Generative ai in Security Market By Type (Network Security, Application Security, Cloud Security, Other Security Types), By Service (Professional Services, Managed Services), By Deployment Mode (Cloud-Based, On-premises), By End Users (Retail, BFSI, Manufacturing, Healthcare, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

37856

-

Aug 2024

-

137

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

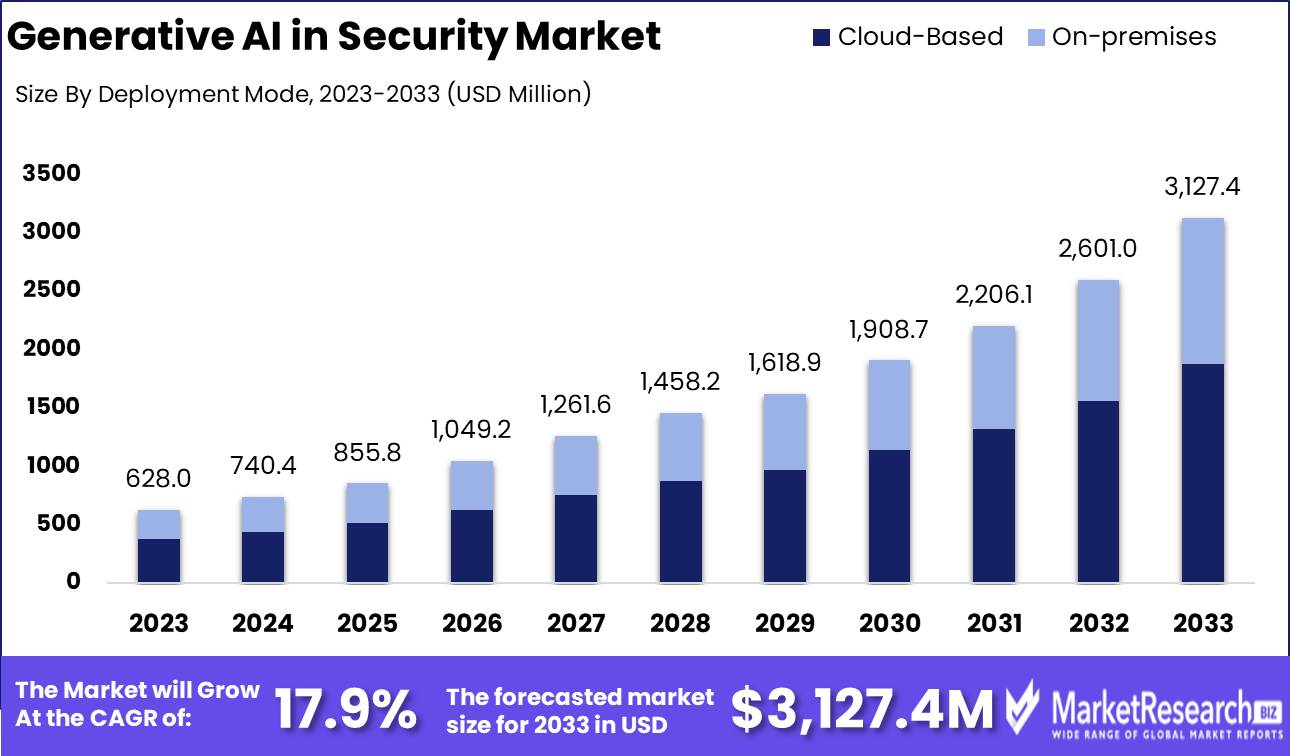

The Global Generative ai in Security Market was valued at USD 628 Mn in 2023. It is expected to reach USD 3127.4 Bn by 2033, with a CAGR of 17.9% during the forecast period from 2024 to 2033.

The Generative AI in Security Market encompasses the use of generative artificial intelligence technologies to enhance cybersecurity measures. This includes AI-driven tools and platforms designed to detect, respond to, and prevent cyber threats in real-time. The market is driven by the increasing sophistication of cyber-attacks and the need for advanced, autonomous security solutions. Generative AI's ability to analyze vast amounts of data and identify patterns makes it a critical component in modern cybersecurity strategies, helping organizations protect sensitive information and maintain operational integrity.

The Generative AI in Security Market is poised for transformative growth, driven by the escalating complexity of cyber threats and the need for advanced, proactive security measures. SentinelOne's AI-driven platform, capable of autonomously responding to threats in under 30 seconds, exemplifies the significant operational efficiency gains offered by generative AI. This rapid response capability is crucial in mitigating damage and maintaining the integrity of organizational systems.

