Global Breakfast Cereals Market By Type (Hot Cereals, Ready-to-Eat (RTE)), By Ingredient (Corn-based Cereals, Rice-based Cereals, Wheat-based Cereals, Oat-based Cereals, Multigrain Cereals), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, E-commerce, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

-

51527

-

March 2025

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

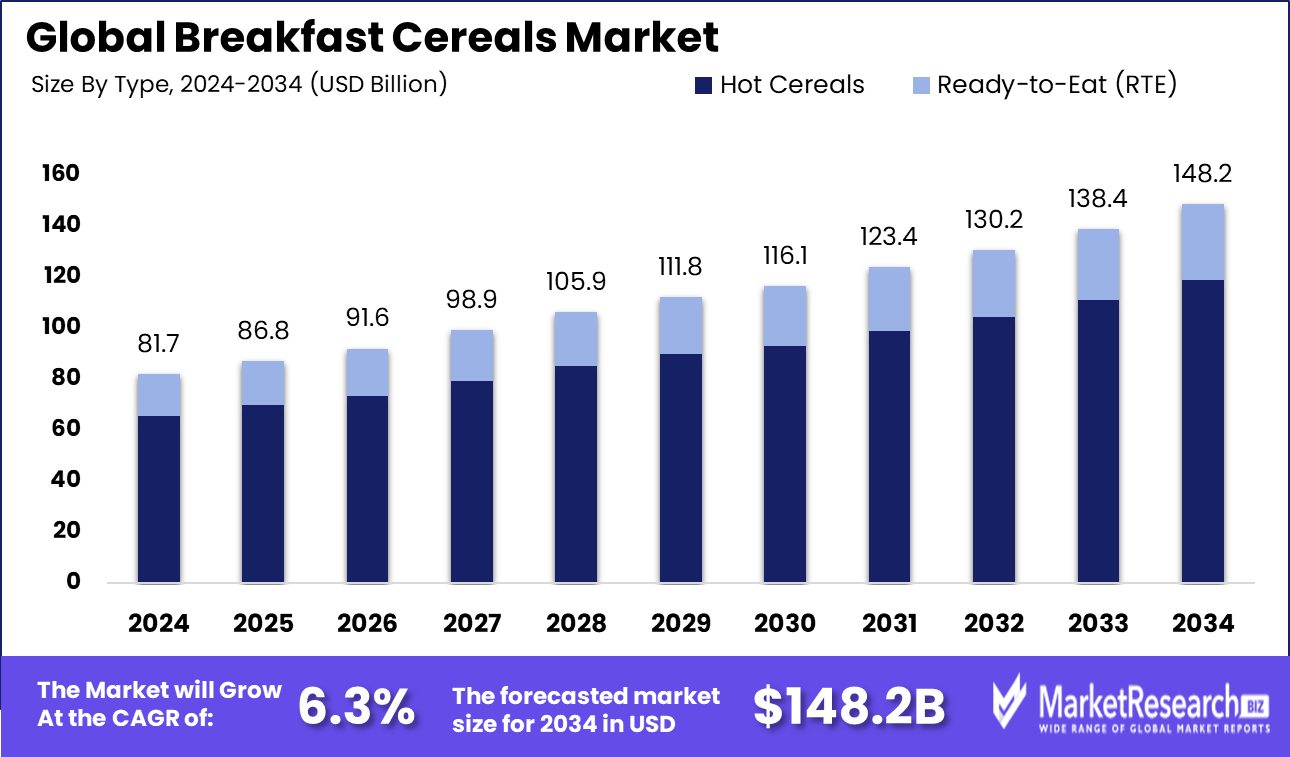

Global Breakfast Cereals Market was valued at USD 81.7 billion in 2024. It is expected to reach USD 148.2 billion by 2034, with a CAGR of 6.3% during the forecast period from 2025 to 2034. With a market value of USD 34.7 billion, North America represented 42.5% of the worldwide Breakfast Cereals Market.

