Fresh Food Market By Product Type(fresh food, Fruits and Vegetables and other), By Distribution Channel (Supermarket, Online, and other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

28451

-

May 2023

-

170

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

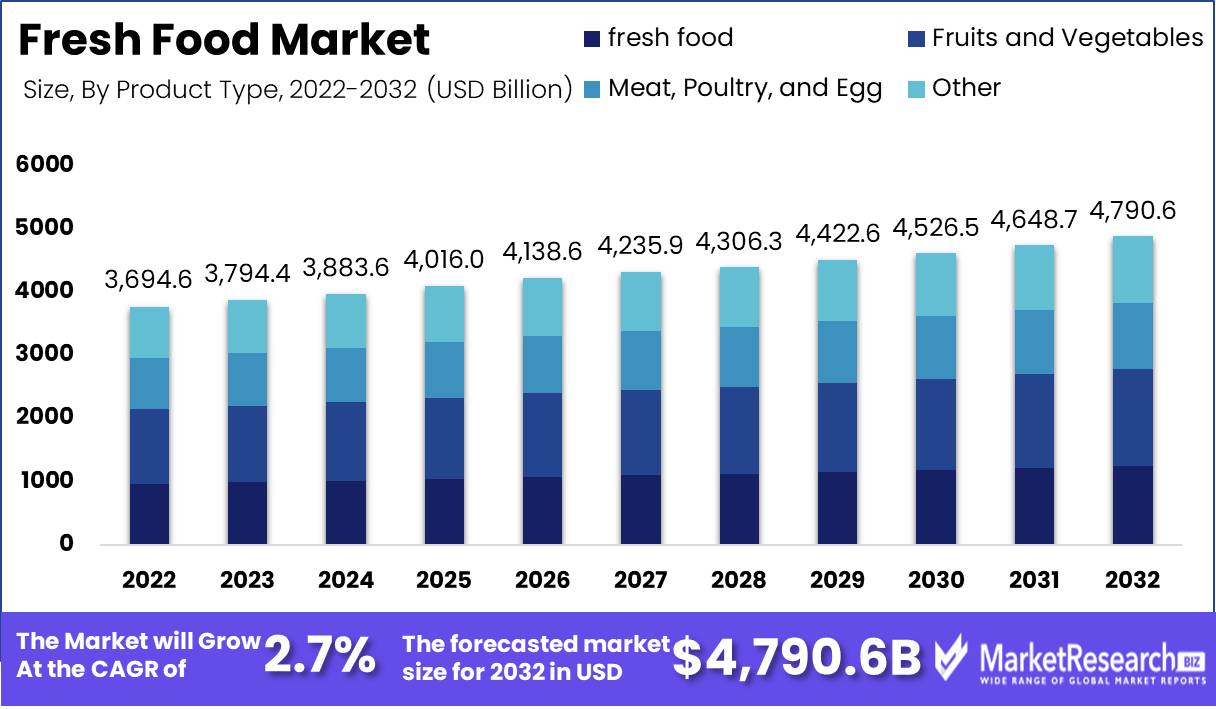

Fresh Food Market size is expected to be worth around USD 4,790.6 Bn by 2032 from USD 3694.6 Bn in 2022, growing at a CAGR of 2.7% during the forecast period from 2023 to 2032.

Fresh food encompasses a vast array of perishable goods, including fruits and vegetables, proteins, dairy products, and baked goods. These items are obtained from local farmers, ranchers, and producers and sold at farmers' markets, specialty shops, and supermarkets. The objective of the market is to provide consumers with high-quality, healthful, and environmentally responsible products that are also sustainable.

The fresh food market is extraordinarily important. By purchasing locally grown produce and supporting small farmers, consumers can enhance the health of their families, stimulate local economies, and reduce the environmental impact of food production. Fresh, seasonal produce is typically more nutrient-dense and flavorful than imported, preserved supermarket options.

The fresh food market offers substantial benefits to small farmers and producers. Selling directly to consumers allows for increased profits, the development of customer relationships, and the avoidance of shipping and distribution costs associated with larger-scale operations.

There have been significant innovations in the fresh food market in recent years. The use of hydroponics, a method of cultivating plants in a controlled water-based environment, is one such innovation. Compared to traditional soil-based agriculture, hydroponics enables quicker growth and higher yields. In addition, regenerative farming practices have acquired popularity, with an emphasis on natural methods to improve soil health and reduce chemical use.

Driving factors

Health Awareness

The rapid expansion of the fresh food market is fueled by the rising prevalence of healthy eating practices. People are becoming more aware of the necessity of consuming fresh and nutritious foods to maintain their health. This change is a response to the global increase in lifestyle-related diseases such as diabetes, obesity, and cardiovascular diseases (CVDs). As a result of individuals' efforts to combat these health concerns, the demand for fresh food has increased.

