Food Packaging Technology & Equipment Market By Material ( Plastics, Metal, Paper & Paperboard, Glass & Wood, Others), By Technology (Vacuum Packaging, Modified Atmosphere Packaging (MAP), Active Packaging), By Equipment's (Coding and Marking Equipment, Labeling Machines, Filling and Sealing Machines, Inspection and Quality Control Systems), By Application ( Confectionery Products, Dairy & Dairy Products, Fruits & Vegetables, Convenience Foods, Poultry, Seafood, Meat Products, Others), By Region And Companies - Industry Segment Outlook, Market Asses

-

45663

-

May 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

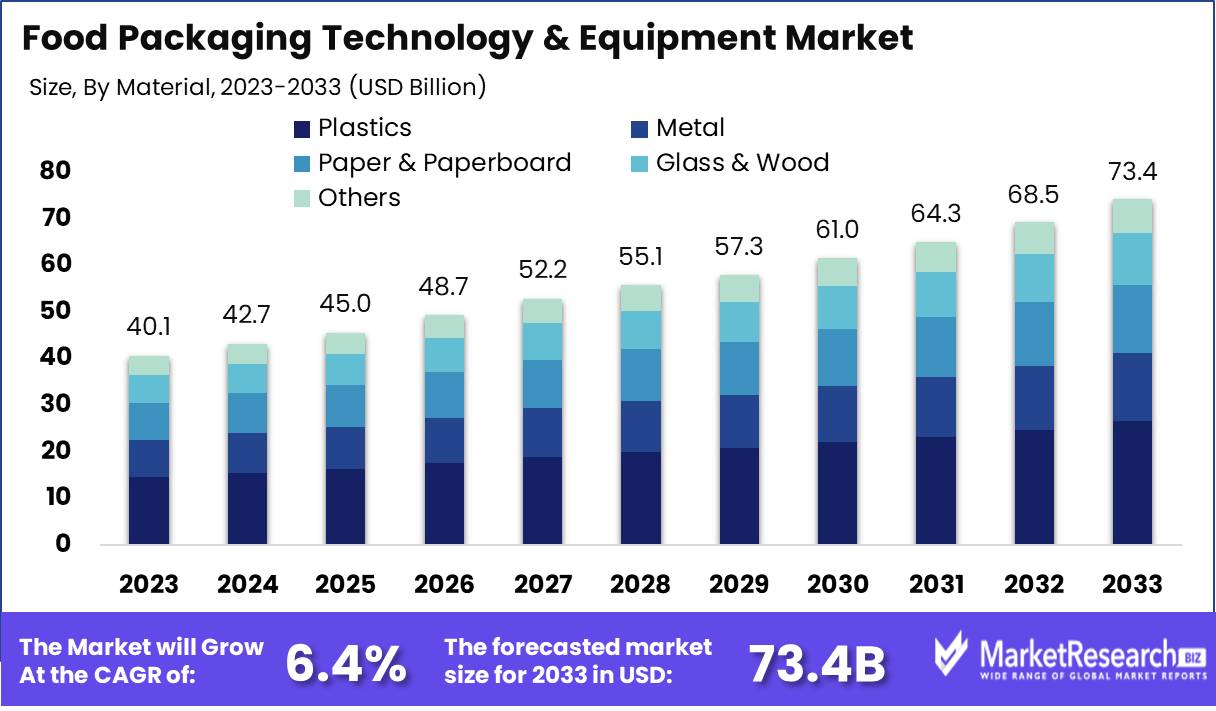

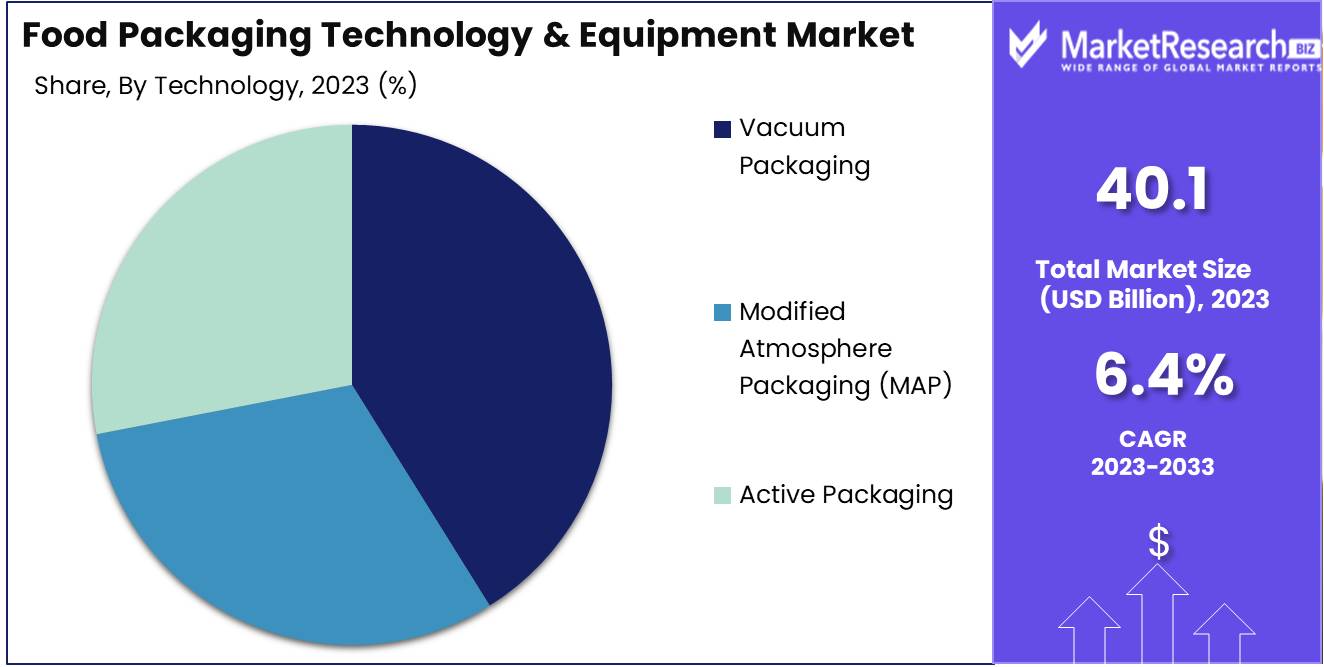

The Food Packaging Technology and Equipment Market was valued at USD 40.1 billion in 2023. It is expected to reach USD 73.4 billion by 2033, with a CAGR of 6.4% during the forecast period from 2024 to 2033. The surge in demand for biodegradable packaging and the rise in demand for smart packaging are some of the major factors driving the food packaging technology and equipment market growth.

The Food Packaging Technology & Equipment Market encompasses a diverse array of technologies and machinery dedicated to the packaging of food products. This market is pivotal in ensuring food safety, extending shelf life, and maintaining nutritional quality through innovations in packaging materials, designs, and automation techniques. It integrates advanced technologies such as intelligent packaging, robotics, and tracking systems to enhance operational efficiency and compliance with international food safety standards. The sector is driven by consumer demands for convenience and sustainability, influencing significant investments in research and development to produce eco-friendly and efficient packaging solutions.

Biodegradable packaging is generally manufactured by using natural fibers from organic renewable resources. It is projected to grow rapidly as excessive use of plastic is harmful to the environment, it cannot be recycled or decomposed. Biodegradable packaging is free from harmful toxins and chemicals emitted by petrol-based plastic items during the breakdown process. There is another form of biodegradable packaging which is edible food packaging. The edible food packaging comprises seaweed-based water pods and plastic covers, edible coffee and tea cups, and crockery made from grains. Globally, we are using more than 400 billion plastic bottles, so any form of packaging that is eco-friendly and decomposable can help the environment from harmful hazards. The gel-captured water pod packaging is not only used by water but can also be used in beverages, sauces, cleaning, and other personal care hygiene products.

