individuals with celiac disease, gluten intolerance, or those choosing gluten-free diets. This market includes various pasta types made from alternative flours such as rice, corn, quinoa, and legumes. Rising health awareness, increasing prevalence of gluten-related disorders, and a growing demand for healthier food options are driving market growth. Innovation in product formulation and expanding retail availability are further enhancing market penetration, making gluten-free pasta a mainstream dietary choice for many consumers globally.

The gluten-free pasta market is experiencing robust growth, driven by increasing health awareness, a rising prevalence of gluten-related disorders, and a growing consumer demand for healthier dietary options. Consumers are increasingly seeking gluten-free alternatives that do not compromise on taste or nutritional value. Products like 100% yellow pea pasta, which are high in fiber, protein, and prebiotics, cater to this demand by offering a nutritious option, though they require careful cooking to maintain texture.

Product innovation and quality remain pivotal for market success. For instance, Tinkyáda, a long-standing player in the market, has historically claimed to offer consistently "al dente" gluten-free pasta. However, recent tests revealing that their pasta disintegrates during cooking contradict these quality assertions, underscoring the importance of maintaining high product standards. This highlights a critical aspect for manufacturers: ensuring that gluten-free products not only meet health criteria but also maintain desired culinary qualities.

The market is also benefiting from the expanded availability of gluten-free pasta across various retail channels, making it easier for consumers to access these products. Additionally, ongoing advancements in food technology are enabling the development of gluten-free pasta that more closely mimics the texture and taste of traditional pasta, further driving consumer adoption.

Key Takeaways

- Market Value: The Global Gluten-Free Pasta Market was valued at USD 7.1 Bn in 2023. It is expected to reach USD 13.0 Bn by 2033, with a CAGR of 6.4% during the forecast period from 2024 to 2033.

- By Raw Material: Brown rice pasta constitutes 30% of the gluten-free pasta market by raw material.

