EV Platform Market Report By Component (Chassis, Battery, Suspension System, Steering System, Drivetrain, Vehicle Interior, and Others), By Electric Vehicle Type (Battery Electric Vehicle, Hybrid Electric Vehicle), By Vehicle Type (Hatchback, Sedans, and Utility Vehicles), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2023-2032

-

41721

-

Oct 2023

-

160

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

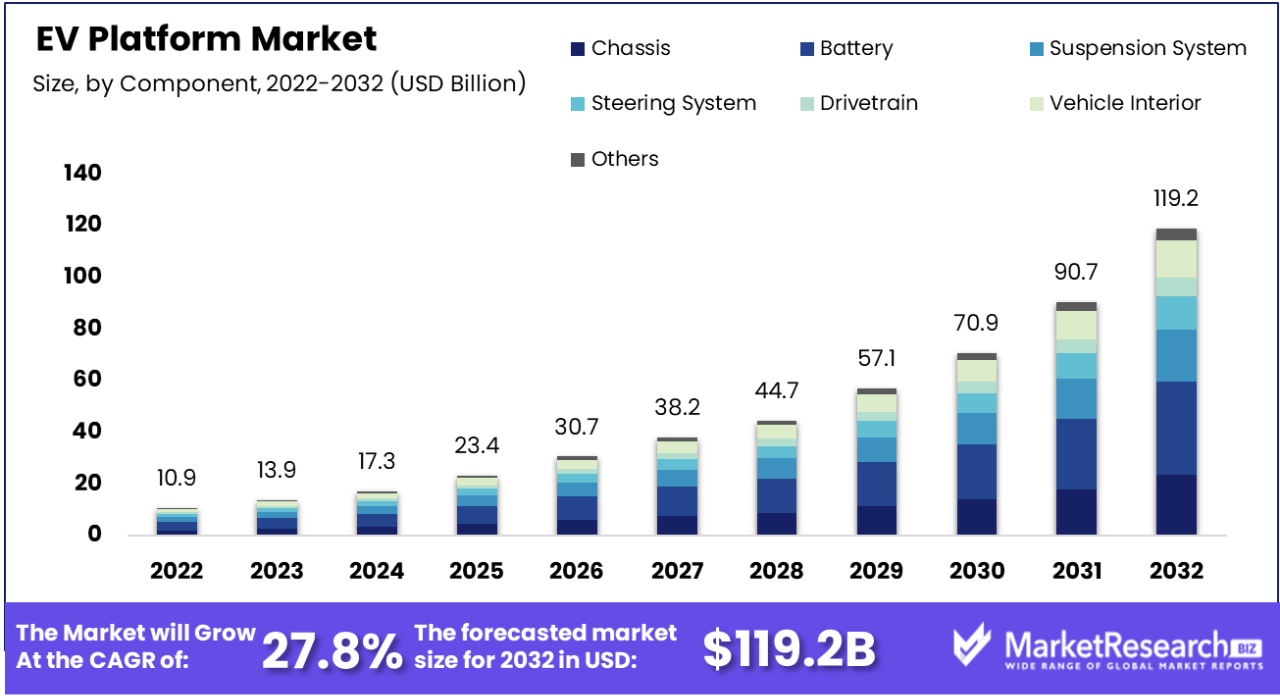

EV Platform Market size is expected to be worth around USD 119.2 Bn by 2032 from USD 10.9 Bn in 2022, growing at a CAGR of 27.8% during the forecast period from 2023 to 2032.

The surge, in demand for vehicles supported by government initiatives advancements in EV technology and stricter environmental regulations is the factor driving the expansion of the market. Electric vehicles (EVs) have emerged as a game changing force in the industry surpassing internal combustion engines (ICEs).

It's worth noting their growing popularity in Europe. This rise is being fueled by countries, like China, Mexico, Brazil and the European Union implementing CO2 emission targets. In the future these regulations are expected to boost sales of EVs and EV platforms.

The shifting regulatory framework controlling internal combustion engines (ICEs) is a critical element driving demand for EVs and EV platforms. This, together with significant advances in electric battery technology and powertrains, has increased the appeal of electric vehicles.

