Flying Taxis Market By Component (Avionics, Aerostructures, Propulsion Systems), By Technology (Electric Vertical Take-Off and Landing (eVTOL), Hybrid Electric), By Propulsion Type (Electric, Hybrid), By Aircraft Type (Multirotor, Lift Plus Cruise, Vectored Thrust, Tail-Sitter), By Passenger Capacity (Single Seat, Double Seat), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

42746

-

Feb 2022

-

171

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- Driving factors

- Restraining Factors

- By Component Analysis

- By Technology Analysis

- By Propulsion Type Analysis

- By Aircraft Type Analysis

- By Passenger Capacity Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

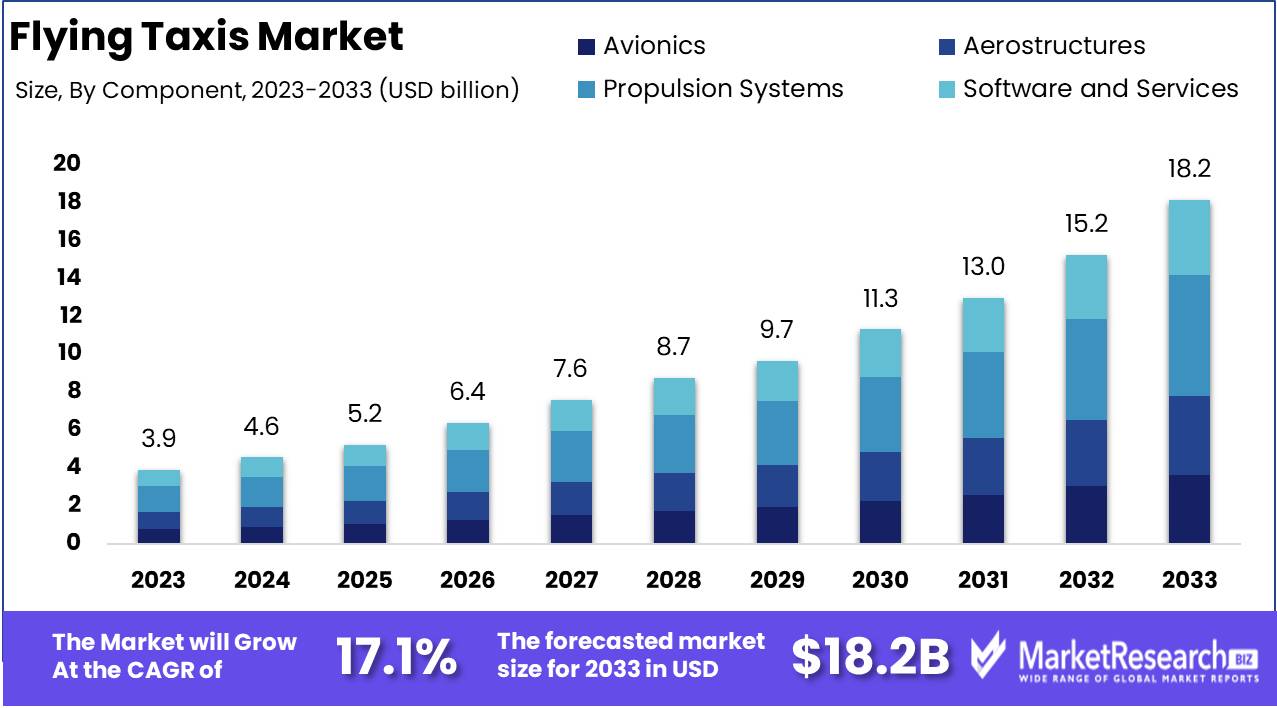

The Global Flying Taxis Market was valued at USD 3.9 Bn in 2023. It is expected to reach USD 18.2 Bn by 2033, with a CAGR of 17.1% during the forecast period from 2024 to 2033.

The Flying Taxis Market encompasses the development, production, and deployment of urban air mobility solutions designed to revolutionize transportation in congested metropolitan areas. These electric or hybrid vertical take-off and landing (VTOL) aircraft aim to provide efficient, sustainable, and rapid transit options. Driven by advancements in aerospace technology, increasing urbanization, and investments from both public and private sectors, the market is poised for significant growth. Key players are focusing on regulatory compliance, safety, and scalable operations to integrate flying taxis into existing transportation networks, addressing the demand for innovative solutions to urban mobility challenges.