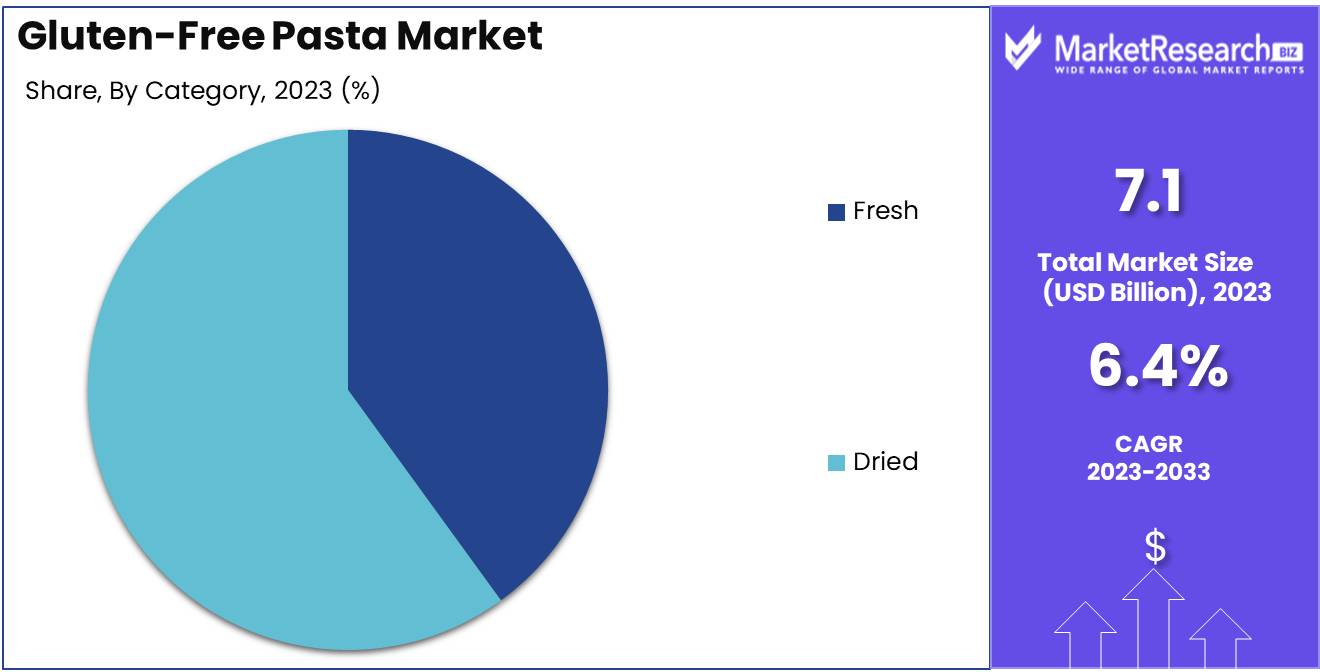

- By Category: Dried gluten-free pasta makes up 70% of the market by category.

- By Distribution Channel: Supermarkets and hypermarkets account for 40% of the gluten-free pasta market by distribution channel.

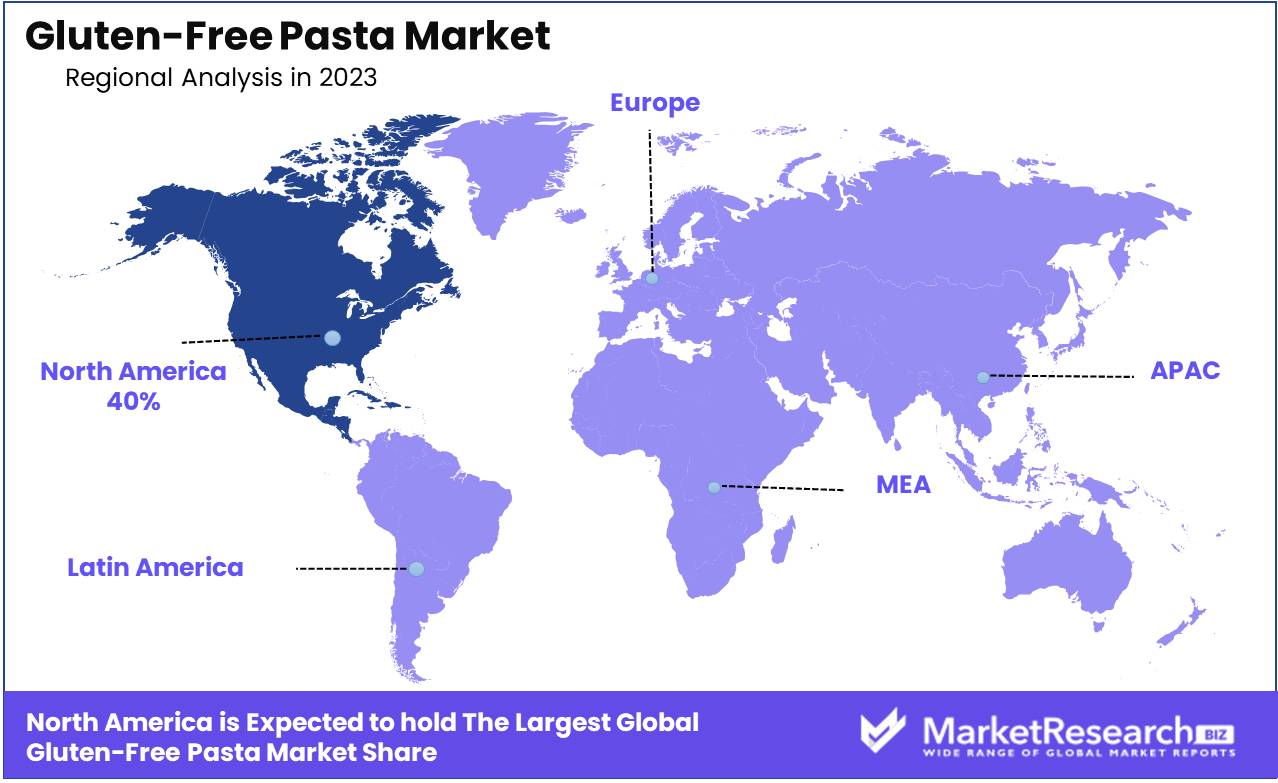

- Regional Dominance: North America leads with 40% of the market share, driven by high consumer awareness and prevalence of gluten-related disorders.