The Generative AI in Security Market is poised for transformative growth, driven by the escalating complexity of cyber threats and the need for advanced, proactive security measures. SentinelOne's AI-driven platform, capable of autonomously responding to threats in under 30 seconds, exemplifies the significant operational efficiency gains offered by generative AI. This rapid response capability is crucial in mitigating damage and maintaining the integrity of organizational systems.In 2022, phishing attacks increased by 21%, highlighting the potential misuse of generative AI by cybercriminals to craft more convincing and sophisticated attacks. This trend underscores the dual-edged nature of AI in cybersecurity—while it provides powerful tools for defense, it also equips attackers with advanced capabilities. Therefore, the deployment of generative AI in security requires continuous innovation and vigilance to stay ahead of evolving threats.

Generative AI enhances security by analyzing vast datasets to identify patterns and anomalies indicative of potential threats. This ability to process and learn from extensive data allows for the development of more accurate and efficient threat detection systems. Additionally, AI-driven platforms can adapt to new types of cyber-attacks more quickly than traditional security systems, providing a robust and dynamic defense mechanism.

The market is further supported by increasing investments in AI and cybersecurity by organizations seeking to protect their assets and data. As cyber threats become more sophisticated, the adoption of generative AI solutions is expected to rise, driven by the need for more effective and autonomous security measures.

Key Takeaways

- Market Value: The Global Generative ai in Security Market was valued at USD 628 Mn in 2023. It is expected to reach USD 3127.4 Bn by 2033, with a CAGR of 17.9% during the forecast period from 2024 to 2033.

- By Type: Network Security constitutes 35% of the market, crucial for protecting digital assets from cyber threats.

- By Service: Managed Services dominate with 55%, providing comprehensive security management solutions.

- By Deployment Mode: Cloud-Based solutions lead with 60%, offering scalability and remote accessibility.

- By End Users: BFSI (Banking, Financial Services, and Insurance) uses 30%, leveraging AI for enhanced security measures.

- Regional Dominance: North America holds a 43% market share, driven by advanced cybersecurity infrastructure and high adoption rates.

- Growth Opportunity: Integrating AI-driven threat detection and response systems can significantly enhance the efficacy of network security measures.

Driving factors

Increasing Cybersecurity Threats: A Catalyst for Market Growth

The rise in cybersecurity threats has become a significant catalyst for the growth of the generative AI in the security market. The rapid digital transformation across industries has exposed enterprises to a myriad of cyber threats, including malware, phishing, and ransomware attacks. According to a recent study, the global cost of cybercrime is expected to reach $10.5 trillion annually by 2025, underscoring the urgent need for advanced security solutions.

Generative AI, with its ability to predict and counteract sophisticated cyber-attacks, is increasingly being adopted by organizations to bolster their defense mechanisms. This growing reliance on AI-driven security solutions to mitigate risks is a primary driver for the market's expansion.

Advancements in AI and Machine Learning: Enhancing Security Capabilities

The continuous advancements in AI and machine learning technologies are profoundly enhancing the capabilities of security systems. Innovations in these fields have led to the development of more sophisticated algorithms that can analyze vast amounts of data, identify patterns, and predict potential threats with high accuracy. According to industry reports, the AI market in cybersecurity is projected to grow at a compound annual growth rate (CAGR) of 23.6% from 2021 to 2026.

These advancements enable generative AI to evolve continuously, adapting to new threat vectors and providing more robust and dynamic security solutions. Consequently, the integration of cutting-edge AI and machine learning technologies is propelling the growth of the generative AI in security market.

Growing Demand for Real-time Threat Detection: Driving Adoption of AI Solutions

The increasing need for real-time threat detection and response is a significant driver for the adoption of generative AI in security applications. Traditional security systems often fall short in providing timely responses to emerging threats, leaving organizations vulnerable to attacks. Generative AI offers real-time monitoring and immediate threat detection, allowing for proactive defense strategies.

The demand for such real-time capabilities is evident, with a survey indicating that 69% of organizations prioritize investing in real-time threat detection technologies. This trend is driving the widespread adoption of generative AI solutions, as they offer the agility and speed required to protect critical infrastructure and sensitive data effectively.

Restraining Factors

High Implementation Costs

The high implementation costs associated with generative AI solutions in security present a significant barrier to market growth. Developing, deploying, and maintaining advanced AI systems require substantial financial investment, often making it difficult for small and medium-sized enterprises (SMEs) to afford such technology. According to industry analysis, the average cost of implementing AI solutions can range from $100,000 to $300,000, depending on the complexity and scale of the project.

