Electrical Bushing Market By Product Type (Oil Impregnated Paper (OIP), Resin Impregnated Paper (RIP) and Others), By Insulation (Porcelain, Polymeric, and Glass), By Voltage (Medium, High, and Extra High Voltage), By Application (Transformer, Switchgear, and Others), By End User (Utilities, Industries, and Others), By Technology, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

-

8811

-

May 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

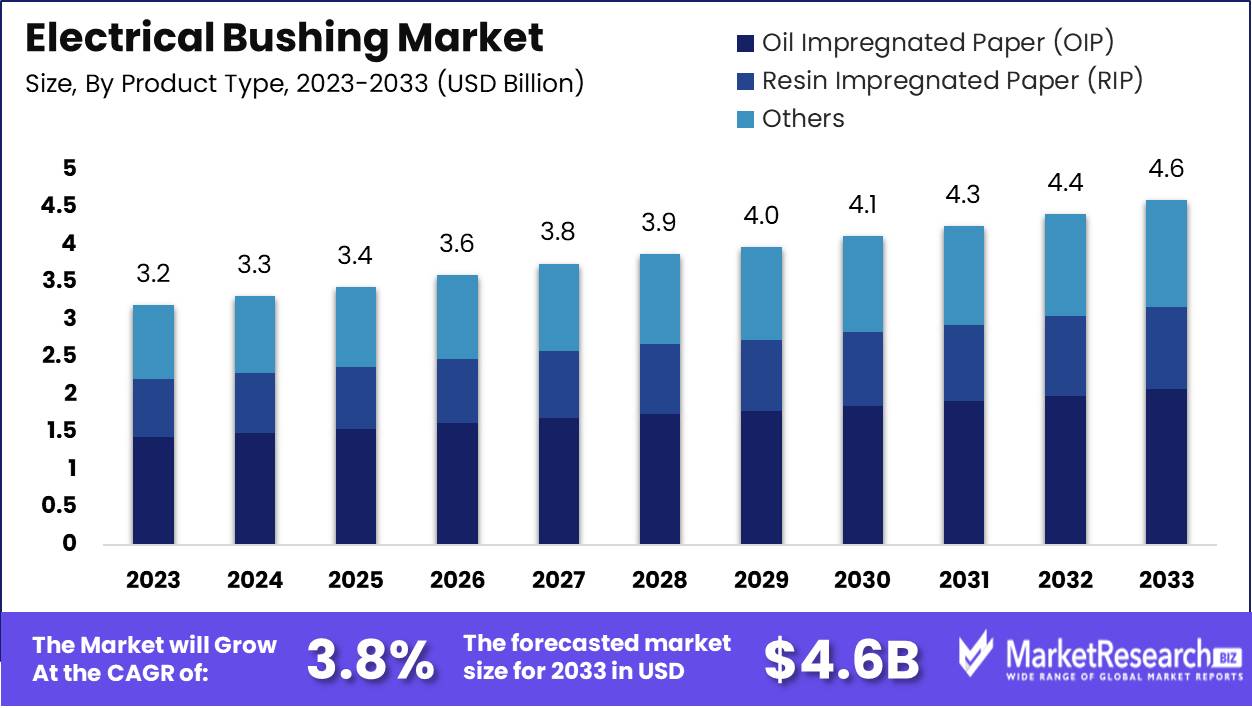

The Electrical Bushing Market was valued at USD 3.2 billion in 2023. It is expected to reach USD 4.6 billion in 2033, with a CAGR of 3.8% during the forecast period from 2024 to 2033.

The surge in demand for integrated insulation bushings and the rapid requirement from the railway and renewable energy industries for electrical equipment are some of the main key factors for the electrical bushing market expansion. The distribution of electricity is carried out in multiple places such as power generation units to commercial setups. Electrical bushing is important and compulsory for the stable distribution of electricity. It has become mandatory because it ensures the safety of both machines and humans.

