Watches Market By Type(Quartz, Mechanical), By Price Range(Low-Range, Mid-Range, Luxury), By Distribution Channel(Offline Retail Stores , Online Retail Stores), By End User(Men, Women, Unisex), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43458

-

Feb 2024

-

179

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

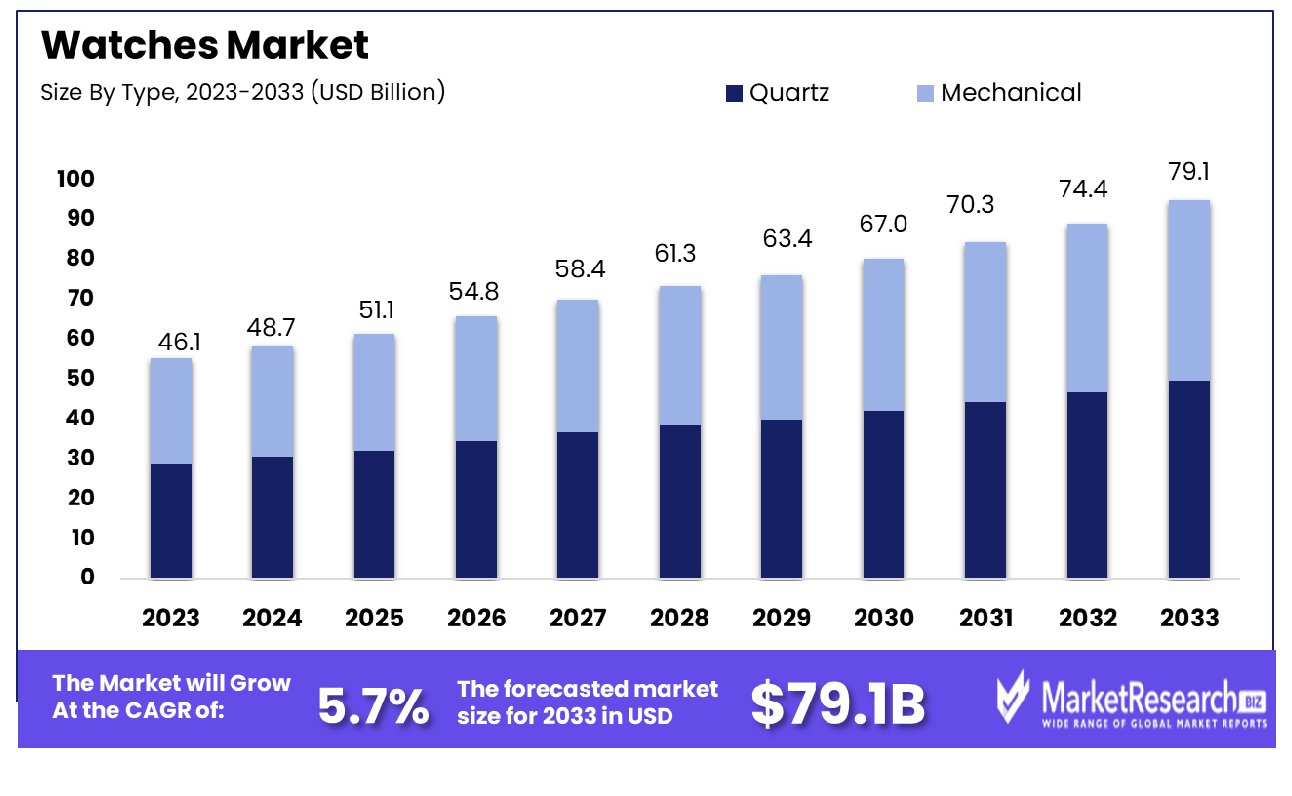

The watches market was valued at USD 46.1 billion in 2023. It is expected to reach USD 79.1 billion by 2033, with a CAGR of 5.7% during the forecast period from 2024 to 2033. The surge in demand for new advanced technologies and the rise in online and e-commerce platforms are some of the main key driving factors for the watch market.