These high costs can deter potential adopters, especially those with limited budgets, thereby slowing down the overall market adoption rate. While large corporations might have the resources to invest in these technologies, the high upfront and ongoing costs remain a critical retraining factor for widespread market penetration.

Concerns over Data Privacy and AI Ethics

Concerns over data privacy and AI ethics are another major retraining factor impacting the generative AI in security market. The deployment of AI-driven security systems often involves the collection and analysis of vast amounts of sensitive data, raising significant privacy issues. Additionally, the ethical implications of using AI in security, such as bias in algorithms and decision-making transparency, have sparked widespread debate and skepticism.

A survey conducted by a leading cybersecurity firm revealed that 67% of organizations are hesitant to adopt AI solutions due to fears of compromising data privacy and ethical concerns. These apprehensions can lead to resistance from both regulators and potential users, impeding the adoption and growth of generative AI technologies in the security sector.

By Type Analysis

Network Security held a dominant market position in the By Type segment of the Generative AI in Security Market, capturing more than a 35% share.

In 2023, Network Security held a dominant market position in the By Type segment of the Generative AI in Security Market, capturing more than a 35% share. This dominance is driven by the increasing complexity and frequency of cyber threats targeting network infrastructures. Generative AI is leveraged in network security to detect and respond to anomalies, predict potential breaches, and automate threat mitigation.

Application Security also plays a significant role, ensuring that software applications are secure from cyber threats during their entire lifecycle. The use of AI in application security helps identify vulnerabilities, conduct code reviews, and enforce security policies.

Cloud Security is increasingly important as more organizations migrate to cloud environments. AI enhances cloud security by providing continuous monitoring, anomaly detection, and automated incident response.

Other Security Types, including endpoint security and identity management, collectively hold a smaller market share. These areas are essential for comprehensive security strategies but are more specialized compared to network security.

By Service Analysis

Managed Services held a dominant market position in the By Service segment of the Generative AI in Security Market, capturing more than a 55% share.

In 2023, Managed Services held a dominant market position in the By Service segment of the Generative AI in Security Market, capturing more than a 55% share. The high demand for managed services is driven by organizations seeking to outsource their security needs to specialized providers. Managed services leverage AI to offer continuous monitoring, threat detection, incident response, and compliance management, providing comprehensive security solutions that are scalable and cost-effective.

Professional Services are also significant, offering consulting, implementation, and integration services for AI-driven security solutions. These services help organizations design and deploy tailored security frameworks. However, their market share is smaller compared to managed services due to the growing preference for outsourced, all-inclusive security solutions provided by managed service providers.

By Deployment Mode Analysis

Cloud-Based held a dominant market position in the By Deployment Mode segment of the Generative AI in Security Market, capturing more than a 60% share.

In 2023, Cloud-Based deployment held a dominant market position in the By Deployment Mode segment of the Generative AI in Security Market, capturing more than a 60% share. The preference for cloud-based solutions is driven by their flexibility, scalability, and ease of deployment. Cloud-based AI security solutions can be quickly updated with the latest threat intelligence and offer seamless integration with existing cloud infrastructures.

On-premises deployment, while still relevant, holds a smaller market share due to the higher initial investment, maintenance costs, and limited scalability compared to cloud-based solutions. On-premises deployments are typically favored by organizations with stringent data sovereignty and compliance requirements.