Nutritional Deficiencies

Nutritional deficiencies have emerged as a major concern, resulting in health issues and a weakened immune system. Deficiencies in calcium, vitamin A, iron, iodine, vitamin B12, and magnesium are common. Fruits and vegetables, in particular, are rich in antioxidants and vitamins, which are essential for bolstering immunity and improving overall health. In addition to aiding in the control and prevention of lifestyle diseases, wholesome food options are favored by consumers.

Regulatory Changes and Technological Impact

Changes in food industry regulations have substantial effects on the fresh food market. Globally, governments are instituting measures to ensure the safety and quality of fresh food products, which can have an impact on pricing and availability. In addition, emerging technologies such as precision agriculture, blockchain, and artificial intelligence have the potential to improve the quality and safety of food products, thereby influencing the fresh food market.

Restraining Factors

Environmental Impact

The runoff of chemicals from outdoor plants can impair waterways, endangering aquatic life and posing risks to humans. These chemical contaminants have been linked to significant health problems such as cancer, liver damage, and kidney diseases. To address this issue, it is essential to promote eco-friendly agricultural and food production methods, with a particular emphasis on natural pest and disease control.

Assurance of Food Safety

At the agricultural level, where crops and livestock are produced, food safety begins. The use of agrochemicals like pesticides and veterinary medications can pose risks to human health, particularly when harmful residues remain on fresh produce. Good Agricultural Practices (GAPs) include the safe use of agrochemicals, effective pest and disease management, and routine monitoring of production processes.

Type Analysis

The fresh food market is segmented into several categories, including dairy products, confectionary items, meat and poultry, and fruits and vegetables. The fruits and vegetables segment is the most dominant of these. It is believed that fruits and vegetables are essential for maintaining a wholesome lifestyle. This trend is propelling the adoption of fresh fruits and vegetables across the globe as consumers become increasingly health-conscious.

Due to the increasing prevalence of lifestyle diseases such as obesity, diabetes, and high blood pressure, the fruits and vegetables segment dominates the fresh food market. The combination of a sedentary lifestyle and poor dietary behaviors results in lifestyle diseases. Fruits and vegetables provide a nutritious solution to these issues.

The vitamins, minerals, and fiber in these foods have numerous health benefits, including strengthening the immune system, aiding digestion, and regulating blood sugar. Moreover, it is believed that a diet abundant in fruits and vegetables helps prevent cancer and other chronic diseases.

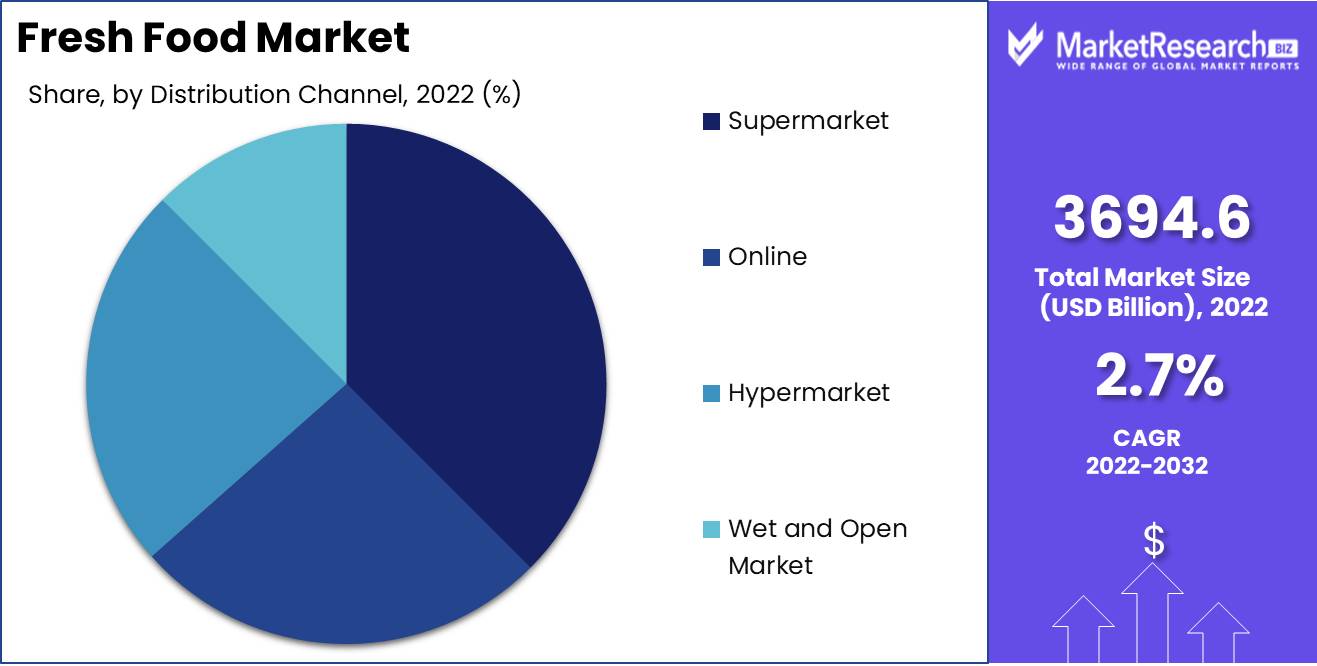

Distribution Channel Analysis

The supermarket segment dominates the fresh food market's numerous subsegments. At competitive prices, supermarkets provide a vast selection of fresh produce, including fruits and vegetables. The convenience of purchasing at a single location has also contributed to the expansion of the supermarket market segment.

