Facade Systems Market By Type (EIFS , Curtain Walls, Siding, Cladding), By End Use (Residential , Non-residential) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43330

-

Feb 2024

-

161

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Driving Factors

- Restraining Factors

- Facade Systems Market Segmentation Analysis

- Facade Systems Industry Segments

- Growth Opportunities

- Facade Systems Market Regional Analysis

- Facade Systems Industry By Region

- Facade Systems Market Key Player Analysis

- Industry Key Players

- Facade Systems Market Recent Development

Report Overview

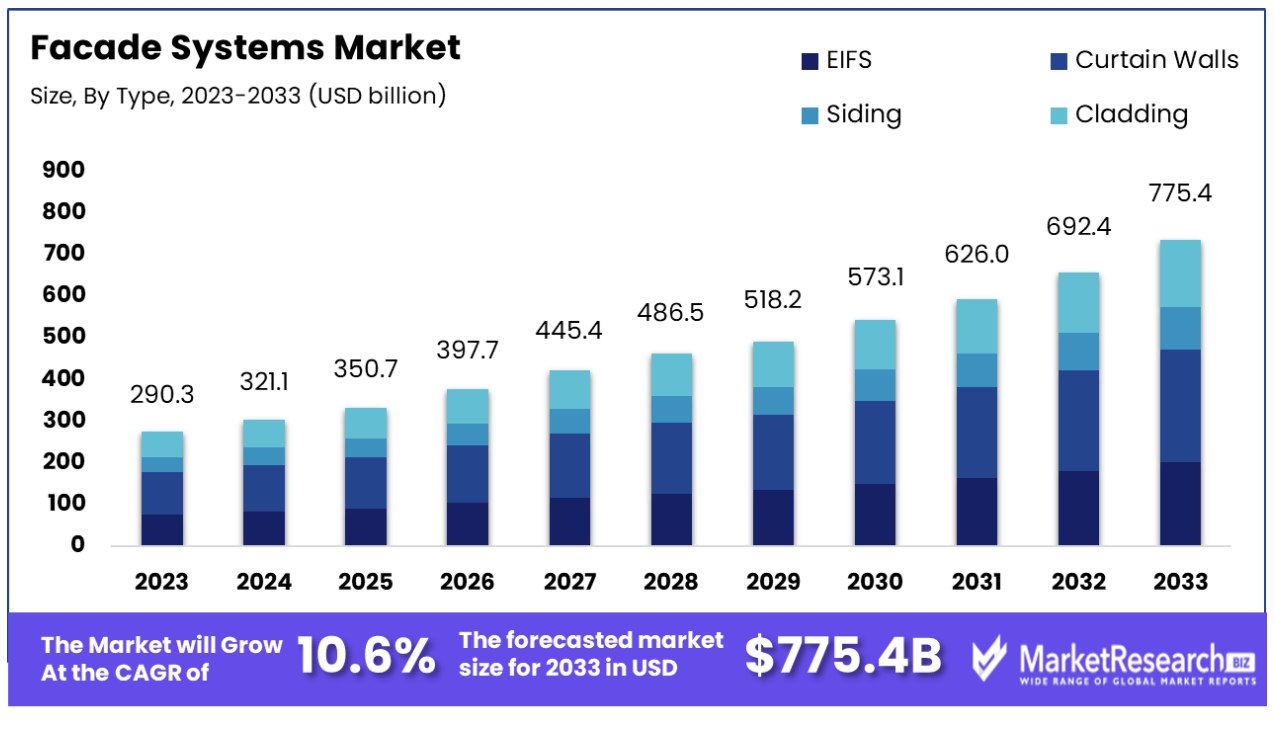

The facade system market was valued at USD 290.34 billion in 2023. It is expected to reach USD 775.4 billion by 2033, with a CAGR of 10.6% during the forecast period from 2024 to 2033.

The surge in demand in the construction sector, especially non-residential and infrastructure-related activities, and advanced technology are some of the main driving factors for the facade system market expansion. In the construction industry, facade systems play an important role. The facade system generally means the front or face of the building. An archetypal facade acts as the building’s main protection shield against the outside elements that could harm the building structure like rain, wind, sun, and moisture. It can also provide shields to the building and help to cool and settle down.

The facade system is important in light transmittance, high performance, and energy efficacy. The facade acts as an intermediate between the inside and outside but has its own unique identity. A building facade provides a chance to highlight the design. Many infrastructures meet the architectural standardizations but in return settle for the standard designs and lack identity and personality. A facade has a huge role in this as it differentiates the exceptionality to the structure which lacks something particular.

