Geophysical Services Market By Technology (Seismic, Magnetic, Electromagnetic, Gravity, LIDAR, Others), By Type (Aerial-based, Marine-based, Land-based), By End-Use (Minerals and Mining, Oil and Gas, Wind Energy, Water Exploration, Archaeological Research, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48229

-

June 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

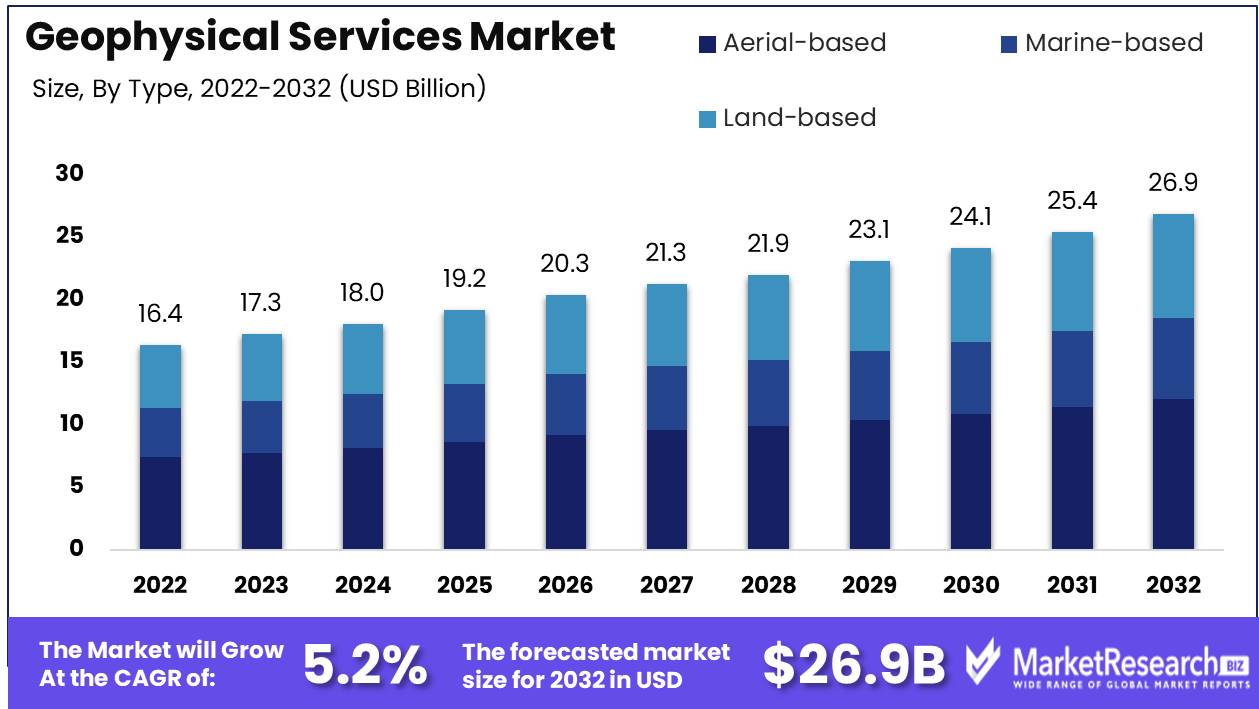

The Geophysical Services Market was valued at USD 16.4 billion in 2023. It is expected to reach USD 26.9 billion by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

The Geophysical Services Market encompasses a range of activities and technologies utilized to explore and analyze subsurface geological formations. This market primarily serves the oil and gas, mining, and environmental sectors, offering critical services such as seismic data acquisition, processing, and interpretation, as well as electromagnetic, gravity, and magnetic surveys. Geophysical services are integral to resource exploration, enhancing accuracy in locating deposits, optimizing extraction processes, and mitigating risks. Advancements in technology, including artificial intelligence and remote sensing, are driving efficiency and precision in this market, making it an essential component of modern geological and environmental assessment strategies.

The geophysical services market is experiencing robust growth, driven primarily by the escalating demand for oil and gas and the imperative to explore new reserves. As global energy consumption continues to rise, the oil and gas sector is intensifying its exploration activities, significantly boosting the demand for geophysical services. This surge is further supported by advancements in geophysical survey technologies, such as 3D and 4D seismic imaging, which enhance the precision and efficiency of data collection and interpretation. These innovations not only streamline exploration processes but also reduce the risk associated with new ventures, thereby offering substantial value to large enterprises.

