Geographic Information System Gis Market By Component(Hardware, Software), By Function(Surveying, Mapping), By Device Type(Desktop, Mobile), By End-Use Industry(Transport and Logistics, Agriculture, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

1522

-

May 2023

-

165

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

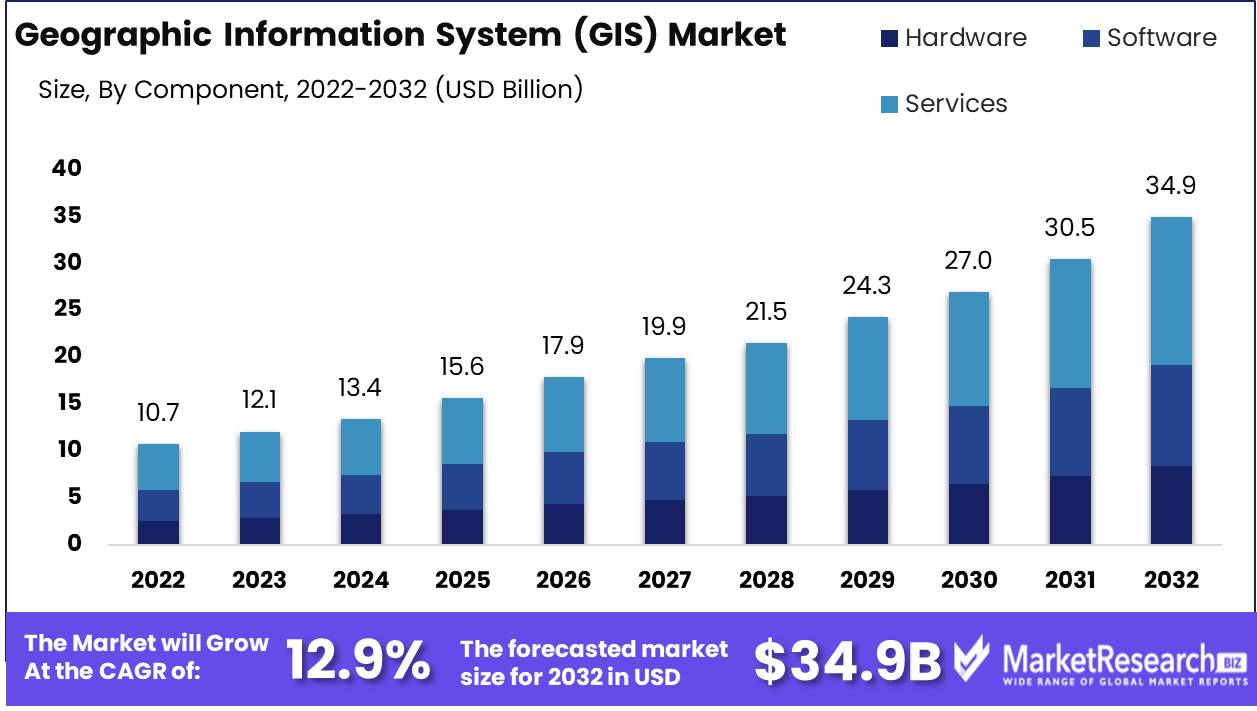

Geographic Information System (GIS) Market size is expected to be worth around USD 34.9 Bn by 2032 from USD 10.7 Bn in 2022, growing at a CAGR of 12.9% during the forecast period from 2023 to 2032.

GIS, or Geographic Information System, is a useful tool for gaining a comprehensive comprehension of a given region by integrating diverse data types, such as maps, satellite imagery, and demographic data. Its primary objective is to improve decision-making processes and provide users with insightful knowledge. Whether it pertains to urban planning, environmental management, or disaster response, GIS provides a robust toolkit for effectively analyzing and managing geospatial data.

The significance and advantages of GIS are numerous. First, it facilitates enhanced resource management and planning. GIS facilitates the identification of optimal locations for diverse projects, such as the construction of new roadways or the establishment of public services, by superimposing multiple layers of information, such as infrastructure, environmental factors, and population density.

Moreover, GIS is indispensable for disaster management and emergency response. It provides real-time data on affected areas and potential hazards, enabling authorities to allocate resources effectively and respond swiftly to disasters. Monitoring changes in land use, land cover, and natural resources, this technology also facilitates environmental monitoring. In turn, this aids conservation efforts and the promotion of sustainable development.

