Furniture Polish Market Report By Product Type (Liquid, Solvent, Aerosols), By Source (Alkyd, Melamine, Polyester, Lacquer, Others), By End Use (Household, Corporate Offices, Hospitality, Educational and Others), By Sales Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

25340

-

March 2023

-

150

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

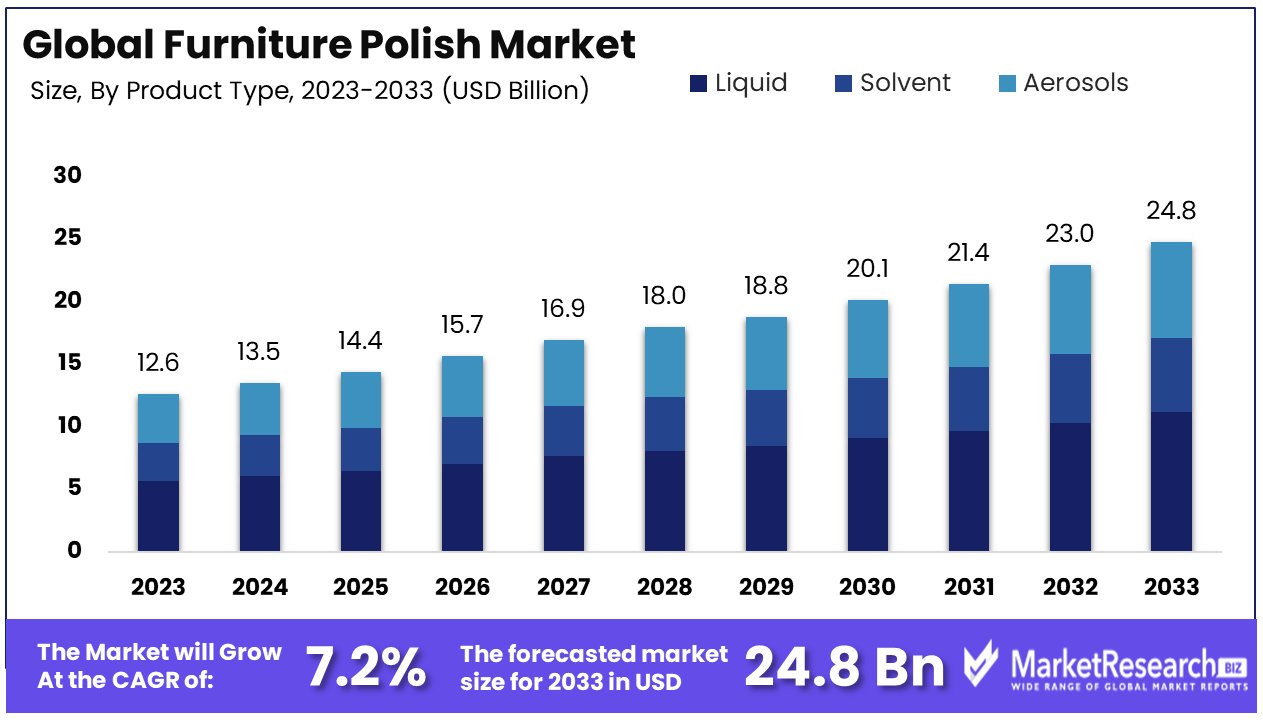

The Global Furniture Polish Market size is expected to be worth around USD 24.8 Billion by 2033, from USD 12.6 Billion in 2023, growing at a CAGR of 7.20% during the forecast period from 2024 to 2033.

Furniture polish is defined as the specialized cleaning and conditioning product developed for the care and maintenance of wooden furniture surfaces. These are generally available in liquid, wax forms and spray as furniture polish offers multiple uses. It sweeps away dirt, dust and fingerprints that improves the aesthetics appeals of the furniture.

