Electric Construction Equipment Market By Vehicle (Forklift, Excavator, Loader, Crane, Roller, Others), By Battery (Lithium-Ion, Lead Acid, Others), By End-Use (Residential, Commercial, Industrial), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47484

-

June 2024

-

300

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

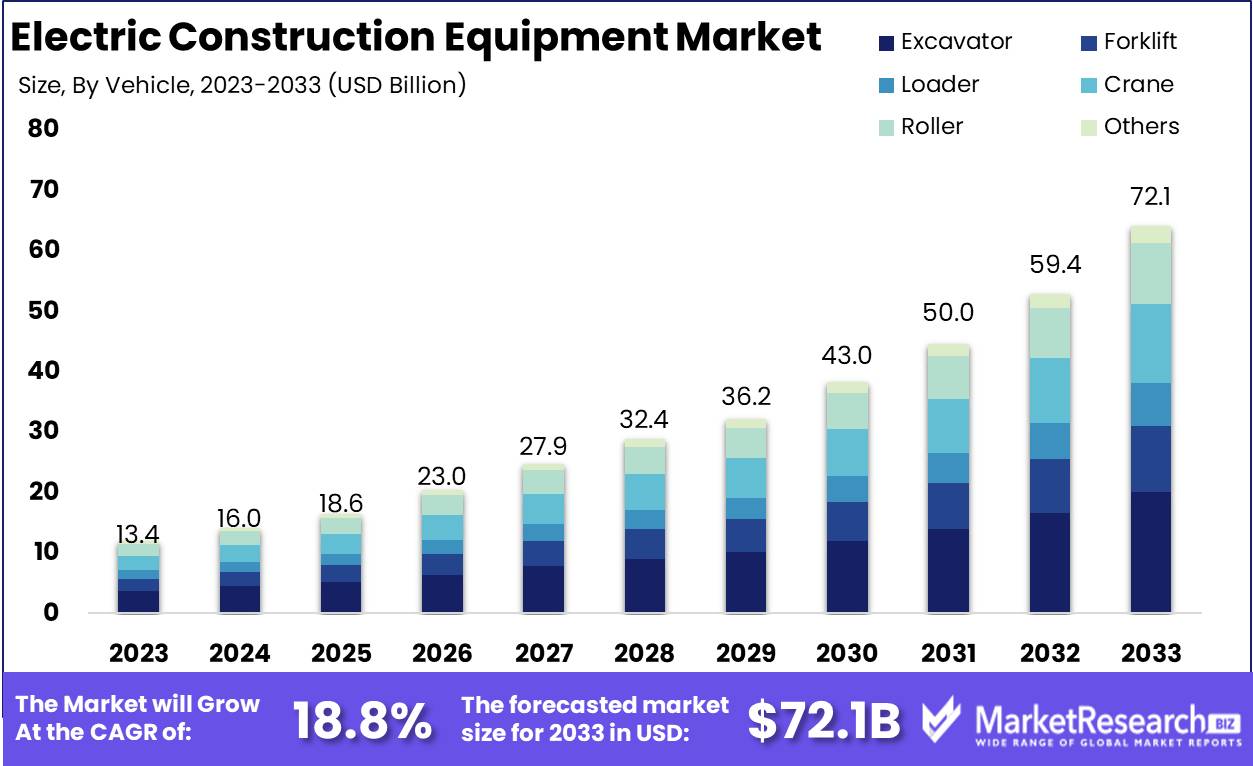

The Electric Construction Equipment Market was valued at USD 13.4 Billion in 2023. It is expected to reach USD 72.1 Billion by 2033, with a CAGR of 18.8% during the forecast period from 2024 to 2033.

The Electric Construction Equipment Market encompasses the development, production, and deployment of electrically powered machinery utilized in construction activities. This market is driven by the need for sustainable solutions, aiming to reduce carbon emissions and enhance operational efficiency.

Electric construction equipment, including excavators, loaders, and cranes, offers benefits such as lower maintenance costs, reduced noise pollution, and compliance with stringent environmental regulations. Advancements in battery technology and growing investments in green construction practices are further propelling market growth, positioning electric construction equipment as a critical component in the future of the construction industry.