There are several factors for working together to ensure the safe and efficient flow of electricity into different systems. One such component is the electrical bushing in transformers that carries high voltage of current through enclosed equipment and offers an insulating shield between the live conductor and the electrical apparatus conducting body. These types of electrical bushings are made up of porcelain, epoxy, and some composite materials. The main purposes of such kinds of electrical bushing are electrical insulation, environmental protection, and voltage distribution. The electrical bushings in the transformers allow the live wire, either high- or low-voltage, to generate power out of the transformer.

For example, Transformers have electrical bushing that creates a bridge between the HV windings and the external electrical lines. Such types of electrical bushings must be secure and have an insulated connection for the electricity to pass from the transformer to the other external circuit. It prevents electrical short circuits that could otherwise happen due to the difference in different voltage levels. The transformers are then protected and ensure efficient transmission of the electric power flow. Electrical bushings are an important element in transformers and act as a shielded interface that ensures the consistent and safe workflow of these elements in electrical power distribution systems.

Additionally, the modernization of the present transformers is a substantial factor in the market expansion. The surge in electrification and rise in urbanization of the developing regions will also contribute to market growth. Electrical bushing is a crucial part of the industry as it offers both electrical insulation and structural support. Thus, it safeguards the operations of multiple electrical systems and contributes to the whole functionality of the industrial infrastructure. Such type of industrial requirements will help the electrical bushing market to expand in the coming future.

Key Takeaways

- Market Growth: The electrical bushing market was valued at USD 3.2 billion in 2023. It is expected to reach 4.6 billion in 2033, with a CAGR of 3.8% during the forecast period from 2024 to 2033.

- By Product Type: Oil Impregnated Paper (OIP) dominates the Electrical Bushing Market with reliability and cost-effectiveness.

- By Insulation: Porcelain dominates the Electrical Bushing Market with unmatched durability and reliability.

- By Voltage: In 2023's Electrical Bushing Market is dominated by Medium Voltage, with robust growth.

- By Application: In 2023 Electrical Bushing Market was led by Transformers, driven by technological advancements.

- By End User: In 2023, Utilities dominated, while Industries and Others contributed significantly.

- Regional Dominance: Asia Pacific dominates with a 45% share, driven by rapid industrialization.

- Growth Opportunity: The global electrical bushing market thrives on upgrading infrastructure and meeting rising renewable energy demands.

Driving factors

Growing Power Demand: Energizing the Electrical Bushing Market

The escalating global demand for electricity is a pivotal driver for the growth of the electrical bushing market. As economies expand and urbanization progresses, the consumption of electricity surges, particularly in emerging markets. According to the International Energy Agency, global electricity demand is expected to grow by 2.1% per year through 2040, necessitating substantial investments in electrical infrastructure.

Electrical bushings, essential for safely conducting electricity through the enclosures of high-voltage equipment, see heightened demand driven by this need for expanded electrical capacity. This increased requirement for electrical infrastructure directly correlates with a higher volume of installations of transformers, switchgear, and other distribution equipment, which are integral components requiring bushings for efficient and safe operation.

Expansion and Upgradation of Grid Structure: Creating a Robust Framework for Market Expansion

The expansion and modernization of grid infrastructure worldwide significantly enhance the growth prospects for the electrical bushing market. As nations strive to improve the reliability and efficiency of power distribution, the upgrade of existing grid structures becomes imperative. This factor is particularly pronounced in developed economies where aging power systems pose risks to energy reliability and efficiency.

Simultaneously, in developing regions, the push to electrify rural areas and integrate renewable energy sources into the grid necessitates the building of new infrastructure. These developments lead to increased demand for high-quality electrical bushings, which are crucial for preventing electrical failures and ensuring the longevity of the infrastructure. Additionally, the trend towards smart grids and the integration of digital technologies into grid operations indirectly supports the bushing market by increasing the overall investment in and sophistication of electrical transmission systems.