Integration of Augmented Reality (AR) technology is an intriguing development in the GIS industry. AR-enabled GIS applications enable users to superimpose digital information on the physical world, resulting in an immersive experience. For instance, augmented reality-enabled GIS can help visitors navigate cities by displaying points of interest and historical data directly on their smartphone screens.

Given the growing demand for GIS services, the industry has made substantial investments. Companies understand the value of integrating GIS into their products and services to obtain a competitive advantage. GIS is incorporated into navigation systems in the automotive industry, for example, to provide real-time traffic updates and optimized routing. Utilizing GIS, the retail sector analyzes customer demographics and optimizes store locations.

Driving factors

Demand for Spatial Data Analysis and Visualization Is Growing

The Geographic Information System (GIS) market is heavily dependent on spatial data analysis and visualization. With the increasing availability of data from multiple sources and the need to make well-informed decisions based on location-specific data, the demand for spatial data analysis and visualization has increased exponentially.

In today's data-driven society, organizations from a variety of industries are beginning to recognize the importance of spatial data analysis and visualization. Utilizing geographic data, this technology enables them to obtain valuable insights and make data-driven decisions. By analyzing data in the context of its spatial relationships, businesses can identify patterns, trends, and correlations that might not be discernible using conventional data analysis techniques.

Smart City and Urban Planning Initiatives Expand

The rapid expansion of smart city and urban planning initiatives is one of the main forces propelling the Geographic Information Systems (GIS) Market. Governments and city planners are turning to GIS to collect, analyze, and visualize geospatial data for effective urban planning in light of the increasing urbanization and the need for sustainable development.

GIS technologies allow city planners to identify locations suitable for infrastructure development, optimize resource allocation, analyze transportation networks, and prepare for disaster management. Using spatial data analysis and visualization, city officials can make informed decisions regarding land use, transportation routes, and public service provision, leading to better resource allocation and an enhanced quality of life for residents.

Technological Advances in Satellite Imaging and Mapping

The use of satellite imaging and other technologies to collect and analyze data has revolutionized how we view the world. With the availability of high-resolution satellite imagery, organizations have access to precise and current data regarding the Earth's surface.

Satellite imaging enables the collection of vast quantities of geospatial data, which can then be combined with data from other sources to produce exhaustive GIS databases. This data can be used to analyze changes in land use, monitor environmental conditions, trace urban development, and even evaluate the effects of natural disasters.

Restraining Factors

Potential Difficulties in Data Accuracy and Integration

Accurate data is essential for any GIS implementation because it serves as the basis for making decisions. Nevertheless, ensuring the accuracy of geographic data can be a difficult endeavor. Data may originate from a variety of sources, each with its own data quality standards, resulting in the potential for inconsistencies or errors when integrating the data into a GIS. Inaccurate or insufficient data can result in erroneous analysis, which undermines the credibility and efficacy of GIS applications.

Organizations must employ robust data validation and integration procedures to address data quality issues. This entails establishing data quality checks, such as consistency checks, ensuring data conforms to predefined data models, and resolving any conflicts or inconsistencies that may arise.

Potential Limitations in Data Interoperability

The ability of various systems and platforms to interchange and utilize data without interruption is referred to as data interoperability. However, due to varying data formats, standards, and protocols, it can be difficult to achieve seamless data interoperability. Organizations may face obstacles such as incompatible data formats, disparate data schemas, and translation and transformation difficulties between different GIS systems.

To overcome these limitations, Open Geospatial Consortium (OGC) standards and other industry standards can facilitate interoperability between GIS platforms. Implementing software tools and frameworks that support data conversion and transformation can also assist in standardizing and bridging the gap between various GIS systems, thereby ensuring efficient data exchange and analysis.

Component Analysis

The geographic information system (GIS) market is a rapidly expanding industry with multiple segments competing for dominance. The Services Segment holds the largest market share among these segments. This dominance can be attributed to several factors, including the growing demand for innovative mapping and geographic analysis solutions.

The economic growth of emerging societies has had a significant impact on the adoption of the Services Segment. As these economies continue to urbanize and develop, the need for efficient and effective GIS solutions becomes paramount. Organizations in these regions are recognizing the value of GIS services in addressing diverse challenges, including infrastructure planning, disaster management, and environmental monitoring.

