Genetically Modified Seeds Market By Crop Type (Corn, Soybean, Cotton, Canola, potato, Sugar Beets, and Other), By Trait Type (Herbicide Tolerance, Insect Resistance, and Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

-

40249

-

July 2023

-

137

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

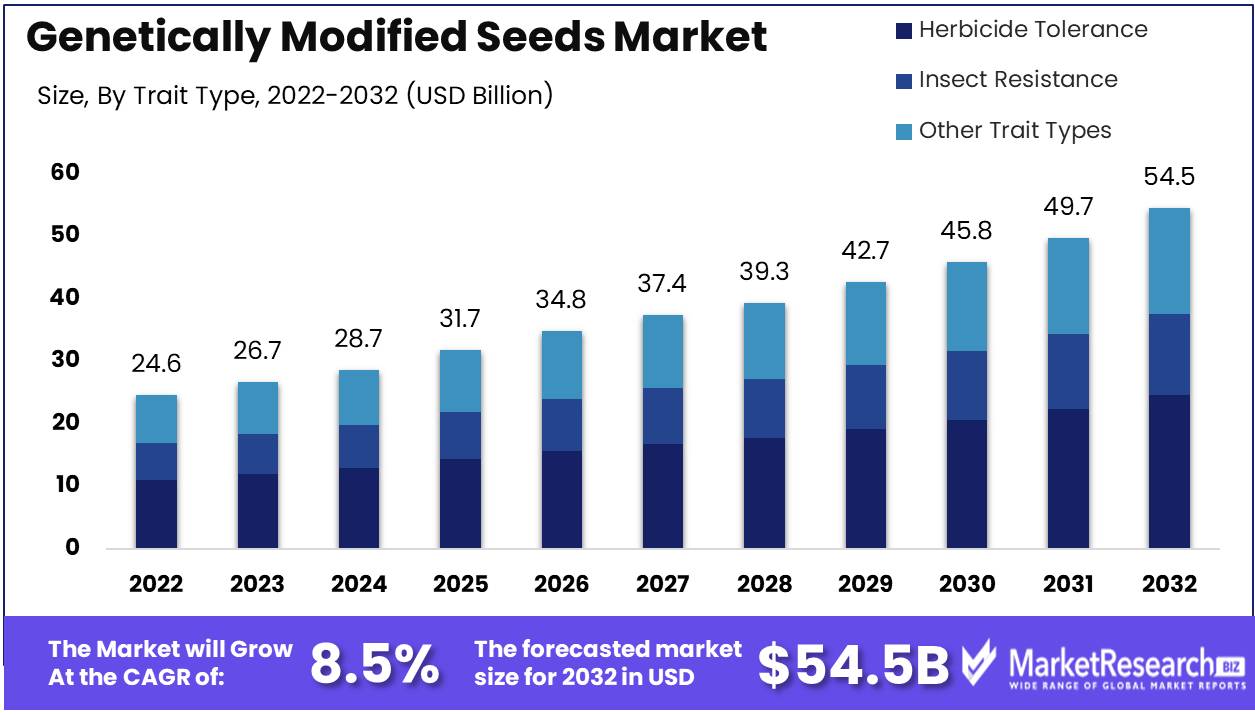

Genetically Modified Seeds Market size is expected to be worth around USD 54.5 Bn by 2032 from USD 24.6 Bn in 2022, growing at a CAGR of 8.5% during the forecast period from 2023 to 2032.

Genetically modified seeds (GM) is a technology that involves inserting DNA into the genome of seeds. For the production of GM plants, new DNA is transferred into plant cells. These cells are usually grown in tissue culture, where they develop into plants. The seeds produced by these plants will inherit the new DNA. The modified seeds are also known as genetically modified organisms.

Driving factors

Increasing Use in Biofuels Production Driving the Growth of Global Genetically Modified (GM) Seeds Market

Modern plant biotechnological applications propel certain useful traits, such as herbicides tolerance and insect repellent, which help in increasing crop yields and protecting crops. The crops with such traits help in reducing the cost of pesticides and herbicides, thus, demand for genetically modified crop seeds is increasing in the market. The increasing adoption of biofuels due to increasing demand for fuel alternatives propels the market growth.