A watch is a convenient, handy, and easy-to-transport timekeeping device made for wristwear and pocket use, which is made of the main key parts such as the movement, hands, case, and dial. The movement is called the main “heart” of the watch that controls time through gears, mechanisms, and springs with different types such as quartz, automatic movements, and mechanical. The dial which is also known as the watch face showcases the time indicators and the hands linked with the movement move all across the dial for time indication.

The case is made up of materials such as stainless steel that encloses and shields the internal elements. The crystal cover is generally made up of synthetic materials that protect the dial while permitting time visibility. Moreover, the characteristics such as the date display, water resistance, and chronographs are included. This combination outcomes in a high-class functionality and virtually attractive timepiece which are now pervasive accessories in people’s day-to-day routines.

The Hour Marker in December 2023, which highlights the data from the Federation of the Swiss watch industry, India’s watch imports rose 18% over 2022 totaling the amount of 133.7 million francs. This also displays a 60% rise from the year 2021, showcasing the rapid growth of the Indian luxury match market. Similarly, according to some of the analyst's forecasts India will top the luxury watch markets within 5 years. As per reports published by Deloitte, the market value will reach 400 million francs by 2028. This also showcases the interest among Indian consumers with 94% articulating to own luxury watches.

Watches are an integral part of our day-to-day life. There are several advantages of wearing a watch such as it displays your style, and helps individuals to stay punctual and organized. It also demonstrates the personality of the individuals. As e-commerce and online shopping platforms have risen, it has made various styles of watches easily available in the market. The demand for the watches will increase due to their requirement in everyday lifestyle, which will help in market expansion in the coming years.

Key Takeaways

- Market Growth: Watches Market was valued at USD 46.1 billion in 2023, It is expected to reach USD 79.1 billion by 2033, with a CAGR of 5.7% during the forecast period from 2024 to 2033.

- By Type: In the quartz segment, dominance prevails, capturing the market with its resilient appeal and functionality.

- By Price Range: Low-range pricing exerts significant influence, attracting budget-conscious consumers seeking quality and value.

