Global Etanercept Market By Drug Type(Enbrel, Benepali, Others), By Application(Rheumatoid Arthritis, Juvenile Idiopathic Arthritis, Psoriatic Arthritis, Ankylosing Spondylitis, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

45509

-

May 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

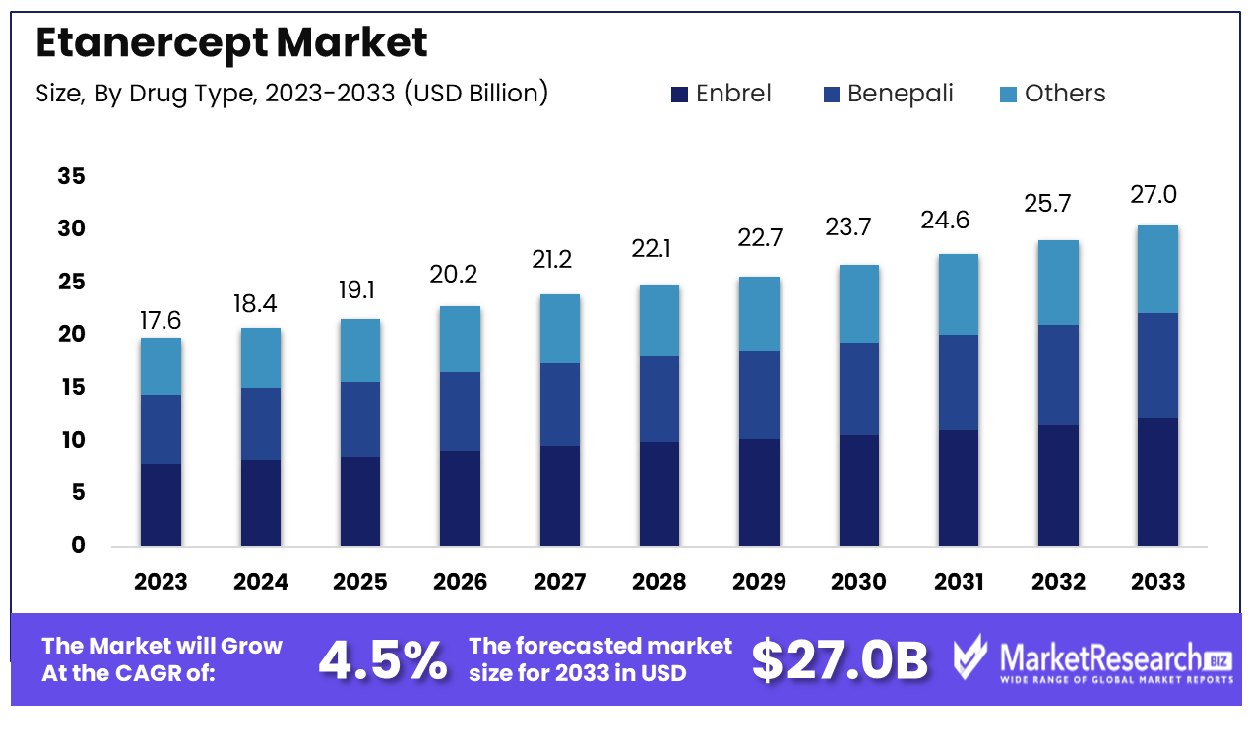

The Global Etanercept Market was valued at USD 17.6 billion in 2023. It is expected to reach USD 27.0 billion by 2033, with a CAGR of 4.5% during the forecast period from 2024 to 2033.

The Etanercept Market encompasses the dynamic landscape surrounding the production, distribution, and consumption of Etanercept, a biologic drug renowned for its efficacy in treating autoimmune diseases such as rheumatoid arthritis, psoriasis, and ankylosing spondylitis. This market segment thrives on the burgeoning demand for advanced therapeutics, driven by an aging population and increasing prevalence of chronic ailments globally.

Its growth trajectory is bolstered by ongoing research and development efforts, regulatory approvals, and strategic partnerships among pharmaceutical giants. As market leaders, executives must monitor market trends, regulatory shifts, and competitive dynamics to capitalize on emerging opportunities and sustain growth.

The Etanercept Market presents a dynamic landscape shaped by the growing prevalence of ankylosing spondylitis (AS) globally. As a key player in the treatment of autoimmune diseases, Etanercept demonstrates promising market potential, driven by increasing incidences of AS particularly in Europe and Asia.

