Global Plant-Based Meat Market By Source (Soy, Pea, Wheat, Blends, Other Sources), By Meat Type (Chicken, Pork, Beef, Fish, Other Meat Types), By Product Type (Burger Patties, Sausages, Strips and Nuggets, Meatballs, Other Product Types), By Storage (Refrigerated, Frozen, Shelf-Stable), By End-User (HoReCa, Food Industry, Households), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

-

51514

-

February 2025

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

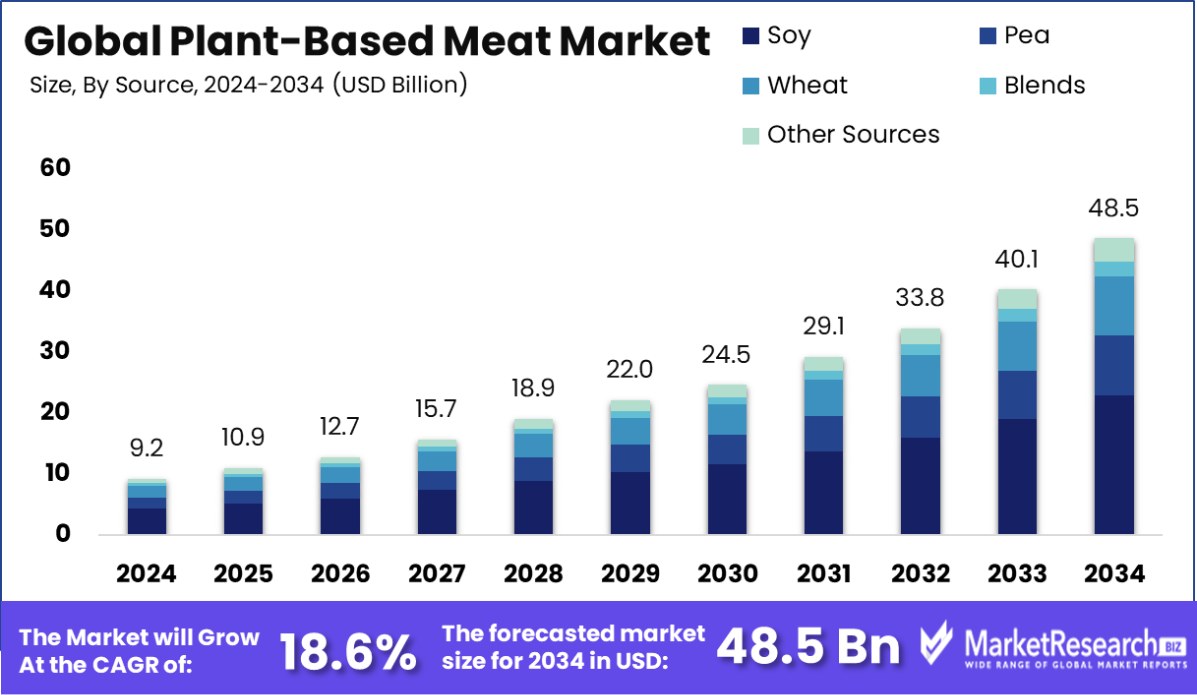

Global Plant-Based Meat Market was valued at USD 48.5 billion in 2024. It is expected to reach USD 9.2 billion by 2034, with a CAGR of 18.6% during the forecast period from 2025 to 2034. North America dominates the Plant-Based Meat Market, with a 39.5% share, USD 19.15 billion.

Plant-based meat is a type of food product designed to mimic the taste, texture, and appearance of animal meat but is made from plant-derived ingredients. These products are typically created using proteins extracted from peas, soybeans, mushrooms, and other vegetables. They offer a sustainable alternative to conventional meat, catering to vegetarians, vegans, and those reducing meat consumption due to health or environmental concerns.

The plant-based meat market refers to the commercial industry involved in producing and distributing meat alternatives. This sector has seen substantial growth as consumer preferences shift towards more ethical and environmentally friendly eating habits. Innovations in food technology and increased awareness of the health benefits associated with plant-based diets are driving the expansion of this market.

One significant growth factor in the plant-based meat market is the rising awareness of the environmental impact of traditional meat production, which has led consumers to seek more sustainable options. Additionally, health concerns related to red and processed meats are prompting people to explore plant-based proteins, which are often lower in calories and fats and free from antibiotics and hormones found in conventional meat.

