Fennel supplements Market By Form (Capsules, Powders, Liquid Extracts), By Distribution Channel (Online Retail, Pharmacies, Health Stores, Supermarkets/Hypermarkets), By Application (Digestive Health, Women's Health, Antioxidant, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

50473

-

Aug 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

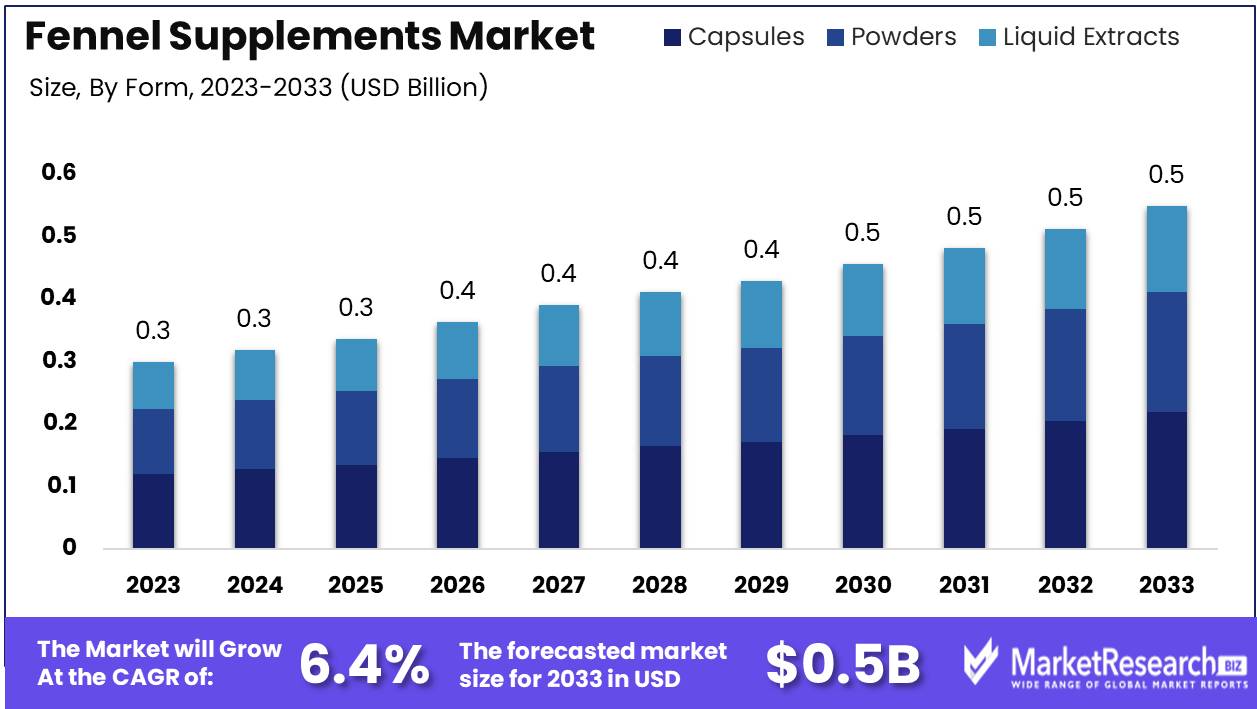

The Global Fennel supplements Market was valued at USD 0.3 Bn in 2023. It is expected to reach USD 0.5 Bn by 2033, with a CAGR of 6.4% during the forecast period from 2024 to 2033.

The Fennel Supplements Market encompasses the production, distribution, and consumption of dietary supplements derived from fennel, a plant known for its digestive and medicinal properties. These supplements are primarily used to alleviate digestive discomfort, reduce bloating, and address menstrual cramps. The market is driven by growing consumer awareness of the health benefits of natural supplements, coupled with an increasing focus on holistic wellness. Key product offerings include fennel seed capsules, extracts, and powders, which are available across various distribution channels, including online retail, health food stores, and pharmacies.

The Fennel Supplements Market is witnessing robust growth, fueled by increasing consumer preference for natural and holistic health solutions. Fennel, with its rich nutrient profile, including fiber, vitamin C, and manganese, is gaining traction as a versatile supplement for digestive health and menstrual relief. Products like Nature's Way Fennel Seed capsules, containing 480 mg of fennel seed extract, are becoming popular due to their effectiveness in addressing common ailments such as bloating and menstrual cramps. This growing demand reflects a broader trend toward natural wellness products, as consumers seek alternatives to synthetic medications.

