Global Generative AI in Investment Banking Market By Component(Software, Services), By Deployment Mode(Cloud, On-premises), By Application(Algorithmic Trading, Risk Management, Fraud Detection, Customer Relationship Management, Portfolio Management, Other Applications), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43909

-

March 2024

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

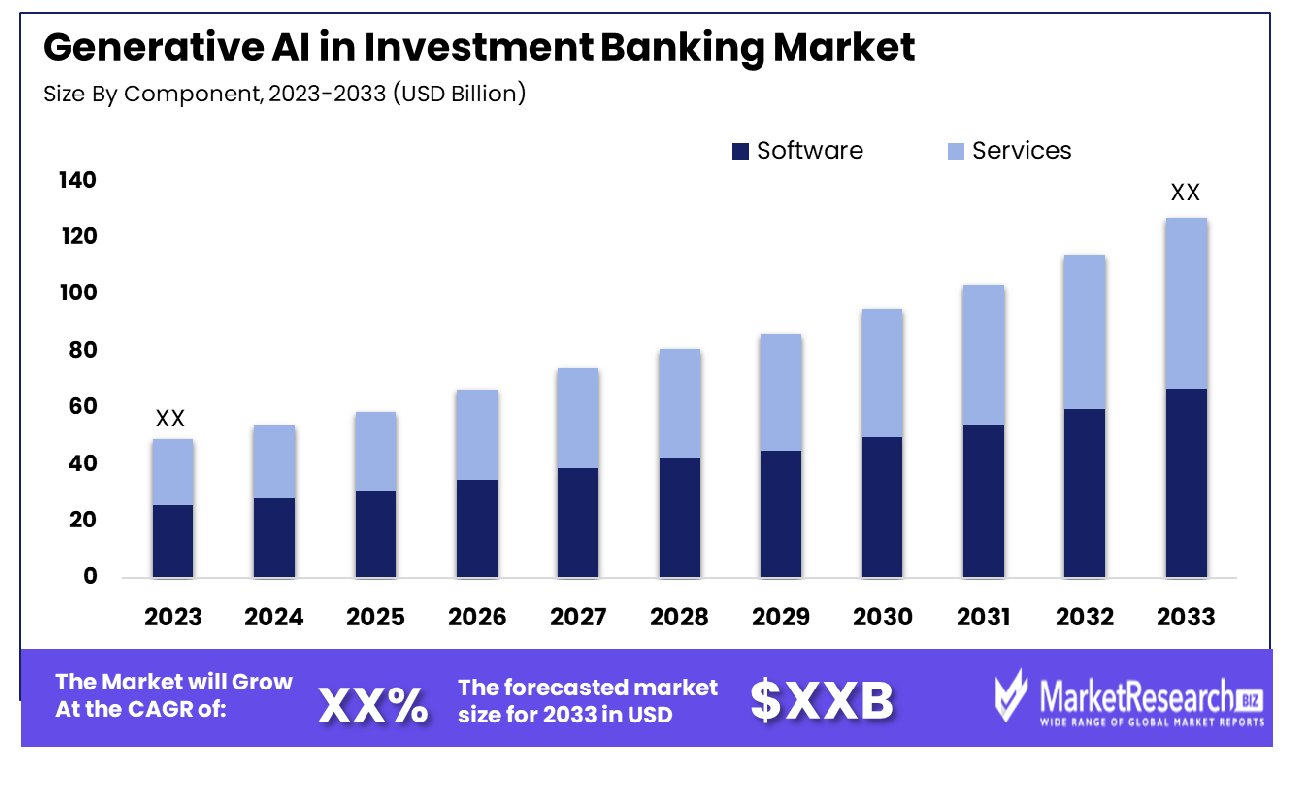

The Global Generative AI in Investment Banking Market was valued at USD XX billion in 2023. It is expected to reach USD XX billion by 2033, with a CAGR of XX% during the forecast period from 2024 to 2033. The surge in demand for advanced technologies and banking sectors, and the rise in monetary transactions are some of the main key driving factors for the generative AI in the investment banking market.

Generative AI in investment banking sector is defined as the usage of AI strategies, especially generative models to improve different aspects of financial analysis, risk management, and decision-making. Such models like generative adversarial networks and variational autoencoders can produce synthetic financial information that closely bears a resemblance to real-world market situations, making better simulation of investment circumstances and risk assessment.

