Care Management Solutions Market By Component (Software and Services), By Application (Disease Management, Case Management, Utilization Management, EMR Management and Others), By Deployment (On-Premise Care Management and Cloud-Based Care Management), By End-User (Payers, Providers and Others), and By Region, 2023-2032

-

41923

-

Nov 2023

-

160

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

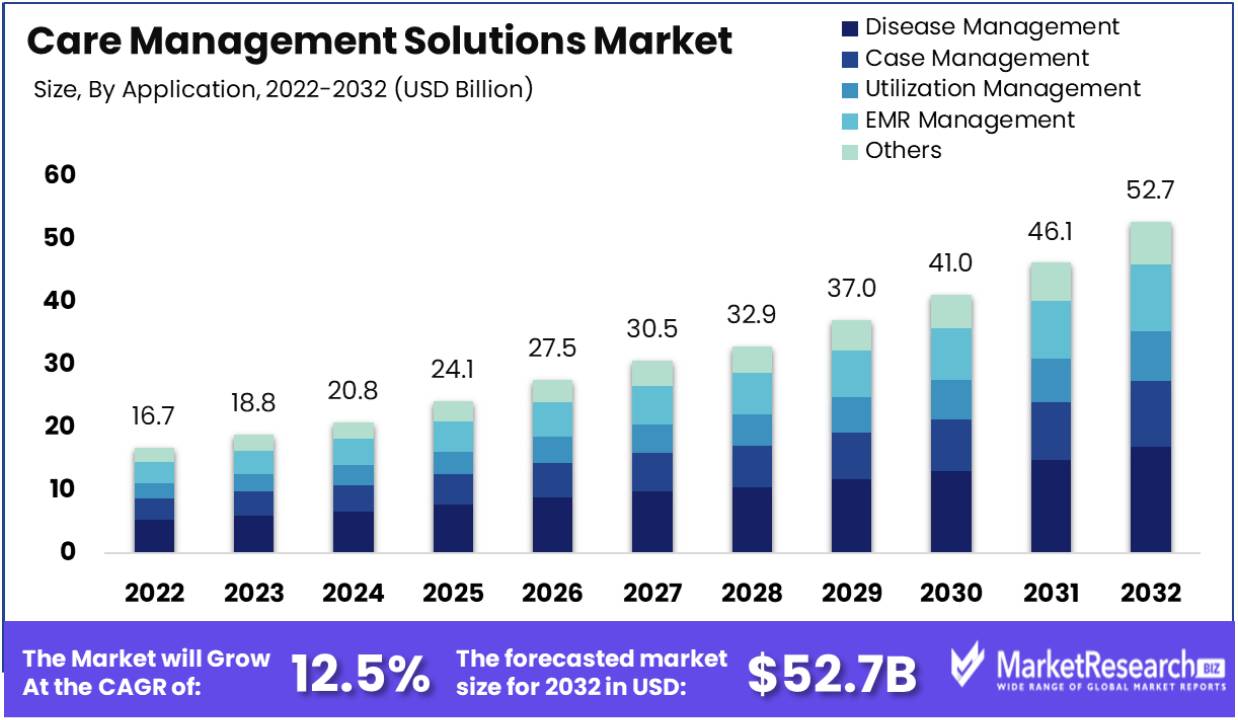

The care management solution market size was valued at USD 16.7 billion in 2022 and is expected to increase its market growth to USD 52.7 billion by 2032, exhibiting a CAGR of 12.5% during the forecast period of 2023-2032. The up surge prevalence of chronic diseases and sudden rise in adoption of electronic medical records (EMR) are the key driving market factor.

There was a substantial impact in the care management solutions market due to the high requirement to handle caregivers and patients at the time of Covid-19 pandemic. For example, as per the research conducted by the nursing open, the caregivers for the patients are important for the consent, life care and mental support. They can also transfer the virus, requiring comprehensive management encircling quality control, risk screening, endemic investigation, dual card management and pre-examination of medical insurance coverage.

However, from the above sources, the care management solution taken by the hospitals and clinics during the time of pandemic was useful in controlling the infection, and it was suggested that each hospitals should have inpatient care management platforms, as the treatment providers seek to have less interaction with the patients to enhance the health care delivery.