In addition to economic growth in emerging economies, another factor influencing the expansion of supermarkets is the growth of these economies. The rise in disposable income has increased the demand for high-quality food items, and supermarkets are regarded as the best locations to purchase fresh produce. As urbanization increases, consumers also seek out convenient food purchasing options. Due to the convenience of supermarket purchasing, consumers are more likely to choose this option.

Key Market Segments

By Product Type

- fresh food

- Fruits and Vegetables

- Meat, Poultry, and Egg

- Other

By Distribution Channel

- Supermarket

- Online

- Hypermarket

- Wet and Open Market

Growth Opportunity

E-Commerce Is Growing Due to Internet Penetration and Smart Devices.

The fresh food market is expanding at an unprecedented rate, and e-commerce is playing a pivotal role in this growth. The increasing prevalence of the internet and the proliferation of smart devices have facilitated the expansion of the fresh food industry. Today's scenario is vastly different from that of ten years ago, but the rate of change is accelerating.

Various Online Platforms

E-commerce has transformed the retail landscape, including the fresh food market. Today, consumers can order fresh cuisine online and have it delivered to their doorsteps within hours. Online marketplaces and shopping apps are fueling the expansion of the fresh food market by making it simple and convenient to purchase fresh produce. This trend has led to an exponential increase in the demand for fresh food products, as consumers seek healthier, more convenient food options.

Convenience and Fast Delivery of Fuel

The growth of fresh food e-commerce sales can be attributed to the convenience offered by these channels. Consumers' schedules are becoming increasingly hectic, and traditional grocery purchasing is becoming increasingly cumbersome. In contrast, online food purchasing is much simpler and quicker. With the ability to purchase online from anywhere and at any time, consumers can save valuable time and effort while having fresh food delivered directly to their doorsteps.

Latest Trends

Internet Connectivity and Smartphone Adoption

Internet connectivity and smartphone usage contribute to the growing demand for fresh food in online retail because of their accessibility. Fresh food is not an exception to the trend of consumers relying significantly on technology to make their lives easier. The convenience of being able to purchase fresh produce online, particularly when they are not always available at local markets or supermarkets, is a significant advantage for many individuals.

Online Marketing Activities and E-commerce Platforms

Implementation of effective online marketing activities and e-commerce platforms, such as Amazon and Alibaba, is another factor driving demand. These initiatives provide customers with easy access to a diverse selection of fresh foods regardless of their location in the globe. Consumers can select and order fresh food items with just a few keystrokes, which are then delivered to their doorstep. This convenience is especially useful for those with hectic schedules who cannot always make it to the store.

Affordable Fresh Foods

The decreased price of fresh foods sold through online retail channels is another important demand driver. According to studies, fresh foods sold online are nearly 40 percent less expensive than when purchased from traditional retailers. This provides consumers with access to fresh, high-quality produce that is both convenient and affordable.

