Global Generative AI in Investment Banking Market By Component(Software, Services), By Deployment Mode(Cloud, On-premises), By Application(Algorithmic Trading, Risk Management, Fraud Detection, Customer Relationship Management, Portfolio Management, Other Applications), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43909

-

March 2024

-

179

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- Driving factors

- Restraining Factors

- Data Privacy and Security Concerns Restrain Market Growth

- By Component Analysis

- By Deployment Mode Analysis

- By Application Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

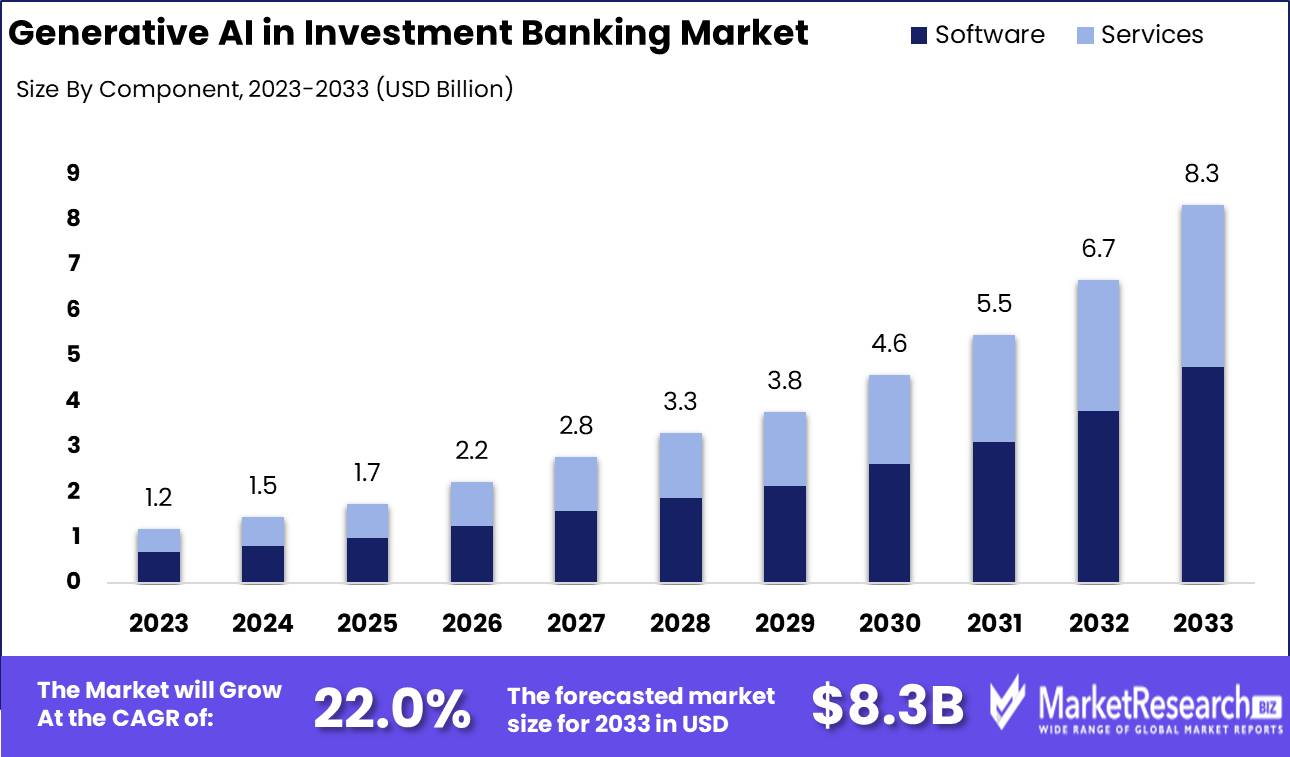

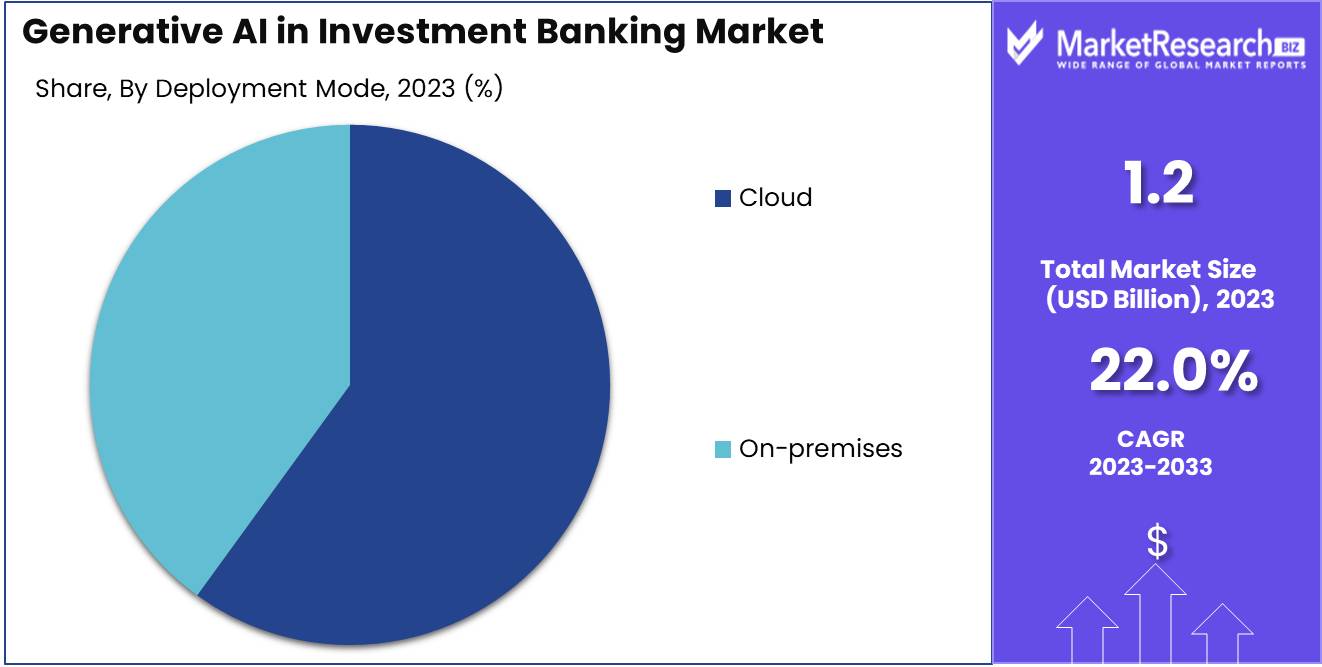

The Global Generative AI in Investment Banking Market was valued at USD 1.2 billion in 2023. It is expected to reach USD 8.3 billion by 2033, with a CAGR of 22.0% during the forecast period from 2024 to 2033.