The electric construction equipment market is experiencing significant transformation, primarily propelled by stringent emission standards and policies fostering green construction practices. As governments worldwide emphasize reducing carbon footprints, the construction industry is rapidly adopting electric machinery to comply with new regulations and meet sustainability goals. This shift is not just regulatory but also driven by an increasing awareness of environmental sustainability among businesses and consumers. Technological advancements in battery efficiency, charging infrastructure, and power management systems have further bolstered the adoption of electric construction equipment, making it a viable alternative to traditional, diesel-powered machinery.

Despite these positive trends, the market faces challenges, particularly the higher upfront costs associated with electric equipment. This initial financial barrier can deter smaller firms from transitioning, potentially slowing market growth in certain segments. However, the long-term cost savings in maintenance and fuel, combined with potential subsidies and incentives, are expected to mitigate these concerns over time.

Additionally, as economies of scale are achieved and manufacturing processes become more efficient, the cost disparity between electric and traditional equipment is likely to narrow, making electric options more accessible to a broader range of businesses. Overall, the trajectory of the electric construction equipment market underscores a significant paradigm shift towards more sustainable construction practices, promising substantial environmental and economic benefits in the long term.

Key Takeaways

- Market Growth: The Electric Construction Equipment Market was valued at USD 13.4 Billion in 2023. It is expected to reach USD 72.1 Billion by 2033, with a CAGR of 18.8% during the forecast period from 2024 to 2033.

- By Vehicle: Excavators dominated the electric construction equipment market's vehicle segment.

- By Battery: Lithium-ion batteries dominated the electric construction equipment market.

