Gas Hydrates Market By Type (Onshore Gas Hydrates, Offshore/Marine Gas Hydrates), By Method of Extraction (Depressurization, Thermal Stimulation, Inhibitor Injection, CO2-Swapping), By Application (Commercial, Industrial, Residential, Transportation, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47426

-

June 2024

-

136

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

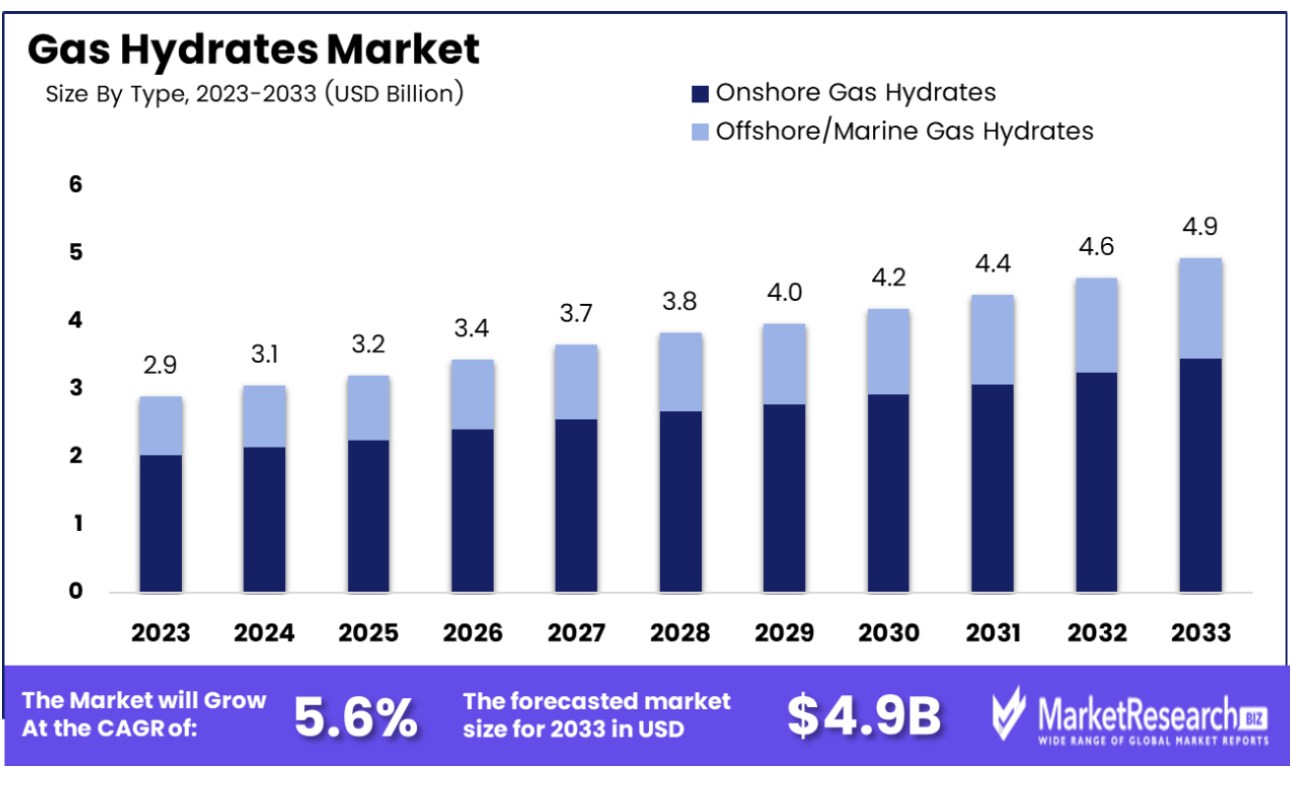

The Global Gas Hydrates Market was valued at USD 2.9 Bn in 2023. It is expected to reach USD 4.9 Bn by 2033, with a CAGR of 5.6% during the forecast period from 2024 to 2033.

The Gas Hydrates Market encompasses the exploration, extraction, and utilization of naturally occurring crystalline compounds formed by the combination of natural gas and water under specific conditions of low temperature and high pressure. This market presents a promising frontier in energy exploration and production, offering substantial reserves of methane, the primary component of natural gas.