Supported by recent data, the estimated cases in Europe range between 1.30 and 1.56 million, while in Asia, they span from 4.63 to 4.98 million. Notably, the UK has witnessed a significant uptick in AS prevalence from 0.13% in 1998 to 0.18% in 2017, notably among women and individuals aged 60 and above.

This upward trend is accompanied by a prolonged median time from symptom onset to diagnosis, underscoring the critical need for effective treatment options. Gender disparity persists, with AS being more prevalent in men, affecting approximately 80% of patients before the age of 30. Furthermore, the varying prevalence of the HLA-B27 gene, a significant marker for AS, among different ethnic groups further elucidates the complex nature of the disease.

Key Takeaways

- Market Growth: The Global Etanercept Market was valued at USD 17.6 billion in 2023. It is expected to reach USD 27.0 billion by 2033, with a CAGR of 4.5% during the forecast period from 2024 to 2033.

- By Drug Type: Enbrel holds a dominant 34% market share within the biologic drug segment.

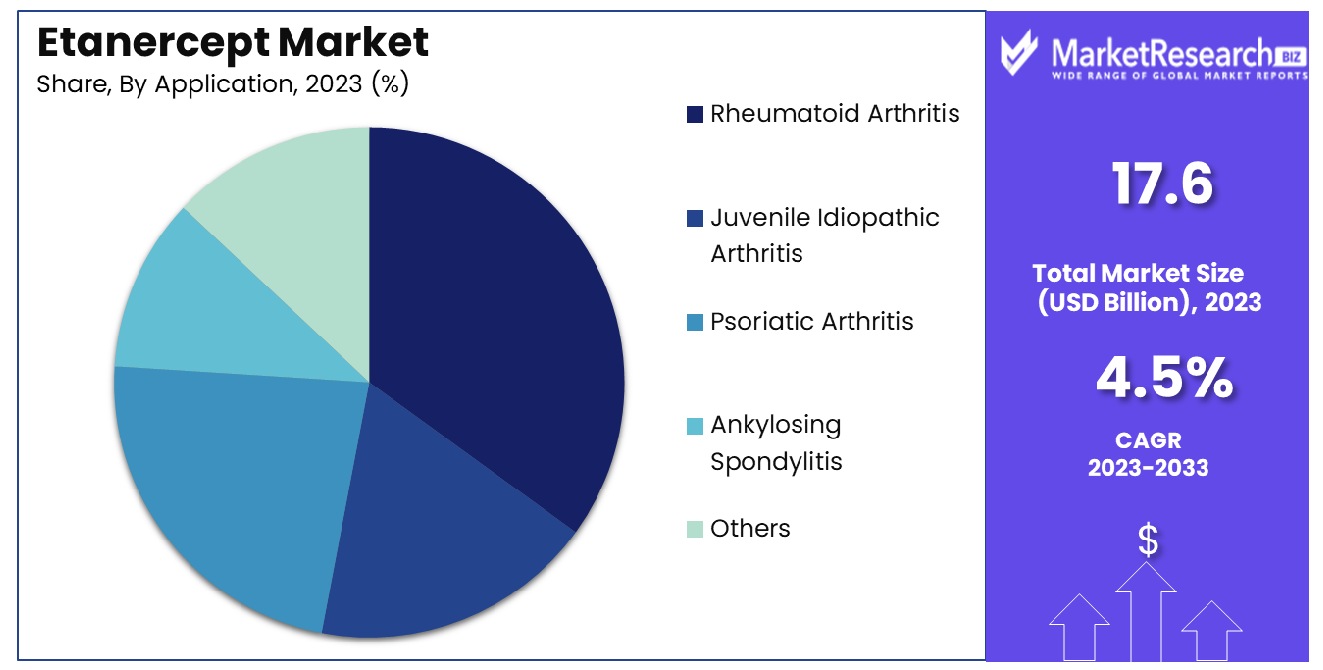

- By Application: Rheumatoid arthritis accounts for 34% of Etanercept's total applications.

