Global Ferrous Sulfate Market By Type(Monohydrate, Heptahydrate), By Application(Pharmaceutical, Water Treatment, Cement, Agricultural, Food & Animal Feed, Others (Pigments, etc.)), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48944

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

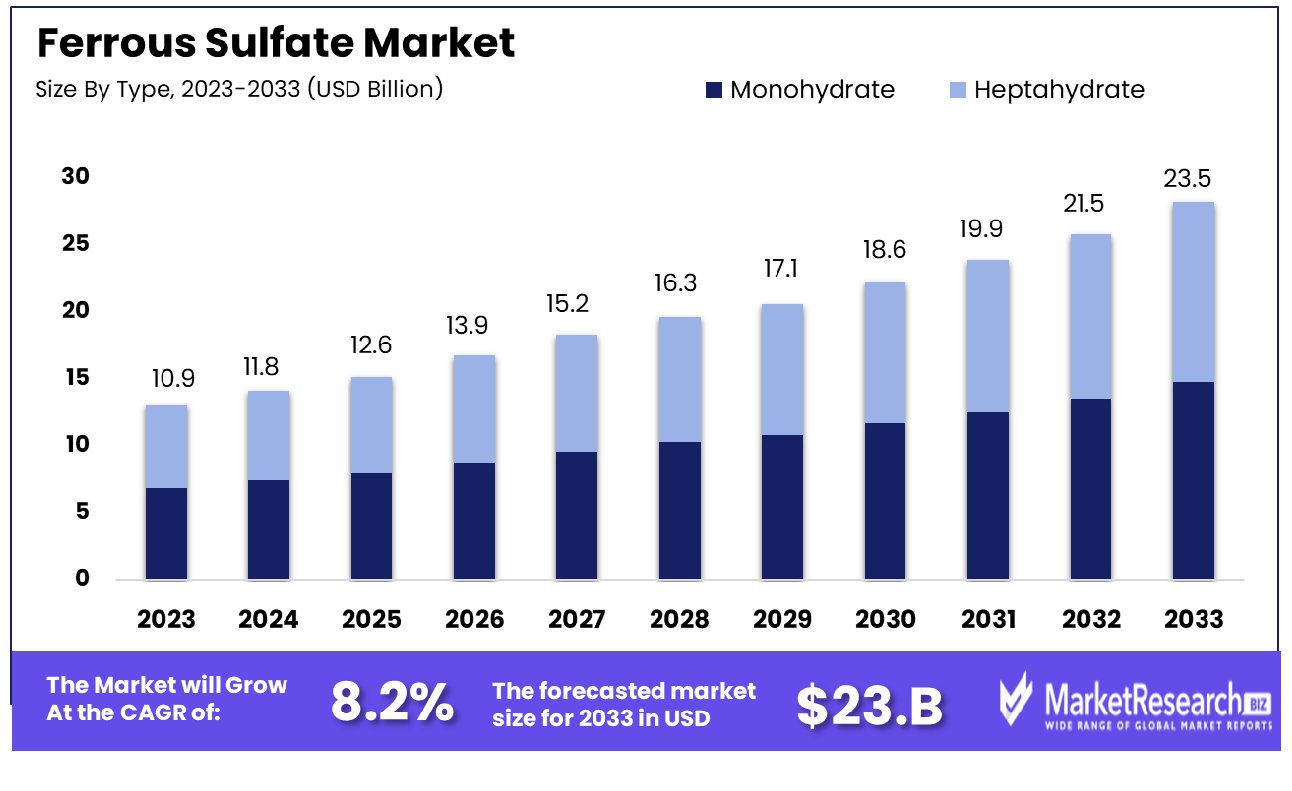

The Global Ferrous Sulfate Market was valued at USD 10.9 billion in 2023. It is expected to reach USD 23.5 billion by 2033, with a CAGR of 8.2% during the forecast period from 2024 to 2033.