Industrial Sector Energy Consumption: Fueling Market Demand Through Sector-Specific Needs

The industrial sector's energy consumption also plays a significant role in shaping the demand for electrical bushings. Industries such as manufacturing, mining, and chemicals are heavily reliant on stable and uninterrupted power supply, which requires robust electrical infrastructure. As industrial entities expand, so too does their energy demand, driving the need for specialized electrical equipment, including bushings that can handle high voltages and ensure operational safety.

Moreover, the push towards energy efficiency and sustainability within the sector encourages upgrades to more reliable and efficient electrical systems, further bolstering the market for advanced bushing solutions. This trend is particularly notable in regions experiencing rapid industrial growth, such as Asia-Pacific, where industrial energy consumption is expected to continue its upward trajectory, directly influencing the demand dynamics in the electrical bushing market.

Restraining Factors

Aging Power Systems as a Constraint on Market Expansion

Aging power systems are a significant restraining factor in the electrical bushing market. As infrastructure ages, the risk of system inefficiencies and failures increases, necessitating rigorous maintenance rather than replacement with new technologies that incorporate advanced bushings. This dynamic can slow down the adoption rate of newer, more efficient bushing technologies which are essential for modern electrical systems. Furthermore, the financial burden of upgrading aging systems often leads to prolonged decision cycles by utilities and industries, further impeding the swift integration of new solutions.

Failure Risks Curtailing Technological Adoption

The inherent risk of failure in electrical bushings poses a critical challenge to market growth. Failures can lead to significant operational disruptions and safety hazards, which in turn increase liability concerns for manufacturers and users. This fear of potential failures makes stakeholders cautious about adopting newer bushing technologies, despite their improved performance and safety features. Consequently, the market's growth is restrained as the industry tends to favor proven, albeit older, technologies over innovative solutions that still need to establish a longer track record of reliability.

By Product Type Analysis

Oil Impregnated Paper (OIP) dominates the Electrical Bushing Market with reliability and cost-effectiveness.

In 2023, Oil Impregnated Paper (OIP) held a dominant market position in the "By Product Type" segment of the Electrical Bushing Market. This segment includes Oil Impregnated Paper (OIP), Resin Impregnated Paper (RIP), and other materials. OIP's predominance in the market can be attributed to its proven reliability and cost-effectiveness in high-voltage applications, making it a preferred choice for utility companies and heavy industries.

The Resin Impregnated Paper (RIP), on the other hand, has been gaining traction due to its enhanced mechanical strength and reduced environmental risks compared to OIP. RIP is increasingly favored in regions with stringent environmental regulations and where operational reliability under varying climatic conditions is critical.

The "Others" category includes newer materials and technologies that are being developed to address specific market needs such as higher performance efficiency, lower maintenance costs, and reduced environmental impact. This segment is expected to grow as technological innovations and sustainability criteria become more influential in market dynamics. Each of these product types is evolving in response to the shifting priorities of energy distribution networks and the increasing demand for more durable and ecologically responsible solutions.

By Insulation Analysis

Porcelain dominates the Electrical Bushing Market with unmatched durability and reliability.

In 2023, Porcelain held a dominant market position in the "By Insulation" segment of the Electrical Bushing Market, underscoring its pivotal role amidst alternatives such as polymeric and glass insulations. Porcelain, known for its excellent electrical insulation properties and high mechanical strength, remains the preferred choice in environments demanding robust performance and durability. This material's longevity and resistance to thermal and environmental stresses have solidified its status as a cornerstone in traditional power infrastructure, particularly in high-voltage applications.

On the other hand, the polymeric and glass segments represent innovative adaptations to evolving market needs. Polymeric bushings, favored for their lighter weight and superior flexibility, offer significant advantages in terms of ease of installation and reduced maintenance costs. These features make them particularly suitable for dynamic modern grid systems. Meanwhile, glass, though less common, provides unique aesthetic options and transparency, aligning with niche applications where visual monitoring of internal conditions is beneficial. Each material brings distinct advantages to the table, shaping the competitive landscape of the electrical bushing market.

By Voltage Analysis

In 2023's Electrical Bushing Market: Dominated by Medium Voltage, robust growth.