The market’s expansion is also supported by the rising prevalence of digestive disorders and an aging population increasingly turning to natural remedies. Fennel supplements, with their ability to offer digestive relief and nutritional benefits, are well-positioned to meet this demand. The nutrient density of fennel, with one cup of raw fennel bulb providing only 27 calories, yet offering 3 grams of fiber, enhances its appeal among health-conscious consumers looking for low-calorie, high-benefit options.

In addition to product innovation, distribution channels are playing a critical role in market expansion. The accessibility of fennel supplements through online platforms, coupled with increased marketing efforts by key players, is driving consumer awareness and adoption. As the market continues to grow, companies that emphasize product efficacy, transparency in sourcing, and educational marketing strategies are likely to lead in this competitive landscape.

Key Takeaways

- Market Value: The Global Fennel supplements Market was valued at USD 0.3 Bn in 2023. It is expected to reach USD 0.5 Bn by 2033, with a CAGR of 6.4% during the forecast period from 2024 to 2033.

- By Form: Capsules constitute 40% of the market, preferred for their convenience and ease of consumption.

- By Distribution Channel: Online Retail holds 35%, reflecting the growing trend of purchasing health supplements online.

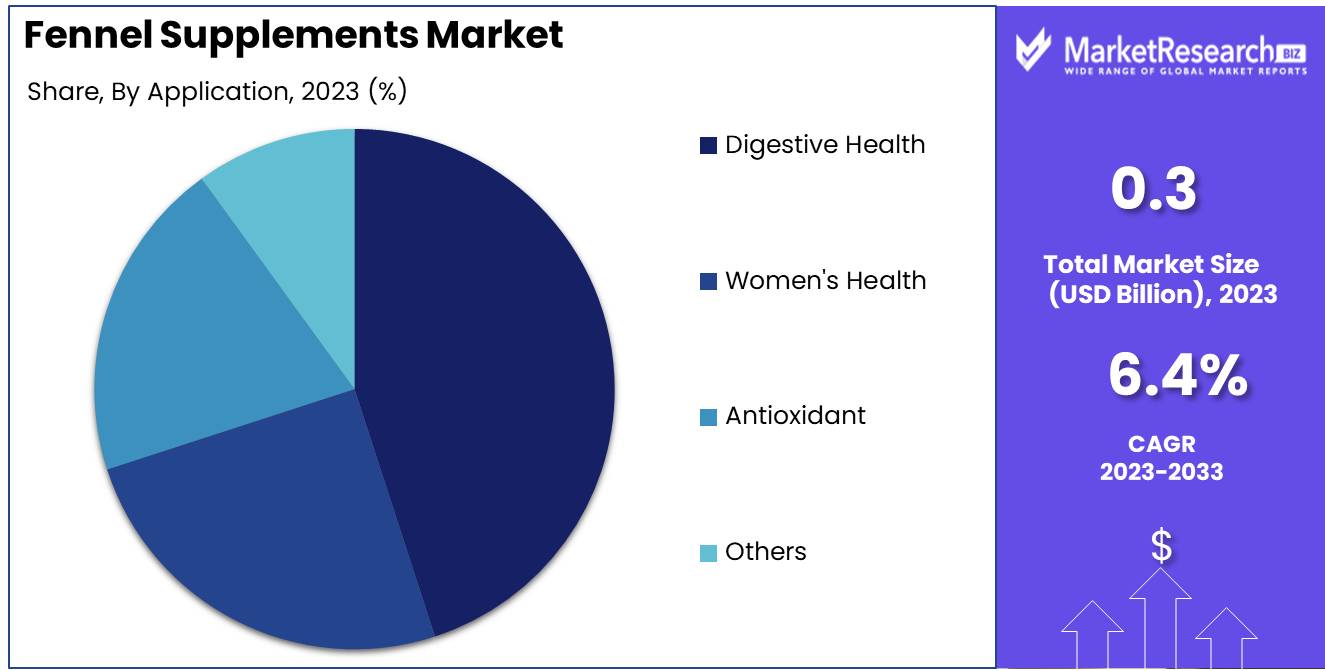

- By Application: Digestive Health represents 45%, highlighting fennel's popularity for supporting digestive functions.