Furthermore, it consists conditioning agents and shield elements like oil, waxes and silicone which helps in nourishing the wood, restore its luster and build a shield layer to protect against moisture and small scratches. These not only enhances the aesthetic look but also help in prolong the life of wooden furniture by avoiding drying, cracking and different forms of damage.

It is important to select a polish appropriate for the particular type of woods to get an ideal outcome and maintain the durability and beauty of the furniture piece. Regular usage of furniture polish is a part of a detailed care routine for wooden furnishings in homes and commercial spaces.

There are several benefits of using furniture polish such as its protects the furniture from UV rays, prevent from moisture and humidity in the air and using cleaning agents. Wood polishing is one of the ideal choice for the furniture polishing. It increases the stain, dust resistance and the longevity of the wood. PU wood polish is very useful and versatile wood furniture polish. It is generally used in bathroom, cabinets, vanities, door and window frames and modular kitchens. It provides the most of the protection against damage and degradation of the wood surface with its strong shield layer.

Moreover, wax based polish is entering and gets absorbed deep in the woods. It is available in liquid and paste forms which are generally wax based polishes which are derived from plants but some are animal based. Furthermore, certain polishes need prep work such as sanding, filling cracks with a wood fillers and staining before they can be applied in other furnitures. The demand for the furniture polish will increase due to its requirements in manufacturing of the furnitures that will help in market expansion in the coming years.

Key Takeaways

- Market Value: The Global Furniture Polish Market is projected to reach approximately USD 24.8 Billion by 2033, exhibiting a robust CAGR of 7.20% from USD 12.6 Billion in 2023.

- Major Segments:

- Product Type Analysis: Liquid furniture polish leads the market, favored for its ease of use and versatility, holding a significant share. Solvent-based polishes are declining due to environmental concerns, while aerosols face scrutiny over VOC emissions.

- Source Analysis: Alkyd-based polishes dominate, valued for their durability and glossy finish. Other sub-segments like Melamine, Polyester, and Lacquer serve specific purposes, catering to diverse consumer preferences and furniture types.