The dominance of the Services Segment is also influenced by consumer trends and behavior. Consumers increasingly rely on location-based services for navigation, social media, and other applications as the use of smartphones and mobile devices grows in popularity. This has increased the demand for GIS services that can provide accurate and up-to-date spatial data.

Function Analysis

In the world of GIS, the Navigation Segment dominates the market and holds center stage. Navigation services have become indispensable in the modern world, as navigation applications and GPS-enabled devices are widely employed. The need for accurate and real-time navigation information has led to the accelerated adoption of GIS solutions in this market segment.

Similar to the Services Segment, economic growth in emerging economies plays a significant role in promoting the adoption of the Navigation Segment. As urban populations increase and transportation networks develop, the demand for dependable navigation systems becomes essential. Cities in developing nations are investing significantly in intelligent transportation infrastructure, which is fueling the growth of the Navigation Segment.

The prominence of the Navigation Segment is also affected by consumer behavior. Users of smartphones rely extensively on navigation apps for directions, traffic information, and points of interest. The convenience and usability of GIS-based navigation services have made them the preferred option for consumers around the globe.

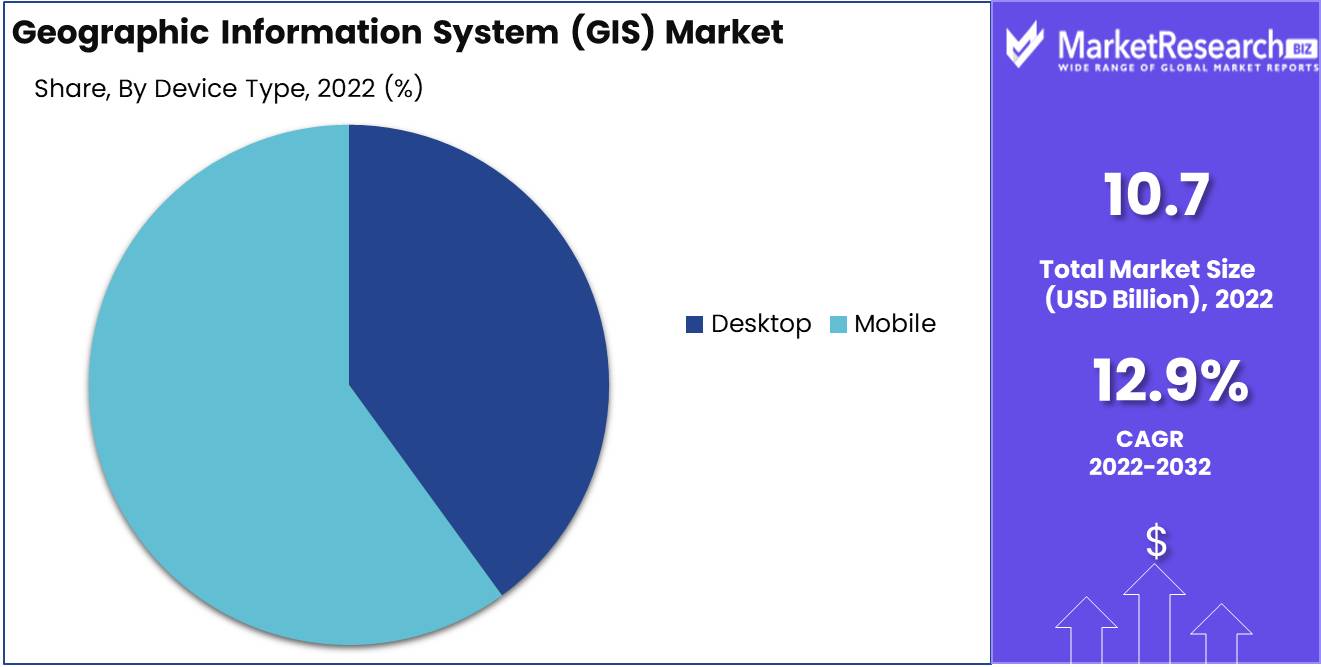

Device Type Analysis

The Mobile Segment dominates other device categories within the GIS industry. In today's society, mobile devices, such as smartphones and tablets, are ubiquitous. The portability and convenience of these devices have resulted in their widespread adoption, making them the preferred method for accessing GIS services.

Mobile segment adoption has been substantially influenced by the economic development of emergent economies. As these economies surpass traditional desktop computing, mobile devices become the primary way to access information and services. The affordability and availability of mobile technology have contributed to its proliferation, resulting in an increase in demand for GIS services on these devices.