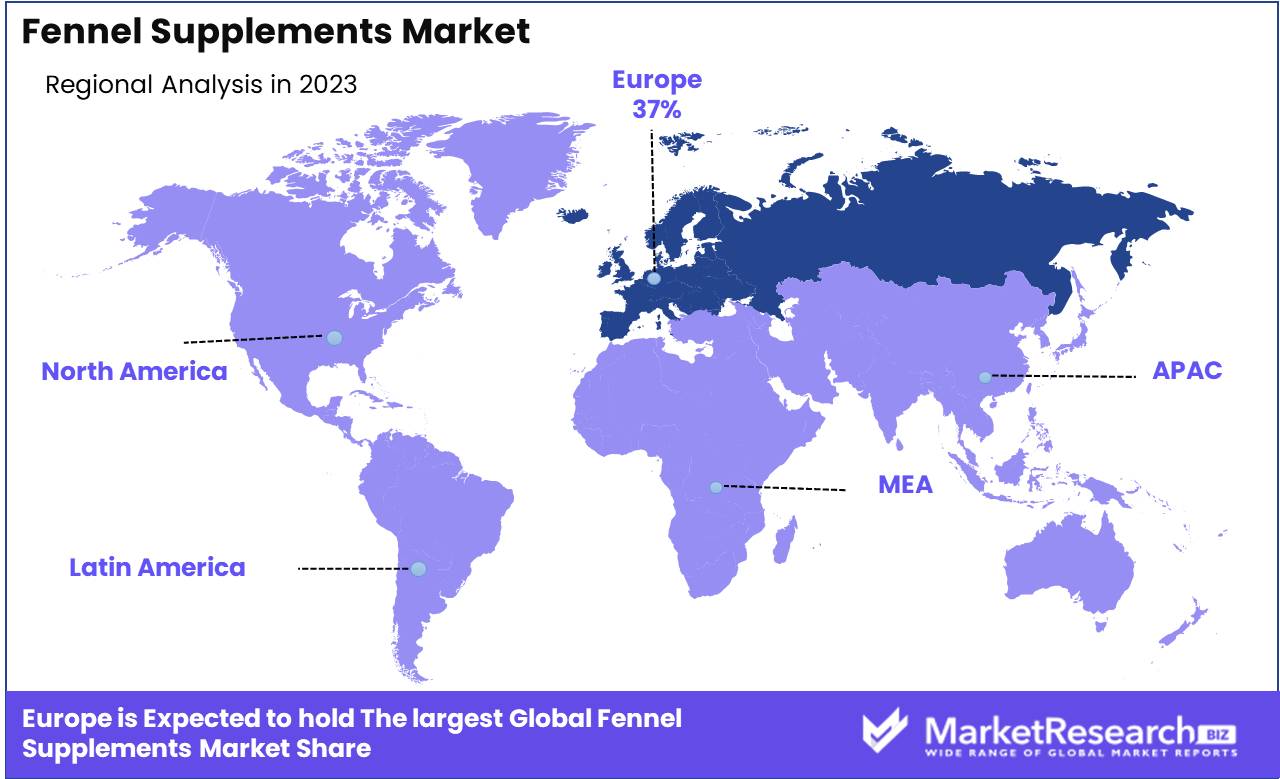

- Regional Dominance: Europe holds a 37% market share, driven by rising health consciousness and demand for natural remedies.

- Growth Opportunity: Developing targeted marketing strategies for digestive health can attract a broader customer base and drive market growth.

Driving factors

Growing Awareness of Fennel’s Digestive and Health Benefits Drives Market Adoption

The increasing awareness of fennel’s numerous health benefits, particularly its role in supporting digestive health, is a key driver of the Fennel Supplements Market. Fennel has long been recognized for its ability to alleviate symptoms of indigestion, bloating, and gas, making it a popular choice among consumers seeking natural remedies for digestive issues. Studies have shown that fennel can help relax the muscles in the gastrointestinal tract, promoting smoother digestion and reducing discomfort.