- Growth Opportunity: The increasing prevalence of gluten intolerance and celiac disease, coupled with a growing consumer trend towards healthier and specialty diets, is propelling the gluten-free pasta market forward.

Driving factors

Rising Awareness of Gluten Intolerance

The growing awareness of gluten intolerance and celiac disease is a primary driver of the gluten-free pasta market. As more people are diagnosed with these conditions, there is an increasing need for gluten-free dietary options. Celiac disease, an autoimmune disorder triggered by gluten consumption, affects approximately 1% of the global population. Additionally, non-celiac gluten sensitivity affects a significant number of people who experience symptoms similar to celiac disease without the autoimmune response.

This heightened awareness has led to a surge in demand for gluten-free products, including pasta. Consumers are becoming more knowledgeable about the health implications of gluten, driving them to seek out gluten-free alternatives. The market has responded with a variety of products made from rice, corn, quinoa, and legumes, providing safe and tasty options for those with gluten intolerance.

Demand for Healthier Diet Options

The demand for healthier diet options is another significant factor driving the growth of the gluten-free pasta market. Beyond those with gluten intolerance, many consumers are adopting gluten-free diets as part of a broader health and wellness trend. People are increasingly aware of the benefits of reducing gluten intake, such as improved digestion, increased energy levels, and better weight management. This shift towards healthier eating habits is expanding the customer base for gluten-free products.

The gluten-free trend often intersects with other health and dietary trends, such as organic, non-GMO, and plant-based diets. Consumers seeking these attributes are likely to choose gluten-free pasta, which often meets multiple dietary preferences. This convergence of health trends amplifies the demand for gluten-free pasta, making it a staple in the diets of health-conscious consumers.

Restraining Factors

Expensive Gluten-Free Ingredients

The high cost of gluten-free ingredients is a significant challenge impacting the growth of the gluten-free pasta market. Producing gluten-free pasta requires alternative ingredients such as rice, quinoa, corn, and legumes, which are often more expensive than traditional wheat. These ingredients not only cost more but also require specialized processing techniques to achieve the desired texture and taste, further increasing production costs.

These elevated costs are typically passed on to consumers, making gluten-free pasta more expensive than conventional pasta. This price disparity can limit the accessibility of gluten-free pasta, particularly for price-sensitive consumers. Despite the growing demand for gluten-free products, the higher cost remains a barrier, potentially slowing market penetration and expansion.

Limited Availability

Limited availability of gluten-free pasta is another factor constraining market growth. While major urban areas and well-developed markets may have a variety of gluten-free options, smaller towns and emerging markets often lack these products. This uneven distribution means that many consumers who would benefit from or are interested in gluten-free pasta cannot easily access it.

Retailers and suppliers face challenges in stocking gluten-free products due to the higher costs and perceived lower demand in certain areas. Additionally, supply chain complexities and the need for specialized storage conditions to prevent cross-contamination with gluten-containing products further complicate distribution efforts.

By Raw Material Analysis

Brown rice pasta led the market by raw material, capturing 30% of the share.

In 2023, Brown Rice Pasta held a dominant market position in the gluten-free pasta market, capturing more than a 30% share. Brown rice pasta is favored for its mild flavor, appealing texture, and nutritional benefits, making it a popular choice among consumers seeking gluten-free alternatives. Its high fiber content and compatibility with various recipes drive its substantial market share. The increasing demand for healthier, gluten-free options supports the growth of brown rice pasta in the market.

Chickpea Pasta is gaining traction due to its high protein content and rich nutritional profile. This pasta variant appeals to health-conscious consumers and those looking for plant-based protein sources. The growing popularity of vegan and vegetarian diets contributes to the rising demand for chickpea pasta.

Multigrain Pasta combines various gluten-free grains such as corn, rice, and quinoa, offering a diverse nutrient profile and unique taste. This type of pasta caters to consumers seeking a balanced diet with multiple health benefits. The versatility and nutritional advantages of multigrain pasta support its significant presence in the market.

Quinoa Pasta is known for its high protein content and essential amino acids, making it a preferred choice for health enthusiasts. Quinoa's reputation as a superfood and its gluten-free properties drive the demand for quinoa pasta, especially among consumers with specific dietary preferences and health concerns.