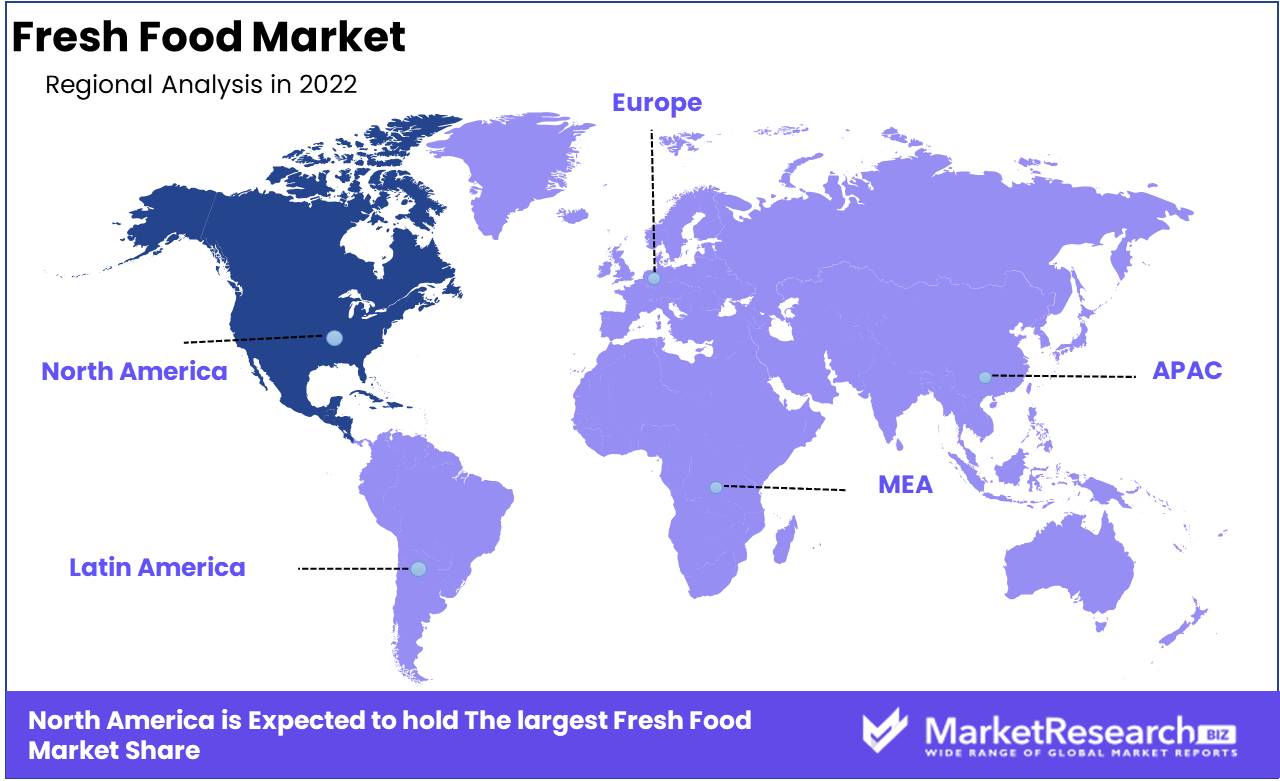

Regional Analysis

North America Region Dominates the fresh food market. There is an abundance of fresh fruits, vegetables, livestock, and fish on the continent. North America has consequently become a dominant force in the production and distribution of fresh food products.

North America has an abundance of fresh produce because of its extensive agriculture. These products are grown in high-tech facilities utilizing cutting-edge technology to maximize yields while minimizing waste. In addition, many crops grown in North America are resistant to parasites and diseases, ensuring they reach the market in their freshest form.

The fresh food market in North America is diverse and varied. In the temperate regions of the continent, pears, cherries, grapes, and strawberries are grown in abundance. In addition, many varieties of tropical fruits, including avocados, citrus fruits, and pineapples, are grown in the southern United States and Mexico.

Vegetables are also a significant portion of the fresh food market in North America. North America cultivates some of the finest tomatoes, carrots, and leafy plants in the world. In addition, the continent is a significant producer of sweetcorn, potatoes, and bell peppers.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Walmart is a global retail behemoth with a sizeable share of the fresh food market. Walmart offers a wide range of fresh food products to consumers through its extensive supply chain and distribution network. The company prioritizes quality, affordability, and sustainability, and has been investing in initiatives to enhance the freshness and traceability of its fresh food offerings.

Kroger operates under numerous brand identities and is one of the largest supermarket chains in the United States. The company places a heavy emphasis on fresh and organic food options, providing a wide variety of fruits, vegetables, proteins, and seafood. Kroger has also been investing in technology to enhance the shopping experience and the quality and safety of its fresh food products.

Nestlé is a prominent global food and beverage company that offers a range of fresh food products, including dairy, meats, and frozen foods. The company has been investing in R&D to create innovative fresh food solutions that meet consumer preferences for nutrition, taste, and convenience. Additionally, Nestlé places a significant emphasis on sustainability and ethical sourcing practices.

Fresh Del Monte is a producer, marketer, and distributor of fresh fruits and vegetables on a global scale. The company's supply chain is vertically integrated, allowing for quality control from the farm to the consumer. Fresh Del Monte focuses on providing premium fresh produce and has expanded its organic and sustainable product lines to satisfy the rising demand for healthier food options.

Top Key Players in the Fresh Food Market

- Leverandørselskabet Danish Crown AmbA

- Dole Food Company, Inc.

- Fresh Del Monte Produce Inc.

- Greenyard NV

- Tyson Foods, Inc.

- D'Arrigo Bros. Co. Of California, Inc.

- Chiquita Brands International, Inc.

- Tanimura & Antle Fresh Foods, Inc.

- Taylor Fresh Foods, Inc.

- Naturipe Farms, LLC

- Other

Recent Development

- In 2022, Walmart announced a $2.7 billion investment in its fresh food supply chain. This investment will enhance the quality and availability of fresh produce, livestock, and seafood in Walmart stores throughout the United States.

- In 2023, Kroger announced that a new "Fresh for You" store would be opening in Cincinnati, Ohio. This store will focus on providing locally derived, fresh, healthy foods.

- In 2023, Whole Foods Market announced that a new "365 by Whole Foods Market" store would be opening in San Francisco, California. This store will provide a cheaper selection of fresh foods than traditional Whole Foods locations.

- In 2023, Amazon announced that it would purchase Just Eat Takeaway.com for $5.4 billion. This acquisition will grant Amazon access to the online food delivery platform of Just Eat Takeaway.com, allowing Amazon to expand its presence in the fresh food market.

