Fortified Beverages Market By Nutrient Type (Vitamins, Minerals, Other), By Product Type (Non-Alcoholic, Alcoholic), By Distribution Channel (Supermarkets and Hypermarkets, Specialist Retailers, and Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

37595

-

June 2023

-

154

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

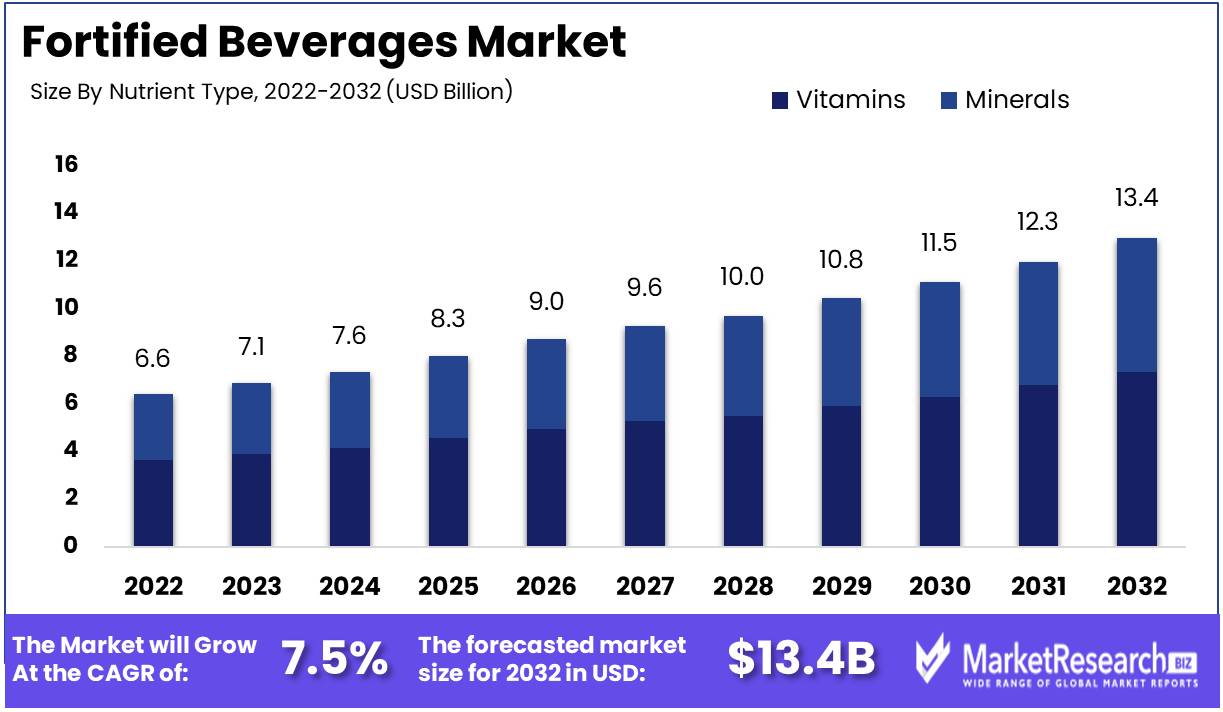

Fortified Beverages Market size is expected to be worth around USD 13.4 Bn by 2032 from USD 6.6 Bn in 2022, growing at a CAGR of 7.5% during the forecast period from 2023 to 2032.

In recent years, the Global Fortified Beverages Market has experienced a remarkable expansion, offering consumers a wide variety of fortified beverages with enticing appeal. This market has experienced a considerable increase in demand as a result of the rising health consciousness among individuals and the unrelenting expansion of the global population. Predictions indicate that the global fortified beverage market will experience unprecedented growth in the coming years, revealing a universe of unrealized potential and a plethora of advantageous opportunities for the industry.

Fortified Beverages, a term referring to beverages containing an added nutritional value, such as vitamins and minerals, have increased in popularity over the years as consumers have become more concerned with their health and the intrinsic value of the products they ingest. These beverages have now permeated the aisles of supermarkets and other retail establishments, permeating the realm of consumer choice with their diverse manifestations, which range from revitalizing teas to invigorating milk and from revitalizing juices to a vast tapestry of liquid indulgences.

The underlying purpose of fortified beverages is to provide an alternative that promotes health and nutrition, in striking contrast to their conventional counterparts, which frequently consist of heavily processed, nutrient-deficient fare. Fortified beverages aim to provide consumers with a welcome infusion of vitamins and minerals, thereby facilitating the optimization of their nutritional goals. The essence of a fortified beverage is the addition of additional vitamins and minerals to its primary ingredients, exceeding what nature intended.