Breakfast cereals are a popular food option made from processed grains and are often eaten as the first meal of the day. They come in various forms, including flakes, muesli, granola, and puffed grains, and are typically consumed with milk, yogurt, or fruit. Favored for their convenience and versatility, breakfast cereals often contain added vitamins and minerals to boost their nutritional value.

The breakfast cereals market encompasses the production, distribution, and sales of cereal products worldwide. This market caters to a diverse demographic, from children to adults, and includes a range of products from sugar-laden cereals to organic and whole-grain options aimed at health-conscious consumers. The market has seen significant growth due to changing food habits and lifestyles.

The primary growth driver for the breakfast cereals market is the increasing awareness of health and wellness among consumers. People are seeking out breakfast options that support a healthy lifestyle, which has led to a surge in demand for cereals containing whole grains, low sugar, and added nutrients. Additionally, the fast-paced lifestyle of modern consumers who prefer quick and easy meal options has also significantly contributed to the growth of this market.

Demand in the breakfast cereals market is also driven by the convenience it offers in busy lifestyles. Ready-to-eat cereals cater to consumers looking for quick, easy, and nutritious meal options. The market is also witnessing a rise in demand for gluten-free and organic cereals as consumers become more health-conscious and aware of dietary restrictions and preferences.

The breakfast cereals market holds substantial opportunities in product innovation and expansion into new geographic regions. There's potential for growth through the introduction of flavors and formulations that cater to local tastes and preferences in emerging markets. Additionally, integrating superfoods and plant-based ingredients can attract health-focused consumers, further expanding the market's reach and appeal.

In fiscal 2024, Post Holdings planned significant capital investments totaling between $420 million and $445 million, with $100 million to $110 million earmarked for the expansion of a precooked and a cage-free egg facility, reflecting its broader strategic growth plans despite a 6% decrease in cereal volumes (excluding acquisitions). Meanwhile, Post's acquisitions led to a sales surge, contributing $428.9 million and increasing overall sales by 16%.

In parallel, General Mills ramped up its innovation, launching approximately 40% more "big bet" products than in the previous year, aiming to capture more market share. General Mills also reported a robust fiscal year, generating over $2.5 billion in free cash flow with a remarkable 96% cash conversion rate, indicating efficient management and strong financial health in the competitive Breakfast Cereals Market.

Key Takeaways

- Global Breakfast Cereals Market was valued at USD 81.7 billion in 2024. It is expected to reach USD 148.2 billion by 2034, with a CAGR of 6.3% during the forecast period from 2025 to 2034.

- RTE cereals dominate, capturing 80.2% of the breakfast cereal market.

- Corn-based cereals hold 25.8% of the market, favored for taste.