Demand for plant-based meat is being fueled by the growing number of consumers adopting vegan and vegetarian lifestyles. Younger generations, in particular, are keen on plant-based diets, supported by a surge in animal welfare activism and a better understanding of the health implications associated with meat consumption.

The market is ripe with opportunities, especially in developing new flavors and textures that more closely resemble those of real meat, catering to meat-eaters who are not ready to compromise on taste. The increasing availability of plant-based meats in fast-food chains and restaurants, along with innovations in product variety, such as plant-based fish and poultry, are creating more entry points for consumers to try these products.

In 2024, the Plant-Based Meat Market continues to attract significant investment, with companies like Tender Food Inc. securing over $11 million in Series A funding to scale up production of its plant-based meat alternatives. This funding will enable the startup to enhance its product offerings and expand its market presence.

Similarly, Paleo, a Belgian precision fermentation company, raised €12 million in Series A funding to scale up production of key ingredients for plant-based meat and fish alternatives. These investments highlight the growing confidence in the sector's future potential.

Key Takeaways

- Global Plant-Based Meat Market was valued at USD 48.5 billion in 2024. It is expected to reach USD 9.2 billion by 2034, with a CAGR of 18.6% during the forecast period from 2025 to 2034.

- Soy leads the plant-based meat market, accounting for 47.2% of its product source.

- Chicken-style plant-based meats dominate, capturing 35.2% of the market by meat type.

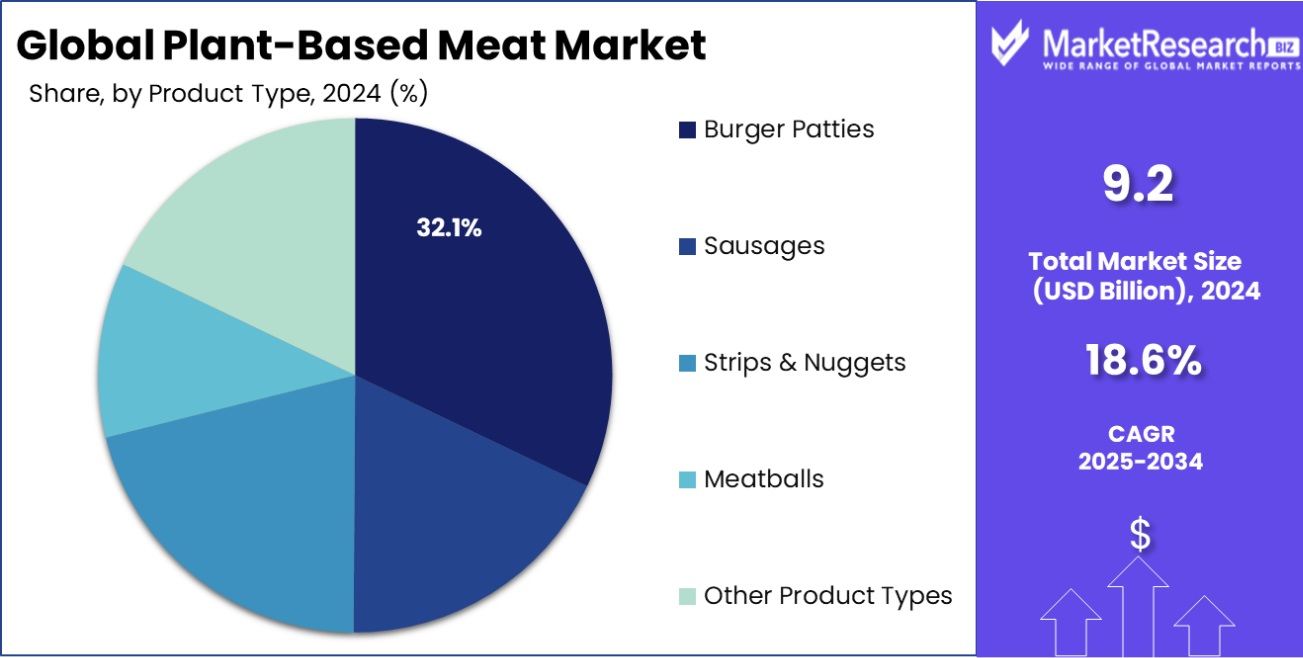

- Burger patties are a popular choice, representing 32.1% of the product type segment.

- The majority of plant-based meats are sold frozen, comprising 55.3% of storage types.