There are different types of a facade system that can be used in modern multi-story buildings such as glass and steel facade systems, large boards comprising of an artistic and watertight covering, metallic cladding, precast concrete panels with different types of finishes, curtain wailing, brick and stonework and insulated render.

The preference for the facade system is dependent on the scale and usage of the multi-story buildings and on its local surroundings and neighbors. The facade system has several types of advantages in construction such as protecting all types of natural elements, it has enhanced its energy efficacy as it offers solar shading and passive cooling automation as well as it has good light penetration and filtrations.

Manufacturers are now opting for clay facades that are sustainable and recyclable materials that provide a variety of options with environmental and unique advantages. These are eco-friendly and tough modern facades which improves the values and design structure of the building. It also provides a sleek look and also offers many benefits over the other facade materials such as glass and metal.

The demand for the facade system will rapidly expand due to its high-end requirement in the construction of non-residential buildings and other infrastructure works that will help contribute to market expansion in the forecast period.

Driving Factors

Aesthetic Appeal Elevates Facade Market

The demand for protective wall systems that secure and aesthetically enhance buildings is a substantial driver for the facade systems market. As architectural designs evolve, there's an increasing trend to merge form with function, making facades critical in defining a building's character while ensuring durability and safety.

This demand is not just a reflection of modern design trends but a deeper recognition of the role aesthetics play in real estate value and occupant satisfaction. As architects and developers continue to innovate, the push for more creative and diverse facade solutions is expected to grow, further stimulating market expansion.

Energy Efficiency Energizes Market Growth

The increasing emphasis on energy efficiency is significantly propelling the facade systems market. Advanced technologies, especially glass facades, are being leveraged to reduce energy consumption by controlling heat and light entry. This is particularly crucial in non-residential buildings where energy costs and environmental impact are a major concern.

As more buildings aim to meet green certification standards and reduce operational costs, the demand for energy-efficient facade systems is expected to surge. This trend is not just a response to immediate energy costs but part of a broader shift towards sustainability in construction, suggesting enduring market growth as energy efficiency becomes a standard demand in building design.

Sustainability Shapes Market Trends

As environmental concerns become central to construction practices, there's a notable shift towards materials and designs that minimize ecological impact. This includes the use of recycled materials, systems that contribute to lower energy consumption, and designs that integrate with natural elements.

This shift is driven by not only regulatory pressures and incentives but also a changing ethos among builders and occupants who prioritize sustainability. As the construction industry continues to evolve with these environmental considerations, the facade systems market is expected to adapt and grow, offering more green solutions to meet this rising demand.

Restraining Factors

Stringent Government Regulations Challenge Facade Systems Market

Stringent government regulations can pose a significant challenge to the facade systems market, particularly in regions with complex regulatory environments. compliance with building codes, safety standards, and environmental regulations requires facade systems to meet strict criteria, which can vary significantly between regions and over time.

Navigating this complex regulatory landscape can be costly and time-consuming, potentially delaying project timelines and increasing costs. Manufacturers and builders may find it challenging to adapt quickly to new or updated regulations, which can limit the market's ability to innovate and respond to changing demands.

The high cost of Raw Materials Limits Facade Systems Market Expansion

The high cost of raw materials, such as glass, metal, and concrete, required for making facade systems can restrain market growth. These materials are fundamental components of facade systems, and their prices can fluctuate due to various factors, including supply chain disruptions, trade policies, and global market dynamics.

When raw material costs rise, the overall cost of facade systems increases, potentially making them less competitive against alternative construction methods. For cost-sensitive projects, the increased expense can be a significant deterrent, limiting the market's potential to attract new customers and expand into new areas.

Facade Systems Market Segmentation Analysis

By Type Analysis

In the facade systems market, Exterior Insulation and Finish Systems (EIFS) emerge as the dominant segment. This preference is largely due to WIFE's excellent thermal insulation properties, versatility, and aesthetic appeal. They provide an energy-efficient solution for building exteriors, reducing heating and cooling costs while offering a range of textures and colors for design flexibility. EIFS are particularly popular in regions with extreme temperature variations, contributing to their widespread adoption.