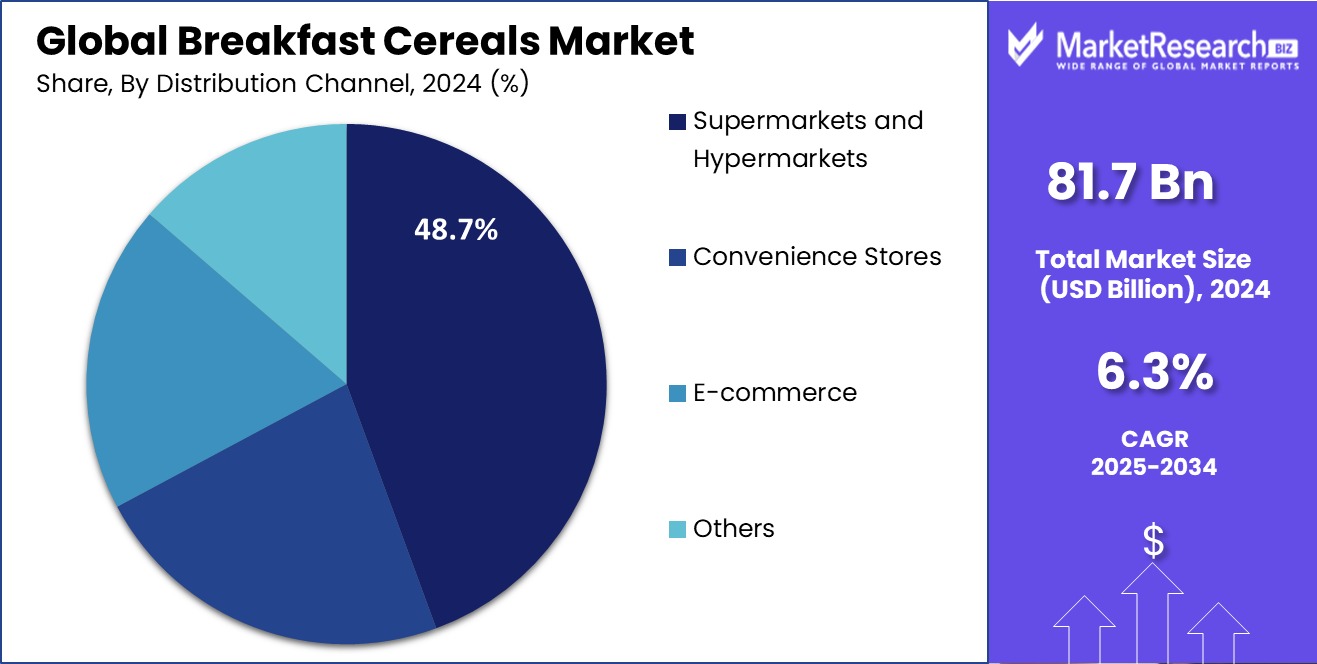

- Supermarkets and hypermarkets lead with 48.7% distribution of breakfast cereals.