However, the high cost associated with these advanced technologies and equipment poses a significant challenge for small and medium-sized enterprises (SMEs), potentially limiting their participation in the market. This financial barrier underscores the need for strategic partnerships and innovative financing solutions to democratize access to cutting-edge geophysical services.

Despite these challenges, the market is poised for continued expansion. The ongoing advancements in geophysical technologies are expected to drive efficiency and cost-effectiveness, potentially lowering the entry barriers over time. Moreover, the growing emphasis on sustainable and efficient exploration practices aligns well with the capabilities of modern geophysical services, positioning the industry favorably for long-term growth. As major players continue to invest in research and development, the sector is likely to witness a proliferation of new technologies that will further enhance exploration capabilities. Consequently, the geophysical services market is set to play a pivotal role in the future of energy exploration, providing critical support to both established enterprises and emerging players in their quest to meet global energy demands.

Key Takeaways

- Market Growth: The Geophysical Services Market was valued at USD 16.4 billion in 2023. It is expected to reach USD 26.9 billion by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

- By Technology: Seismic technology dominated the Geophysical Services Market segment.

- By Type: Aerial-based solutions dominated geophysical services due to efficiency.

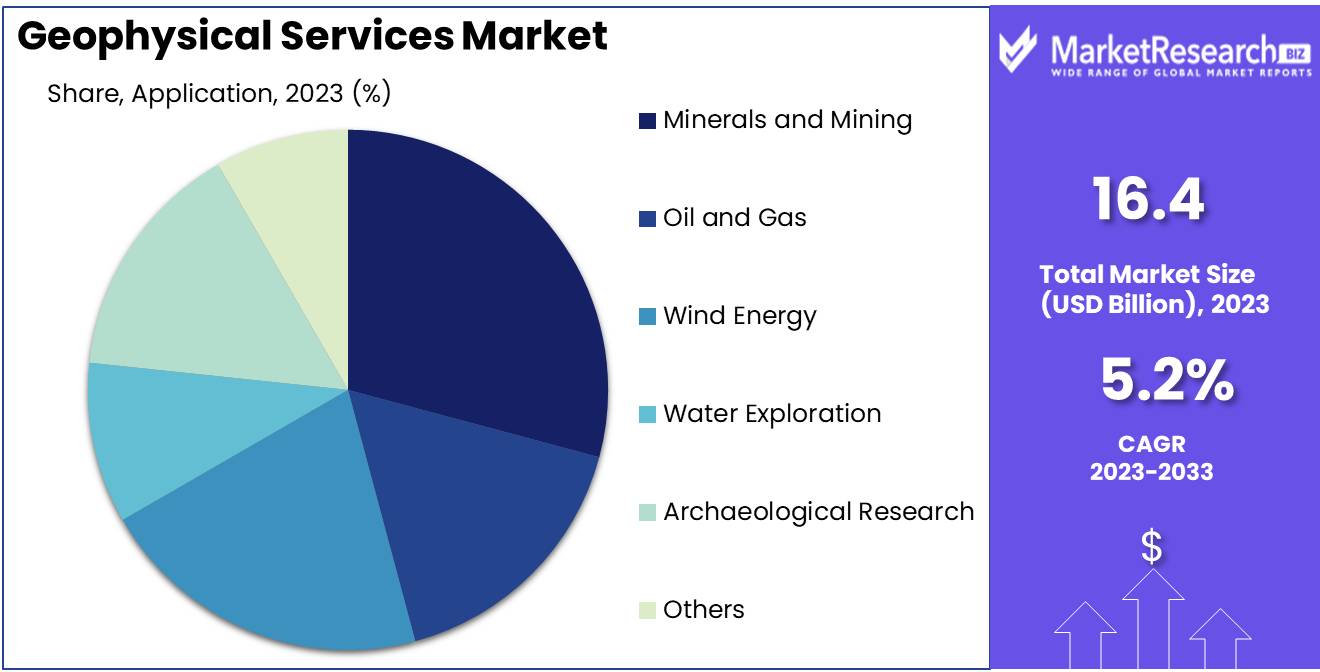

- By End-Use: The Minerals & Mining segment dominated the geophysical services market by end-use applications.