The crops such as canola and soybean are known as energy crops which are used in the fermentation process of biofuel production to form bioalcohols, butanol, and production of ethanol. The fuels which are based on plants come from renewable sources and can be grown anywhere and they have low carbon emissions which have a positive impact on genetically modified seeds market growth. Several countries in North America and the Asia Pacific region are concentrating on the production of biofuels due to the increasing costs of crude oil. The increasing demand for animal feed, and rising preference for oleo-chemicals driving the market growth.

Also the emergence of new technologies in farming such as vertical farming, and increasing demand for plant-based meat products driving the growth rate of the market. Genetic engineering reduces the costs of food production, reduced the need for pesticides, helps in increasing nutrient composition, provides high resistance to pests, and provides tremendous health benefits. Also, genetically modified crops help farmers to reduce environmental footprints by reducing the use of fuels and pesticides. These are some key factors driving the growth of the genetically modified seeds market.

Restraining Factors

Allergic Issues and Lost of Insect Diversity have Negative Impact on Market Growth

Genetically modified crops disrupt the natural process of gene flow. Sometimes genetically modified seeds result in allergic reactions in several individuals. The genetic engineering of seeds required high cost which has a negative impact on genetically modified seeds market growth. Genetically modified crops reduce insect biodiversity when crops are resistant to insects.

