Smart Lighting Market Report By Offering (Hardware, Software, Services), By Communication Technology (Wired , Wireless), By Light Source (LED Lamps, Fluorescent Lamps, Compact Fluorescent Lamps (CFL), High-Intensity Discharge (HID) Lamps), By End User (Indoor, Outdoor, Others), )By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

44000

-

March 2024

-

130

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

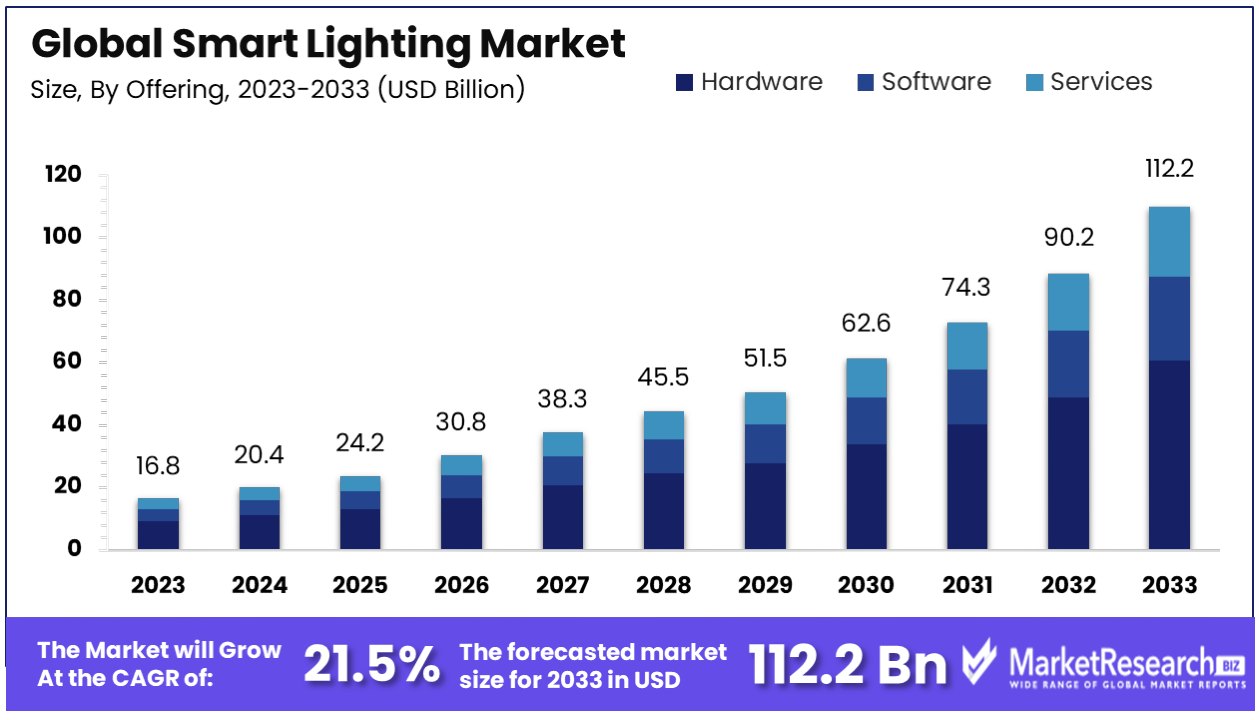

The Global Smart Lighting Market size is expected to be worth around USD 112.2 Billion by 2033, from USD 16.8 Billion in 2023, growing at a CAGR of 21.50% during the forecast period from 2024 to 2033.

The surge in demand for advanced technologies, increase in popularity for commercial and residential spaces, and individual preferences are some of the main key driving factors for the smart lighting market.

Smart lighting defines as an advanced lighting systems that uses technologies to offer improvise the control, automation and energy efficiency. Unlike old style lighting, smart lighting integrates features like sensors, connectivity to the internet and programmable settings permitting users to handle lighting remotely through smartphones and automation platforms.

Smart lighting systems often comprises LED bulbs equipped with embedded sensors to maintain brightness, ambience and color based on customer’s choices and environmental conditions.