In 2023, the Electrical Bushing Market saw varying degrees of dominance across different voltage segments, each serving specific operational needs in power infrastructure. The Medium Voltage segment maintained a substantial market share, driven by extensive applications in industrial and urban infrastructure where safety and reliability are critical. This segment benefits from a broad base of established installations and ongoing upgrades to more efficient and safer systems.

Moving to the High Voltage segment, its significance is underscored by the need for robust systems capable of handling the demands of long-distance transmission and substations. This segment's growth is propelled by the expanding reach of grid networks and the integration of renewable energy sources, necessitating advanced bushing solutions that minimize electrical losses and enhance performance.

The Extra High Voltage segment, while more niche, is critical for regions pushing the boundaries of power transmission over vast distances. This segment is essential for interconnecting power grids across countries and continents, facilitating large-scale energy distribution with minimal losses. Innovations in materials and technology in this segment are pivotal, as they directly impact efficiency and system stability in high-demand scenarios. Each segment addresses unique challenges and plays a vital role in the broader landscape of electrical infrastructure development.

By Application Analysis

In 2023 Electrical Bushing Market was led by Transformers, driven by technological advancements.

In 2023, the Electrical Bushing Market saw distinct segmental dominance across various applications, particularly highlighting Transformers, Switchgear, and Other relevant applications.

Transformers, as a primary application, held a dominant market position, reflecting their critical role in basis of voltage regulation and electrical insulation within power systems. This segment benefits significantly from advancements in material science and an increased focus on grid stability in renewable energy transitions. Switchgear, another key segment, also showed substantial growth, driven by the escalating demand for high-voltage transmission systems and the integration of smart grid technologies. This segment's expansion is further supported by investments in infrastructure upgrades and enhanced safety standards.

The 'Others' category, encompassing applications such as generators and capacitors, though smaller, is witnessing innovation-driven growth, particularly in response to the evolving needs for energy-efficient and compact power equipment. Each segment, therefore, presents unique opportunities and challenges, underscored by technological advancements and regulatory frameworks shaping the market dynamics.