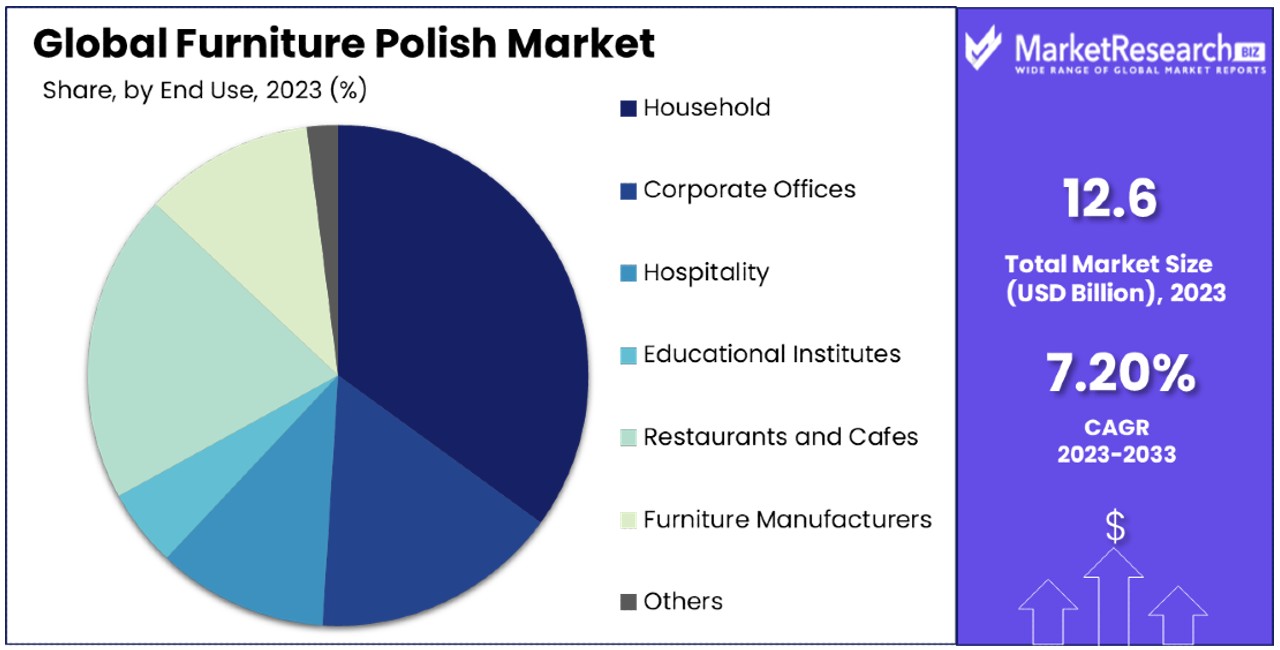

- End Use Analysis: The Household segment is the largest consumer base, driven by the increasing trend of home decor and the need for regular furniture maintenance. Other segments like Corporate Offices, Hospitality, and Furniture Manufacturers contribute to market growth by diversifying demand.

- Sales Channel Analysis: Online Stores emerge as dominant, capitalizing on the growing trend of e-commerce and offering a wide range of products. Wholesaler/Distributors, Supermarket/Hypermarkets, and Specialty Stores play crucial roles in distribution and accessibility.

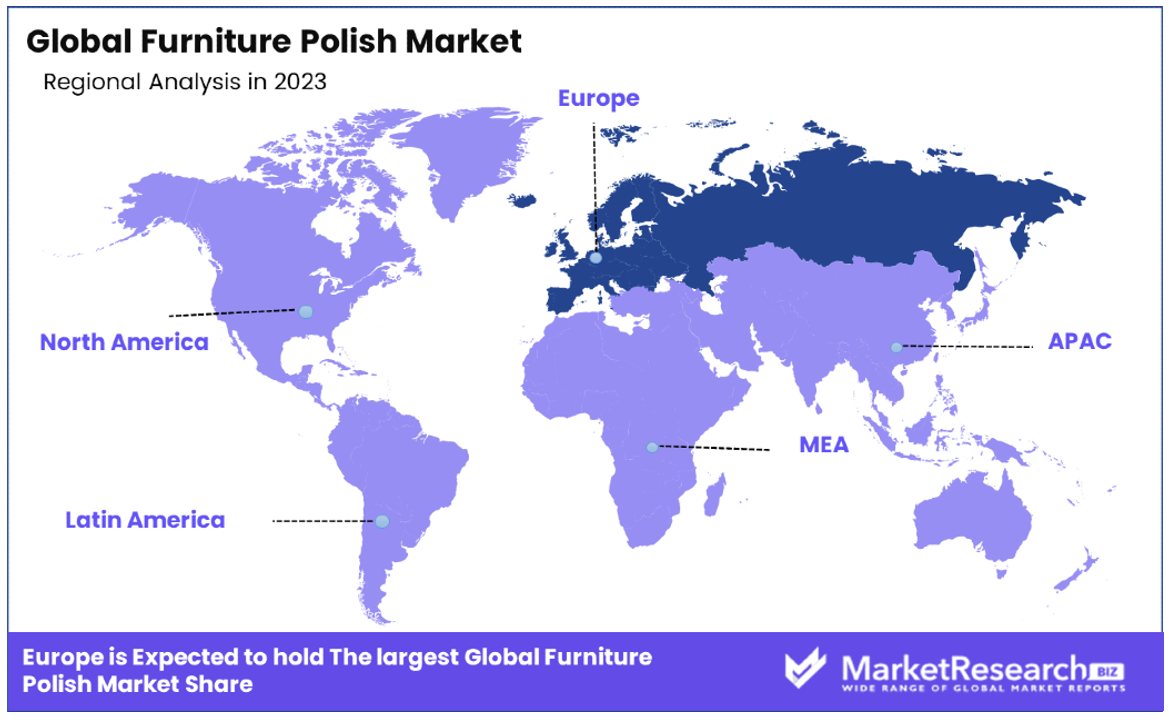

- Regional Dynamics: Europe dominates the Furniture Polish Market with a 31% market share, followed closely by North America with around 28%. Europe's growth is influenced by robust consumer spending on home furnishings and a trend towards sustainable living.