The care management solutions market is projected to have a surge growth due to the rising global population and the burden of chronic diseases decrease healthcare expenditure. This leads to the joint initiatives taken by the government authorities across the world-wide to have a smooth healthcare services and organization. For instance, WHO reported that more than 18 million individuals died from cardiovascular diseases with and average death rate of 32% globally.

As per these death rates majority deaths which can account around 85% are due to the heart stroke. The second leading cause for death is cancer. The cancer incidence that has the global impact has estimated that more than 19.3 million have been detected with cancer, as per GLOBOCAN. Thus, the increasing pervasiveness of cardiovascular diseases, cancer and other chronic diseases is projected to fuel the care management solution market during the forecasted period.

In addition, the older population, the rise in chronic disease rates and rising demand of patient-centric services by healthcare experts are all the major factors that contributes to the market growth for care management solutions. Over the time during this forecast period, there will new opportunities which will be add-on to the care management solutions market by improves IT solutions advancements and big data competences.

Driving Factors

Sudden Rise in Chronic Diseases Among the Older Population

The high demand for quality care for the older population, the prevalence of chronic diseases in elder age is the main cause for the growth of the care management solutions market. Change in lifestyle and restricted access towards the preventive care like cardio disease, cancer, heart stroke and respiratory related diseases are often common.

New Initiatives to Less Chance of Risk from Healthcare Payers to Treatment Providers

Many new initiatives have been taken and embedded to transfer the risk from healthcare payers to treatment provider. In order to enhance the effectiveness of the healthcare provision and substantial decline on unnecessary spending, this transmits promotes the adaption of new healthcare information technology services, such as care management services.

There were several payment pathways like cumulative payments, doctor’s incentives and consumer’s incentives. These were used to boost valued-based care. By these process healthcare providers take the responsibility for the care they provide and the payment models that focus to transfer from payers to providers.

Technological Progression

Patient-centric treatment is the main driving factor in the healthcare industry. This driving factor is due to the growing demand of big data and its substantial impact over the industry. Care management solution has a significantly grown as a result of an elder population that is day by day increasing and the rising prevalence of chronic disease. The most effective workflow procedure is provided by such solutions that builds appealing opportunities for market participants in the chronic disease market.

The market opportunity is predicated as a result of IT progress and up surging of healthcare for the effective administration of huge quantity of information. Furthermore, care management solutions have the ability to cartel patient centric EHR information with claims-based data sources that permits the custom of analytics for clinical decision support.

Restraining Factors

Cost and Budget Restrictions

Care management solutions can include substantial upfront costs for healthcare organization. This comprises expenditure related to software acquisition, personalization, combined existing system, training and ongoing maintenance. Smaller treatment providers with limited costs may find it difficult to assign resources for such funds. Some care management solutions may come forward with subscription fees which can more strain the cost.

The ROI for cost management solutions may not be immediately apparent, making it challenging for the companies to justify the expenditures. This can be substantial restraining factor particularly for financially restricted treatment providers.

Interoperability and Integration Difficulties

Combining care management solutions with the current EHR systems, practice management tools and other healthcare organization can be difficult. Several healthcare companies have funded heavily in legacy systems and assures hassle-free interoperability with new care management solution can be very challenging.

Lack of interoperability can lead to inefficiencies, information silos and less effectiveness of care management efforts. It can also hamper the capability to share patient data across various care settings, which is important for coordinated and patient specified care. Treatment providers may be uncertain to adopt care management solutions if they antedate problems in assimilating them with their current technology stack.

By Component

Based on component, software segment holds a strong position in market share and the service segment is projected to witness the fast growing segment in this forecasted period. The software provides assistance to many functions related to care management solutions such as patient’s record and their history related to any specific diseases as well as insurance covered in the treatment procedure, e-prescriptions, diagnostic reports and others.

Additionally, the care management software can be used in several ways like when the clinics or hospitals requires an elaborated data about the patients they can access the software and collect all the required data at just one click.

By Application

The disease management segment dominates the market share and is expected to grow rapidly during the forecast period. The disease management programs are intended to enhance the health of the patients with chronic conditions and decrease the expenses related with avoidable complications by knowing and treating chronic conditions more rapidly and quickly, thereby slowing the advancement of those diseases. Additionally, disease management encourages healthy routine by aiming on preclusion such as risk factor change, hospitalization reduction, medication observance and healthcare access.