The Flying Taxis Market is on the cusp of a significant transformation, driven by rapid technological advancements, increased urbanization, and strong investment from both public and private sectors. Companies like Honeywell and Volocopter are at the forefront of this innovation. Honeywell's collaboration with Lilium to co-develop a lightweight, zero-emissions electric motor (e-motor) for Lilium's eVTOL jet, weighing less than 10 pounds, exemplifies the cutting-edge advancements propelling the market forward. Such innovations are crucial for enhancing the efficiency and sustainability of flying taxis, making them viable alternatives to traditional urban transportation.

Volocopter's plans to launch air taxis in Paris by 2024 highlight the imminent commercialization of urban air mobility solutions. This initiative is a testament to the growing confidence in flying taxi technology and its potential to revolutionize urban transit. As regulatory frameworks become more supportive and infrastructure develops, the integration of flying taxis into urban transportation networks will likely accelerate.

The market's growth is also driven by the increasing demand for efficient, quick, and eco-friendly transportation solutions in congested cities. The ability to bypass ground traffic and reduce travel time positions flying taxis as a promising solution to urban mobility challenges. Key industry players are focusing on regulatory compliance, safety, and scalable operations to ensure the successful deployment of these innovative aircraft engines.

Key Takeaways

- Market Value: The Global Flying Taxis Market was valued at USD 3.9 Bn in 2023. It is expected to reach USD 18.2 Bn by 2033, with a CAGR of 17.1% during the forecast period from 2024 to 2033.

- By Component: Propulsion Systems form an integral 35% of the market components, crucial for achieving efficient and reliable flight operations in urban air mobility.

- By Technology: Electric Vertical Take-Off and Landing (eVTOL) technologies lead with a 50% market share, pivotal in transforming urban transportation with their reduced environmental impact.

- By Propulsion Type: Electric propulsion systems, holding 45% of the market, are central to the development of sustainable urban air mobility solutions.