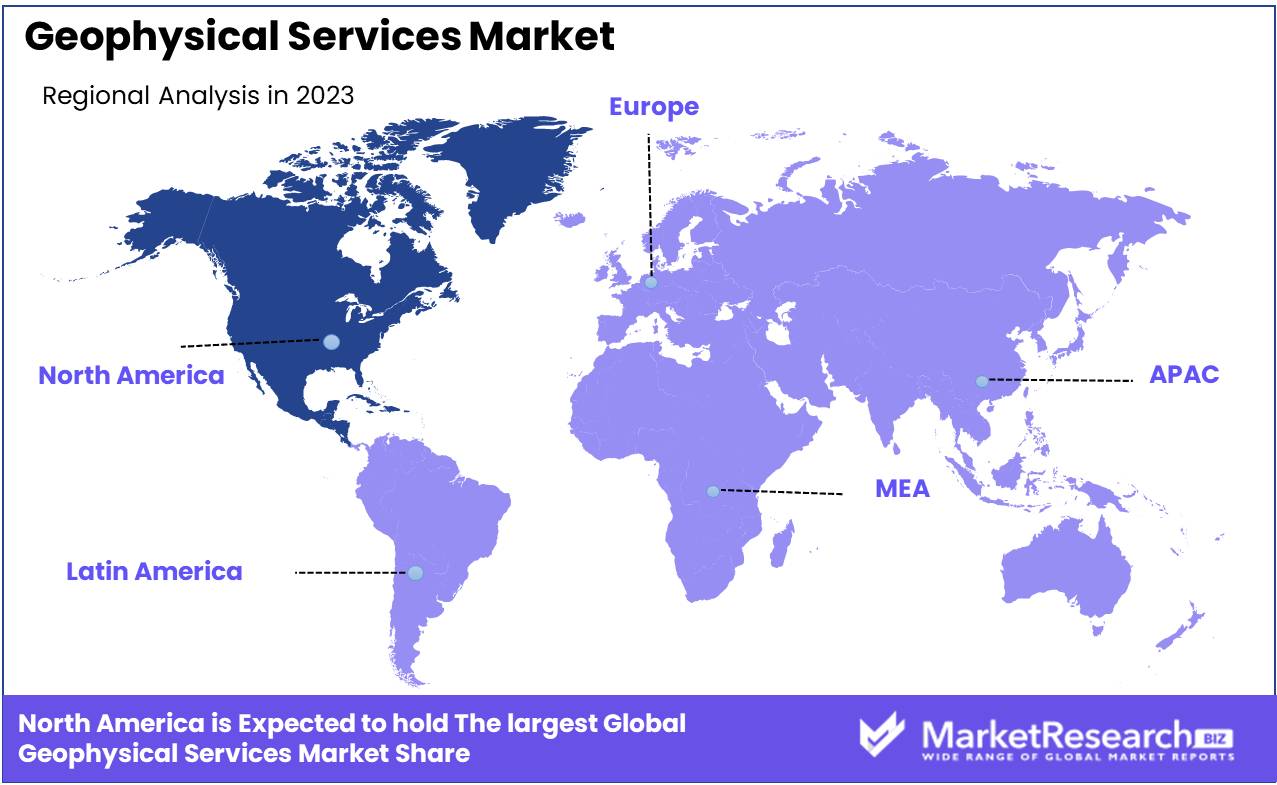

- Regional Dominance: North America dominates the geophysical services market with a 35% largest market share.

- Growth Opportunity: Sustainability and infrastructure development are driving growth in geophysical services, with advanced techniques enhancing efficiency and meeting regulatory demands.

Driving factors

Increasing Demand for Energy and Mineral Resources: Fueling Market Expansion

The burgeoning global demand for energy and mineral resources is a primary driver of the geophysical services market. As countries and industries strive to meet the rising energy needs of growing populations and expanding economies, the exploration and extraction of oil, gas, and minerals become critical. According to recent industry reports, the global energy demand is projected to increase by 30% by 2040. This surge necessitates advanced geophysical surveys to locate new reserves and optimize extraction processes, thereby significantly boosting the geophysical services sector.