- The HoReCa sector is the largest end-user, consuming 59.2% of plant-based meats.

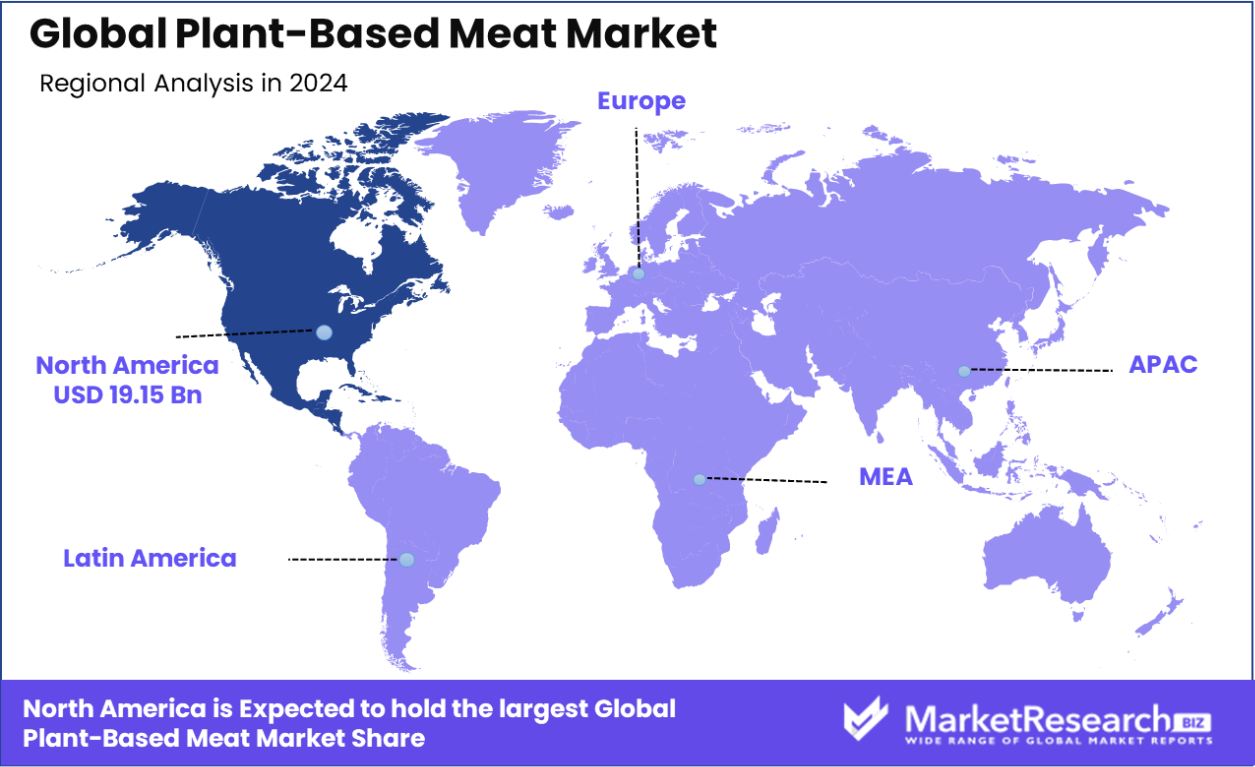

- In 2024, North America dominated the Plant-Based Meat Market with a 39.5% share, valued at USD 19.15 billion.

By Source Analysis

Soy dominates, holding 47.2% of the plant-based meat market.

In 2024, Soy held a dominant market position in the By Source segment of the Plant-Based Meat Market, with a 49.2% share. Soy-based products have established themselves as a preferred choice due to their high protein content and versatility in mimicking the texture and flavor of meat.

This source is widely used in plant-based meat alternatives, ranging from burgers to sausages, and is particularly favored for its ability to deliver a complete amino acid profile, making it an attractive option for health-conscious consumers.

The growing demand for plant-based diets and sustainable alternatives to animal-based protein has significantly contributed to soy’s strong performance in the market. Furthermore, soybeans are readily available, cost-effective, and have a long history of use in food production, further solidifying soy's dominance in the segment.

Additionally, increasing awareness about the environmental benefits of plant-based diets, along with continuous innovations in processing techniques to improve taste and texture, has fostered the expansion of soy-based meat substitutes. However, potential challenges, such as concerns over allergies and genetic modification of soy, may influence market dynamics in the coming years.

