Gas Leak Detector Market By Product Type (Portable Gas Leak Detectors, Fixed Gas Leak Detectors), By Technology (Electrochemical Gas Leak Detectors, Ultrasonic Gas Leak Detectors, Infrared Gas Leak Detectors, Optical Gas Leak Detectors, Photo-ionization Gas Leak Detectors, Others), By Application (Industrial Gas Leak Detectors, Commercial Gas Leak Detectors, Residential Gas Leak Detectors, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47074

-

June 2024

-

137

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

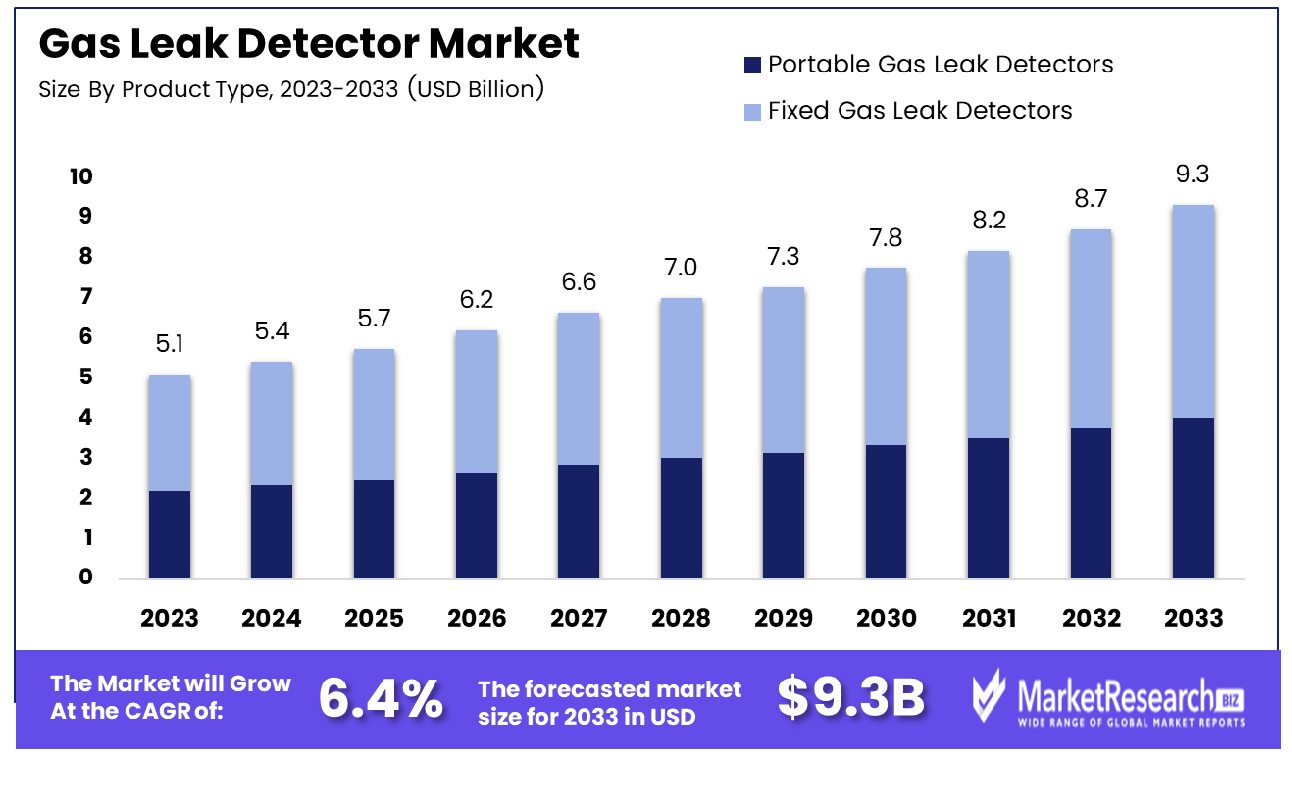

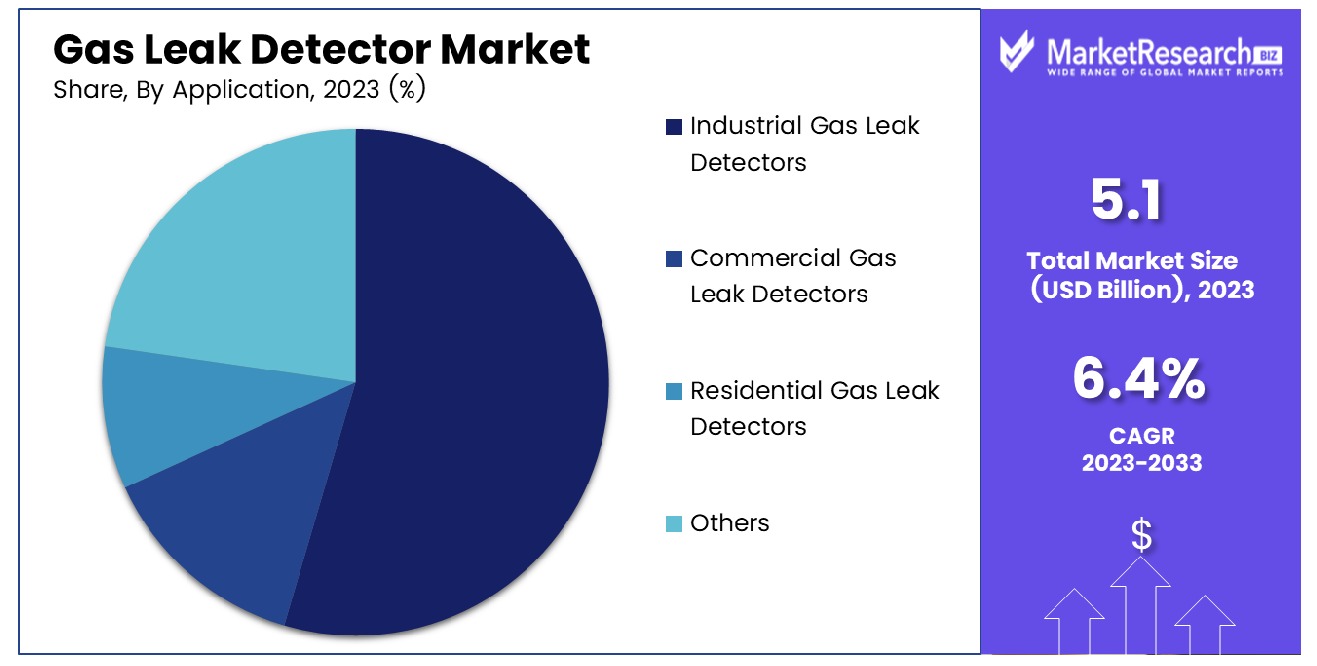

The Global Gas Leak Detector Market was valued at USD 5.1 Bn in 2023. It is expected to reach USD 9.3 Bn by 2033, with a CAGR of 6.4% during the forecast period from 2024 to 2033.

The Gas Leak Detector Market encompasses a sector dedicated to the development, manufacturing, and distribution of sophisticated detection systems designed to identify and mitigate gas leaks across industrial, commercial, and residential settings. These cutting-edge solutions play a critical role in safeguarding assets, ensuring workplace safety, and minimizing environmental risks associated with gas leaks. With heightened regulatory scrutiny and a growing awareness of the importance of gas leak prevention, the market is witnessing a surge in demand for advanced detection technologies. Stakeholders must stay abreast of evolving industry standards, technological innovations, and market dynamics to effectively navigate this rapidly expanding market landscape.

The Gas Leak Detector Market presents a compelling landscape characterized by evolving safety regulations, technological advancements, and increasing awareness of environmental concerns. Detectors, tailored to detect gas concentrations within specific ranges like 0-100% LEL (Lower Explosive Limit) or 0-10,000 ppm, serve as critical assets in mitigating potential hazards across diverse industries. While heightened sensitivity enhances early leak detection, it also raises concerns regarding false alarms. Key players like GL Sciences exemplify excellence in this domain, offering reliable solutions such as the LD239, renowned for its sensitivity in helium leak detection and user-friendly design.