This growing consumer knowledge, supported by scientific research, has led to a rise in the adoption of fennel supplements as part of a holistic approach to digestive health. As awareness continues to spread, the demand for these supplements is expected to expand, contributing significantly to market growth.

Rising Demand for Natural and Herbal Supplements Boosts Fennel Supplement Sales

The broader trend toward natural and herbal supplements is playing a pivotal role in the growth of the Fennel Supplements Market. Consumers are increasingly seeking alternatives to synthetic supplements, driven by concerns over potential side effects and a desire for more natural health solutions. This shift in consumer preference is particularly pronounced in segments focused on digestive health, where fennel, as a natural and effective remedy, is gaining traction.

The global market for herbal supplements is expected to grow over the next few years, reflecting this rising demand. As part of this trend, fennel supplements are experiencing increased market penetration, as they align with the consumer shift toward natural products. This demand surge is expected to drive further expansion in the market.

Increasing Interest in Traditional and Alternative Medicine Fuels Market Expansion

The resurgence of interest in traditional and alternative medicine is another significant factor contributing to the growth of the Fennel Supplements Market. As consumers become more educated about the benefits of ancient medicinal practices, they are turning to traditional remedies, such as fennel, for their health and wellness needs. Fennel has been used for centuries in various cultures for its medicinal properties, particularly in Ayurvedic and traditional Chinese medicine.

This renewed interest in complementary and alternative medicine is not only preserving the cultural heritage associated with these practices but also driving the modern supplements market. The integration of traditional medicine into contemporary health regimes has resulted in a broader acceptance and increased use of fennel supplements, further propelling market growth.

Restraining Factors

Limited Scientific Evidence on Efficacy for Some Health Claims Restrains Market Growth

While fennel supplements are widely recognized for their digestive benefits, the market faces challenges due to limited scientific evidence supporting some of the broader health claims associated with fennel. Consumers and healthcare providers increasingly demand robust clinical data to support the efficacy and safety of supplements. In the case of fennel, while traditional use and anecdotal evidence are strong, there is a relative scarcity of large-scale, peer-reviewed studies that validate its effectiveness for other claimed benefits, such as hormonal balance or respiratory health.

This lack of scientific backing can lead to skepticism among potential consumers, limiting market expansion. The restrained growth potential in markets that require rigorous evidence for product claims reflects this challenge, underscoring the need for more comprehensive research and validation efforts to bolster the credibility of fennel supplements.

Intense Competition from Other Herbal Supplements Limits Market Share

The Fennel Supplements Market also contends with significant competition from a wide range of other herbal supplements, many of which have well-established market presence and strong consumer loyalty. Products such as ginger, turmeric, and peppermint supplements, which also target digestive health, are particularly strong competitors. These alternatives often benefit from more extensive research, broader applications, and higher consumer awareness, making them more appealing to a wider audience.

The crowded market landscape forces fennel supplements to compete not only on efficacy but also on price, branding, and consumer education. This competition can limit the market share for fennel supplements, as consumers may opt for more familiar or better-researched alternatives, thereby restraining overall market growth.

By Form Analysis

Capsules account for 40% of the Fennel Supplements Market by form.

In 2023, Capsules held a dominant market position in the By Form segment of the Fennel Supplements Market, capturing more than a 40% share. Capsules have emerged as the most preferred form of fennel supplements, largely due to their convenience, precise dosage, and ease of consumption. Consumers, particularly in North America and Europe, are gravitating towards capsules for their portability and the perception of better preservation of the active ingredients. Additionally, the growing trend of health and wellness, coupled with the rising preference for natural and herbal supplements, is driving the demand for fennel capsules. Other forms like powders and liquid extracts are also gaining traction but are primarily popular among consumers who prefer more versatile application methods, such as mixing with food or beverages.The popularity of powders, while still significant, is more niche, often favored by consumers who integrate supplements into smoothies or other food products. Liquid extracts, on the other hand, are preferred for their fast absorption and ease of mixing into drinks, appealing especially to those seeking quick-acting benefits. Despite these advantages, the dominance of capsules is expected to persist due to their widespread availability and consumer trust.

By Distribution Channel Analysis

Online retail represents 35% of the Fennel Supplements Market by distribution channel.