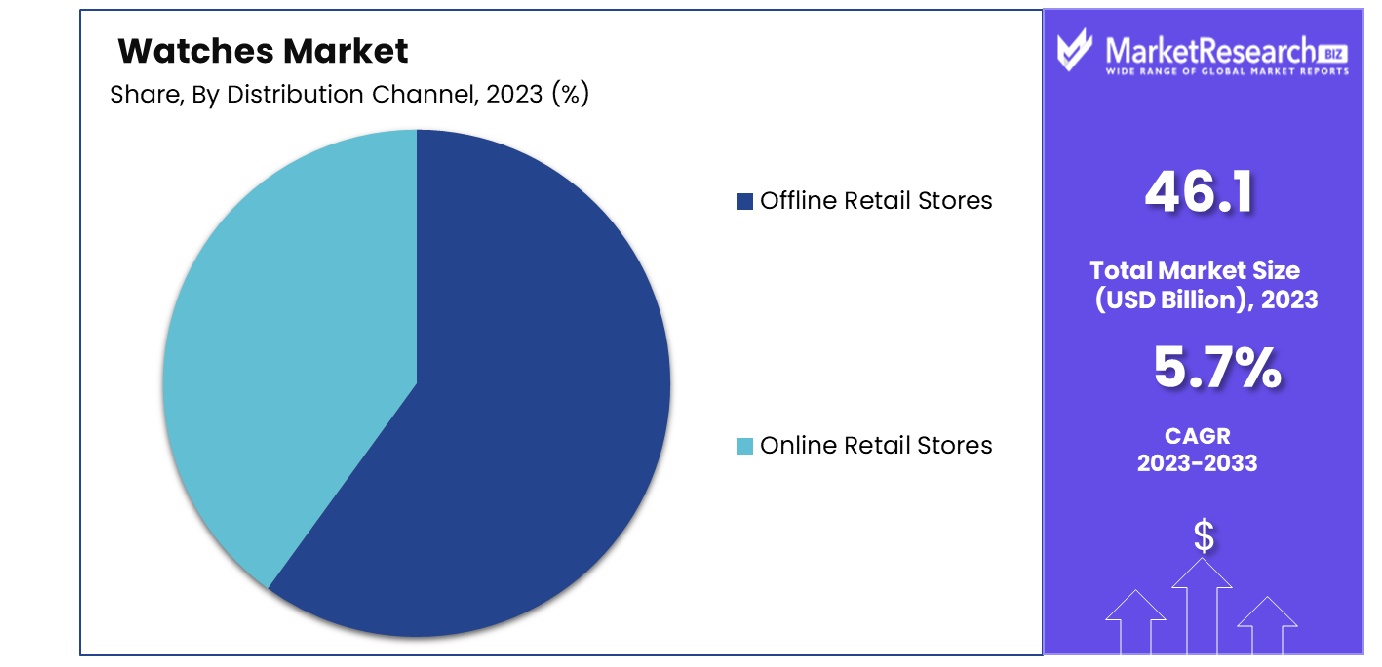

- By Distribution Channel: Offline retail stores emerge as the predominant distribution channel, facilitating tangible product experiences and customer interactions.

- By End User: Men, women, and unisex preferences collectively contribute to market diversity, shaping consumer trends comprehensively.

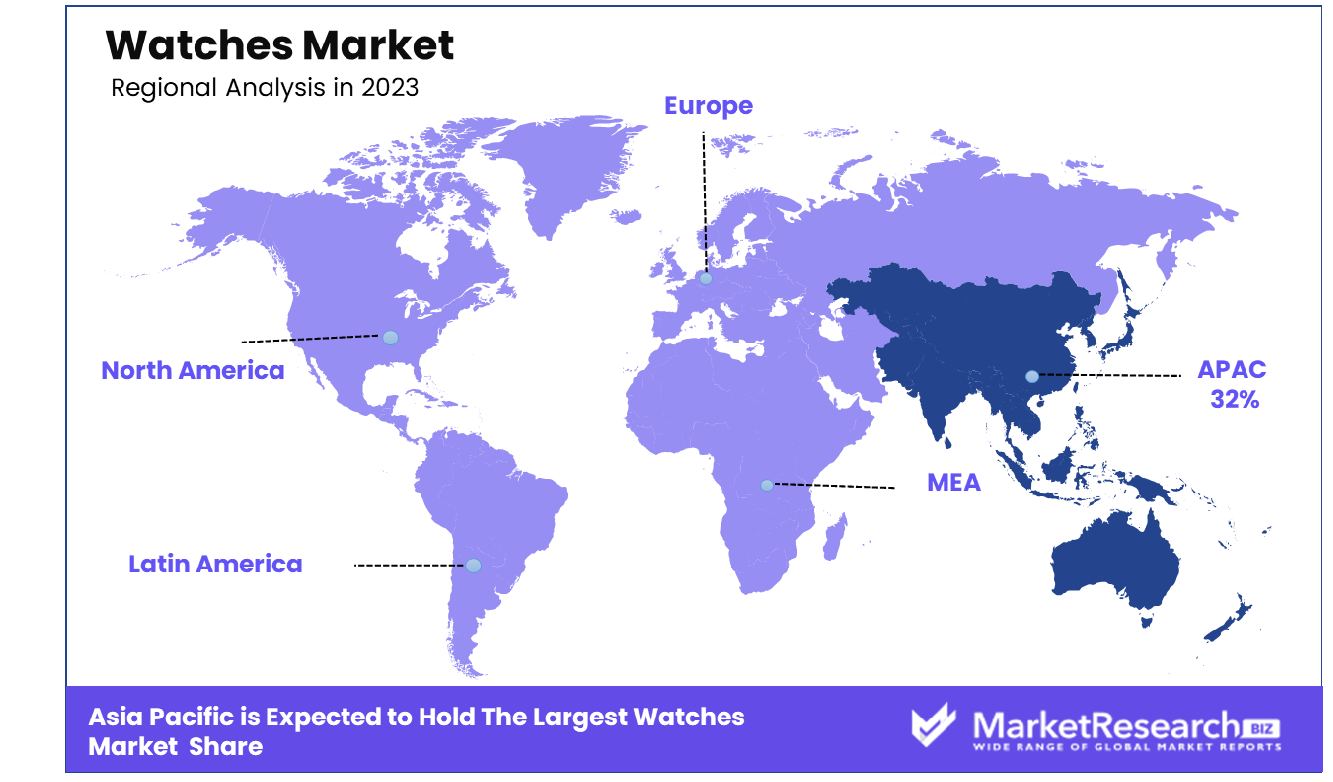

- Regional Dominance: Asia Pacific Dominates with 32% Market Share in Watches Industry

- Growth Opportunity: Fashion brand partnerships redefine watches, turning them into stylish accessories; customization options meet the demand for unique, personalized timepieces, driving the market growth.

