ESG Reporting Software Market By Product (Chatbot and Smart Speaker), By Procedure (Automatic Speech Recognition, Text to Speech, Text-based, Others), By End User (BFSI, Consumer Electronics, Automotive, Healthcare, Education, Retail, IT & Telecom, Travel & Hospitality, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47855

-

June 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

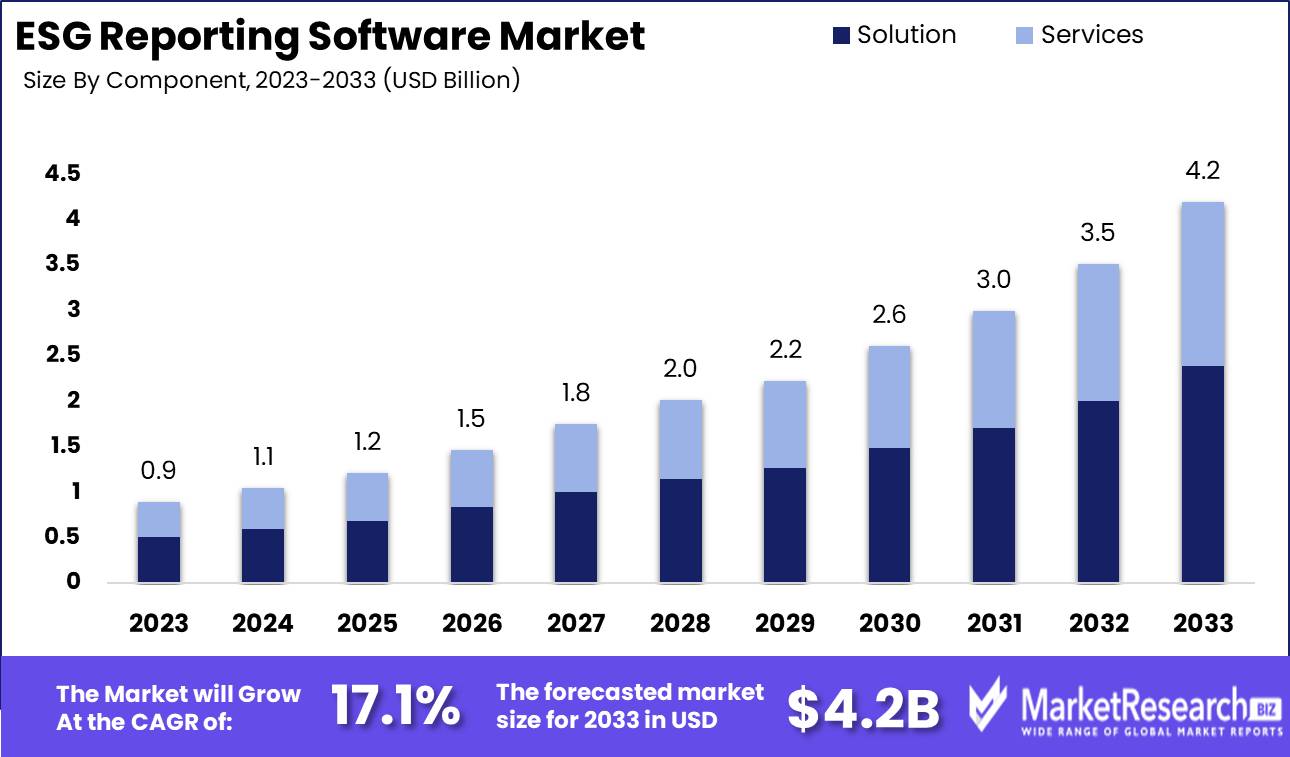

The ESG Reporting Software Market was valued at USD 0.9 billion in 2023. It is expected to reach USD 4.2 billion by 2033, with a CAGR of 17.1% during the forecast period from 2024 to 2033.

The ESG Reporting Software Market encompasses technology solutions designed to streamline and enhance the Environmental, Social, and Governance (ESG) reporting process. These platforms facilitate data collection, analysis, and reporting to meet regulatory requirements, investor expectations, and internal sustainability goals. They enable companies to track ESG metrics, ensuring transparency and accountability in their sustainability practices.

The Environmental, Social, and Governance (ESG) Reporting Software Market is poised for significant growth, driven by an increasingly stringent regulatory environment, heightened corporate focus on sustainability, and the need for robust risk management frameworks. Organizations are under pressure to comply with a complex web of global regulations, such as the EU's Sustainable Finance Disclosure Regulation (SFDR) and the Task Force on Climate-related Financial Disclosures (TCFD). This regulatory landscape compels companies to adopt advanced ESG reporting tools that ensure compliance, transparency, and accountability. Furthermore, as stakeholders, including investors, consumers, and employees, demand greater corporate responsibility, the ability to accurately report and manage ESG metrics has become integral to maintaining a strong corporate reputation and mitigating risks.

In addition, integrating AI and Big Data within ESG reporting software is revolutionizing the industry by enhancing analytics and predictive capabilities. These advanced technologies enable organizations to gain deeper insights into their ESG performance, identify trends, and make informed decisions to drive sustainability initiatives. However, the complexity and integration of diverse data sources remain a significant challenge. Effective ESG reporting requires harmonizing vast amounts of data from disparate systems, necessitating sophisticated software solutions capable of managing this complexity.

As a result, the market is seeing increased investment in platforms that offer seamless data integration, user-friendly interfaces, and robust analytics. These innovations are not only facilitating compliance and risk management but also empowering companies to leverage ESG data strategically, ultimately contributing to long-term value creation and sustainable growth.

Key Takeaways

- Market Growth: The ESG Reporting Software Market was valued at USD 0.9 billion in 2023. It is expected to reach USD 4.2 billion by 2033, with a CAGR of 17.1% during the forecast period from 2024 to 2033.

- By Component: Solutions dominated ESG Reporting Software, complemented by essential Services.

- By Vertical: Healthcare & Life Sciences dominate the ESG software market with a sustainability focus.

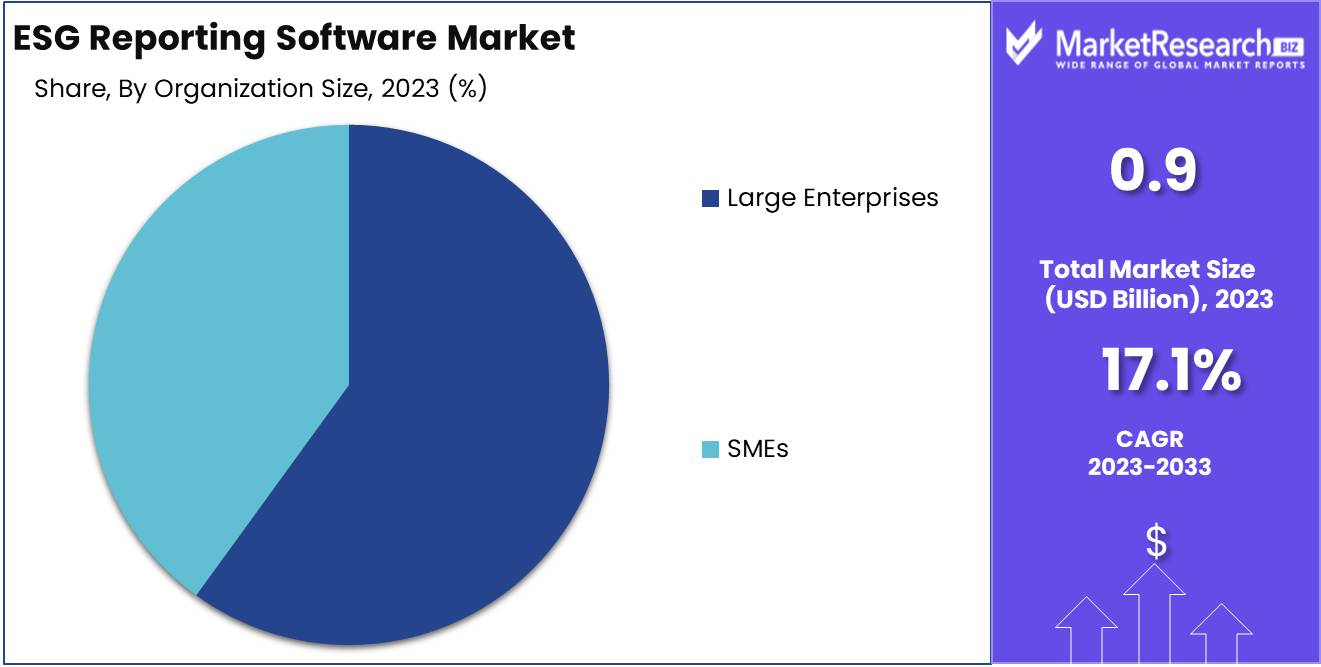

- By Organization Size: Large enterprises dominate the ESG reporting software market, driving compliance and transparency.