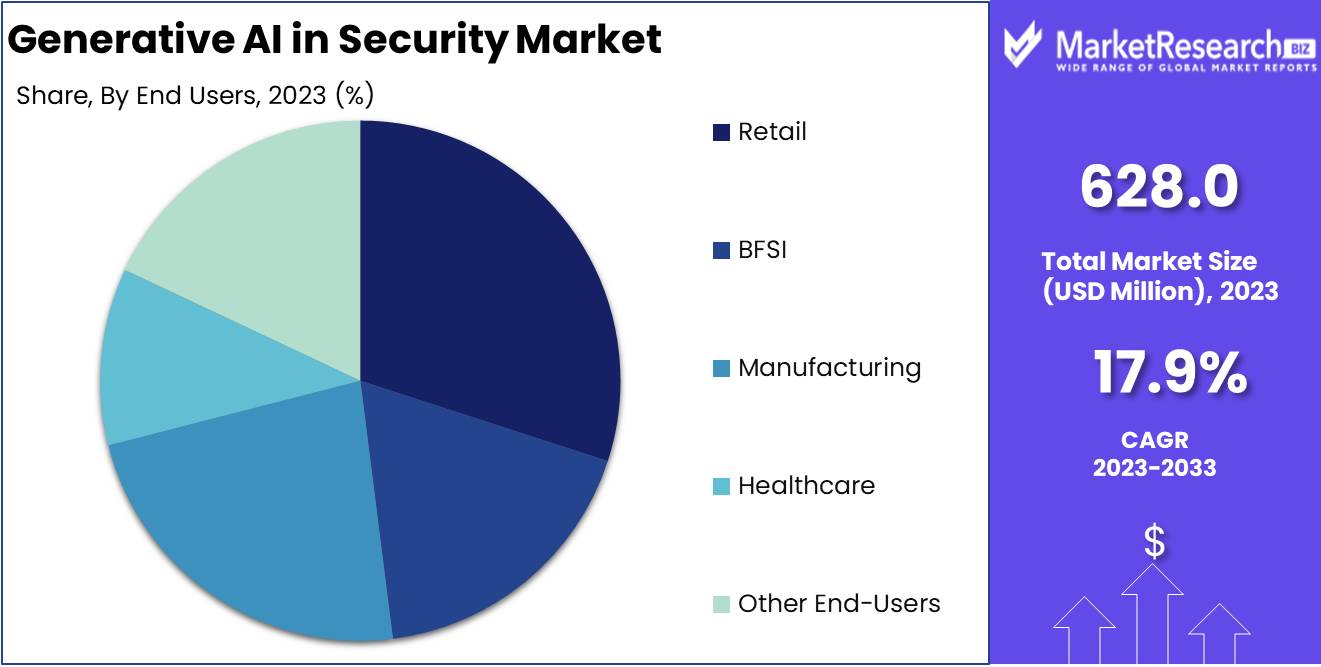

By End Users Analysis

BFSI held a dominant market position in the By End Users segment of the Generative AI in Security Market, capturing more than a 30% share.

In 2023, BFSI (Banking, Financial Services, and Insurance) held a dominant market position in the By End Users segment of the Generative AI in Security Market, capturing more than a 30% share. The BFSI sector's focus on safeguarding sensitive financial data and meeting regulatory compliance drives the adoption of AI-driven security solutions.

Retail is also a significant end-user, utilizing AI for fraud detection, securing customer data, and managing supply chain security. However, its market share is smaller compared to BFSI due to the relatively lower regulatory pressures and data sensitivity.

Manufacturing employs AI in security to protect intellectual property, secure industrial control systems, and monitor supply chains. The market share for manufacturing is growing but remains smaller than BFSI and retail due to the sector's diverse security needs.

Healthcare relies on AI to protect patient data, secure electronic health records, and ensure compliance with health data regulations. The healthcare sector's adoption of AI security solutions is increasing, driven by the need to protect sensitive health information.

Other End-Users, including government, education, and energy sectors, also adopt AI-driven security solutions to protect critical infrastructure and data. These sectors collectively hold a smaller market share but are crucial for the overall security landscape.

Key Market Segments

By Type

- Network Security

- Application Security

- Cloud Security

- Other Security Types

By Service

- Professional Services

- Managed Services

By Deployment Mode

- Cloud-Based

- On-premises

By End Users

- Retail

- BFSI

- Manufacturing

- Healthcare

- Other End-Users

Growth Opportunity

Use of Advanced Materials for Better Performance

In 2024, one of the most significant trends in the automotive transparent antenna market will be the use of advanced materials to enhance performance. Innovations in materials science are leading to the development of antennas that are not only transparent but also more durable, efficient, and capable of supporting higher frequency signals.

These advanced materials, such as transparent conductive films and nanomaterials, offer superior conductivity and flexibility, enabling the production of antennas that are both aesthetically pleasing and highly functional. This trend is expected to drive the adoption of transparent antennas in more vehicle models, as automakers seek to leverage these performance enhancements to offer better connectivity solutions.

Integration with Vehicle Communication Systems

The integration of transparent antennas with vehicle communication systems will be another pivotal trend in 2024. As vehicles become more connected and reliant on seamless communication for navigation, safety, and entertainment, the need for integrated antenna solutions grows.

Transparent antennas can be embedded into windshields and other glass surfaces, providing a sleek and unobtrusive solution that supports various communication protocols, including vehicle-to-everything (V2X), GPS, and infotainment systems. This integration not only enhances the aesthetic appeal of the vehicle but also ensures robust and reliable connectivity, which is crucial for the functioning of modern vehicles.