- Analyst Viewpoint: Analysts anticipate significant growth in the furniture polish market, driven by consumer trends towards home decor, sustainability, and convenience. The dominance of online channels and the focus on eco-friendly formulations are expected to shape market dynamics.

- Growth Opportunities: Opportunities lie in the development of eco-friendly formulations, catering to the growing demand for sustainable products. Additionally, expanding distribution channels and targeting niche segments like hospitality and furniture manufacturing offer avenues for market growth and diversification.

Driving Factors

Increasing Demand for Home Furnishings Fuels Market Expansion

The global surge in disposable incomes and the expansion of the middle class, particularly in emerging economies, have significantly propelled the demand for home furnishings. This surge is evidenced by the robust growth of the furniture industry in key markets such as China and India, which, in turn, has directly bolstered the demand for furniture polish products. The correlation between high-quality furniture purchases and the need for furniture polish underscores the market's expansion, highlighting a pivotal trend in consumer investment behaviors.

Home Decor and Interior Design Trends Amplify Market Growth

The increasing consumer interest in home decor and interior design has positioned furniture polish as a crucial element in creating visually appealing and well-maintained living spaces. Influencers and social media platforms have played a vital role in emphasizing the importance of furniture polish in achieving a polished home environment. According to a 2022 study by the National Association of Home Builders, new homeowners spend an average of approximately $12,000 on renovations, $5,000 on furnishings, and $4,000 on appliances within the first year, underscoring the significant potential market for furniture polish.

Residential Construction Sector Expansion Boosts Furniture Polish Demand

The global residential construction sector's steady growth, driven by urbanization, population growth, and increased affluence, especially in emerging markets like India, China, and Brazil, has led to an upsurge in furniture demand and, subsequently, furniture polish. According to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, at the end of January 2024, there were 1,686,000 privately-owned housing units under construction, seasonally adjusted. This statistic indicates a significant opportunity for the furniture polish market, as new homes require furnishing and maintenance.

Innovation and Eco-Friendly Products Propel Market Forward

The furniture polish market is witnessing a transformation driven by product innovation and the development of eco-friendly formulations. Manufacturers are introducing products with plant-based ingredients and multifunctional benefits, such as UV and moisture protection, catering to the growing consumer demand for sustainable and high-performance products. This shift towards environmentally friendly solutions reflects a broader consumer trend towards sustainable living and represents a key driver in the market's evolution.

Restraining Factors

Environmental Concerns and Regulations Restrains Market Growth

Growing environmental worries over the use of traditional furniture polish, which often includes volatile organic compounds (VOCs) and other harmful chemicals, significantly impact market growth. The European Union's stringent VOC regulations in consumer products highlight the challenge, leading to costly reformulations for manufacturers.

These environmental regulations aim to protect human health and the planet, but they also tighten the market by increasing cost of production of furniture and limiting the use of certain chemicals in furniture polish formulations, forcing companies to innovate or face potential declines in demand.

Competition from Alternative Products Limits Market Expansion

The furniture polish market is under pressure from alternative cleaning and maintenance products, such as multipurpose cleaners, wood cleaners, and furniture restoration kits. These alternatives, often viewed by consumers as more convenient, cost-effective, or environmentally friendly, pose a significant challenge to the demand for specialized furniture polish.