Moreover, it can support algorithm trading tactics by developing synthetic market data for back-testing purposes, augmenting trading algorithms, and understanding potential market opportunities. Additionally, it helps in identifying fraud and anomaly detection by analyzing patterns in transactional information and recognizing doubtful activities. It also encourages financial institutions to make more informed decisions, mitigate challenges, and enhance operational efficiency in a rapidly growing market landscape.

Reyazat in March 2024, highlights that the corporate and investment banking (CIB) sector has witnessed magnificent resilience and growth. In 2022, the industry has reported USD 2.9 trillion which constitutes 44% of the overall banking industry revenue, with an impressive annual growth rate that exceeds 5% since 2020. Over 80% of the CIB revenue was extracted from commercial lending cash management services underscoring the industry’s main role in aiding the real economy. These banks have improved their fore-office productivity by an exceptional 27% to 35% by implementing generative AI.

Moreover, Deloitte has also estimated that each front office employee can contribute an extra USD 3.5 million in revenue by 2026. Furthermore, analysis aids the long effect of generative AI all across the CIB that suggests the productivity enhancement ranges from 30% to 90% in core activities and has the capability of adding 9% to 15% to CIB operating profits. Additionally, Katana launched by ING, highlights that this tool has been designed to support bond traders who make better and quicker pricing decisions through predictive analytics. This has made the traders quote prices faster for 90% of the trades and improve pricing precision.

The generative AI in investment banking functions provides risk assessment through the generation of synthetic financial information for scenario analysis. It supports algorithmic trading by developing realistic market simulations for testing tactics. Moreover, it enhances fraud detection by identifying transactional structures and patterns by making better decision-making and market security. The demand for generative AI in investment banking products will increase due to its requirement in the future of banking industry and trading sectors which will help in the market expansion in the coming years.

Key Takeaways

- Market Growth: Global Generative AI in Investment Banking Market was valued at USD XX billion in 2023. It is expected to reach USD XX billion by 2033, with a CAGR of XX% during the forecast period from 2024 to 2033.

- By Component: The dominant sub-segment in the software component is driving innovation and efficiency in various industries.

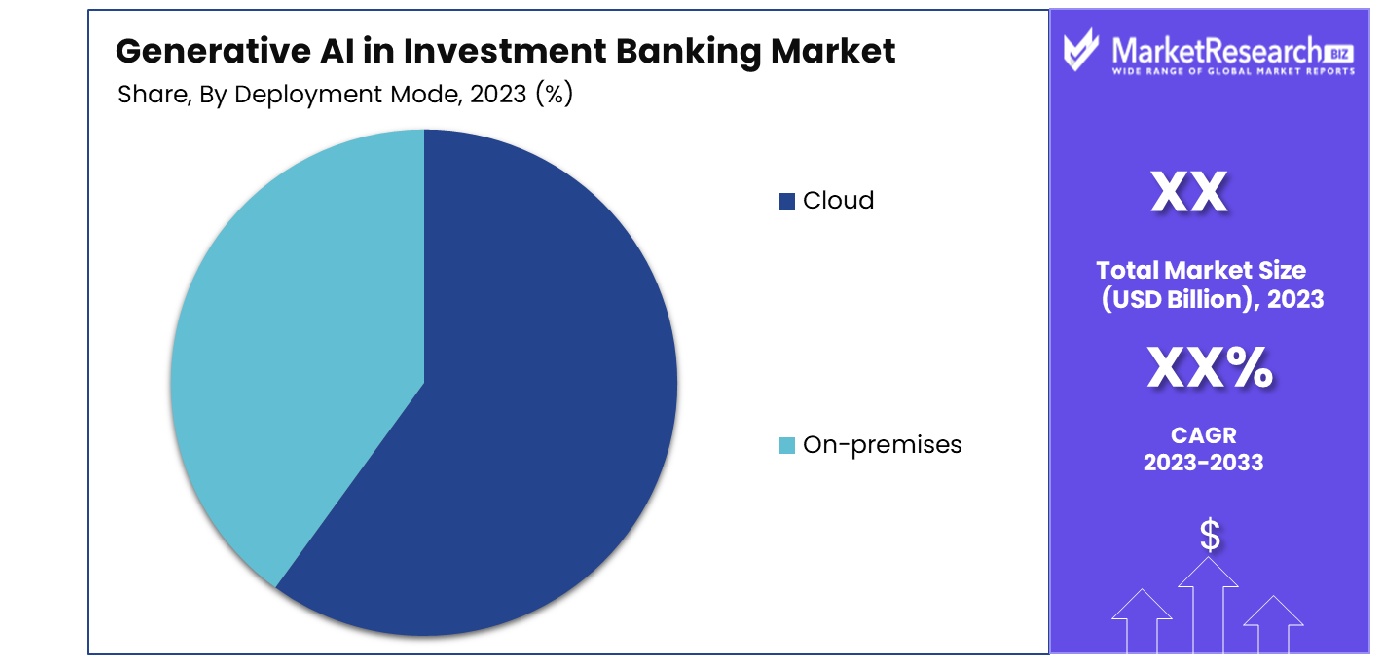

- By Deployment Mode: Cloud deployment mode leads with its scalability, flexibility, and accessibility advantages.