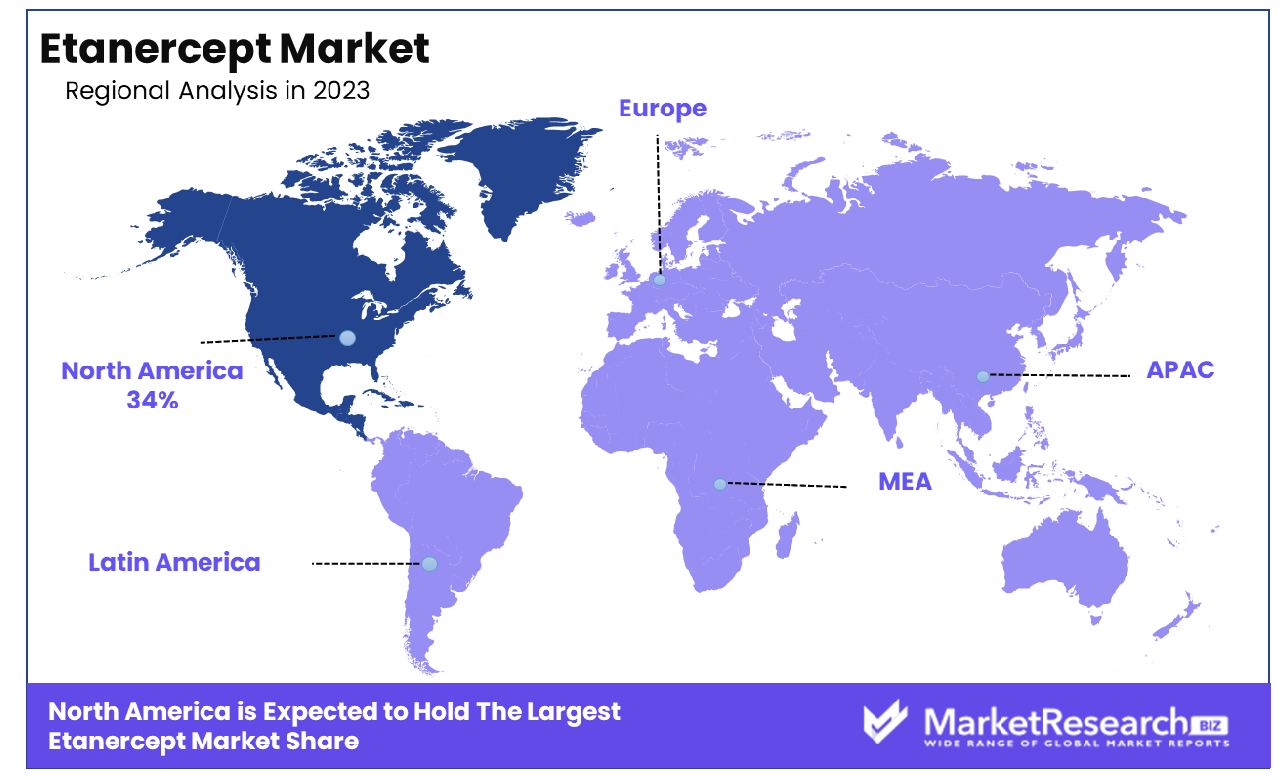

- Regional Dominance: In North America, the Etanercept market captured a significant share: 34%.

- Growth Opportunity: The 2023 growth outlook for the global Etanercept market is promising, driven by its increasing use in Non-Radiographic Axial Spondyloarthritis and expansion into emerging autoimmune disease markets.

Driving factors

Favorable Reimbursement Policies Propel Etanercept Market Growth

Favorable reimbursement policies play a pivotal role in propelling the growth of the Etanercept Market. As governments and insurance providers increasingly recognize the efficacy of Etanercept in treating autoimmune diseases such as rheumatoid arthritis and psoriasis, reimbursement policies have become more accommodating.

This has significantly reduced the financial burden on patients, encouraging higher adoption rates and driving market expansion. According to recent statistics, countries with robust reimbursement frameworks have witnessed a notable surge in Etanercept utilization, leading to substantial revenue growth within the market.

Synergy of AI Adoption and Etanercept Market Growth

The growing adoption of artificial intelligence (AI) in healthcare has synergized with the expansion of the Etanercept Market. AI-driven advancements in diagnostic techniques, patient monitoring, and personalized treatment regimens have enhanced the efficacy and precision of Etanercept therapy.

By leveraging AI algorithms to analyze patient data, healthcare providers can optimize treatment outcomes and minimize adverse reactions, thereby fostering greater confidence in Etanercept among both prescribers and patients. This convergence of AI technologies and biopharmaceutical innovations has accelerated market growth, with projections indicating a sustained upward trajectory in the foreseeable future.