Such systems provide personalized lighting situations, scheduling options and the potentiality to combine with other smart devices for a hassle-free connected home experience. With the potentiality to save energy, build customized lighting environments and improve convenience, smart lighting is becoming popular in homes offices and commercial spaces.

According to an article published by digital trends in October 2023, Nanoleaf discloses 4 new Matter devices comprising of 2 smart lamps. Moreover, the Cono portable lamp aids more than 16 million colors which lasts 5 hours needing a recharge and is created in such a manner that it can be angled towards the walls, ceiling or directly down at the surface its sitting on.

The Cup smart lamp is more unique as it serves as the storage bin for pens, scissors and other small items around the home. It also supports 16 million colors and can be controlled by using the Matter. Furthermore, all the 4 items are available online. The GU10 ships in early December and costs USD 50 for a 3 packs. The Downlight ships in mid- November and costs USD 35 for a single light. The Cono portable smart lamps ships in November and costs USD 95, while the cup smart lamp costs USD 130 and ships in April 2024.

Smart lighting is gaining much attention due to its energy efficiency, personalization and combination with smart home eco-systems. With features such as remote control, automation and sensor-based adjustments, it improves convenience, decrease energy consumption and contributes to a more connected and responsive living environment, bringing into line with modern eco-friendly and lifestyle trends.

Key Takeaways

- Market Value: The Global Smart Lighting Market is projected to reach approximately USD 112.2 Billion by 2033, experiencing substantial growth from USD 16.8 Billion in 2023, with a remarkable CAGR of 21.50% during the forecast period from 2024 to 2033.

- Dominant Segments:

- Offering Analysis: The 'Hardware' segment dominates with a 54.7% share, driven by smart bulbs, fixtures, and lighting controls that offer energy efficiency, user experience enhancements, and ambient customization.

- Communication Technology Analysis: 'Wired' communication technology leads with a 66.3% share, valued for its reliability and security, especially in commercial and industrial applications.

- Light Source Analysis: LED Lamps dominate the market due to their energy efficiency, longer lifespan, and adaptability, gradually replacing traditional lighting solutions like Fluorescent Lamps and Compact Fluorescent Lamps (CFL).