- By Application: Risk management emerges as the dominant sub-segment in applications, ensuring robust mitigation strategies.

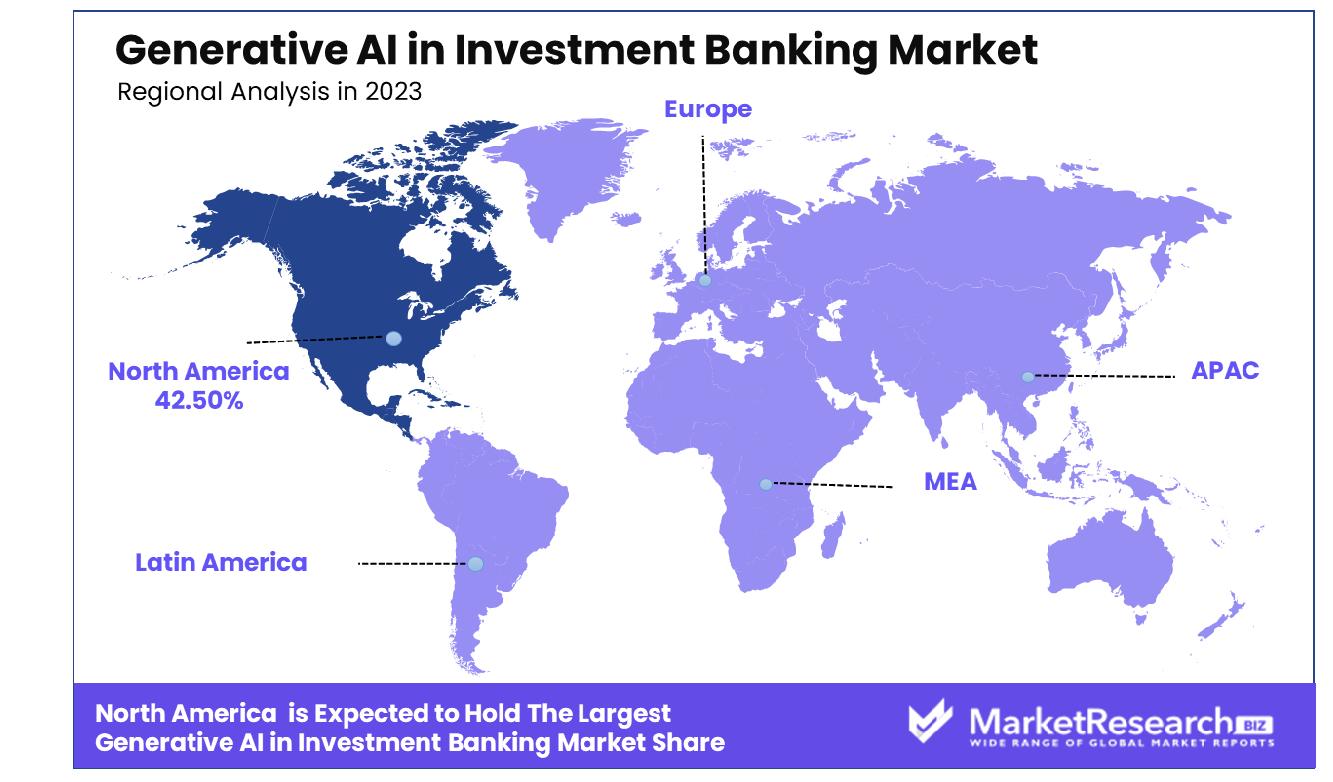

- Regional Dominance: North America dominates the Generative AI in Investment Banking market, capturing a significant 42.50% share.

- Growth Opportunity: Generative AI integration in investment banking drives innovation, offering growth prospects through tailored product development and optimized trade execution. This technological advancement enhances efficiency, reduces costs, and strengthens client relationships, bolstering competitive advantage.