Latest Trends

Integration with Existing Security Frameworks

In 2024, a critical trend in the generative AI in security market will be the seamless integration of generative AI technologies with existing security frameworks. Organizations are increasingly recognizing the need to bolster their current security infrastructure with advanced AI capabilities. Generative AI can enhance traditional security measures by providing adaptive and proactive defense mechanisms.

The integration process involves embedding AI algorithms within the existing security systems to improve threat detection, response times, and overall system resilience. This trend underscores the importance of AI-driven innovation in fortifying cybersecurity defenses without the need to overhaul entire security architectures.

Use of AI for Predictive Threat Intelligence

Another prominent trend in the generative AI in security market is the use of AI for predictive threat intelligence. Generative AI excels at analyzing vast datasets to identify patterns and anomalies that may indicate potential security threats. By leveraging predictive analytics, organizations can anticipate and mitigate cyber threats before they manifest into significant security breaches.

This proactive approach is crucial in an era where cyber threats are becoming increasingly sophisticated and frequent. Predictive threat intelligence enables security teams to stay ahead of attackers, enhancing their ability to protect sensitive data and critical systems.

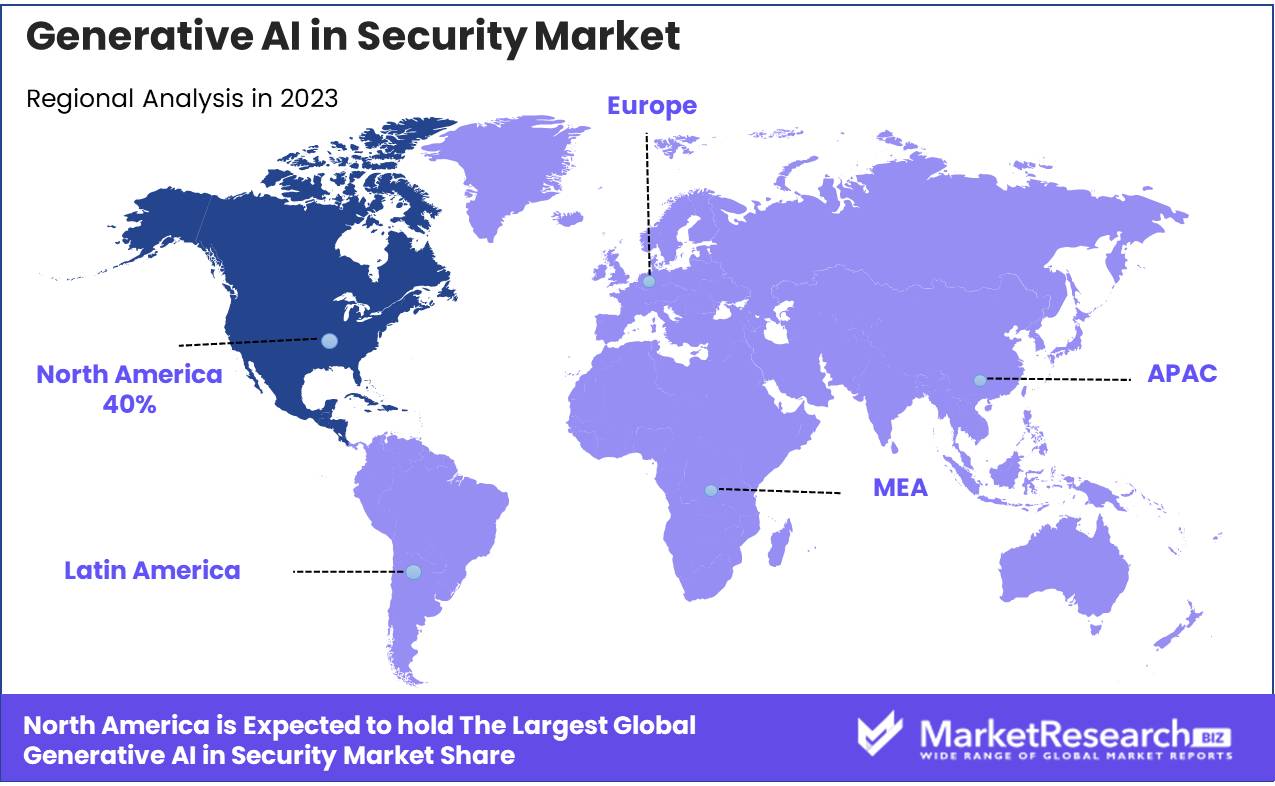

Regional Analysis

North America held a dominant market position in the Generative AI in Security Market, capturing more than a 43% share.