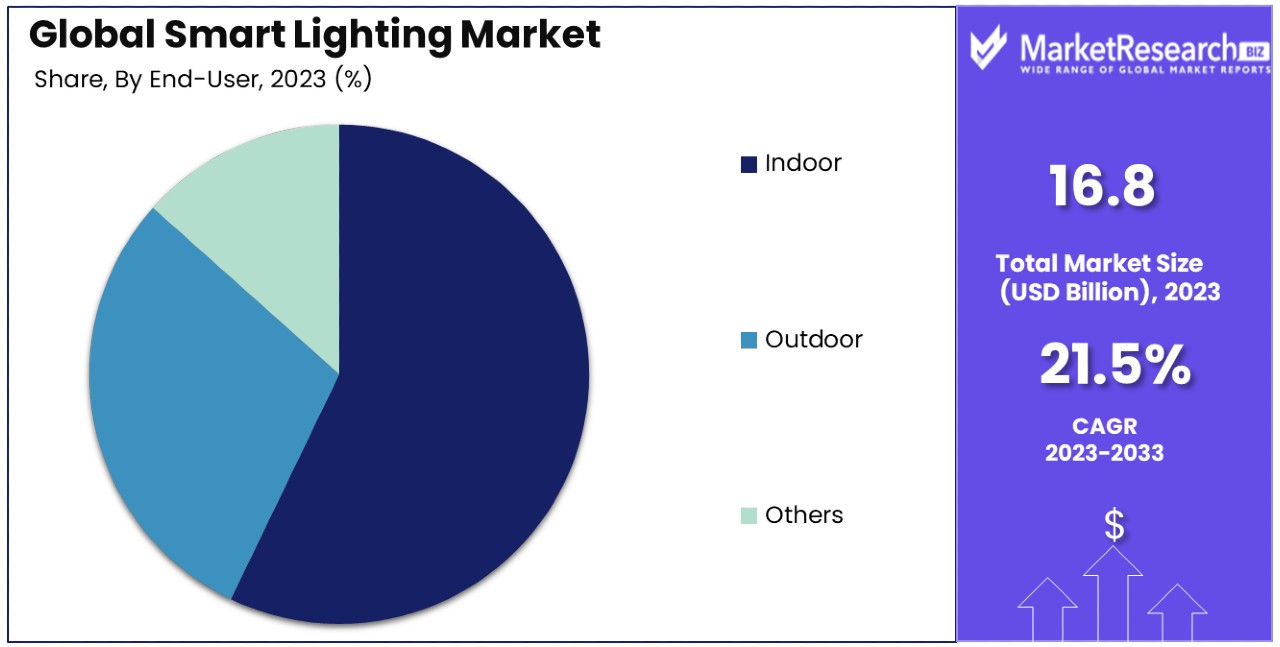

- End User Analysis: The 'Indoor' segment, covering Residential and Commercial applications, dominates with a 64% share, driven by the adoption of smart home technologies and energy-efficient lighting solutions.

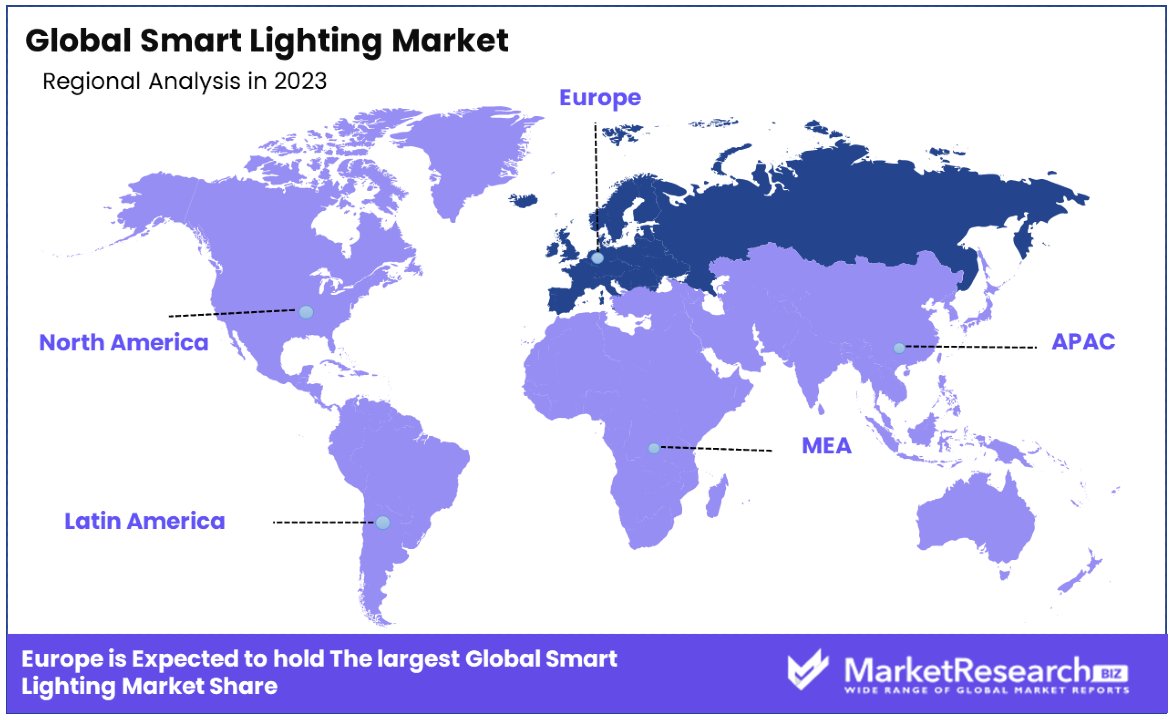

- Regional Analysis: Europe leads with a 38.6% market share, followed closely by North America with approximately 35%. Europe benefits from early adoption and significant investments in IoT infrastructure, while North America's rapid adoption of smart home technologies contributes to its market position.

- Key Players: Major players in the Smart Lighting Market include Signify (formerly Philips Lighting), Acuity Brands, Inc., General Electric Company, Osram Licht AG, and Eaton Corporation, among others.