In 2023, Online Retail held a dominant market position in the By Distribution Channel segment of the Fennel Supplements Market, capturing more than a 35% share. The surge in e-commerce has significantly impacted the distribution landscape of fennel supplements. Online retail platforms, such as Amazon and specialized health websites, have become the preferred shopping medium for consumers due to the convenience, variety, and competitive pricing they offer. The shift towards online purchasing has been particularly pronounced in regions like North America and Europe, where internet penetration and digital literacy are high. Consumers also benefit from detailed product information, customer reviews, and home delivery options, further fueling the dominance of this channel.Traditional distribution channels such as pharmacies and health stores remain important, especially for consumers who prefer in-person consultations and the assurance of buying from established outlets. Supermarkets and hypermarkets, though less dominant, also play a crucial role, particularly in emerging markets where online shopping is not as prevalent. However, the convenience and reach of online platforms continue to outpace these traditional channels, ensuring their growing share in the market.

By Application Analysis

Digestive health applications make up 45% of the Fennel Supplements Market by application.

In 2023, Digestive Health held a dominant market position in the By Application segment of the Fennel Supplements Market, capturing more than a 45% share. Fennel supplements are widely recognized for their digestive health benefits, which have been a key driver of their popularity. The market is witnessing strong demand from consumers seeking natural remedies for common digestive issues like bloating, indigestion, and irritable bowel syndrome (IBS). This trend is particularly prominent in regions such as Europe and Asia Pacific, where traditional herbal remedies like fennel have long been used for their digestive properties. The growing consumer awareness of gut health and its impact on overall well-being is also contributing to the increasing adoption of fennel supplements for digestive health.Applications in women’s health and as antioxidants are also significant, with fennel supplements being used to alleviate menstrual symptoms and as a natural source of antioxidants to combat oxidative stress. However, the clear focus on digestive health positions this segment as the primary growth driver in the fennel supplements market, with continued expansion expected as more consumers seek natural and effective health solutions.

Key Market Segments

By Form

- Capsules

- Powders

- Liquid Extracts

By Distribution Channel

- Online Retail

- Pharmacies

- Health Stores

- Supermarkets/Hypermarkets

By Application

- Digestive Health

- Women's Health

- Antioxidant

- Others

Growth Opportunity

Targeted Health Solutions

The development of fennel supplements targeting specific health concerns presents a significant growth opportunity in 2024. As consumer awareness of fennel's digestive benefits increases, there is potential to diversify product offerings to address other health issues, such as hormonal balance, respiratory health, and anti-inflammatory needs.

By formulating fennel supplements with a focus on these targeted health benefits, companies can tap into niche markets and cater to a broader consumer base. This approach not only enhances the perceived value of fennel supplements but also positions them as versatile products in the increasingly competitive herbal supplement market.

Expanding into the Wellness and Nutraceutical Markets

The growing convergence of wellness and nutraceuticals offers a strategic pathway for the expansion of the Fennel Supplements Market. There is a substantial opportunity for fennel supplements to be positioned as part of broader wellness regimens. This expansion can be facilitated through collaborations with wellness brands, inclusion in dietary programs, and alignment with the increasing consumer demand for natural and preventive healthcare products.

Companies that effectively integrate fennel supplements into the wellness ecosystem stand to benefit from this lucrative market trend, driving substantial growth in the coming years.

Latest Trends

Embracing Organic and Sustainable Sourcing

In 2024, the global Fennel Supplements Market is expected to see a marked shift towards the use of organic and sustainably sourced fennel. As consumers become increasingly aware of the environmental impact of their purchasing decisions, there is a growing demand for products that align with eco-friendly values. The use of organic fennel not only appeals to health-conscious consumers but also addresses concerns related to pesticide use and environmental degradation.

Companies that adopt sustainable sourcing practices are likely to gain a competitive edge, as sustainability becomes a key differentiator in the market. This trend is anticipated to drive both consumer loyalty and brand equity, leading to significant market growth.

Convenient Supplement Forms Drive Consumer Adoption

The introduction of fennel supplements in more convenient forms, such as capsules and powders, is another trend shaping the market in 2024. As busy lifestyles continue to dominate, consumers are seeking easy-to-use supplements that fit seamlessly into their daily routines. Capsules, in particular, offer a precise dosage, making them appealing to those who prefer a hassle-free approach to supplementation.