Driving factors

Demand for Faster and More Customized Client Services Drives Market Growth

In the competitive realm of investment banking, generative AI is a game-changer, offering the ability to quickly generate customized financial solutions for clients. This technology enables banks to produce personalized pitches, detailed reports, and precise recommendations tailored to individual client profiles and investment goals. The result is a significant enhancement in client satisfaction and loyalty, as services become more responsive and aligned with client expectations.

Moreover, this rapid customization capability allows banks to differentiate themselves in a crowded market, attracting a broader client base. The long-term implications of this trend include a shift towards more dynamic, client-centered business models in investment banking workforce, where AI-driven customization becomes a key competitive advantage.

Need for More Accurate Forecasts and Insights Fuels Market Expansion

Generative AI's capacity to sift through and analyze extensive datasets for pattern recognition transforms how investment banks approach market analysis and investment strategy development. This technology provides unprecedented accuracy in forecasts and insights, enabling banks to make more informed decisions with a higher probability of success. The strategic advantage gained through AI-driven analytics encourages further investment in AI technologies, driving the sector's expansion.

As the industry becomes increasingly data-driven, banks that leverage AI for deeper insights will lead the market, setting new standards for operational efficiency and strategic foresight. The growing reliance on accurate, AI-generated forecasts and insights signifies a fundamental shift towards analytics-driven investment banking.

Regulatory Requirements for Transparency Enhance Adoption

The adoption of generative AI in investment banking is further propelled by regulatory pressures demanding greater transparency and accountability in financial services. AI technologies facilitate the generation of comprehensive reports and analyses, making it easier for banks to comply with regulatory standards and document their decision-making processes. This capability is crucial for maintaining client trust and regulatory compliance, especially in complex financial markets.

As regulatory frameworks continue to emphasize transparency, the role of AI in ensuring compliance and fostering an environment of trust and clarity in financial transactions will become increasingly central. This trend underscores the alignment between technological advancement and regulatory compliance, enhancing the stability and integrity of financial markets.

Competition from FinTech Companies Spurs Innovation

The rise of FinTech companies, characterized by their quick adoption of cutting-edge technologies, including AI, challenges traditional investment banks to innovate or risk obsolescence. This competitive pressure is a powerful catalyst for the adoption of generative AI within traditional banking institutions, driving them to embrace technological innovation to enhance efficiency, accuracy, and client service.

The race to integrate AI reflects a broader industry trend towards digital transformation, where leveraging advanced technologies is no longer optional but essential for survival and growth. This dynamic competition encourages continuous improvement and innovation in financial services, ensuring that the sector remains at the forefront of technological adoption. The enduring impact of this competition will likely be a more agile, technologically adept investment banking industry that can better serve the evolving needs of its clients.

Restraining Factors

Data Privacy and Security Concerns Restrain Market Growth

Data privacy and security concerns significantly limit the expansion of Generative AI in investment banking. Given the sector's reliance on confidential client data, any potential errors or vulnerabilities introduced by AI technologies could result in severe data breaches. The imperative for stringent data governance and robust security measures before AI deployment makes financial institutions cautious.

This caution slows down the adoption rate, as banks must ensure that their use of AI complies with the highest standards of data protection. The challenge lies in balancing innovation with the need to protect sensitive information, a critical factor in maintaining client trust and regulatory compliance.

Regulatory Uncertainty Limits AI Deployment

The lack of clear regulations governing the use of AI in financial services creates a significant barrier to the broader deployment of Generative AI in investment banking. Banks operate in a highly regulated environment, and the uncertainty surrounding AI applications makes them hesitant to implement these technologies at scale.

Until there is more definitive regulatory guidance on AI usage, investment banks are likely to proceed with caution, limiting the potential growth of Generative AI within the sector. This regulatory ambiguity not only hampers innovation but also restricts the industry's ability to leverage AI for improved efficiency and client service.

By Component Analysis

In the software component, cloud-based solutions dominate the market landscape significantly.

In the Generative AI in Investment Banking Market, the Software segment emerges as the dominant sub-segment. This prominence is attributed to the pivotal role of AI software in enhancing decision-making processes, operational efficiencies, and client service levels within investment banking. AI software enables banks to generate insightful analytics, automate repetitive tasks, and offer innovative financial products. This segment's growth is driven by the increasing demand for advanced analytical generative AI toolsand algorithms that can process vast amounts of data to uncover market trends and investment opportunities.