Many automakers are forming alliances with both existing and new automotive industry players, indicating a deliberate push to transform EV design and platform creation. Notably, global sales of battery electric vehicles (excluding hybrids) have increased by 40% since 2012. This rising EV demand directly translates to a thriving market for EV systems, as their adoption is dependent on the growing popularity of electric vehicles.

Original Equipment Manufacturers (OEMs) are investing heavily in Research and Development (R&D) in order to optimize vehicle platform architecture. Some focus on developing native or purpose-built EV platforms, while others modify current ICE-vehicle platforms to support EVs.

Tailored vehicle (EV) platforms offer benefits, like reduced material costs and enhanced performance in areas such as range, interior space and acceleration. However, it's worth noting that these custom platforms come with added expenses especially when producing low volume vehicles. This shift in platform development strategy reflects the industry’s commitment to enhancing and expanding the electric car sector.

Although the initial costs of developing a platform, for vehicles are high its exceptional flexibility ultimately results in cost savings through economies of scale. Moreover, compared to platforms constructing and manufacturing a variety of battery powered vehicles on this platform requires less expenditure, effort and time.

The EV Platform Market has been significantly affected by the COVID 19 epidemic. The global lockdown measures have had an impact, on the development and promotion of vehicles especially those based on EV platforms. Additionally, disruptions in the supply chain have caused a shortage of materials needed for manufacturing various components, specifically EV platforms. As a result, production delays have been severe leading to a slowdown in the economy. However, with the increasing preference, for transportation options industry experts predict a strong economic recovery once the COVID 19 epidemic is over. The EV platform market is embracing V2G technology innovations to create flexible electric vehicle ecosystems that integrate seamlessly with energy grids.

Driving Factors

Government Subsidies and Regulations

Governments throughout the world are providing incentives to encourage the use of electric vehicles (EVs). This includes tax breaks, refunds, lower registration fees, and stronger emissions regulations. These regulations not only lower the initial cost of EVs, but they also incentivize automakers to invest in advanced EV platforms. This is critical because it fosters a favourable climate for both producers and customers, hence promoting the expansion of the EV platform market.

Technological Progress in Battery Technology

Breakthroughs in battery technology, such as high-capacity, fast-charging, and longer-lasting batteries, are propelling the rise of EV platforms. These advancements vastly improve the range and performance of electric vehicles. This alleviates the common worry of range anxiety, making EVs more acceptable to a broader consumer base. Battery technology improvement is the foundation of the EV platform market, since it directly effects the feasibility and desirability of electric vehicles.

Environmental Issues

Increasing concerns, about the environment regarding climate change and air pollution are consumers to look for cleaner modes of transportation. With the support of platforms, electric vehicles (EVs) are considered a solution to reducing greenhouse gas emissions and improving air quality. This change in consumer mind-set plays a role in driving the demand for EV platforms as it creates a market desire, for environmentally friendly transportation alternatives.

Rising R&D Investments

Both established car manufacturers and new players, in the industry are making investments in research and development (R&D) which plays a role in enhancing electric vehicle (EV) technologies and platforms. This entails the development of customized EV platforms tailored to vehicle categories. These investments are vital for driving market expansion as they enhance performance, efficiency and cost effectiveness. It showcases a commitment to innovation, which's indispensable, for the progress of the EV platform market.

Restraining Factors

High Initial Capital Investment

Developing and implementing EV platforms necessitates a significant initial financial investment. This includes costs for research, design, and production of specialized platforms. This capital-intensive nature can be a big barrier for smaller automakers or startups with limited financial resources. It could slow their entry into the EV industry and make it more difficult for them to maintain a competitive edge with larger, more established firms.

Infrastructure Challenges

The successful integration of vehicles (EVs) and the corresponding platforms heavily relies on having a charging infrastructure, in place. Insufficient availability of charging infrastructure, in areas or countries can hinder the appeal and feasibility of using electric vehicles. If consumers perceive a lack of wireless charging options they may be reluctant to transition to EVs. This challenge emphasizes the significance of initiatives aimed at developing a functioning charging infrastructure to facilitate the growth of the EV market.