Brands like Method and Mrs. Meyer's, offering versatile cleaning solutions that work on various surfaces including furniture, exemplify this competitive threat. The availability of such multipurpose products can divert consumers from traditional furniture polishes, thereby constraining market growth.

Product Type Analysis

In the Furniture Polish Market, the product type segment is crucial in understanding consumer preferences and industry trends. The dominant sub-segment within this category is Liquid furniture polish, known for its ease of use, effective cleaning, and polishing capabilities. Liquid polishes are preferred by both consumers and professional cleaners for their versatility in application across various furniture surfaces and their ability to provide a long-lasting shine without leaving residue.

Solvent-based polishes, although effective for heavy-duty cleaning, have seen a decline in popularity due to environmental concerns and the push for safer, less toxic products. Aerosols, on the other hand, offer convenience and ease of use but face scrutiny over their environmental impact, particularly concerning VOC emissions.

The growth of the Liquid segment can be attributed to consumer demand for products that are not only effective but also safer and more environmentally friendly. Innovations within this segment focusing on eco-friendly and health-conscious formulations have further bolstered its market position.

Meanwhile, the other sub-segments, such as Solvents and Aerosols, contribute to the market by catering to niche needs where specific application methods or cleaning intensities are required. Despite facing challenges in terms of environmental regulations and changing consumer preferences, these segments remain integral to the market, offering specialized solutions that the dominant Liquid segment may not fully address.

Source Analysis

When examining the Furniture Polish Market by source, Alkyd-based polishes emerge as the dominant sub-segment. Alkyd polishes are favored for their durability, glossy finish, and ease of application, making them a go-to choice for both residential and commercial users seeking long-lasting protection for their furniture.

Melamine, Polyester, and Lacquer are other notable sub-segments within this category, each serving specific purposes and preferences in furniture care. Melamine and Polyester polishes offer durability and high-gloss finishes, suitable for modern furniture surfaces, while Lacquer provides a hard, protective finish ideal for antique and high-end furniture pieces.

The dominance of Alkyd-based polishes is largely due to their balanced performance, offering a combination of ease of use, aesthetic appeal, and protective qualities. However, environmental concerns and the trend towards sustainable products have led to increased interest in the "Others" category, which includes water-based and natural ingredient formulations. This shift reflects the industry's broader move towards eco-friendly alternatives that meet consumer demand for safer, greener furniture care options.

Other sub-segments like Melamine, Polyester, and Lacquer, though not as dominant, play a crucial role in the market by providing options tailored to specific furniture types and finishes. Their role in the market's growth lies in catering to diverse consumer needs, from everyday furniture maintenance to the care of specialty or high-value items.

End Use Analysis

The Furniture Polish Market, when analyzed by end use, reveals that the Household segment stands as the dominant sub-segment. Household furniture represent the largest consumer base for furniture polish, driven by the ongoing need to maintain and protect furniture as part of regular home care routines. The demand in this segment is fueled by the increasing emphasis on home decor and the desire to extend the life of furniture items, which necessitates regular polishing and maintenance.

Corporate Offices, Hospitality, Educational Institutes, Restaurants and Cafes, and Furniture Manufacturers also constitute important segments. Each of these segments has specific requirements that influence their choice of furniture polish, ranging from the need for durability and ease of maintenance in corporate offices and educational institutes, to the aesthetic appeal in hospitality and restaurants. Furniture Manufacturers, on the other hand, require high-quality polish that enhances the finish of their products and offers long-lasting protection.

The growth within the Household segment can be attributed to the rise in disposable incomes and the increasing trend of home improvement trends and decoration. As consumers invest more in their living spaces, the demand for furniture polish to maintain these investments grows.

Meanwhile, the other segments contribute to the overall market growth by diversifying the demand for furniture polish. Corporate offices and educational institutes, for example, require bulk purchasing, which supports the volume sales in the market. The hospitality sector, emphasizing the aesthetic and durability aspects of furniture care, pushes for innovations in polish formulations. Furniture manufacturers, leveraging high-quality polishes in their production processes, ensure the end product meets consumer expectations for finish and longevity.