Online Retail Strategies Amplify Etanercept Market Reach

The strategic initiatives undertaken by online retailers have amplified the reach and accessibility of Etanercept, further fueling market expansion. E-commerce platforms provide a convenient avenue for patients to procure pharmaceutical products, including biologics like Etanercept, without the constraints of traditional distribution channels. Through targeted marketing campaigns, competitive pricing strategies, and streamlined delivery services, online retailers have effectively penetrated underserved markets and captured a larger share of Etanercept sales.

This omnichannel approach not only enhances consumer convenience but also cultivates brand loyalty and fosters sustained market growth. Recent industry data indicates a significant uptick in Etanercept sales through online channels, underscoring the strategic significance of digital commerce in driving market expansion.

Restraining Factors

Development of Alternative Therapies Challenges Etanercept Market Growth

The development of alternative therapies presents a significant challenge to the growth of the Etanercept Market. As pharmaceutical companies continue to innovate, new treatment modalities emerge, offering patients alternative options for managing autoimmune conditions. These therapies, ranging from biosimilars to novel biologics and small molecule inhibitors, intensify competition within the market, eroding Etanercept's market share.

Despite its established efficacy, Etanercept faces mounting pressure from these alternative treatments, as healthcare providers and patients weigh the benefits of newer options against established standards of care. Recent market analysis indicates a gradual decline in Etanercept sales in regions where alternative therapies have gained traction, underscoring the impact of evolving treatment landscapes on market dynamics.

Uncertainty in Reimbursement Policies Deters Etanercept Market Expansion

Uncertainty in reimbursement policies serves as a significant deterrent to the expansion of the Etanercept Market. Fluctuations in reimbursement guidelines and coverage decisions create instability for both patients and healthcare providers, hindering widespread adoption of Etanercept. In regions where reimbursement policies are subject to frequent revisions or lack clarity, patients may face barriers to accessing Etanercept therapy, resulting in suboptimal treatment outcomes and dampened market demand.

Moreover, uncertainty surrounding reimbursement can deter investment in research and development efforts aimed at expanding Etanercept's indications or improving its formulation, further impeding market growth. Recent market data indicates a correlation between regions with ambiguous reimbursement policies and slower Etanercept market penetration, highlighting the critical role of reimbursement stability in fostering market expansion.

By Drug Type Analysis

Enbrel holds a commanding 34% share in the Etanercept Market, dominating the competition by drug type.

In 2023, Enbrel held a dominant market position in the By Drug Type segment of the Etanercept Market, capturing more than a 34% share. Enbrel's prominent position underscores its efficacy and established presence in the treatment landscape. Benepali also emerged as a significant contender, contributing to the competitive dynamics within the market. Other players in the segment, although collectively holding a considerable share, faced the challenge of competing with these established brands.

Enbrel, a flagship product of its manufacturer, boasts a robust market presence attributed to its proven effectiveness in managing chronic inflammatory conditions. Its widespread adoption among healthcare providers and patients alike has solidified its position as a preferred choice in the treatment paradigm. The brand's continued investment in research and development, coupled with strategic marketing initiatives, has fortified its market leadership.

Benepali, another notable player in the segment, has steadily gained traction owing to its bioequivalence to Enbrel and cost-effectiveness. Its entry into the market has provided healthcare practitioners and patients with a viable alternative, driving competition and potentially exerting downward pricing pressure.

Despite the dominance of Enbrel and the emergence of Benepali, the segment also encompasses various other players. These include both branded and generic alternatives striving to carve out their niche in the competitive landscape. Their contributions collectively enrich the treatment options available to patients and foster a dynamic market environment.

By Application Analysis

Similarly, Rheumatoid Arthritis accounts for 34% of the market share, showcasing significant application dominance.

In 2023, Rheumatoid Arthritis held a dominant market position in the By Application segment of the Etanercept Market, capturing more than a 34% share. Etanercept, a tumor necrosis factor (TNF) inhibitor, has emerged as a cornerstone therapy for various inflammatory conditions, including Rheumatoid Arthritis, Juvenile Idiopathic Arthritis, Psoriatic Arthritis, Ankylosing Spondylitis, and other related disorders.

