Global Acetic Acid Market By Application (Vinyl Acetate Monomer (VAM), Purified Terephthalic Acid (PTA), Ester Solvents, Acetic Anhydride, and Others), By End-User (Food and beverages, Paints and coating, Plastics & Polymers, Pharmaceutical, Chemicals, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

-

51562

-

March 2025

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

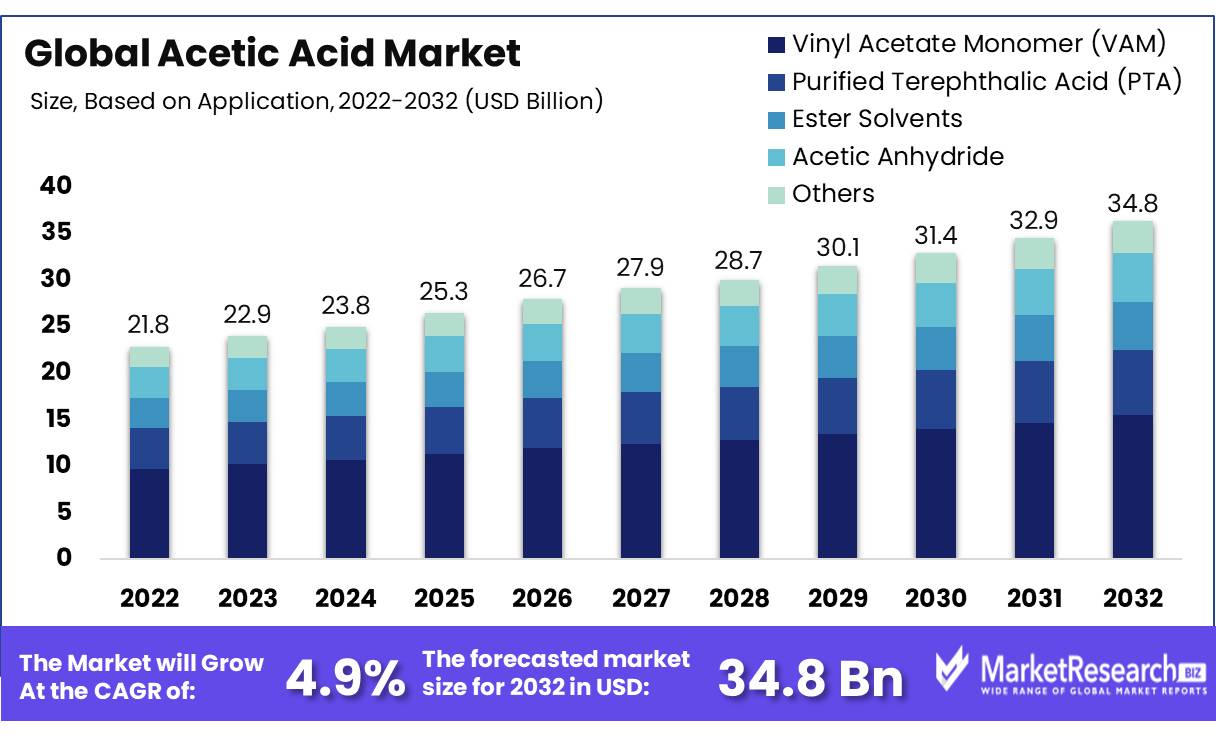

The Global Acetic Acid Market size is expected to be worth around USD 34.8 billion by 2032 from USD 21.8 billion in 2022, growing at a CAGR of 4.9% from 2022 to 2032.

Acetic acid, also known as ethanoic acid, is a vital organic compound with the chemical formula CH₃COOH. It is a colorless liquid with a distinctive sour taste and pungent smell, primarily known as the main component of vinegar apart from water. Acetic acid is extensively used in the manufacturing of various chemical compounds, most notably vinyl acetate monomer (VAM) and acetic anhydride, which find applications across a wide range of industries including textiles, synthetic fibers, and adhesives.