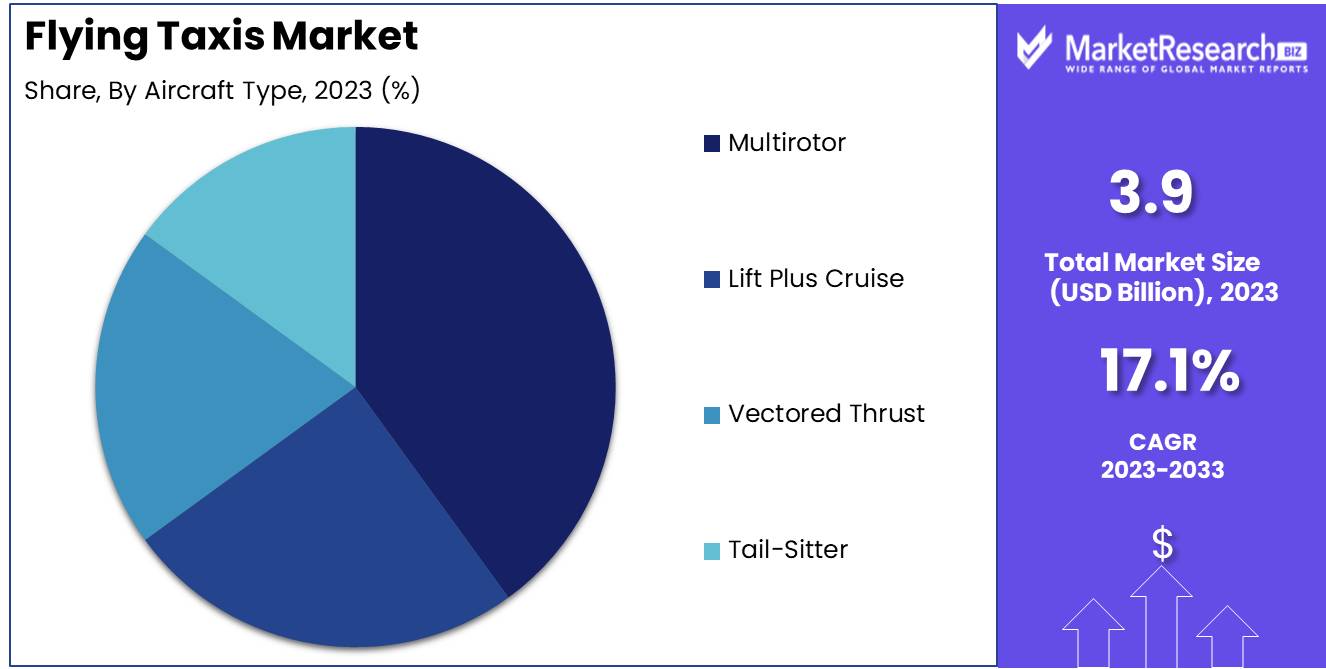

- By Aircraft Type: Multirotor aircraft types, capturing 40% of this segment, are favored for their stability and ease of operation in densely populated urban environments.

- By Passenger Capacity: Double Seat configurations are the most common, representing 60% of this category, catering to the demand for personal or small-group urban travel.

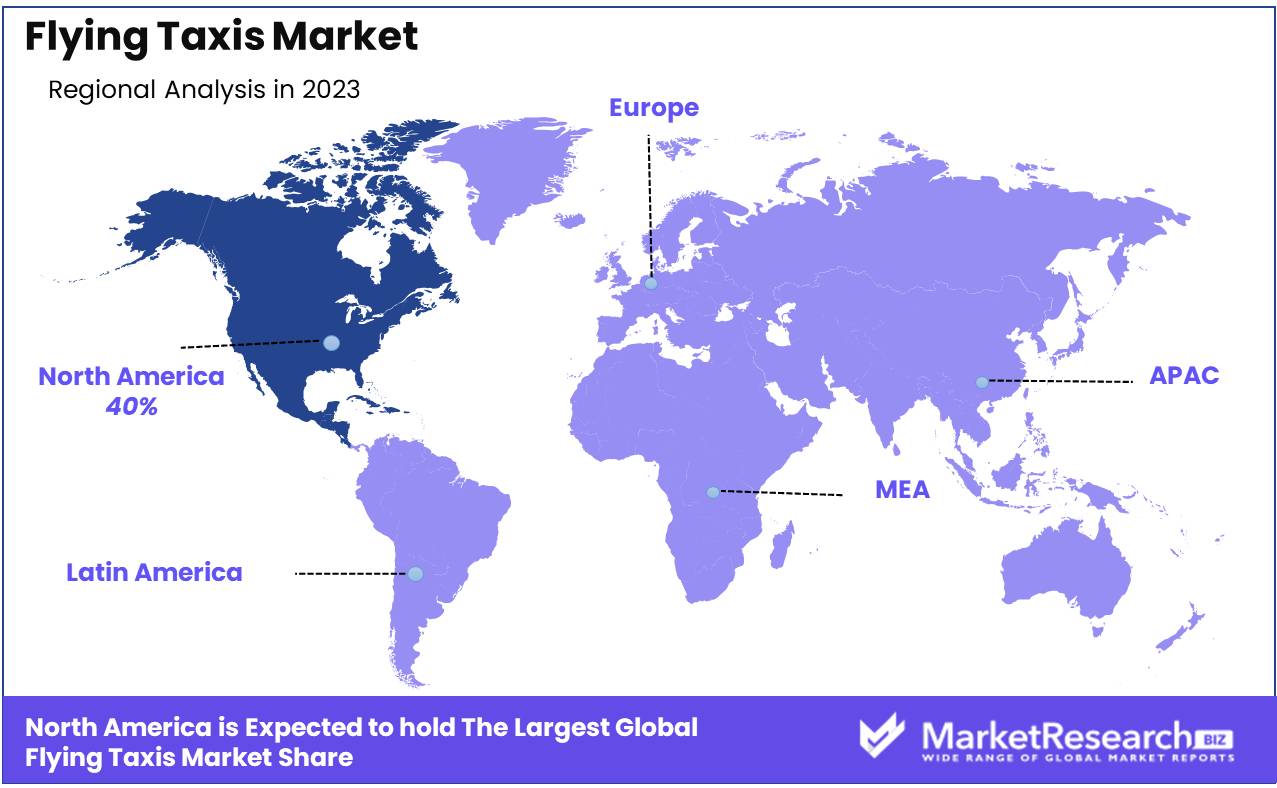

- Regional Dominance: North America plays a significant role, accounting for 40% of the market, driven by technological innovation and regulatory advancements in urban air mobility.