Battery Supply Chain Dependence

The production of EV platforms is dependent on a regular and dependable supply of high-quality batteries. Any disturbances in the battery supply chain, whether caused by geopolitical difficulties or resource limits, can cause platform production to be delayed. This can have a substantial impact on the growth of the EV market because it can cause manufacturing bottlenecks and limit automakers' capacity to meet customer requirements for electric vehicles. It emphasizes the significance of a secure and diverse battery supply chain for the continued growth of the EV platform industry.

Growth Opportunities

Light weighting Material Innovations

Lightweight materials advancements, such as carbon fibre composites and improved alloys, can reduce the overall weight of EV systems. This results in enhanced energy efficiency and range. The Light weighting technologies will enhance EV efficiency, resulting in longer battery life and higher performance. It will also help to lessen the environmental impact of EV production.

Infrastructure for Energy-Dense Charging

Developing high-energy-density charging stations can shorten charging times dramatically, making EVs more convenient for consumers. Furthermore, incorporating renewable energy sources into charging infrastructure might encourage sustainable charging practices. Faster charging can help ease concerns, about range and make electric vehicles (EVs) more attractive, to a range of people. Additionally, adopting charging methods will enhance the benefits of EV usage.

Vehicle-to-Grid (V2G) Technology and Grid Integration

Creating EV platforms with V2G capabilities enables electric vehicles to communicate with the electrical grid, allowing for bidirectional energy transfer. This can help to maintain the grid, decrease peak demand, and offer EV owners with an extra money source. V2G technology will be critical to grid stability, particularly as the number of renewable energy sources grows. Electric vehicle platforms with V2G capabilities will be critical in establishing a more robust and sustainable energy ecology.

Improved Battery Technology

Battery technology developments, such as solid-state batteries and greater energy density cells, have the potential to transform the performance and range of electric vehicles (EVs) built on EV platforms. This will help ease concerns, about running out of battery power and increase trust among consumers who are considering switching to vehicles. The advancements in battery technology will significantly improve the distance that electric vehicles can travel making them a viable option for trips. Additionally, it will reduce the time needed for charging making electric vehicles more convenient and accessible, for customers.

By Component Type

The battery industry is anticipated to play a vital role, with a significant share over the projected period. This popularity is due to Original Equipment Manufacturers (OEMs) focusing their efforts on developing new EV batteries that promise lower emissions at a lower cost. This increased emphasis on building cutting-edge batteries is generating significant investments in research and development, helping not only the battery market but also the overall advancement of EV platforms.

Advanced EV batteries are critical in deciding electric vehicle performance, range, and efficiency. These batteries are designed to have energy density, which means that vehicles can go distances, on one charge. Additionally, they allow for charging addressing a concern called "range anxiety" that many potential EV buyers have.

By Electric Vehicle Type

Under EV type, the battery electric vehicle (BEV) category is dominating with its rapid expansion. This is due to most Original Equipment Manufacturers' (OEMs') strategic change toward emphasizing the development of BEVs on freshly built EV platforms over hybrid electric cars (HEVs). The larger demand for BEVs in compared to HEVs supports this transition.

Compared to battery vehicles (BEVs) manufacturing electric vehicles (HEVs) requires a significantly higher initial investment and specialized expertise. This is due, to the complexity involved in combining an internal combustion engine (ICE) with a powertrain on a platform. In contrast BEVs operate on electricity eliminating the need, for an ICE and thereby simplifying the production process.