By Deployment

On-premise care management solutions hold a strong position in the market share. The market size for this segment is forecasted to increase. Additionally, cloud-based care management solutions will grow significantly in this period. A special fusion of real-time linked data and handles care best practices that is made possible by care management solutions.

Treatment providers can gain the effectiveness of patient’s health management program by using on-premise care management technologies and services. Furthermore, it is predicted that over the next coming years, the rising requirement of cloud computing in the healthcare market would gain more demand for cloud-based care management systems.

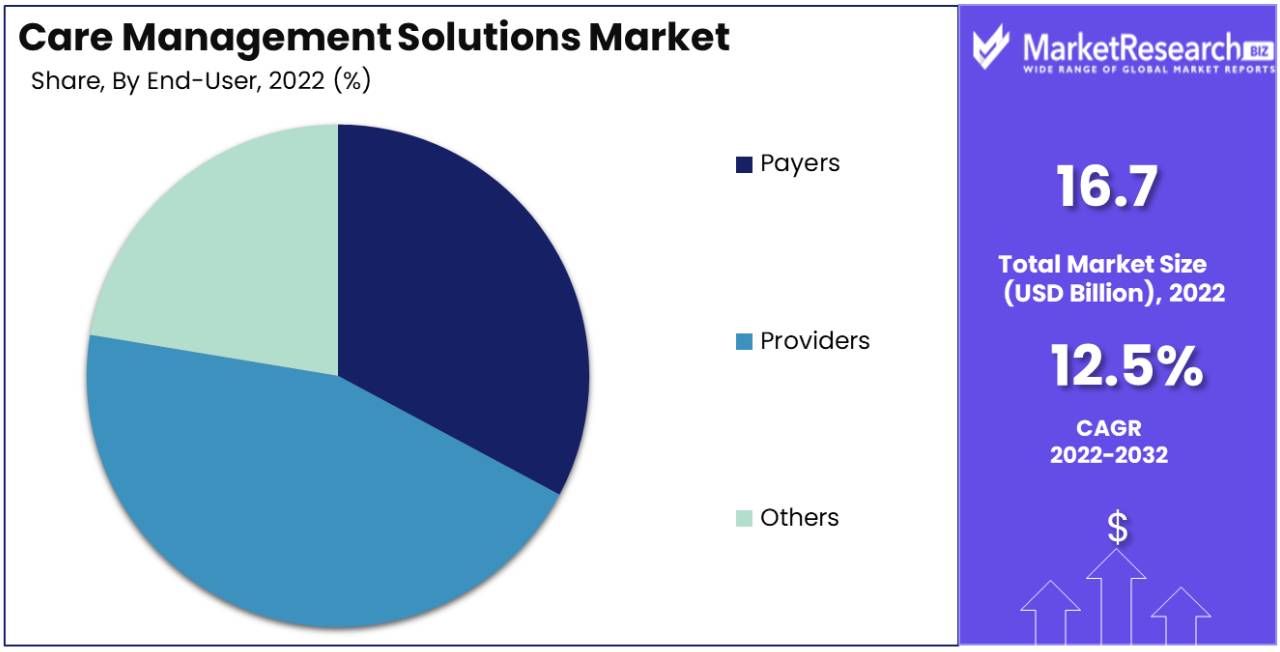

By End-User

The providers segment holds a strong position in the market share and is predicted to become one of the growing segment during the forecast period. In this segments the key players are the doctors, chiropractors, physical therapists, nurses, pharmacist, clinics and X-ray centres of treatment providers. Several treatment providers have introduced care management tools as the medical industry has shifted its focus to patients.

Key Market Segments

By Component

- Software

- Services

By Application

- Disease Management

- Case Management

- Utilization Management

- EMR Management

- Others

By Deployment

- On-Premise Care Management

- Cloud-Based Care Management

By End-User

- Payers

- Providers

- Others

Growth Opportunity

Incorporating Social Determinants of Health (SDOH)

By knowing the significance of social determinants on health results, there is a rise in prominence on integrating SDOH information into care management tactics. Solutions that can assimilate and analyse information related to several factors like housing, access to mode of transportation and economic stability permits healthcare groups to attend the wider determinants of health and give more quality care.

Information Analytics and Predictive Framework

Advanced data analytics and predictive framework are becoming more important in care management solutions. These tools help healthcare companies to identify high-rise patients, analyse potential health crisis and custom interventions to patient’s requirement. By leveraging, information-driven insights, care management programs can be more highlighted and efficient in enhancing patient results.