Driving factors

Online Retailing Expands Watch Market Accessibility

The evolution of online retailing has significantly broadened the global accessibility of watches. E-commerce giants like Amazon have emerged as key retail platforms, offering an extensive array of timepieces. This digital shift has democratized the purchase of watches, allowing consumers from varied geographies to access a wide range of products with ease. The convenience of online shopping, coupled with the expansive selection and competitive pricing, has propelled the watch market to new heights. The ubiquity of online retailing also enables smaller and emerging watch brands to reach a global audience, diversifying the market and fueling growth.

Smartwatch Adoption Driven by Smartphone Integration

The smartwatch segment, with over 200 million users globally, is experiencing rapid growth, particularly among younger consumers who value the seamless integration with smartphones. As of 2023, the smartwatch user penetration rate stands at 2.5%, reflecting the deepening relationship between smartwatches and smartphones. Notifications, health tracking, and app functionalities enhance the utility of smartwatches, making them more than just timekeeping devices. This symbiotic relationship with smartphones is central to the growth trajectory of the smartwatch market, redefining the traditional watch industry.

Luxury Watches as Symbols of Status in Rising Economies

Rising disposable incomes, especially in developing markets, are fueling consumer interest in premium, high-end mechanical watches. Renowned brands like Rolex, Omega, and Cartier are witnessing increased demand as these watches become symbols of status and luxury. The appeal of luxury watches transcends timekeeping, embodying craftsmanship, heritage, and prestige. This trend is particularly pronounced in emerging economies, where a growing affluent class is keen to invest in luxury timepieces as a reflection of their socio-economic ascent.

Material Advancements Enhance Watch Durability and Value

Technological advancements in materials and movement engineering are enhancing the durability and accuracy of watches, thereby elevating their value proposition. The use of robust materials like ceramic and sapphire crystal glass, coupled with superior mechanical movements, has redefined the standards of watchmaking. High-end watches, such as those from Richard Mille Co., symbolize wealth and resilience, capable of withstanding extreme conditions, thus appealing to a niche clientele including athletes and celebrities. These innovations not only improve functionality but also reinforce the watch's status as a luxury item and a technological marvel.

Restraining Factors

Economic Cycles Impact Consumer Spending in the Watch Market

The watch market is significantly influenced by the cyclical nature of the economy, which leads to fluctuations in consumer discretionary spending. During economic downturns or recessions, consumers tend to prioritize essential spending and postpone purchases of luxury or non-essential items, including watches. This behavior results in a noticeable decline in watch sales during such periods. The correlation between economic health and consumer spending patterns is a critical factor in the watches market, underscoring its susceptibility to broader economic trends and cycles.

Technological Obsolescence Devalues Smartwatch Inventory

The rapid pace of technological advancement, particularly in the smartwatch segment, poses a challenge to the watches market. Older models of smartwatches quickly become obsolete as new versions are released, leading to the devaluation of unsold inventory. This phenomenon results in financial losses for retailers and manufacturers who are unable to sell older stock at full value. For example, the Apple Watch Series 3, once a flagship model, has seen significant price reductions following the release of newer models. This trend of quick obsolescence and inventory devaluation is a major constraint for the growth of the smartwatch market segment.

By Type Analysis

Quartz watches dominate the market, leading in sales and popularity.

In the watches market, Quartz watches dominate due to their precision, affordability, and low maintenance. Quartz technology revolutionized the watch industry by offering greater accuracy compared to mechanical movements, powered by a battery and a quartz crystal. The segment's dominance is underpinned by the widespread consumer preference for reliable, cost-effective timepieces, suitable for everyday wear. Quartz watches cater to a broad demographic, from entry-level consumers to enthusiasts seeking accuracy and practicality.