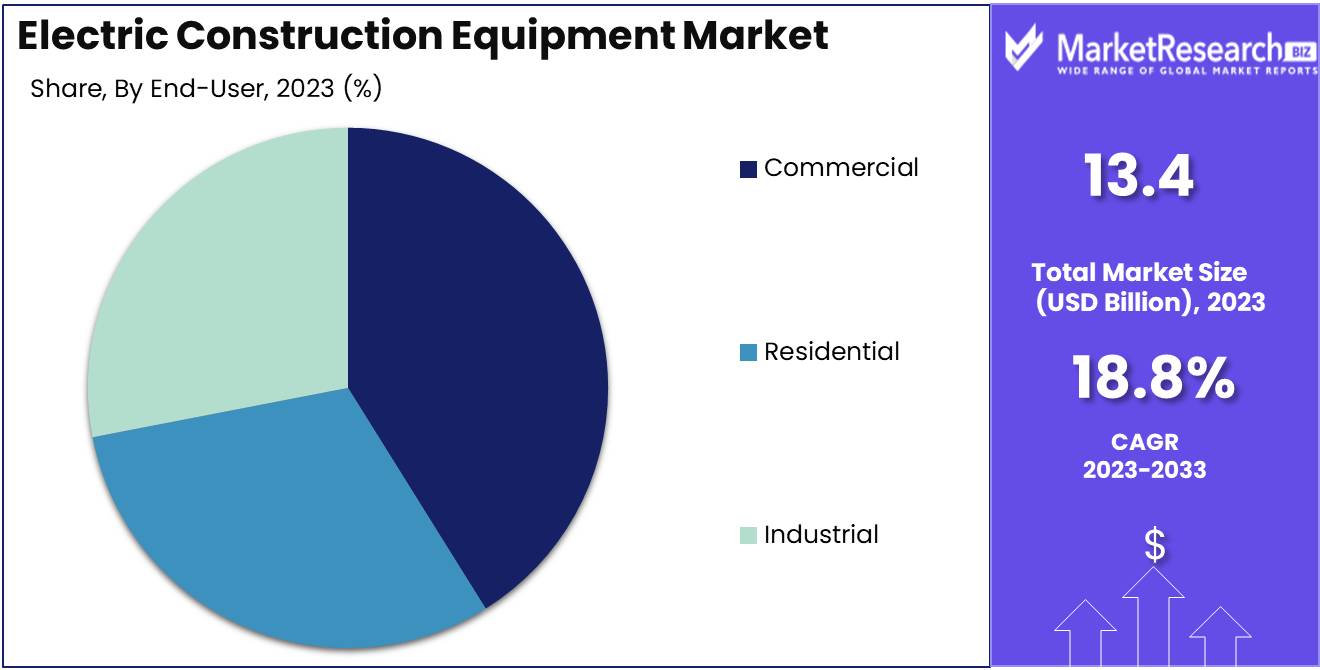

- By End-Use: The Commercial segment dominated the Electric Construction Equipment Market.

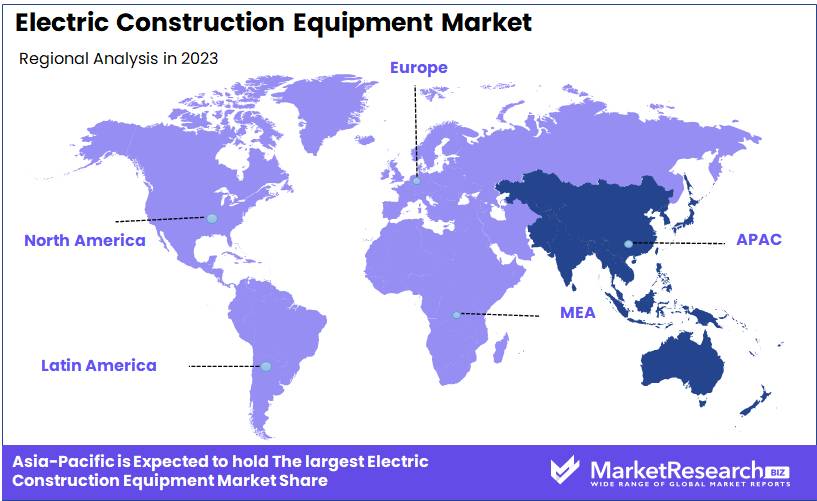

- Regional Dominance: Asia Pacific leads the electric construction equipment market, holding over 40% largest market share.

- Growth Opportunity: The global electric construction equipment market is primed for dynamic growth driven by hydrogen technology and sector-specific adoption.

Driving factors

Stringent Environmental Regulations and Emission Reduction: Accelerating the Shift to Electric Construction Equipment

Environmental regulations and emission reduction mandates play a pivotal role in the growth of the electric construction equipment market. Governments worldwide are increasingly imposing stringent regulations to curb greenhouse gas emissions and reduce the carbon footprint of the construction industry. These regulations often include penalties for non-compliance, making it economically and operationally advantageous for companies to adopt electric machinery.

For instance, the European Union’s Green Deal aims to achieve net-zero emissions by 2050, prompting construction companies to transition to cleaner technologies. The introduction of low-emission zones in major cities further incentivizes the adoption of electric construction equipment, as traditional diesel-powered machines are restricted or face higher operating costs in these areas.

Cost Savings and Operational Efficiency: The Economic Case for Electric Construction Equipment

The cost-saving potential and operational efficiency of electric construction equipment are significant drivers of market growth. Electric machinery offers lower operating costs compared to traditional diesel-powered equipment, primarily due to reduced fuel expenses and maintenance requirements. Electric motors have fewer moving parts than internal combustion engines, resulting in lower wear and tear and extended equipment lifespan.

A study highlighted that electric construction equipment could reduce operating costs by up to 30% over its lifetime compared to diesel counterparts. Additionally, advancements in predictive maintenance and IoT integration enable more efficient fleet management, minimizing downtime and maximizing productivity.

Advancements in Battery Technology: Enabling Longer Use and Broader Adoption

Advancements in battery technology are crucial in driving the adoption and growth of electric construction equipment. The development of high-capacity, fast-charging, and long-lasting batteries addresses one of the primary challenges faced by electric machinery with limited operational range. Innovations in lithium-ion and solid-state batteries have significantly increased energy density, allowing electric equipment to operate for longer periods on a single charge.