Lentil Pasta offers a high-protein, high-fiber alternative to traditional pasta. It is particularly popular among consumers looking for nutrient-dense options that support weight management and overall health. The increasing focus on plant-based diets further fuels the demand for lentil pasta.

Others include various gluten-free pasta made from alternative raw materials such as corn, amaranth, and soy. These options cater to niche markets and specific dietary needs, contributing to the overall diversity and growth of the gluten-free pasta market.

By Category Analysis

Dried pasta was the most popular category, with a 70% share.

In 2023, Dried gluten-free pasta held a dominant market position in the gluten-free pasta market, capturing more than a 70% share. Dried gluten-free pasta is favored for its long shelf life, convenience, and ease of storage, making it a staple in households and foodservice establishments. Its extended shelf stability and wide availability in various retail channels drive its significant market share. The demand for pantry-stable, easy-to-cook meal options supports the robust growth of dried gluten-free pasta in the market.

Fresh gluten-free pasta, while holding a smaller share, remains popular for its superior taste and texture. Fresh pasta appeals to consumers seeking premium, artisanal-quality products and is often preferred for its authentic culinary experience. The shorter shelf life and specific storage requirements of fresh pasta limit its market penetration compared to dried pasta. However, the growing trend towards fresh, minimally processed foods and the increasing availability of fresh gluten-free pasta in specialty stores and online platforms contribute to its steady demand.

By Distribution Channel Analysis

Supermarkets and hypermarkets were the primary distribution channels, accounting for 40% of the market.

In 2023, Supermarkets/Hypermarkets held a dominant market position in the gluten-free pasta market, capturing more than a 40% share. These large retail chains are preferred by consumers for their convenience, extensive product ranges, and competitive pricing. The broad visibility and availability of gluten-free pasta in supermarkets and hypermarkets drive significant consumer traffic, contributing to their substantial market share. The ability of these stores to offer a diverse array of brands and products under one roof makes them a primary shopping destination for gluten-free pasta.

Specialty Stores also represent a significant portion of the gluten-free pasta market. These stores cater specifically to health-conscious consumers and those with dietary restrictions, offering curated selections of high-quality, niche products. Specialty stores often provide expert knowledge and personalized service, attracting consumers looking for specific dietary products, including gluten-free pasta.

Convenience/Grocery Stores play an important role in the distribution of gluten-free pasta, particularly for everyday and impulse purchases. These stores are easily accessible and cater to the immediate needs of consumers, offering a range of gluten-free options. While they may not have the extensive variety found in larger supermarkets, their convenience and proximity to residential areas ensure a steady demand.

E-commerce is rapidly gaining traction as a distribution channel for gluten-free pasta. Online platforms provide consumers with the convenience of shopping from home, a wider product selection, and often access to specialty and international brands that may not be available locally. The growing trend of online shopping, accelerated by the COVID-19 pandemic, has significantly boosted the e-commerce segment, offering consumers the convenience of direct-to-doorstep delivery and subscription options.

Key Market Segments

By Raw Material

- Chickpea Pasta

- Multigrain Pasta

- Brown Rice pasta

- Quinoa Pasta

- Lentil Pasta

- Others

By Category

- Fresh

- Dried

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience/Grocery Stores

- E-commerce

Growth Opportunity

Expansion into Emerging Markets

The expansion into emerging markets presents significant opportunities for the gluten-free pasta market in 2024. As awareness of gluten intolerance and demand for healthier dietary options grow globally, there is an untapped potential in regions such as Asia-Pacific, Latin America, and Africa. These areas are experiencing rising disposable incomes, urbanization, and increasing health consciousness among consumers. By strategically entering these markets, manufacturers can capitalize on the growing consumer base seeking gluten-free alternatives.

Establishing local production facilities and forming partnerships with regional distributors can enhance market penetration. This strategy not only reduces costs associated with importation but also ensures fresher and more readily available products for consumers. Furthermore, tailored marketing campaigns that address local dietary habits and preferences can significantly boost brand recognition and adoption in these regions.

Innovations in Gluten-Free Recipes

Innovations in gluten-free recipes are another key opportunity driving the growth of the gluten-free pasta market. Advances in food science and technology are enabling manufacturers to develop gluten-free pasta that closely mimics the texture and taste of traditional wheat-based pasta. Utilizing alternative flours such as chickpea, lentil, and quinoa not only caters to gluten-free needs but also introduces additional nutritional benefits, appealing to health-conscious consumers.