The Mobile Segment's dominance is also influenced by consumer trends and behavior. Consumers have come to expect GIS services to be available at their fingertips as their reliance on mobile devices for a variety of daily activities grows. From locating local restaurants to navigating unfamiliar areas, mobile devices have evolved into indispensable resources.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Function

- Surveying

- Mapping

- Navigation

By Device Type

- Desktop

- Mobile

By End-Use Industry

- Transport and Logistics

- Agriculture

- Construction

- Mining and Geology

- Oil & Gas

- Other

Growth Opportunity

Integration of Artificial Intelligence (AI) into GIS

The integration of artificial intelligence (AI) technologies represents one of the most promising growth opportunities in the Geographic Information Systems (GIS) Market. As AI continues to develop, its capacity to consolidate and automate processes within GIS applications becomes increasingly apparent. GIS solutions powered by AI can analyze immense quantities of geospatial data, enabling more precise decision-making and resource allocation. GIS technology can handle complex spatial analysis duties, improve data visualization, and improve the user experience overall with the integration of AI.

Utilizing Big Data and Artificial Intelligence in GIS

The integration of big data and machine learning (ML) techniques is another growth opportunity for the Geographic Information Systems (GIS) Market. As organizations amass vast quantities of data, the difficulty resides in gleaning meaningful insights from it. GIS is well-positioned to utilize big data and machine learning (ML) algorithms to process, analyze, and interpret geospatial data. By incorporating these technologies, GIS is better able to identify patterns, trends, and correlations in the data, resulting in enhanced decision-making across multiple sectors, including urban planning, transportation, environmental management, and disaster response.

Amplification of Indoor GIS Applications

Despite the fact that GIS has been primarily associated with outdoor mapping and spatial analysis, there is a significant unrealized potential in utilizing GIS for indoor applications. As businesses and institutions place a greater emphasis on optimizing their indoor spaces, the demand for precise and real-time indoor mapping solutions increases. Indoor GIS applications can provide invaluable insights regarding space utilization, navigation, and asset tracking in complex indoor environments such as retail malls, airports, hospitals, and manufacturing facilities.

Latest Trends

Web-Based And Interactive GIS Platforms Are Expanding

The growth and prevalence of web-based and interactive GIS platforms is one of the most important market trends in GIS. GIS-based platforms, in contrast to traditional GIS software, enable users to access and work with spatial data via a web browser, eliminating the need for complex installations. This accessibility and usability have revolutionized how businesses manage geospatial data. These platforms provide scalable and cost-effective solutions for storing, administering, and analyzing geospatial data, thanks to the development of cloud computing technology. They enable real-time collaboration, which makes it simpler for geographically dispersed teams to work seamlessly together.

Demand for 3D and Augmented Reality (AR) Geographic Information System (GIS) Visualization

Another significant trend that is changing the Geographic Information Systems (GIS) Market is the demand for 3D and augmented reality (AR) GIS visualization. Traditional 2D maps are limited in their ability to depict the complex spatial relationships of the actual world. With the addition of 3D visualization capabilities to GIS software, businesses can now visualize geospatial data in a more realistic and immersive manner. This technology enables users to investigate landscapes, buildings, and other physical features from a more in-depth and expansive perspective.

Utilization of Geographic Information Systems (GIS) in Precision Agriculture and Environmental Management

GIS has made significant contributions to the fields of precision agriculture and environmental management. The ability to collect, analyze, and visualize geospatial data has provided producers and environmental professionals with valuable insights and tools. Integrating data from multiple sources, such as weather patterns, soil composition, and crop health, GIS enables precision agriculture. Farmers can optimize irrigation, fertilization, and pest control by analyzing this data, resulting in increased crop yields and reduced environmental impact.

Advancement of Indoor Mapping and Navigation Services

In recent years, the demand for indoor mapping and navigation solutions powered by GIS technology has increased. Traditional navigation systems focused predominantly on outdoor environments, but the need for precise indoor guidance is becoming increasingly important. GIS is utilized by indoor mapping and navigation solutions to generate detailed floor plans, map indoor locations, and provide users with turn-by-turn directions within buildings. This technology has applications in industries such as retail, healthcare, and transportation.