- Growth Opportunity: The Flying Taxis Market is poised for growth due to advancements in autonomous flight technology and growing urbanization leading to increased demand for alternative transportation solutions.

Driving factors

Urbanization and Traffic Congestion

The rapid urbanization of cities around the world is significantly driving the growth of the Flying Taxis Market. As more people move to urban areas, traffic congestion becomes a critical issue, leading to longer commute times and decreased quality of life. According to the United Nations, 68% of the global population is projected to live in urban areas by 2050.

This massive urban influx exacerbates traffic problems, making traditional road transport increasingly inefficient. Flying taxis offer a promising solution by providing a new dimension of urban mobility, effectively bypassing ground traffic and reducing commute times. The pressing need to address traffic congestion in growing cities propels the demand for innovative transportation solutions like flying taxis.

Technological Advancements in Autonomous and Electric Flight Technologies

Technological advancements in autonomous and electric flight technologies are pivotal to the growth of the Flying Taxis Market. Innovations in electric propulsion systems, such as Honeywell's development of a lightweight, zero-emissions electric motor for Lilium's eVTOL jet, are enhancing the efficiency, safety, and environmental sustainability of flying taxis.

Autonomous aircraft technologies further contribute to market growth by enabling pilotless operations, which can reduce operating costs and increase scalability. These advancements make flying taxis a viable and attractive option for urban transportation, addressing both environmental concerns and the need for efficient, scalable solutions.

Supportive Government Policies for Urban Air Mobility (UAM) Initiatives

Supportive government policies are crucial in facilitating the growth of the Flying Taxis Market. Governments worldwide are increasingly recognizing the potential of urban air mobility (UAM) to alleviate urban transportation challenges. Regulatory frameworks are being developed to ensure the safe integration of flying taxis into existing airspace.

Cities like Paris are actively working with companies like Volocopter to launch air taxi services by 2024, reflecting a growing governmental commitment to UAM initiatives. These policies not only provide a clear regulatory path but also often include financial incentives, infrastructure development, and public-private partnerships, all of which are essential for the successful deployment of flying taxis.

Restraining Factors

Safety and Regulatory Hurdles

Safety and regulatory hurdles are significant challenges that impact the growth of the Flying Taxis Market. Ensuring the safety of passengers and integrating flying taxis into the existing airspace without disrupting other aviation activities are critical concerns. Regulatory bodies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) are developing stringent safety standards and certification processes for flying taxis.

These regulations are essential for public trust and the safe operation of urban air mobility (UAM) systems but can also slow down the deployment and commercialization of flying taxis. The complexity of these regulations, coupled with the need for extensive testing and certification, poses a considerable barrier to market entry and expansion.

High Development and Operational Costs

The high development and operational costs associated with flying taxis present another substantial challenge for the market. The development of advanced technologies, such as electric propulsion systems and autonomous flight capabilities, requires significant investment in research and development (R&D). Companies must invest heavily in the design, prototyping, and testing phases to meet safety and regulatory standards. Additionally, the operational costs, including maintenance, energy consumption, and pilot training (if not fully autonomous), can be prohibitively high.

These costs are often passed on to consumers, making flying taxi services expensive and limiting their accessibility. While economies of scale and technological advancements may reduce these costs over time, they remain a significant barrier to widespread adoption in the near term.

By Component Analysis

Propulsion Systems form 35% of the market components.

In 2023, Propulsion Systems held a dominant market position in the By Component segment of the Flying Taxis Market, capturing more than a 35% share. This dominance is driven by the critical role propulsion systems play in the overall functionality and performance of flying taxis. Advanced propulsion technologies, including electric and hybrid-electric systems, are central to achieving the efficiency, range, and reliability required for urban air mobility solutions. The continuous innovation in battery technology, electric motors, and fuel-efficient systems has significantly bolstered the market presence of propulsion systems in this burgeoning sector.