Mechanical watches, comprising both manual and automatic movements, appeal to collectors and luxury buyers due to their craftsmanship, longevity, and aesthetic appeal. However, the complexity, higher price point, and maintenance requirements of mechanical watches limit their market reach compared to quartz timepieces. The quartz segment's blend of accessibility, reliability, and affordability solidifies its market dominance.

By Price Range Analysis

Low-range price options prevail, appealing to a wide audience.

Low-range watches are the dominant segment by price range in the watches market. This dominance is driven by the widespread consumer demand for affordable, functional, and stylish timepieces. Low-range watches are accessible to a vast consumer base, including emerging markets and price-sensitive customers. They often feature quartz movements, aligning with the segment's dominance by type, and offer durability and varied designs, catering to diverse tastes and preferences.

Mid-range and Luxury watches cater to specific market niches. Mid-range watches strike a balance between quality and affordability, appealing to consumers seeking premium features at reasonable prices. Luxury watches, characterized by their high-quality materials, craftsmanship, and brand prestige, target an affluent clientele. Despite their appeal, the sheer volume and accessibility of low-range watches underscore their prevailing market position.

By Distribution Channel Analysis

Offline retail stores serve as the primary distribution channel.

Offline Retail Stores represent the most significant distribution channel in the watches market. Their dominance is attributed to consumers' preference for a tactile buying experience, where they can try on different models and assess the look and feel of the watches. Offline retail stores, including brand boutiques, department stores, and authorized dealers, offer personalized customer service, which is crucial for mid-range and luxury segments.

Online Retail Stores are growing rapidly, offering convenience, wider selections, and competitive pricing. However, the experiential aspect of purchasing watches, especially within the mid-range and luxury segments, favors offline channels. The ability to provide immediate ownership, along with expert advice and after-sales services, cements the dominance of offline retail stores in the watches market.

By End User Analysis

End users include men, women, and those seeking unisex options.

The watches market caters to Men, Women, and Unisex segments. Historically, men's watches have dominated the market, driven by traditional views of watches as a male accessory and the prevalence of male-oriented designs. Men's watches often feature larger dials, robust designs, and diverse functionalities, from sports to luxury models.

Women's watches have gained significant market share, with brands offering a range of styles from elegant, jewelry-inspired pieces to practical, everyday watches. The growing emphasis on female consumers in the watch industry reflects broader social changes and the increasing purchasing power of women.

Key Market Segments

By Type

- Quartz

- Mechanical

By Price Range

- Low-Range

- Mid-Range

- Luxury

By Distribution Channel

- Offline Retail Stores

- Online Retail Stores

By End User

- Men

- Women

- Unisex

Growth Opportunity

Partnerships with Fashion Brands: Infusing Style into Watches Market

The watch market is witnessing a surge in collaborations with fashion brands, transforming watches into stylistic and lifestyle-oriented accessories. Collaborations like Vivienne Westwood X Swatch and Gucci X Fnatic are making watches more than just timekeepers; they are now fashion statements. These partnerships, including those with artists like Takashi Murakami and Felipe Pantone, are creating limited-edition pieces that appeal to fashion-conscious consumers. These collaborations not only enhance brand visibility but also open up new market segments, catering to consumers who seek exclusivity and style in their accessories.

Customization Options: Personalizing Timepieces for Market Growth

Offering customization in watches presents significant growth potential in the watch market. By providing options for personalized materials, colors, and straps, brands like Swatch are catering to consumers' desires for uniqueness. This level of personalization meets the growing demand for products that reflect individual styles and preferences. Customization extends the appeal of watches beyond traditional demographics, attracting a broader customer base seeking to express their personality through their accessories. This trend not only boosts customer engagement but also adds a competitive edge to brands in a crowded market.

Latest Trends

Sustainable Timepieces

The watches market is witnessing a surge in demand for sustainable and eco-friendly timepieces. Consumers are increasingly conscious of the environmental impact of their purchases, driving brands to adopt sustainable practices. From ethically sourced materials to innovative recycling initiatives, watchmakers are incorporating eco-conscious elements into their designs, appealing to a growing segment of environmentally aware consumers.