- Analyst Viewpoint: The Smart Lighting Market's exponential growth is fueled by increasing awareness of energy efficiency, technological advancements in communication and lighting technologies, and the adoption of smart home solutions. Growth opportunities lie in further technological innovation, expanding market reach through targeted applications, and fostering interoperability and standardization within the industry.

Driving Factors

Energy Efficiency and Cost Savings Drive Smart Lighting Market Growth

Smart lighting systems are becoming increasingly popular due to their significant energy savings and reduced operational costs. These systems use advanced technologies to optimize lighting usage, adjusting brightness based on natural light availability and occupancy, leading to lower energy consumption.

The International Energy Agency (IEA) highlights the global target to double energy efficiency progress to 4% in 2023, which could reduce energy bills in advanced countries by one-third and account for 50% of CO2 reductions by 2030. This potential for substantial cost savings and environmental benefits is a major driving force behind the adoption of smart lighting in residential, commercial, and industrial sectors. As awareness of energy conservation grows and technology improves, smart lighting systems are set to become even more integral to achieving global energy efficiency goals, further propelling market growth.

Integration with Smart Home Technology Fuels Smart Lighting Market Expansion

The integration of smart lighting systems with the broader ecosystem of smart home technology is catalyzing market growth. The rise of the Internet of Things (IoT) has created a connected environment where devices communicate and operate together, enhancing the functionality and convenience of smart homes.

Smart lighting, as an integral component of this ecosystem, can be controlled and automated via smartphones, tablets, or voice-activated devices, offering seamless interaction with other smart home solutions. This interoperability not only enhances the user experience but also promotes the adoption of smart lighting systems as consumers seek more integrated, automated homes. As the smart home market continues to expand, the demand for compatible smart lighting solutions is expected to rise, contributing significantly to the sector's growth.

Improved User Experience and Convenience Enhance Smart Lighting Market Appeal

Smart lighting systems are revolutionizing the lighting industry by offering users unprecedented control and customization options. Features such as remote control, scheduling, dimming, and color-changing capabilities not only provide enhanced convenience but also allow users to personalize their lighting to suit their mood, activity, or the time of day.

This improved user experience is a key factor driving the smart lighting market's growth. Consumers are increasingly drawn to products that offer greater functionality and convenience, and smart lighting systems deliver on both fronts. As technology evolves and these systems become more sophisticated, their appeal is likely to increase further, attracting a wider audience and spurring continued market expansion.

Restraining Factors

Interoperability and Compatibility Issues Restrain Smart Lighting Market Growth

The growth of the Smart Lighting Market is hampered by interoperability and compatibility challenges among various smart lighting systems and smart home platforms. Without standardized protocols, integrating products from different manufacturers into a cohesive smart home environment becomes problematic, potentially leading to a fragmented user experience.

This lack of seamless integration can discourage consumers from adopting smart lighting solutions, fearing the complexity and inconvenience of managing incompatible devices. Addressing these interoperability issues is crucial for the market's expansion, as streamlined and user-friendly integration capabilities are essential for encouraging broader adoption of smart lighting technologies.

Security and Privacy Concerns Limit Smart Lighting Market Expansion

Security and privacy concerns present significant barriers to the growth of the Smart Lighting Market. As smart lighting systems become more interconnected with the Internet of Things (IoT), they potentially expose users to risks such as data breaches and unauthorized access. These concerns can deter consumers from incorporating smart lighting solutions into their homes, fearing for their personal information and privacy.

Building consumer trust through enhanced security measures and clear, transparent privacy policies is essential for overcoming these hurdles. Manufacturers and industry stakeholders must prioritize the development and implementation of robust security protocols to reassure users and foster a safer smart lighting ecosystem.

Offering Analysis

In the Smart Lighting Market, the 'Hardware' segment, including Smart Bulbs, Fixtures, and Lighting Controls, is dominant, holding a 54.7% share. This predominance is due to the tangible, immediate improvements these products offer in energy efficiency, user experience, and ambient enhancement.

Smart bulbs and fixtures provide users with unprecedented control over their lighting environments, allowing for adjustments in brightness, color, and scheduling, all of which contribute to energy savings and personalized spaces. Lighting controls, such as sensors and smart switches, further refine this experience by automating lighting based on occupancy or time of day, enhancing convenience and efficiency.