Sales Channel Analysis

In the Furniture Polish Market, analyzed by sales channels, Online Stores have emerged as a dominant sub-segment. The growth of e-commerce platforms and the convenience of online shopping have significantly increased the accessibility and availability of furniture polish products to consumers. Online stores offer a wide range of products from different brands, including eco-friendly and specialty formulations, catering to a broad spectrum of consumer preferences and needs.

Wholesaler/Distributors, Supermarket/Hypermarke ts, and Specialty Stores are other crucial segments that facilitate the distribution and sale of furniture polish products. Wholesalers and distributors play a key role in supplying products to both retail outlets and institutional buyers, supporting bulk purchase needs. Supermarket/Hypermarkets offer consumer convenience by providing a variety of household furniture maintenance products under one roof, while Specialty Stores cater to consumers seeking expert advice and high-quality, niche products.

The dominance of Online Stores is driven by the digitalization trend and the consumer shift towards online shopping, offering ease of comparison, wider selection, and the convenience of home delivery. This channel's growth is further accelerated by the increasing penetration of the internet and smart devices, making it easier for consumers to access and purchase furniture polish products.

The other sales channels contribute to market dynamics by ensuring the availability of furniture polish across different consumer touchpoints. Wholesalers and distributors ensure a steady supply to the market, supermarkets/hypermarkets provide accessibility and convenience, and specialty stores offer expertise and specialized product ranges. Each channel plays a vital role in reaching different customer segments and meeting their specific purchasing preferences and requirements.

Key Market Segments

By Product Type

- Solvent

- Liquid

- Aerosols

By Source

- Alkyd

- Melamine

- Polyester

- Lacquer

- Others

By End Use

- Household

- Corporate Offices

- Hospitality

- Educational Institutes

- Restaurants and Cafes

- Furniture Manufacturers

- Others

By Sales Channel

- Wholesaler/Distributors

- Supermarket/Hypermarkets

- Specialty Stores

- Online Stores

Growth Opportunities

Premiumization and Luxury Positioning Offers Growth Opportunity

The trend towards premiumization and luxury positioning within the Furniture Polish Market opens up avenues for brands to cater to the upscale segment of the market. By developing and marketing premium furniture polish formulations, brands can target consumers looking to maintain and protect their high-end furniture investments.

This approach not only meets the specific needs of affluent consumers but also allows brands to command higher prices, enhancing profitability. Premium brands like Guardsman and RENOVA exemplify this strategy, having successfully established themselves as go-to solutions for luxury furniture care. The emphasis on quality and exclusivity resonates with consumers willing to invest in superior care products for their expensive furniture, presenting a significant growth opportunity for brands in this niche market segment.

Expansion into Emerging Markets Presents Substantial Growth Potential

The Furniture Polish Market's expansion into emerging markets, especially in regions like Asia-Pacific and Latin America, offers substantial growth opportunities. Rising disposable incomes, coupled with increasing urbanization rates in these areas, are driving the demand for furniture and subsequently for furniture polish products.

Successfully tapping into these markets requires brands to adapt their products to local tastes, implement strategic pricing, and establish effective distribution channels. The potential for growth in these regions is significant, as the expanding middle class becomes more inclined to invest in home furnishings, creating a growing consumer base for furniture polish products. Tailoring offerings to meet the preferences and purchasing power of consumers in these markets is key to unlocking the expansive potential of the Furniture Polish Market in emerging economies.

Trending Factors

Eco-Friendly and Natural Formulations Are Trending Factors

The shift towards eco-friendly and natural formulations in the Furniture Polish Market is a response to growing environmental consciousness and health concerns. Consumers are increasingly wary of the impacts of traditional chemical-based polishes on the environment and their health, leading to a surge in demand for furniture polish products that are plant-based, biodegradable, and contain low levels of volatile organic compounds (VOCs).