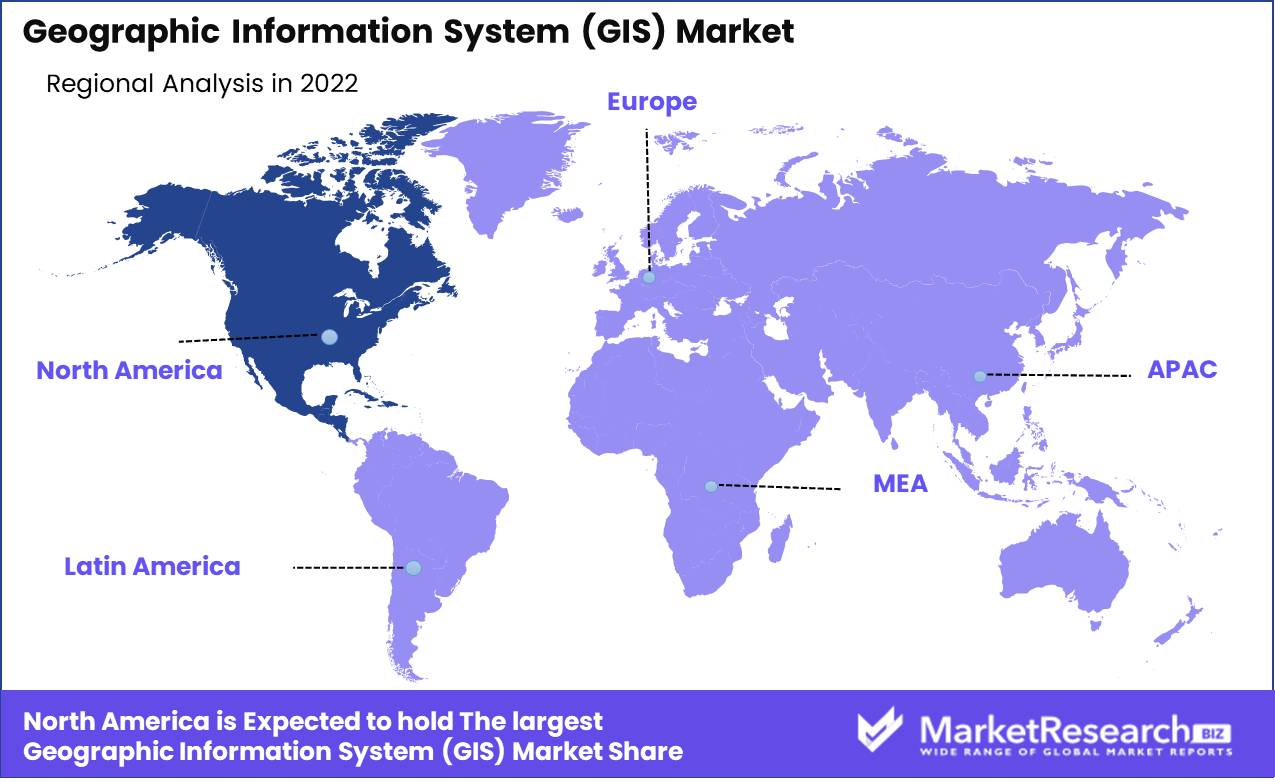

Regional Analysis

North America maintains a substantial market share in the GIS industry and continues to experience rapid expansion. This dominance can be attributed to a number of factors, such as the presence of major GIS software vendors, a strong emphasis on technological advancements, and the widespread adoption of GIS.

The presence of major GIS software vendors is a significant factor in North America's dominance in the Geographic Information Systems (GIS) Market. The majority of these companies are based in the United States, and they have developed cutting-edge technology to support their mission. These vendors have propelled North America to the vanguard of the GIS industry by continuously innovating and providing robust product lines.

In addition, North America's strong commitment to technological progress strengthens its position in the Geographic Information Systems (GIS) Market. The region's advanced IT infrastructure provides a firm foundation for the adoption and incorporation of GIS technology. This infrastructure enables organizations to manage, analyze, and visualize large volumes of spatial data efficiently, thereby driving the demand for GIS solutions.