Rheumatoid Arthritis (RA) remains the primary driver of demand for Etanercept, owing to its high prevalence globally and the substantial burden it places on patients' quality of life. With a significant portion of the population afflicted by this chronic autoimmune disease, the demand for effective treatments like Etanercept continues to rise steadily.

Following closely behind Rheumatoid Arthritis is Juvenile Idiopathic Arthritis (JIA), a group of chronic inflammatory diseases affecting children and adolescents. While comprising a smaller portion of the Etanercept Market compared to RA, the demand for this indication is noteworthy due to the long-term management required for pediatric patients.

Psoriatic Arthritis (PsA) and Ankylosing Spondylitis (AS) also contribute significantly to the demand for Etanercept. PsA, a condition that affects individuals with psoriasis, and AS, a form of arthritis affecting the spine, both require effective anti-inflammatory therapies like Etanercept to manage symptoms and improve patient's quality of life.

The "Others" category encompasses a range of less prevalent inflammatory conditions, including but not limited to non-radiographic axial spondyloarthritis and plaque psoriasis. While individually these indications may not command a large share of the market, collectively, they contribute to the overall demand for Etanercept across diverse patient populations.

Key Market Segments

By Drug Type

- Enbrel

- Benepali

- Others

By Application

- Rheumatoid Arthritis

- Juvenile Idiopathic Arthritis

- Psoriatic Arthritis

- Ankylosing Spondylitis

- Others

Growth Opportunity

Utilization in Non-Radiographic Axial Spondyloarthritis

In 2023, the global Etanercept market witnessed a significant growth opportunity attributed to its expanding utilization in Non-Radiographic Axial Spondyloarthritis (nr-axSpA). With advancements in diagnostic techniques and increased awareness, there has been a notable rise in the diagnosis of nr-axSpA cases globally.

Etanercept, a tumor necrosis factor (TNF) inhibitor, has emerged as a promising treatment option for nr-axSpA, offering relief from symptoms and improving patients' quality of life. Clinical studies have demonstrated the efficacy of Etanercept in reducing inflammation and improving physical function in nr-axSpA patients, driving its adoption in clinical practice.

Penetrating Emerging Markets for Autoimmune Diseases

Another growth avenue for the global Etanercept market in 2023 stemmed from its penetration into emerging markets for autoimmune diseases. Rising healthcare expenditure, improving access to healthcare services, and increasing awareness about autoimmune disorders have fueled the demand for biologic therapies like Etanercept in emerging economies.

These regions are witnessing a surge in autoimmune disease prevalence, creating a substantial market opportunity for Etanercept manufacturers. Strategic partnerships, expanded distribution networks, and regulatory approvals have facilitated market entry, enabling companies to tap into the potential of these burgeoning markets.

Latest Trends

Emerging Biosimilar Competition

In 2023, the global Etanercept market experienced a significant shift due to emerging biosimilar competition. Biosimilars, biologic drugs highly similar to originator products, have gained traction in recent years, offering cost-effective alternatives to branded biologics like Etanercept.

With the expiration of patents and regulatory pathways for biosimilar approvals becoming more established, several pharmaceutical companies introduced Etanercept biosimilars into the market. This influx of biosimilars has intensified competition, leading to price erosion and market share redistribution. However, biosimilars have also expanded patient access to Etanercept therapy, driving market growth despite pricing pressures.

Increasing Investment in Healthcare Infrastructure

Another notable trend shaping the global Etanercept market in 2023 was the increasing investment in healthcare infrastructure. Governments and private entities worldwide have been channeling resources into enhancing healthcare facilities and expanding access to biologic therapies, including Etanercept.

Improved healthcare infrastructure, such as specialized treatment centers and infusion facilities, has facilitated the administration of biologics, driving uptake among patients with autoimmune diseases. Moreover, initiatives aimed at improving healthcare delivery, such as telemedicine and digital health platforms, have streamlined patient management and monitoring, further supporting the growth of the Etanercept market.

Regional Analysis

In North America, the Etanercept market accounted for a substantial 34% share in 2023.

North America emerged as the dominant region in the Etanercept market, commanding a substantial share of 34%. This dominance can be attributed to factors such as well-established healthcare infrastructure, high prevalence of autoimmune diseases, and early adoption of biological therapies. Moreover, increasing healthcare expenditure and favorable reimbursement policies further bolstered market growth in this region.