- By Deployment Mode: On-premise dominated ESG reporting, with Cloud rapidly rising.

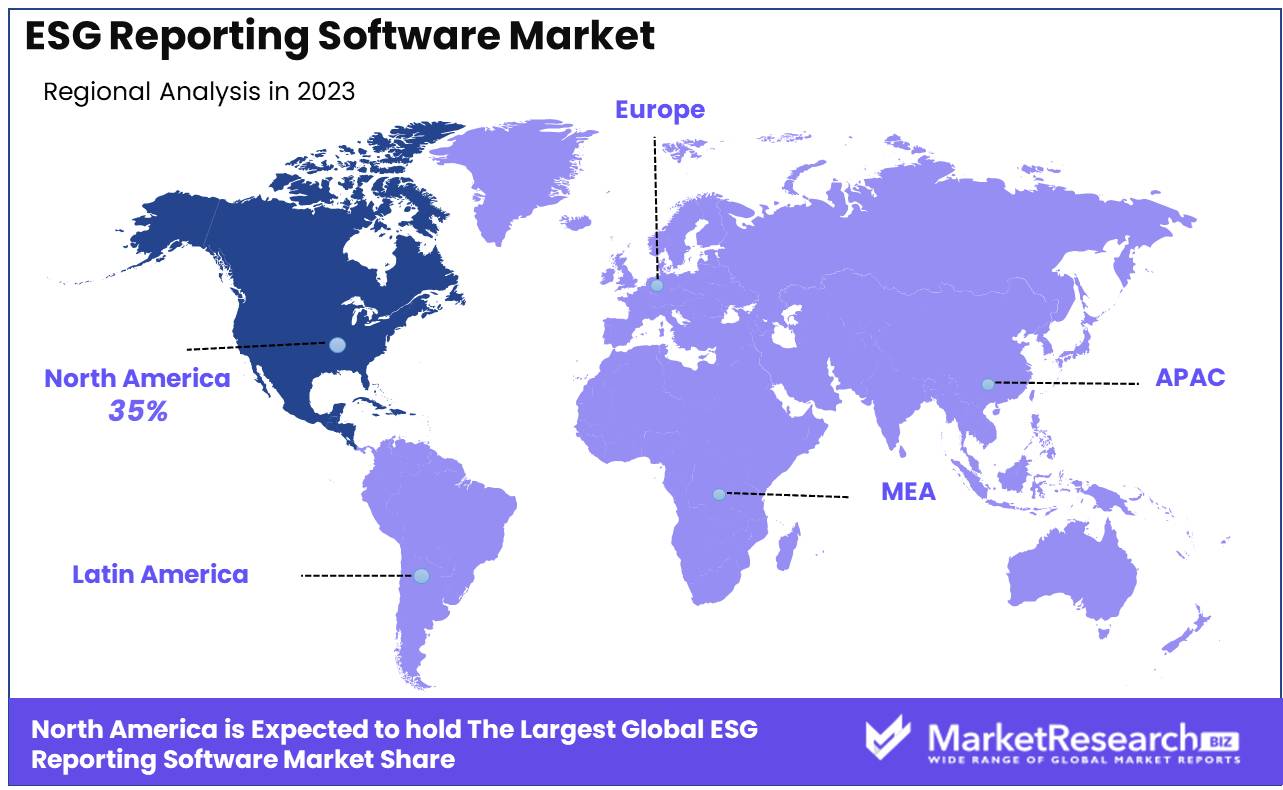

- Regional Dominance: North America dominates ESG reporting software with a 35% global share.

- Growth Opportunity: The Global ESG reporting software market will grow significantly due to advanced analytics, visualization technologies, and increased investor demand.

Driving factors

Tightening Government Regulations: Catalysts for ESG Reporting Software Adoption

Government regulations worldwide are increasingly stringent, compelling organizations to comply with enhanced Environmental, Social, and Governance (ESG) reporting standards. These regulations mandate transparent reporting on various ESG metrics, including carbon emissions, labor practices, and corporate governance structures. As a result, companies are investing heavily in ESG reporting software to ensure compliance, avoid penalties, and enhance their corporate reputation. For instance, the requires comprehensive sustainability reporting from a broad range of companies, driving the demand for robust ESG reporting solutions. This regulatory push ensures that the market for ESG reporting software will continue to expand as more organizations seek to align with evolving legal requirements.

Integration with Enterprise Systems: Enhancing Efficiency and Data Accuracy

The seamless integration of ESG reporting software with existing enterprise systems, such as Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) platforms, significantly boosts the market. This integration facilitates the efficient collection, analysis, and reporting of ESG data by leveraging existing data infrastructure, thereby reducing manual efforts and improving data accuracy. Companies can thus streamline their reporting processes, enhance decision-making, and ensure more accurate and timely disclosures.

For example, ESG reporting tools integrated with ERP systems can automatically extract relevant data on resource usage, financial performance, and supply chain practices, making ESG reporting more efficient and comprehensive. This capability is particularly appealing to large enterprises seeking to enhance their sustainability reporting without overhauling their entire IT ecosystem.

Growing Emphasis on Sustainability: Driving Corporate Responsibility and Market Expansion

The increasing emphasis on sustainability among stakeholders including investors, customers, and employees is a major driver for the ESG reporting software market. Companies are under mounting pressure to demonstrate their commitment to sustainable practices and social responsibility. This trend is reflected in the growing number of investors prioritizing ESG criteria in their investment decisions and consumers favoring brands with strong sustainability credentials.

According to a recent survey, over 70% of investors consider ESG factors in their investment decisions, highlighting the critical importance of comprehensive and credible ESG reporting. As a result, businesses are adopting ESG reporting software to meet these expectations, enhance their market positioning, and attract capital. The heightened focus on sustainability is not only driving demand for these solutions but also fostering innovation in the market, as vendors develop more advanced and user-friendly tools to meet evolving needs.

Restraining Factors

Regulatory Uncertainty: A Barrier to Standardization and Adoption

Regulatory uncertainty significantly hampers the growth of the ESG Reporting Software Market by creating a fragmented and unpredictable landscape for companies looking to adopt these tools. Different regions and countries have varying standards and regulations for environmental, social, and governance (ESG) reporting, leading to confusion and hesitation among potential users of ESG reporting software. For instance, while the European Union has been proactive with the Corporate Sustainability Reporting Directive (CSRD), other regions lag behind or have inconsistent regulations. This disparity forces software providers to continuously adapt their products to meet divergent standards, increasing development costs and complicating the sales process.

Moreover, companies are often reluctant to invest in ESG reporting software without clear regulatory guidance, fearing that any future changes could render their current systems obsolete or non-compliant. This reluctance slows market adoption rates as businesses prefer to wait for more consistent and predictable regulatory environments before committing resources. The lack of uniform regulatory frameworks also undermines the potential for a standardized approach to ESG reporting, which is critical for ensuring data comparability and reliability across industries and geographies.

High Implementation Costs: A Deterrent to Wide-Scale Deployment

The high implementation costs associated with ESG reporting software represent a significant restraining factor for market growth. These costs encompass not only the purchase price of the software itself but also the expenses related to integration, customization, training, and ongoing maintenance. For many organizations, particularly small and medium-sized enterprises (SMEs), these costs can be prohibitively high. According to market data, the initial investment for comprehensive ESG reporting solutions can range from tens to hundreds of thousands of dollars, depending on the scale and complexity of the system.