The global market for fortified beverages has been the epicenter of numerous ground-breaking innovations, revealing a tapestry of captivating novelties that have enthralled consumers and fueled industry growth. Innovations such as fortified energy drinks, effervescent carbonated concoctions, libations infused with the vitality of alcohol, and a plethora of other dazzling creations have succeeded in capturing the imagination of consumers, igniting a veritable revolution and providing the industry with numerous avenues for continued growth.

Driving factors

Rise of Fortified Beverages for Enhanced Health and Wellness

Beyond simple refreshments, consumers increasingly seek functional and health-enhancing beverages today. Fortified beverages have become a popular option, offering a convenient method to enhance overall health and well-being. According to a report by MarketResearch.Biz, the demand for such beverages is on the rise, propelling the growth of the global fortified beverages market.

Addressing Micronutrient Deficiencies for Better Health

Deficiencies in micronutrients are a global problem that contributes to numerous health issues. The lack of essential vitamins and minerals in the diets of numerous individuals results in malnutrition. By offering a convenient and efficient way to supplement the body with essential micronutrients, fortified beverages play a crucial role in addressing these deficiencies. This enhances individual health and contributes to the growth of the market for fortified beverages.

Technological Progresses Enhancing Bioavailability

Due to advances in fortification technologies, the market for fortified beverages has experienced substantial growth. Utilizing new technologies, manufacturers are increasing the bioavailability of vitamins and minerals in their products, making them more readily assimilated and utilized by the body. As a result, there is a vast selection of fortified beverages on the market, catering to a variety of requirements and preferences.

Restraining Factors

Authentic Taste and Texture

Fortified beverages frequently undergo formulation changes to include additional nutrients, which can occasionally affect their taste and texture. These modifications may be unappealing to consumers, resulting in a reluctance to purchase or ingest fortified beverages. For companies operating in this market, overcoming taste and texture challenges and delivering a product that meets consumer expectations can be significant obstacles.

Competition from Traditional Beverages

Traditional beverages like carbonated soft drinks, juices, and bottled water present a significant challenge to fortified beverages. These traditional options typically have an established market presence and consumer loyalty, making it challenging for fortified beverages to acquire significant market share. It can be difficult to convince consumers to transition from their usual beverages to fortified alternatives.

Perception of Artificial Ingredients

To improve their nutritional profile, some fortified beverages contain artificial constituents or synthetic forms of nutrients. However, a growing preference among consumers for natural and organic products has led to a negative perception of artificial constituents. This perception can hinder the acceptability and adoption of fortified beverages, especially among consumers who are health-conscious.

Distribution Challenges

It is essential for the success of any beverage product, including fortified beverages, to establish a robust distribution network. In certain regions, the distribution infrastructure for these products may be limited or underdeveloped, making it difficult to effectively reach target consumers. Access restrictions to distribution channels can hinder market penetration and growth prospects.

Nutrient Type Analysis

The Vitamins segment accounts for the highest market share on the global market for fortified beverages. The rise in demand for functional and nutritional beverages is a major factor fueling the expansion of the fortified beverages market. Vitamins provide numerous health benefits, including enhanced immune system function, healthful skin and hair, and a reduced risk of chronic disease. In light of this, it is anticipated that the demand for nutrient-rich beverages such as vitamin-fortified beverages will increase significantly in the future years.

Globally, the consumption of beverages within the Vitamins segment is expanding, with emerging economies leading the way. The expansion of the middle class and the increase in disposable income in emergent economies, such as Asia and Africa, have made functional beverages more affordable and accessible. These regions have large, increasingly health-conscious populations, which drives the demand for fortified beverages. Therefore, the adoption of the Vitamins segment is driven by economic development in emerging economies.

Product Type Analysis

With the greatest market share, the Non-Alcoholic Segment dominates the Global Fortified Beverages Market. The demand for beverages in the Non-Alcoholic Segment is driven by the rising demand for healthful and natural beverage alternatives, especially among the younger demographic. Non-Alcoholic Segment beverages provide a number of health benefits, such as stimulating the metabolism, calming the nerves, and enhancing the immune system. Consequently, the Non-Alcoholic Segment is anticipated to experience significant growth in the coming years.

Adoption of the Non-Alcoholic Segment is expanding globally, with emerging economies holding the lead. The increasing size and disposable income of the middle class in emergent economies make functional beverages, including non-alcoholic beverages, more affordable and accessible. These regions have large, increasingly health-conscious populations, which drives the demand for fortified beverages. Thus, the adoption of the Non-Alcoholic Segment is driven by economic development in emerging economies.