As global energy demand surges and traditional hydrocarbon reserves become increasingly constrained, the Gas Hydrates Market represents an innovative opportunity for industry players to diversify their energy portfolios and address future energy needs in a sustainable and environmentally responsible manner.

The Gas Hydrates Market stands at the forefront of energy exploration and production, characterized by the extraction and utilization of naturally occurring gas hydrates—crystalline compounds of methane and water found predominantly in permafrost regions and on the ocean floor, particularly at depths exceeding 500 meters. With the estimated methane reserves trapped within these deposits ranging from 250,000 to 700,000 trillion cubic feet, the market presents an immense opportunity for industry players seeking to diversify energy portfolios and address growing global energy demands.

The Gas Hydrates Market stands at the forefront of energy exploration and production, characterized by the extraction and utilization of naturally occurring gas hydrates—crystalline compounds of methane and water found predominantly in permafrost regions and on the ocean floor, particularly at depths exceeding 500 meters. With the estimated methane reserves trapped within these deposits ranging from 250,000 to 700,000 trillion cubic feet, the market presents an immense opportunity for industry players seeking to diversify energy portfolios and address growing global energy demands.Gas hydrates represent a significant untapped resource, offering a potential solution to future energy needs amidst dwindling conventional hydrocarbon reserves. However, despite their vast potential, the commercialization of gas hydrates presents numerous challenges, including technological complexities, environmental concerns, and economic viability. Overcoming these hurdles requires strategic collaboration among industry stakeholders, governments, and research institutions to develop innovative extraction techniques, mitigate environmental risks, and ensure economic feasibility.

In conclusion, while the Gas Hydrates Market holds immense promise for meeting future energy demands, its realization requires a concerted effort to overcome technical, environmental, and economic challenges. By fostering innovation, collaboration, and sustainable practices, stakeholders can harness the potential of gas hydrates to drive long-term growth and energy security on a global scale.

Key Takeaways

- Market Value: The Global Gas Hydrates Market was valued at USD 2.9 Bn in 2023. It is expected to reach USD 4.9 Bn by 2033, with a CAGR of 5.6% during the forecast period from 2024 to 2033.

- By Type: Offshore/marine gas hydrates dominate the gas hydrates market, comprising a significant 60% share, highlighting the vast potential of offshore reserves in meeting energy demands.

- By Method of Extraction: Depressurization emerges as the predominant method of gas hydrate extraction, accounting for 30% of the market, owing to its effectiveness in releasing trapped gases for commercial use.