Additionally, the implementation process often requires substantial time and resources, including the need for specialized personnel or consultants to manage the deployment and ensure that the software integrates seamlessly with existing systems. This complexity can lead to extended timelines before the software becomes fully operational, further delaying any potential return on investment. High costs and complexity also deter organizations from upgrading or switching to new systems, limiting the market's potential growth.

By Component Analysis

In 2023, Solutions dominated ESG Reporting Software, complemented by essential Services.

In 2023, Solution held a dominant market position in the By Component segment of the ESG Reporting Software Market, encompassing both Solution and Services. The Solution segment includes comprehensive software platforms designed for efficient ESG data management, reporting, and analytics. These solutions are pivotal for organizations seeking to enhance their sustainability reporting capabilities, comply with regulatory requirements, and achieve transparency in ESG disclosures. Key features typically include automated data collection, integration with existing enterprise systems, real-time analytics, and customizable reporting templates, catering to diverse industry needs.

The Services segment, while secondary in market dominance, plays a crucial supportive role. It comprises consultancy, implementation, and training services that ensure organizations can effectively deploy and utilize ESG reporting solutions. Services facilitate seamless integration, user training, and ongoing support, enabling companies to optimize their ESG reporting processes and derive maximum value from their software investments. As businesses increasingly prioritize ESG criteria, the comprehensive offerings of both solutions and services are critical in driving adoption and enhancing the overall efficacy of ESG reporting practices. This dual approach underscores the holistic nature of market leadership in the ESG Reporting Software Market.

By Vertical Analysis

Healthcare & Life Sciences dominate the ESG software market with a sustainability focus.

In 2023, Healthcare & Life Sciences held a dominant market position in the By Vertical segment of the ESG Reporting Software Market. The Healthcare & Life Sciences sector has emerged as a leader in the adoption of ESG (Environmental, Social, and Governance) reporting software, driven by increasing regulatory scrutiny and a growing emphasis on sustainability and ethical practices. The need for transparency in environmental impacts, patient safety, and ethical considerations in clinical trials has accelerated the integration of sophisticated ESG reporting tools. This sector's commitment to reducing its carbon footprint and improving social outcomes aligns with the broader trend towards sustainable and responsible business practices.

BFSI (Banking, Financial Services, and Insurance) is another significant player, motivated by investor demand for transparency in ESG performance and risk management. The sector leverages ESG reporting to enhance reputation and meet regulatory requirements.

IT & ITeS (Information Technology and Information Technology Enabled Services) firms prioritize ESG reporting to attract socially responsible investors and improve operational efficiencies. Their tech-driven approach enables robust data management and analytics, critical for ESG compliance.

Manufacturing industries are increasingly adopting ESG reporting to manage environmental impact, ensure supply chain transparency, and meet regulatory standards. This shift is crucial for maintaining competitiveness and meeting consumer expectations for sustainability.

Retail & Consumer Goods companies utilize ESG reporting to track sustainability efforts and enhance brand loyalty among eco-conscious consumers. Transparent reporting practices help mitigate reputational risks and align with global sustainability goals.

Government & Public Sector entities are progressively implementing ESG reporting to improve accountability, transparency, and public trust. These practices support policy implementation and sustainable development initiatives.

Energy & Utilities sectors focus on ESG reporting to manage environmental impact, particularly carbon emissions, and to comply with stringent regulations. These efforts are critical in the transition to renewable energy sources and sustainable operations.

Others, including sectors like education, transportation, and hospitality, are also recognizing the importance of ESG reporting. These sectors adopt ESG practices to enhance sustainability, meet regulatory requirements, and improve stakeholder engagement.

By Organization Size Analysis

Large enterprises dominate the ESG reporting software market, driving compliance and transparency.

In 2023, Large enterprises held a dominant market position in the ESG reporting software market, underscoring their significant investment capabilities and extensive regulatory requirements. Large enterprises, often with complex and global operations, necessitate robust ESG reporting solutions to ensure compliance, enhance transparency, and manage stakeholder expectations. These organizations are leveraging advanced software to streamline data collection, improve accuracy, and generate comprehensive ESG reports that meet international standards. Their ability to allocate substantial resources to integrate sophisticated ESG tools further consolidates their leading market share.

Conversely, SMEs are increasingly recognizing the importance of ESG reporting, driven by mounting pressure from customers, investors, and regulatory bodies. Although historically slower to adopt comprehensive ESG reporting software due to budget constraints, SMEs are beginning to invest in scalable and cost-effective solutions that cater to their specific needs. These solutions often offer modular features, allowing SMEs to gradually enhance their ESG reporting capabilities. The rising awareness among SMEs about the strategic benefits of ESG reporting such as improved access to capital, enhanced brand reputation, and competitive differentiation is expected to drive their adoption rates, gradually expanding their footprint in the ESG reporting software market.

By Deployment Mode Analysis

In 2023, On-Premise dominated ESG reporting, with Cloud rapidly rising.

In 2023, The On-Premise deployment mode held a dominant market position in the ESG Reporting Software Market. The On-Premise segment is particularly favored by large enterprises that prioritize data security and have robust IT infrastructure. These organizations often manage sensitive data that necessitates stringent security measures, which are more controllable through on-premise solutions. Additionally, on-premise deployment offers greater customization capabilities, allowing businesses to tailor the software to meet specific compliance and reporting requirements, enhancing its appeal to sectors with complex regulatory landscapes.

Conversely, the Cloud deployment mode has been gaining significant traction, especially among small to medium-sized enterprises (SMEs) and startups. The flexibility, scalability, and cost-effectiveness of cloud-based solutions make them an attractive option. Cloud deployment enables real-time data access and collaboration across geographically dispersed teams, which is essential for dynamic and fast-growing companies. Moreover, advancements in cloud security and the integration of AI and machine learning for enhanced analytics are driving the adoption of cloud-based ESG reporting software. As digital transformation accelerates, the cloud segment is expected to witness robust growth, potentially challenging the on-premise dominance shortly.

Key Market Segments

By Component

- Solution

- Services

By Vertical

- BFSI

- IT & ITeS

- Manufacturing

- Retail & Consumer Goods

- Government & Public Sector

- Healthcare & Life Sciences

- Energy & Utilities

- Others

By Organization Size

- Large Enterprises

- SMEs

By Deployment Mode

- On-premise

- Cloud

Growth Opportunity

Advanced Analytics and Visualization

The global ESG (Environmental, Social, and Governance) reporting software market is poised for significant growth, driven by advancements in analytics and visualization technologies. These enhancements enable companies to not only track and report their ESG metrics with greater accuracy but also to derive actionable insights from complex data sets. Advanced analytics tools are transforming raw data into meaningful patterns and trends, providing organizations with a clearer understanding of their sustainability performance. Visualization technologies further enhance this process by presenting data in intuitive formats, allowing stakeholders to quickly grasp key insights and make informed decisions. Companies investing in these sophisticated tools are likely to gain a competitive edge, as they can more effectively communicate their ESG initiatives and outcomes to stakeholders.

Increased Investor and Stakeholder Demand

The escalating demand from investors and stakeholders for transparent and robust ESG reporting is another critical driver of market growth. This trend is expected to intensify as more investors prioritize ESG factors in their decision-making processes. Regulatory pressures and societal expectations are pushing companies to adopt comprehensive ESG reporting practices. Investors are increasingly scrutinizing ESG performance as an indicator of long-term sustainability and risk management, compelling companies to improve their reporting capabilities. This growing demand creates a substantial market opportunity for ESG reporting software providers, who can offer solutions that meet the evolving needs of businesses aiming to enhance their ESG transparency and accountability.

Latest Trends

Artificial Intelligence and Machine Learning Integration: Enhancing Data Accuracy and Predictive Capabilities

The integration of artificial intelligence (AI) and machine learning (ML) into ESG (Environmental, Social, and Governance) reporting software is expected to be a game-changer. These technologies are anticipated to significantly enhance the accuracy and granularity of data collection and analysis. AI and ML can automate the aggregation of large datasets from diverse sources, identify patterns, and generate predictive insights. This leads to more robust and reliable ESG reports, enabling companies to better anticipate regulatory changes and investor expectations.