The Ferrous Sulfate Market refers to the industry centered around the production, distribution, and utilization of ferrous sulfate, a chemical compound primarily used for its iron content. Predominantly employed in water treatment processes, agriculture as a soil amendment, and in the medical field as a supplement to treat iron deficiency, this market is integral to various sectors.

The market dynamics are influenced by environmental regulations, agricultural productivity demands, and health sector needs. Key stakeholders include manufacturers of ferrous sulfate, agricultural enterprises, healthcare providers, and regulatory bodies, all focusing on efficiency, cost-effectiveness, and sustainability in their operations.

The Ferrous Sulfate Market is increasingly gaining prominence, driven by its critical applications across various industries. In 2023, a systematic review and meta-analysis underscored ferrous sulfate's efficacy in medical applications, revealing that it significantly enhances hemoglobin levels more than other iron compounds, with a mean difference of 0.53 (95% CI 0.22 to 0.83, p<0.001). This finding solidifies its position in the pharmaceutical sector, particularly in addressing iron deficiency anemia. Moreover, its role in agriculture, as a soil amendment, and in water treatment processes highlights its versatility and indispensable nature.

From an industrial standpoint, the demand for ferrous sulfate is influenced by regulatory trends toward environmental sustainability and efficient farming practices, which promote its use. However, challenges such as price volatility and the need for technological advancements in production and recycling processes remain prevalent. Innovations in product formulation and application methods are expected to open new market avenues and enhance its competitive edge.

Furthermore, the market's potential expansion is illustrated through a hypothetical calculation from recent studies, suggesting the amount of ferrous sulfate heptahydrate required to fortify 100 kg of wheat with 10 ppm of iron. Although this scenario is not derived from current real-world data, it indicates possible growth areas and applications that could be explored further as global nutritional standards evolve. This analytical projection not only serves as a theoretical exercise but also points to significant opportunities for stakeholders to leverage ferrous sulfate in enhancing food fortification processes.

Key Takeaways

- Market Growth: The Global Ferrous Sulfate Market was valued at USD 10.9 billion in 2023. It is expected to reach USD 23.5 billion by 2033, with a CAGR of 8.2% during the forecast period from 2024 to 2033.

- By Type: Monohydrate dominates the market type, holding a substantial 55% share.