A packaging manufacturer plays an important role in the food packaging process. They design the packaging to protect and conserve the food. Packaging manufacturers need to implement new and innovative packaging technologies to fulfill the food industry’s demand. For example, modified atmosphere packaging, commonly known as MAP is one of the natural distribution and composition of the atmospheric gases that has been shifted. MAP can control the gases that are present in the food package to generate suitable conditions for expanding a longer durability life and decreasing oxidation and decline of the unpreserved food and beverage items. There are more types of food packaging technologies such as aseptic packaging, vacuum packaging, thermoforming packaging, injection packaging, and foil packaging. These are some of the commonly used packaging technologies that will expand rapidly and by using such methods packaging will be more efficient and effective. Such type of advancements in food packaging technology and equipment will grow in the coming future.

Key Takeaways

- Market Growth: The Food Packaging Technology and Equipment Market was valued at USD 40.1 billion in 2023. It is expected to reach USD 73.4 billion by 2033, with a CAGR of 6.4% during the forecast period from 2024 to 2033.

- By Material: Plastics dominate due to versatility and sustainability in food packaging.

- By Technology: Vacuum packaging dominates due to its cost-effective, simple shelf-life extension.

- By Equipment: In 2023, Coding and Marking Equipment dominated Food Packaging Technology advancements.

- By Application: Convenience Foods dominate with 49.2% in a diverse, dynamic market.

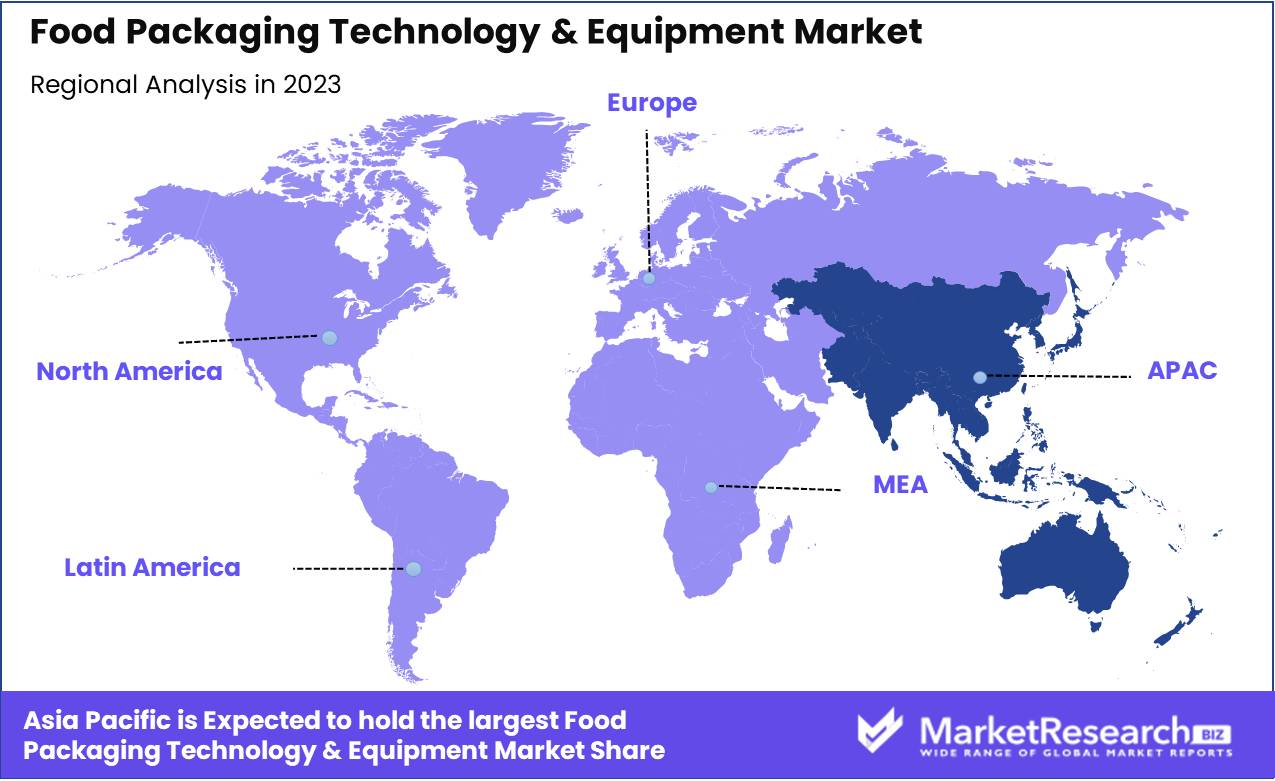

- Regional Dominance: Asia-Pacific leads with 38.11%, driven by urbanization and innovation.