Other components, such as Services, also play a critical role in the market's expansion. Services encompass installation, integration, support, and maintenance, which are essential for the effective deployment and utilization of AI software. The Services segment ensures that the sophisticated AI solutions are seamlessly integrated into the existing banking infrastructure, facilitating smooth operations and enhancing the software's value proposition.

By Deployment Mode Analysis

Cloud deployment prevails as the favored mode for software integration.

The Cloud deployment mode holds a dominant position in the Generative AI in Investment Banking Market due to its scalability, flexibility, and cost-effectiveness. Cloud-based solutions offer investment banks the ability to access AI capabilities without significant upfront investments in infrastructure. This deployment mode supports the dynamic needs of investment banking, enabling banks to quickly adapt to market changes and leverage AI-powered analytics and tools from anywhere.

On-premises deployment, while still relevant, offers banks full control over their AI systems and data. It is preferred for operations requiring stringent data security measures. However, the agility and efficiency provided by cloud deployments are driving a shift towards this model, further propelled by advancements in cloud security that address many concerns associated with data privacy and regulatory compliance.

By Application Analysis

Within applications, risk management stands out as the dominant sub-segment.

Risk Management stands out as the dominant application of Generative AI in investment banking, driven by the sector's need to identify, assess, and mitigate various financial and operational risks. AI enhances risk management processes by providing predictive analytics, real-time monitoring, and scenario analysis, enabling banks to make informed decisions and maintain regulatory compliance. This application is crucial for sustaining profitability and ensuring stability in the volatile financial market.

Other applications, including Algorithmic Trading, Fraud Detection, Customer Relationship Management, Portfolio Management, and Other Applications, significantly contribute to the market's growth. Each application leverages AI to improve specific aspects of investment banking operations, from automating trading strategies and detecting fraudulent activities to personalizing client interactions and optimizing portfolio allocations. The diverse applications of Generative AI underscore its transformative potential across the entire spectrum of investment banking activities.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- Cloud

- On-premises

By Application

- Algorithmic Trading

- Risk Management

- Fraud Detection

- Customer Relationship Management

- Portfolio Management

- Other Applications

Growth Opportunity

New Product Development Offers Growth Opportunity

The introduction of Generative AI into new product development in investment banking serves as a catalyst for innovation, presenting substantial growth opportunities. By harnessing the power of AI, banks can swiftly design financial products that are closely tailored to the evolving needs of their clients.

This agility in product development not only enhances client satisfaction but also opens up new revenue streams for banks. The capability to quickly adapt and offer novel solutions in response to market demands positions investment banks as leaders in financial innovation, driving competitive advantage and market expansion.

Optimizing Trade Execution Offers Growth Opportunity

Generative AI revolutionizes trade execution by analyzing the market's microstructure to optimize trading strategies, thereby reducing operational costs and enhancing trading revenues. This technological advancement allows investment banks to execute trades more efficiently, minimizing slippage and improving price outcomes for their clients.

By leveraging AI to refine trade execution processes, banks can offer superior services to their clients, strengthening client relationships, and securing a competitive edge in the market. The improved efficiency and cost savings directly contribute to the bottom line, highlighting the strategic value of AI in trading operations.

Latest Trends

Automated Document Generation

The application of Generative AI in automating document generation transforms the labor-intensive process of creating client-facing documents, such as research reports, pitch books, and term sheets. This automation significantly reduces the time analysts spend on document preparation, allowing them to focus on higher-value activities.

By improving operational efficiency and reducing the potential for human error, investment banks can enhance the quality and speed of their service delivery, thereby improving client satisfaction and loyalty. The efficiency gains from automated document generation represent a notable growth opportunity for investment banks by streamlining internal processes and improving service quality.

Chatbots for Customer Service

Deploying intelligent chatbots for customer service in investment banking introduces a significant growth opportunity by automating client interactions. These AI-powered chatbots can handle inquiries, account openings, and other repetitive tasks, delivering prompt and accurate responses 24/7. The use of chatbots improves the client experience by providing instant support, thereby increasing client engagement and satisfaction.

Additionally, chatbots reduce the workload on human staff, allowing them to concentrate on more complex and revenue-generating activities. The strategic deployment of chatbots signifies a move towards more scalable and efficient customer service models in investment banking, driving operational efficiency and enhancing client retention.