The surge in demand for advanced technologies and banking sectors, and the rise in monetary transactions are some of the main key driving factors for the generative AI in the investment banking market.

Generative AI in investment banking sector is defined as the usage of AI strategies, especially generative models to improve different aspects of financial analysis, risk management, and decision-making. Such models like generative adversarial networks and variational autoencoders can produce synthetic financial information that closely bears a resemblance to real-world market situations, making better simulation of investment circumstances and risk assessment.

Moreover, it can support algorithm trading tactics by developing synthetic market data for back-testing purposes, augmenting trading algorithms, and understanding potential market opportunities. Additionally, it helps in identifying fraud and anomaly detection by analyzing patterns in transactional information and recognizing doubtful activities. It also encourages financial institutions to make more informed decisions, mitigate challenges, and enhance operational efficiency in a rapidly growing market landscape.

Reyazat in March 2024, highlights that the corporate and investment banking (CIB) sector has witnessed magnificent resilience and growth. In 2022, the industry has reported USD 2.9 trillion which constitutes 44% of the overall banking industry revenue, with an impressive annual growth rate that exceeds 5% since 2020. Over 80% of the CIB revenue was extracted from commercial lending cash management services underscoring the industry’s main role in aiding the real economy. These banks have improved their fore-office productivity by an exceptional 27% to 35% by implementing generative AI.

Moreover, Deloitte has also estimated that each front office employee can contribute an extra USD 3.5 million in revenue by 2026. Furthermore, analysis aids the long effect of generative AI all across the CIB that suggests the productivity enhancement ranges from 30% to 90% in core activities and has the capability of adding 9% to 15% to CIB operating profits. Additionally, Katana launched by ING, highlights that this tool has been designed to support bond traders who make better and quicker pricing decisions through predictive analytics. This has made the traders quote prices faster for 90% of the trades and improve pricing precision.

The generative AI in investment banking functions provides risk assessment through the generation of synthetic financial information for scenario analysis. It supports algorithmic trading by developing realistic market simulations for testing tactics. Moreover, it enhances fraud detection by identifying transactional structures and patterns by making better decision-making and market security. The demand for generative AI in investment banking products will increase due to its requirement in the future of banking industry and trading sectors which will help in the market expansion in the coming years.

Key Takeaways

- Market Growth: Global Generative AI in Investment Banking Market was valued at USD 1.2 billion in 2023. It is expected to reach USD 8.3 billion by 2033, with a CAGR of 22.0% during the forecast period from 2024 to 2033.

- By Component: The dominant sub-segment in the software component is driving innovation and efficiency in various industries.

- By Deployment Mode: Cloud deployment mode leads with its scalability, flexibility, and accessibility advantages.

- By Application: Risk management emerges as the dominant sub-segment in applications, ensuring robust mitigation strategies.

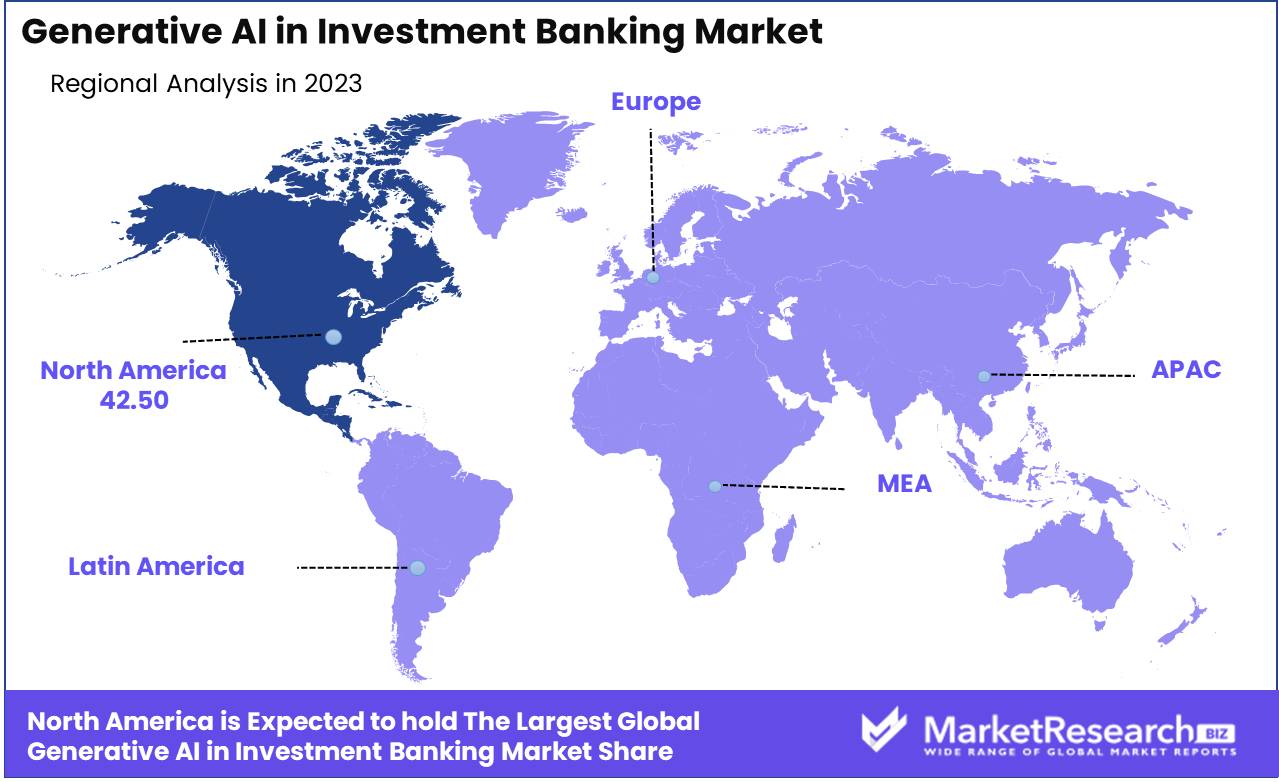

- Regional Dominance: North America dominates the Generative AI in Investment Banking market, capturing a significant 42.50% share.