In addition, North America has embraced the potential of GIS in multiple sectors, including government, transportation, healthcare, environment, and natural resources. GIS is utilized by governments at all levels, from local municipalities to federal agencies, to enhance urban planning, create effective public safety measures, and better manage natural resources. GIS is utilized in the transportation industry to optimize logistics, route planning, and traffic management. In addition, GIS plays a crucial role in healthcare by enabling providers to analyze disease patterns, monitor the spread of infections, and prepare for emergencies. These sectors' extensive GIS implementations have contributed to the region's dominance in the market.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Esri, headquartered in the United States, is widely regarded as a GIS technology pioneer. Since 1969, Esri has consistently stretched the limits of GIS, revolutionizing the way spatial data is collected, managed, and analyzed. Their flagship product, ArcGIS, remains at the forefront of the GIS industry and is utilized by professionals in a variety of fields, including government, non-profit, and academic institutions.

Hexagon, headquartered in Sweden, is a global leader in intelligent digital solutions with a solid foundation in the GIS market. The business offers geospatial software, hardware, and services that enable clients to capture, analyze, and visualize location-based data. Hexagon's dedication to innovation has resulted in the creation of cutting-edge technologies, such as their primary product, Hexagon Smart M.App, which enables users to create dynamic geospatial applications tailored to their particular business requirements.

Pitney Bowes Inc., a prominent United States-based company, specializes in providing spatial analytics solutions that span the entire GIS spectrum. Their capabilities range from data creation and administration to geocoding and location intelligence. Pitney Bowes utilizes its extensive industry expertise to provide customized GIS solutions that meet the specific needs of each client.

Top Key Players in Geographic Information System GIS Market

- Environmental Systems Research Institute Inc. (Esri) (U.S.)

- Hexagon (Sweden)

- Pitney Bowes Inc. (U.S.)

- Autodesk Inc. (U.S.)

- Trimble Inc. (U.S.)

- Topcon (Japan)

- Hi-Target. (China)

- BENTLEY SYSTEMS IncORPORATED (U.S.)

- Caliper Corporation (U.S.)

- Computer Aided Development Corporation Limited (Cadcorp) (U.K.)

- SuperMap Software Co. Ltd. (China)

- L3Harris Technologies Inc. (U.S.)

- Maxar Technologies (U.S.)

Recent Development

- In 2023, Esri, one of the leading participants in the GIS market, astonished the industry by announcing the upcoming release of a revolutionary GIS platform designed to provide an unmatched user experience. This user-friendly platform is anticipated to revolutionize the way professionals utilize geospatial data.

- In 2022, Hexagon, a prominent provider of geospatial technology solutions, announced its intent to acquire Bentley Systems, a prominent GIS solutions provider. This alliance, which is expected to be finalized, will combine Bentley's innovative GIS offerings with Hexagon's expertise, expanding the options for users pursuing advanced geospatial solutions across industries.

- In 2021, By announcing the expansion of its GIS portfolio, Trimble, a reputable provider of positioning and location-based technology, caused a stir in the GIS market. Their strategic decision to introduce new products and services demonstrates Trimble's commitment to providing innovative, customer-specific solutions.

Report Scope

Report Features Description Market Value (2022) USD 10.7 Bn Forecast Revenue (2032) USD 34.9 Bn CAGR (2023-2032) 12.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component(Hardware, Software), By Function(Surveying, Mapping), By Device Type(Desktop, Mobile), By End-Use Industry(Transport and Logistics, Agriculture, Other) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Environmental Systems Research Institute Inc. (Esri) (U.S.), Hexagon (Sweden), Pitney Bowes Inc. (U.S.), Autodesk Inc. (U.S.), Trimble Inc. (U.S.), Topcon (Japan), Hi-Target. (China), BENTLEY SYSTEMS IncORPORATED (U.S.), Caliper Corporation (U.S.), Computer Aided Development Corporation Limited (Cadcorp) (U.K.), SuperMap Software Co. Ltd. (China), L3Harris Technologies Inc. (U.S.), Maxar Technologies (U.S.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Environmental Systems Research Institute Inc. (Esri) (U.S.)

- Hexagon (Sweden)

- Pitney Bowes Inc. (U.S.)

- Autodesk Inc. (U.S.)

- Trimble Inc. (U.S.)

- Topcon (Japan)

- Hi-Target. (China)

- BENTLEY SYSTEMS IncORPORATED (U.S.)

- Caliper Corporation (U.S.)

- Computer Aided Development Corporation Limited (Cadcorp) (U.K.)

- SuperMap Software Co. Ltd. (China)

- L3Harris Technologies Inc. (U.S.)

- Maxar Technologies (U.S.)