Regional Analysis

North America Dominates with a 42.50% Market Share

North America's commanding 42.50% share in the Generative AI in Investment Banking Market is primarily driven by the region's robust financial sector, high technology adoption rates, and significant investments in AI and machine learning technologies. The presence of leading investment banks and technology firms in the U.S. and Canada fosters a conducive environment for innovation and early adoption of generative AI applications. This region benefits from advanced infrastructure, skilled talent pools, and supportive regulatory frameworks that encourage the development and integration of AI technologies in financial services. These factors collectively contribute to North America's dominance in the market.

Europe: A Key Player in Generative AI Adoption

Europe holds a significant position in the Generative AI in Investment Banking Market, attributed to its strong regulatory framework, which emphasizes data protection and ethical AI use. European investment banks are rapidly adopting generative AI to enhance efficiency, comply with stringent regulations, and stay competitive. The region's commitment to innovation, combined with its focus on sustainable and responsible banking practices, positions Europe as a critical market for generative AI technologies. The collaborative efforts between the public and private sectors to foster AI development further reinforce Europe's role in the global market.

Asia-Pacific: Rapid Growth and Innovation Hub

The Asia-Pacific region is witnessing rapid growth in the Generative AI in Investment Banking Market, driven by increasing digitalization, growing fintech ecosystems, and substantial investments in AI and blockchain technologies. Countries like China, Japan, and South Korea are at the forefront of technological innovation, leveraging AI to transform their financial services sector. The region's large, tech-savvy population and the push for financial inclusion through technology are key drivers behind the adoption of generative AI. With its dynamic market and continuous investment in research and development, Asia-Pacific is poised to increase its market share and influence in the coming years.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the Generative AI in Investment Banking Market, key players such as IBM Corporation, Google LLC, Microsoft Corporation, Amazon Web Services, Inc., NVIDIA Corporation, SAS Institute Inc., and Accenture plc, alongside other influential companies, have significantly shaped the industry landscape. These corporations collectively possess a substantial market influence through their innovative technologies, comprehensive AI solutions, and strategic partnerships that redefine investment banking operations.

IBM Corporation and SAS Institute Inc. are renowned for their robust analytics and AI-driven platforms, enhancing risk management and customer service efficiency. Google LLC and Microsoft Corporation lead in developing advanced AI tools and cloud computing services that empower banks to optimize trading strategies and personalize customer interactions. Amazon Web Services, Inc. and NVIDIA Corporation provide critical infrastructure and processing capabilities that support the vast data analysis needs of generative AI applications. Accenture plc stands out for its consulting services, assisting banks in integrating AI technologies seamlessly into their existing systems.

These key players, through their pioneering efforts, have not only propelled the adoption of generative AI in investment banking but have also set the stage for ongoing innovation and competition. Their strategic positioning in the market, characterized by a deep focus on research and development, has enabled them to offer cutting-edge solutions that address the complex challenges of modern investment banking, from algorithmic trading to fraud detection and regulatory compliance. The collective impact of these companies is a testament to their role in driving forward the capabilities and efficiencies of the investment banking sector on a global scale.

Market Key Players

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Amazon Web Services, Inc.

- NVIDIA Corporation

- SAS Institute Inc.

- Accenture plc

- Other Key Players

Recent Development

- In February 2024, Celent reports rapid AI growth in banking, emphasizing payments' potential. Banks explore Gen AI; 58% testing, 23% planning. Focus on revenue outcomes, data privacy, and regulation. Various AI applications optimize front, middle, and back-office workflows for efficiency and agility.

- In February 2024, PitchBook's report notes global VC funding dipped by 15% in Q4 2023, the lowest since 2020. US, China decline amidst uncertainty; Europe up 7% driven by AI, fintech. Seed-stage thrives; CVC deals steady at 20%. Generative AI attracts robust investment, defying trends.

- In February 2024, Deloitte's report forecasts a 27-25% boost in front-office productivity for top global investment banks using generative AI. Prioritization matrix aids adoption, addressing risks. Andrea Haskell and Val Srinivas provide insights.

Report Scope

Report Features Description Market Value (2023) USD XX Billion Forecast Revenue (2033) USD XX Billion CAGR (2024-2032) XX% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component(Software, Services), By Deployment Mode(Cloud, On-premises), By Application(Algorithmic Trading, Risk Management, Fraud Detection, Customer Relationship Management, Portfolio Management, Other Applications) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape IBM Corporation, Google LLC, Microsoft Corporation, Amazon Web Services, Inc., NVIDIA Corporation, SAS Institute Inc., Accenture plc, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Amazon Web Services, Inc.

- NVIDIA Corporation

- SAS Institute Inc.

- Accenture plc

- Other Key Players