- Growth Opportunity: Sustainable and active packaging drives market leadership and global growth.

Driving factors

Rise in Preference for Online Shopping of Grocery: Facilitating Demand for Advanced Packaging Solutions

The surge in online grocery shopping, notably accelerated by the global pandemic, continues to exert a significant influence on the food packaging technology and equipment market. As consumers increasingly turn to digital platforms for their grocery purchases, the demand for robust, secure, and efficient packaging solutions has spiked. This shift necessitates innovations in packaging technologies that can ensure product integrity, freshness, and safe delivery from warehouses to consumers' doorsteps.

For instance, advanced barrier materials that prevent moisture and air entry, and smart packaging solutions equipped with QR codes for better tracking and consumer engagement, are becoming more prevalent. Statistically, the online grocery market, which saw a growth of over 30% in 2020, is expected to expand further, compounding the need for enhanced packaging solutions that cater to e-commerce logistics and consumer preferences for sustainability and convenience.

Increased Consumption of Healthy Food: Driving Demand for Protective and Informative Packaging

The rising consumer focus on health and wellness has led to increased consumption of healthy food products, such as organic produce, plant-based items, and functional foods. This shift impacts the food packaging sector by heightening the need for packaging that not only preserves the quality and nutritional value of food products but also communicates this value clearly to health-conscious consumers. Technologies like modified atmosphere packaging (MAP) are critical in extending the shelf life of fresh and minimally processed foods without the use of preservatives, aligning with consumer demand for 'clean label' products.

Additionally, the integration of transparent labeling and enhanced graphic capabilities facilitates better consumer decisions, further buoying the growth of sophisticated packaging technologies. As the health food market continues to expand, the role of effective packaging in maintaining product integrity and fostering consumer trust becomes increasingly pivotal.

Increased Focus on Shelf Life of Convenience Foods: Catalyzing Innovations in Packaging Technologies

Convenience foods have seen a marked rise in popularity due to their ease of use and time-saving properties, especially among urban populations. Coupled with this trend is an increased focus on extending the shelf life of these products, which compels advancements in packaging technology. Techniques such as aseptic processing, vacuum packaging, and active packaging play critical roles in preserving the freshness, nutritional quality, and taste of convenience foods.

For instance, oxygen scavengers or moisture absorbers embedded in packaging materials can significantly prolong the shelf life and safety of packaged foods. The synergy between the demand for convenience and extended shelf life is driving technological innovations in the food packaging industry, thus supporting market growth. Market analysis suggests that as the global urban population increases, projected to rise by about 2.5 billion by 2050, the demand for highly efficient food packaging solutions will grow proportionately.

Restraining Factors

High Initial Investment: A Major Barrier to Entry and Innovation

The high initial investment required for food packaging technology and equipment represents a significant restraining factor in the market's growth. This investment includes the cost of acquiring state-of-the-art machinery and the technology necessary to operate it efficiently in compliance with the stringent regulations that govern food safety and packaging standards. The high cost of setup not only acts as a barrier to entry for new players but also limits the ability of existing companies to innovate or expand their operations. For instance, advanced technologies like automated packing lines or aseptic processing equipment come with high capital costs, which can deter smaller or less financially robust companies from adopting them.

Maintenance Costs: Ongoing Financial Burden Impeding Operational Efficiency

Maintenance costs are a critical ongoing financial burden that can significantly impact the profitability and operational efficiency of companies in the food packaging technology and equipment market. Regular maintenance is essential to ensure machinery operates at peak efficiency, complies with industry regulations, and minimizes downtime. However, the complexity and sophistication of modern food packaging equipment mean that maintenance is not only more frequent but also more costly. These costs can be particularly prohibitive for small to medium-sized enterprises (SMEs) that operate on tighter margins.

By Material Analysis

Plastics dominate due to versatility and sustainability in food packaging.