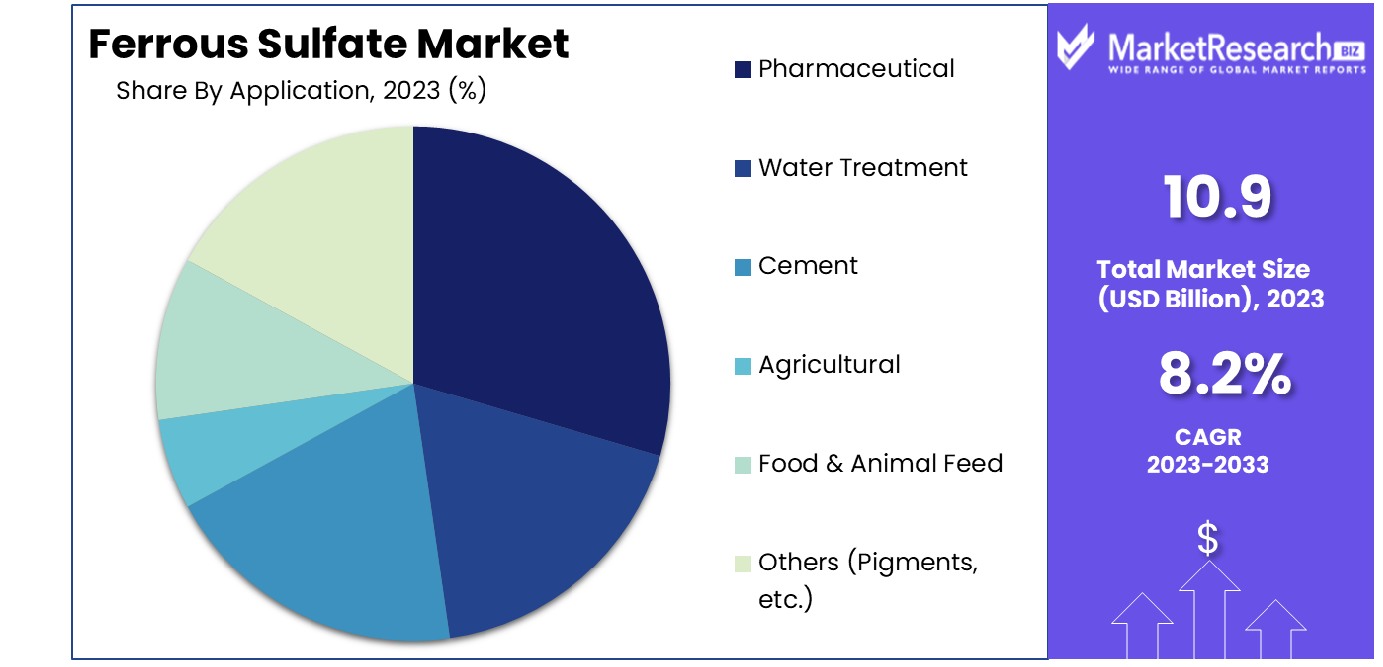

- By Application: Pharmaceutical uses lead, capturing 30% of the market.