Geophysical methods such as seismic surveys, magnetic, and gravity studies are indispensable in identifying subsurface characteristics crucial for hydrocarbon and mineral exploration. The deployment of these advanced techniques enables energy companies to mitigate risks and enhance the efficiency of resource extraction. Consequently, the continuous quest for energy and minerals propels the demand for sophisticated geophysical services, ensuring sustained market growth.

Expansion of the Construction Sector: Enhancing Market Opportunities

The construction sector's expansion presents significant growth opportunities for the geophysical services market. With global urbanization trends and infrastructure development projects on the rise, there is an increased need for comprehensive geophysical surveys. The global construction market is expected to reach $15.5 trillion by 2030, driven by rapid urbanization and the need for modern infrastructure.

Geophysical services play a crucial role in the construction industry by providing essential data on subsurface conditions. This information is vital for site selection, foundation design, and risk assessment of construction projects. Techniques such as ground-penetrating radar, electrical resistivity tomography, and seismic refraction surveys help in identifying potential geohazards, ensuring the safety and stability of structures. Therefore, the growth of the construction sector directly contributes to the expansion of the geophysical services market, as these services become integral to successful project execution.

Growth in Renewable Energy Projects: Diversifying Market Applications

The accelerated growth of renewable energy projects is a key driver in diversifying the applications of geophysical services. As the global energy landscape shifts towards sustainable and environmentally friendly sources, investments in wind, solar, and geothermal energy projects are surging. The renewable energy sector is expected to attract $2.6 trillion in investments by 2030, highlighting its significant expansion.

Geophysical services are essential in the development of renewable energy projects. For instance, in wind energy, geophysical surveys assess ground conditions for turbine installations, while in geothermal energy, they help locate and evaluate potential geothermal reservoirs. The integration of geophysical techniques in renewable energy projects not only ensures optimal site selection and resource management but also contributes to the overall efficiency and feasibility of these projects. Consequently, the rise in renewable energy initiatives broadens the scope of geophysical services, fostering market growth through diversified applications.

Restraining Factors

Environmental Concerns and Stringent Regulations: A Double-Edged Sword for Geophysical Services Market Growth

The geophysical services market faces significant challenges due to environmental concerns and stringent regulations. Governments and international bodies have implemented rigorous environmental standards to mitigate the impact of geophysical explorations on ecosystems. These regulations often require extensive environmental impact assessments (EIAs), which can delay project timelines and increase costs.

Moreover, compliance with these regulations demands substantial investment in environmentally friendly technologies and practices. Companies in the geophysical services market must allocate resources to develop and adopt sustainable methods, such as reduced-impact seismic technologies and non-invasive survey techniques. While these investments can enhance operational efficiency and minimize ecological footprints, they also increase operational expenditures and can be a barrier for smaller firms with limited capital.

Opposition from Local Communities: A Barrier to Market Expansion

Opposition from local communities represents another critical restraining factor for the growth of the geophysical services market. Local communities often resist geophysical exploration activities due to concerns about environmental degradation, disruption of local ecosystems, and potential negative impacts on their livelihoods. This resistance can manifest in various forms, including protests, legal challenges, and demands for higher compensation, all of which can delay or halt geophysical projects.

Community opposition is particularly pronounced in regions where indigenous populations reside, as these communities frequently have strong ties to their land and are more likely to oppose activities that threaten their traditional ways of life. For example, in Canada, indigenous groups have successfully delayed several geophysical projects through legal actions, emphasizing the need for companies to engage in meaningful consultations and negotiations with local stakeholders.

The necessity for extensive community engagement and the potential for prolonged negotiations can significantly increase project costs and timelines. Companies must invest in social license-to-operate (SLO) initiatives, including community outreach programs, fair compensation schemes, and environmental conservation projects, to gain local support. While these efforts can facilitate smoother project execution, they also add to the overall project costs and can strain financial resources.

By Technology Analysis

In 2023, Seismic technology segment dominated the Geophysical Services Market segment.