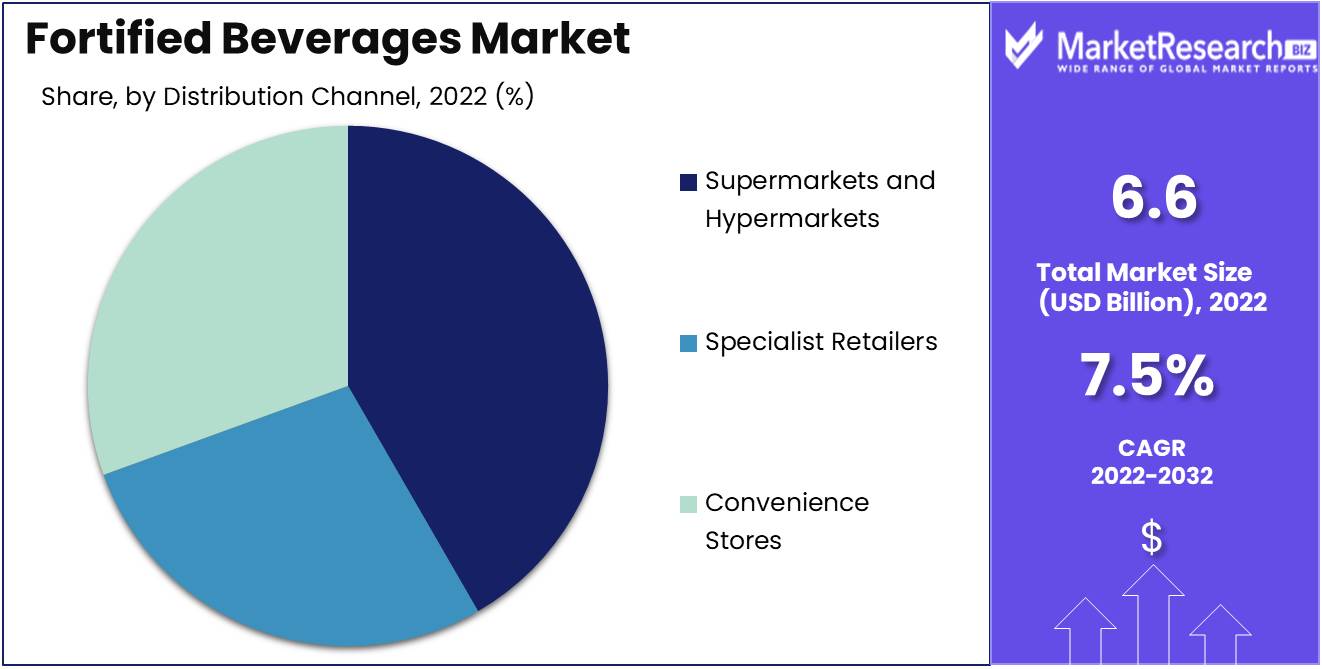

Distribution Channel Analysis

Supermarkets and hypermarkets hold the highest market share in the global fortified beverages market. Supermarkets and Hypermarkets are dominant due to the trend toward convenient purchasing experiences and a large number of consumers attracted to these channels.

Globally, supermarkets and hypermarkets are proliferating, with emergent economies also at the forefront. The increasing size and disposable income of the middle class in emerging economies make supermarket purchasing more affordable and accessible. These regions have large, increasingly health-conscious populations, which drives the demand for fortified beverages. Therefore, the adoption of Supermarkets and Hypermarkets is driven by economic development in emerging economies.

Key Market Segments

By Nutrient Type

- Vitamins

- Minerals

- Other Nutrient Types

By Product Type

- Non-Alcoholic

- Alcoholic

By Distribution Channel

- Supermarkets and Hypermarkets

- Specialist Retailers

- Convenience Stores

- Other Distribution Channels

Growth Opportunity

Innovative and Appealing Formulations

Historically, consumers viewed fortified beverages as having a medicinal flavor, rendering them unappealing. However, the industry has recognized the significance of developing nutritious and delicious products. To accomplish this, manufacturers are concentrating on developing natural and organic fortified beverages with appealing flavor profiles. Fruit and vegetable mixtures are being incorporated to improve the nutritional value and flavor of the products.

Catering to Specific Target Groups

The market for fortified beverages is growing due to the expansion of offerings catered to specific demographics, such as children and seniors. As the senior population ages, there is a growing demand for products that cater to their specific requirements. Fortified beverages for healthful aging are growing in popularity. Recognizing the benefits of these products, parents are seeking out fortified beverages to supplement their children's nutritional requirements.