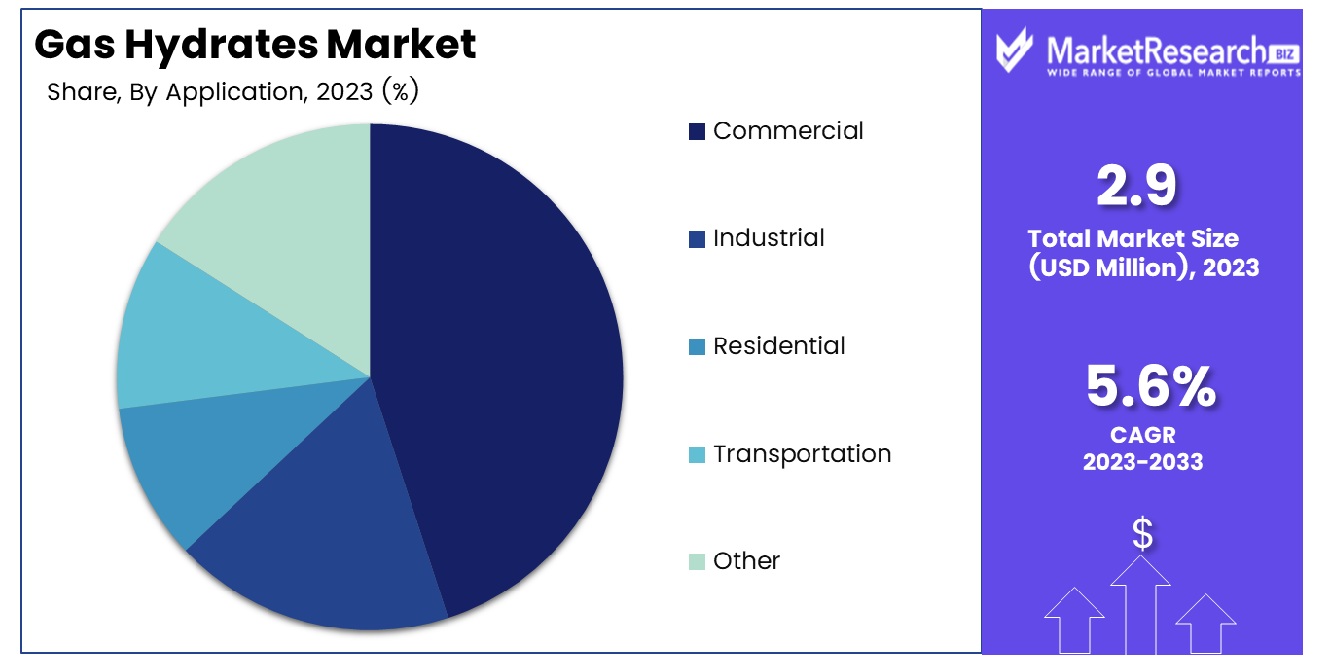

- By Application: The commercial sector emerges as the primary application area for gas hydrates, commanding a notable 45% share, underscoring their importance in meeting industrial and energy needs.

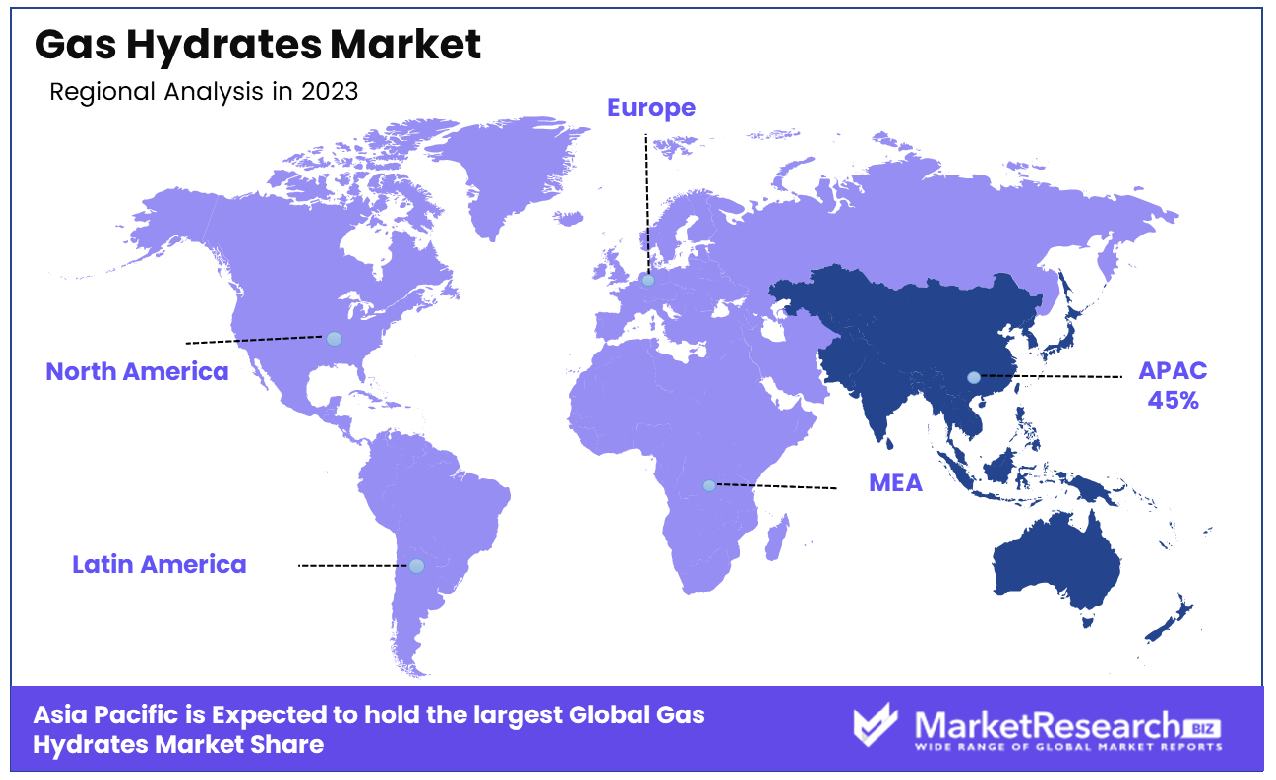

- Regional Dominance: The Asia-Pacific region emerges as the dominant market for gas hydrates, capturing 45% of the market share, fueled by growing energy demand and extensive offshore reserves.