Furthermore, AI-driven analytics can offer deeper insights into ESG performance, helping organizations identify areas for improvement and implement strategic initiatives more effectively.

Cloud-Based Deployment: Driving Accessibility and Scalability in ESG Reporting Solutions

The shift towards cloud-based deployment of ESG reporting software is poised to accelerate. Cloud solutions offer unparalleled accessibility, allowing stakeholders to access ESG data and reporting tools from anywhere, fostering greater collaboration and transparency. The scalability of cloud-based platforms ensures that as companies grow or as reporting requirements become more complex, the software can adapt without the need for significant additional investment.

Moreover, cloud deployment enhances data security and compliance, as providers continuously update and secure their systems to meet evolving standards. This trend supports the growing need for real-time data reporting and the integration of ESG metrics into broader corporate performance dashboards.

Regional Analysis

North America dominates ESG reporting software with a 35% global share.

The ESG (Environmental, Social, and Governance) reporting software market is experiencing varied growth dynamics across different regions, each driven by unique regulatory landscapes and market demands. North America leads the market, commanding approximately 35% of the global share. This dominance is propelled by stringent regulatory requirements and a heightened emphasis on corporate transparency. The U.S. and Canada are spearheading this growth, with substantial investments in ESG initiatives by major corporations and institutional investors.

Europe follows closely, with a significant market share driven by robust regulatory frameworks such as the EU Taxonomy and the Sustainable Finance Disclosure Regulation (SFDR). Countries like Germany, France, and the UK are at the forefront, pushing for enhanced corporate accountability and sustainability reporting.

In the Asia Pacific region, rapid industrialization and growing awareness of sustainable practices are fueling market expansion. Nations like China, Japan, and Australia are witnessing increased adoption of ESG reporting software, supported by government initiatives promoting sustainability.

The Middle East & Africa and Latin America are emerging markets, characterized by the gradual adoption of ESG reporting practices. In these regions, multinational corporations and local enterprises are beginning to recognize the value of ESG compliance, spurred by global market pressures and investor expectations.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global ESG (Environmental, Social, and Governance) Reporting Software Market in 2024 is witnessing robust growth driven by increased regulatory pressures, investor demand for transparency, and corporate commitments to sustainability. Among the key players, Wolters Kluwer (Netherlands) and Nasdaq (US) stand out for their comprehensive compliance and reporting solutions that cater to stringent EU and US regulations. PwC (UK) and Bain & Co. (US) leverage their extensive consultancy backgrounds to offer integrated ESG reporting and strategic advisory services, enhancing their clients' sustainability frameworks.

Workiva (US) and Diligent (US) are noted for their advanced, user-friendly platforms that streamline complex ESG data collection and reporting processes, aiding companies in achieving regulatory compliance efficiently. Refinitiv (UK) and Greenstone (UK) provide robust data analytics capabilities, empowering businesses to derive actionable insights from ESG data.

Canadian firms Cority and Intelex are at the forefront of integrating ESG reporting with broader environmental, health, and safety (EHS) management systems, providing a holistic approach to corporate sustainability. Sphera (US) and Anthesis (UK) offer specialized solutions that emphasize risk management and operational performance, essential for industries with significant environmental footprints.

Emerging players like Novisto (Canada) and Emex (Ireland) bring innovative, scalable solutions to the market, catering particularly to mid-sized enterprises. The acquisition of Accuvio by Diligent underscores a trend toward consolidation, aiming to enhance service offerings through integrated platforms.

Overall, the ESG Reporting Software Market is characterized by a dynamic interplay of established leaders and agile innovators, collectively driving advancements in sustainability reporting and compliance.

Market Key Players

- Wolters Kluwer (Netherlands)

- Nasdaq (US)

- PwC (UK)

- Workiva (US)

- Refinitiv (UK)

- Diligent (US)

- Sphera (US)

- Cority (Canada)

- Intelex (Canada)

- Greenstone (UK)

- Novisto (Canada)

- Emex (Ireland)

- Enhelix (US)

- Anthesis (UK)

- Diginex (Hong Kong)

- Bain & Co. (US)

- Keramida (US)

- Isometric (US)

- Accuvio (acquired by Diligent) (US)

- Others

Recent Development

- In May 2024, Salesforce introduced its expanded ESG Cloud, a comprehensive suite of tools designed to help organizations track, report, and improve their ESG metrics. The latest enhancements include automated data collection, real-time reporting capabilities, and integration with existing Salesforce products to streamline ESG management across all business operations.

- In April 2024, Enablon, a leading provider of ESG and risk management software, announced the launch of its next-generation ESG reporting module. This update integrates advanced analytics and AI-driven insights, enabling organizations to enhance the accuracy and depth of their ESG disclosures. The new features aim to help companies better align with evolving regulatory requirements and stakeholder expectations.

- In March 2024, Sphera, a global leader in ESG and sustainability software, released a major update to its SpheraCloud platform. The new version includes enhanced carbon accounting features and industry-specific reporting templates. These improvements are geared towards helping companies in high-impact sectors, such as manufacturing and energy, to more accurately report their environmental footprints and meet stringent compliance standards.

Report Scope

Report Features Description Market Value (2023) USD 0.9 Billion Forecast Revenue (2033) USD 4.2 Billion CAGR (2024-2032) 17.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution and Services), By Vertical (BFSI, IT & ITeS, Manufacturing, Retail & Consumer Goods, Government & Public Sector, Healthcare & Life Sciences, Energy & Utilities, Others), By Organization Size (Large Enterprises and SMEs), By Deployment Mode (On-premise and Cloud) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Wolters Kluwer (Netherlands), Nasdaq (US), PwC (UK), Workiva (US), Refinitiv (UK), Diligent (US), Sphera (US), Cority (Canada), Intelex (Canada), Greenstone (UK), Novisto (Canada), Emex (Ireland), Enhelix (US), Anthesis (UK), Diginex (Hong Kong), Bain & Co. (US), Keramida (US), Isometrix (US), Accuvio (acquired by Diligent) (US), Others Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global ESG Reporting Software Market Overview

- 2.1. ESG Reporting Software Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. ESG Reporting Software Market Dynamics

- 3. Global ESG Reporting Software Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global ESG Reporting Software Market Analysis, 2016-2021

- 3.2. Global ESG Reporting Software Market Opportunity and Forecast, 2023-2032

- 3.3. Global ESG Reporting Software Market Analysis, Opportunity and Forecast, By Component, 2016-2032

- 3.3.1. Global ESG Reporting Software Market Analysis by Component: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component, 2016-2032

- 3.3.3. Solution

- 3.3.4. Services

- 3.4. Global ESG Reporting Software Market Analysis, Opportunity and Forecast, By Vertical, 2016-2032

- 3.4.1. Global ESG Reporting Software Market Analysis by Vertical: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vertical, 2016-2032

- 3.4.3. BFSI

- 3.4.4. IT & ITeS

- 3.4.5. Manufacturing

- 3.4.6. Retail & Consumer Goods

- 3.4.7. Government & Public Sector

- 3.4.8. Healthcare & Life Sciences

- 3.4.9. Energy & Utilities

- 3.4.10. Others

- 3.5. Global ESG Reporting Software Market Analysis, Opportunity and Forecast, By Organization size, 2016-2032

- 3.5.1. Global ESG Reporting Software Market Analysis by Organization size: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Organization size, 2016-2032

- 3.5.3. Large Enterprises

- 3.5.4. SMEs

- 3.6. Global ESG Reporting Software Market Analysis, Opportunity and Forecast, By Deployment Mode, 2016-2032

- 3.6.1. Global ESG Reporting Software Market Analysis by Deployment Mode: Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Deployment Mode, 2016-2032

- 3.6.3. On premise

- 3.6.4. Cloud

- 4. North America ESG Reporting Software Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America ESG Reporting Software Market Analysis, 2016-2021

- 4.2. North America ESG Reporting Software Market Opportunity and Forecast, 2023-2032

- 4.3. North America ESG Reporting Software Market Analysis, Opportunity and Forecast, By Component, 2016-2032

- 4.3.1. North America ESG Reporting Software Market Analysis by Component: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component, 2016-2032