In Europe, the Etanercept market experienced steady growth, driven by a rising incidence of autoimmune disorders and expanding treatment options. Countries like Germany, France, and the UK accounted for significant market shares, owing to robust healthcare systems and extensive research and development activities in the biopharmaceutical sector. The presence of key market players and strategic collaborations also contributed to market expansion in Europe.

The Asia Pacific region emerged as a lucrative market for Etanercept, fueled by rapid urbanization, increasing healthcare expenditure, and a growing patient pool. Countries such as Japan, China, and India witnessed notable market growth, driven by rising awareness about autoimmune diseases and improving access to biologic therapies. Furthermore, government initiatives aimed at improving healthcare infrastructure and expanding insurance coverage supported market development in the region.

In the Middle East & Africa and Latin America regions, the Etanercept market exhibited moderate growth due to evolving healthcare systems and increasing focus on chronic disease management. Despite facing challenges such as limited access to advanced therapies and healthcare disparities, these regions presented untapped potential for market expansion, driven by improving economic conditions and rising healthcare investments.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Etanercept market witnessed a dynamic landscape driven by key players striving to maintain market dominance and expand their presence in the biopharmaceutical sector. Among the prominent contenders, Pfizer, Inc., emerges as a leading force, leveraging its robust research capabilities and extensive global network to drive innovation and ensure widespread accessibility of Etanercept-based therapies.

Takeda Pharmaceutical Company Ltd. stands tall as another influential player, capitalizing on its diverse portfolio and strategic partnerships to enhance market penetration and cater to the evolving needs of patients worldwide. Meanwhile, Johnson and Johnson's steadfast commitment to excellence in healthcare continues to solidify its position as a key contributor to the Etanercept market, exemplifying innovation and efficacy in its product offerings.

GlaxoSmithKline Pharmaceuticals, Ltd., remains a formidable contender, recognized for its unwavering dedication to advancing medical science and delivering high-quality pharmaceutical solutions. Samsung Bioepis Co., Ltd., emerges as a rising star, harnessing cutting-edge technology and collaborative ventures to drive product development and meet the escalating demand for Etanercept therapies.

F. Hoffmann-La Roche Ltd., Cipla Limited, Novartis International AG, Celltrion Inc., and Immunex Corporation round out the list of key players, each bringing its unique strengths and perspectives to the competitive arena. With a focus on research and development, strategic alliances, and market expansion initiatives, these companies collectively shape the trajectory of the global Etanercept market, driving growth, innovation, and progress in the pursuit of improved patient outcomes and enhanced healthcare delivery.

Market Key Players

- Pfizer, Inc.

- Takeda Pharmaceutical Company Ltd.

- Johnson and Johnson

- GlaxoSmithKline Pharmaceuticals, Ltd

- Samsung Bioepis Co., Ltd.

- F. Hoffmann-La Roche Ltd.

- Cipla Limited

- Novartis International AG

- Celltrion Inc.

- Immunex Corporation

Recent Development

- In December 2023, Intas Pharmaceuticals partners with mAbxience to distribute biosimilar Etanercept in 150+ countries. The agreement leverages mAbxience's manufacturing expertise and Intas' strong biosimilar portfolio.

- In December 2023, the Australian government's pricing policy led to over $6 million in savings after the etanercept biosimilar Brenzys launch. A real-world study published in the Internal Medicine Journal analyzed treatment persistence and cost-effectiveness.

Report Scope

Report Features Description Market Value (2023) USD 17.6 Billion Forecast Revenue (2033) USD 27.0 Billion CAGR (2024-2032) 4.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Type(Enbrel, Benepali, Others), By Application(Rheumatoid Arthritis, Juvenile Idiopathic Arthritis, Psoriatic Arthritis, Ankylosing Spondylitis, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Pfizer, Inc., Takeda Pharmaceutical Company Ltd., Johnson and Johnson, GlaxoSmithKline Pharmaceuticals, Ltd, Samsung Bioepis Co., Ltd., F. Hoffmann-La Roche Ltd., Cipla Limited, Novartis International AG, Celltrion Inc., Immunex Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Pfizer, Inc.

- Takeda Pharmaceutical Company Ltd.

- Johnson and Johnson

- GlaxoSmithKline Pharmaceuticals, Ltd

- Samsung Bioepis Co., Ltd.

- F. Hoffmann-La Roche Ltd.

- Cipla Limited

- Novartis International AG

- Celltrion Inc.

- Immunex Corporation