Avionics also represent a substantial segment within the flying taxis market. Avionics systems encompass a wide range of electronic systems used for communication, navigation, monitoring, and control of the aircraft. These systems are integral to ensuring the safety, reliability, and efficiency of flying taxis, particularly in complex urban environments. The growing emphasis on advanced navigation systems, collision avoidance technologies, and autonomous flight capabilities has fueled demand for sophisticated avionics solutions, contributing to the segment’s robust growth.

Aerostructures, which include the airframe components such as the fuselage, wings, and landing gear, are another critical segment. The development of lightweight, durable materials and innovative design techniques are key factors driving the growth of the aerostructures segment. The need for high-performance and fuel-efficient flying taxis necessitates the use of advanced composites and aerostructures that reduce weight while maintaining structural integrity and safety standards.

The Software and Services segment, though smaller in comparison, is poised for significant growth as well. This segment includes the software platforms for flight management, maintenance, and passenger services, as well as the support services required for the operational efficiency of flying taxis. The integration of AI, IoT, and big data analytics into these software solutions enhances operational capabilities and safety, driving adoption in the market.

By Technology Analysis

Electric Vertical Take-Off and Landing (eVTOL) technologies lead, with a 50% market share.

In 2023, Electric Vertical Take-Off and Landing (eVTOL) held a dominant market position in the By Technology segment of the Flying Taxis Market, capturing more than a 50% share. This significant market share is attributed to the rapid advancements and widespread adoption of eVTOL technology, which promises efficient, low-emission, and cost-effective urban air mobility solutions. The development of eVTOL aircraft is driven by breakthroughs in battery technology, electric propulsion systems, and lightweight materials, which collectively enhance the range, safety, and performance of these vehicles. The growing investment from both public and private sectors into eVTOL technology further underscores its pivotal role in the future of urban transportation.

Hybrid Electric flying taxis represent another important segment within the market, combining internal combustion engines with electric propulsion systems to extend range and operational flexibility. Hybrid systems are particularly beneficial in scenarios where the current limitations of battery technology—such as energy density and charging infrastructure—pose challenges. By leveraging the strengths of both electric and conventional propulsion, hybrid electric flying taxis offer a practical transition towards more sustainable urban air mobility solutions, especially in areas with less developed electric infrastructure.

Hydrogen Fuel Cell technology, although currently a smaller segment, is gaining traction due to its potential for long-range, zero-emission flights. Hydrogen fuel cells offer a high energy density and quick refueling times compared to batteries, making them a promising alternative for longer flights and heavier payloads. The growing focus on hydrogen as a clean energy source, supported by advancements in fuel cell technology and infrastructure development, is expected to drive future growth in this segment. Hydrogen fuel cell flying taxis could play a crucial role in achieving sustainable aviation goals, particularly in regions committed to reducing carbon emissions.

By Propulsion Type Analysis

Electric propulsion systems account for 45% of the market.

In 2023, Electric propulsion held a dominant market position in the By Propulsion Type segment of the Flying Taxis Market, capturing more than a 45% share. The prominence of electric propulsion is driven by the increasing demand for sustainable and efficient urban air mobility solutions. Electric flying taxis offer significant advantages, including lower emissions, reduced noise levels, and lower operational costs compared to traditional propulsion systems. Technological advancements in battery storage, electric motors, and power management systems have played a crucial role in enhancing the performance and reliability of electric flying taxis, making them a preferred choice in the market.

The Hybrid propulsion segment also holds a substantial share within the flying taxis market, blending electric propulsion with traditional internal combustion engines. Hybrid systems provide greater flexibility and extended range, addressing current limitations in battery technology such as range anxiety and lengthy recharging times.

By combining the strengths of both electric and conventional propulsion, hybrid flying taxis offer a practical and scalable solution for urban air mobility, especially in areas with underdeveloped electric infrastructure. The hybrid approach is seen as an intermediate step towards fully electric urban air transport.