In 2023, Seismic segment held a dominant market position in the By Technology segment of the Geophysical Services Market. Seismic technology, which involves the use of seismic waves to map subsurface structures, remains a cornerstone in geophysical exploration due to its high resolution and accuracy in identifying hydrocarbon reservoirs. The technology's ability to provide detailed imaging of the Earth's subsurface makes it indispensable for oil and gas exploration, leading to significant investments and advancements in this field.

Magnetic methods, utilizing the Earth's magnetic field variations to detect mineral deposits, ranked second in prominence. This technology is widely used in mining exploration due to its cost-effectiveness and capability to cover large areas rapidly. Electromagnetic technology, which measures the Earth's conductivity, is crucial for identifying groundwater and mineral resources, contributing to its growing adoption. Gravity methods, leveraging gravitational field variations to map subsurface density changes, are particularly valuable in oil and gas exploration for identifying basin structures.

LIDAR (Light Detection and Ranging), known for its precision in topographic mapping and environmental monitoring, is increasingly used in geological studies and natural resource management. Other technologies, including ground-penetrating radar and radiometric methods, also play significant roles in specialized applications, enhancing the comprehensive nature of geophysical services. These varied technologies collectively advance the sector, with seismic technology leading the way due to its unparalleled depth and clarity in subsurface imaging.

By Type Analysis

In 2023, Aerial-based surveys dominated geophysical services due to efficiency.

In 2023, Aerial-based Survey held a dominant market position in the geophysical services market within the 'By Type' segment. Aerial-based geophysical services, which include the use of drones and aircraft to survey geological formations, have seen significant adoption due to their ability to cover vast and inaccessible areas with high precision. These services provide crucial data for mineral exploration, oil and gas discovery, and environmental monitoring. The primary advantage of aerial-based geophysical services lies in their efficiency and cost-effectiveness, enabling rapid data acquisition over large terrains compared to traditional ground surveys. Technological advancements in remote sensing, LiDAR, and hyperspectral imaging have further enhanced the capabilities of aerial surveys, offering more detailed and accurate geological data.

Marine-based geophysical services focus on underwater surveying techniques essential for offshore oil and gas exploration, subsea mining, and seabed mapping. Technologies such as seismic reflection, sonar, and magnetic surveys are employed to detect and map underwater geological structures. While marine-based services are critical for exploring vast ocean resources, they tend to be more expensive and logistically challenging compared to aerial solutions.

Land-based geophysical services involve ground-based techniques such as seismic surveys, ground-penetrating radar (GPR), and electromagnetic methods to analyze subsurface characteristics. These services are indispensable for detailed site investigations, infrastructure development, and environmental assessments. Although land-based services offer high resolution and depth of data, their application is often limited by terrain accessibility and the slower pace of data collection compared to aerial methods.

By End-Use Analysis

The minerals and Mining segment dominated the geophysical services market by end-use applications.

In 2023, The Minerals and Mining segment held a dominant market position in the Geophysical Services Market by end-use. The demand for geophysical services in this segment is driven by the increased need for mineral exploration and extraction activities. Technological advancements have enabled more precise and efficient geophysical survey methods, crucial for identifying and evaluating mineral deposits. Furthermore, the growing demand for metals and minerals in various industries, including electronics and construction, has fueled this segment's growth.

The Oil and Gas segment also significantly contributes to the geophysical services market, with continued investments in exploration and production activities. Advanced geophysical techniques are essential for locating new reserves and optimizing extraction processes, particularly in deepwater and unconventional resources.

Wind Energy is another critical segment, leveraging geophysical services for site assessment and foundation analysis, crucial for the successful deployment of offshore wind farms. Similarly, Water Exploration relies on geophysical methods to locate and manage groundwater resources, vital for agricultural and urban water supply.

Archaeological Research benefits from non-invasive geophysical techniques to uncover and study historical sites, providing detailed subsurface imaging without excavation. Lastly, the Others category encompasses various applications, including environmental studies and infrastructure development, where geophysical services are used to assess subsurface conditions and inform project planning.