In 2023, the "By Material" segment of the Food Packaging Technology & Equipment Market saw a significant portion dominated by plastics, largely due to their cost-effectiveness, versatility, and lightweight properties. Plastics have evolved to meet various regulatory standards and consumer demands for safety and sustainability, enhancing their application across many food products. This material's adaptability allows for innovations in packaging technologies, including improved barrier properties and recyclability, positioning it as a primary choice for manufacturers seeking efficiency and durability in packaging solutions.

Other materials, such as metal, paper & paperboard, glass, and wood, also play critical roles in the market. Metal is prized for its robustness and excellent barrier qualities, making it ideal for canned goods. Paper and paperboard are favored for their eco-friendliness and are extensively used in packaging dry food items. Glass, often used for its non-reactivity and premium aesthetic, remains popular for preserving the quality of perishables and liquids. Wood, though less common, is utilized in niche applications like luxury packaging, underscoring the market's diversity and responsiveness to varying consumer preferences and environmental considerations.

By Technology Analysis

Vacuum packaging dominates due to its cost-effective, simple shelf-life extension.

In 2023, Vacuum Packaging held a dominant market position in the "By Technology" segment of the Food Packaging Technology & Equipment Market. This technology's prominence is primarily attributed to its extensive application in extending the shelf life of perishable goods, a critical requirement in the global food supply chain. Vacuum packaging removes air from the package before sealing, significantly reducing the oxygen level. This process inhibits the growth of aerobic bacteria and fungi, and prevents the evaporation of volatile components, thereby preserving the quality and freshness of food products.

The efficacy of vacuum packaging in preventing food spoilage positions it as a preferred choice over other technologies such as Modified Atmosphere Packaging (MAP) and Active Packaging. While MAP replaces the air inside the packaging with a gas mixture to achieve similar preservative effects, and Active Packaging involves interactions within the packaging environment to maintain food quality, the simplicity and cost-effectiveness of Vacuum Packaging make it more accessible and widely adopted across diverse food sectors. As consumer demand for longer-lasting food products continues to rise, driven by increasing global food distribution channels and the need for sustainability, the adoption of vacuum packaging technology is expected to grow, reinforcing its market dominance.

By Equipment Analysis

In 2023, Coding and Marking Equipment dominated Food Packaging Technology advancements.

In 2023, the Coding and Marking Equipment segment held a dominant position in the Equipment category of the Food Packaging Technology & Equipment Market. This segment benefits from heightened regulatory demands for traceability and transparency, driving adoption across diverse food packaging applications. Alongside, Labeling Machines also saw significant utilization, primarily driven by the need for compliance with international labeling standards and consumer demands for product information.

Filling and Sealing Machines continued to evolve, focusing on automation to enhance efficiency and reduce operational costs in high-volume production environments. Lastly, the Inspection and Quality Control Systems segment has become increasingly critical as manufacturers prioritize the integrity and safety of food products, integrating advanced technologies like AI and machine learning for real-time quality assurance. Each of these segments responds to distinct market forces but collectively moves towards greater automation, regulatory compliance, and technological integration to meet the growing complexities of food packaging and safety standards.

By Application Analysis

Convenience Foods dominates with 49.2% in a diverse, dynamic market.

In 2023, the Food Packaging Technology & Equipment Market saw varying levels of market penetration across different application segments. Among these, Convenience Foods held a dominant market position, capturing more than a 49.2% share. This segment's robust performance can be attributed to rising consumer demand for ready-to-eat and easy-to-prepare food products, driven by busy lifestyles and the increasing prevalence of dual-income households. The technology and equipment used in this segment have evolved to ensure extended shelf life, maintain food safety, and enhance convenience, aligning with consumer preferences for quick and easy meal solutions.

Other significant segments include Dairy & dairy Products, Meat Products, and Fruits & Vegetables. Each of these segments has adapted to market demands through innovations in packaging technologies that address specific industry challenges such as freshness preservation and sustainability. The Dairy & dairy Products segment, for instance, has incorporated advanced aseptic packaging technologies to improve product shelf life and reduce spoilage. Meanwhile, packaging solutions for Meat Products have focused on vacuum sealing and atmosphere control to maintain quality and prevent contamination. These advancements underscore the industry's commitment to meeting consumer expectations and regulatory requirements, shaping the market dynamics within each category.