The significance of gas leak detectors in ensuring workplace safety, environmental protection, and asset preservation. The market's trajectory is influenced by factors such as industry standards, technological innovations, and consumer preferences for reliable, high-quality detection systems. With regulatory mandates tightening and stakeholders prioritizing risk mitigation strategies, demand for advanced gas leak detection technologies is poised to escalate.

In this dynamic market landscape, strategic foresight and agility are paramount. Companies must prioritize research and development initiatives to enhance detector sensitivity, minimize false alarms, and improve user experience.

Key Takeaways

- Market Value: The Global Gas Leak Detector Market was valued at USD 5.1 Bn in 2023. It is expected to reach USD 9.3 Bn by 2033, with a CAGR of 6.4% during the forecast period from 2024 to 2033.

- By Product Type: Fixed Gas Leak Detectors dominate the market with a 55% share, favored for their continuous monitoring capabilities in industrial settings.

- By Technology: Infrared Gas Leak Detectors hold a 40% market share, owing to their high sensitivity and reliability in detecting gas leaks across various applications.

- By Application: Industrial Gas Leak Detectors dominate the market with a 60% share, due to stringent safety regulations and the high risks associated with gas leaks in industrial environments.

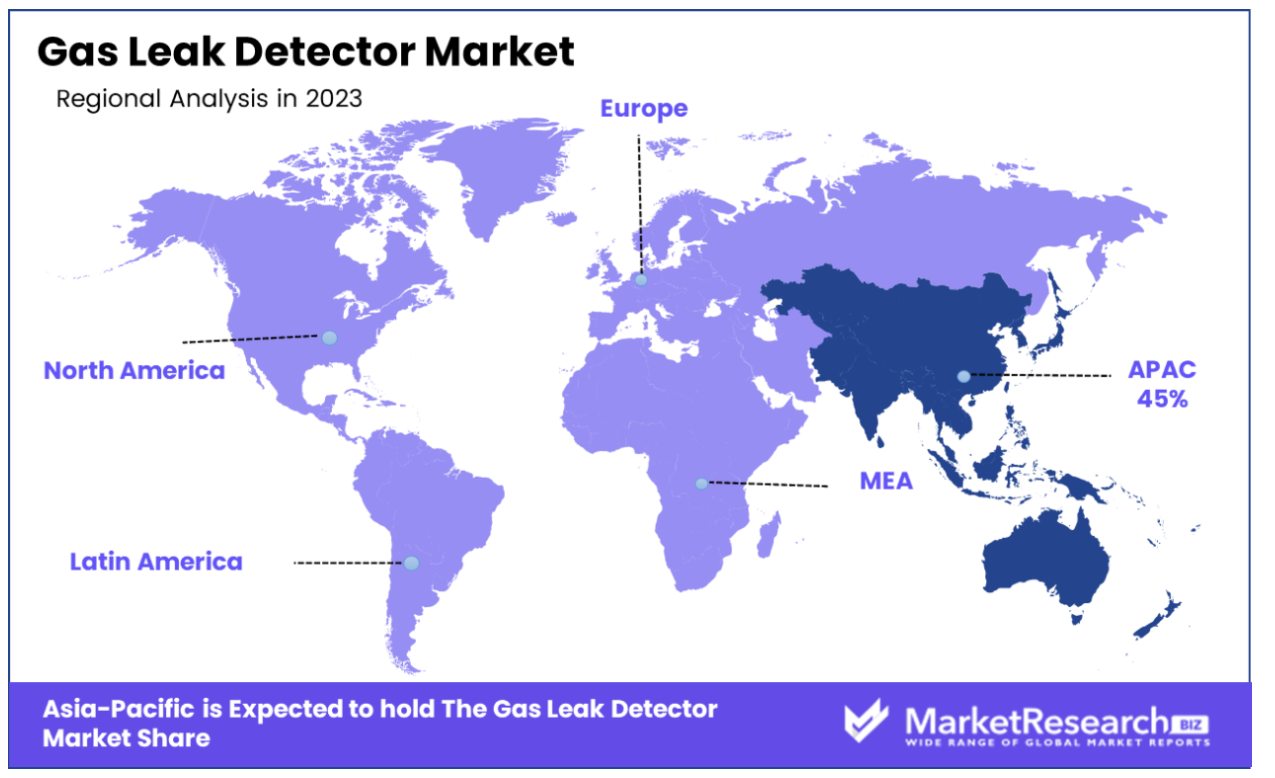

- Regional Dominance: Asia-Pacific holds the dominant position in the Gas Leak Detector Market with a 45% market share, fueled by rapid industrialization and stringent safety regulations in the region.

- Growth Opportunity: The Gas Leak Detector Market offers growth potential in the development of advanced wireless and IoT-enabled detection systems for improved safety and monitoring.

Driving factors

Safety Regulations

The enforcement of stringent safety regulations by governments and industry bodies worldwide is a major driving force behind the growth of the gas leak detector market. These regulations mandate the installation of gas detection systems in residential, commercial, and industrial settings to prevent accidents and ensure the safety of occupants and workers. For instance, the Occupational Safety and Health Administration (OSHA) in the United States and similar organizations in other countries have set forth strict guidelines for the detection and management of gas leaks in various industries. Compliance with these regulations necessitates the widespread adoption of advanced gas leak detectors, thereby propelling market growth.

Regulations such as the European Union’s ATEX directives for equipment used in explosive atmospheres further drive the demand for sophisticated gas detection systems. These regulations not only require the installation of gas detectors but also specify the standards for their performance and reliability, thereby boosting the market for high-quality gas leak detection solutions.