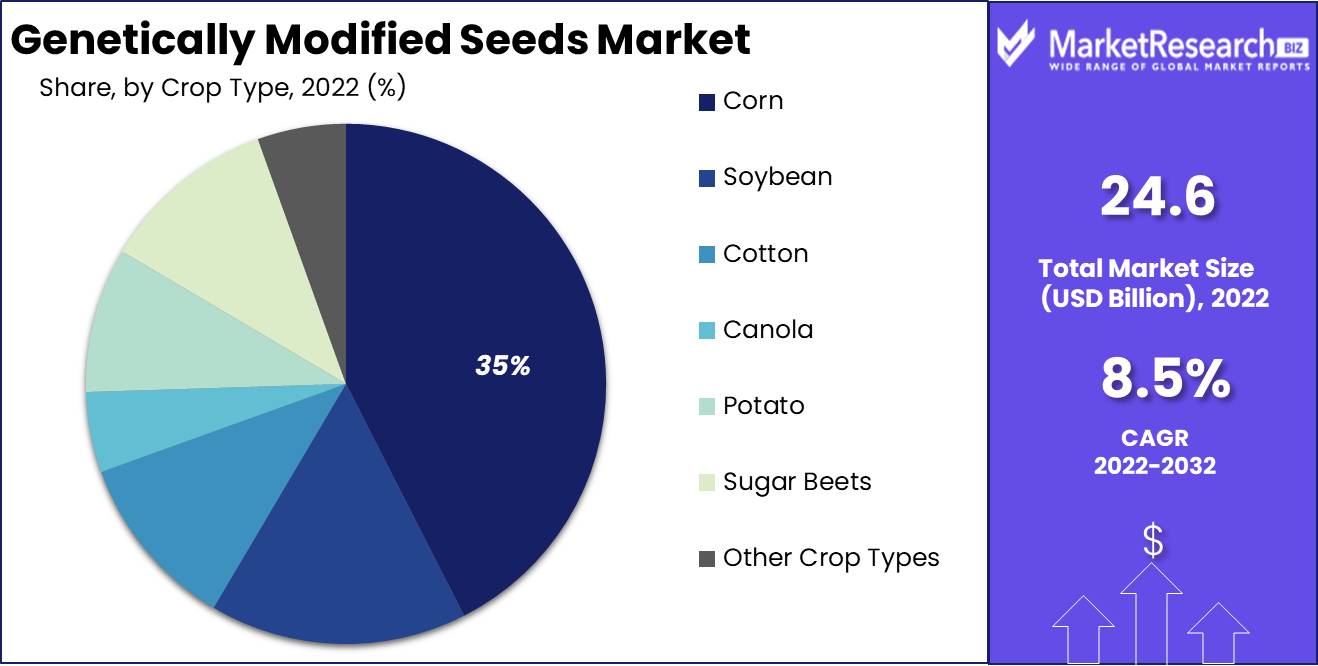

Crop Type Analysis

The Corn Segment is Dominant in the Market, with Largest Market Revenue Share

By crop type, the market is segmented into corn, soybean, cotton, canola, potato, sugar beets, and other crop types. The corn segment was dominant in the market, with the largest market revenue share of 35% in 2022. A lot of genetically modified corn and soybean are used in processed foods and drinks. Most of the corn is used as feed for livestock. Thus, the demand is increasing in the genetically modified seeds market. About 90% of corn and soybean are genetically modified and mostly used in the United States.

The United States has the largest area of genetically modified crops worldwide, at 71.5 million hectares, followed by Brazil with 52.8 million hectares. The GMO soybean is used as feed for livestock, predominantly poultry, and livestock, and in making soybean oil. Genetically modified soybean crops are also containing nutritional values such as proteins which are widely used in processed foods and dietary supplements. Soybean and corn are also used as energy crops in the production of biofuels. The cotton crops segment is expected to grow at the fastest CAGR during the forecast period.

The genetically modified crop cotton, also known as BT Cotton, is highly pest-resistant. Brazil cultivates around 44.2 million hectares’ area of modified cotton. The canola crop is genetically modified to decrease the tolerance of herbicides. The canola is commonly used to feed many types of farm animals used for meat and milk production. The demand for animal feed is increasing in animal farming. Thus, the demand for genetically modified alfalfa is increasing in the market.

Trait Type Analysis

Herbicide Tolerance Segment is Dominant in Market

By trait type, the market is segmented into herbicide tolerance, insect resistance, and other trait types. The herbicide tolerance segment was dominant in the market, with the largest genetically modified seeds market revenue share of 83% in 2022. Most of the herbicide resistance GM crops have been engineered for glyphosate tolerance; in the USA, 93% of soybean and most of the GM maize grown is glyphosate tolerant.

Genetically modified herbicide-tolerant crop growth is not affected by herbicides used on the weeds around them. The farmers prefer herbicide-tolerant crops, are help in increasing crop yields and reduce costs. These types of crops are commonly known as “Roundup Ready” in American agriculture, with 93% of soybeans, 82% of cotton, and 85% of corn planted engineered to be herbicide resistant.

The insect resistance segment is expected to grow at the fastest CAGR during the forecast period due to changes in climatic conditions and the tolerance of insects that affect crop yields. Most of the seeds that are genetically modified and used for insect resistance come from the Bacillus thuringgiensis bacterium. This type of crop includes soybean, maize, cotton, canola, and alfalfa, which are genetically modified crops.

Key Market Segments

By Crop Type

- Corn

- Soybean

- Cotton

- Canola

- Potato

- Sugar Beets

- Other Crop Types

By Trait Type

- Herbicide Tolerance

- Insect Resistance

- Other Trait Types

Growth Opportunity

The Advancements in Agricultural Biotechnology is Expected to Create Lucrative Growth Opportunities in Market

Genetically modified crops help to reduce agricultural greenhouse gas (GHG) emissions. With the increasing demand for natural fuels such as biofuels which helps in reducing greenhouse gas emission, the demand for genetically modified seeds is expected to increase in the forecast period. Genetically modified crops use fewer chemicals, water, soil, and energy as compared to traditional crops. The increasing innovations in agricultural biotechnology allow farmers to improve crop yield, and efficient land use, which is expected to drive the genetically modified seeds market in the forecast period.

About 75% of processed foods are produced by using genetically modified crops. Worldwide concerns regarding health among individuals is increasing, therefore the demand for GMO soybean is increasing in the dietary supplement manufacturing industries. Several industries in agricultural biotechnology are focusing on improving R&D activities to gain high crop yields with reducing operating costs. Also, stringent regulations on the emission of hazardous gases drive the demand for energy crops in biofuel production.