Key Market Segments

By Technology

- Seismic

- Magnetic

- Electromagnetic

- Gravity

- LIDAR

- Others

By Type

- Aerial-based

- Marine-based

- Land-based

By End-Use

- Minerals and Mining

- Oil and Gas

- Wind Energy

- Water Exploration

- Archaeological Research

- Others

Growth Opportunity

Embracing Sustainability in Geophysical Services

The global push for sustainability is reshaping industries, and the geophysical services market is no exception. With increasing regulatory pressures and corporate commitments to environmental stewardship, the demand for sustainable geophysical practices is growing. Companies are investing in technologies that minimize environmental impact, such as non-invasive survey methods and renewable energy-powered equipment. This shift is not only about compliance but also about gaining a competitive advantage. Organizations that integrate sustainable practices can enhance their market positioning, attract eco-conscious clients, and potentially access green financing. This sustainability focus presents a significant growth opportunity, driving innovation and opening new markets.

Catalyzing Growth Through Infrastructure Development

The global surge in infrastructure development is another major driver for the geophysical services market. Governments worldwide are investing heavily in upgrading and expanding infrastructure, from transportation networks to energy systems, to stimulate economic growth. This trend is particularly prominent in emerging economies where infrastructure gaps are significant. Geophysical services are crucial in these projects, providing essential data for safe and efficient construction. Advanced geophysical techniques improve project accuracy, reduce risks, and enhance safety, making them indispensable in modern infrastructure projects. Consequently, the increasing volume of infrastructure projects is expected to substantially boost demand for geophysical services in and beyond.

Latest Trends

Advancements in 2D/3D Land Seismic Technology

The geophysical services market is poised to witness significant advancements in 2D and 3D land seismic technology. These innovations are driven by the need for higher-resolution subsurface imaging, essential for accurate exploration and production activities. Enhanced data acquisition techniques, coupled with sophisticated processing algorithms, are enabling more precise subsurface models. This evolution is particularly critical for identifying and de-risking hydrocarbon reserves in complex geological settings. Companies that integrate these cutting-edge technologies can expect to reduce exploration costs and improve operational efficiency. Furthermore, the shift towards digitalization and real-time data analytics is facilitating better decision-making processes, ensuring that operators can quickly adapt to new information and optimize exploration strategies.

Increased Use of Non-Seismic Methods

Alongside advancements in seismic technology, there is a marked increase in the adoption of non-seismic methods within the geophysical services market. Techniques such as gravity, magnetic, and electromagnetic surveys are gaining traction due to their ability to provide complementary data that enhance seismic interpretations. These methods are particularly valuable in areas where seismic acquisition is challenging or cost-prohibitive. Additionally, non-seismic techniques offer environmental and operational benefits, as they often have a lower ecological footprint and can be deployed more flexibly. The integration of non-seismic data into exploration workflows allows for a more comprehensive understanding of subsurface structures, ultimately leading to more accurate resource estimates and better risk management. As the industry continues to seek sustainable and efficient exploration methods, the role of non-seismic technologies is set to expand, driving innovation and diversification in geophysical services.

Regional Analysis

North America dominates the geophysical services market with a 35% largest market share.

North America dominates the market, accounting for approximately 35% of the global share. This leadership is attributed to substantial investments in oil and gas exploration, particularly in the United States and Canada. The U.S. shale revolution has significantly bolstered demand for advanced geophysical technologies, contributing to market growth. Additionally, the presence of key industry players and continuous technological advancements foster a robust market environment in the region.

In Europe, the market holds a notable share, driven by offshore exploration activities in the North Sea and the Mediterranean. Countries like Norway and the United Kingdom are pivotal, with their strong focus on renewable energy projects and advanced geophysical surveying techniques. The European market is also characterized by stringent environmental regulations, which necessitate the use of sophisticated geophysical services.

The Asia Pacific region is experiencing rapid market expansion, with China, India, and Australia leading the charge. The increasing energy demand, coupled with significant investments in mineral exploration, drives the market. Australia's robust mining sector and China's ambitious infrastructure projects further amplify regional demand.

Middle East & Africa represents a critical market segment due to extensive oil and gas reserves. Countries such as Saudi Arabia, UAE, and South Africa are key contributors, with ongoing exploration and production activities necessitating advanced geophysical services. The market here is bolstered by substantial investments in both conventional and unconventional hydrocarbon resources.