Continuous improvement in recipes and production processes can address the common criticisms of gluten-free pasta, such as poor texture and flavor. By enhancing the sensory qualities of gluten-free pasta, manufacturers can attract a broader audience, including those without gluten intolerance but who are seeking healthier or more diverse dietary options. Innovative packaging and marketing that highlight these improvements can further drive consumer interest and market growth.

Latest Trends

Popularity of Plant-Based Pasta

One of the prominent trends driving the gluten-free pasta market in 2024 is the rising popularity of plant-based pasta. Consumers are increasingly seeking alternatives that align with various dietary preferences, including vegan and vegetarian diets. Plant-based gluten-free pasta, made from ingredients such as lentils, chickpeas, and edamame, not only caters to those avoiding gluten but also appeals to consumers looking for protein-rich, nutritious options. This trend is driven by a broader movement towards plant-based eating, which is associated with health benefits, environmental sustainability, and ethical considerations.

The integration of plant-based options into the gluten-free pasta market enhances its appeal across a wider audience, beyond just those with gluten intolerance. As plant-based diets continue to gain traction, the demand for innovative and diverse pasta products is expected to grow, providing substantial opportunities for market expansion and product differentiation.

Focus on Organic and Non-GMO Products

The focus on organic and non-GMO products is another significant trend shaping the gluten-free pasta market in 2024. Health-conscious consumers are increasingly prioritizing products that are free from genetically modified organisms (GMOs) and produced using organic farming practices. These consumers perceive organic and non-GMO products as healthier and more environmentally friendly, driving demand for gluten-free pasta that meets these criteria.

Manufacturers are responding to this trend by sourcing high-quality, non-GMO ingredients and obtaining organic certifications for their products. This focus not only aligns with consumer preferences but also enhances brand credibility and appeal. Marketing strategies that emphasize these attributes can attract a loyal customer base committed to health and sustainability.

Regional Analysis

North America holds the largest market share at 40%.

North America leads the gluten-free pasta market, holding a dominant 40% share. This dominance is driven by increasing health consciousness and a high prevalence of celiac disease and gluten sensitivity among consumers. The United States, in particular, is a key contributor to market growth, with a well-developed health food industry and widespread availability of gluten-free products. The market is further supported by strong marketing efforts and a growing trend toward healthy eating, which drives consumer demand for gluten-free pasta options.

Europe follows closely, with significant market traction in countries like Italy, Germany, and the UK. The European market benefits from a strong tradition of pasta consumption combined with rising health awareness and dietary shifts. Italy, renowned for its pasta, is seeing a growing segment of consumers opting for gluten-free alternatives.

Asia Pacific is poised for substantial growth in the gluten-free pasta market, driven by rising health awareness and increasing incidences of gluten intolerance. Countries such as Australia, China, and Japan are leading the charge, with consumers increasingly adopting gluten-free diets. The expanding middle class, urbanization, and changing dietary habits contribute to the market's growth.

Middle East & Africa show emerging potential in the gluten-free pasta market, particularly in the Gulf Cooperation Council (GCC) countries. The region's market growth is driven by increasing health consciousness and a growing expatriate population with dietary preferences for gluten-free foods. Rising disposable incomes and a burgeoning food retail sector also support the adoption of gluten-free pasta.

Latin America presents moderate growth prospects, with Brazil and Mexico being the primary contributors. The region's market is supported by an increasing awareness of gluten-related health issues and a growing demand for health food products.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global gluten-free pasta market is projected to witness substantial growth in 2024, driven by increasing consumer awareness of gluten intolerance and the rising demand for healthier dietary options. Key players in the market are leveraging innovation, quality, and strategic marketing to capture and expand their market share.

Pinnacle Foods Co continues to be a prominent player, capitalizing on its well-established brands and extensive distribution network. Their focus on expanding product lines to include various gluten-free options meets diverse consumer preferences and dietary needs.

Dr. Schär AG/SPA leads with its dedicated focus on gluten-free products, offering a wide range of high-quality pasta options. Their commitment to rigorous quality control and extensive R&D investments supports their strong market position.