All-Natural and Bioavailable Ingredients

Consumers are increasingly cognizant of the origin and quality of the ingredients in their food and beverages. In response to this demand, manufacturers are utilizing bioavailable natural ingredients. This indicates that the body readily absorbs and utilizes these ingredients. Calcium derived from natural sources, as found in calcium-fortified beverages, is more readily assimilated by the body than calcium derived from synthetic sources. Utilizing such bioavailable fortification ingredients improves the overall effectiveness of fortified beverages.

Latest Trends

Fortified Beverages with Vitamin and Mineral Content

Increasing consumer health consciousness has resulted in an increase in the demand for vitamin- and mineral-enriched beverages. Vitamin and mineral-fortified beverages provide essential nutrients that are absent from the average diet. These beverages include fruit-based beverages, fruit liquids, and non-carbonated beverages. The market for fortified beverages has experienced substantial growth, notably in the Asia-Pacific region.

Plant-based and Dairy Alternatives with Added Nutrients

On the global market for fortified beverages, plant-based and dairy alternatives with added nutrients are also gathering traction. The demand for plant-based and dairy alternatives with added nutrients is a result of consumers' heightened awareness of health, the environment, and animal welfare. In recent years, these products have acquired popularity due to the rise in vegan and vegetarian diets.

Functional Beverages Targeting Specific Health Concerns

Consumer interest in functional beverages addressing specific health concerns, such as weight loss, detox, and skin health, is growing. Significant demand exists for energy beverages that claim to reduce fatigue and enhance cognitive performance. Also garnering popularity are beverages marketed as pre-workout and post-workout supplements.

Clean-Label Fortification Solutions

The demand for clean-label fortification solutions has increased over the years due to consumers' growing health consciousness and demand for natural ingredients. Clean-label beverage fortification solutions include natural constituents such as fruits, vegetables, and herbs. This trend is especially evident in the market segment for ready-to-drink coffee.