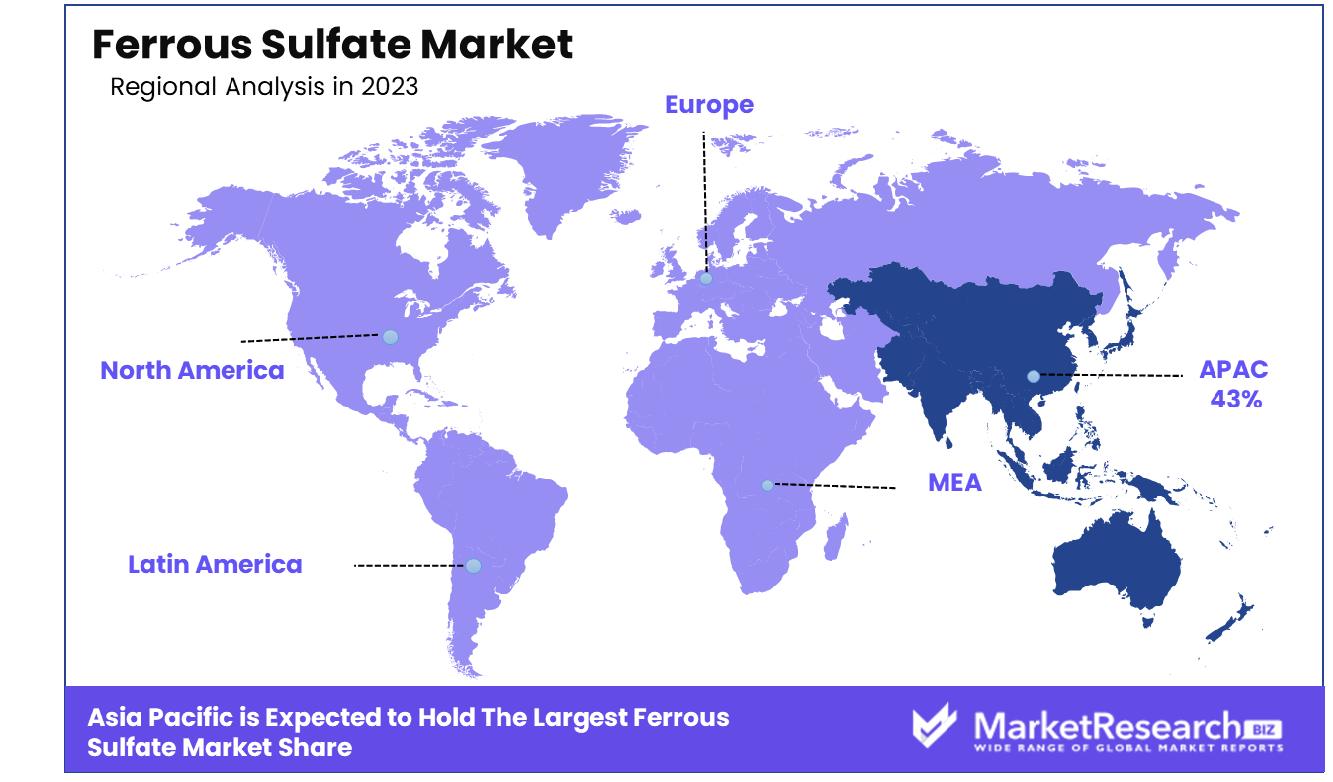

- Regional Dominance: Asia-Pacific dominates the Ferrous Sulfate Market with a 43% share.

Driving factors

Enhanced Use in Water Treatment Applications

The increasing demand for ferrous sulfate in water treatment applications is a pivotal driver of market growth. Ferrous sulfate is employed extensively to precipitate phosphate, thus reducing algae growth and improving water quality in treatment facilities. This application is crucial in regions with stringent environmental regulations concerning water purity.

The expansion of the global water treatment industry, projected to grow at a compound annual growth rate (CAGR) of over 6% from 2021 to 2028, directly correlates with increased consumption of ferrous sulfate. Consequently, the rising emphasis on sustainable water management practices worldwide enhances the demand for effective and economical treatment chemicals, thereby bolstering the ferrous sulfate market.

Expansion in Agricultural Applications

Growth in the agriculture sector significantly impacts the demand for ferrous sulfate, which is used as a soil amendment to correct iron deficiency. Iron deficiency in soil can lead to chlorosis in plants, impacting agricultural productivity. The global push towards higher agricultural yields necessitates the use of soil amendments to enhance soil quality and crop health.

As the agriculture industry expands, driven by the need to feed a growing global population projected to reach 9.7 billion by 2050, the demand for ferrous sulfate is expected to rise concurrently. This trend is supported by the increasing adoption of precision farming techniques that optimize resource use and increase the efficacy of soil amendments like ferrous sulfate.

Rising Demand in Iron Compound Production

The demand for ferrous sulfate in the production of other iron compounds also contributes significantly to market growth. Ferrous sulfate serves as a primary feedstock in the manufacture of ferric oxide, which is used in pigments, and the steel industry for purification processes. The growth of these downstream industries propels the demand for ferrous sulfate.

As global construction and manufacturing sectors recover and expand, particularly in emerging economies, the requirement for iron compounds escalates. This upsurge is anticipated to drive the ferrous sulfate market forward, with a compounded effect from the rising urbanization and industrial activities that demand more iron-based products.

Restraining Factors

Environmental Impact of Mining and Processing

Environmental concerns associated with the mining and processing of ferrous sulfate significantly restrain market growth. The extraction and processing phases of ferrous sulfate production involve considerable energy consumption and potential pollution, which can lead to soil and water contamination. Regulatory bodies worldwide have tightened environmental regulations, compelling industries to adopt more sustainable practices or face heavy penalties.

These regulatory pressures increase operational costs and could limit production capacities, thereby restraining the growth of the ferrous sulfate market. Moreover, as public and governmental focus on environmental sustainability intensifies, companies in the ferrous sulfate market may need to invest in cleaner, more sustainable technologies, which could initially slow market growth due to the high cost of innovation and implementation.

Competition from Alternative Products

The availability of alternative products that offer similar benefits also poses a challenge to the ferrous sulfate market. Products such as ferric sulfate, poly aluminum chloride, and other organic compounds are being used increasingly in applications like water treatment and soil amendments due to their lower environmental impact and enhanced efficacy in certain conditions.

For instance, these alternatives often require lower dosages and have reduced sludge production in water treatment processes, making them more appealing to end-users seeking cost-effective and environmentally friendly solutions. As the efficacy of these alternatives becomes more widely recognized and their costs decrease due to technological advancements and increased production, the market for ferrous sulfate could face significant competition, impacting its growth trajectory.