By Meat Type Analysis

Plant-based chicken captures 35.2% market share, popular among consumers.

In 2024, Chicken held a dominant market position in the By Meat Type segment of the Plant-Based Meat Market, with a 35.2% share. The preference for plant-based chicken alternatives has surged due to increasing consumer demand for products that closely replicate the texture and flavor of traditional poultry. These plant-based chicken alternatives cater to a growing number of consumers transitioning to plant-based diets or seeking sustainable protein options.

The dominance of plant-based chicken is driven by its broad appeal across various demographics, particularly in North America and Europe, where chicken is a staple protein in many diets. Additionally, innovations in plant-based formulations, including the use of pea protein and other plant-derived ingredients, have significantly improved the taste, texture, and overall sensory experience of plant-based chicken protein products.

Market players have also focused on diversifying product offerings, including ready-to-eat meals, chicken nuggets, and strips, to cater to a variety of consumer preferences. As the plant-based meat sector continues to expand, the demand for chicken alternatives is expected to grow, driven by increased awareness about animal welfare, environmental concerns, and health benefits associated with plant-based diets.

By Product Type Analysis

Burger patties account for 32.1% of the plant-based product types.

In 2024, Burger Patties held a dominant market position in the By Product Type segment of the Plant-Based Meat Market, with a 32.1% share. Plant-based burger patties have become one of the most popular product categories, driven by increasing consumer demand for convenient, meat-like alternatives that cater to both vegetarians and flexitarians.

The ability to closely replicate the taste, texture, and overall eating experience of traditional beef burgers has made plant-based burger patties a key offering in the plant-based meat sector.

The growth of this product segment is fueled by several factors, including the rise of fast-casual dining and quick-service restaurants offering plant-based burger options on their menus. Additionally, the retail market has seen a significant increase in the availability of plant-based burger patties, with leading brands expanding their product lines to meet consumer preferences for plant-based foods.

Moreover, plant-based burger patties are often marketed as healthier and more sustainable alternatives to meat, aligning with growing concerns about health, animal welfare, and environmental sustainability. As innovation in plant-based meat continues to progress, the segment is expected to remain a dominant force, attracting new consumers and further solidifying its position in the broader plant-based meat market.

By Storage Analysis

The majority, 55.3%, prefer their plant-based meats stored frozen

In 2024, Frozen held a dominant market position in the By Storage segment of the Plant-Based Meat Market, with a 55.3% share. Frozen plant-based meat products have become increasingly popular due to their convenience, extended shelf life, and ability to maintain product quality over time. The demand for frozen options has been particularly strong in retail environments, where consumers value the ability to store products for longer periods, reducing the need for frequent purchases.

The frozen segment benefits from its alignment with the growing trend of at-home meal preparation, as well as the expansion of frozen food aisles in supermarkets. This trend is driven by the increasing availability of frozen plant-based meat options, such as burger patties, nuggets, and meatballs, which are easy to store and prepare. Additionally, frozen plant-based meat products often provide better value for consumers, as they tend to be more affordable compared to fresh alternatives.

Frozen products also offer flexibility in meal planning, which appeals to busy consumers seeking nutritious and sustainable options. As consumer awareness of the environmental and health benefits of plant-based diets continues to rise, the frozen segment is expected to retain its strong market position and experience sustained growth in the coming years.

By End-User Analysis

HoReCa leads usage, with 59.2% opting for plant-based options.

In 2024, HoReCa (Hotel, Restaurant, and Catering) held a dominant market position in the By End-User segment of the Plant-Based Meat Market, with a 59.2% share. The HoReCa sector has seen significant adoption of plant-based meat alternatives, driven by increasing consumer demand for diverse and sustainable menu options.

Restaurants, hotels, and catering services have been quick to integrate plant-based dishes into their offerings, responding to the rising trend of plant-based diets and flexitarian consumption.

The HoReCa industry's dominance in this segment can be attributed to its ability to influence consumer eating habits and preferences on a large scale. Many food service providers are incorporating plant-based meats to cater to health-conscious consumers, those with dietary restrictions, and individuals seeking more sustainable food options. The growing availability of plant-based substitutes for popular dishes such as burgers, sausages, and tacos has also fueled this trend.

Moreover, as sustainability and ethical concerns become increasingly important to consumers, the HoReCa sector has embraced plant-based offerings as part of its corporate responsibility strategies. As demand for plant-based foods continues to rise globally, the HoReCa segment is expected to maintain a dominant position, driving growth in the plant-based meat market and contributing to its long-term expansion.