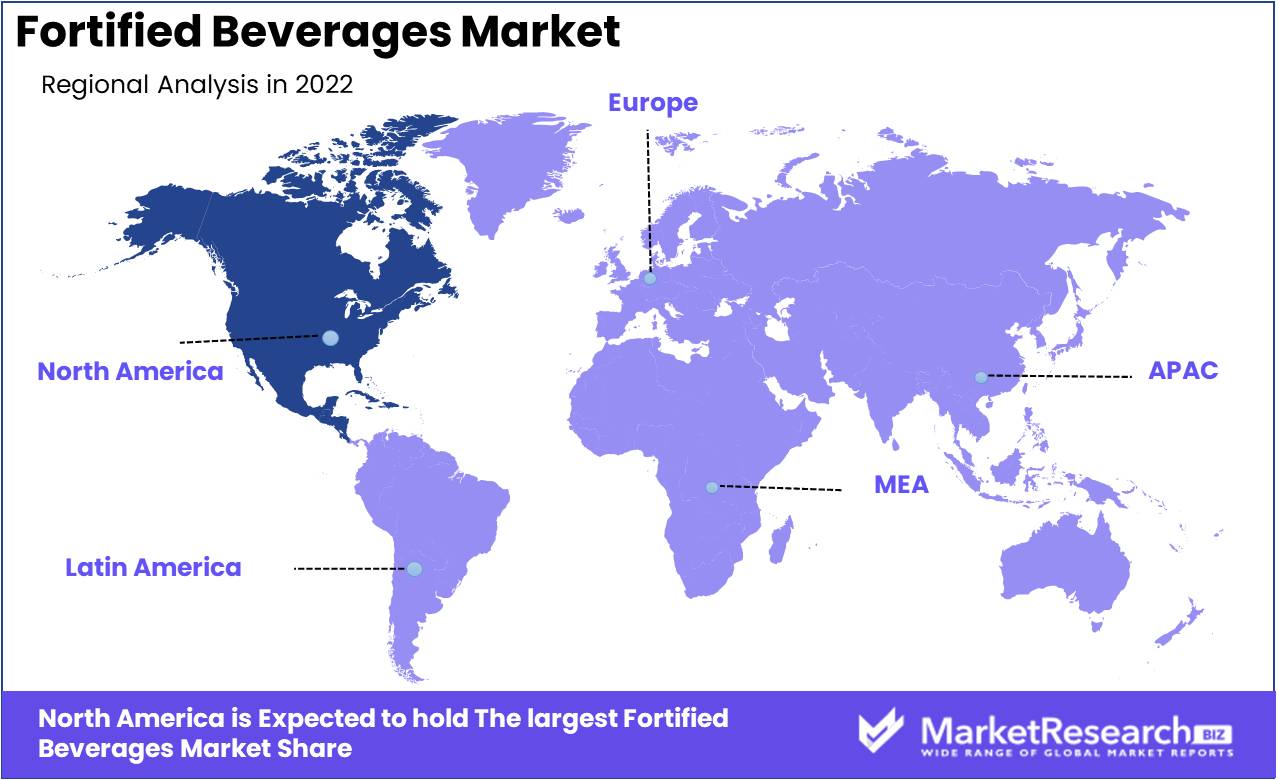

Regional Analysis

North America Dominates the Global Fortified Beverages Market. A fortified beverage is a drink with added vitamins, minerals, and other nutrients. As people seek healthier alternatives that offer more benefits than traditional drinks, these types of beverages have become increasingly popular. North America has emerged as the dominant participant in the market for fortified beverages in recent years, and this trend is anticipated to continue in the coming years.

Increasing consumer awareness of the benefits of fortified beverages is propelling the expansion of the market. People are becoming more health-conscious and are constantly searching for methods to enhance their immunity, increase their energy, and enhance their well-being as a whole. Fortified beverages are an excellent method to obtain all of these health benefits in a single drink.

Changing lifestyles are an additional factor propelling the market for fortified beverages. Many individuals do not have the time to prepare nutritious meals or ingest enough vitamins and minerals due to their hectic lifestyles. Fortified beverages are a simple and efficient method to meet daily nutrient needs without exerting excessive effort.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

One of the largest food and beverage companies in the world, Nestle, offers a wide range of fortified beverage products, including Milo, Nesquik, and Nestea. The company has a strong global presence and a robust distribution network, allowing it to cater to consumers in numerous regions.

PepsiCo is another major participant in the fortified beverage market, offering products like Gatorade and Tropicana. To cater to changing consumer requirements and preferences, the company focuses on innovation and the creation of new products.

Coca-Cola is another significant player in the market for fortified beverages, offering a wide range of products like Minute Maid, Coca-Cola Cherry, and Sprite. The company's strong brand recognition and global reach give it a competitive edge in the market.

Under its brands like Actimel and Danone, Danone offers a range of fortified beverages. The company focuses on healthy, functional beverages and targets consumers who are health-conscious.

GlaxoSmithKline offers Horlicks, a ubiquitous malt-based fortified beverage, under its Horlicks brand. The company focuses on providing nutrition and energy to consumers of all ages.

The Campbell Soup Company offers vegetable and fruit-based V8 beverages. The company focuses on providing consumers with nutritious and healthy beverages.

Top Key Players in the Fortified Beverages Market

- PepsiCo

- Nestle, SA

- The Coca-Cola Company

- CG Roxane, LLC

- Tempo Beverage Ltd

- The Kraft Heinz Company

- Campbell Soup Company

- Dr Pepper/Seven Up, Inc

- Tropicana Products Inc

- Other

Recent Development

- In 2021, Coca-Cola, a leader in the beverage industry, introduced a new line of fortified beverages intended to provide consumers with essential nutrients. The new line of beverages, which consists of juices, sports drinks, and tea, is fortified with vitamins, minerals, and other essential nutrients, making them a healthier alternative to conventional soft drinks.

- In 2022, PepsiCo, a competitor, made a significant acquisition when it paid $38 billion for the popular fortified water brand SoBe LifeWater. The acquisition of SoBe LifeWater is viewed as a strategic move by PepsiCo to strengthen its portfolio of healthier beverage options and expand its presence in the fortified beverage market.

- In 2023, Keurig Dr Pepper intends to introduce a new line of fortified coffee drinks. The new line of beverages will be fortified with vitamins and other essential nutrients and marketed as a healthier alternative to standard coffee.

Report Scope

Report Features Description Market Value (2022) USD 6.6 Bn Forecast Revenue (2032) USD 13.4 Bn CAGR (2023-2032) 7.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Nutrient Type

Vitamins

Minerals

OtherBy Product Type

Non-Alcoholic

AlcoholicBy Distribution Channel

Supermarkets and Hypermarkets

Specialist Retailers

Convenience Stores

OtherRegional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape PepsiCo, Nestle, SA, The Coca-Cola Company, CG Roxane, LLC, Tempo Beverage Ltd, The Kraft Heinz Company, Campbell Soup Company, Dr Pepper/Seven Up, Inc, Tropicana Products Inc, Other Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- PepsiCo

- Nestle, SA

- The Coca-Cola Company

- CG Roxane, LLC

- Tempo Beverage Ltd

- The Kraft Heinz Company

- Campbell Soup Company

- Dr Pepper/Seven Up, Inc

- Tropicana Products Inc

- Other