- Growth Opportunity: Advancements in extraction technologies and rising energy demands spur growth opportunities, particularly in offshore exploration and production.

Driving factors

Rising Energy Demand

The incessant rise in global energy demand is a primary driving force behind the growth trajectory of the gas hydrates market. As populations grow, urbanize, and industrialize, the need for energy escalates. Gas hydrates present a promising solution, particularly as conventional energy sources face challenges such as depletion and environmental concerns.

The demand for energy is not only increasing in scale but also in diversity. Emerging economies, in particular, are experiencing rapid industrialization and urbanization, propelling energy requirements skyward. Gas hydrates, with their vast potential as an energy source, offer a viable means of meeting this burgeoning demand.

Alternative Energy Sources

In the evolving energy landscape, the exploration and utilization of alternative energy sources like gas hydrates are gaining prominence. This shift is driven by various factors, including environmental concerns, technological advancements, and geopolitical considerations.

Gas hydrates represent a significant opportunity in the quest for diversified energy portfolios. As countries seek to reduce their reliance on traditional fossil fuels, they are investing in research and development initiatives to harness the potential of unconventional energy sources, including gas hydrates.

Restraining Factors

Lack of Commercial Viability

The gas hydrates market faces a significant hurdle in the form of limited commercial viability. Despite the vast potential of gas hydrates as an energy source, challenges in extraction, processing, and transportation impede their widespread adoption.

One of the primary obstacles is the high cost and technical complexity associated with extracting gas hydrates from deep-sea deposits or permafrost regions. Current extraction techniques are still in the experimental phase, requiring substantial investment in research and development to improve efficiency and reduce costs.

Environmental Concerns

Environmental considerations pose another significant challenge to the growth of the gas hydrates market. While gas hydrates offer potential benefits as a cleaner alternative to conventional fossil fuels, concerns persist regarding their environmental impact and sustainability.

The extraction and utilization of gas hydrates raise environmental concerns related to habitat disruption, water quality degradation, and greenhouse gas emissions. The release of methane, a potent greenhouse gas, during extraction and production processes could exacerbate climate change if not properly managed.

By Type Analysis

Offshore/marine gas hydrates dominate with a commanding 60% share by type.

In 2023, Offshore/Marine Gas Hydrates held a dominant market position in the Type segment of the Gas Hydrates Market, capturing more than a 60% share. This commanding share underscores the significant potential and commercial viability of offshore and marine gas hydrate deposits as a source of energy.

Onshore Gas Hydrates, while also promising, did not match the dominance of Offshore/Marine Gas Hydrates in the market. While specific market share figures were not provided, Onshore Gas Hydrates represented a notable segment within the Gas Hydrates Market, characterized by its distinct geological formations and extraction challenges compared to offshore deposits.

While Offshore/Marine Gas Hydrates led the market, Onshore Gas Hydrates continued to garner interest from industry players and researchers due to their potential contribution to global energy supplies.

By Method of Extraction Analysis

Depressurization emerges as the favored method of extraction, capturing 30% of the market.

In 2023, Depressurization held a dominant market position in the Method of Extraction segment of the Gas Hydrates Market, capturing more than a 30% share. This significant market share underscores the effectiveness and widespread adoption of depressurization as a primary method for extracting gas hydrates from geological formations.

Thermal Stimulation emerged as another notable method of extraction within the Gas Hydrates Market. While specific market share figures were not provided, Thermal Stimulation represented a substantial segment characterized by the application of heat to dissociate gas hydrates and release trapped gas, particularly in reservoirs with high water depths or low temperatures.

Inhibitor Injection, although not as dominant as Depressurization, played a vital role in the Gas Hydrates Market's Method of Extraction segment. This method involves the injection of chemical inhibitors to disrupt the hydrate lattice structure and prevent the formation of gas hydrates during gas production operations.

CO2-Swapping, while relatively less prevalent compared to other extraction methods, offered a promising approach for gas hydrate extraction and carbon capture. By injecting carbon dioxide (CO2) into gas hydrate reservoirs, CO2-Swapping facilitates the replacement of methane molecules within the hydrate lattice, enabling methane recovery while sequestering CO2 underground.