Newlat Food SPA benefits from its extensive experience in the pasta industry, providing gluten-free options that do not compromise on taste or texture. Their strategic partnerships and brand reputation enhance their competitive edge.

Barilla Group, a global leader in the pasta industry, leverages its brand strength and innovation capabilities to offer premium gluten-free pasta. Their focus on high-quality ingredients and advanced production techniques ensures consumer trust and loyalty.

Jovial Foods, Inc differentiates itself with organic and artisanal gluten-free pasta products. Their emphasis on sustainable sourcing and traditional production methods appeals to health-conscious and environmentally aware consumers.

Pastificio Lucio Garofalo S.p.A. and Naturally YoursWheafree are known for their high-quality gluten-free offerings, focusing on authentic Italian recipes and natural ingredients. Their commitment to quality and authenticity resonates well with consumers seeking premium options.

The Kraft Heinz Company (Heinz) leverages its strong brand portfolio and extensive distribution network to penetrate the gluten-free market effectively. Their ability to innovate and adapt to consumer trends supports their growth.

PENNSYLVANIA MACARONI COMPANY and RP's Pasta Company offer niche, artisanal gluten-free pasta products, catering to a specific segment of consumers seeking unique and high-quality options. Their focus on craftsmanship and local ingredients adds value.

Hain Celestial Group emphasizes organic and natural products, including gluten-free pasta, aligning with the growing consumer preference for clean-label products. Their diverse brand portfolio supports market expansion.

Molino Di Ferro UK and Quinoa Corporation (Ancient Harvest) offer specialty gluten-free pasta, incorporating alternative grains like quinoa. Their focus on nutritional benefits and innovative formulations meets the demand for health-oriented products.

Bionaturae and AMERICAN BEAUTY are recognized for their high standards in gluten-free pasta production, offering a range of products that combine taste, quality, and nutritional value. Their dedication to meeting consumer needs ensures sustained market presence.'

Market Key Players

- Pinnacle Foods Co

- Dr. Schär AG/SPA

- Newlat Food SPA

- Barilla Group

- Jovial Foods, Inc

- Pastificio Lucio Garofalo S.p.A.

- Naturally YoursWheafree

- The Kraft Heinz Company (Heinz)

- PENNSYLVANIA MACARONI COMPANY

- RP's Pasta Company

- Hain Celestial Group

- Molino Di Ferro UK

- Quinoa Corporation (Ancient Harvest)

- Bionaturae

- AMERICAN BEAUTY

Recent Development

- In April 2024, Mahmoud Abu-Ghoush et al researchers developed high-fiber, gluten-free pasta using lupin and flaxseed flours, enhancing nutritional value for celiac disease patients.

- In July 2023, Pasta Rumo launched a new gluten-free pasta product range in the Whole Foods Market across the U.S., aiming to expand its presence in the leading pasta-consuming country

Report Scope

Report Features Description Market Value (2023) USD 7.1 Bn Forecast Revenue (2033) USD 13.0 Bn CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material (Chickpea Pasta, Multigrain Pasta, Brown Rice pasta, Quinoa Pasta, Lentil Pasta, Others), By Category (Fresh, Dried), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience/Grocery Stores, E-commerce) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pinnacle Foods Co, Dr. Schär AG/SPA, Newlat Food SPA, Barilla Group, Jovial Foods, Inc, Pastificio Lucio Garofalo S.p.A., Naturally YoursWheafree, The Kraft Heinz Company (Heinz), PENNSYLVANIA MACARONI COMPANY, RP's Pasta Company, Hain Celestial Group, Molino Di Ferro UK, Quinoa Corporation (Ancient Harvest), Bionaturae, AMERICAN BEAUTY Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Pinnacle Foods Co

- Dr. Schär AG/SPA

- Newlat Food SPA

- Barilla Group

- Jovial Foods, Inc

- Pastificio Lucio Garofalo S.p.A.

- Naturally YoursWheafree

- The Kraft Heinz Company (Heinz)

- PENNSYLVANIA MACARONI COMPANY

- RP's Pasta Company

- Hain Celestial Group

- Molino Di Ferro UK

- Quinoa Corporation (Ancient Harvest)

- Bionaturae

- AMERICAN BEAUTY