The production of acetic acid is heavily concentrated in Asia-Pacific, particularly in China, which accounts for more than 30% of the global production. Key players in the market include British Petroleum, Celanese Corporation, and Eastman Chemical Company, who are expanding their production capacities to meet the rising global demand.

The growth of the acetic acid market is primarily driven by the increasing demand for vinyl acetate monomer (VAM) in various applications such as adhesives, paints, and coatings. VAM itself is a critical material in the production of polyvinyl acetate and polyvinyl alcohol - substances that are widely used in the adhesive and textile industries. Additionally, the surge in demand for purified terephthalic acid (PTA), which is used to produce polyester, further propels the consumption of acetic acid.

Various government initiatives across the globe support the acetic acid market. For example, environmental regulations in Europe and North America that promote the use of bio-based chemicals have led to research into the production of acetic acid from renewable sources. This is expected to open new growth avenues for the acetic acid market.

Key Takeaways

- Acetic Acid Market size is expected to be worth around USD 34.8 billion by 2032 from USD 21.8 billion in 2022, growing at a CAGR of 4.9%

- vinyl acetate monomer (VAM) held a dominant market position, capturing more than a 44.5% share

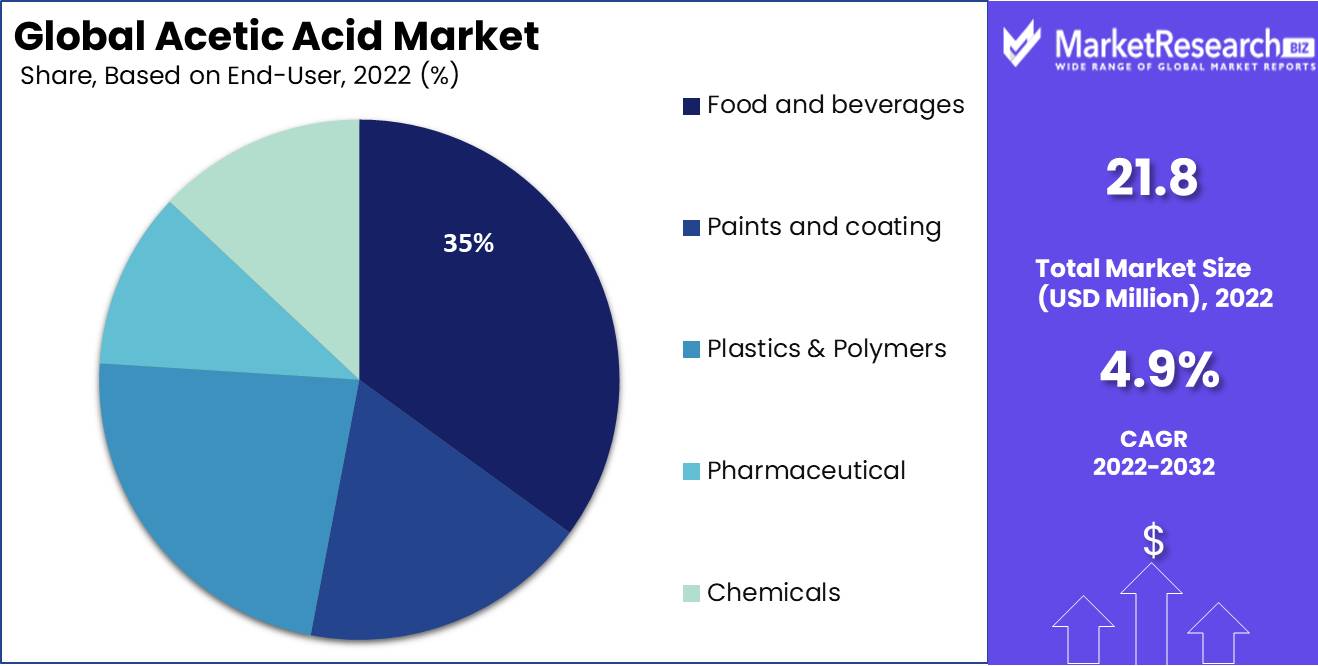

- food and beverages sector held a dominant position in the acetic acid market, capturing more than a 35.0% share.