Smart Integration

As technology continues to advance, the integration of smart features into traditional timepieces is becoming more prevalent. Smartwatches are no longer just gadgets but sophisticated accessories offering health tracking, notifications, and connectivity features. This fusion of technology with traditional craftsmanship caters to tech-savvy consumers seeking both functionality and style in their timepieces. As a result, the watch market is experiencing a shift towards hybrid designs that seamlessly blend classic aesthetics with modern functionality.

Regional Analysis

Asia Pacific Dominates with 32% Market Share in the Watch Industry

Asia Pacific's significant 32% share of the global watch market is largely attributed to its booming economies and an expanding middle-class population with increasing disposable income. The region is home to key luxury watch markets like China, Japan, and Hong Kong, where consumers exhibit a strong affinity for high-end timepieces. Furthermore, the presence of several major watch manufacturing hubs in the region, particularly in countries like Japan and China, contributes to its dominance. The region's rapid urbanization and growth in the fashion and retail sectors also play crucial roles in driving watch sales.

The watch market in Asia Pacific is characterized by a diverse consumer base with varying preferences, ranging from luxury and premium watches to affordable smartwatches. There is a growing trend towards digitalization and smart features in watches, particularly among the younger demographic. The region is also witnessing an increase in online retailing, which has made watches more accessible to a wider audience. Additionally, cultural factors, such as the importance of gifting, also bolster the market, particularly during festive seasons.

North America's Influence on the Watch Market

North America’s watch market is driven by a strong consumer preference for luxury and designer brands. The region's high consumer spending power and the presence of several flagship stores of major global brands contribute to its market share. The trend towards smartwatches and fitness trackers is particularly strong in this region.

Europe’s Role in the Watch Market

Europe, with its rich history in watchmaking, particularly in countries like Switzerland, plays a crucial role in the global watch industry. The region is known for its craftsmanship and luxury watch brands. The European market is characterized by a strong demand for high-end, precision timepieces and is a hub for watch exports and innovation.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the prestigious realm of the global watches market, each key player contributes uniquely to the sector's dynamics. Rolex, with its emblematic status, epitomizes luxury and timeless elegance, commanding significant market influence and brand loyalty. Cartier, blending artistry with sophistication, appeals to a clientele seeking both luxury and heritage.

Omega and Patek Philippe, steeped in horological history, maintain their prestige through innovation and association with significant cultural and historical milestones. Their market positioning is bolstered by their craftsmanship and legacy. Similarly, Audemars Piguet and Breitling have carved niches with distinctive designs and functionality, appealing to connoisseurs and enthusiasts alike.

Tag Heuer and Longines balance heritage with modernity, offering a blend of performance and elegance, while Tissot and Seiko are lauded for their precision and affordability, expanding the market’s reach to a broader audience.

Market Key Players

- Rolex

- Cartier

- Omega

- Patek Philippe

- Audemars Piguet

- Breitling

- Tag Heuer

- Longines

- Tissot

- Seiko

- Citizen

- Hublot

- IWC Schaffhausen

- Panerai

- Chopard

Recent Development

- In December 2023, Masimo, a billion-dollar medical technology company, won a crucial ruling against Apple over patent infringement. Masimo's pulse oximetry technology, central to its success, faces legal battles with tech giant Apple.

- In November 2023, H. Moser & Cie introduced the Streamliner Small Seconds Blue Enamel, featuring a new 39 mm size, grand feu enamel dial, and the innovative HMC 500 caliber, offering a blend of modernity and artistic elegance.

Report Scope

Report Features Description Market Value (2023) USD 46.1 Billion Forecast Revenue (2033) USD 79.1 Billion CAGR (2024-2032) 5.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Quartz, Mechanical), By Price Range(Low-Range, Mid-Range, Luxury), By Distribution Channel(Offline Retail Stores , Online Retail Stores), By End User(Men, Women, Unisex) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Rolex, Cartier, Omega, Patek Philippe, Audemars Piguet, Breitling, Tag Heuer, Longines, Tissot, Seiko, Citizen, Hublot, IWC Schaffhausen, Panerai, Chopard Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Rolex

- Cartier

- Omega

- Patek Philippe

- Audemars Piguet

- Breitling

- Tag Heuer

- Longines

- Tissot

- Seiko

- Citizen

- Hublot

- IWC Schaffhausen

- Panerai

- Chopard