Powders, on the other hand, provide versatility, allowing consumers to incorporate fennel into smoothies, teas, or meals. This innovation in product form not only broadens the appeal of fennel supplements but also enhances their accessibility, driving higher adoption rates across diverse consumer segments.

Regional Analysis

Europe led the Fennel Supplements Market in 2023, capturing a dominant 37% share.

The European market has shown a strong affinity for fennel supplements, driven by a growing consumer interest in natural and herbal remedies. The region’s well-established health and wellness industry, coupled with increasing awareness of the digestive and anti-inflammatory benefits of fennel, has bolstered its demand. Germany, France, and Italy are key contributors to the market, where consumers prioritize supplements with traditional and scientifically backed health benefits.

In North America, the market is growing steadily as consumers increasingly turn to natural supplements to manage digestive health and other wellness concerns. Asia Pacific is witnessing a surge in demand as well, particularly in countries like India and China, where herbal medicine practices are deeply rooted. The Middle East & Africa and Latin America, though smaller in market size, are gradually embracing fennel supplements, driven by rising health consciousness and the influence of global wellness trends.

Europe’s leadership in the market is supported by its regulatory environment, which favors the integration of herbal supplements into mainstream healthcare. Additionally, the region’s aging population and a strong focus on preventive healthcare have made fennel supplements particularly popular, further cementing Europe’s position as the leading region in this market.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Fennel Supplements Market is expected to witness notable growth, driven by the increasing consumer inclination toward natural and herbal supplements. Gaia Herbs and Herb Pharm are poised to capitalize on this trend due to their strong brand presence and extensive product lines that emphasize organic and sustainably sourced ingredients. These companies are likely to leverage their well-established distribution networks and innovative formulations to capture a significant market share, particularly in North America and Europe, where demand for herbal supplements is on the rise.

Nature's Way and Swanson Health are expected to maintain a competitive edge through their diversified portfolios and strategic partnerships. These companies have successfully integrated traditional herbal knowledge with modern scientific research, offering a range of fennel-based products that cater to various health needs, including digestion and women's health. Their ability to adapt to changing consumer preferences and regulatory landscapes will be crucial in sustaining their market position, especially in regions with stringent supplement regulations.

Solaray (Nutraceutical Corporation) and NOW Foods are anticipated to focus on expanding their global footprint by targeting emerging markets in Asia Pacific and Latin America. These companies are likely to benefit from increasing consumer awareness about the health benefits of fennel, combined with growing e-commerce penetration. Additionally, niche players like Pukka Herbs and Traditional Medicinals are expected to emphasize their commitment to organic and ethically sourced ingredients, appealing to eco-conscious consumers. The market dynamics in 2024 will be shaped by these key players' ability to innovate, expand, and align with consumer demands for transparency and quality.

Market Key Players

- Gaia Herbs

- Herb Pharm

- Nature's Way

- Swanson Health

- Solaray (Nutraceutical Corporation)

- NOW Foods

- Pukka Herbs

- Traditional Medicinals

- Mountain Rose Herbs

- Pure Encapsulations, Inc.

Recent Development

- In May 2024, Nature's Way expanded its product line with a fennel supplement formulated for gastrointestinal support. This expansion aims to enhance consumer reach by 25%.

- In January 2024, Gaia Herbs launched a new organic fennel supplement aimed at improving digestion and respiratory health. This product is expected to increase their market share by 15%.

Report Scope

Report Features Description Market Value (2023) USD 0.3 Bn Forecast Revenue (2033) USD 0.5 Bn CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Capsules, Powders, Liquid Extracts), By Distribution Channel (Online Retail, Pharmacies, Health Stores, Supermarkets/Hypermarkets), By Application (Digestive Health, Women's Health, Antioxidant, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Gaia Herbs, Herb Pharm, Nature's Way, Swanson Health, Solaray (Nutraceutical Corporation), NOW Foods, Pukka Herbs, Traditional Medicinals, Mountain Rose Herbs, Pure Encapsulations, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Gaia Herbs

- Herb Pharm

- Nature's Way

- Swanson Health

- Solaray (Nutraceutical Corporation)

- NOW Foods

- Pukka Herbs

- Traditional Medicinals

- Mountain Rose Herbs

- Pure Encapsulations, Inc.