By Type Analysis

Monohydrate ferrous sulfate dominates the market by type, holding a substantial 55% of the global share.

In 2023, Monohydrate held a dominant market position in the By Type segment of the Ferrous Sulfate Market, capturing more than a 55% share. This prominent stance is attributed to its extensive application across various industries, including water treatment, agriculture, and pharmaceuticals. Monohydrate ferrous sulfate is preferred for its high purity and effectiveness in treating iron deficiency in soils and as a coagulant in water treatment processes. Its significant role in the pharmaceutical sector, particularly in iron supplementation products, underscores its dominance. The form's stability and ease of handling further enhance its applicability, supporting its widespread adoption over other forms.

Conversely, Heptahydrate, which holds the remainder of the market share, is utilized primarily in applications where lower purity levels are acceptable or where cost considerations are paramount. This form is commonly used in large-scale industrial applications such as pigment production and as a reducing agent in cement. Heptahydrate's hygroscopic nature makes it suitable for these applications, although it is less favored in high-purity applications like pharmaceuticals and precision agriculture.

The differing physical and chemical properties of these types underline their specific market niches. While Monohydrate leads due to its versatility and efficacy, Heptahydrate remains integral in specific industrial applications, contributing to the overall diversity and resilience of the Ferrous Sulfate Market. The ongoing research and development in production methods and potential new applications for both types are likely to further shape their market dynamics and opportunities for growth.

By Application Analysis

In applications, pharmaceutical uses lead, commanding 30% of the market, highlighting its critical role in healthcare.

In 2023, Pharmaceuticals held a dominant market position in the By Application segment of the Ferrous Sulfate Market, capturing more than a 30% share. This leadership is primarily driven by the global increase in healthcare initiatives and the rising prevalence of iron deficiency anemia, which has boosted the demand for iron supplements, where ferrous sulfate is a key ingredient. The pharmaceutical industry’s rigorous standards for purity and efficacy favor the use of high-quality ferrous sulfate, ensuring sustained demand within this sector.

Water Treatment follows closely, leveraging ferrous sulfate for its properties as a flocculant to remove impurities and contaminants from water. This application is critical in both developed and developing regions that are enhancing their water treatment infrastructure to meet higher regulatory standards and public health goals.

The Cement industry also integrates ferrous sulfate to improve the color and strength of concrete, contributing significantly to its market share. Its role in reducing chromium VI levels in cement makes it indispensable for meeting environmental and health regulations in the construction industry.

In Agricultural applications, ferrous sulfate is used to correct soil pH and remedy iron chlorosis in plants, supporting higher crop yields and better-quality agricultural products. This segment remains vital due to the expanding agricultural activities worldwide.

The Food & Animal Feed segment utilizes ferrous sulfate as a nutritional additive to fortify foods and feeds with iron, thereby enhancing nutritional value and promoting health.

Other applications, including the use in Pigments, etc., although smaller, recognize ferrous sulfate’s utility in varied industrial processes, contributing to the overall market diversity and resilience. Each segment underscores the versatile applications of ferrous sulfate, maintaining its broad market relevance and potential for growth across multiple industries.

Key Market Segments

By Type

- Monohydrate

- Heptahydrate

By Application

- Pharmaceutical

- Water Treatment

- Cement

- Agricultural

- Food & Animal Feed

- Others (Pigments, etc.)

Growth Opportunity

Expansion in the Pharmaceutical Sector

In 2023, significant growth opportunities for the global Ferrous Sulfate Market are anticipated in the pharmaceutical industry, where ferrous sulfate is increasingly used as a nutritional supplement. As public health awareness rises and preventive healthcare becomes a priority worldwide, the demand for dietary supplements is surging. Ferrous sulfate, being a crucial source of iron, is essential for combating iron deficiency anemia—a condition prevalent across various demographic segments globally.