The 'Software' segment, though smaller, is critical for the integration and management of smart lighting systems. It includes applications and platforms that allow users to control and customize their lighting settings remotely. As smart lighting systems become more complex, the role of software in providing a seamless, user-friendly interface becomes increasingly important.

'Services' encompass installation, maintenance, and consulting services that support the deployment and optimization of smart lighting systems. As the market matures, the demand for professional services is expected to grow, particularly in commercial and industrial settings where lighting systems are more complex.

Communication Technology Analysis

The 'Wired' communication technology segment leads the Smart Lighting Market with a 66.3% share. This dominance is attributed to its reliability, security, and ability to handle high data volumes without interference, which are crucial in commercial and industrial applications where lighting systems are extensive and integral to operations. Wired systems, such as DALI (Digital Addressable Lighting Interface), are preferred in settings where a stable and secure connection is paramount.

The 'Wireless' segment, while smaller, is rapidly growing due to its flexibility, ease of installation, and scalability. Wireless technologies, including Zigbee, Bluetooth, and Wi-Fi, offer significant advantages for residential and small-scale commercial applications. They allow for easier retrofitting into existing buildings and provide users with the ability to easily expand or modify their smart lighting systems.

The growth in the 'Wireless' segment is propelled by advancements in technology that are improving the reliability and range of wireless communication. As these improvements continue, the gap between the capabilities of wired and wireless systems is narrowing, opening up new opportunities for wireless smart lighting solutions in a wider range of applications.

Light Source Analysis

The Smart Lighting Market is significantly diversified across various light sources, including LED Lamps, Fluorescent Lamps, Compact Fluorescent Lamps (CFL), and High-Intensity Discharge (HID) Lamps.

Among these, LED Lamps emerge as the dominant segment. Their ascendancy is attributed to their superior energy efficiency, longer lifespan, and decreasing cost over time compared to traditional lighting solutions. LEDs offer flexibility in terms of color temperature and brightness, making them ideal for integration into smart lighting systems that demand adaptability and energy conservation.

Fluorescent Lamps and Compact Fluorescent Lamps (CFL) have historically played significant roles in the market due to their energy efficiency over incandescent lamps. However, as technology progresses and environmental considerations become paramount, their market share is gradually being encroached upon by LED solutions.

High-Intensity Discharge (HID) Lamps, known for their high light output and efficiency, are typically used in large spaces or outdoor areas. However, the shift towards LED technology is evident in this segment as well, driven by LED's advancements and versatility.

End User Analysis

When analyzing the Smart Lighting Market by End User, the 'Indoor' segment, encompassing Residential and Commercial uses, dominates with a 64% share. This dominance is rooted in the increasing adoption of smart home technologies and energy-efficient lighting solutions within both homes and businesses. The drive for energy savings, coupled with the desire for enhanced ambiance and automated control over lighting, propels the demand for smart lighting solutions in these settings.

The 'Outdoor' segment, including Highways and Roadways, Architectural lighting, and others, while smaller, represents a significant area of growth. Smart lighting in outdoor settings is not only about energy efficiency but also plays crucial roles in safety, security, and enhancing the aesthetic appeal of public spaces. Innovations in this area, such as adaptive lighting and integration with citywide management systems, offer promising avenues for expansion.

The 'Others' category, which can include specialized applications such as horticultural lighting or lighting for healthcare settings, highlights the versatility and broad potential of smart lighting technologies. While currently a smaller part of the market, these niche applications could see growth driven by specific technological advancements and increasing recognition of the benefits of smart lighting solutions in diverse environments.

Key Market Segments

By Offering

- Hardware

- Software

- Services

By Communication Technology

- Wired

- Wireless

By Light Source

- LED Lamps

- Fluorescent Lamps

- Compact Fluorescent Lamps (CFL)

- High-Intensity Discharge (HID) Lamps

By End User

- Indoor

- Outdoor

- Others

Growth Opportunities

Integration with Smart Home Ecosystems Offers Growth Opportunity

The rising trend of smart home ecosystems is significantly enhancing the growth potential for the Smart Lighting Market. As households increasingly adopt smart devices, from voice assistants to home automation systems, the demand for smart lighting solutions that can integrate seamlessly into these ecosystems is escalating.