Key Market Segments

By Source

- Soy

- Pea

- Wheat

- Blends

- Other Sources

By Meat Type

- Chicken

- Pork

- Beef

- Fish

- Other Meat Types

By Product Type

- Burger Patties

- Sausages

- Strips & Nuggets

- Meatballs

- Other Product Types

By Storage

- Refrigerated

- Frozen

- Shelf-Stable

By End-User

- HoReCa

- Food Industry

- Households

Driving Factors

Rising Consumer Demand for Healthier Diets

One of the key driving factors behind the growth of the plant-based meat market is the increasing consumer demand for healthier diets. As awareness about the health risks associated with traditional meat consumption grows, more people are turning to plant-based alternatives.

Consumers are becoming more conscious of the benefits of plant-based proteins, such as lower cholesterol levels, reduced risk of heart disease, and overall better nutrition. This trend is particularly strong among health-conscious individuals and those looking to reduce their intake of saturated fats and processed meats.

The rise of flexitarian diets, where individuals reduce meat consumption but do not eliminate it entirely, has significantly boosted the demand for plant-based meat products. This factor is expected to drive continuous growth in the market.

Restraining Factors

High Cost of Plant-Based Meat Products

A major restraining factor in the plant-based meat market is the higher cost compared to traditional meat products. Plant-based meats often involve expensive ingredients, specialized processing, and research and development to achieve the desired taste and texture, which increases the overall production cost.

This higher price point makes plant-based meat alternatives less affordable for a significant portion of consumers, especially in price-sensitive markets.

While the cost of plant-based products has been decreasing over time due to improved production efficiency, the price gap between plant-based and conventional meats still remains substantial in many regions. Until production costs continue to fall and price parity is achieved, this will continue to be a barrier to mass adoption and broader market penetration.

Growth Opportunity

Expanding Retail Availability of Plant-Based Products

A significant growth opportunity for the plant-based meat market lies in expanding the availability of these products in retail outlets. As consumer demand for plant-based alternatives continues to rise, the increase in the number of supermarkets, grocery stores, and convenience stores carrying plant-based meat options will play a crucial role in market growth. Expanding product availability in both physical and online retail channels makes plant-based options more accessible to a broader audience.

Additionally, offering a wider variety of plant-based meats, from burgers to sausages, at competitive prices will help meet the growing interest from both health-conscious and environmentally aware consumers. This retail expansion could lead to a broader adoption of plant-based meats, boosting market penetration and overall sales.

Latest Trends

Innovative Product Development in Plant-Based Meats

A notable trend in the plant-based meat market is the ongoing innovation in product development to improve taste, texture, and nutritional value. Companies are increasingly focusing on creating plant-based meats that closely resemble the taste and mouthfeel of traditional animal-based meats.

This includes innovations such as the use of pea protein, mung beans, and other plant sources that mimic the texture of chicken, beef, and pork. Additionally, new formulations are focusing on enhancing the nutritional profile, making products richer in protein, fiber, and vitamins while reducing sodium and unhealthy fats.

These innovations cater to both vegetarians and flexitarians who want an alternative that satisfies their craving for familiar flavors and textures. This trend is expected to drive growth by attracting a wider range of consumers.

Regional Analysis

In 2024, North America held 39.5% of the Plant-Based Meat Market, valued at USD 19.15 billion.

In 2024, North America held a dominant position in the global Plant-Based Meat Market, with a market share of 39.5%, valued at USD 19.15 billion. This region is driven by high consumer demand for plant-based alternatives, especially in the U.S., where awareness about health, sustainability, and animal welfare is on the rise. Significant investments by leading plant-based brands and a broadening retail presence have fueled this growth.

Europe follows as a strong market, holding a substantial share due to increasing consumer preference for sustainable and ethical food sources. The European market benefits from supportive government policies promoting plant-based diets and environmentally friendly practices.

In Asia Pacific, rapid urbanization and rising disposable incomes are contributing to increased demand for plant-based products. Countries like China and India are emerging as key markets, though they are still in the early stages of adopting plant-based meats.

Middle East & Africa show a growing interest in plant-based options, driven by rising health awareness and increasing vegetarian populations, although market penetration remains lower compared to other regions.