By Application Analysis

Commercial applications lead, accounting for a substantial 45% share.

In 2023, Commercial held a dominant market position in the Application segment of the Gas Hydrates Market, capturing more than a 45% share. This significant market share underscores the widespread utilization of gas hydrates for commercial purposes across various industries and sectors.

Industrial applications emerged as another significant segment within the Gas Hydrates Market's Application category. While specific market share figures were not provided, Industrial applications encompassed a diverse range of uses, including gas production for manufacturing processes, power generation, and heating applications in industrial facilities.

Residential applications represented a notable segment within the Gas Hydrates Market, catering to the energy management systems needs of households for heating, cooking, and other domestic purposes. Although exact market share data for Residential applications were not available, residential gas consumption contributed to the overall demand for gas hydrates in the residential sector.

Transportation applications, while relatively smaller compared to other segments, offered promising opportunities for utilizing gas hydrates as an alternative fuel source for vehicles and transportation fleets. By converting gas hydrates into compressed natural gas (CNG) or liquefied natural gas (LNG), transportation applications aimed to reduce greenhouse gas emissions and dependency on traditional fossil fuels.

The "Other" segment encompassed additional applications beyond the aforementioned categories, including research and development, marine exploration, and niche industrial uses. While specific market share details were not provided, the "Other" segment represented a diverse array of opportunities for leveraging gas hydrates in specialized applications and emerging markets.

Key Market Segments

By Type

- Onshore Gas Hydrates

- Offshore/Marine Gas Hydrates

By Method of Extraction

- Depressurization

- Thermal Stimulation

- Inhibitor Injection

- CO2-Swapping

By Application

- Commercial

- Industrial

- Residential

- Transportation

- Other

Growth Opportunity

Investments in Exploration and Extraction

Investments in exploration and extraction technologies stand as pivotal drivers propelling the global gas hydrates market towards unprecedented growth in 2024. With increasing recognition of gas hydrates' potential as a significant energy source, both public and private entities are allocating substantial resources to advance exploration efforts and develop efficient extraction techniques.

These investments not only enhance the understanding of gas hydrate reservoirs but also accelerate the transition towards commercial viability, fostering market expansion.

Empowering Remote Communities

The year 2024 presents unique opportunities for the gas hydrates market to address the energy needs of remote communities sustainably. As conventional energy sources often prove economically and logistically challenging for such regions, gas hydrates offer a promising solution. Their abundance and potential for decentralized production make them well-suited for powering off-grid communities.

By providing access to clean and reliable energy, gas hydrates contribute to social and economic development while reducing dependence on environmentally detrimental energy sources.

Latest Trends

Advanced Seismic Imaging

In 2024, advanced seismic imaging emerges as a transformative trend shaping the global gas hydrates market. Technological advancements in seismic survey techniques, such as high-resolution imaging and 3D mapping, revolutionize the exploration and characterization of gas hydrate reservoirs.

These cutting-edge methods enable more accurate delineation of subsurface structures and identification of potential hydrate accumulations, thereby reducing exploration risks and enhancing resource assessment capabilities. As companies and research institutions harness the power of advanced seismic imaging, they unlock new frontiers for gas hydrate exploration and pave the way for future commercialization.

Pilot Projects and Demonstration Initiatives

Another prominent trend in the 2024 gas hydrates market is the proliferation of pilot projects and demonstration initiatives. Recognizing the need to bridge the gap between research and commercialization, stakeholders across the globe are undertaking pilot-scale extraction projects and demonstration ventures to validate extraction technologies and assess economic feasibility.

These initiatives serve as crucial milestones in de-risking gas hydrate development, providing valuable insights into operational challenges, environmental considerations, and market dynamics. By showcasing successful extraction and utilization processes, pilot projects and demonstration initiatives catalyze investor confidence, regulatory support, and industry collaboration, accelerating the transition towards widespread commercial adoption of gas hydrates.

Regional Analysis

Asia-Pacific dominates the global gas hydrates market with a substantial share of approximately 45%.

Asia-Pacific emerges as the dominant region in the global gas hydrates market, capturing a significant share of approximately 45%. This dominance is propelled by robust economic growth, increasing energy demand, and extensive research and development initiatives in countries such as China, Japan, and India. Asia-Pacific boasts vast reserves of natural gas hydrates, particularly in offshore regions, which has spurred exploration and production activities.