- Growth Opportunity: Generative AI integration in investment banking drives innovation, offering growth prospects through tailored product development and optimized trade execution. This technological advancement enhances efficiency, reduces costs, and strengthens client relationships, bolstering competitive advantage.

Driving factors

Demand for Faster and More Customized Client Services Drives Market Growth

In the competitive realm of investment banking, generative AI is a game-changer, offering the ability to quickly generate customized financial solutions for clients. This technology enables banks to produce personalized pitches, detailed reports, and precise recommendations tailored to individual client profiles and investment goals. The result is a significant enhancement in client satisfaction and loyalty, as services become more responsive and aligned with client expectations.

Moreover, this rapid customization capability allows banks to differentiate themselves in a crowded market, attracting a broader client base. The long-term implications of this trend include a shift towards more dynamic, client-centered business models in investment banking workforce, where AI-driven customization becomes a key competitive advantage.

Need for More Accurate Forecasts and Insights Fuels Market Expansion

Generative AI's capacity to sift through and analyze extensive datasets for pattern recognition transforms how investment banks approach market analysis and investment strategy development. This technology provides unprecedented accuracy in forecasts and insights, enabling banks to make more informed decisions with a higher probability of success. The strategic advantage gained through AI-driven analytics encourages further investment in AI technologies, driving the sector's expansion.

As the industry becomes increasingly data-driven, banks that leverage AI for deeper insights will lead the market, setting new standards for operational efficiency and strategic foresight. The growing reliance on accurate, AI-generated forecasts and insights signifies a fundamental shift towards analytics-driven investment banking.

Regulatory Requirements for Transparency Enhance Adoption

The adoption of generative AI in investment banking is further propelled by regulatory pressures demanding greater transparency and accountability in financial services. AI technologies facilitate the generation of comprehensive reports and analyses, making it easier for banks to comply with regulatory standards and document their decision-making processes. This capability is crucial for maintaining client trust and regulatory compliance, especially in complex financial markets.

As regulatory frameworks continue to emphasize transparency, the role of AI in ensuring compliance and fostering an environment of trust and clarity in financial transactions will become increasingly central. This trend underscores the alignment between technological advancement and regulatory compliance, enhancing the stability and integrity of financial markets.

Competition from FinTech Companies Spurs Innovation

The rise of FinTech companies, characterized by their quick adoption of cutting-edge technologies, including AI, challenges traditional investment banks to innovate or risk obsolescence. This competitive pressure is a powerful catalyst for the adoption of generative AI within traditional banking institutions, driving them to embrace technological innovation to enhance efficiency, accuracy, and client service.

The race to integrate AI reflects a broader industry trend towards digital transformation, where leveraging advanced technologies is no longer optional but essential for survival and growth. This dynamic competition encourages continuous improvement and innovation in financial services, ensuring that the sector remains at the forefront of technological adoption. The enduring impact of this competition will likely be a more agile, technologically adept investment banking industry that can better serve the evolving needs of its clients.

Restraining Factors

Data Privacy and Security Concerns Restrain Market Growth

Data privacy and security concerns significantly limit the expansion of Generative AI in investment banking. Given the sector's reliance on confidential client data, any potential errors or vulnerabilities introduced by AI technologies could result in severe data breaches. The imperative for stringent data governance and robust security measures before AI deployment makes financial institutions cautious.

This caution slows down the adoption rate, as banks must ensure that their use of AI complies with the highest standards of data protection. The challenge lies in balancing innovation with the need to protect sensitive information, a critical factor in maintaining client trust and regulatory compliance.

Regulatory Uncertainty Limits AI Deployment

The lack of clear regulations governing the use of AI in financial services creates a significant barrier to the broader deployment of Generative AI in investment banking. Banks operate in a highly regulated environment, and the uncertainty surrounding AI applications makes them hesitant to implement these technologies at scale.

Until there is more definitive regulatory guidance on AI usage, investment banks are likely to proceed with caution, limiting the potential growth of Generative AI within the sector. This regulatory ambiguity not only hampers innovation but also restricts the industry's ability to leverage AI for improved efficiency and client service.

By Component Analysis

In the software component, cloud-based solutions dominate the market landscape significantly.

In the Generative AI in Investment Banking Market, the Software segment emerges as the dominant sub-segment. This prominence is attributed to the pivotal role of AI software in enhancing decision-making processes, operational efficiencies, and client service levels within investment banking. AI software enables banks to generate insightful analytics, automate repetitive tasks, and offer innovative financial products. This segment's growth is driven by the increasing demand for advanced analytical generative AI toolsand algorithms that can process vast amounts of data to uncover market trends and investment opportunities.

Other components, such as Services, also play a critical role in the market's expansion. Services encompass installation, integration, support, and maintenance, which are essential for the effective deployment and utilization of AI software. The Services segment ensures that the sophisticated AI solutions are seamlessly integrated into the existing banking infrastructure, facilitating smooth operations and enhancing the software's value proposition.

By Deployment Mode Analysis

Cloud deployment prevails as the favored mode for software integration.

The Cloud deployment mode holds a dominant position in the Generative AI in Investment Banking Market due to its scalability, flexibility, and cost-effectiveness. Cloud-based solutions offer investment banks the ability to access AI capabilities without significant upfront investments in infrastructure. This deployment mode supports the dynamic needs of investment banking, enabling banks to quickly adapt to market changes and leverage AI-powered analytics and tools from anywhere.