Report Scope

Report Features Description Market Value (2022) USD 3694.6 Bn Forecast Revenue (2032) USD 4,790.6 Bn CAGR (2023-2032) 2.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(fresh food, Fruits and Vegetables and other), By Distribution Channel (Supermarket, Online, and other) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Leverandørselskabet Danish Crown AmbA, Dole Food Company, Inc., Fresh Del Monte Produce Inc., Greenyard NV, Tyson Foods, Inc., D'Arrigo Bros. Co. Of California, Inc., Chiquita Brands International, Inc., Tanimura & Antle Fresh Foods, Inc., Taylor Fresh Foods, Inc., Naturipe Farms, LLC, Other Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Fresh Food Market Overview

- 2.1. Fresh Food Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Fresh Food Market Dynamics

- 3. Global Fresh Food Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Fresh Food Market Analysis, 2016-2021

- 3.2. Global Fresh Food Market Opportunity and Forecast, 2023-2032

- 3.3. Global Fresh Food Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 3.3.1. Global Fresh Food Market Analysis by By Product Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 3.3.3. fresh food

- 3.3.4. Fruits and Vegetables

- 3.3.5. Meat, Poultry, and Egg

- 3.3.6. Other

- 3.4. Global Fresh Food Market Analysis, Opportunity and Forecast, By By Distribution Channel, 2016-2032

- 3.4.1. Global Fresh Food Market Analysis by By Distribution Channel: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Distribution Channel, 2016-2032

- 3.4.3. Supermarket

- 3.4.4. Online

- 3.4.5. Hypermarket

- 3.4.6. Wet and Open Market

- 4. North America Fresh Food Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Fresh Food Market Analysis, 2016-2021

- 4.2. North America Fresh Food Market Opportunity and Forecast, 2023-2032

- 4.3. North America Fresh Food Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 4.3.1. North America Fresh Food Market Analysis by By Product Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 4.3.3. fresh food

- 4.3.4. Fruits and Vegetables

- 4.3.5. Meat, Poultry, and Egg

- 4.3.6. Other

- 4.4. North America Fresh Food Market Analysis, Opportunity and Forecast, By By Distribution Channel, 2016-2032

- 4.4.1. North America Fresh Food Market Analysis by By Distribution Channel: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Distribution Channel, 2016-2032

- 4.4.3. Supermarket

- 4.4.4. Online

- 4.4.5. Hypermarket

- 4.4.6. Wet and Open Market

- 4.5. North America Fresh Food Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Fresh Food Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Fresh Food Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Fresh Food Market Analysis, 2016-2021

- 5.2. Western Europe Fresh Food Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Fresh Food Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 5.3.1. Western Europe Fresh Food Market Analysis by By Product Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 5.3.3. fresh food

- 5.3.4. Fruits and Vegetables

- 5.3.5. Meat, Poultry, and Egg

- 5.3.6. Other

- 5.4. Western Europe Fresh Food Market Analysis, Opportunity and Forecast, By By Distribution Channel, 2016-2032

- 5.4.1. Western Europe Fresh Food Market Analysis by By Distribution Channel: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Distribution Channel, 2016-2032

- 5.4.3. Supermarket

- 5.4.4. Online

- 5.4.5. Hypermarket

- 5.4.6. Wet and Open Market

- 5.5. Western Europe Fresh Food Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Fresh Food Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Fresh Food Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Fresh Food Market Analysis, 2016-2021

- 6.2. Eastern Europe Fresh Food Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Fresh Food Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 6.3.1. Eastern Europe Fresh Food Market Analysis by By Product Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 6.3.3. fresh food

- 6.3.4. Fruits and Vegetables

- 6.3.5. Meat, Poultry, and Egg

- 6.3.6. Other

- 6.4. Eastern Europe Fresh Food Market Analysis, Opportunity and Forecast, By By Distribution Channel, 2016-2032

- 6.4.1. Eastern Europe Fresh Food Market Analysis by By Distribution Channel: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Distribution Channel, 2016-2032

- 6.4.3. Supermarket

- 6.4.4. Online

- 6.4.5. Hypermarket

- 6.4.6. Wet and Open Market

- 6.5. Eastern Europe Fresh Food Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Fresh Food Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Fresh Food Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Fresh Food Market Analysis, 2016-2021

- 7.2. APAC Fresh Food Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Fresh Food Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 7.3.1. APAC Fresh Food Market Analysis by By Product Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 7.3.3. fresh food

- 7.3.4. Fruits and Vegetables

- 7.3.5. Meat, Poultry, and Egg

- 7.3.6. Other

- 7.4. APAC Fresh Food Market Analysis, Opportunity and Forecast, By By Distribution Channel, 2016-2032

- 7.4.1. APAC Fresh Food Market Analysis by By Distribution Channel: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Distribution Channel, 2016-2032

- 7.4.3. Supermarket

- 7.4.4. Online

- 7.4.5. Hypermarket

- 7.4.6. Wet and Open Market

- 7.5. APAC Fresh Food Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Fresh Food Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Fresh Food Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Fresh Food Market Analysis, 2016-2021