While EIFS leads the market due to their energy efficiency and design versatility, other types like curtain Walls, Siding, and cladding also hold significant positions. Curtain walls are chosen for their ability to provide sleek, modern exteriors with large glass panels, allowing natural light while offering protection against the elements. Siding is popular in residential constructions for its aesthetic and protective qualities, and cladding is used in both residential and commercial buildings for added insulation and visual appeal.

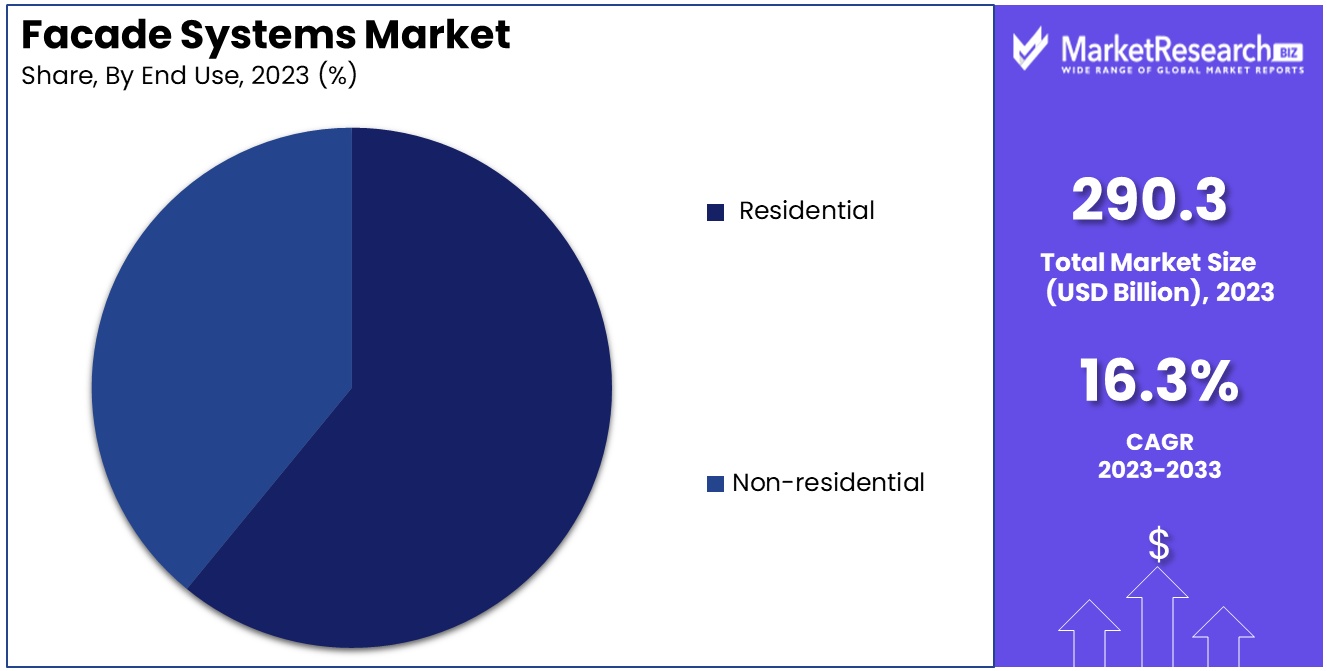

By End-Use Analysis

The Residential sector is the dominant end-use segment in the facade systems market. The growing demand for residential buildings, driven by urbanization and population growth, fuels the need for facade systems that provide aesthetic appeal and energy efficiency. Homeowners and builders often prefer facade systems that not only enhance the building's appearance but also offer insulation, durability, and low maintenance.

While the Residential sector leads, the Non-residential sector, including commercial and industrial buildings, also significantly utilizes facade systems. In these sectors, facade systems are crucial for defining the building's aesthetic, brand identity, and energy efficiency. commercial buildings, in particular, invest in high-quality facade systems to create iconic structures that stand out, while industrial buildings use them for practical purposes like weather protection and insulation.

Facade Systems Industry Segments

By Type

- EIFS

- Curtain Walls

- Siding

- Cladding

By End Use

- Residential

- Non-residential

Growth Opportunities

Energy-Efficient Facade Systems Propel Market Growth in Non-Residential Buildings

The increasing demand for energy-efficient facade systems is a significant factor driving market growth, particularly in non-residential buildings. As energy conservation becomes a priority for commercial and industrial structures, there's a growing need for facade systems that minimize heat loss and reduce cooling costs. Energy-efficient facades, with improved insulation and solar control, are becoming essential in modern building designs. This trend reflects a substantial growth opportunity for the facade systems market, driven by the need for buildings that combine aesthetic appeal with energy performance.