On-premises deployment, while still relevant, offers banks full control over their AI systems and data. It is preferred for operations requiring stringent data security measures. However, the agility and efficiency provided by cloud deployments are driving a shift towards this model, further propelled by advancements in cloud security that address many concerns associated with data privacy and regulatory compliance.

By Application Analysis

Within applications, risk management stands out as the dominant sub-segment.

Risk Management stands out as the dominant application of Generative AI in investment banking, driven by the sector's need to identify, assess, and mitigate various financial and operational risks. AI enhances risk management processes by providing predictive analytics, real-time monitoring, and scenario analysis, enabling banks to make informed decisions and maintain regulatory compliance. This application is crucial for sustaining profitability and ensuring stability in the volatile financial market.

Other applications, including Algorithmic Trading, Fraud Detection, Customer Relationship Management, Portfolio Management, and Other Applications, significantly contribute to the market's growth. Each application leverages AI to improve specific aspects of investment banking operations, from automating trading strategies and detecting fraudulent activities to personalizing client interactions and optimizing portfolio allocations. The diverse applications of Generative AI underscore its transformative potential across the entire spectrum of investment banking activities.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- Cloud

- On-premises

By Application

- Algorithmic Trading

- Risk Management

- Fraud Detection

- Customer Relationship Management

- Portfolio Management

- Other Applications

Growth Opportunity

New Product Development Offers Growth Opportunity

The introduction of Generative AI into new product development in investment banking serves as a catalyst for innovation, presenting substantial growth opportunities. By harnessing the power of AI, banks can swiftly design financial products that are closely tailored to the evolving needs of their clients.

This agility in product development not only enhances client satisfaction but also opens up new revenue streams for banks. The capability to quickly adapt and offer novel solutions in response to market demands positions investment banks as leaders in financial innovation, driving competitive advantage and market expansion.

Optimizing Trade Execution Offers Growth Opportunity

Generative AI revolutionizes trade execution by analyzing the market's microstructure to optimize trading strategies, thereby reducing operational costs and enhancing trading revenues. This technological advancement allows investment banks to execute trades more efficiently, minimizing slippage and improving price outcomes for their clients.

By leveraging AI to refine trade execution processes, banks can offer superior services to their clients, strengthening client relationships, and securing a competitive edge in the market. The improved efficiency and cost savings directly contribute to the bottom line, highlighting the strategic value of AI in trading operations.

Latest Trends

Automated Document Generation

The application of Generative AI in automating document generation transforms the labor-intensive process of creating client-facing documents, such as research reports, pitch books, and term sheets. This automation significantly reduces the time analysts spend on document preparation, allowing them to focus on higher-value activities.

By improving operational efficiency and reducing the potential for human error, investment banks can enhance the quality and speed of their service delivery, thereby improving client satisfaction and loyalty. The efficiency gains from automated document generation represent a notable growth opportunity for investment banks by streamlining internal processes and improving service quality.

Chatbots for Customer Service

Deploying intelligent chatbots for customer service in investment banking introduces a significant growth opportunity by automating client interactions. These AI-powered chatbots can handle inquiries, account openings, and other repetitive tasks, delivering prompt and accurate responses 24/7. The use of chatbots improves the client experience by providing instant support, thereby increasing client engagement and satisfaction.

Additionally, chatbots reduce the workload on human staff, allowing them to concentrate on more complex and revenue-generating activities. The strategic deployment of chatbots signifies a move towards more scalable and efficient customer service models in investment banking, driving operational efficiency and enhancing client retention.

Regional Analysis

North America Dominates with a 42.50% Market Share

North America's commanding 42.50% share in the Generative AI in Investment Banking Market is primarily driven by the region's robust financial sector, high technology adoption rates, and significant investments in AI and machine learning technologies. The presence of leading investment banks and technology firms in the U.S. and Canada fosters a conducive environment for innovation and early adoption of generative AI applications. This region benefits from advanced infrastructure, skilled talent pools, and supportive regulatory frameworks that encourage the development and integration of AI technologies in financial services. These factors collectively contribute to North America's dominance in the market.

Europe: A Key Player in Generative AI Adoption

Europe holds a significant position in the Generative AI in Investment Banking Market, attributed to its strong regulatory framework, which emphasizes data protection and ethical AI use. European investment banks are rapidly adopting generative AI to enhance efficiency, comply with stringent regulations, and stay competitive. The region's commitment to innovation, combined with its focus on sustainable and responsible banking practices, positions Europe as a critical market for generative AI technologies. The collaborative efforts between the public and private sectors to foster AI development further reinforce Europe's role in the global market.

Asia-Pacific: Rapid Growth and Innovation Hub

The Asia-Pacific region is witnessing rapid growth in the Generative AI in Investment Banking Market, driven by increasing digitalization, growing fintech ecosystems, and substantial investments in AI and blockchain technologies. Countries like China, Japan, and South Korea are at the forefront of technological innovation, leveraging AI to transform their financial services sector. The region's large, tech-savvy population and the push for financial inclusion through technology are key drivers behind the adoption of generative AI. With its dynamic market and continuous investment in research and development, Asia-Pacific is poised to increase its market share and influence in the coming years.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the Generative AI in Investment Banking Market, key players such as IBM Corporation, Google LLC, Microsoft Corporation, Amazon Web Services, Inc., NVIDIA Corporation, SAS Institute Inc., and Accenture plc, alongside other influential companies, have significantly shaped the industry landscape. These corporations collectively possess a substantial market influence through their innovative technologies, comprehensive AI solutions, and strategic partnerships that redefine investment banking operations.

IBM Corporation and SAS Institute Inc. are renowned for their robust analytics and AI-driven platforms, enhancing risk management and customer service efficiency. Google LLC and Microsoft Corporation lead in developing advanced AI tools and cloud computing services that empower banks to optimize trading strategies and personalize customer interactions. Amazon Web Services, Inc. and NVIDIA Corporation provide critical infrastructure and processing capabilities that support the vast data analysis needs of generative AI applications. Accenture plc stands out for its consulting services, assisting banks in integrating AI technologies seamlessly into their existing systems.