North America stands as another significant player in the gas hydrates market, characterized by advanced technology adoption, favorable regulatory frameworks, and substantial investments in shale gas exploration. The region showcases considerable potential for gas hydrate deposits, particularly in Arctic regions and deepwater reservoirs.

Europe exhibits promising growth opportunities in the gas hydrates market, fueled by initiatives to reduce carbon emissions and transition towards cleaner energy sources. While Europe's gas hydrate reserves are comparatively limited, the region is actively engaged in research activities aimed at understanding the geological characteristics and potential extraction methods of gas hydrate deposits.

The Middle East & Africa and Latin America regions also present potential growth avenues in the gas hydrates market, albeit at a slower pace compared to other regions. The Middle East & Africa region boasts substantial offshore gas hydrate deposits, particularly in deepwater regions along the continental margins.

Latin America showcases emerging opportunities in gas hydrate exploration, with countries like Brazil and Mexico initiating research programs to assess the feasibility of commercial production. Market growth in these regions is influenced by factors such as regulatory frameworks, investment climate, and technological capabilities.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Gas Hydrates market is poised for significant expansion, driven by the increasing demand for alternative energy sources and technological advancements in extraction and production. Among the key players, Schlumberger Limited stands out as a leader, leveraging its comprehensive portfolio of technologies and services to tap into the vast potential of gas hydrates.

Schlumberger's expertise in subsurface characterization and reservoir management positions it well to explore and develop gas hydrate resources effectively. Their investment in research and development, coupled with strategic partnerships, underscores their commitment to innovation in this emerging field.

Halliburton and Baker Hughes Company are also pivotal players in the gas hydrates market, providing essential drilling and production technologies. Halliburton's advanced well construction and completion solutions are critical for the efficient and safe extraction of gas hydrates. Similarly, Baker Hughes' integrated service offerings and innovative technologies contribute to the optimization of hydrate extraction processes, ensuring both environmental and economic viability.

Energy giants such as ExxonMobil Corporation, Chevron Corporation, and TotalEnergies SE are expected to play a crucial role in commercializing gas hydrate resources. These companies possess the financial strength and technical expertise required to undertake large-scale exploration and production projects. Their global operational footprint and commitment to sustainable energy practices make them influential in shaping the future of the gas hydrates market.

Asian entities like China National Petroleum Corporation (CNPC) and Japan Oil, Gas and Metals National Corporation (JOGMEC) are actively investing in gas hydrate research and development. Their efforts are aimed at securing energy independence and diversifying energy sources, highlighting the strategic importance of gas hydrates in the region.

Market Key Players

- Schlumberger Limited

- Halliburton

- Baker Hughes Company

- Weatherford International plc

- ConocoPhillips

- Chevron Corporation

- ExxonMobil Corporation

- Statoil ASA (Equinor)

- TotalEnergies SE

- China National Petroleum Corporation (CNPC)

- Japan Oil, Gas and Metals National Corporation (JOGMEC)

- PetroChina Company Limited

- Royal Dutch Shell plc

- BP plc

- Mitsubishi Corporation

Recent Development

- In March 2024, KCAS Bio and Crux Biolabs announced a global alliance to provide harmonized spectral flow cytometry using the Cytek Aurora platform, supporting clinical research across the US, Europe, and Australia.

- In March 2024, Ardena expanded its nanomedicines facility with a €20 million investment, receiving GMP approval from the Dutch Healthcare Authority to advance nanomedicine research, development, and manufacturing.

Report Scope

Report Features Description Market Value (2023) USD 2.9 Bn Forecast Revenue (2033) USD 4.9 Bn CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Onshore Gas Hydrates, Offshore/Marine Gas Hydrates), By Method of Extraction (Depressurization, Thermal Stimulation, Inhibitor Injection, CO2-Swapping), By Application (Commercial, Industrial, Residential, Transportation, Other) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Schlumberger Limited, Halliburton, Baker Hughes Company, Weatherford International plc, ConocoPhillips, Chevron Corporation, ExxonMobil Corporation, Statoil ASA (Equinor), TotalEnergies SE, China National Petroleum Corporation (CNPC), Japan Oil, Gas and Metals National Corporation (JOGMEC), PetroChina Company Limited, Royal Dutch Shell plc, BP plc, Mitsubishi Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-