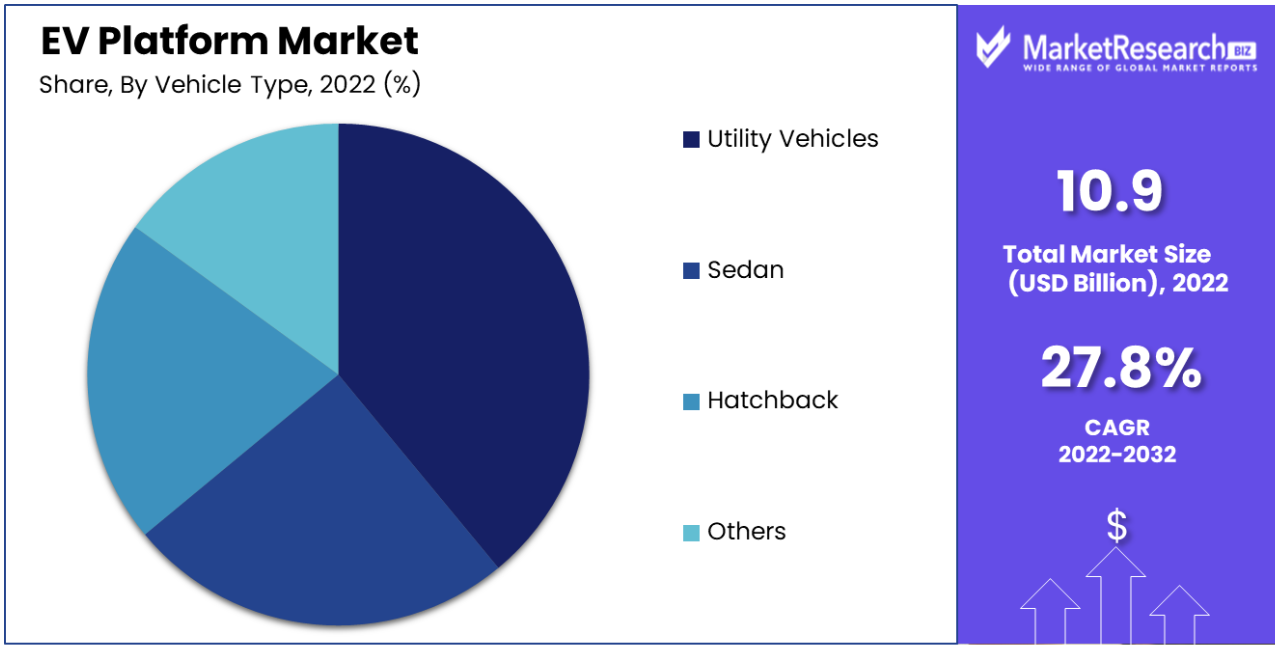

By Vehicle Type

Utility vehicles have emerged as a significant player in the global vehicle type category. Notably, Chinese consumers have always preferred compact sedans; but, with the arrival of more appealing SUV models, a significant shift in preference has been noted. Sedan sales have fallen as a result of the shift in demand toward utility vehicles.

The reasoning behind this move is based on customer preferences in both Asia and the United States. These markets show a clear preference for cars that combine spaciousness and practicality, both of which are essentially associated with SUVs. Sedans, on the other hand, fall short in terms of usefulness when compared to more compact and versatile hatchbacks.

Furthermore, demand for hatchbacks has decreased in the European and Latin American markets. This is due to a trend in which smaller vehicles are becoming larger. Conveniently, as hatchbacks grow in size, they grow less manoeuvrable and useful, reducing their appeal.

Key Market Segments

By Component

- Chassis

- Battery

- Suspension System

- Steering System

- Drivetrain

- Vehicle Interior

- Others

By Electric Vehicle Type

- Battery Electric Vehicle

- Hybrid Electric Vehicle

By Vehicle Type

- Hatchback

- Sedan

- Utility Vehicles

- Others

Latest Trends

Platforms Focused on Software

The integration of sophisticated software systems within EV platforms is gaining traction. These platforms include sophisticated connectivity features, improved user experiences, and support over-the-air updates. These features are becoming increasingly important in addressing consumer demand for smart, connected vehicles.

Multi-Use Platforms

EV platforms that can support a variety of vehicle types, from sedans to SUVs, are increasingly being designed by manufacturers. This multi-purpose approach improves production flexibility and efficiency, ultimately lowering costs and increasing market growth.

Modular Architecture

Modular EV platforms enable common foundation structures that can be changed for different models. This method simplifies manufacturing procedures, decreases development time, and allows for the production of multiple vehicle types on a single platform.