By End User Analysis

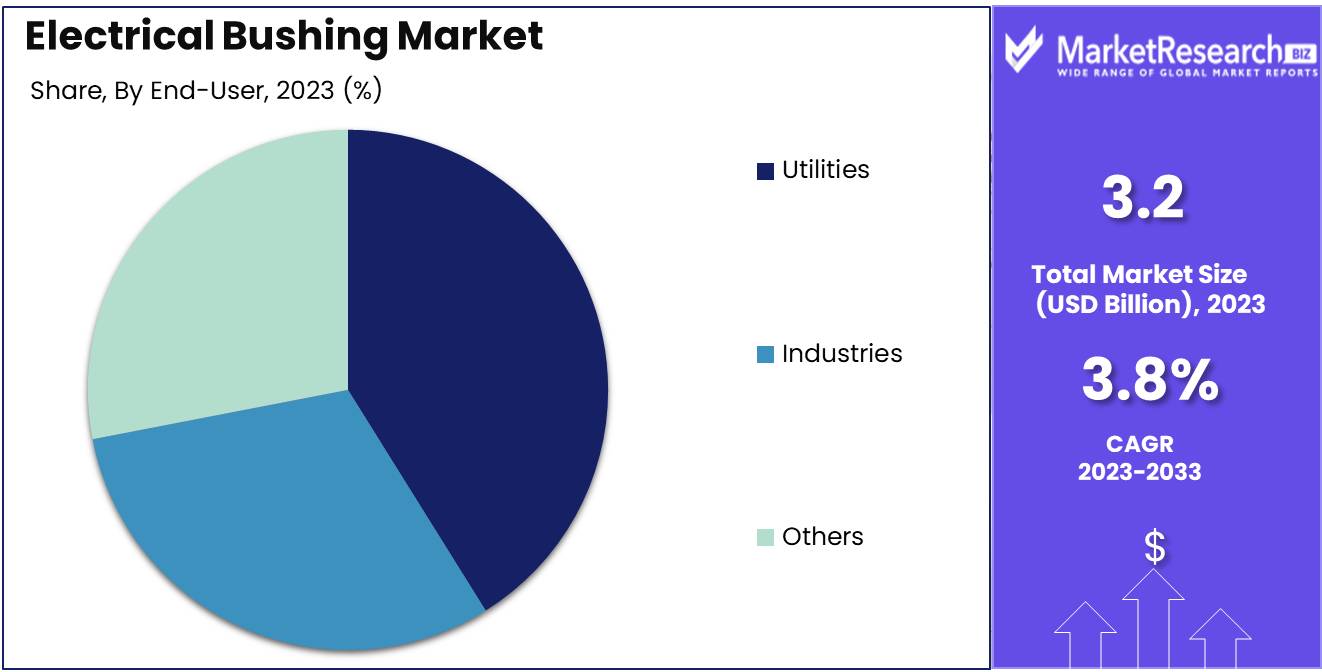

In 2023, Utilities dominated, while Industries and Others contributed significantly.

In 2023, Utilities held a dominant market position in the Electrical Bushing Market's By End User segment. Utilities, encompassing power generation, transmission, and distribution entities, emerged as the primary consumers of electrical bushings. The sector's reliance on electrical infrastructure for efficient energy delivery drove the demand for bushings, crucial components facilitating safe electrical insulation and power transmission. Moreover, stringent regulatory frameworks emphasizing grid reliability and safety standards further propelled the adoption of advanced bushing technologies within utility networks.

Concurrently, Industries constituted another significant end-user segment, comprising manufacturing, mining, and oil and gas sectors. These industries integrated electrical bushings into their operational frameworks to ensure uninterrupted power supply and safeguard critical equipment against electrical faults.

Additionally, Other end users, including commercial establishments and infrastructure projects, contributed to market growth by incorporating bushings for diverse electrical applications. This robust demand across multiple end-user segments underscores the pivotal role of electrical bushings in sustaining reliable and efficient electrical systems.

Key Market Segments

By Product Type

- Oil Impregnated Paper (OIP)

- Resin Impregnated Paper (RIP)

- Others

By Insulation

- Porcelain

- Polymeric

- Glass

By Voltage

- Medium

- High

- Extra High Voltage

By Application

- Transformer

- Switchgear

- Others

By End User

- Utilities

- Industries

- Others

Growth Opportunity

Upgrading and Modernizing Aging Electrical Infrastructure

The global electrical bushing market stands poised for significant expansion in 2024, primarily fueled by the imperative need to upgrade and modernize aging electrical infrastructure worldwide. As established economies continue to grapple with outdated systems, the demand for efficient and reliable electrical components, including bushings, escalates. With governments and private entities allocating substantial investments toward infrastructure revitalization projects, the electrical bushing market is expected to witness a surge in demand.

According to recent industry analysis, the global electrical bushing market growth can be attributed to the pressing requirement for enhanced grid reliability and resilience, particularly in regions with aging infrastructure. As countries embark on ambitious electrification programs, the role of electrical bushings in ensuring the seamless transmission of electricity becomes increasingly pivotal.

Increasing Demand for Renewable Energy

Furthermore, the escalating demand for renewable energy sources further augments the growth opportunities for the electrical bushing market. As the world transitions toward sustainable energy solutions, there is a burgeoning need for robust electrical systems capable of accommodating the intermittency associated with renewable sources. Electrical bushings play a critical role in facilitating the efficient transmission of power generated from renewable assets such as wind and solar farms.

Recent market studies indicate that the renewable energy sector is poised for exponential growth, with investments reaching unprecedented levels. By capitalizing on this trend, manufacturers in the electrical bushing market can align their product offerings with the evolving needs of renewable energy infrastructure, thereby unlocking new avenues for expansion and innovation.