Patient Interactions and Self-Management Tools

Encouraging patients to take an active role in their own care is an important tool of effective care management. Services that provide patient interaction tools, like mobile applications, patient portals and educational resources that can enhance adherence to care plans and simplify better communication between patients and treatment providers. Self-management features such as medication reminders and symptom resulting contribute to better health result.

Latest Trends

Incorporation Telehealth and Remote Monitoring

The up surging expansion of telehealth services, especially with response to the Covid-19 pandemic, has developed a significant growth chance for care management solutions. Integrating telehealth abilities into care management platform allows for remote patient monitoring, remote visits and real-time communication between patients and healthcare groups. This not only enhances quality of care, especially for patients in the remote areas but also improvise the effectiveness of care management programs.

Integration of AI and ML

These two technologies are being integrated into care management solutions to improvise decision making, predictive analytics and tailored care planning. AI and ML can analyse huge quantity of individual’s information to know patterns, predict health results and advices personalized interventions.

As AI-powered algorithms can assist healthcare groups to prioritize high-risk patients, enhance care plans and extemporize resource assignments. Moreover, remote health assistants and chatbot leveraging AI can improvise patient engagement and provide 24/7 support for regular inquires.

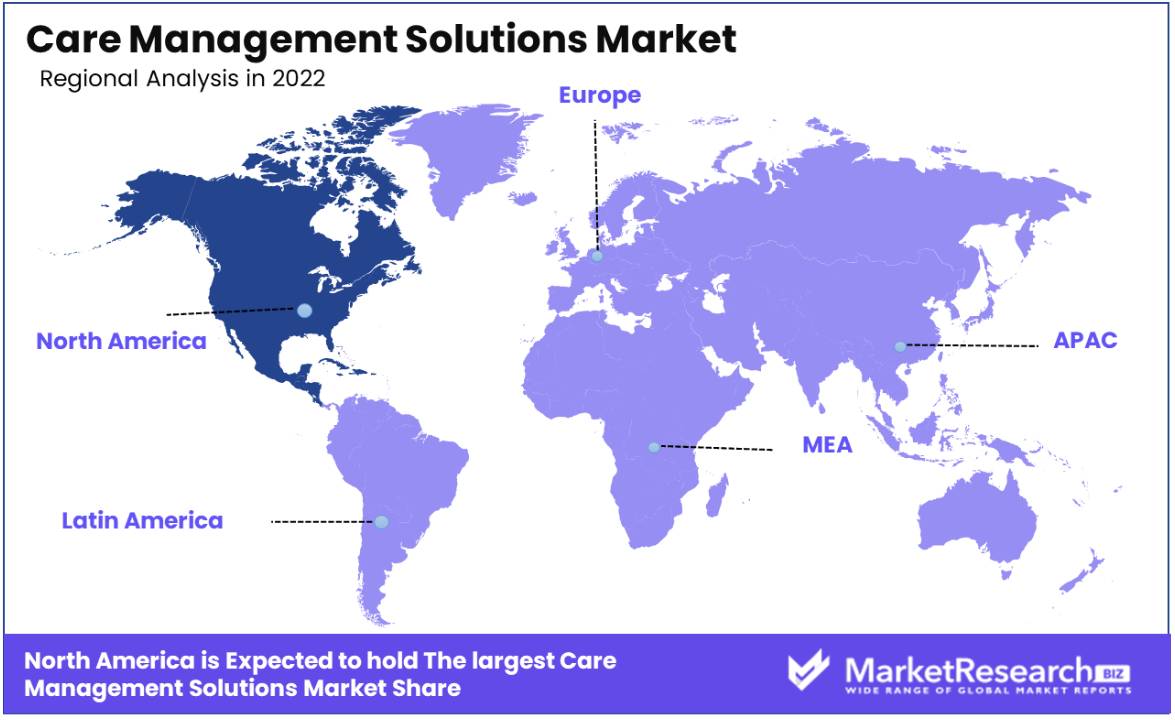

By Regional Analysis

By regional analysis, North America dominates the market segment due to the existence of major key player, requirement for patient-focused support system for handling medical situations, compatible technical and healthcare organization as well as health-tech awareness among population. Additionally, US care management solutions holds a strong position and Canada care management secures its position as the second largest market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The care management solutions market is very competitive with the market players competing to secure their market positions, collaborations and several major investments in R&D. The market is divided with the up surging competition, new product launches, rise in collaboration partnerships and other tactical decision to get operational efficiency.