- 8.2. Latin America Fresh Food Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Fresh Food Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 8.3.1. Latin America Fresh Food Market Analysis by By Product Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 8.3.3. fresh food

- 8.3.4. Fruits and Vegetables

- 8.3.5. Meat, Poultry, and Egg

- 8.3.6. Other

- 8.4. Latin America Fresh Food Market Analysis, Opportunity and Forecast, By By Distribution Channel, 2016-2032

- 8.4.1. Latin America Fresh Food Market Analysis by By Distribution Channel: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Distribution Channel, 2016-2032

- 8.4.3. Supermarket

- 8.4.4. Online

- 8.4.5. Hypermarket

- 8.4.6. Wet and Open Market

- 8.5. Latin America Fresh Food Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Fresh Food Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Fresh Food Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Fresh Food Market Analysis, 2016-2021

- 9.2. Middle East & Africa Fresh Food Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Fresh Food Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 9.3.1. Middle East & Africa Fresh Food Market Analysis by By Product Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 9.3.3. fresh food

- 9.3.4. Fruits and Vegetables

- 9.3.5. Meat, Poultry, and Egg

- 9.3.6. Other

- 9.4. Middle East & Africa Fresh Food Market Analysis, Opportunity and Forecast, By By Distribution Channel, 2016-2032

- 9.4.1. Middle East & Africa Fresh Food Market Analysis by By Distribution Channel: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Distribution Channel, 2016-2032

- 9.4.3. Supermarket

- 9.4.4. Online

- 9.4.5. Hypermarket

- 9.4.6. Wet and Open Market

- 9.5. Middle East & Africa Fresh Food Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Fresh Food Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Fresh Food Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Fresh Food Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Fresh Food Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Leverandørselskabet Danish Crown AmbA

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Dole Food Company, Inc.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Fresh Del Monte Produce Inc.

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Greenyard NV

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Tyson Foods, Inc.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. D'Arrigo Bros. Co. Of California, Inc.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Chiquita Brands International, Inc.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Tanimura & Antle Fresh Foods, Inc.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Taylor Fresh Foods, Inc.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Naturipe Farms, LLC

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13. Other

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global Fresh Food Market Revenue (US$ Mn) Market Share by By Product Type in 2022

- Figure 2: Global Fresh Food Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 3: Global Fresh Food Market Revenue (US$ Mn) Market Share by By Distribution Channelin 2022

- Figure 4: Global Fresh Food Market Attractiveness Analysis by By Distribution Channel, 2016-2032

- Figure 5: Global Fresh Food Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Fresh Food Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Fresh Food Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Fresh Food Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Fresh Food Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 10: Global Fresh Food Market Revenue (US$ Mn) Comparison by By Distribution Channel (2016-2032)

- Figure 11: Global Fresh Food Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Fresh Food Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 13: Global Fresh Food Market Y-o-Y Growth Rate Comparison by By Distribution Channel (2016-2032)

- Figure 14: Global Fresh Food Market Share Comparison by Region (2016-2032)

- Figure 15: Global Fresh Food Market Share Comparison by By Product Type (2016-2032)

- Figure 16: Global Fresh Food Market Share Comparison by By Distribution Channel (2016-2032)

- Figure 17: North America Fresh Food Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 18: North America Fresh Food Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 19: North America Fresh Food Market Revenue (US$ Mn) Market Share by By Distribution Channelin 2022

- Figure 20: North America Fresh Food Market Attractiveness Analysis by By Distribution Channel, 2016-2032

- Figure 21: North America Fresh Food Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Fresh Food Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Fresh Food Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Fresh Food Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 26: North America Fresh Food Market Revenue (US$ Mn) Comparison by By Distribution Channel (2016-2032)

- Figure 27: North America Fresh Food Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Fresh Food Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 29: North America Fresh Food Market Y-o-Y Growth Rate Comparison by By Distribution Channel (2016-2032)

- Figure 30: North America Fresh Food Market Share Comparison by Country (2016-2032)

- Figure 31: North America Fresh Food Market Share Comparison by By Product Type (2016-2032)

- Figure 32: North America Fresh Food Market Share Comparison by By Distribution Channel (2016-2032)

- Figure 33: Western Europe Fresh Food Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 34: Western Europe Fresh Food Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 35: Western Europe Fresh Food Market Revenue (US$ Mn) Market Share by By Distribution Channelin 2022

- Figure 36: Western Europe Fresh Food Market Attractiveness Analysis by By Distribution Channel, 2016-2032

- Figure 37: Western Europe Fresh Food Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Fresh Food Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Fresh Food Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Fresh Food Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 42: Western Europe Fresh Food Market Revenue (US$ Mn) Comparison by By Distribution Channel (2016-2032)

- Figure 43: Western Europe Fresh Food Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Fresh Food Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 45: Western Europe Fresh Food Market Y-o-Y Growth Rate Comparison by By Distribution Channel (2016-2032)

- Figure 46: Western Europe Fresh Food Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Fresh Food Market Share Comparison by By Product Type (2016-2032)

- Figure 48: Western Europe Fresh Food Market Share Comparison by By Distribution Channel (2016-2032)