Latin America shows promising growth, primarily led by Brazil and Mexico. These countries are investing heavily in offshore drilling activities, with the pre-salt fields in Brazil being particularly noteworthy. The region's market growth is supported by favorable government policies and international investments in energy and mining sectors.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global geophysical services market is projected to witness robust growth in 2024, driven by technological advancements and increased exploration activities. Key players are leveraging innovation and strategic partnerships to enhance their market positions.

TGS Geophysical Company, a leader in multi-client geoscience data, continues to expand its data library and improve data analytics capabilities. Schlumberger, with its extensive portfolio and global presence, remains a dominant force, focusing on integrated geophysical and drilling solutions. Petroleum Geo-Services and Shearwater Services are strengthening their marine seismic data acquisition and processing capabilities, critical for offshore exploration. Fugro leverages its expertise in geotechnical and survey services to support renewable energy projects, enhancing its market relevance amid the energy transition.

Dawson Geophysical Company and CGG maintain strong footholds in land seismic services, emphasizing innovation in data acquisition technologies. SGS SA continues to diversify its geophysical services, ensuring comprehensive quality and risk management solutions. Emerging players like EON Geosciences Inc. and NUVIA Dynamics Inc. are gaining traction by offering specialized geophysical surveying and monitoring solutions. Spectrum Geophysics and Abitibi Geophysics focus on mineral exploration, leveraging advanced geophysical techniques.

Xcalibur Multiphysics, Getech, and Phoenix Geophysics are notable for their expertise in airborne geophysical surveys, critical for large-scale exploration projects. ION Geophysical Corporation innovates in seismic technologies and software solutions, while Ramboll Group A/S integrates geophysical services with environmental and engineering consulting.

In conclusion, the geophysical services market in 2024 will be characterized by a blend of established giants and dynamic newcomers, all driving forward through technological innovation and strategic growth initiatives.

Market Key Players

- TGS Geophysical Company

- Schlumberger

- Petroleum Geo-service

- Shearwater Services

- Fugro

- Dawson Geophysical Company

- SGS SA

- CGG

- EON Geosciences Inc.

- NUVIA Dynamics Inc.

- Spectrum Geophysics

- Abitibi Geophysics

- Xcalibur Multiphysics

- Getech and Ramboll Group A/S

- Phoenix Geophysics

- ION Geophysical Corporation

Recent Development

- In May 2024, Baker Hughes launched its Integrated Geophysical Solution (IGS), which combines seismic data with electromagnetic and gravity data for comprehensive subsurface characterization. The IGS aims to provide a more holistic view of the subsurface, facilitating better decision-making in exploration and production.

- In April 2024, Schlumberger introduced a new marine seismic technology named "AquaSeis" designed to deliver higher resolution and more detailed subsurface images. This technology leverages innovative sensor arrays and enhanced data acquisition techniques, targeting offshore oil and gas exploration activities.

- In March 2024, CGG announced the expansion of its data processing capabilities by incorporating advanced machine learning and AI algorithms into its geophysical data analysis processes. This enhancement aims to improve the accuracy and efficiency of subsurface imaging, catering to the increasing demand for high-resolution geophysical data in the energy sector.

Report Scope

Report Features Description Market Value (2023) USD 16.4 Billion Forecast Revenue (2033) USD 26.9 Billion CAGR (2024-2032) 5.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Seismic, Magnetic, Electromagnetic, Gravity, LIDAR, Others), By Type (Aerial-based, Marine-based, Land-based), By End-Use (Minerals and Mining, Oil and Gas, Wind Energy, Water Exploration, Archaeological Research, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape TGS Geophysical Company, Schlumberger, Petroleum Geo-service, Shearwater Services, Fugro, Dawson Geophysical Company, SGS SA, CGG, EON Geosciences Inc., NUVIA Dynamics Inc., Spectrum Geophysics, Abitibi Geophysics, Xcalibur Multiphysics, Getech and Ramboll Group A/S, Phoenix Geophysics, ION Geophysical Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- TGS

- Schlumberger

- Petroleum Geo-service

- Shearwater Services

- Fugro

- Dawson Geophysical Company

- SGS SA

- CGG

- EON Geosciences

- NUVIA Dynamics Inc.

- Spectrum Geophysics

- Abitibi Geophysics

- Xcalibur Multiphysics

- Getech and Ramboll Group A/S

- Phoenix Geophysics

- ION Geophysical Corporation