These key players, through their pioneering efforts, have not only propelled the adoption of generative AI in investment banking but have also set the stage for ongoing innovation and competition. Their strategic positioning in the market, characterized by a deep focus on research and development, has enabled them to offer cutting-edge solutions that address the complex challenges of modern investment banking, from algorithmic trading to fraud detection and regulatory compliance. The collective impact of these companies is a testament to their role in driving forward the capabilities and efficiencies of the investment banking sector on a global scale.

Market Key Players

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Amazon Web Services, Inc.

- NVIDIA Corporation

- SAS Institute Inc.

- Accenture plc

- Other Key Players

Recent Development

- In February 2024, Celent reports rapid AI growth in banking, emphasizing payments' potential. Banks explore Gen AI; 58% testing, 23% planning. Focus on revenue outcomes, data privacy, and regulation. Various AI applications optimize front, middle, and back-office workflows for efficiency and agility.

- In February 2024, PitchBook's report notes global VC funding dipped by 15% in Q4 2023, the lowest since 2020. US, China decline amidst uncertainty; Europe up 7% driven by AI, fintech. Seed-stage thrives; CVC deals steady at 20%. Generative AI attracts robust investment, defying trends.

- In February 2024, Deloitte's report forecasts a 27-25% boost in front-office productivity for top global investment banks using generative AI. Prioritization matrix aids adoption, addressing risks. Andrea Haskell and Val Srinivas provide insights.

Report Scope

Report Features Description Market Value (2023) USD 1.2 Billion Forecast Revenue (2033) USD 8.3 Billion CAGR (2024-2032) 22.0% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component(Software, Services), By Deployment Mode(Cloud, On-premises), By Application(Algorithmic Trading, Risk Management, Fraud Detection, Customer Relationship Management, Portfolio Management, Other Applications) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape IBM Corporation, Google LLC, Microsoft Corporation, Amazon Web Services, Inc., NVIDIA Corporation, SAS Institute Inc., Accenture plc, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Generative AI in Investment Banking Market Overview

- 2.1. Generative AI in Investment Banking Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Generative AI in Investment Banking Market Dynamics

- 3. Global Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Generative AI in Investment Banking Market Analysis, 2016-2021

- 3.2. Global Generative AI in Investment Banking Market Opportunity and Forecast, 2023-2032

- 3.3. Global Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 3.3.1. Global Generative AI in Investment Banking Market Analysis by By Component: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 3.3.3. Software

- 3.3.4. Services

- 3.4. Global Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Deployment Mode, 2016-2032

- 3.4.1. Global Generative AI in Investment Banking Market Analysis by By Deployment Mode: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Deployment Mode, 2016-2032

- 3.4.3. Cloud

- 3.4.4. On-premises

- 3.5. Global Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.5.1. Global Generative AI in Investment Banking Market Analysis by By Application: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.5.3. Algorithmic Trading

- 3.5.4. Risk Management

- 3.5.5. Fraud Detection

- 3.5.6. Customer Relationship Management

- 3.5.7. Portfolio Management

- 3.5.8. Other Applications

- 4. North America Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Generative AI in Investment Banking Market Analysis, 2016-2021

- 4.2. North America Generative AI in Investment Banking Market Opportunity and Forecast, 2023-2032

- 4.3. North America Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 4.3.1. North America Generative AI in Investment Banking Market Analysis by By Component: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 4.3.3. Software

- 4.3.4. Services

- 4.4. North America Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Deployment Mode, 2016-2032

- 4.4.1. North America Generative AI in Investment Banking Market Analysis by By Deployment Mode: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Deployment Mode, 2016-2032

- 4.4.3. Cloud

- 4.4.4. On-premises

- 4.5. North America Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.5.1. North America Generative AI in Investment Banking Market Analysis by By Application: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.5.3. Algorithmic Trading

- 4.5.4. Risk Management

- 4.5.5. Fraud Detection

- 4.5.6. Customer Relationship Management

- 4.5.7. Portfolio Management

- 4.5.8. Other Applications

- 4.6. North America Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Generative AI in Investment Banking Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Generative AI in Investment Banking Market Analysis, 2016-2021

- 5.2. Western Europe Generative AI in Investment Banking Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 5.3.1. Western Europe Generative AI in Investment Banking Market Analysis by By Component: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 5.3.3. Software

- 5.3.4. Services

- 5.4. Western Europe Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Deployment Mode, 2016-2032

- 5.4.1. Western Europe Generative AI in Investment Banking Market Analysis by By Deployment Mode: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Deployment Mode, 2016-2032

- 5.4.3. Cloud

- 5.4.4. On-premises

- 5.5. Western Europe Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.5.1. Western Europe Generative AI in Investment Banking Market Analysis by By Application: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.5.3. Algorithmic Trading

- 5.5.4. Risk Management

- 5.5.5. Fraud Detection

- 5.5.6. Customer Relationship Management

- 5.5.7. Portfolio Management

- 5.5.8. Other Applications

- 5.6. Western Europe Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Generative AI in Investment Banking Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Generative AI in Investment Banking Market Analysis, 2016-2021

- 6.2. Eastern Europe Generative AI in Investment Banking Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 6.3.1. Eastern Europe Generative AI in Investment Banking Market Analysis by By Component: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 6.3.3. Software

- 6.3.4. Services

- 6.4. Eastern Europe Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Deployment Mode, 2016-2032

- 6.4.1. Eastern Europe Generative AI in Investment Banking Market Analysis by By Deployment Mode: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Deployment Mode, 2016-2032

- 6.4.3. Cloud

- 6.4.4. On-premises

- 6.5. Eastern Europe Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.5.1. Eastern Europe Generative AI in Investment Banking Market Analysis by By Application: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.5.3. Algorithmic Trading

- 6.5.4. Risk Management

- 6.5.5. Fraud Detection

- 6.5.6. Customer Relationship Management

- 6.5.7. Portfolio Management

- 6.5.8. Other Applications

- 6.6. Eastern Europe Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Generative AI in Investment Banking Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Generative AI in Investment Banking Market Analysis, 2016-2021