Consumers value the convenience and enhanced control offered by centralized smart home platforms, making smart lighting an essential component. This integration facilitates not just the convenience of voice-activated and remote-controlled lighting but also enables sophisticated scenarios and routines, such as lights that adjust based on time of day or occupancy. The ability of smart lighting systems to work harmoniously with other smart devices is a critical driver of market expansion, appealing to tech-savvy consumers and those seeking a cohesive smart home experience.

Energy-Efficient and Environmentally Conscious Solutions Offer Growth Opportunity

Amid growing environmental concerns and the global push towards sustainability, energy-efficient and environmentally friendly smart lighting solutions are set to capture significant market interest. Consumers are increasingly aware of their energy consumption's impact on both their wallets and the planet, prompting a shift towards lighting solutions that minimize energy use and carbon footprint.

Smart lighting systems, with their ability to precisely control light intensity, schedule operation, and adapt to ambient light conditions, present an attractive proposition. This shift towards eco-conscious consumption opens up avenues for manufacturers to innovate and market smart lighting products not just as a technological upgrade but as a contribution towards a more sustainable and energy-efficient lifestyle. The alignment of smart lighting with environmental sustainability principles is poised to be a key factor driving consumer adoption and market growth.

Trending Factors

Wireless Connectivity and Interoperability Are Trending Factors

The growing demand for smart lighting systems equipped with wireless connectivity is reshaping the Smart Lighting Market. Technologies like Wi-Fi, Bluetooth, and Zigbee are pivotal because they allow smart lighting solutions to connect and communicate effortlessly with a wide array of devices and platforms. This trend addresses the critical need for compatibility and seamless integration within the broader smart home ecosystem, enhancing user convenience and experience.

Wireless interoperability enables users to control their lighting systems through smartphones, voice assistants, or other smart devices, promoting a unified smart home environment. As consumers increasingly value the ease of managing their home environments through a single interface, the importance of wireless connectivity and interoperability in smart lighting systems continues to grow, driving market innovation and expansion.

Customizable and Personalized Lighting Experiences Are Trending Factors

Customizable and personalized lighting solutions are becoming a significant trend in the Smart Lighting Market. Today's consumers desire more than just illumination from their lighting systems; they seek the ability to personalize their living spaces with tunable color temperatures, dynamic lighting scenes, and scheduling features. This demand stems from the desire to have lighting that adapts to individual lifestyles, moods, and activities, moving away from the limitations of traditional, one-size-fits-all lighting solutions.

Personalized lighting experiences allow users to create ambiances that reflect their preferences and needs, significantly enhancing the appeal of smart lighting solutions. As manufacturers continue to innovate in providing more adaptable and user-centric lighting options, customizable and personalized experiences are set to drive the market forward, making smart lighting an integral part of modern, user-focused home design.

Regional Analysis

Europe Dominates with 38.6% Market Share

Europe's leadership in the Smart Lighting Market, holding a 38.6% share, is driven by several key factors. High levels of environmental awareness, advanced technological infrastructure, and strong regulatory support for energy efficiency across the EU contribute significantly. European consumers and businesses are increasingly adopting smart lighting solutions as part of broader smart home and smart city initiatives, bolstered by government policies aimed at reducing energy consumption and CO2 emissions.

Market dynamics in Europe are further influenced by the region's focus on innovation and sustainability. European manufacturers and tech companies are at the forefront of developing smart lighting technologies that integrate seamlessly with other smart home systems, offering enhanced functionality and user experiences.

Europe's market presence is expected to remain influential, with continued growth driven by sustainable urban development projects and the increasing adoption of IoT devices. The region's commitment to environmental goals and digital transformation is likely to spur further innovations in the smart lighting sector, maintaining Europe's position as a key market leader.

Regional Market Shares and Dynamics:

- North America: Following closely, North America accounts for approximately 35% of the market, driven by the rapid adoption of smart home technologies and significant investments in IoT infrastructure.