The expanding pharmaceutical sector, driven by a growing global population and increased healthcare spending, which is projected to rise by 5% annually through 2023, positions ferrous sulfate as a key component in nutritional therapies. This trend is likely to augment the market’s expansion as it taps into the health and wellness sector, providing substantial growth avenues.

Development of Eco-friendly Production Methods

Another promising growth opportunity for the Ferrous Sulfate Market lies in the development of innovative, environmentally friendly production methods. The increasing stringency of environmental regulations and the rising societal push towards sustainable practices urge the industry to innovate cleaner production technologies. Market leaders are thus incentivized to invest in research and development to discover and commercialize production processes that minimize environmental impact.

Such advancements not only comply with regulatory standards but also enhance the market appeal of ferrous sulfate by aligning with the global shift toward sustainability. Companies that pioneer these green technologies are likely to gain competitive advantages, securing a larger share in a market that is increasingly driven by eco-conscious consumer and business practices. These innovations are expected to drive considerable market growth by opening new industrial applications and improving market penetration in regulated environments.

Latest Trends

Increased Recycling of Ferrous Waste Materials

A notable trend in the global Ferrous Sulfate Market in 2023 is the increased recycling of ferrous waste materials for the production of ferrous sulfate. This trend aligns with global sustainability goals by promoting the circular economy model and reducing waste. Industries generating ferrous waste are now seeing the value in recycling these materials, turning what was once considered scrap into a valuable commodity.

This practice not only mitigates the environmental impact associated with mining and raw material processing but also reduces production costs for ferrous sulfate manufacturers. The adoption of recycling practices is being supported by advancements in technology that allow for more efficient recovery and processing of ferrous waste into high-quality ferrous sulfate. This trend is expected to gain momentum as industries continue to face pressure to implement sustainable and cost-effective production methods, providing a steady growth trajectory for the market.

Fortification of Foods with Ferrous Sulfate

Another significant trend in 2023 is the growing use of ferrous sulfate in the fortification of foods to combat iron deficiency. Iron deficiency remains a global health concern, affecting large populations in both developing and developed countries. Governments and health organizations are increasingly advocating for the fortification of staple foods with iron to improve public health outcomes.

Ferrous sulfate, due to its high bioavailability and effectiveness in raising hemoglobin levels, is a preferred choice for this purpose. The expansion of food fortification programs across the globe, particularly in regions with high rates of iron deficiency anemia, is expected to drive substantial demand for ferrous sulfate. This trend not only highlights the market's potential for growth in the food sector but also underscores its role in addressing critical public health issues.

Regional Analysis

The Asia-Pacific region dominates the Ferrous Sulfate Market, holding a significant 43% share of the global demand.

In analyzing the global Ferrous Sulfate Market, regional segmentation highlights distinct dynamics and growth patterns. Asia-Pacific is the most dominant region, accounting for approximately 43% of the global market. This substantial share is driven by the region's extensive agricultural activities, particularly in countries like China and India, where there is a high demand for ferrous sulfate as a soil amendment. Additionally, the rapid industrialization in these countries contributes to the demand for water treatment and pigment industries.

North America and Europe also present significant markets for ferrous sulfate, primarily driven by stringent environmental regulations that promote the use of ferrous sulfate in water treatment processes to reduce phosphorus levels. North America, with its advanced agricultural technologies, also sees substantial use of ferrous sulfate in soil conditioning and fortification efforts.

The market in Latin America is growing, fueled by the agricultural sector in countries such as Brazil and Argentina, where there is increasing use of ferrous sulfate to improve crop yield and soil quality. This region is also seeing a gradual increase in water treatment projects, which utilize ferrous sulfate for contaminant removal.