Latest Trends

The Demand for Herbicide Tolerance GMOs is Increasing

Major players in the genetically modified seed industry are expanding their business in their respective countries for expanding their footprints and geographical reach. Most of the GMO crops grown today are developed to help farmers prevent crop loss. Farmers worldwide prefer genetically modified herbicide tolerance and insect-resistant crops to reduce farming costs and increase crop yields. The demand for nutrition-rich food is increasing worldwide, therefore farmers are shifting towards GM crops to provide nutritional values. These are some key market trends in the genetically modified seeds market.

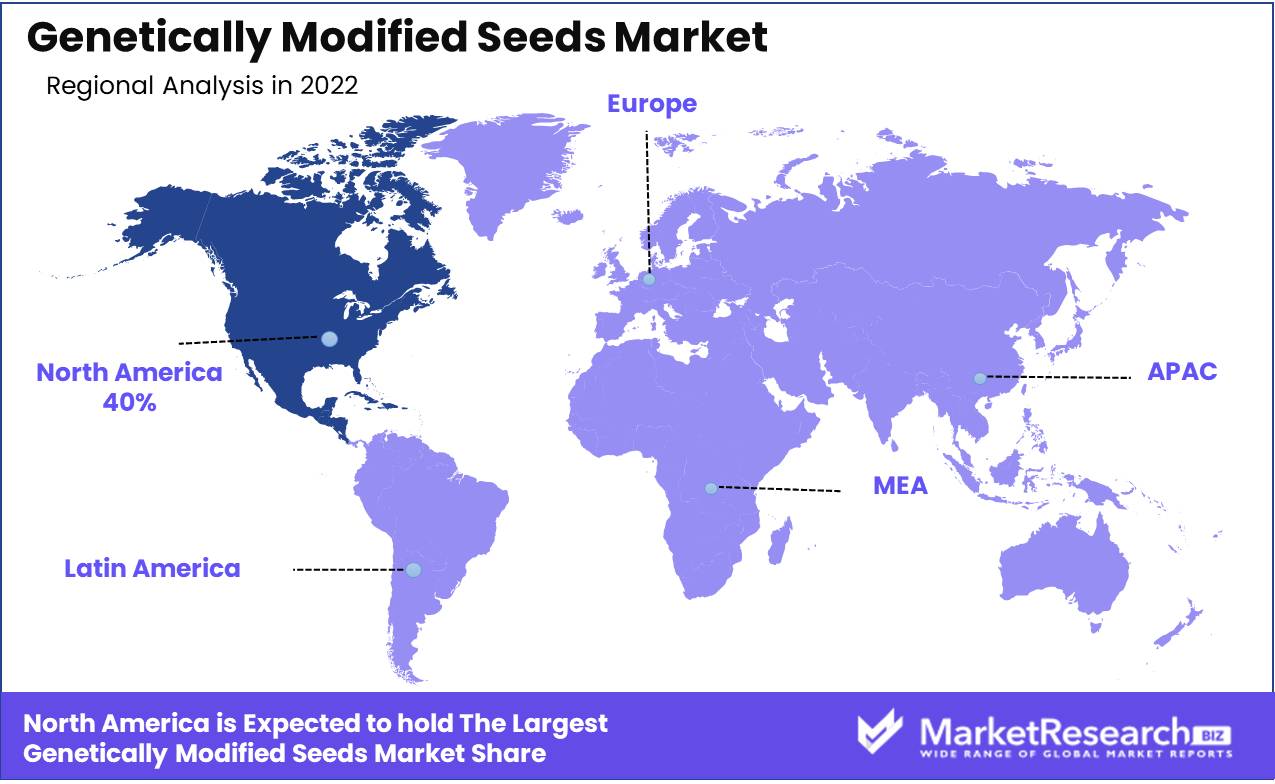

Regional Analysis

North America Region is Dominant in the Market with Largest Market Share

The North America region was dominant in the market with the largest market share of 40% in 2022. About 85-90% of soybean and corn crops are cultivated in the North America region, propelling the genetically modified seeds market growth. The GMO crops are used to make ingredients that Americans eat such as corn oil, corn syrup, soybean oil, and granulated sugar. There are more than 120 varieties of genetically modified crops in the United States mostly herbicide-tolerant and insect-resistant crops. Also increasing the costs of petrol and diesel the need for biofuels is increasing, thus the demand for GMOs is increasing in the region.