- Figure 49: Eastern Europe Fresh Food Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 50: Eastern Europe Fresh Food Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 51: Eastern Europe Fresh Food Market Revenue (US$ Mn) Market Share by By Distribution Channelin 2022

- Figure 52: Eastern Europe Fresh Food Market Attractiveness Analysis by By Distribution Channel, 2016-2032

- Figure 53: Eastern Europe Fresh Food Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Fresh Food Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Fresh Food Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Fresh Food Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 58: Eastern Europe Fresh Food Market Revenue (US$ Mn) Comparison by By Distribution Channel (2016-2032)

- Figure 59: Eastern Europe Fresh Food Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Fresh Food Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 61: Eastern Europe Fresh Food Market Y-o-Y Growth Rate Comparison by By Distribution Channel (2016-2032)

- Figure 62: Eastern Europe Fresh Food Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Fresh Food Market Share Comparison by By Product Type (2016-2032)

- Figure 64: Eastern Europe Fresh Food Market Share Comparison by By Distribution Channel (2016-2032)

- Figure 65: APAC Fresh Food Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 66: APAC Fresh Food Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 67: APAC Fresh Food Market Revenue (US$ Mn) Market Share by By Distribution Channelin 2022

- Figure 68: APAC Fresh Food Market Attractiveness Analysis by By Distribution Channel, 2016-2032

- Figure 69: APAC Fresh Food Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Fresh Food Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Fresh Food Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Fresh Food Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 74: APAC Fresh Food Market Revenue (US$ Mn) Comparison by By Distribution Channel (2016-2032)

- Figure 75: APAC Fresh Food Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Fresh Food Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 77: APAC Fresh Food Market Y-o-Y Growth Rate Comparison by By Distribution Channel (2016-2032)

- Figure 78: APAC Fresh Food Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Fresh Food Market Share Comparison by By Product Type (2016-2032)

- Figure 80: APAC Fresh Food Market Share Comparison by By Distribution Channel (2016-2032)

- Figure 81: Latin America Fresh Food Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 82: Latin America Fresh Food Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 83: Latin America Fresh Food Market Revenue (US$ Mn) Market Share by By Distribution Channelin 2022

- Figure 84: Latin America Fresh Food Market Attractiveness Analysis by By Distribution Channel, 2016-2032

- Figure 85: Latin America Fresh Food Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Fresh Food Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Fresh Food Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Fresh Food Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 90: Latin America Fresh Food Market Revenue (US$ Mn) Comparison by By Distribution Channel (2016-2032)

- Figure 91: Latin America Fresh Food Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Fresh Food Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 93: Latin America Fresh Food Market Y-o-Y Growth Rate Comparison by By Distribution Channel (2016-2032)

- Figure 94: Latin America Fresh Food Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Fresh Food Market Share Comparison by By Product Type (2016-2032)

- Figure 96: Latin America Fresh Food Market Share Comparison by By Distribution Channel (2016-2032)

- Figure 97: Middle East & Africa Fresh Food Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 98: Middle East & Africa Fresh Food Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 99: Middle East & Africa Fresh Food Market Revenue (US$ Mn) Market Share by By Distribution Channelin 2022

- Figure 100: Middle East & Africa Fresh Food Market Attractiveness Analysis by By Distribution Channel, 2016-2032

- Figure 101: Middle East & Africa Fresh Food Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Fresh Food Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Fresh Food Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Fresh Food Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 106: Middle East & Africa Fresh Food Market Revenue (US$ Mn) Comparison by By Distribution Channel (2016-2032)

- Figure 107: Middle East & Africa Fresh Food Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Fresh Food Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 109: Middle East & Africa Fresh Food Market Y-o-Y Growth Rate Comparison by By Distribution Channel (2016-2032)

- Figure 110: Middle East & Africa Fresh Food Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Fresh Food Market Share Comparison by By Product Type (2016-2032)

- Figure 112: Middle East & Africa Fresh Food Market Share Comparison by By Distribution Channel (2016-2032)

List of Tables

- Table 1: Global Fresh Food Market Comparison by By Product Type (2016-2032)

- Table 2: Global Fresh Food Market Comparison by By Distribution Channel (2016-2032)

- Table 3: Global Fresh Food Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Fresh Food Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Fresh Food Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Fresh Food Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 7: Global Fresh Food Market Revenue (US$ Mn) Comparison by By Distribution Channel (2016-2032)

- Table 8: Global Fresh Food Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Fresh Food Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 10: Global Fresh Food Market Y-o-Y Growth Rate Comparison by By Distribution Channel (2016-2032)

- Table 11: Global Fresh Food Market Share Comparison by Region (2016-2032)

- Table 12: Global Fresh Food Market Share Comparison by By Product Type (2016-2032)

- Table 13: Global Fresh Food Market Share Comparison by By Distribution Channel (2016-2032)

- Table 14: North America Fresh Food Market Comparison by By Distribution Channel (2016-2032)

- Table 15: North America Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Fresh Food Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Fresh Food Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 19: North America Fresh Food Market Revenue (US$ Mn) Comparison by By Distribution Channel (2016-2032)