Sustainability and the Circular Economy

There is a rising emphasis on sustainability in the EV platform industry. This involves using recycled resources, environmentally friendly manufacturing processes, and end-of-life recycling options. These efforts are consistent with broader environmental goals and customer preferences for greener products.

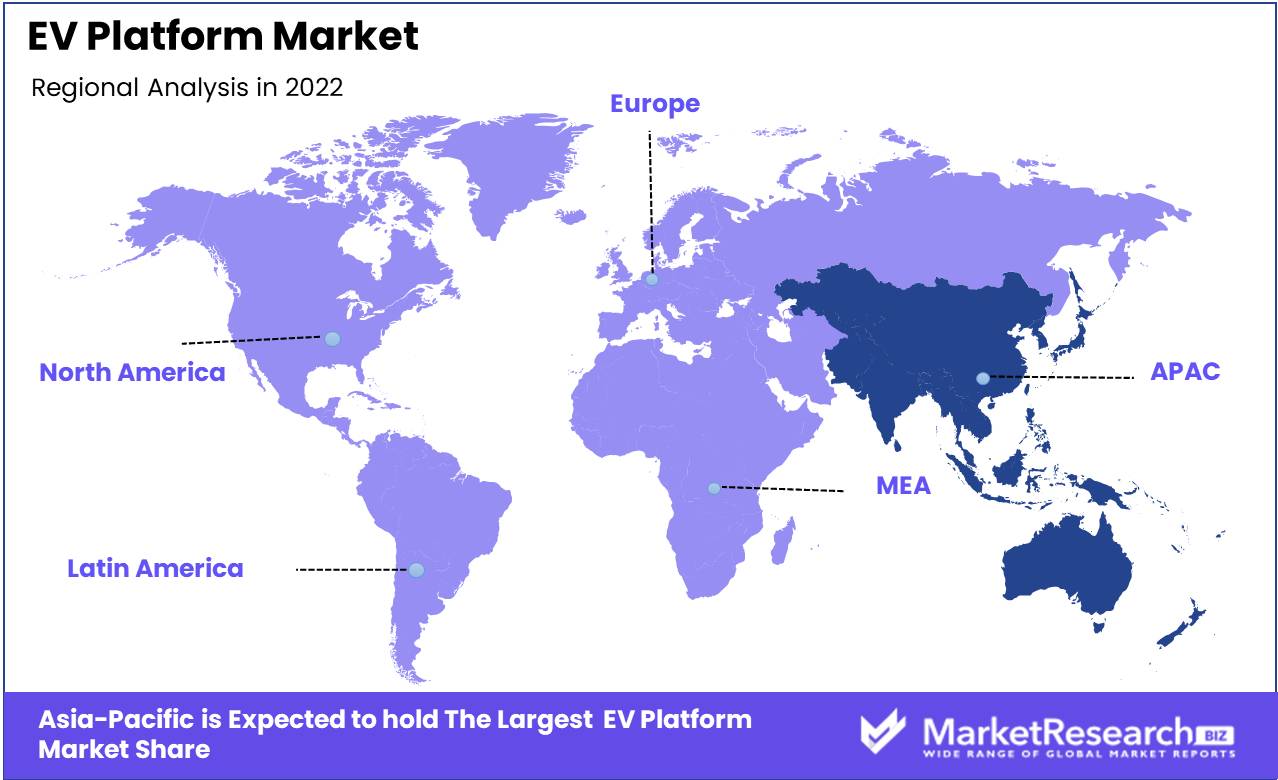

Regional Analysis

North America, Europe, APAC, Latin America, and the Middle East and Africa account for the majority of the worldwide EV platform market. Notably, APAC and Europe are seeing a large increase in EV adoption, owing to significant investments in research and development (R&D). EV penetration is increasing rapidly, particularly in Europe, with a matching increase in demand expected throughout the projected period. This, in turn, is expected to propel the EV platform market forward.

APAC is primed for rapid growth, closely followed by Europe and North America. China, Japan, and South Korea are key players in the automobile sector, differentiated by their concentration on technology, innovation, and the development of cutting-edge EVs. Furthermore, the growth of advanced and efficient charging stations is expected to boost the EV market even further, favourably influencing demand for EV platforms.