The Asia Pacific region is expected to grow at the fastest CAGR and holds the largest market size during the forecast period due to increasing research and development activities in agricultural biotechnology. Japan imports about 3.2 million tons of soybeans, 2.4 million tons of canola, and 16 million metric tons of corn per year. The Government regulatory bodies in various countries are focusing on genetic engineering for agricultural developments and increasing crop yields. Also the increasing population of emerging economies such as China, India, and Japan, the need for food is increasing, which is expected to drive the genetically modified seeds market in the forecast period.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

key market players are focused on a variety of strategic policies to develop their respective businesses in foreign markets. Key players in agricultural biotechnology are focusing on R&D activities to expand their business and stay competitive in the market. The Major key players in genetically modified seeds market are Barenbrug Holding B.V, BASF S.E., Bayer A.G, Corteva Inc., Groupe Limagrain Holding, KWS SAAT SE & Co. KGaA, Land O Lakes Inc., Sakata Seed Corp., Syngenta AG, Takii & Co. Ltd., Calytx Inc., JK Agri Genetics Ltd., Vimorin & Cie SA, Bejo Zadan B.V., DLF seeds A/S, DowDupont Inc., Canterra Seeds Holdings Ltd., and Other Key Players.

Top Key Players in Genetically Modified Seeds Market

- Barenbrug Holding B.V

- BASF S.E.

- Bayer A.G

- Corteva Inc.

- Groupe Limagrain Holding

- KWS SAAT SE & Co. KGaA

- Land O Lakes Inc.

- Sakata Seed Corp.

- Syngenta AG

- Takii & Co. Ltd.

- Calytx Inc.

- JK Agri Genetics Ltd.

- Vimorin & Cie SA

- Bejo Zadan B.V.

- DLF seeds A/S

- DowDupont Inc.

- Canterra Seeds Holdings Ltd.

- Other key Players

Recent Development

- In 2020, ChemChina transferred its entire agricultural business to Syngenta Group, which also includes Adama and the agricultural activities of Sinochem in addition to Syngenta.

- In February 2019, the U.S. approved the soybean event FAD2KO for food and feed use.

Report Scope:

Report Features Description Market Value (2022) USD 24.6 Bn Forecast Revenue (2032) USD 54.5 Bn CAGR (2023-2032) 8.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Crop Type- Corn, Soybean, Cotton, Canola, potato, Sugar Beets, and Other Crop Types; By Trait Type- Herbicide Tolerance, Insect Resistance, and Other Trait Types. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Barenbrug Holding B.V, BASF S.E., Bayer A.G, Corteva Inc., Groupe Limagrain Holding, KWS SAAT SE & Co. KGaA, Land O Lakes Inc., Sakata Seed Corp., Syngenta AG, Takii & Co. Ltd., Calytx Inc., JK Agri Genetics Ltd., Vimorin & Cie SA, Bejo Zadan B.V., DLF seeds A/S, DowDupont Inc.,Canterra Seeds Holdings Ltd., and Other key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Barenbrug Holding B.V

- BASF S.E.

- Bayer A.G

- Corteva Inc.

- Groupe Limagrain Holding

- KWS SAAT SE & Co. KGaA

- Land O Lakes Inc.

- Sakata Seed Corp.

- Syngenta AG

- Takii & Co. Ltd.

- Calytx Inc.

- JK Agri Genetics Ltd.

- Vimorin & Cie SA

- Bejo Zadan B.V.

- DLF seeds A/S

- DowDupont Inc.

- Canterra Seeds Holdings Ltd.

- Other key Players