Latest Trends

Renewable Energy Projects

The burgeoning demand for renewable energy sources continues to propel the Electrical Bushing Market forward. With increasing environmental consciousness and governmental initiatives favoring clean energy, the integration of electrical bushings in renewable energy projects, such as solar and wind farms, has witnessed unprecedented growth. The intricate design and high voltage requirements of these projects necessitate specialized bushings capable of withstanding harsh environmental conditions, thereby driving innovation and expansion within the market.

Modernization of Existing Transformers

Another prominent trend is the modernization drive within the Electrical Bushing Market driven by the imperative to upgrade existing transformer infrastructure. As aging transformers face obsolescence and inefficiencies, utilities and industries are investing in retrofitting and upgrading initiatives to enhance operational efficiency and prolong asset lifespan. This trend not only fosters the adoption of advanced bushing technologies but also presents lucrative opportunities for manufacturers to provide retrofit solutions tailored to the specific needs of diverse transformer installations.

Regional Analysis

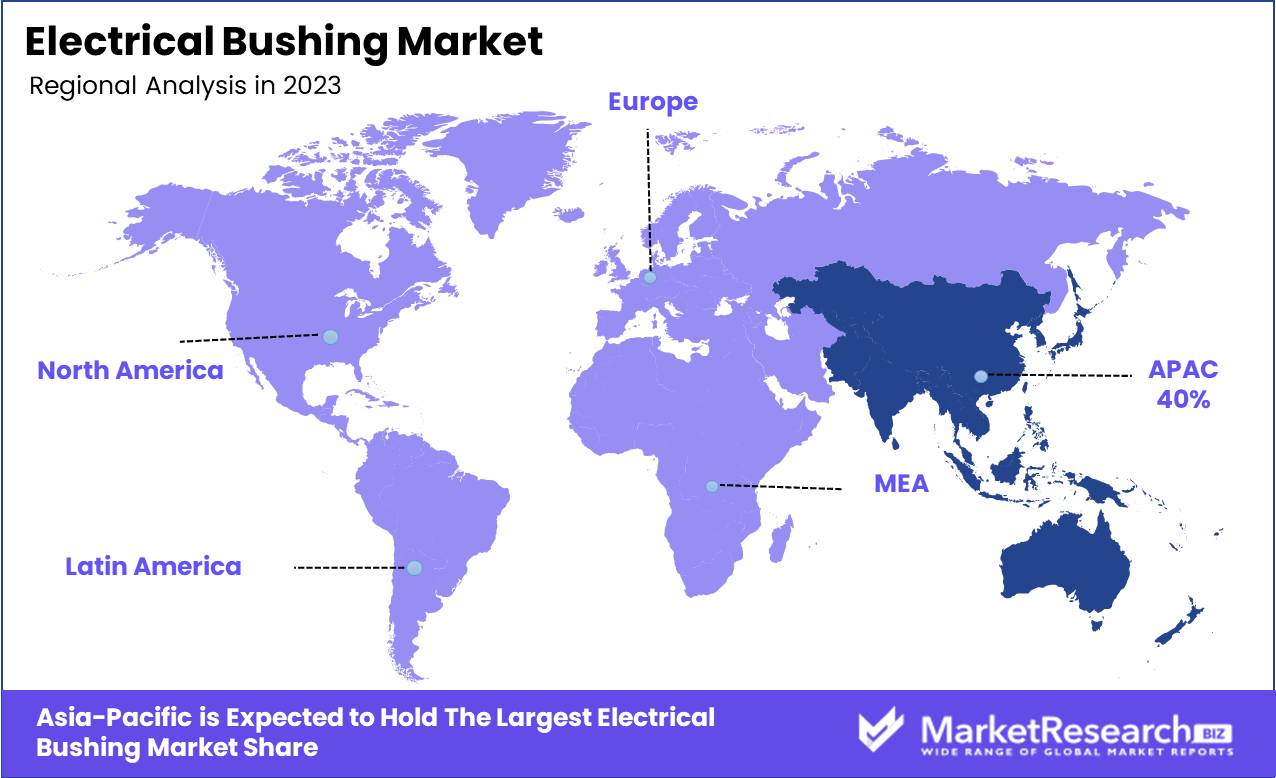

Asia Pacific dominates with a 45% share, driven by rapid industrialization.