This regional trend emphasizes the critical role that APAC and Europe play in promoting EV innovation and adoption. Their collaborative R&D and infrastructure development efforts are critical in moving the global EV platform market ahead. As these regions continue to lead in EV integration, they serve as important indications of the global automotive landscape's evolution.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Many of manufacturers control a sizable piece of the worldwide EV platform industry. To increase their market presence, key industry players are actively incorporating cutting-edge technologies. Dominant corporations use a variety of techniques, including acquisitions, collaborations, and the introduction of new products. These market leaders are putting a lot of attention on introducing cutting-edge, technology-infused products.

Furthermore, they are driving strategic initiatives such as mergers, acquisitions, and collaborative alliances to strengthen their market position. This proactive strategy demonstrates their determination to strengthen their position in the competitive landscape.

Key Players in EV Platform Market

- Alcraft Motor Company

- Baic Motor

- BMW

- BYD

- Byton

- Canoo

- Chery

- Daimler

- Faraday Future

- Fisker

- Ford

- Geely

- General Motors

- Honda

- Hyundai

- JAC

- Kia Motors

- Nissan Motor

- Open Motors

- REE Auto

- Rivian

- Saic Motor

- Toyota

- Volkswagen

- Volvo

- XAOS Motors

- Zotye

Recent Developments

- BYD revealed their revolutionary e4 quad-motor platform for high-performance automobiles in January 2023. The first offers on this platform will be a 5-meter electric off-road SUV and a high-speed hyper car, both to be released under the newly founded Yangwang brand.

- In October 2023, Foxconn, the world's leading electronics manufacturer, has selected NVIDIA's cutting-edge technology, including the NVIDIA DRIVE Hyperion 9 platform. This platform features the NVIDIA DRIVE Thor central computer and a next-generation sensor architecture.

- In October 2023, Lancia, part of the Stellantis group, is planning to introduce a flagship electric vehicle in 2026. Lancia's focus is primarily on the European market, and these new EVs are not expected to be available in the United States.

- Nidec has initiated the development of a versatile wheeled platform, which plays a crucial role in the widespread adoption of electric vehicles (EVs). As more emerging manufacturers enter the EV market, the ability to purchase EV platforms will enable them to sell finished EVs without the need to develop an expensive platform themselves.

- Hyundai Motor Company announced the BEV Platform E-GMP, a cutting-edge electric vehicle platform specialized for the Indian market, in November 2022, with the IONIQ 5. The E-GMP platform's chassis includes a battery, motor, and power electric system, as well as a long-range battery pack and a configurable bi-directional charging port.

Report Scope

Report Features Description Market Value (2022) US$ 10.9 Bn Forecast Revenue (2032) US$ 119.2 Bn CAGR (2023-2032) 27.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered EV Platform Market Report By Component (Chassis, Battery, Suspension System, Steering System, Drivetrain, Vehicle Interior, and Others), By Electric Vehicle Type (Battery Electric Vehicle, Hybrid Electric Vehicle), By Vehicle Type (Hatchback, Sedans, and Utility Vehicles) Regional Analysis North America – The US, Canada, Mexico, Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America, Eastern Europe – Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe, Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC, Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA Competitive Landscape Alcraft Motor Company, Baic Motor, BMW, BYD, Byton, Canoo, Chery, Daimler, Faraday Future, Fisker, Ford, Geely, General Motors, Honda, Hyundai, JAC, Kia Motors, Nissan Motor, Open Motors, REE Auto, Rivian, Saic Motor, Toyota, Volkswagen, Volvo, XAOS Motors, Zotye Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Alcraft Motor Company

- Baic Motor

- BMW

- BYD

- Byton

- Canoo

- Chery

- Daimler

- Faraday Future

- Fisker

- Ford

- Geely

- General Motors

- Honda

- Hyundai

- JAC

- Kia Motors

- Nissan Motor

- Open Motors

- REE Auto

- Rivian

- Saic Motor

- Toyota

- Volkswagen

- Volvo

- XAOS Motors

- Zotye