- 7.2. APAC Generative AI in Investment Banking Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 7.3.1. APAC Generative AI in Investment Banking Market Analysis by By Component: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 7.3.3. Software

- 7.3.4. Services

- 7.4. APAC Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Deployment Mode, 2016-2032

- 7.4.1. APAC Generative AI in Investment Banking Market Analysis by By Deployment Mode: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Deployment Mode, 2016-2032

- 7.4.3. Cloud

- 7.4.4. On-premises

- 7.5. APAC Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.5.1. APAC Generative AI in Investment Banking Market Analysis by By Application: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.5.3. Algorithmic Trading

- 7.5.4. Risk Management

- 7.5.5. Fraud Detection

- 7.5.6. Customer Relationship Management

- 7.5.7. Portfolio Management

- 7.5.8. Other Applications

- 7.6. APAC Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Generative AI in Investment Banking Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Generative AI in Investment Banking Market Analysis, 2016-2021

- 8.2. Latin America Generative AI in Investment Banking Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 8.3.1. Latin America Generative AI in Investment Banking Market Analysis by By Component: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 8.3.3. Software

- 8.3.4. Services

- 8.4. Latin America Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Deployment Mode, 2016-2032

- 8.4.1. Latin America Generative AI in Investment Banking Market Analysis by By Deployment Mode: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Deployment Mode, 2016-2032

- 8.4.3. Cloud

- 8.4.4. On-premises

- 8.5. Latin America Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.5.1. Latin America Generative AI in Investment Banking Market Analysis by By Application: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.5.3. Algorithmic Trading

- 8.5.4. Risk Management

- 8.5.5. Fraud Detection

- 8.5.6. Customer Relationship Management

- 8.5.7. Portfolio Management

- 8.5.8. Other Applications

- 8.6. Latin America Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Generative AI in Investment Banking Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Generative AI in Investment Banking Market Analysis, 2016-2021

- 9.2. Middle East & Africa Generative AI in Investment Banking Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 9.3.1. Middle East & Africa Generative AI in Investment Banking Market Analysis by By Component: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 9.3.3. Software

- 9.3.4. Services

- 9.4. Middle East & Africa Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Deployment Mode, 2016-2032

- 9.4.1. Middle East & Africa Generative AI in Investment Banking Market Analysis by By Deployment Mode: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Deployment Mode, 2016-2032

- 9.4.3. Cloud

- 9.4.4. On-premises

- 9.5. Middle East & Africa Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.5.1. Middle East & Africa Generative AI in Investment Banking Market Analysis by By Application: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.5.3. Algorithmic Trading

- 9.5.4. Risk Management

- 9.5.5. Fraud Detection

- 9.5.6. Customer Relationship Management

- 9.5.7. Portfolio Management

- 9.5.8. Other Applications

- 9.6. Middle East & Africa Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Generative AI in Investment Banking Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Generative AI in Investment Banking Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Generative AI in Investment Banking Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Generative AI in Investment Banking Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. IBM Corporation

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Google LLC

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Microsoft Corporation

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Amazon Web Services, Inc.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. NVIDIA Corporation

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. SAS Institute Inc.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Accenture plc

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Other Key Players

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Component in 2022

- Figure 2: Global Generative AI in Investment Banking Market Market Attractiveness Analysis by By Component, 2016-2032

- Figure 3: Global Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Deployment Modein 2022

- Figure 4: Global Generative AI in Investment Banking Market Market Attractiveness Analysis by By Deployment Mode, 2016-2032

- Figure 5: Global Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 6: Global Generative AI in Investment Banking Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 7: Global Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Generative AI in Investment Banking Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Generative AI in Investment Banking Market Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Figure 12: Global Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Deployment Mode (2016-2032)

- Figure 13: Global Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 14: Global Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Figure 16: Global Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Deployment Mode (2016-2032)

- Figure 17: Global Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 18: Global Generative AI in Investment Banking Market Market Share Comparison by Region (2016-2032)

- Figure 19: Global Generative AI in Investment Banking Market Market Share Comparison by By Component (2016-2032)

- Figure 20: Global Generative AI in Investment Banking Market Market Share Comparison by By Deployment Mode (2016-2032)

- Figure 21: Global Generative AI in Investment Banking Market Market Share Comparison by By Application (2016-2032)

- Figure 22: North America Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Componentin 2022

- Figure 23: North America Generative AI in Investment Banking Market Market Attractiveness Analysis by By Component, 2016-2032

- Figure 24: North America Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Deployment Modein 2022

- Figure 25: North America Generative AI in Investment Banking Market Market Attractiveness Analysis by By Deployment Mode, 2016-2032

- Figure 26: North America Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 27: North America Generative AI in Investment Banking Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 28: North America Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Generative AI in Investment Banking Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Generative AI in Investment Banking Market Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Figure 33: North America Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Deployment Mode (2016-2032)

- Figure 34: North America Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 35: North America Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Figure 37: North America Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Deployment Mode (2016-2032)

- Figure 38: North America Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 39: North America Generative AI in Investment Banking Market Market Share Comparison by Country (2016-2032)

- Figure 40: North America Generative AI in Investment Banking Market Market Share Comparison by By Component (2016-2032)

- Figure 41: North America Generative AI in Investment Banking Market Market Share Comparison by By Deployment Mode (2016-2032)

- Figure 42: North America Generative AI in Investment Banking Market Market Share Comparison by By Application (2016-2032)

- Figure 43: Western Europe Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Componentin 2022

- Figure 44: Western Europe Generative AI in Investment Banking Market Market Attractiveness Analysis by By Component, 2016-2032

- Figure 45: Western Europe Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Deployment Modein 2022

- Figure 46: Western Europe Generative AI in Investment Banking Market Market Attractiveness Analysis by By Deployment Mode, 2016-2032

- Figure 47: Western Europe Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 48: Western Europe Generative AI in Investment Banking Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 49: Western Europe Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Generative AI in Investment Banking Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Figure 54: Western Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Deployment Mode (2016-2032)

- Figure 55: Western Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 56: Western Europe Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Figure 58: Western Europe Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Deployment Mode (2016-2032)

- Figure 59: Western Europe Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 60: Western Europe Generative AI in Investment Banking Market Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Generative AI in Investment Banking Market Market Share Comparison by By Component (2016-2032)