Middle East & Africa show potential for market growth due to the developing agricultural and water treatment industries. Efforts to improve food security and water quality in countries like South Africa and the Gulf Cooperation Council (GCC) countries are expected to drive the demand for ferrous sulfate.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Ferrous Sulfate Market sees significant contributions and competitive dynamics from key players such as Chemland Group, Coogee, Crown Technology, Inc., Kemira, Merck KGaA, Pencco, Inc., Rech Chemicals Co Ltd, Thermo Fisher Scientific Inc., Venator Materials PLC, and KRONOS INTERNATIONAL, Inc. These companies are pivotal in shaping market trends through strategic expansions, technological innovations, and production capacities.

Kemira and Merck KGaA stand out for their robust commitment to research and development, driving innovations in ferrous sulfate applications, particularly in pharmaceuticals and water treatment. Their focus on sustainable and efficient production methods positions them as leaders in the market, especially in regions with strict environmental regulations.

Venator Materials PLC and KRONOS INTERNATIONAL, Inc. leverage their extensive global networks to ensure a consistent supply of ferrous sulfate, catering to the demand in diverse industries from water treatment to pigments and coatings. Their strategic global presence helps mitigate regional fluctuations in demand and supply.

Coogee and Pencco, Inc. focus on tailored solutions for the agriculture and water treatment sectors, enhancing their market share through specialized products that meet specific local requirements. Their expertise in application-specific formulations allows them to secure strong positions in niche markets.

Thermo Fisher Scientific Inc. utilizes its scientific and technological capabilities to ensure high purity and quality in ferrous sulfate, making it a preferred supplier for critical applications, including scientific research and laboratory use.

Rech Chemicals Co. Ltd and Crown Technology, Inc. emphasize cost-effective production while expanding their footprint in emerging markets, particularly in Asia and Africa, where the demand for water treatment chemicals and agricultural amendments is growing.

Market Key Players

- Chemland Group

- Coogee

- Crown Technology, Inc.

- Kemira

- Merck KGaA

- Pencco, Inc.

- Rech Chemicals Co Ltd

- Thermo Fisher Scientific Inc.

- Venator Materials PLC

- KRONOS INTERNATIONAL, Inc.

Recent Development

- In May 2024, Chemland Group, a key player in the chemicals market, introduced a new high-purity ferrous sulfate product aimed at the pharmaceutical industry. This product is designed to meet stringent quality standards and support the production of medicines and supplements. The launch aims to address the increasing demand for high-quality ferrous sulfate in the healthcare sector.

- In April 2024, Coogee, a company known for its chemical manufacturing and distribution, expanded its production capacity for ferrous sulfate by 20%. This expansion is aimed at meeting the rising demand in agricultural applications, where ferrous sulfate is used as a soil amendment. Coogee's investment in production infrastructure highlights its commitment to growth and customer satisfaction.

- In March 2024, Crown Technology, Inc., a U.S.-based provider of metal surface treatment chemicals, launched a new ferrous sulfate-based product for water treatment. This innovative product is designed to improve the efficiency of water purification processes. The launch reflects Crown Technology's ongoing efforts to develop environmentally friendly and effective solutions for industrial applications.

Report Scope

Report Features Description Market Value (2023) USD 10.9 Billion Forecast Revenue (2033) USD 23.5 Billion CAGR (2024-2032) 8.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Monohydrate, Heptahydrate), By Application(Pharmaceutical, Water Treatment, Cement, Agricultural, Food & Animal Feed, Others (Pigments, etc.)) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Chemland Group, Coogee, Crown Technology, Inc., Kemira, Merck KGaA, Pencco, Inc., Rech Chemicals Co Ltd, Thermo Fisher Scientific Inc., Venator Materials PLC, KRONOS INTERNATIONAL, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) - Market Growth: The Global Ferrous Sulfate Market was valued at USD 10.9 billion in 2023. It is expected to reach USD 23.5 billion by 2033, with a CAGR of 8.2% during the forecast period from 2024 to 2033.

-

-

- Chemland Group

- Coogee

- Crown Technology, Inc.

- Kemira

- Merck KGaA

- Pencco, Inc.

- Rech Chemicals Co Ltd

- Thermo Fisher Scientific Inc.

- Venator Materials PLC

- KRONOS INTERNATIONAL, Inc.