The North America region dominated the Generative AI in Security Market in 2023, capturing more than a 43% share. This dominance is driven by the region's advanced technological infrastructure, high adoption rates of AI technologies, and significant investments in cybersecurity solutions. The U.S., in particular, is a major contributor, with numerous tech companies and startups developing innovative AI-driven security applications. The increasing frequency of cyber threats and stringent regulatory requirements further drive the adoption of generative AI in security across various industries, including finance, healthcare, and retail.

Europe follows closely, with a strong focus on data protection and privacy regulations such as GDPR. Countries like Germany, the UK, and France are investing heavily in AI-driven security solutions to protect critical infrastructure and ensure compliance with regulatory standards. The market growth in Europe is supported by government initiatives and public-private partnerships aimed at enhancing cybersecurity.

The Asia Pacific region is experiencing rapid growth in the adoption of generative AI in security, driven by the expanding digital landscape and increasing cyber threats. Countries like China, Japan, and India are investing in AI technologies to bolster their cybersecurity frameworks. The rising number of connected devices and the growth of e-commerce and digital services contribute to the demand for advanced security solutions in the region.

In the Middle East & Africa, the market is emerging, with growing awareness of the importance of cybersecurity. Countries in the Middle East, such as the UAE and Saudi Arabia, are making significant investments in AI-driven security solutions to protect their digital infrastructure. The region's market growth is also supported by government initiatives aimed at building robust cybersecurity frameworks.

Latin America is steadily adopting generative AI in security, with countries like Brazil and Mexico leading the charge. The increasing digitalization and growing number of cyber threats are driving the demand for advanced security solutions in the region.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

IBM's extensive expertise in AI and cybersecurity positions it as a leader in the generative AI in security market. Leveraging Watson AI, IBM provides advanced threat detection and response capabilities, enhancing security protocols and mitigating risks effectively.

Intel's focus on AI hardware and software innovations strengthens its role in generative AI applications for security. Its processors optimize AI performance, enabling rapid analysis and response to security threats, making it a crucial player in this market.

NVIDIA’s AI-driven GPU technology is pivotal in enhancing generative AI security solutions. Its hardware accelerates AI processing, facilitating real-time threat detection and mitigation, thus significantly contributing to the market's growth.

Securonix's advanced security analytics and operations platform utilizes generative AI to detect anomalies and predict security breaches. Its innovative approach enhances the efficacy of security measures, making it a key player in the market.

Specializing in mobile threat defense, Skycure integrates generative AI to identify and neutralize emerging mobile threats. Its cutting-edge solutions ensure comprehensive security for mobile environments, reinforcing its market position.

ThreatMetrix employs generative AI to deliver robust digital identity verification and fraud prevention solutions. Its AI-driven approach enhances security protocols, reducing fraud risks and establishing it as a critical market player.

Numerous other companies are contributing to the market with innovative generative AI solutions. Their collective efforts are driving advancements in security, enhancing threat detection, and response capabilities across the industry.

Market Key Players

- IBM Corp.

- Intel Corp.

- NVIDIA Corp.

- Securonix Inc.

- Skycure Inc.

- Threatmetrix Inc.

- Other Key Players

Recent Development

- In June 2024, Securonix Inc. secured $20 million in funding to develop advanced generative AI solutions for insider threat detection. This funding will support research and development efforts to enhance security measures.

- In February 2024, IBM Corp. launched a new generative AI tool designed to detect and mitigate cybersecurity threats in real-time. This tool aims to reduce incident response times by 25%.

Report Scope

Report Features Description Market Value (2023) USD 628 Mn Forecast Revenue (2033) USD 3127.4 Bn CAGR (2024-2033) 17.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Network Security, Application Security, Cloud Security, Other Security Types), By Service (Professional Services, Managed Services), By Deployment Mode (Cloud-Based, On-premises), By End Users (Retail, BFSI, Manufacturing, Healthcare, Other End-Users) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape IBM Corp., Intel Corp., NVIDIA Corp., Securonix Inc., Skycure Inc., Threatmetrix Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- IBM Corp.

- Intel Corp.

- NVIDIA Corp.

- Securonix Inc.

- Skycure Inc.

- Threatmetrix Inc.

- Other Key Players