Latin America is witnessing gradual market expansion, with Brazil and Argentina showing early signs of adoption, driven by a young, health-conscious population. However, the region still represents a smaller share of the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Plant-Based Meat Market continues to witness intense competition, with a diverse set of key players driving innovation, market penetration, and consumer adoption. Beyond Meat Inc. and Impossible Foods Inc. remain at the forefront, capitalizing on their strong brand presence and innovative product offerings.

Both companies have significantly influenced the market with their meat-like products, leveraging technologies that replicate the texture, taste, and appearance of animal meat, thus appealing to a wide consumer base, including both vegans and flexitarians.

Maple Leaf Foods Inc. and Conagra Inc., with their extensive product lines and established distribution channels, are making significant strides in the plant-based segment, increasing accessibility through retail and foodservice channels. Similarly, Kellogg NA Co. has been enhancing its portfolio by introducing plant-based products, further expanding its reach among health-conscious consumers.

Vegetarian Butcher and Tofurky focus on premium, ethical offerings, establishing strong relationships with consumers who prioritize sustainability and animal welfare. Meanwhile, Amy’s Kitchen Inc. and Lightlife Foods Inc. continue to provide a diverse range of organic and plant-based foods that cater to both niche and mass-market audiences.

Other emerging players like No Evil Foods, Gold&Green Foods Ltd., and Ojah B.V. are also gaining traction, particularly with products that emphasize clean ingredients and innovative production methods. Eat Just Inc., known for its plant-based egg products, is also contributing to the expansion of plant-based protein alternatives, further diversifying the market.

Top Key Players in the Market

- Beyond Meat Inc.

- Impossible Foods Inc.

- Maple Leaf Foods Inc.

- Vegetarian Butcher

- Conagra Inc.

- Kellogg NA Co.

- Marlow Foods Ltd.

- Amy’s Kitchen Inc.

- Lightlife Foods Inc.

- Trader Joe’s

- The Hain-Celestial Canada ULC

- Marlow Foods Ltd.

- Tofurky

- Gold&Green Foods Ltd.

- Praeger’s Sensible Foods

- VBites Foods Ltd.

- LikeMeat GmbH

- Ojah B.V.

- Eat Just Inc.

- No Evil Foods

- Other Key Players

Recent Developments

- In 2024, Mars announced its acquisition of Kellanova for $35.9 billion, aiming to expand its global snacking business. This move integrates popular brands like Pringles® and Cheez-It® into Mars' portfolio, supporting future growth and aligning with consumer trends toward health and wellness.

- In 2023, Marlow Foods, owner of Quorn, faced a £63 million loss due to declining demand and rising costs. Retail sales dropped by 8.6%, resulting in job cuts. Despite these challenges, Quorn remains competitive through product innovations like its snacking range.

Report Scope

Report Features Description Market Value (2024) USD 9.2 Billion Forecast Revenue (2034) USD 48.5 Billion CAGR (2025-2034) 18.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source (Soy, Pea, Wheat, Blends, Other Sources), By Meat Type (Chicken, Pork, Beef, Fish, Other Meat Types), By Product Type (Burger Patties, Sausages, Strips & Nuggets, Meatballs, Other Product Types), By Storage (Refrigerated, Frozen, Shelf-Stable), By End-User (HoReCa, Food Industry, Households) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Beyond Meat Inc., Impossible Foods Inc., Maple Leaf Foods Inc., Vegetarian Butcher, Conagra Inc., Kellogg NA Co., Marlow Foods Ltd., Amy’s Kitchen Inc., Lightlife Foods Inc., Trader Joe’s, The Hain-Celestial Canada ULC, Marlow Foods Ltd., Tofurky, Gold&Green Foods Ltd., Praeger’s Sensible Foods, VBites Foods Ltd., LikeMeat GmbH, Ojah B.V., Eat Just Inc., No Evil Foods, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Beyond Meat Inc.

- Impossible Foods Inc.

- Maple Leaf Foods Inc.

- Vegetarian Butcher

- Conagra Inc.

- Kellogg NA Co.

- Marlow Foods Ltd.

- Amy’s Kitchen Inc.

- Lightlife Foods Inc.

- Trader Joe’s

- The Hain-Celestial Canada ULC

- Marlow Foods Ltd.

- Tofurky

- Gold&Green Foods Ltd.

- Praeger’s Sensible Foods

- VBites Foods Ltd.

- LikeMeat GmbH

- Ojah B.V.

- Eat Just Inc.

- No Evil Foods

- Other Key Players