- 4.3.3. Solution

- 4.3.4. Services

- 4.4. North America ESG Reporting Software Market Analysis, Opportunity and Forecast, By Vertical, 2016-2032

- 4.4.1. North America ESG Reporting Software Market Analysis by Vertical: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vertical, 2016-2032

- 4.4.3. BFSI

- 4.4.4. IT & ITeS

- 4.4.5. Manufacturing

- 4.4.6. Retail & Consumer Goods

- 4.4.7. Government & Public Sector

- 4.4.8. Healthcare & Life Sciences

- 4.4.9. Energy & Utilities

- 4.4.10. Others

- 4.5. North America ESG Reporting Software Market Analysis, Opportunity and Forecast, By Organization size, 2016-2032

- 4.5.1. North America ESG Reporting Software Market Analysis by Organization size: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Organization size, 2016-2032

- 4.5.3. Large Enterprises

- 4.5.4. SMEs

- 4.6. North America ESG Reporting Software Market Analysis, Opportunity and Forecast, By Deployment Mode, 2016-2032

- 4.6.1. North America ESG Reporting Software Market Analysis by Deployment Mode: Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Deployment Mode, 2016-2032

- 4.6.3. On premise

- 4.6.4. Cloud

- 4.7. North America ESG Reporting Software Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.7.1. North America ESG Reporting Software Market Analysis by Country : Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.7.2.1. The US

- 4.7.2.2. Canada

- 4.7.2.3. Mexico

- 5. Western Europe ESG Reporting Software Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe ESG Reporting Software Market Analysis, 2016-2021

- 5.2. Western Europe ESG Reporting Software Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe ESG Reporting Software Market Analysis, Opportunity and Forecast, By Component, 2016-2032

- 5.3.1. Western Europe ESG Reporting Software Market Analysis by Component: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component, 2016-2032

- 5.3.3. Solution

- 5.3.4. Services

- 5.4. Western Europe ESG Reporting Software Market Analysis, Opportunity and Forecast, By Vertical, 2016-2032

- 5.4.1. Western Europe ESG Reporting Software Market Analysis by Vertical: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vertical, 2016-2032

- 5.4.3. BFSI

- 5.4.4. IT & ITeS

- 5.4.5. Manufacturing

- 5.4.6. Retail & Consumer Goods

- 5.4.7. Government & Public Sector

- 5.4.8. Healthcare & Life Sciences

- 5.4.9. Energy & Utilities

- 5.4.10. Others

- 5.5. Western Europe ESG Reporting Software Market Analysis, Opportunity and Forecast, By Organization size, 2016-2032

- 5.5.1. Western Europe ESG Reporting Software Market Analysis by Organization size: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Organization size, 2016-2032

- 5.5.3. Large Enterprises

- 5.5.4. SMEs

- 5.6. Western Europe ESG Reporting Software Market Analysis, Opportunity and Forecast, By Deployment Mode, 2016-2032

- 5.6.1. Western Europe ESG Reporting Software Market Analysis by Deployment Mode: Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Deployment Mode, 2016-2032

- 5.6.3. On premise

- 5.6.4. Cloud

- 5.7. Western Europe ESG Reporting Software Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.7.1. Western Europe ESG Reporting Software Market Analysis by Country : Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.7.2.1. Germany

- 5.7.2.2. France

- 5.7.2.3. The UK

- 5.7.2.4. Spain

- 5.7.2.5. Italy

- 5.7.2.6. Portugal

- 5.7.2.7. Ireland

- 5.7.2.8. Austria

- 5.7.2.9. Switzerland

- 5.7.2.10. Benelux

- 5.7.2.11. Nordic

- 5.7.2.12. Rest of Western Europe

- 6. Eastern Europe ESG Reporting Software Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe ESG Reporting Software Market Analysis, 2016-2021

- 6.2. Eastern Europe ESG Reporting Software Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe ESG Reporting Software Market Analysis, Opportunity and Forecast, By Component, 2016-2032

- 6.3.1. Eastern Europe ESG Reporting Software Market Analysis by Component: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component, 2016-2032

- 6.3.3. Solution

- 6.3.4. Services

- 6.4. Eastern Europe ESG Reporting Software Market Analysis, Opportunity and Forecast, By Vertical, 2016-2032

- 6.4.1. Eastern Europe ESG Reporting Software Market Analysis by Vertical: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vertical, 2016-2032

- 6.4.3. BFSI

- 6.4.4. IT & ITeS

- 6.4.5. Manufacturing

- 6.4.6. Retail & Consumer Goods

- 6.4.7. Government & Public Sector

- 6.4.8. Healthcare & Life Sciences

- 6.4.9. Energy & Utilities

- 6.4.10. Others

- 6.5. Eastern Europe ESG Reporting Software Market Analysis, Opportunity and Forecast, By Organization size, 2016-2032

- 6.5.1. Eastern Europe ESG Reporting Software Market Analysis by Organization size: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Organization size, 2016-2032

- 6.5.3. Large Enterprises

- 6.5.4. SMEs

- 6.6. Eastern Europe ESG Reporting Software Market Analysis, Opportunity and Forecast, By Deployment Mode, 2016-2032

- 6.6.1. Eastern Europe ESG Reporting Software Market Analysis by Deployment Mode: Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Deployment Mode, 2016-2032

- 6.6.3. On premise

- 6.6.4. Cloud

- 6.7. Eastern Europe ESG Reporting Software Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.7.1. Eastern Europe ESG Reporting Software Market Analysis by Country : Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.7.2.1. Russia

- 6.7.2.2. Poland

- 6.7.2.3. The Czech Republic

- 6.7.2.4. Greece

- 6.7.2.5. Rest of Eastern Europe

- 7. APAC ESG Reporting Software Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC ESG Reporting Software Market Analysis, 2016-2021

- 7.2. APAC ESG Reporting Software Market Opportunity and Forecast, 2023-2032

- 7.3. APAC ESG Reporting Software Market Analysis, Opportunity and Forecast, By Component, 2016-2032

- 7.3.1. APAC ESG Reporting Software Market Analysis by Component: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component, 2016-2032

- 7.3.3. Solution

- 7.3.4. Services

- 7.4. APAC ESG Reporting Software Market Analysis, Opportunity and Forecast, By Vertical, 2016-2032

- 7.4.1. APAC ESG Reporting Software Market Analysis by Vertical: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vertical, 2016-2032

- 7.4.3. BFSI

- 7.4.4. IT & ITeS

- 7.4.5. Manufacturing

- 7.4.6. Retail & Consumer Goods

- 7.4.7. Government & Public Sector

- 7.4.8. Healthcare & Life Sciences

- 7.4.9. Energy & Utilities

- 7.4.10. Others

- 7.5. APAC ESG Reporting Software Market Analysis, Opportunity and Forecast, By Organization size, 2016-2032

- 7.5.1. APAC ESG Reporting Software Market Analysis by Organization size: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Organization size, 2016-2032

- 7.5.3. Large Enterprises

- 7.5.4. SMEs

- 7.6. APAC ESG Reporting Software Market Analysis, Opportunity and Forecast, By Deployment Mode, 2016-2032

- 7.6.1. APAC ESG Reporting Software Market Analysis by Deployment Mode: Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Deployment Mode, 2016-2032

- 7.6.3. On premise

- 7.6.4. Cloud

- 7.7. APAC ESG Reporting Software Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.7.1. APAC ESG Reporting Software Market Analysis by Country : Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.7.2.1. China

- 7.7.2.2. Japan

- 7.7.2.3. South Korea

- 7.7.2.4. India

- 7.7.2.5. Australia & New Zeland

- 7.7.2.6. Indonesia

- 7.7.2.7. Malaysia

- 7.7.2.8. Philippines

- 7.7.2.9. Singapore

- 7.7.2.10. Thailand

- 7.7.2.11. Vietnam

- 7.7.2.12. Rest of APAC

- 8. Latin America ESG Reporting Software Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America ESG Reporting Software Market Analysis, 2016-2021

- 8.2. Latin America ESG Reporting Software Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America ESG Reporting Software Market Analysis, Opportunity and Forecast, By Component, 2016-2032

- 8.3.1. Latin America ESG Reporting Software Market Analysis by Component: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component, 2016-2032