Furthermore, care management solutions are differentiated by marking its presence in worldwide, catering to the increasing predominance of chronic diseases. The enhanced infrastructure and rise in adoption of care management solutions is further gaining its growth of the care management solutions market during this forecasted period.

Top Key Players in Care Management Solutions Market

- Koninklijke Philips NV (Netherlands)

- Oracle Corporation (US)

- Medecision Inc (US)

- ExlService Holdings, Inc (US)

- Zyter|Trucare (US)

- Athenahealth (US)

- ZeOmega (US)

- Epic Systems Corporation (US)

- Cognizant (US)

- Allscripts Healthcare, LLC (US)

- Salesforce, Com (US)

- Pegasystems (US)

- IBM (US)

- Casenet LLC (acquired by Zyter|Trucare) (US)

- ZeOmega (US)

- Cerner Corporation (US)

- Allscripts Healthcare Solutions (US)

Recent Developments

- In November 2023, EXL, a prominent data analytics and digital operations solutions company, proudly declared its designation as a Leader in the Everest Group Clinical and Care Management (CCM) Operations Services PEAK Matrix® Assessment 2023. This recognition underscores EXL's exemplary performance and expertise in the field of clinical and care management operations

- In October 2023, Prevounce Health, a leading provider of remote care management solutions, secured an extension of its Series A funding, totalling an impressive $7 million. This substantial infusion of capital is earmarked to bolster product development initiatives and facilitate the expansion of their team. The extension of funding underscores the robust investor confidence in the promising future of remote care solutions.

- In October 2023, Axxess and OnePoint Patient Care made a significant announcement regarding the integration of Axxess Hospice with OnePoint Patient Care's Pharmacy Benefit Management platform. This collaborative effort is poised to have far-reaching benefits, including the reduction of administrative burdens, heightened nurse satisfaction, enhanced retention rates, and ultimately, the delivery of improved patient outcomes.

- In April 2023, Accredo, a division of Evernorth, introduced a specialized care management program for rare, intricate medical conditions. The initiative's primary objective was to support members and plan sponsors in effectively navigating the expenses and intricacies associated with treatments for uncommon diseases.

- In April 2023, Medecision, a leading provider of digital care management solutions and services, unveiled the Aerial Social Care Coordinator. This innovative solution is engineered to offer health plans and healthcare providers instantaneous access to crucial information regarding individuals' social determinants of health barriers.

- In March 2023, Philips introduced Virtual Care Management, offering solutions for remote patient engagement, reducing hospital visits, and managing chronic conditions effectively.

Report Scope

Report Features Description Market Value (2022) US$ 16.7 Bn Forecast Revenue (2032) US$ 52.7 Bn CAGR (2023-2032) 12.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software and Services), By Application (Disease Management, Case Management, Utilization Management, EMR Management and Others), By Deployment (On-Premise Care Management and Cloud-Based Care Management), By End-User (Payers, Providers and Others) Regional Analysis North America – The US, Canada, Mexico, Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America, Eastern Europe – Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe, Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC, Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA Competitive Landscape Koninklijke Philips NV (Netherlands), Oracle Corporation (US), Medecision Inc (US), ExlService Holdings, Inc (US), Zyter, Inc. (US), Athenahealth (US), ZeOmega (US), Epic Systems Corporation (US), Cognizant (US), Allscripts Healthcare, LLC (US), Salesforce, Com (US), Pegasystems (US), IBM (US), Casenet LLC (US), ZeOmega (US), Cerner Corporation (US), Allscripts Healthcare Solutions (US) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Koninklijke Philips NV (Netherlands)

- Oracle Corporation (US)

- Medecision Inc (US)

- ExlService Holdings, Inc (US)

- Zyter, Inc. (US)

- Athenahealth (US)

- ZeOmega (US)

- Epic Systems Corporation (US)

- Cognizant (US)

- Allscripts Healthcare, LLC (US)

- Salesforce, Com (US)

- Pegasystems (US)

- IBM (US)

- Casenet LLC (US)

- ZeOmega (US)

- Cerner Corporation (US)

- Allscripts Healthcare Solutions (US)