Urbanization

The rapid pace of urbanization globally has led to significant growth in infrastructure development, including residential, commercial, and industrial construction. This expansion increases the risk of gas leaks, particularly in densely populated urban areas where the consequences of such incidents can be catastrophic.There is a heightened awareness of the need for effective gas leak detection systems to protect people and property.

Urbanization also leads to the proliferation of gas-powered appliances and heating systems in homes and commercial buildings, further elevating the demand for reliable gas leak detectors. The increasing complexity of urban infrastructure, including the extensive use of underground gas pipelines, necessitates continuous monitoring to prevent leaks and ensure safety. This scenario is driving the adoption of advanced gas detection technologies, such as Internet of Things (IoT)-enabled devices that offer real-time monitoring and alerts, thus fueling market growth.

Environmental Concerns

Growing environmental concerns and the need to address greenhouse gas emissions are significant factors contributing to the expansion of the gas leak detector market. Methane, a common gas that leaks from pipelines and industrial processes, is a potent greenhouse gas with a global warming potential much higher than carbon dioxide. Detecting and mitigating methane leaks is crucial for reducing overall greenhouse gas emissions and combating climate change.

Environmental regulations aimed at reducing emissions have spurred the adoption of gas leak detection technologies. For example, the Environmental Protection Agency (EPA) in the United States has implemented rules to control methane emissions from the oil and gas industry, which includes the requirement for regular monitoring and leak detection. Similar initiatives are being adopted worldwide, driving the demand for advanced gas leak detectors that can accurately identify and quantify emissions.

Restraining Factors

Limited Fire Hazard Control

Limited fire hazard control is a critical concern that significantly influences the gas leak detector market. Gas leaks pose a substantial fire risk, particularly in industrial settings where flammable gases are used in large quantities. Traditional fire hazard control measures are often insufficient to prevent incidents, emphasizing the need for advanced gas leak detection systems that can identify leaks before they lead to fires.

This concern drives the adoption of high-sensitivity gas detectors capable of early leak detection. industries dealing with combustible gases like propane or methane require detectors that can quickly and accurately identify even minute leaks to prevent fires and explosions. The growing recognition of these risks is pushing companies to invest in sophisticated gas detection technologies, thus expanding the market.