Key Market Segments

By Material

- Plastics

- Metal

- Paper & Paperboard

- Glass & Wood

- Others

By Technology

- Vacuum Packaging

- Modified Atmosphere Packaging (MAP)

- Active Packaging

By Equipment

- Coding and Marking Equipment

- Labeling Machines

- Filling and Sealing Machines

- Inspection and Quality Control Systems

By Application

- Confectionery Products

- Dairy & dairy Products

- Fruits & Vegetables

- Convenience Foods

- Poultry

- Seafood

- Meat Products

- Others

Growth Opportunity

Embracing Sustainability: The Rise of Eco-Friendly Solutions

The global food packaging technology and equipment market is poised to capitalize significantly on the surge in consumer demand for sustainable packaging solutions. As environmental concerns drive consumer preferences, there is a growing shift towards packaging options that minimize ecological impact. This trend not only reflects an ethical commitment but also opens new growth avenues for companies that innovate in biodegradable materials, recycling technologies, and energy-efficient manufacturing processes. Firms that can integrate sustainability into their value proposition are likely to gain a competitive edge, enhancing their market share and brand loyalty among environmentally conscious consumers.

Innovation Through Active Packaging: Next-Level Product Integrity

Parallel to the push for sustainability, advancements in active packaging technology present substantial opportunities for market growth in 2024. Active packaging extends the shelf life and enhances the safety of food products by interacting chemically or biologically with the contents. This technology is rapidly evolving, incorporating features such as moisture control, oxygen scavengers, and ethylene absorbers, which significantly improve product quality. The adoption of such innovative solutions enables manufacturers to meet stringent food safety regulations and cater to the global demand for high-quality, long-lasting food products.

Latest Trends

Integration of Smart Packaging Systems: Enhancing Efficiency and Consumer Engagement

The global Food Packaging Technology & Equipment Market is set to be significantly influenced by the integration of smart packaging systems. These systems, which include intelligent labels and IoT-enabled sensors, offer manufacturers unprecedented capabilities in tracking, freshness monitoring, and interactive communication with consumers. This trend is driven by the increasing consumer demand for transparency in food sourcing and real-time data on product quality and safety. Smart packaging not only helps in extending the shelf life of food products but also enables personalized marketing strategies and enhanced consumer engagement, thereby adding value beyond mere packaging.

Adoption of Automation and Robotics: Streamlining Operations and Reducing Costs

Another transformative trend is the widespread adoption of automation and robotics across the food packaging industry. As labor costs continue to rise and the need for faster production cycles grows, companies are investing heavily in automated systems and robotic solutions. These technologies facilitate more efficient production processes, reduce the potential for human error, and improve safety standards by minimizing human involvement in hazardous environments.

The adoption of robotics also supports sustainability goals by optimizing energy use and reducing waste, thereby addressing both economic and environmental concerns. Automation not only ensures consistent product quality but also enables scalability of operations to meet increasing market demands. This strategic shift is crucial for companies aiming to enhance competitiveness and operational efficiency in a crowded market.

Regional Analysis

Asia-Pacific leads with 38.11%, driven by urbanization and innovation.

The food packaging technology and equipment market showcases distinctive trends and dynamics across various global regions. In Asia-Pacific, this market leads with a commanding share of 38.11%. This region benefits from rapid urbanization, increasing disposable incomes, and the expansion of the food retail sector, which drives demand for innovative packaging solutions that extend shelf life and enhance convenience. North America follows, with advanced technological integration such as smart packaging and active packaging systems, aimed at improving food safety and sustainability. This region's focus on regulatory standards and consumer demands for eco-friendly packaging also plays a crucial role in shaping the market landscape.