Vertical Takeoff and Landing (VTOL) technology, encompassing both electric and hybrid systems, is integral to the flying taxis market. VTOL capability is essential for operating in urban environments where space is limited and conventional runways are impractical. The development of VTOL technology has been driven by advancements in aerodynamics, control systems, and lightweight materials.

Jet propulsion, while representing a smaller segment, is notable for its application in longer-range flying taxis and high-speed urban air travel. Jet-powered flying taxis offer advantages in terms of speed and payload capacity, making them suitable for intercity travel and routes that require rapid transportation.

By Aircraft Type Analysis

Multirotor aircraft types are prevalent, holding 40% of the segment.

In 2023, Multirotor held a dominant market position in the By Aircraft Type segment of the Flying Taxis Market, capturing more than a 40% share. Multirotor flying taxis, characterized by multiple rotors providing lift and thrust, are favored for their simplicity, stability, and ease of control. These attributes make multirotor designs particularly suitable for urban environments where maneuverability and the ability to hover are essential. The widespread adoption of multirotor flying taxis is driven by their relatively lower development and manufacturing costs, as well as their suitability for short-range, intra-city travel.

The Lift Plus Cruise segment is also significant in the flying taxis market. This aircraft type combines vertical takeoff and landing capabilities with efficient forward flight by using separate systems for lift and cruise. Lift Plus Cruise flying taxis offer improved range and speed compared to purely multirotor designs, making them suitable for longer urban routes and intercity travel. The ability to switch between lift and cruise modes enhances operational efficiency, driving interest and investment in this versatile aircraft type.

Vectored Thrust flying taxis, which use tilting rotors or ducted fans to direct thrust for both lift and forward flight, represent another critical segment. This technology allows for greater aerodynamic efficiency and faster speeds, positioning vectored thrust aircraft as ideal for high-demand routes requiring quick transit times.

Tail-Sitter flying taxis, designed to take off and land on their tails and transition to horizontal flight, constitute a smaller but notable segment. These aircraft offer unique advantages in terms of flight efficiency and reduced infrastructure needs, as they can operate in confined spaces without the need for runways. The tail-sitter design is particularly promising for specialized applications and niche markets, although its operational complexity requires sophisticated control systems and pilot training.

By Passenger Capacity Analysis

Double Seat configurations are most common, representing 60%.

In 2023, Double Seat held a dominant market position in the By Passenger Capacity segment of the Flying Taxis Market, capturing more than a 60% share. The dominance of double-seat flying taxis is driven by their ability to offer greater flexibility and efficiency in urban air mobility solutions. These vehicles cater to a broader range of use cases, from personal commuting to ride-sharing services, making them more versatile and commercially viable. The capacity to carry two passengers significantly enhances the utility and appeal of flying taxis, balancing operational efficiency with passenger convenience.

Single Seat flying taxis, while occupying a smaller market share, are still an essential segment within the industry. These single-occupant vehicles are particularly suited for individual travel and specific niche applications such as quick, solo commutes, and time-sensitive deliveries. The simplicity and potentially lower operational costs of single-seat flying taxis make them attractive for personal use and specialized services. However, their limited passenger capacity restricts their scalability and broader market adoption compared to double-seat models.

The prominence of double-seat configurations reflects the current market preference for solutions that maximize operational flexibility and passenger throughput. As urban areas continue to grapple with congestion and the need for efficient transportation alternatives, double-seat flying taxis provide a practical solution that balances the need for capacity with the benefits of vertical takeoff and landing capabilities.

Key Market Segments

By Component

- Avionics

- Aerostructures

- Propulsion Systems

- Software and Services

By Technology

- Electric Vertical Take-Off and Landing (eVTOL)

- Hybrid Electric

- Hydrogen Fuel Cell

By Propulsion Type

- Electric

- Hybrid

- Vertical Takeoff and Landing (VTOL)

- Jet

By Aircraft Type

- Multirotor

- Lift Plus Cruise

- Vectored Thrust

- Tail-Sitter

By Passenger Capacity

- Single Seat

- Double Seat

Growth Opportunity

Partnerships Between Automotive and Aviation Companies

Strategic partnerships between automotive and aviation companies are creating significant growth opportunities for the Flying Taxis Market in 2024. Collaborations such as Hyundai's partnership with Uber Elevate and Toyota's investment in Joby Aviation exemplify how these alliances can combine automotive manufacturing expertise with advanced aviation technologies.