In North America, the electrical bushing market is marked by steady growth, attributed primarily to robust infrastructural development and ongoing modernization initiatives in the power transmission and distribution sector. Regulatory emphasis on energy efficiency and the adoption of renewable energy sources further bolster market expansion.

Europe showcases a mature market landscape with a focus on upgrading aging power infrastructure, driving demand for advanced bushing technologies. Asia Pacific emerges as the dominating region, spearheading market growth with a significant largest market share attributed to rapid industrialization, urbanization, and escalating energy demand. According to recent industry analyses, Asia Pacific commands approximately 45% of the global electrical bushing market, driven by substantial investments in grid expansion projects and renewable energy integration.

Middle East & Africa and Latin America exhibit promising growth prospects, propelled by burgeoning investments in power generation and transmission infrastructure, albeit with varying degrees of market penetration. Collectively, these regions present a dynamic landscape for electrical bushing manufacturers, with Asia Pacific leading the charge in market dominance.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the landscape of the global Electrical Bushing Market in 2024, key players such as ABB Group, TRENCH Group (SIEMENS), General Electric, Eaton, and others stand as pivotal entities shaping the industry's trajectory. These major companies, renowned for their innovation and expertise, wield considerable influence over market dynamics.

The ABB Group, for instance, continues to fortify its position through strategic acquisitions and technological advancements, cementing its reputation as a leader in electrical solutions. Similarly, TRENCH Group (SIEMENS) leverages its extensive experience and global reach to offer cutting-edge bushing solutions tailored to diverse market needs.

General Electric and Eaton, stalwarts in the electrical industry, consistently demonstrate a commitment to innovation and quality, driving market growth through their comprehensive product portfolios and customer-centric approach.

Moreover, emerging players like Elliot Industries, Gipro GMBH, and RHM International inject dynamism into the market with their specialized offerings and agile business strategies, challenging established norms and fostering healthy competition.

As the global demand for reliable electrical infrastructure continues to surge, key players like Toshiba, Webster-Wilkinson, Siemens, and Nexans play an instrumental role in meeting these needs through their robust product offerings and unwavering dedication to excellence.

Market Key Players

- ABB Group

- TRENCH Group (SIEMENS)

- General Electric

- Eaton

- Elliot Industries

- Gipro GMBH

- RHM International

- Toshiba

- Webster-Wilkinson

- Siemens (Germany)

- Nexans (France)

Recent Development

- In June 2023, At CWIEME Berlin, Hitachi Energy unveiled cutting-edge solutions, spotlighting breakthroughs in transformer insulation and components. Their product launch included interactive sessions on EasyDry®, a pioneering dry-type, paperless bushing.

- In December 2023, Bechtel Energy Inc. entrusted ABB with the task of delivering comprehensive automation, electrical, and digital solutions for Phase 1 of the Rio Grande LNG facility in Brownsville, Texas, as per the contract awarded.

Report Scope

Report Features Description Market Value (2023) USD 3.2 billion Forecast Revenue (2033) USD 4.6 billion CAGR (2024-2032) 3.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Oil Impregnated Paper (OIP), Resin Impregnated Paper (RIP) and Others), By Insulation (Porcelain, Polymeric, and Glass), By Voltage (Medium, High, and Extra High Voltage), By Application (Transformer, Switchgear, and Others), By End User(Utilities, Industries, and Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape ABB Group, TRENCH Group (SIEMENS), General Electric, Eaton, Elliot Industries, Gipro GMBH, RHM International, Toshiba, Webster-Wilkinson, Siemens (Germany), Nexans (France) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- ABB Group

- TRENCH Group (SIEMENS)

- General Electric

- Eaton

- Elliot Industries

- Gipro GMBH

- RHM International

- Toshiba

- Webster-Wilkinson

- Siemens (Germany)

- Nexans (France)