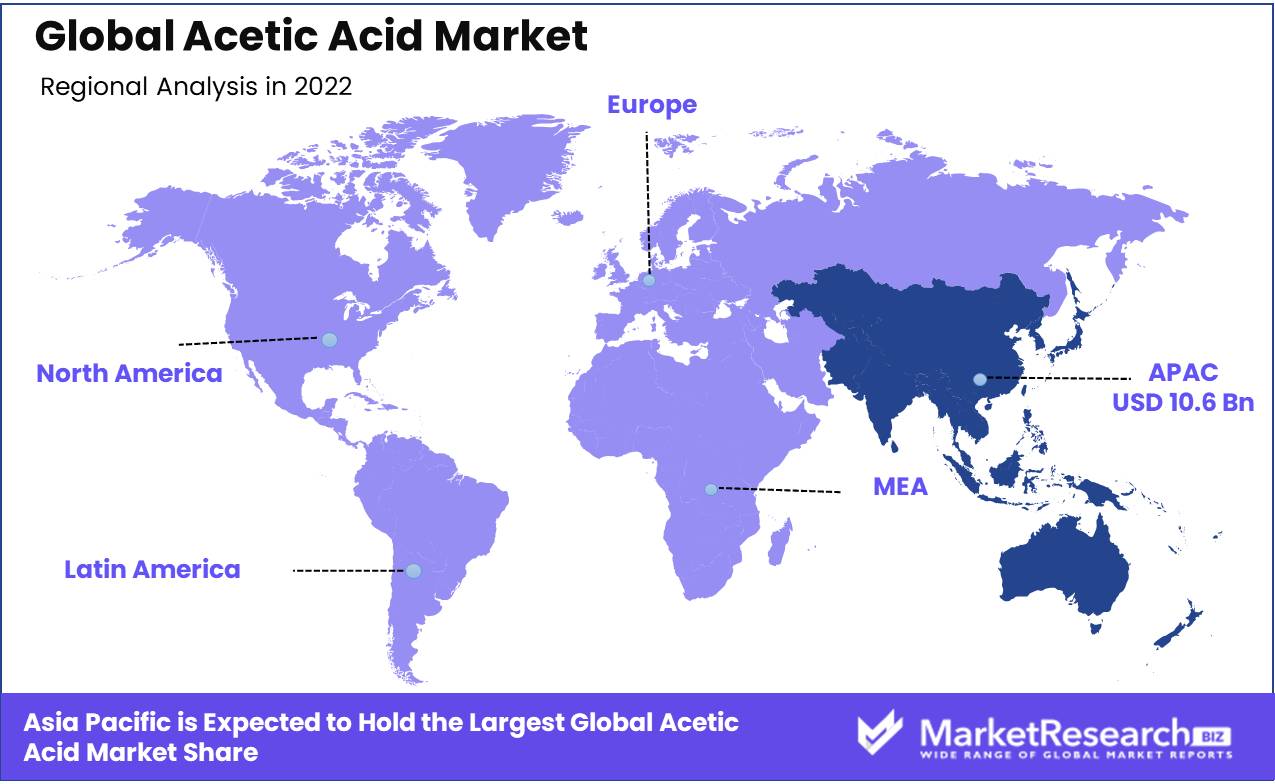

- Asia-Pacific region stands as a powerhouse in the acetic acid market, commanding a dominant 48.8% share with a market valuation of approximately $10.6 billion.