These partnerships facilitate the development of innovative flying taxi solutions by leveraging the strengths of both industries, including mass production capabilities, cutting-edge design, and advanced propulsion systems. The integration of automotive and aviation expertise accelerates the development and commercialization of flying taxis, making them more viable and scalable.

Expansion of Infrastructure for Vertical Takeoff and Landing (VTOL) Aircraft

The expansion of infrastructure for vertical takeoff and landing (VTOL) aircraft is another critical opportunity driving market growth. The development of vertiports and other supporting infrastructure is essential for the operational success of flying taxis. Cities like Paris and Los Angeles are already investing in vertiport infrastructure to support upcoming flying taxi services.

These facilities provide the necessary landing, takeoff, charging, and maintenance capabilities required for efficient VTOL operations. As more cities recognize the potential of urban air mobility, investments in VTOL infrastructure are expected to increase, facilitating the seamless integration of flying taxis into urban transportation networks.

Latest Trends

Development of Electric Vertical Takeoff and Landing (eVTOL) Vehicles

The development of electric vertical takeoff and landing (eVTOL) vehicles is a pivotal trend in the Flying Taxis Market for 2024. eVTOL technology offers a sustainable and efficient solution for urban air mobility, with zero emissions and reduced noise levels compared to traditional aircraft. Companies like Lilium and Joby Aviation are at the forefront of eVTOL development, focusing on creating vehicles that are both environmentally friendly and capable of operating in congested urban areas.

Honeywell’s collaboration with Lilium to develop a lightweight, zero-emissions electric motor underscores the industry's commitment to advancing eVTOL technology. As eVTOL vehicles become more advanced and commercially viable, they are expected to dominate the market, providing a green alternative to ground transportation.

Integration of Artificial Intelligence for Autonomous Operations

The integration of artificial intelligence (AI) for autonomous operations is another significant trend shaping the Flying Taxis Market in 2024. AI technology enhances the safety, efficiency, and scalability of flying taxis by enabling autonomous navigation, obstacle avoidance, and optimized flight paths.

Autonomous flying taxis can reduce operational costs by eliminating the need for pilots and increasing the frequency and reliability of services. Companies like EHang are pioneering AI-driven autonomous flying taxis, showcasing the potential of AI to revolutionize urban air mobility. The advancement of AI technology is crucial for achieving fully autonomous operations, which will be a key differentiator in the competitive flying taxi market.

Regional Analysis

North America is a significant player, capturing 40% of the market.

In 2023, North America held a dominant position in the Flying Taxis Market, capturing a substantial 40% share. This leading market position is driven by the region's strong technological infrastructure, significant investments in urban air mobility (UAM), and supportive regulatory environment. The United States, in particular, is at the forefront, with major cities like New York, Los Angeles, and San Francisco emerging as early adopters of flying taxi services. The presence of key industry players, robust R&D activities, and collaborations between private companies and government agencies further enhance North America's market leadership.

Europe represents a rapidly growing region in the flying taxis market, supported by its advanced aerospace industry and strong focus on sustainable urban transportation solutions. The European Union's commitment to reducing carbon emissions and promoting smart city initiatives also drives the adoption of flying taxis in the region, positioning Europe as a significant player in the market.

The Asia Pacific region is poised for significant growth in the flying taxis market, driven by increasing urbanization, rising disposable incomes, and a growing emphasis on innovative transportation solutions. The region's large population base and the need for efficient urban mobility solutions present vast opportunities for market expansion. The Middle East & Africa and Latin America are emerging markets, with increasing government support and strategic investments aimed at enhancing urban mobility and reducing traffic congestion, further contributing to the global growth of the flying taxis market.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global flying taxis market in 2024 is anticipated to experience substantial growth, driven by technological advancements, increasing investments, and growing urban mobility needs. Key players are expected to leverage their expertise in aerospace and automotive industries, forming strategic partnerships to gain a competitive edge.