Rising Demand for Aesthetic Protective Wall Systems Drives Market Growth

Facade systems play an integral part in creating buildings' aesthetic appeal while offering protection from environmental factors. Their demand is expected to spur market expansion. Market demand is steadily rising for facade systems that combine durability, weather resistance, and design flexibility into one package. Architectural trends continue to shift and place an increasing emphasis on building aesthetics, presenting facade systems that deliver both functional performance and visual impact with great potential. consumers seek out products that will distinguish their buildings while providing necessary protection. This trend is driving market demand.

Facade Systems Market Regional Analysis

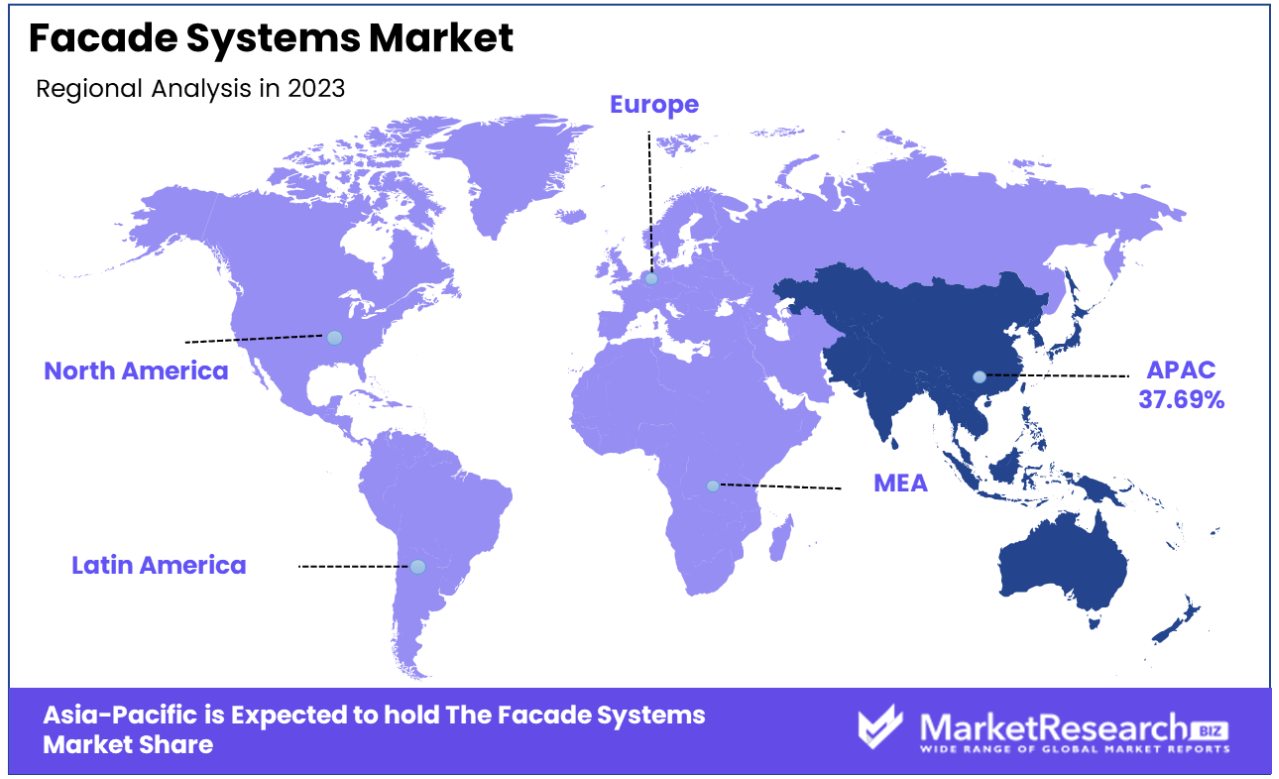

Asia Pacific Dominates with 37.69% Market Share in Facade Systems Market

Asia-Pacific's substantial 37.69% share of the facade systems market is driven by the region's rapid urbanization, burgeoning construction industry, and increasing emphasis on modern infrastructure. countries like China, India, and Japan are witnessing significant investments in both commercial and residential construction projects, which demand advanced facade systems for aesthetic appeal and energy efficiency. Additionally, the availability of raw materials and cost-effective labor makes Asia-Pacific an attractive hub for facade system manufacturers.