Driving Factors

Surge in Demand for Vinyl Acetate Monomer

One significant driver propelling the growth of the acetic acid market is the increasing demand for vinyl acetate monomer (VAM), especially from the adhesives and paints sectors. As a critical ingredient in the production of polyvinyl acetate and polyvinyl alcohol, VAM plays a pivotal role in various industrial applications, ranging from adhesives in packaging to binders in paint formulations.

In 2024, industries consuming VAM, particularly the construction and automotive sectors, saw substantial growth due to urbanization and increased consumer spending on home improvement and vehicle maintenance. The booming construction industry, backed by governmental infrastructure initiatives and private investments, has led to a heightened demand for adhesives and sealants, which extensively utilize VAM. These applications underscore the critical role of VAM in enhancing product attributes such as durability, flexibility, and resistance to environmental factors.

Moreover, environmental regulations have shifted the focus toward more sustainable and less volatile organic compound (VOC) emitting products. VAM-based adhesives and paints align well with these regulatory frameworks, as they offer reduced VOC emissions compared to their solvent-based counterparts. This regulatory push has not only sustained but also amplified the demand for VAM, thereby driving the acetic acid market.

Government initiatives, such as the European Union's regulations on reducing VOC emissions in manufacturing processes, further encourage industries to adopt VAM-based formulations. Such policies are instrumental in shaping market trends and driving innovation in the chemical manufacturing sector.

Restraining Factors

Volatility in Raw Material Prices

A major restraining factor for the acetic acid market is the volatility in the prices of its raw materials, primarily methanol, from which acetic acid is predominantly produced. Methanol price fluctuations can be attributed to changes in the natural gas market, as natural gas is a key feedstock in methanol production. These fluctuations often result in inconsistent acetic acid pricing, impacting profitability for manufacturers and creating budgeting challenges for end-users.

For instance, a sudden increase in natural gas prices due to geopolitical tensions or supply disruptions can lead to a sharp rise in methanol costs, subsequently pushing up the prices of acetic acid. This price volatility can deter investment in acetic acid-based projects and influence buyers to seek more stable, cost-effective alternatives.

Government initiatives aimed at stabilizing the market have a critical role in mitigating these impacts. For example, regulatory frameworks and strategic reserves of natural gas aim to cushion the blow of sudden price hikes and ensure a steady supply. However, despite these efforts, the inherent unpredictability of commodity markets continues to pose a challenge.

Furthermore, the dependency on such volatile feedstocks compels acetic acid producers to explore alternative production methods or raw materials that offer more stability and cost predictability. This shift is not only driven by economic factors but also by the push towards more sustainable industrial practices, which favor feedstocks with a lower environmental impact.

Application Analysis

Vinyl Acetate Monomer: Commanding the Market with a 44.5% Share in 2024

In 2024, vinyl acetate monomer (VAM) held a dominant market position, capturing more than a 44.5% share of the acetic acid application landscape. This substantial market share underscores VAM's crucial role in the production of various polymers and resins used extensively in adhesives, paints, coatings, and textiles. VAM's widespread use is primarily driven by its properties that enhance the performance of these materials, contributing to superior adhesion, water resistance, and film formation capabilities.

The market's reliance on VAM can be attributed to the growing demand for adhesives and sealants in the construction and automotive industries. The expanding global infrastructure and increasing automotive production are key factors bolstering this demand. Moreover, the paint and coatings industry continues to thrive, propelled by the booming construction sector and the rising need for residential and commercial building renovations. This has further solidified VAM's position as a pivotal component in decorative and protective coatings.

End-User Analysis

Food and Beverages Industry Leads with Over 35% Market Share in Acetic Acid Usage

In 2024, the food and beverages sector held a dominant position in the acetic acid market, capturing more than a 35.0% share. This substantial market share is largely attributed to acetic acid’s critical role in food preservation and flavoring. Within the industry, acetic acid is essential for vinegar production, which is a staple in culinary practices worldwide, serving not only as a key ingredient in dressings and marinades but also as a preservative. The consistent demand for packaged foods and an increased focus on food safety standards have driven the use of acetic acid, ensuring its continued significance in the food and beverages industry.