Sensor Limitations

Sensor limitations in traditional gas leak detectors represent a challenge that spurs innovation and market growth. Conventional sensors often suffer from issues such as limited sensitivity, cross-sensitivity to other gases, and reduced performance in extreme environmental conditions. These limitations can lead to undetected leaks or false alarms, compromising safety and operational efficiency.

The integration of digital technologies like AI and machine learning development with gas detection systems is enhancing their accuracy and reliability. These technologies enable predictive maintenance and real-time monitoring, reducing the chances of sensor failure and improving overall safety. The demand for such advanced solutions is driving growth in the gas leak detector market, as industries seek to overcome the limitations of traditional sensors and ensure more effective leak detection.

By Product Type Analysis

Fixed Gas Leak Detectors dominate with a 55% market share, prized for continuous monitoring in industries.

In 2023, Fixed Gas Leak Detectors held a dominant market position in the By Product Type segment of the Gas Leak Detector Market, capturing more than a 55% share. The extensive adoption of fixed gas leak detectors across various industries, including oil & gas, chemical, and manufacturing, drives this dominance. These detectors are integral for continuous monitoring and early detection of gas leaks, ensuring workplace safety and compliance with stringent regulatory standards.

The Portable Gas Leak Detectors segment also captured a notable share of the Gas Leak Detector Market. The portability and flexibility offered by these detectors make them essential tools for field inspections, maintenance, and emergency response activities. Industries such as utilities, residential, and commercial buildings rely on portable detectors for their ease of use and ability to detect leaks in various environments.

By Technology Analysis

Infrared Gas Leak Detectors hold 40% market share, valued for sensitivity and reliability.

In 2023, Infrared Gas Leak Detectors held a dominant market position in the By Technology segment of the Gas Leak Detector Market, capturing more than a 40% share. The preference for infrared technology is driven by its high accuracy, reliability, and capability to detect a wide range of gases. These detectors are widely used in industries such as oil & gas, petrochemical, and manufacturing, where precision in gas leak detection is critical.

The Electrochemical instruments like Gas Leak Detectors segment accounted for a substantial share of the Gas Leak Detector Market. Known for their sensitivity and specificity to various toxic gases, these detectors are extensively used in industrial and residential applications.

Ultrasonic Gas Leak Detectors held a notable share in the market. These detectors are particularly valued for their ability to detect gas leaks by sensing the ultrasonic sound produced by escaping gas, even in noisy industrial environments.

The Optical Gas Leak Detectors segment also captured a significant portion of the market. These detectors, which utilize laser technology to identify gas leaks, are favored for their high precision and rapid response times.

Photo-ionization Gas Leak Detectors maintained a steady market share. These detectors are highly effective in detecting volatile organic compounds (VOCs) and are commonly used in environmental monitoring, industrial hygiene, and emergency response. The increasing awareness of air quality and environmental protection drives the demand for photo-ionization gas leak detectors.

The 'Others' category, encompassing various emerging and niche gas leak detection technologies, also played a role in the market.

By Application Analysis

Industrial Gas Leak Detectors command a 60% share, driven by strict safety regulations.

In 2023, Industrial Gas Leak Detectors held a dominant market position in the By Application segment of the Gas Leak Detector Market, capturing more than a 60% share. The widespread use of gas leak detectors in industrial settings, such as oil & gas, chemical, petrochemical, and manufacturing plants, drives this dominance. The critical need for safety, regulatory compliance, and prevention of hazardous incidents in these high-risk environments significantly contributes to the strong market share of industrial gas leak detectors.

The Commercial Gas Leak Detectors segment accounted for a substantial share of the Gas Leak Detector Market. These detectors are essential in ensuring safety in commercial buildings, including shopping malls, office complexes, hospitals, and schools.

Residential Gas Leak Detectors also captured a significant portion of the market. The rising awareness of household safety and the prevention of gas-related accidents contribute to the growing adoption of gas leak detectors in residential areas. The availability of affordable and user-friendly detectors for domestic use supports the expansion of this segment.

The 'Others' category, which includes gas leak detectors used in various niche applications such as transportation, laboratories, and research facilities, also played a notable role in the market.