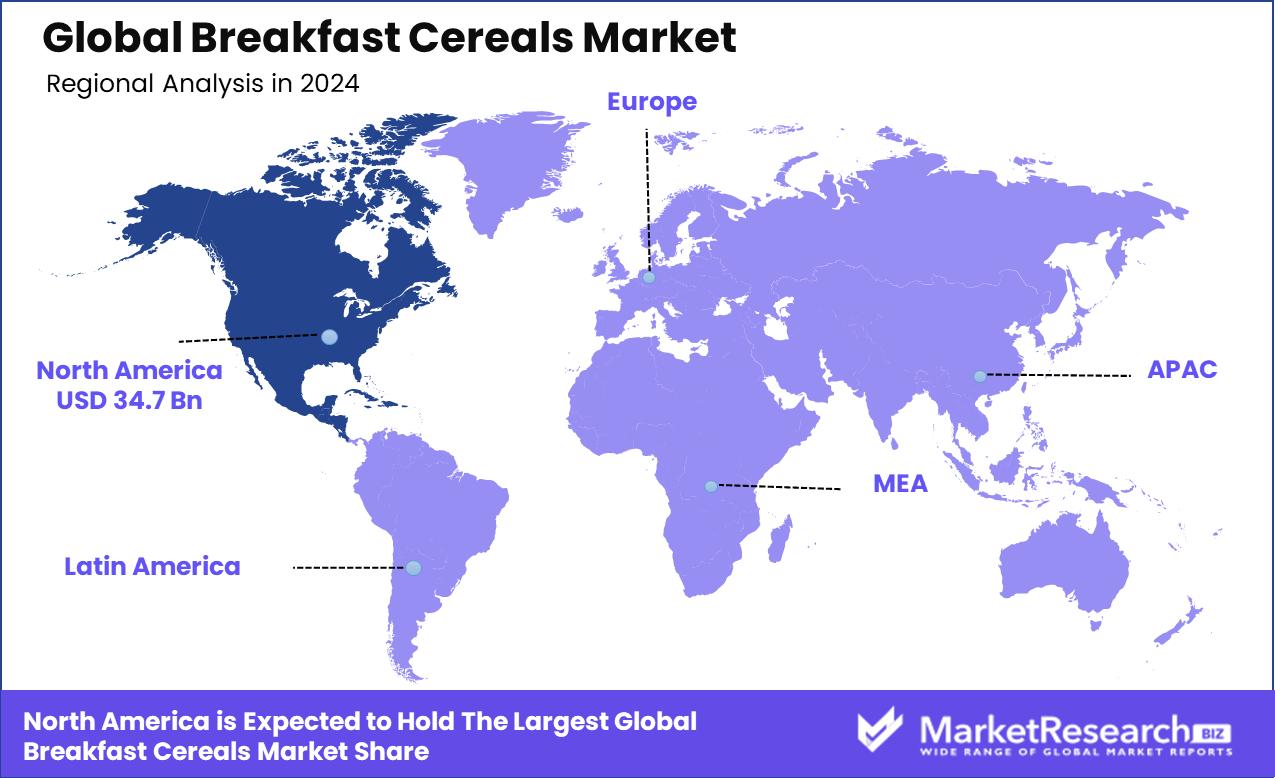

- The Breakfast Cereals Market in North America was worth USD 34.7 billion, accounting for 42.5% of the global share.

By Type Analysis

Ready-to-Eat (RTE) cereals dominate the market, holding a significant share of 80.2%.

In 2024, Ready-to-Eat (RTE) cereals held a dominant market position in the "By Type" segment of the Breakfast Cereals Market, capturing an impressive 80.2% share. This significant market share underscores the strong consumer preference for convenience and speed in meal preparation, especially in urban areas where fast-paced lifestyles predominate. RTE cereals appeal to a broad demographic, including working professionals, busy parents, and health-conscious individuals looking for quick yet nutritious meal options.

The success of RTE cereals can be attributed to their wide variety of flavors and health-oriented formulations. Manufacturers have effectively responded to consumer demand for healthier eating options by introducing cereals that incorporate whole grains, have low sugar levels, and are enriched with essential vitamins and minerals. The market has also seen a surge in offerings that cater to specific dietary needs, such as gluten-free and organic options, which have broadened the consumer base and further entrenched RTE cereals' position in the market.

Moving forward, the RTE segment's dominance is expected to continue as manufacturers innovate with new flavors and ingredients to meet evolving consumer tastes and preferences, reinforcing the segment's strong foothold in the Breakfast Cereals Market.

By Ingredient Analysis

Corn-based cereals are a popular choice, accounting for 25.8% of the breakfast cereals market.

In 2024, Corn-based Cereals held a dominant market position in the "By Ingredient" segment of the Breakfast Cereals Market, with a 25.8% share. This leading position reflects the widespread consumer preference for corn-based options, which are valued for their versatility and appealing flavor profile. Corn-based cereals cater to a variety of taste preferences and dietary requirements, making them a staple in households worldwide.

The appeal of corn-based cereals stems largely from their nutritional benefits, including being a good source of essential vitamins, minerals, and fiber, which aligns well with the growing consumer emphasis on health and wellness. Additionally, the ability of corn to blend well with both sweet and savory flavors enhances its appeal, allowing for a broad range of product innovations.

Manufacturers have capitalized on this by expanding their product lines to include corn-based cereals that feature additional health benefits, such as being fortified with vitamins or low in sugar. The market for corn-based cereals is further bolstered by their affordability and the extensive availability of corn as a raw material, which ensures consistent product quality and supply chain stability.

By Distribution Channel Analysis

Supermarkets and hypermarkets are the leading distribution channels, capturing 48.7% of market sales.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the "By Distribution Channel" segment of the Breakfast Cereals Market, with a 48.7% share. This dominant position can be attributed to their widespread accessibility and the comprehensive range of breakfast cereal products they offer. These retail giants are pivotal in making diverse cereal options available to a broad customer base, catering to varying tastes and dietary preferences all under one roof.

Supermarkets and hypermarkets benefit from high foot traffic and the convenience of one-stop shopping for consumers looking to combine their grocery purchases with other household needs. This convenience is a key driver for the segment, as busy consumers appreciate the efficiency of obtaining their breakfast staples alongside other essentials. Moreover, the ability to physically evaluate product quality, packaging, and nutritional information directly influences purchasing decisions, further boosting sales through these channels.

Given their extensive reach and the strategic placement of products, supermarkets and hypermarkets are well-positioned to leverage promotional activities and in-store advertising effectively. These strategies not only enhance product visibility but also stimulate impulse purchases, thereby reinforcing the strong market hold of supermarkets and hypermarkets in the distribution of breakfast cereals.