Key Market Segments

Based on Application

- Vinyl Acetate Monomer (VAM)

- Purified Terephthalic Acid (PTA)

- Ester Solvents

- Acetic Anhydride

- Others

Based on End-User

- Food and beverages

- Paints and coating

- Plastics & Polymers

- Pharmaceutical

- Chemicals

- Others

Growth Opportunity

Expansion into Bio-based Acetic Acid

One significant growth opportunity in the acetic acid market is the development and commercialization of bio-based acetic acid. This shift is driven by the increasing consumer and regulatory demand for more sustainable and environmentally friendly chemical production processes. Bio-based acetic acid, produced from renewable sources like biomass, presents a sustainable alternative to traditional petroleum-based acetic acid, aligning with global sustainability goals and reducing the industry's carbon footprint.

The push towards eco-friendly materials has been supported by various government initiatives that encourage the adoption of green chemistry. For example, the U.S. Department of Agriculture's BioPreferred Program aims to increase the purchase and use of biobased products. Programs like these not only promote the use of renewable resources but also open new markets for bio-based acetic acid producers by providing certification and labeling that help consumers make informed choices.

The food industry, a major consumer of acetic acid for preservatives and flavoring agents, shows a growing preference for ingredients derived from natural sources, reflecting broader consumer trends towards natural and organic products. The transition to bio-based acetic acid could meet these market demands while maintaining the functional benefits of conventional acetic acid.

Furthermore, technological advancements in fermentation processes and genetic engineering are making the production of bio-based acetic acid more cost-effective and scalable. This lowers the entry barriers for new players and encourages existing producers to transition towards bio-based methods.

Latest Trends

Rising Adoption of Acetic Acid in Sustainable Packaging Solutions

A prominent trend in the acetic acid market is its increasing use in the production of biodegradable plastics, which are gaining traction in the sustainable packaging industry. This trend is largely driven by the growing environmental concerns and the push for reducing plastic waste, which has led to a surge in demand for eco-friendly packaging solutions.

Acetic acid plays a crucial role in the production of polyvinyl alcohol (PVA), a polymer used in making water-soluble films. These films are ideal for creating biodegradable packaging, particularly for single-use products such as detergents, agrochemicals, and food wrappers. The advantage of using PVA films is that they dissolve in water, leaving no toxic residue, thus offering an environmentally friendly alternative to traditional plastics.

The push towards sustainable packaging is supported by governmental policies and initiatives aimed at reducing the environmental impact of packaging waste. For instance, the European Union's Circular Economy Action Plan encourages the use of sustainable materials in packaging and mandates recycling and reuse. Such policies not only promote the use of biodegradable materials but also open up new market opportunities for acetic acid in sectors committed to ecological responsibility.

Regional Analysis

The Asia-Pacific region stands as a powerhouse in the acetic acid market, commanding a dominant 48.8% share with a market valuation of approximately $10.6 billion. This significant share is propelled by robust industrial growth across major economies such as China, India, and Japan. China, in particular, emerges as the regional leader due to its expansive chemical manufacturing sector and the widespread use of acetic acid in textiles, plastics, and pesticides production.

India also contributes notably to the regional demand, driven by its burgeoning food and beverages industry where acetic acid is extensively used as a preservative and flavoring agent. The country's shift towards processed and packaged foods amplifies the demand for vinegar, further bolstering acetic acid consumption.

Japan's contribution to the Asia-Pacific acetic acid market is marked by its use in the production of synthetic fibers and resins, reflecting the nation's advanced technological landscape in chemical processing.