This trend is particularly pronounced among younger consumers and those who prioritize sustainability and wellness. Brands that have recognized and responded to this demand, by offering eco-friendly solutions, are gaining a competitive edge, reflecting a broader market trend towards sustainability and natural ingredients.

Smart Packaging and Delivery Systems Are Major Trends

Innovation in packaging and delivery systems is transforming the Furniture Polish Market, making application and sustainability key trending factors. Furniture polish wipes and sprays offer consumers unprecedented convenience, simplifying the furniture maintenance process.

Furthermore, the introduction of refillable and concentrate-based packaging options represents a significant stride towards reducing plastic waste and enhancing environmental sustainability. These smart packaging solutions not only appeal to consumers looking for easy-to-use products but also resonate with those committed to reducing their environmental footprint, marking a shift towards more sustainable consumption within the market.

Digital Marketing and E-Commerce Are Trending Factors

The adoption of digital marketing strategies and e-commerce platforms is a key trend reshaping the Furniture Polish Market. With consumers increasingly turning to online channels for shopping and product discovery, brands are leveraging social media, influencer partnerships, and online marketplaces to enhance their visibility, engage with a wider audience, and facilitate easy purchase processes.

This trend is driven by the convenience of online shopping and the expansive reach of digital marketing, allowing brands to tap into new consumer segments and offer personalized shopping experiences. The growing significance of e-commerce in the furniture polish market underscores the evolving consumer shopping behaviors and the importance of digital presence for brands.

Regional Analysis

Europe Dominates with 31% Market Share in the Furniture Polish Market

Europe holds a commanding 31% of the global Furniture Polish Market share, a testament to the region's strong consumer demand and advanced market infrastructure. Key factors contributing to this dominance include Europe's heightened environmental awareness, leading to a strong preference for eco-friendly and natural furniture polish formulations. The stringent EU regulations on chemical use also push manufacturers towards more sustainable practices, aligning with consumer values.

The market dynamics in Europe are shaped by its affluent consumer base, high standards for home decor, and a robust furniture manufacturing industry. These elements combine to create a sophisticated market where premium and eco-friendly furniture care products thrive. Europe's leading position is further supported by well-established retail networks and a growing emphasis on digital marketing and online sales channels, which enhance product accessibility and consumer engagement.

Regional Market Share and Growth Rates:

- North America: North America holds a significant market share, with around 28% of the global Furniture Polish Industry. The region's growth is driven by a robust consumer lifestyles spending on home furnishings and a growing trend towards sustainable living, construction activities influencing product preferences.

- Asia Pacific: The Asia Pacific region is rapidly emerging as a key market, currently accounting for approximately 25% of the market share. High economic growth, urbanization, and increasing disposable incomes contribute to the rising demand for furniture polish, with significant growth potential in emerging economies like China and India.

- Middle East & Africa: Holding a smaller share of the market at around 8%, the Middle East & Africa region is experiencing gradual growth. The luxury furniture market's expansion and the increasing urban middle class are key growth drivers in this region.

- Latin America: Latin America or South America, with around 8% market share, shows potential for growth due to its expanding middle class and increasing awareness of furniture maintenance and care.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of Middle East & Africa

Key Players Analysis

In the Furniture Polish Industry, key players such as The Sherwin-William Company, Reckitt Benckiser PLC, and Axalta Coating Systems Ltd. play pivotal roles in shaping market dynamics through their extensive product launches and innovative solutions.

These companies, along with others like The Valspar Corporation and Asian Paints, have established strong market positions by offering a diverse array of furniture care products, from traditional polishes to advanced protective coatings. Strategic positioning is crucial, with companies like Libéron, Pledge Restoring Oil, and Howard Feed-N-Wax focusing on niche segments, including luxury and eco-friendly formulations, to meet specific consumer needs.