In Europe, the market is driven by stringent food safety regulations and the high demand for recyclable and biodegradable packaging. The region's strong emphasis on reducing food waste and carbon footprint supports the adoption of advanced packaging technologies. Meanwhile, Latin America and the Middle East & Africa are experiencing growth due to rising food processing industry activities and increasing consumer awareness about health and hygiene, which in turn stimulate investments in food packaging technologies. These regions, though smaller in market size compared to Asia-Pacific, are pivotal in the global context due to their potential for rapid growth and innovation in food packaging.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global Food Packaging Technology & Equipment Market witnesses dynamic competition, led by prominent players such as Arpac LLC, Oyster Holding GmbH, GEA Group, and Bosch Packaging Technology. Arpac LLC's innovative packaging solutions, coupled with Oyster Holding GmbH's commitment to sustainability, redefine industry standards.

GEA Group's diversified portfolio and Bosch Packaging Technology's cutting-edge advancements reflect market adaptability and technological prowess. Coesia Group's strategic acquisitions and Innovia Filmckner Pentaplas's focus on eco-friendly materials reinforce market leadership.

Ishida Co. Ltd.'s precision engineering and MULTIVAC Group's comprehensive packaging solutions cater to diverse consumer demands. Nichrome India Ltd.'s regional expertise complements Robert Bosch GmbH's global presence, enhancing market reach. Omori Machinery Co. Ltd.'s automation capabilities and Lindquist Machine Corporation's reliability contribute to market stability. IMA Group's dedication to innovation and quality underscores industry evolution, driving sustainable growth. As the market evolves, these key players continue to shape its trajectory through technological innovation, strategic partnerships, and a commitment to meeting evolving consumer needs.

Market Key Players

- Arpac LLC

- Oyster Holding GmbH

- GEA Group

- Bosch Packaging Technology

- Coesia Group

- Innovia Filmckner Pentaplas

- Ishida Co. Ltd

- MULTIVAC Group

- Nichrome India Ltd.

- Robert Bosch GmbH

- Omori Machinery Co. Ltd.

- Lindquist Machine Corporation

- IMA Group

Recent Development

- In February 2024, ProMach, a global supplier of processing and packaging solutions, announced that it had completed its acquisition of Zanichelli Meccanica S.p.A., known better as Zacmi, an Italian producer of filling, seaming, and pasteurization systems. Financial details of the transaction were not disclosed.

- In February 2024, Jintian Packaging Machinery Co., Ltd., a leading innovator in packaging solutions, revealed its strategic initiative to aggressively enter the U.S. market in 2024. With a robust lineup of cutting-edge products, including vertical form fill seal(VFFS) machines, stick pack machines, multi-head weigher packing machines, etc, the company aims to bring its expertise and advanced technology to American industries.

- In December 2023, The Packaging Development Centre, worth US$10.8 million, was officially opened by SIG on the location of the company's packaging facilities in Linnich, Germany.

- In August 2023, The Oregon-based GEM Equipment, which produces fryers and blanchers, was acquired by the international freezing and cooling equipment manufacturer FPS Food Process Solutions.

Report Scope

Report Features Description Market Value (2023) USD 40.1 Billion Forecast Revenue (2033) USD 73.4 Billion CAGR (2024-2032) 6.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material ( Plastics, Metal, Paper & Paperboard, Glass & Wood, Others), By Technology (Vacuum Packaging, Modified Atmosphere Packaging (MAP), Active Packaging), By Equipment's (Coding and Marking Equipment, Labeling Machines, Filling and Sealing Machines, Inspection and Quality Control Systems), By Application ( Confectionery Products, Dairy & Dairy Products, Fruits & Vegetables, Convenience Foods, Poultry, Seafood, Meat Products, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Arpac LLC, Oyster Holding GmbH, GEA Group, Bosch Packaging Technology, Coesia Group, Innovia Filmckner Pentaplas, Ishida Co. Ltd, MULTIVAC Group, Nichrome India Ltd., Robert Bosch GmbH, Omori Machinery Co. Ltd., Lindquist Machine Corporation, IMA Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Arpac LLC

- Oyster Holding GmbH

- GEA Group

- Bosch Packaging Technology

- Coesia Group

- Innovia Filmckner Pentaplas

- Ishida Co. Ltd

- MULTIVAC Group

- Nichrome India Ltd.

- Robert Bosch GmbH

- Omori Machinery Co. Ltd.

- Lindquist Machine Corporation

- IMA Group