Key Market Segments

By Type

- Hot Cereals

- Ready-to-Eat (RTE)

By Ingredient

- Corn-based Cereals

- Rice-based Cereals

- Wheat-based Cereals

- Oat-based Cereals

- Multigrain Cereals

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- E-commerce

- Others

Driving Factors

Increasing Demand for Convenient Breakfast Options

In the Breakfast Cereals Market, one of the top driving factors is the growing demand for convenient meal solutions. Today's fast-paced lifestyle has led consumers to seek out breakfast options that save time without compromising on nutritional value. Ready-to-Eat (RTE) cereals perfectly cater to this need by offering a quick, effortless meal that is also nutritious.

The versatility of breakfast cereals, available in various flavors and fortified with vitamins and minerals, makes them a popular choice among all age groups. Additionally, manufacturers have responded to health trends by creating options that are lower in sugar, higher in fiber, and include organic or gluten-free ingredients, further driving their appeal and market growth.

Restraining Factors

Rising Health Concerns Over Sugar Content

A major restraining factor in the Breakfast Cereals Market is the growing consumer concern over high sugar content in many cereal products. As awareness of the negative health impacts of excessive sugar intake increases, more consumers are scrutinizing food labels and seeking healthier alternatives.

This shift in consumer behavior is challenging for cereal manufacturers who traditionally rely on sugar to enhance the taste appeal of their products. To address these concerns, companies are being pushed to reformulate their products to reduce sugar levels without compromising taste, which can be costly and complex. This trend is reshaping the market dynamics, as brands must now balance taste, health, and cost to maintain their market positions.

Growth Opportunity

Expansion into Organic and Gluten-Free Cereals

A significant growth opportunity within the Breakfast Cereals Market lies in the expansion into organic and gluten-free products. With health and wellness trends gaining momentum, there is a rising demand for cereals that cater to specific dietary needs, including organic eating practices and gluten intolerance.

By introducing organic cereals made from non-GMO, pesticide-free ingredients and gluten-free options that ensure safety for those with celiac disease or gluten sensitivity, manufacturers can tap into a new segment of health-conscious consumers.

This move not only broadens the market base but also enhances brand image and trust among consumers looking for healthier eating options. Capitalizing on this trend can lead to increased market share and higher profit margins, as these products often command a premium price.

Latest Trends

Surge in Plant-Based and Vegan Cereals

One of the latest trends in the Breakfast Cereals Market is the surge in popularity of plant-based and vegan cereals. This trend is driven by the increasing number of consumers adopting vegan and vegetarian lifestyles, coupled with the growing awareness of the environmental and health benefits of plant-based diets.

Manufacturers are responding by developing cereals that are free from animal-derived ingredients, using plant-based proteins and alternative sweeteners to cater to this niche yet expanding consumer base.

These cereals often incorporate superfoods like chia seeds, flaxseeds, and quinoa, enhancing their nutritional profile. By embracing this trend, brands can not only attract health-conscious consumers but also differentiate their products in a competitive market, tapping into the growing demand for sustainable and ethical food choices.

Regional Analysis

In 2024, North America held 42.5% of the global Breakfast Cereals Market, valued at USD 34.7 billion.

In the global Breakfast Cereals Market, North America stands out as the dominant region, holding a substantial 42.5% market share valued at USD 34.7 billion. This prominence is primarily due to the high consumer preference for convenient and healthy breakfast options, coupled with a well-established food processing industry.

Europe follows closely, driven by increasing demand for organic and whole-grain cereals that cater to a health-conscious populace. Manufacturers in Europe are focusing on product innovation, particularly in the realm of sugar reduction and dietary fibers, to attract a broader customer base.

The Asia Pacific region is witnessing rapid growth due to changing dietary habits and the Westernization of food preferences. Increasing urbanization and rising disposable incomes are pushing consumers toward ready-to-eat breakfast solutions, making it a high-potential market for future expansion.