- Figure 62: Western Europe Generative AI in Investment Banking Market Market Share Comparison by By Deployment Mode (2016-2032)

- Figure 63: Western Europe Generative AI in Investment Banking Market Market Share Comparison by By Application (2016-2032)

- Figure 64: Eastern Europe Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Componentin 2022

- Figure 65: Eastern Europe Generative AI in Investment Banking Market Market Attractiveness Analysis by By Component, 2016-2032

- Figure 66: Eastern Europe Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Deployment Modein 2022

- Figure 67: Eastern Europe Generative AI in Investment Banking Market Market Attractiveness Analysis by By Deployment Mode, 2016-2032

- Figure 68: Eastern Europe Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 69: Eastern Europe Generative AI in Investment Banking Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 70: Eastern Europe Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Generative AI in Investment Banking Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Figure 75: Eastern Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Deployment Mode (2016-2032)

- Figure 76: Eastern Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 77: Eastern Europe Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Figure 79: Eastern Europe Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Deployment Mode (2016-2032)

- Figure 80: Eastern Europe Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 81: Eastern Europe Generative AI in Investment Banking Market Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Generative AI in Investment Banking Market Market Share Comparison by By Component (2016-2032)

- Figure 83: Eastern Europe Generative AI in Investment Banking Market Market Share Comparison by By Deployment Mode (2016-2032)

- Figure 84: Eastern Europe Generative AI in Investment Banking Market Market Share Comparison by By Application (2016-2032)

- Figure 85: APAC Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Componentin 2022

- Figure 86: APAC Generative AI in Investment Banking Market Market Attractiveness Analysis by By Component, 2016-2032

- Figure 87: APAC Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Deployment Modein 2022

- Figure 88: APAC Generative AI in Investment Banking Market Market Attractiveness Analysis by By Deployment Mode, 2016-2032

- Figure 89: APAC Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 90: APAC Generative AI in Investment Banking Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 91: APAC Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Generative AI in Investment Banking Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Generative AI in Investment Banking Market Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Figure 96: APAC Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Deployment Mode (2016-2032)

- Figure 97: APAC Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 98: APAC Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Figure 100: APAC Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Deployment Mode (2016-2032)

- Figure 101: APAC Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 102: APAC Generative AI in Investment Banking Market Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Generative AI in Investment Banking Market Market Share Comparison by By Component (2016-2032)

- Figure 104: APAC Generative AI in Investment Banking Market Market Share Comparison by By Deployment Mode (2016-2032)

- Figure 105: APAC Generative AI in Investment Banking Market Market Share Comparison by By Application (2016-2032)

- Figure 106: Latin America Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Componentin 2022

- Figure 107: Latin America Generative AI in Investment Banking Market Market Attractiveness Analysis by By Component, 2016-2032

- Figure 108: Latin America Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Deployment Modein 2022

- Figure 109: Latin America Generative AI in Investment Banking Market Market Attractiveness Analysis by By Deployment Mode, 2016-2032

- Figure 110: Latin America Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 111: Latin America Generative AI in Investment Banking Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 112: Latin America Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Generative AI in Investment Banking Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Generative AI in Investment Banking Market Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Figure 117: Latin America Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Deployment Mode (2016-2032)

- Figure 118: Latin America Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 119: Latin America Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Figure 121: Latin America Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Deployment Mode (2016-2032)

- Figure 122: Latin America Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 123: Latin America Generative AI in Investment Banking Market Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Generative AI in Investment Banking Market Market Share Comparison by By Component (2016-2032)

- Figure 125: Latin America Generative AI in Investment Banking Market Market Share Comparison by By Deployment Mode (2016-2032)

- Figure 126: Latin America Generative AI in Investment Banking Market Market Share Comparison by By Application (2016-2032)

- Figure 127: Middle East & Africa Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Componentin 2022

- Figure 128: Middle East & Africa Generative AI in Investment Banking Market Market Attractiveness Analysis by By Component, 2016-2032

- Figure 129: Middle East & Africa Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Deployment Modein 2022

- Figure 130: Middle East & Africa Generative AI in Investment Banking Market Market Attractiveness Analysis by By Deployment Mode, 2016-2032

- Figure 131: Middle East & Africa Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 132: Middle East & Africa Generative AI in Investment Banking Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 133: Middle East & Africa Generative AI in Investment Banking Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Generative AI in Investment Banking Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Generative AI in Investment Banking Market Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Figure 138: Middle East & Africa Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Deployment Mode (2016-2032)

- Figure 139: Middle East & Africa Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 140: Middle East & Africa Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Figure 142: Middle East & Africa Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Deployment Mode (2016-2032)

- Figure 143: Middle East & Africa Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 144: Middle East & Africa Generative AI in Investment Banking Market Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Generative AI in Investment Banking Market Market Share Comparison by By Component (2016-2032)

- Figure 146: Middle East & Africa Generative AI in Investment Banking Market Market Share Comparison by By Deployment Mode (2016-2032)

- Figure 147: Middle East & Africa Generative AI in Investment Banking Market Market Share Comparison by By Application (2016-2032)

"

- List of Tables

- "

- Table 1: Global Generative AI in Investment Banking Market Market Comparison by By Component (2016-2032)

- Table 2: Global Generative AI in Investment Banking Market Market Comparison by By Deployment Mode (2016-2032)

- Table 3: Global Generative AI in Investment Banking Market Market Comparison by By Application (2016-2032)

- Table 4: Global Generative AI in Investment Banking Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Generative AI in Investment Banking Market Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Table 8: Global Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Deployment Mode (2016-2032)

- Table 9: Global Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 10: Global Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Table 12: Global Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Deployment Mode (2016-2032)

- Table 13: Global Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 14: Global Generative AI in Investment Banking Market Market Share Comparison by Region (2016-2032)

- Table 15: Global Generative AI in Investment Banking Market Market Share Comparison by By Component (2016-2032)

- Table 16: Global Generative AI in Investment Banking Market Market Share Comparison by By Deployment Mode (2016-2032)

- Table 17: Global Generative AI in Investment Banking Market Market Share Comparison by By Application (2016-2032)

- Table 18: North America Generative AI in Investment Banking Market Market Comparison by By Deployment Mode (2016-2032)

- Table 19: North America Generative AI in Investment Banking Market Market Comparison by By Application (2016-2032)