- 8.3.3. Solution

- 8.3.4. Services

- 8.4. Latin America ESG Reporting Software Market Analysis, Opportunity and Forecast, By Vertical, 2016-2032

- 8.4.1. Latin America ESG Reporting Software Market Analysis by Vertical: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vertical, 2016-2032

- 8.4.3. BFSI

- 8.4.4. IT & ITeS

- 8.4.5. Manufacturing

- 8.4.6. Retail & Consumer Goods

- 8.4.7. Government & Public Sector

- 8.4.8. Healthcare & Life Sciences

- 8.4.9. Energy & Utilities

- 8.4.10. Others

- 8.5. Latin America ESG Reporting Software Market Analysis, Opportunity and Forecast, By Organization size, 2016-2032

- 8.5.1. Latin America ESG Reporting Software Market Analysis by Organization size: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Organization size, 2016-2032

- 8.5.3. Large Enterprises

- 8.5.4. SMEs

- 8.6. Latin America ESG Reporting Software Market Analysis, Opportunity and Forecast, By Deployment Mode, 2016-2032

- 8.6.1. Latin America ESG Reporting Software Market Analysis by Deployment Mode: Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Deployment Mode, 2016-2032

- 8.6.3. On premise

- 8.6.4. Cloud

- 8.7. Latin America ESG Reporting Software Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.7.1. Latin America ESG Reporting Software Market Analysis by Country : Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.7.2.1. Brazil

- 8.7.2.2. Colombia

- 8.7.2.3. Chile

- 8.7.2.4. Argentina

- 8.7.2.5. Costa Rica

- 8.7.2.6. Rest of Latin America

- 9. Middle East & Africa ESG Reporting Software Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa ESG Reporting Software Market Analysis, 2016-2021

- 9.2. Middle East & Africa ESG Reporting Software Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa ESG Reporting Software Market Analysis, Opportunity and Forecast, By Component, 2016-2032

- 9.3.1. Middle East & Africa ESG Reporting Software Market Analysis by Component: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component, 2016-2032

- 9.3.3. Solution

- 9.3.4. Services

- 9.4. Middle East & Africa ESG Reporting Software Market Analysis, Opportunity and Forecast, By Vertical, 2016-2032

- 9.4.1. Middle East & Africa ESG Reporting Software Market Analysis by Vertical: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vertical, 2016-2032

- 9.4.3. BFSI

- 9.4.4. IT & ITeS

- 9.4.5. Manufacturing

- 9.4.6. Retail & Consumer Goods

- 9.4.7. Government & Public Sector

- 9.4.8. Healthcare & Life Sciences

- 9.4.9. Energy & Utilities

- 9.4.10. Others

- 9.5. Middle East & Africa ESG Reporting Software Market Analysis, Opportunity and Forecast, By Organization size, 2016-2032

- 9.5.1. Middle East & Africa ESG Reporting Software Market Analysis by Organization size: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Organization size, 2016-2032

- 9.5.3. Large Enterprises

- 9.5.4. SMEs

- 9.6. Middle East & Africa ESG Reporting Software Market Analysis, Opportunity and Forecast, By Deployment Mode, 2016-2032

- 9.6.1. Middle East & Africa ESG Reporting Software Market Analysis by Deployment Mode: Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Deployment Mode, 2016-2032

- 9.6.3. On premise

- 9.6.4. Cloud

- 9.7. Middle East & Africa ESG Reporting Software Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.7.1. Middle East & Africa ESG Reporting Software Market Analysis by Country : Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.7.2.1. Algeria

- 9.7.2.2. Egypt

- 9.7.2.3. Israel

- 9.7.2.4. Kuwait

- 9.7.2.5. Nigeria

- 9.7.2.6. Saudi Arabia

- 9.7.2.7. South Africa

- 9.7.2.8. Turkey

- 9.7.2.9. The UAE

- 9.7.2.10. Rest of MEA

- 10. Global ESG Reporting Software Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global ESG Reporting Software Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global ESG Reporting Software Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Wolters Kluwer (Netherlands)

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Nasdaq (US)

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. PwC (UK)

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Workiva (US)

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Refinitiv (UK)

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Diligent (US)

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Sphera (US)

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Cority (Canada)

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Intelex (Canada)

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Greenstone (UK)

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Novisto (Canada)

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Enhelix (US)

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Anthesis (UK)

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Diginex (Hong Kong)

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 11.18. Bain & Co. (US)

- 11.18.1. Company Overview

- 11.18.2. Financial Highlights

- 11.18.3. Product Portfolio

- 11.18.4. SWOT Analysis

- 11.18.5. Key Strategies and Developments

- 11.19. Keramida (US)

- 11.19.1. Company Overview

- 11.19.2. Financial Highlights

- 11.19.3. Product Portfolio

- 11.19.4. SWOT Analysis

- 11.19.5. Key Strategies and Developments

- 11.20. Isometrix (US)

- 11.20.1. Company Overview

- 11.20.2. Financial Highlights

- 11.20.3. Product Portfolio

- 11.20.4. SWOT Analysis

- 11.20.5. Key Strategies and Developments

- 11.21. Accuvio (acquired by Diligent) (US)

- 11.21.1. Company Overview

- 11.21.2. Financial Highlights

- 11.21.3. Product Portfolio

- 11.21.4. SWOT Analysis

- 11.21.5. Key Strategies and Developments

- 11.22. Others

- 11.22.1. Company Overview

- 11.22.2. Financial Highlights

- 11.22.3. Product Portfolio

- 11.22.4. SWOT Analysis

- 11.22.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global ESG Reporting Software Market Revenue (US$ Mn) Market Share by Component in 2022

- Figure 2: Global ESG Reporting Software Market Market Attractiveness Analysis by Component, 2016-2032

- Figure 3: Global ESG Reporting Software Market Revenue (US$ Mn) Market Share by Verticalin 2022

- Figure 4: Global ESG Reporting Software Market Market Attractiveness Analysis by Vertical, 2016-2032

- Figure 5: Global ESG Reporting Software Market Revenue (US$ Mn) Market Share by Organization sizein 2022

- Figure 6: Global ESG Reporting Software Market Market Attractiveness Analysis by Organization size, 2016-2032

- Figure 7: Global ESG Reporting Software Market Revenue (US$ Mn) Market Share by Deployment Modein 2022

- Figure 8: Global ESG Reporting Software Market Market Attractiveness Analysis by Deployment Mode, 2016-2032

- Figure 9: Global ESG Reporting Software Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 10: Global ESG Reporting Software Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 11: Global ESG Reporting Software Market Market Revenue (US$ Mn) (2016-2032)

- Figure 12: Global ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 13: Global ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Figure 14: Global ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Vertical (2016-2032)

- Figure 15: Global ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Organization size (2016-2032)

- Figure 16: Global ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Deployment Mode (2016-2032)

- Figure 17: Global ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 18: Global ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Figure 19: Global ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Vertical (2016-2032)

- Figure 20: Global ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Organization size (2016-2032)

- Figure 21: Global ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Deployment Mode (2016-2032)

- Figure 22: Global ESG Reporting Software Market Market Share Comparison by Region (2016-2032)

- Figure 23: Global ESG Reporting Software Market Market Share Comparison by Component (2016-2032)

- Figure 24: Global ESG Reporting Software Market Market Share Comparison by Vertical (2016-2032)

- Figure 25: Global ESG Reporting Software Market Market Share Comparison by Organization size (2016-2032)

- Figure 26: Global ESG Reporting Software Market Market Share Comparison by Deployment Mode (2016-2032)

- Figure 27: North America ESG Reporting Software Market Revenue (US$ Mn) Market Share by Componentin 2022

- Figure 28: North America ESG Reporting Software Market Market Attractiveness Analysis by Component, 2016-2032

- Figure 29: North America ESG Reporting Software Market Revenue (US$ Mn) Market Share by Verticalin 2022

- Figure 30: North America ESG Reporting Software Market Market Attractiveness Analysis by Vertical, 2016-2032

- Figure 31: North America ESG Reporting Software Market Revenue (US$ Mn) Market Share by Organization sizein 2022

- Figure 32: North America ESG Reporting Software Market Market Attractiveness Analysis by Organization size, 2016-2032