Key Market Segments

By Product Type

- Portable Gas Leak Detectors

- Fixed Gas Leak Detectors

By Technology

- Electrochemical Gas Leak Detectors

- Ultrasonic Gas Leak Detectors

- Infrared Gas Leak Detectors

- Optical Gas Leak Detectors

- Photo-ionization Gas Leak Detectors

- Others

By Application

- Industrial Gas Leak Detectors

- Commercial Gas Leak Detectors

- Residential Gas Leak Detectors

- Others

Growth Opportunity

Energy Transition

The global shift towards cleaner energy sources and the transition from coal and oil to natural gas is a significant growth driver for the gas leak detector market in 2024. As countries strive to reduce carbon emissions and meet sustainability goals, natural gas is becoming a preferred energy source due to its lower environmental impact. This transition necessitates the development of extensive gas infrastructure, including pipelines, storage facilities, and distribution networks, all of which require robust leak detection systems.

The increased demand for natural gas, driven by energy transition policies, presents substantial growth opportunities for advanced gas leak detectors that ensure the safety and efficiency of gas operations.

Occupational Health and Safety

Occupational health and safety (OHS) regulations are becoming increasingly stringent worldwide, emphasizing the need for effective gas leak detection to protect workers from hazardous exposures. According to the International Labour Organization (ILO), over 2.3 million workers die annually from work-related accidents or diseases, with a significant portion attributed to gas-related incidents. In response, industries are adopting more sophisticated gas detection technologies to comply with OHS standards and create safer work environments.

This regulatory pressure and the growing awareness of workplace safety drive the market for gas leak detectors, as businesses seek to mitigate risks and enhance the health and safety of their employees.

Latest Trends

Wireless Technologies

In 2024, the adoption of wireless technologies is poised to transform the gas leak detector market. Wireless gas detectors offer numerous advantages, including ease of installation, flexibility in monitoring, and reduced maintenance costs. These systems enable real-time data transmission and remote monitoring, making them ideal for large industrial sites and urban infrastructures where traditional wired systems can be cumbersome.

The integration of wireless technologies with IoT platforms enhances their functionality, allowing for predictive maintenance and instant alerts in case of leaks. This trend is expected to drive significant growth as industries seek more efficient and scalable gas detection solutions.

Portable Gas Detectors

The rising demand for portable gas detectors is another notable trend in 2024. These compact and lightweight devices provide on-the-go detection, making them essential for maintenance workers, emergency responders, and safety inspectors. The portability of these detectors allows for quick and precise identification of gas leaks in various locations, ensuring immediate action can be taken to mitigate risks.

With advancements in battery life and sensor technology, portable gas detectors are becoming more reliable and user-friendly, driving their increased adoption across multiple sectors, including oil and gas, manufacturing, and construction.

Electrochemical and Catalytic Sensors

The market is witnessing a surge in the use of electrochemical and catalytic sensors due to their high sensitivity and reliability in detecting a wide range of gases. Electrochemical sensors are particularly effective for detecting toxic gases at low concentrations, while catalytic sensors are well-suited for identifying flammable gases.

The continuous improvement in these sensor technologies, driven by advances in materials science and manufacturing processes, is enhancing their performance and durability. This trend is crucial for industries that require precise and consistent gas detection to ensure safety and compliance with regulatory standards.

Regional Analysis

In the gas leak detector market, Asia-Pacific dominates with a commanding 45% share.

Asia Pacific leads the global gas leak detector market, commanding a dominant share of approximately 45%. The region's growth is fueled by rapid industrialization, urbanization, and stringent safety regulations across key economies such as China, India, and Japan. With the expanding oil & gas industry and increasing awareness regarding workplace safety, there is a heightened demand for gas leak detection systems in the region.

North America stands as a significant player in the global gas leak detector market, with a notable share attributed to its stringent safety regulations and advanced technological infrastructure. The region boasts a considerable demand for gas leak detection systems across various sectors, including oil & gas, chemical, and manufacturing industries, to ensure workplace safety and regulatory compliance.