Meanwhile, the Middle East & Africa, and Latin America are emerging markets with growing potential, primarily driven by an increasing young population and an expanding retail sector. These regions present lucrative opportunities for breakfast cereal companies looking to diversify their geographical presence and capitalize on untapped markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Breakfast Cereals market is highly competitive, with key players like Kellogg Co., General Mills, PepsiCo Inc., Post Holdings, and Nestlé S.A. driving innovation and market expansion.

Kellogg Co. remains a formidable leader in the market, leveraging its strong brand portfolio and extensive distribution network to maintain and expand its market presence. The company’s strategic initiatives to penetrate emerging markets and its focus on health-oriented products are pivotal in attracting a broader consumer base looking for nutritious breakfast options.

General Mills, in partnership with lifestyle brands like GHOST, is capitalizing on the high-protein trend, introducing cereals that cater to health-conscious consumers and fitness enthusiasts. This approach not only broadens its market appeal but also differentiates its offerings in a crowded market.

PepsiCo, through its subsidiary Quaker Oats Co., continues to innovate in the wholesome cereals segment. By focusing on whole grains and protein-enriched products and steering clear of artificial additives, PepsiCo addresses the growing consumer demand for natural and healthy eating options, strengthening its position in the market.

Post Holdings targets niche markets with its array of cereal brands, focusing on both premium and health-specific products. This strategy allows Post to capture diverse consumer segments, from budget-conscious families to health-focused individuals, enhancing its market share and brand loyalty.

Nestlé S.A. leverages its global brand recognition and extensive R&D capabilities to innovate continually. By adapting to regional tastes and nutritional requirements, Nestlé effectively competes in various geographic markets, ensuring its cereals appeal to a global audience.

Top Key Players in the Market

- Kellogg Co.

- General Mills

- PepsiCo Inc.

- Post Holdings

- Nestle S.A.

- Abbott Nutrition

- Carmans Fine Foods

- Food for Life Baking Co. Inc.

- Migros

- Back to Nature Food Company, LLC

- Dr. Oetker

- Attune Foods

- Bob’s Red Mill Natural Foods

- Freedom Foods Group

Recent Developments

- In April 2024, GHOST, a lifestyle brand, unveiled a new line of high-protein breakfast cereals in partnership with General Mills. Available in Peanut Butter and Marshmallow flavors, these cereals are designed to provide a nutritious yet delicious start to the day. Each serving of the Peanut Butter flavor contains 18 grams of protein, while the Marshmallow flavor contains 17 grams.

- In December 2023, Kellogg’s, a leading company in the global food industry, set a goal to double its household reach within India's breakfast cereal market. Currently holding a dominant 75% share of the market, Kellogg’s focuses on expanding its presence among children, adults, and families through targeted strategic initiatives.

- In October 2023, Quaker Oats Co., a subsidiary of PepsiCo, introduced Quaker Chewy Granola, a new breakfast cereal option. Made from 100% whole grains, this cereal combines granola clusters and rice crisps, offering 5 grams of protein per serving. It comes in two flavors, chocolate and strawberry, and is free from artificial colors, preservatives, and flavors.

Report Scope

Report Features Description Market Value (2024) USD 81.7 Billion Forecast Revenue (2034) USD 148.2 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Hot Cereals, Ready-to-Eat (RTE)), By Ingredient (Corn-based Cereals, Rice-based Cereals, Wheat-based Cereals, Oat-based Cereals, Multigrain Cereals), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kellogg Co., General Mills, PepsiCo Inc., Post Holdings, Nestle S.A., Abbott Nutrition, Carmans Fine Foods, Food for Life Baking Co. Inc., Migros, Back to Nature Food Company, LLC, Dr. Oetker, Attune Foods, Bob’s Red Mill Natural Foods, Freedom Foods Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Kellogg Co.

- General Mills

- PepsiCo Inc.

- Post Holdings

- Nestle S.A.

- Abbott Nutrition

- Carmans Fine Foods

- Food for Life Baking Co. Inc.

- Migros

- Back to Nature Food Company, LLC

- Dr. Oetker

- Attune Foods

- Bob’s Red Mill Natural Foods

- Freedom Foods Group