- Table 20: North America Fresh Food Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Fresh Food Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 22: North America Fresh Food Market Y-o-Y Growth Rate Comparison by By Distribution Channel (2016-2032)

- Table 23: North America Fresh Food Market Share Comparison by Country (2016-2032)

- Table 24: North America Fresh Food Market Share Comparison by By Product Type (2016-2032)

- Table 25: North America Fresh Food Market Share Comparison by By Distribution Channel (2016-2032)

- Table 26: Western Europe Fresh Food Market Comparison by By Product Type (2016-2032)

- Table 27: Western Europe Fresh Food Market Comparison by By Distribution Channel (2016-2032)

- Table 28: Western Europe Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Fresh Food Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Fresh Food Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 32: Western Europe Fresh Food Market Revenue (US$ Mn) Comparison by By Distribution Channel (2016-2032)

- Table 33: Western Europe Fresh Food Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Fresh Food Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 35: Western Europe Fresh Food Market Y-o-Y Growth Rate Comparison by By Distribution Channel (2016-2032)

- Table 36: Western Europe Fresh Food Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Fresh Food Market Share Comparison by By Product Type (2016-2032)

- Table 38: Western Europe Fresh Food Market Share Comparison by By Distribution Channel (2016-2032)

- Table 39: Eastern Europe Fresh Food Market Comparison by By Product Type (2016-2032)

- Table 40: Eastern Europe Fresh Food Market Comparison by By Distribution Channel (2016-2032)

- Table 41: Eastern Europe Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Fresh Food Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Fresh Food Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 45: Eastern Europe Fresh Food Market Revenue (US$ Mn) Comparison by By Distribution Channel (2016-2032)

- Table 46: Eastern Europe Fresh Food Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Fresh Food Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 48: Eastern Europe Fresh Food Market Y-o-Y Growth Rate Comparison by By Distribution Channel (2016-2032)

- Table 49: Eastern Europe Fresh Food Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Fresh Food Market Share Comparison by By Product Type (2016-2032)

- Table 51: Eastern Europe Fresh Food Market Share Comparison by By Distribution Channel (2016-2032)

- Table 52: APAC Fresh Food Market Comparison by By Product Type (2016-2032)

- Table 53: APAC Fresh Food Market Comparison by By Distribution Channel (2016-2032)

- Table 54: APAC Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Fresh Food Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Fresh Food Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 58: APAC Fresh Food Market Revenue (US$ Mn) Comparison by By Distribution Channel (2016-2032)

- Table 59: APAC Fresh Food Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Fresh Food Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 61: APAC Fresh Food Market Y-o-Y Growth Rate Comparison by By Distribution Channel (2016-2032)

- Table 62: APAC Fresh Food Market Share Comparison by Country (2016-2032)

- Table 63: APAC Fresh Food Market Share Comparison by By Product Type (2016-2032)

- Table 64: APAC Fresh Food Market Share Comparison by By Distribution Channel (2016-2032)

- Table 65: Latin America Fresh Food Market Comparison by By Product Type (2016-2032)

- Table 66: Latin America Fresh Food Market Comparison by By Distribution Channel (2016-2032)

- Table 67: Latin America Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Fresh Food Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Fresh Food Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 71: Latin America Fresh Food Market Revenue (US$ Mn) Comparison by By Distribution Channel (2016-2032)

- Table 72: Latin America Fresh Food Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Fresh Food Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 74: Latin America Fresh Food Market Y-o-Y Growth Rate Comparison by By Distribution Channel (2016-2032)

- Table 75: Latin America Fresh Food Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Fresh Food Market Share Comparison by By Product Type (2016-2032)

- Table 77: Latin America Fresh Food Market Share Comparison by By Distribution Channel (2016-2032)

- Table 78: Middle East & Africa Fresh Food Market Comparison by By Product Type (2016-2032)

- Table 79: Middle East & Africa Fresh Food Market Comparison by By Distribution Channel (2016-2032)

- Table 80: Middle East & Africa Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Fresh Food Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Fresh Food Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Fresh Food Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 84: Middle East & Africa Fresh Food Market Revenue (US$ Mn) Comparison by By Distribution Channel (2016-2032)

- Table 85: Middle East & Africa Fresh Food Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Fresh Food Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 87: Middle East & Africa Fresh Food Market Y-o-Y Growth Rate Comparison by By Distribution Channel (2016-2032)

- Table 88: Middle East & Africa Fresh Food Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Fresh Food Market Share Comparison by By Product Type (2016-2032)

- Table 90: Middle East & Africa Fresh Food Market Share Comparison by By Distribution Channel (2016-2032)

- 1. Executive Summary

-

- Leverandørselskabet Danish Crown AmbA

- Dole Food Company, Inc.

- Fresh Del Monte Produce Inc.

- Greenyard NV

- Tyson Foods, Inc.

- D'Arrigo Bros. Co. Of California, Inc.

- Chiquita Brands International, Inc.

- Tanimura & Antle Fresh Foods, Inc.

- Taylor Fresh Foods, Inc.

- Naturipe Farms, LLC

- Other Key Players