Europe emerges as a prominent region in the gas leak detector market, propelled by stringent environmental regulations and growing awareness regarding gas safety measures. Countries such as Germany, the United Kingdom, and France are witnessing significant investments in gas infrastructure and pipeline safety, thereby driving the demand for advanced leak detection solutions.

While holding a comparatively smaller share of the global gas leak detector market, the Middle East & Africa region is witnessing steady growth, propelled by the expansion of oil & gas exploration activities and increasing investments in industrial safety measures. Market projections suggest a gradual rise in the adoption of gas leak detection systems in the region, supported by infrastructure development projects and regulatory mandates for gas safety compliance.

Latin America presents opportunities for growth in the gas leak detector market, supported by the region's expanding oil & gas industry and growing investments in industrial safety infrastructure. Countries like Brazil, Mexico, and Argentina are witnessing increasing awareness regarding gas safety measures, driving the demand for advanced leak detection technologies.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Gas Leak Detector Market is poised for significant expansion, with key players such as MSA Safety Inc., 3M Co., and Danfoss A/S leading the industry. These companies play pivotal roles in ensuring safety and efficiency across various sectors where gas leaks pose serious risks.

MSA Safety Inc., a recognized leader in safety solutions, is expected to maintain its dominant position in the gas leak detector market. The company's innovative products, coupled with its commitment to quality and reliability, make it a trusted choice for customers worldwide.

3M Co., renowned for its diversified portfolio of industrial solutions, brings its expertise to the gas leak detector market. With a focus on technological advancements and customer-centric innovation, 3M Co. is well-positioned to capitalize on the increasing demand for reliable gas detection solutions.

Danfoss A/S, known for its expertise in engineering and manufacturing, offers a range of cutting-edge gas leak detection solutions. Its focus on sustainability and energy efficiency aligns with the growing emphasis on environmental responsibility, further bolstering its market position.

Other significant players such as Det-Tronics Corporation, PSI Software AG, and Emerson Electric Co. also contribute to the market's growth. These companies leverage their expertise in sensor technology, data analytics, and industrial automation to provide comprehensive gas leak detection solutions.

Market Key Players

- MSA Safety Inc.

- 3M Co.

- Danfoss A/S

- Det-Tronics Corporation

- PSI Software AG

- Emerson Electric Co.

- Honeywell International Inc.

- Yokogawa Electric Corporation

- Inficon Holding AG

- Draegerwerk AG & Co KGaA

- Testo SE & Co KGaA

- Tyco International PLC

Recent Development

- In May 2024, Blackline Safety Corp. enhances G6 single-gas detector with real-time connectivity, SOS feature, and advanced analytics. New service plans offer tailored safety solutions. Ideal for industrial settings.

- In March 2024, Kidde Nighthawk Plug-in Carbon Monoxide and Explosive Gas Detector now 18% off. Detects methane, propane, and CO. Convenient mounting, battery backup. Reliable detection with digital display.

Report Scope

Report Features Description Market Value (2023) USD 5.1 Bn Forecast Revenue (2033) USD 9.3 Bn CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Portable Gas Leak Detectors, Fixed Gas Leak Detectors), By Technology (Electrochemical Gas Leak Detectors, Ultrasonic Gas Leak Detectors, Infrared Gas Leak Detectors, Optical Gas Leak Detectors, Photo-ionization Gas Leak Detectors, Others), By Application (Industrial Gas Leak Detectors, Commercial Gas Leak Detectors, Residential Gas Leak Detectors, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape MSA Safety Inc., 3M Co., Danfoss A/S, Det-Tronics Corporation, PSI Software AG, Emerson Electric Co., Honeywell International Inc., Yokogawa Electric Corporation, Inficon Holding AG, Draegerwerk AG & Co KGaA, Testo SE & Co KGaA, Tyco International PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- MSA Safety Inc.

- 3M Co.

- Danfoss A/S

- Det-Tronics Corporation

- PSI Software AG

- Emerson Electric Co.

- Honeywell International Inc.

- Yokogawa Electric Corporation

- Inficon Holding AG

- Draegerwerk AG & Co KGaA

- Testo SE & Co KGaA

- Tyco International PLC