Airbus SE and The Boeing Company are likely to maintain their leadership positions due to their extensive experience in aviation and robust R&D capabilities. Their established global networks and ongoing projects in urban air mobility (UAM) will enable them to dominate the market. Airbus’s CityAirbus and Boeing’s partnerships in UAM initiatives reflect their commitment to pioneering in this sector.

Volocopter GmbH and EHang Holdings Limited are anticipated to play significant roles with their innovative electric vertical take-off and landing (eVTOL) technologies. Volocopter’s extensive test flights and regulatory advancements, along with EHang’s autonomous flight systems, position them as key innovators driving the market forward.

Joby Aviation Inc. and Lilium GmbH are expected to capitalize on their advanced electric aircraft designs and significant venture capital investments. Their focus on creating efficient, long-range eVTOLs for urban and regional air mobility highlights their potential to reshape the industry.

Vertical Aerospace Group Ltd. and Jaunt Air Mobility Corporation are poised for growth through strategic partnerships and innovative design approaches. Their efforts in developing practical and scalable UAM solutions will enhance their market presence.

Hyundai Motor Company and Wisk Aero LLC bring a unique blend of automotive and aviation expertise to the market. Hyundai’s collaboration with Uber Elevate and Wisk’s backing by Boeing underscore their strategic initiatives to revolutionize urban transportation.

Textron Inc., Guangzhou EHang Intelligent Technology Co. Ltd., Uber Technologies Inc., Bell Textron Inc., and Aurora Flight Sciences Corporation are expected to contribute significantly through their diverse technological advancements and strategic collaborations. These companies’ focus on integrating cutting-edge technology and navigating regulatory landscapes will be crucial for market expansion.

Market Key Players

- Airbus SE

- The Boeing Company

- Volocopter GmbH

- EHang Holdings Limited

- Joby Aviation Inc.

- Lilium GmbH

- Vertical Aerospace Group Ltd.

- Hyundai Motor Company

- Jaunt Air Mobility Corporation

- Wisk Aero LLC

- Textron Inc.

- Guangzhou EHang Intelligent Technology Co. Ltd.

- Uber Technologies Inc.

- Bell Textron Inc.

- Aurora Flight Sciences Corporation

Recent Development

- In April 2023: Volocopter completed the critical design review of VoloCity, gearing up to start production of this electric air taxi, aiming to launch commercial services in cities like Paris.

- In January 2022: Wisk Aero, in partnership with Boeing, secured $450 million to advance the development of certified autonomous electric flight, reinforcing its commitment to autonomous air mobility.

Report Scope

Report Features Description Market Value (2023) USD 3.9 Bn Forecast Revenue (2033) USD 18.2 Bn CAGR (2024-2033) 17.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Avionics, Aerostructures, Propulsion Systems, Software and Services), By Technology (Electric Vertical Take-Off and Landing (eVTOL), Hybrid Electric, Hydrogen Fuel Cell), By Propulsion Type (Electric, Hybrid, Vertical Takeoff and Landing (VTOL), Jet), By Aircraft Type (Multirotor, Lift Plus Cruise, Vectored Thrust, Tail-Sitter), By Passenger Capacity (Single Seat, Double Seat) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Airbus SE, The Boeing Company, Volocopter GmbH, EHang Holdings Limited, Joby Aviation Inc., Lilium GmbH, Vertical Aerospace Group Ltd., Hyundai Motor Company, Jaunt Air Mobility Corporation, Wisk Aero LLC, Textron Inc., Guangzhou EHang Intelligent Technology Co. Ltd., Uber Technologies Inc., Bell Textron Inc., Aurora Flight Sciences Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Airbus SE

- The Boeing Company

- Volocopter GmbH

- EHang Holdings Limited

- Joby Aviation Inc.

- Lilium GmbH

- Vertical Aerospace Group Ltd.

- Hyundai Motor Company

- Jaunt Air Mobility Corporation

- Wisk Aero LLC

- Textron Inc.

- Guangzhou EHang Intelligent Technology Co. Ltd.

- Uber Technologies Inc.

- Bell Textron Inc.

- Aurora Flight Sciences Corporation