- Asia Pacific: With around 20% market share, Asia Pacific is experiencing fast growth due to expanding urbanization, smart city initiatives, and increasing awareness of energy efficiency.

- Middle East & Africa: Holding a smaller share of around 4%, the MEA region is witnessing gradual growth with the development of smart cities and increased focus on sustainable energy solutions.

- Latin America: Representing about 3% of the market, Latin America is slowly adopting smart lighting solutions, with growth hindered by economic variability but potential driven by urban modernization efforts.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the smart lighting industry, major players are strategically positioned to capitalize on the growing adoption of intelligent lighting systems across various sectors. Honeywell International Inc., OSRAM Licht AG, and Wipro Lighting hold significant market influence, commanding the largest market share.

The smart lighting market size continues to expand, driven by increasing investments in smart city projects and the commercial sector. Companies such as Acuity Brands Inc. and Zumtobel Group AG are leveraging their expertise to cater to the evolving needs of these initiatives, securing a substantial revenue share.

Philips Hue, Lutron Electronics Co. Inc., and Schneider Electric SE are among the major companies driving innovation in smart lighting technology. Their focus on developing efficient and scalable solutions has positioned them as key players in the industry, attracting significant attention from both consumers and businesses.

One of the main challenges in the smart lighting market is the initial cost of installation, particularly for outdoor applications. However, with advancements in technology and the emergence of more cost-effective solutions, players like Hubbell Incorporated and Cree Inc. are working towards mitigating this barrier, driving broader adoption.

Legrand S.A. and Bridgelux Inc. are also making significant contributions to the smart lighting industry, aiming to capture a larger share of the market through innovative product offerings and strategic partnerships.

As the demand for smart lighting solutions continues to rise, major players are expected to play a pivotal role in shaping the future of this dynamic sector. With their strong market presence and commitment to innovation, these companies are well-positioned to capitalize on emerging opportunities and drive further growth in the smart lighting market.

Market Key Players

- Honeywell International Inc.

- OSRAM Licht AG

- Wipro Lighting

- Acuity Brands Inc.

- Zumtobel Group AG

- Legrand S.A.

- Philips Hue

- Lutron Electronics Co. Inc.

- Schneider Electric SE

- Hubbell Incorporated

- Cree Inc.

- Bridgelux Inc.

Recent Developments

- On March 2024, Nanoleaf unveiled its Smart Lamp Collection in collaboration with Umbra, introducing the Cono Portable Lamp and Cup Lamp.

- On February 2024, Lifx, a prominent smart lighting company, reemerged with a new line of outdoor lights, marking its return to the market after facing financial challenges and almost going out of business in 2022.

- On February 2024, Signify launched the Philips Smart Light Hub in New Delhi, offering customers a comprehensive destination for all their lighting needs with over 300 SKUs in an immersive and interactive environment designed to showcase the latest innovations in smart lighting technology

- On January 2024, Halonix Technologies launched India's first 'UP-DOWN GLOW' LED Bulb, catering to modern-day consumers seeking cost-effective and innovative lighting solutions.

Report Scope

Report Features Description Market Value (2023) USD 16.8 Billion Forecast Revenue (2033) USD 112.2 Billion CAGR (2024-2033) 21.50% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware, Software, Services), By Communication Technology (Wired , Wireless), By Light Source (LED Lamps, Fluorescent Lamps, Compact Fluorescent Lamps (CFL), High-Intensity Discharge (HID) Lamps), By End User (Indoor, Outdoor, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Honeywell International Inc., OSRAM Licht AG, Wipro Lighting, Acuity Brands Inc., Zumtobel Group AG, Legrand S.A., Philips Hue, Lutron Electronics Co. Inc., Schneider Electric SE, Hubbell Incorporated, Cree Inc., Bridgelux Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Honeywell International Inc.

- OSRAM Licht AG

- Wipro Lighting

- Acuity Brands Inc.

- Zumtobel Group AG

- Legrand S.A.

- Philips Hue

- Lutron Electronics Co. Inc.

- Schneider Electric SE

- Hubbell Incorporated

- Cree Inc.

- Bridgelux Inc.