- Table 20: North America Generative AI in Investment Banking Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Generative AI in Investment Banking Market Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Table 24: North America Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Deployment Mode (2016-2032)

- Table 25: North America Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 26: North America Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Table 28: North America Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Deployment Mode (2016-2032)

- Table 29: North America Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 30: North America Generative AI in Investment Banking Market Market Share Comparison by Country (2016-2032)

- Table 31: North America Generative AI in Investment Banking Market Market Share Comparison by By Component (2016-2032)

- Table 32: North America Generative AI in Investment Banking Market Market Share Comparison by By Deployment Mode (2016-2032)

- Table 33: North America Generative AI in Investment Banking Market Market Share Comparison by By Application (2016-2032)

- Table 34: Western Europe Generative AI in Investment Banking Market Market Comparison by By Component (2016-2032)

- Table 35: Western Europe Generative AI in Investment Banking Market Market Comparison by By Deployment Mode (2016-2032)

- Table 36: Western Europe Generative AI in Investment Banking Market Market Comparison by By Application (2016-2032)

- Table 37: Western Europe Generative AI in Investment Banking Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Table 41: Western Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Deployment Mode (2016-2032)

- Table 42: Western Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 43: Western Europe Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Table 45: Western Europe Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Deployment Mode (2016-2032)

- Table 46: Western Europe Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 47: Western Europe Generative AI in Investment Banking Market Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Generative AI in Investment Banking Market Market Share Comparison by By Component (2016-2032)

- Table 49: Western Europe Generative AI in Investment Banking Market Market Share Comparison by By Deployment Mode (2016-2032)

- Table 50: Western Europe Generative AI in Investment Banking Market Market Share Comparison by By Application (2016-2032)

- Table 51: Eastern Europe Generative AI in Investment Banking Market Market Comparison by By Component (2016-2032)

- Table 52: Eastern Europe Generative AI in Investment Banking Market Market Comparison by By Deployment Mode (2016-2032)

- Table 53: Eastern Europe Generative AI in Investment Banking Market Market Comparison by By Application (2016-2032)

- Table 54: Eastern Europe Generative AI in Investment Banking Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Table 58: Eastern Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Deployment Mode (2016-2032)

- Table 59: Eastern Europe Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 60: Eastern Europe Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Table 62: Eastern Europe Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Deployment Mode (2016-2032)

- Table 63: Eastern Europe Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 64: Eastern Europe Generative AI in Investment Banking Market Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Generative AI in Investment Banking Market Market Share Comparison by By Component (2016-2032)

- Table 66: Eastern Europe Generative AI in Investment Banking Market Market Share Comparison by By Deployment Mode (2016-2032)

- Table 67: Eastern Europe Generative AI in Investment Banking Market Market Share Comparison by By Application (2016-2032)

- Table 68: APAC Generative AI in Investment Banking Market Market Comparison by By Component (2016-2032)

- Table 69: APAC Generative AI in Investment Banking Market Market Comparison by By Deployment Mode (2016-2032)

- Table 70: APAC Generative AI in Investment Banking Market Market Comparison by By Application (2016-2032)

- Table 71: APAC Generative AI in Investment Banking Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Generative AI in Investment Banking Market Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Table 75: APAC Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Deployment Mode (2016-2032)

- Table 76: APAC Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 77: APAC Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Table 79: APAC Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Deployment Mode (2016-2032)

- Table 80: APAC Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 81: APAC Generative AI in Investment Banking Market Market Share Comparison by Country (2016-2032)

- Table 82: APAC Generative AI in Investment Banking Market Market Share Comparison by By Component (2016-2032)

- Table 83: APAC Generative AI in Investment Banking Market Market Share Comparison by By Deployment Mode (2016-2032)

- Table 84: APAC Generative AI in Investment Banking Market Market Share Comparison by By Application (2016-2032)

- Table 85: Latin America Generative AI in Investment Banking Market Market Comparison by By Component (2016-2032)

- Table 86: Latin America Generative AI in Investment Banking Market Market Comparison by By Deployment Mode (2016-2032)

- Table 87: Latin America Generative AI in Investment Banking Market Market Comparison by By Application (2016-2032)

- Table 88: Latin America Generative AI in Investment Banking Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Generative AI in Investment Banking Market Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Table 92: Latin America Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Deployment Mode (2016-2032)

- Table 93: Latin America Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 94: Latin America Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Table 96: Latin America Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Deployment Mode (2016-2032)

- Table 97: Latin America Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 98: Latin America Generative AI in Investment Banking Market Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Generative AI in Investment Banking Market Market Share Comparison by By Component (2016-2032)

- Table 100: Latin America Generative AI in Investment Banking Market Market Share Comparison by By Deployment Mode (2016-2032)

- Table 101: Latin America Generative AI in Investment Banking Market Market Share Comparison by By Application (2016-2032)

- Table 102: Middle East & Africa Generative AI in Investment Banking Market Market Comparison by By Component (2016-2032)

- Table 103: Middle East & Africa Generative AI in Investment Banking Market Market Comparison by By Deployment Mode (2016-2032)

- Table 104: Middle East & Africa Generative AI in Investment Banking Market Market Comparison by By Application (2016-2032)

- Table 105: Middle East & Africa Generative AI in Investment Banking Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Generative AI in Investment Banking Market Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Table 109: Middle East & Africa Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Deployment Mode (2016-2032)

- Table 110: Middle East & Africa Generative AI in Investment Banking Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 111: Middle East & Africa Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Table 113: Middle East & Africa Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Deployment Mode (2016-2032)

- Table 114: Middle East & Africa Generative AI in Investment Banking Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 115: Middle East & Africa Generative AI in Investment Banking Market Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Generative AI in Investment Banking Market Market Share Comparison by By Component (2016-2032)

- Table 117: Middle East & Africa Generative AI in Investment Banking Market Market Share Comparison by By Deployment Mode (2016-2032)

- Table 118: Middle East & Africa Generative AI in Investment Banking Market Market Share Comparison by By Application (2016-2032)

- 1. Executive Summary

-

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Amazon Web Services, Inc.

- NVIDIA Corporation

- SAS Institute Inc.

- Accenture plc

- Other Key Players