- Figure 33: North America ESG Reporting Software Market Revenue (US$ Mn) Market Share by Deployment Modein 2022

- Figure 34: North America ESG Reporting Software Market Market Attractiveness Analysis by Deployment Mode, 2016-2032

- Figure 35: North America ESG Reporting Software Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 36: North America ESG Reporting Software Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 37: North America ESG Reporting Software Market Market Revenue (US$ Mn) (2016-2032)

- Figure 38: North America ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 39: North America ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Figure 40: North America ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Vertical (2016-2032)

- Figure 41: North America ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Organization size (2016-2032)

- Figure 42: North America ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Deployment Mode (2016-2032)

- Figure 43: North America ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: North America ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Figure 45: North America ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Vertical (2016-2032)

- Figure 46: North America ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Organization size (2016-2032)

- Figure 47: North America ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Deployment Mode (2016-2032)

- Figure 48: North America ESG Reporting Software Market Market Share Comparison by Country (2016-2032)

- Figure 49: North America ESG Reporting Software Market Market Share Comparison by Component (2016-2032)

- Figure 50: North America ESG Reporting Software Market Market Share Comparison by Vertical (2016-2032)

- Figure 51: North America ESG Reporting Software Market Market Share Comparison by Organization size (2016-2032)

- Figure 52: North America ESG Reporting Software Market Market Share Comparison by Deployment Mode (2016-2032)

- Figure 53: Western Europe ESG Reporting Software Market Revenue (US$ Mn) Market Share by Componentin 2022

- Figure 54: Western Europe ESG Reporting Software Market Market Attractiveness Analysis by Component, 2016-2032

- Figure 55: Western Europe ESG Reporting Software Market Revenue (US$ Mn) Market Share by Verticalin 2022

- Figure 56: Western Europe ESG Reporting Software Market Market Attractiveness Analysis by Vertical, 2016-2032

- Figure 57: Western Europe ESG Reporting Software Market Revenue (US$ Mn) Market Share by Organization sizein 2022

- Figure 58: Western Europe ESG Reporting Software Market Market Attractiveness Analysis by Organization size, 2016-2032

- Figure 59: Western Europe ESG Reporting Software Market Revenue (US$ Mn) Market Share by Deployment Modein 2022

- Figure 60: Western Europe ESG Reporting Software Market Market Attractiveness Analysis by Deployment Mode, 2016-2032

- Figure 61: Western Europe ESG Reporting Software Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 62: Western Europe ESG Reporting Software Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 63: Western Europe ESG Reporting Software Market Market Revenue (US$ Mn) (2016-2032)

- Figure 64: Western Europe ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 65: Western Europe ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Figure 66: Western Europe ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Vertical (2016-2032)

- Figure 67: Western Europe ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Organization size (2016-2032)

- Figure 68: Western Europe ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Deployment Mode (2016-2032)

- Figure 69: Western Europe ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 70: Western Europe ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Figure 71: Western Europe ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Vertical (2016-2032)

- Figure 72: Western Europe ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Organization size (2016-2032)

- Figure 73: Western Europe ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Deployment Mode (2016-2032)

- Figure 74: Western Europe ESG Reporting Software Market Market Share Comparison by Country (2016-2032)

- Figure 75: Western Europe ESG Reporting Software Market Market Share Comparison by Component (2016-2032)

- Figure 76: Western Europe ESG Reporting Software Market Market Share Comparison by Vertical (2016-2032)

- Figure 77: Western Europe ESG Reporting Software Market Market Share Comparison by Organization size (2016-2032)

- Figure 78: Western Europe ESG Reporting Software Market Market Share Comparison by Deployment Mode (2016-2032)

- Figure 79: Eastern Europe ESG Reporting Software Market Revenue (US$ Mn) Market Share by Componentin 2022

- Figure 80: Eastern Europe ESG Reporting Software Market Market Attractiveness Analysis by Component, 2016-2032

- Figure 81: Eastern Europe ESG Reporting Software Market Revenue (US$ Mn) Market Share by Verticalin 2022

- Figure 82: Eastern Europe ESG Reporting Software Market Market Attractiveness Analysis by Vertical, 2016-2032

- Figure 83: Eastern Europe ESG Reporting Software Market Revenue (US$ Mn) Market Share by Organization sizein 2022

- Figure 84: Eastern Europe ESG Reporting Software Market Market Attractiveness Analysis by Organization size, 2016-2032

- Figure 85: Eastern Europe ESG Reporting Software Market Revenue (US$ Mn) Market Share by Deployment Modein 2022

- Figure 86: Eastern Europe ESG Reporting Software Market Market Attractiveness Analysis by Deployment Mode, 2016-2032

- Figure 87: Eastern Europe ESG Reporting Software Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 88: Eastern Europe ESG Reporting Software Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 89: Eastern Europe ESG Reporting Software Market Market Revenue (US$ Mn) (2016-2032)

- Figure 90: Eastern Europe ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 91: Eastern Europe ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Figure 92: Eastern Europe ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Vertical (2016-2032)

- Figure 93: Eastern Europe ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Organization size (2016-2032)

- Figure 94: Eastern Europe ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Deployment Mode (2016-2032)

- Figure 95: Eastern Europe ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 96: Eastern Europe ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Figure 97: Eastern Europe ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Vertical (2016-2032)

- Figure 98: Eastern Europe ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Organization size (2016-2032)

- Figure 99: Eastern Europe ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Deployment Mode (2016-2032)

- Figure 100: Eastern Europe ESG Reporting Software Market Market Share Comparison by Country (2016-2032)

- Figure 101: Eastern Europe ESG Reporting Software Market Market Share Comparison by Component (2016-2032)

- Figure 102: Eastern Europe ESG Reporting Software Market Market Share Comparison by Vertical (2016-2032)

- Figure 103: Eastern Europe ESG Reporting Software Market Market Share Comparison by Organization size (2016-2032)

- Figure 104: Eastern Europe ESG Reporting Software Market Market Share Comparison by Deployment Mode (2016-2032)

- Figure 105: APAC ESG Reporting Software Market Revenue (US$ Mn) Market Share by Componentin 2022

- Figure 106: APAC ESG Reporting Software Market Market Attractiveness Analysis by Component, 2016-2032

- Figure 107: APAC ESG Reporting Software Market Revenue (US$ Mn) Market Share by Verticalin 2022

- Figure 108: APAC ESG Reporting Software Market Market Attractiveness Analysis by Vertical, 2016-2032

- Figure 109: APAC ESG Reporting Software Market Revenue (US$ Mn) Market Share by Organization sizein 2022

- Figure 110: APAC ESG Reporting Software Market Market Attractiveness Analysis by Organization size, 2016-2032

- Figure 111: APAC ESG Reporting Software Market Revenue (US$ Mn) Market Share by Deployment Modein 2022

- Figure 112: APAC ESG Reporting Software Market Market Attractiveness Analysis by Deployment Mode, 2016-2032

- Figure 113: APAC ESG Reporting Software Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 114: APAC ESG Reporting Software Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 115: APAC ESG Reporting Software Market Market Revenue (US$ Mn) (2016-2032)

- Figure 116: APAC ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 117: APAC ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Figure 118: APAC ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Vertical (2016-2032)

- Figure 119: APAC ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Organization size (2016-2032)

- Figure 120: APAC ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Deployment Mode (2016-2032)

- Figure 121: APAC ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 122: APAC ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Figure 123: APAC ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Vertical (2016-2032)

- Figure 124: APAC ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Organization size (2016-2032)

- Figure 125: APAC ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Deployment Mode (2016-2032)

- Figure 126: APAC ESG Reporting Software Market Market Share Comparison by Country (2016-2032)

- Figure 127: APAC ESG Reporting Software Market Market Share Comparison by Component (2016-2032)

- Figure 128: APAC ESG Reporting Software Market Market Share Comparison by Vertical (2016-2032)

- Figure 129: APAC ESG Reporting Software Market Market Share Comparison by Organization size (2016-2032)

- Figure 130: APAC ESG Reporting Software Market Market Share Comparison by Deployment Mode (2016-2032)

- Figure 131: Latin America ESG Reporting Software Market Revenue (US$ Mn) Market Share by Componentin 2022