Looking ahead, the facade systems market in Asia-Pacific is expected to continue its growth trajectory. The ongoing urban development, coupled with the increasing awareness of building aesthetics and energy efficiency, is likely to drive further market expansion. Asia-Pacific's commitment to creating eco-friendly cities, along with ongoing innovations in facade materials and designs, should allow it to remain the leader of the global facade systems market.

North America: Technological Advancements and Energy Efficiency Focus

North America's facade systems market is driven by technological innovations and an emphasis on energy efficiency. Stringent building codes and demand for green construction support the adoption of cutting-edge facade systems. The well-established construction sector and the presence of leading facade system manufacturers contribute to market growth.

Europe: Stringent Regulations and Architectural Heritage

Europe’s facade systems market is characterized by stringent regulations regarding building energy efficiency and a rich architectural heritage. The region's focus on preserving historical aesthetics while integrating modern facade solutions drives the demand for advanced systems. European commitments to environmental sustainability and the increase in renovation activities on an aging building stock provide substantial opportunities for the facade systems market. An emphasis on quality and durability in construction materials also facilitates market development.

Facade Systems Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Facade Systems Market Key Player Analysis

Facade Systems Market companies play an essential role in modern construction and architectural aesthetics, pioneering innovation and setting industry trends. AGc Inc. and Saint Gobain are leaders in providing high-quality materials like glass and cladding, known for their commitment to sustainability and energy efficiency. Their strategic positioning emphasizes advanced materials and design solutions, significantly influencing architectural trends and building standards.

Knauf and Kingspan Group plc are key players with a strong focus on insulation and energy-efficient facade systems, reflecting the industry's shift towards more sustainable and performance-oriented building envelopes. Louisiana-Pacific Corporation and Rock Panel Group, recognized for their innovative siding and cladding products, contribute to the market with a focus on durability and aesthetic versatility.

Bouygues and Skanska, with their extensive construction expertise, are pivotal in integrating facade systems into large-scale projects, showcasing the industry's potential for comprehensive and customized building solutions. Enclose and National Enclosure Company LLC which specializes in facade design and engineering plays crucial roles in advancing facade technology and implementation.

Industry Key Players

- AGC Inc. (Japan)

- Saint Gobain (France)

- Knauf (Germany)

- Kingspan Group plc (Ireland)

- Louisiana-Pacific Corporation (US)

- Rock Panel Group (Netherlands)

- Bouygues (France)

- Enclose (US)

- Apple (US)

- Hansen Group (US)

- Hochstein (Germany)

- National Enclosure Company LLC (US)

- Schuck International (OTTO FUCHS KG) (US)

- Skanska (Sweden)

Facade Systems Market Recent Development

- In October 2023 Kingspan Group plc acquired the CALOSTAT(r) brand of high-performance insulation boards from German specialty chemicals company Evonik Industries AG

- In September 2023 AGC Inc. announced that by the year 2022, it will be able to develop a range of float glass with a significant reduction in carbon footprint, which is less than 7kg of CO2 per square meter in clear glass (4 millimeters thickness).

- In September 2023 Saint Gobain announced a strategic alliance with a European solar producer. The partnership will allow Saint-Gobain to broaden its sustainability solutions for facades and become the top provider of BIPV facade solutions across Europe.Report Scope

Report Features Description Market Value (2023) USD 290.34 Billion Forecast Revenue (2033) USD 775.4 Billion CAGR (2024-2032) 10.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(EIFS , Curtain Walls, Siding, Cladding), By End Use(Residential , Non-residential) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape AGC Inc., Saint Gobain, Knauf, Kingspan Group plc, Louisiana-Pacific Corporation, Rock Panel Group, Bouygues, Enclose, Apple, Hansen Group, Hochstein, National Enclosure Company LLC, Schuck International, Skanska Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- AGC Inc. (Japan)

- Saint Gobain (France)

- Knauf (Germany)

- Kingspan Group plc (Ireland)

- Louisiana-Pacific Corporation (US)

- Rock Panel Group (Netherlands)

- Bouygues (France)

- Enclose (US)

- Apple (US)

- Hansen Group (US)

- Hochstein (Germany)

- National Enclosure Company LLC (US)

- Schuck International (OTTO FUCHS KG) (US)

- Skanska (Sweden)