The region's dominance is also fueled by favorable government policies supporting industrial growth, significant investments in research and development within the chemical sector, and an expanding export base. Moreover, the Asia-Pacific market benefits from the availability of raw materials and relatively lower production costs, enhancing its competitive edge in the global acetic acid market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- APAC

- China

- Vietnam

- Japan

- Indonesia

- South Korea

- India

- Australia & New Zealand

- Singapore

- Thailand

- Malaysia

- Philippines

- Rest of APAC

- Latin America

- Colombia

- Chile

- Brazil

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- United Arab Emirates

- Saudi Arabia

- Kuwait

- Nigeria

- Israel

- South Africa

- Turkey

- Rest of the Middle East and Africa.

Key Players Analysis

Eastman Chemical Company is a prominent player in the acetic acid market, leveraging advanced technology to enhance production efficiency. The company's integrated supply chain and strategic global presence allow it to meet the rising demand effectively. Eastman focuses on sustainable practices and innovation to maintain a competitive edge, catering primarily to sectors like textiles, food packaging, and industrial chemicals.

Celanese Corporation stands out in the acetic acid industry due to its strong focus on acetic anhydride and vinyl acetate monomer production. The company's global network and significant investments in capacity expansion have bolstered its market position. Celanese is known for its operational excellence and strategic acquisitions, which strengthen its supply chain and expand its market reach, particularly in emerging markets.

LyondellBasell Industries Holding B.V.: As one of the largest plastics, chemicals, and refining companies globally, LyondellBasell plays a crucial role in the acetic acid market. The company's consistent focus on cost-efficient manufacturing processes and high-volume production capacity ensures a reliable supply to industries such as automotive, construction, and textiles. LyondellBasell is also committed to sustainability, aiming to reduce environmental impact while meeting global demand.

Market Key Players

- Eastman Chemical Company

- Celanese Corporation

- LyondellBasell Industries Holding B.V.

- SABIC

- HELM AG

- Airedale Chemical Company Limited

- Indian Oil Corporation Ltd

- Gujrat Narmada Valley Fertilizers & Chemicals Limited

- Pentokey Organic

- Ashok Alco Chem Limited

- DAICEL CORPORATION

- The Dow Chemical Product

- DubiChem

- INEOS

- Other Key Players

Recent Developments

- January 2021 - In order to expand its geographic reach and diversify its product offering, INEOS will join BP's global aromatics and acetyls business, comprising 15 different manufacturing sites and 10 joint ventures around the world.

- In March 2020, South Korean Lotte and British chemical and energy company BP collaborated to expand South Korea's acetic acid production capacity. The cost of the investment is approximately $175 million, and the capacity will be increased to 100,000 t/y by May 2019.

Report Scope

Report Features Description Market Value (2022) US$ 21.8 Bn Forecast Revenue (2032) US$ 34.8 Bn CAGR (2023-2032) 4.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application (Vinyl Acetate Monomer (VAM), Purified Terephthalic Acid (PTA), Ester Solvents, Acetic Anhydride, and Others), By End-User (Food and beverages, Paints and coating, Plastics & Polymers, Pharmaceutical, Chemicals, and Others), By Region and Companies Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Eastman Chemical Company, Celanese Corporation, LyondellBasell Industries Holding B.V., SABIC, HELM AG, Airedale Chemical Company Limited, Indian Oil Corporation Ltd, Gujrat Narmada Valley Fertilizers & Chemicals Limited, Pentokey Organy, Ashok Alco Chem Limited, DAICEL CORPORATION, The Dow Chemical Product, DubiChem, INEOS, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Eastman Chemical Company

- Celanese Corporation

- LyondellBasell Industries Holding B.V.

- SABIC

- HELM AG

- Airedale Chemical Company Limited

- Indian Oil Corporation Ltd

- Gujrat Narmada Valley Fertilizers & Chemicals Limited

- Pentokey Organic

- Ashok Alco Chem Limited

- DAICEL CORPORATION

- The Dow Chemical Product

- DubiChem

- INEOS

- Other Key Players