- Figure 132: Latin America ESG Reporting Software Market Market Attractiveness Analysis by Component, 2016-2032

- Figure 133: Latin America ESG Reporting Software Market Revenue (US$ Mn) Market Share by Verticalin 2022

- Figure 134: Latin America ESG Reporting Software Market Market Attractiveness Analysis by Vertical, 2016-2032

- Figure 135: Latin America ESG Reporting Software Market Revenue (US$ Mn) Market Share by Organization sizein 2022

- Figure 136: Latin America ESG Reporting Software Market Market Attractiveness Analysis by Organization size, 2016-2032

- Figure 137: Latin America ESG Reporting Software Market Revenue (US$ Mn) Market Share by Deployment Modein 2022

- Figure 138: Latin America ESG Reporting Software Market Market Attractiveness Analysis by Deployment Mode, 2016-2032

- Figure 139: Latin America ESG Reporting Software Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 140: Latin America ESG Reporting Software Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 141: Latin America ESG Reporting Software Market Market Revenue (US$ Mn) (2016-2032)

- Figure 142: Latin America ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 143: Latin America ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Figure 144: Latin America ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Vertical (2016-2032)

- Figure 145: Latin America ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Organization size (2016-2032)

- Figure 146: Latin America ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Deployment Mode (2016-2032)

- Figure 147: Latin America ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 148: Latin America ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Figure 149: Latin America ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Vertical (2016-2032)

- Figure 150: Latin America ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Organization size (2016-2032)

- Figure 151: Latin America ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Deployment Mode (2016-2032)

- Figure 152: Latin America ESG Reporting Software Market Market Share Comparison by Country (2016-2032)

- Figure 153: Latin America ESG Reporting Software Market Market Share Comparison by Component (2016-2032)

- Figure 154: Latin America ESG Reporting Software Market Market Share Comparison by Vertical (2016-2032)

- Figure 155: Latin America ESG Reporting Software Market Market Share Comparison by Organization size (2016-2032)

- Figure 156: Latin America ESG Reporting Software Market Market Share Comparison by Deployment Mode (2016-2032)

- Figure 157: Middle East & Africa ESG Reporting Software Market Revenue (US$ Mn) Market Share by Componentin 2022

- Figure 158: Middle East & Africa ESG Reporting Software Market Market Attractiveness Analysis by Component, 2016-2032

- Figure 159: Middle East & Africa ESG Reporting Software Market Revenue (US$ Mn) Market Share by Verticalin 2022

- Figure 160: Middle East & Africa ESG Reporting Software Market Market Attractiveness Analysis by Vertical, 2016-2032

- Figure 161: Middle East & Africa ESG Reporting Software Market Revenue (US$ Mn) Market Share by Organization sizein 2022

- Figure 162: Middle East & Africa ESG Reporting Software Market Market Attractiveness Analysis by Organization size, 2016-2032

- Figure 163: Middle East & Africa ESG Reporting Software Market Revenue (US$ Mn) Market Share by Deployment Modein 2022

- Figure 164: Middle East & Africa ESG Reporting Software Market Market Attractiveness Analysis by Deployment Mode, 2016-2032

- Figure 165: Middle East & Africa ESG Reporting Software Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 166: Middle East & Africa ESG Reporting Software Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 167: Middle East & Africa ESG Reporting Software Market Market Revenue (US$ Mn) (2016-2032)

- Figure 168: Middle East & Africa ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 169: Middle East & Africa ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Figure 170: Middle East & Africa ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Vertical (2016-2032)

- Figure 171: Middle East & Africa ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Organization size (2016-2032)

- Figure 172: Middle East & Africa ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Deployment Mode (2016-2032)

- Figure 173: Middle East & Africa ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 174: Middle East & Africa ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Figure 175: Middle East & Africa ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Vertical (2016-2032)

- Figure 176: Middle East & Africa ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Organization size (2016-2032)

- Figure 177: Middle East & Africa ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Deployment Mode (2016-2032)

- Figure 178: Middle East & Africa ESG Reporting Software Market Market Share Comparison by Country (2016-2032)

- Figure 179: Middle East & Africa ESG Reporting Software Market Market Share Comparison by Component (2016-2032)

- Figure 180: Middle East & Africa ESG Reporting Software Market Market Share Comparison by Vertical (2016-2032)

- Figure 181: Middle East & Africa ESG Reporting Software Market Market Share Comparison by Organization size (2016-2032)

- Figure 182: Middle East & Africa ESG Reporting Software Market Market Share Comparison by Deployment Mode (2016-2032)

"

- List of Tables

- "

- Table 1: Global ESG Reporting Software Market Market Comparison by Component (2016-2032)

- Table 2: Global ESG Reporting Software Market Market Comparison by Vertical (2016-2032)

- Table 3: Global ESG Reporting Software Market Market Comparison by Organization size (2016-2032)

- Table 4: Global ESG Reporting Software Market Market Comparison by Deployment Mode (2016-2032)

- Table 5: Global ESG Reporting Software Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global ESG Reporting Software Market Market Revenue (US$ Mn) (2016-2032)

- Table 7: Global ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 8: Global ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Table 9: Global ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Vertical (2016-2032)

- Table 10: Global ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Organization size (2016-2032)

- Table 11: Global ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Deployment Mode (2016-2032)

- Table 12: Global ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 13: Global ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Table 14: Global ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Vertical (2016-2032)

- Table 15: Global ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Organization size (2016-2032)

- Table 16: Global ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Deployment Mode (2016-2032)

- Table 17: Global ESG Reporting Software Market Market Share Comparison by Region (2016-2032)

- Table 18: Global ESG Reporting Software Market Market Share Comparison by Component (2016-2032)

- Table 19: Global ESG Reporting Software Market Market Share Comparison by Vertical (2016-2032)

- Table 20: Global ESG Reporting Software Market Market Share Comparison by Organization size (2016-2032)

- Table 21: Global ESG Reporting Software Market Market Share Comparison by Deployment Mode (2016-2032)

- Table 22: North America ESG Reporting Software Market Market Comparison by Vertical (2016-2032)

- Table 23: North America ESG Reporting Software Market Market Comparison by Organization size (2016-2032)

- Table 24: North America ESG Reporting Software Market Market Comparison by Deployment Mode (2016-2032)

- Table 25: North America ESG Reporting Software Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 26: North America ESG Reporting Software Market Market Revenue (US$ Mn) (2016-2032)

- Table 27: North America ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 28: North America ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Table 29: North America ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Vertical (2016-2032)

- Table 30: North America ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Organization size (2016-2032)

- Table 31: North America ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Deployment Mode (2016-2032)

- Table 32: North America ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 33: North America ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Table 34: North America ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Vertical (2016-2032)

- Table 35: North America ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Organization size (2016-2032)

- Table 36: North America ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Deployment Mode (2016-2032)

- Table 37: North America ESG Reporting Software Market Market Share Comparison by Country (2016-2032)

- Table 38: North America ESG Reporting Software Market Market Share Comparison by Component (2016-2032)

- Table 39: North America ESG Reporting Software Market Market Share Comparison by Vertical (2016-2032)

- Table 40: North America ESG Reporting Software Market Market Share Comparison by Organization size (2016-2032)

- Table 41: North America ESG Reporting Software Market Market Share Comparison by Deployment Mode (2016-2032)

- Table 42: Western Europe ESG Reporting Software Market Market Comparison by Component (2016-2032)

- Table 43: Western Europe ESG Reporting Software Market Market Comparison by Vertical (2016-2032)

- Table 44: Western Europe ESG Reporting Software Market Market Comparison by Organization size (2016-2032)

- Table 45: Western Europe ESG Reporting Software Market Market Comparison by Deployment Mode (2016-2032)

- Table 46: Western Europe ESG Reporting Software Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 47: Western Europe ESG Reporting Software Market Market Revenue (US$ Mn) (2016-2032)

- Table 48: Western Europe ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 49: Western Europe ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Table 50: Western Europe ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Vertical (2016-2032)

- Table 51: Western Europe ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Organization size (2016-2032)

- Table 52: Western Europe ESG Reporting Software Market Market Revenue (US$ Mn) Comparison by Deployment Mode (2016-2032)

- Table 53: Western Europe ESG Reporting Software Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)