Ashburn Chemical Technologies and BYK underscore the importance of innovation in product development and sustainability, appealing to environmentally conscious consumers. Meanwhile, retail giants such as The Home Depot, Lowe's Companies, Inc., and IKEA extend the market's reach by providing accessibility to a wide range of furniture polish products, catering to both DIY enthusiasts and professional users.

The combined impact of these players on the market is significant, driving competition, product innovation, and market expansion. Their strategic approaches, from product differentiation to global distribution networks, play essential roles in meeting diverse consumer preferences and adapting to changing market trends. This dynamic interplay among key players not only enhances the consumer choice but also propels the market forward through continuous evolution and growth.

Market Key Players

- Sherwin-Williams Company

- Reckitt Benckiser Group plc

- PPG Industries Inc.

- Axalta Coating Systems Ltd.

- The Valspar Corporation

- Asian Paints Ltd.

- Ashburn Chemical Technologies

- Furniture Clinic Limited

- Riverside Paper Co. Inc.

- Starco Chemical Co. Inc.

- S.C. Johnson & Son Inc.

- Howard Products Inc.

- Libéron

- Pledge Restoring Oil

- Howard Feed-N-Wax

- Blanchon UK Ltd

- The Thomasnet Company

- The Home Depot

- Lowe's Companies, Inc.

- Liberon Limited

- Golden Star Inc.

- Milsek Furniture Polish Inc.

- Cleenol Group Ltd.

- Chemisphere Corporation

Recent Developments

- On January 2024, Duroply, a leading plywood manufacturer in India, launched a new decorative textured veneer named 'Bohemia'. This innovative product was developed in response to the growing demand for premium and aesthetic textured decorative veneers among the avant-garde audience

- On July 2023, Life O' Products acquired the century-old Life O' Wood furniture polish brand, emphasizing its dedication to quality and preservation. This acquisition marks a significant step for the newly formed company, Life O' Products, in upholding traditional values and commitment to excellence in furniture care.

Report Scope

Report Features Description Market Value (2023) USD 12.6 Billion Forecast Revenue (2033) USD 24.8 Billion CAGR (2024-2033) 7.20% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Liquid, Solvent, Aerosols), By Source (Alkyd, Melamine, Polyester, Lacquer, Others), By End Use (Household, Corporate Offices, Hospitality, Educational Institutes, Restaurants and Cafes, Furniture Manufacturers, Others), By Sales Channel (Online Stores, Wholesaler/Distributors, Supermarket/Hypermarkets, Specialty Stores) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Sherwin-Williams Company, Reckitt Benckiser Group plc, PPG Industries Inc., Axalta Coating Systems Ltd., The Valspar Corporation, Asian Paints Ltd., Ashburn Chemical Technologies, Furniture Clinic Limited, Riverside Paper Co. Inc., Starco Chemical Co. Inc., S.C. Johnson & Son Inc., Howard Products Inc., Libéron, Pledge Restoring Oil, Howard Feed-N-Wax, Blanchon UK Ltd, The Thomasnet Company, The Home Depot, Lowe's Companies, Inc., Liberon Limited, Golden Star Inc., Milsek Furniture Polish Inc., Cleenol Group Ltd., Chemisphere Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- ltana

- Cleenol Group Ltd.

- Liberon Limited

- Reckitt Benckiser Group plc (Old English)

- S.C. Johnson & Son Inc. (Pledge)

- The Sherwin-Williams Company

- PPG Industries Inc.

- Akzo Nobel N.V.

- Axalta Coating Systems

- Masco Cabinetry LLC

- RPM Wood Finishes Group

- Blend well Chemicals

- Milsek Furniture Polish Inc.

- Golden Star Inc.

- Blanchon UK Ltd

- Movac Group

- Chestnut Products

- Teknos (UK) Ltd

- Symphony Coatings Group Ltd

- ?and Bona U.S.