For example, recent breakthroughs have enabled battery life extensions that support a full day’s work without recharging, making electric construction equipment more practical for various applications. Fast-charging capabilities reduce downtime, allowing for quick recharges during breaks and ensuring continuous operation.

Restraining Factors

Prolonged Charging Times Impede Operational Efficiency and Market Growth

The extended charging times required for electric construction equipment significantly impact productivity levels on construction sites. Unlike their diesel-powered counterparts, electric machines often need several hours to recharge, during which they cannot be used. This downtime can disrupt workflow, delay project timelines, and increase labor costs due to the need for backup equipment or additional shifts to compensate for lost time. Consequently, many construction firms are hesitant to adopt electric equipment, viewing the extended charging times as a substantial operational inefficiency. The reduced productivity stemming from these prolonged charging periods acts as a considerable barrier to market growth, as companies weigh the environmental benefits against the economic drawbacks.

Battery Durability and Replacement Costs Pose Long-Term Financial Risks

Concerns over battery durability and the associated replacement costs further restrain the growth of the electric construction equipment market. The high initial cost of electric machinery is compounded by the uncertainty surrounding battery lifespan and performance degradation over time. Batteries for heavy-duty construction equipment are subject to intense use and harsh conditions, leading to faster wear and the need for frequent replacements. This not only incurs significant costs but also necessitates downtime for maintenance, adding to the total cost of ownership.

Furthermore, the limited availability of advanced battery technologies that can withstand the rigors of construction work adds to the reluctance of businesses to transition to electric options. The perceived financial risks associated with battery durability and replacement, therefore, hinder broader market adoption and slow the pace of growth.

By Vehicle Analysis

In 2023, Excavators dominated the electric construction equipment market's vehicle segment.

In 2023, The Excavator held a dominant market position in the by-vehicle segment of the electric construction equipment market. This leadership is attributed to the rising demand for sustainable and efficient construction of heavy machinery. The increased adoption of electric excavators, driven by stringent emission regulations and the need for reduced operational costs, has propelled this segment's growth. Forklifts also exhibited significant market traction, fueled by the expansion of e-commerce and warehousing industries requiring electric alternatives for material handling. Loaders gained prominence due to their versatility in various construction applications, offering enhanced efficiency and reduced environmental impact.

Cranes saw an uptick in adoption as urbanization and infrastructure development necessitated cleaner lifting solutions. Rollers, though a smaller segment, benefited from the growing emphasis on green construction practices, while other miscellaneous equipment segments experienced steady growth driven by niche applications and technological advancements. Collectively, these trends underscore a broader shift towards electrification in construction equipment, aligning with global sustainability goals and economic efficiencies. This comprehensive market evolution reflects the strategic pivot of the construction industry towards greener, more efficient machinery.

By Battery Analysis

In 2023, Lithium-ion batteries dominated the electric construction equipment market.

In 2023, Lithium-Ion held a dominant market position in the Battery segment of the Electric Construction Equipment Market. The superior energy density and longer lifecycle of lithium-ion batteries have established them as the preferred choice among manufacturers and consumers alike. Compared to traditional lead-acid batteries, lithium-ion variants offer faster charging times and greater efficiency, aligning with the increasing demand for high-performance, environmentally friendly construction equipment.

The lead-acid segment, while more cost-effective, is witnessing a gradual decline due to its lower energy capacity and maintenance requirements. Additionally, other battery technologies, although still in developmental or niche phases, are emerging as potential contenders, driven by advancements in solid-state and flow batteries. However, these alternatives have yet to achieve the commercial viability and market penetration that lithium-ion batteries currently enjoy. The robust growth trajectory of the lithium-ion segment is further supported by ongoing investments in research and development, aimed at enhancing battery performance and reducing costs. As a result, lithium-ion batteries are poised to maintain their market leadership, capitalizing on the shift towards sustainable and efficient construction solutions.

By End-Use Analysis

The Commercial segment dominated the Electric Construction Equipment Market in 2023.

In 2023, The Commercial segment held a dominant market position in the By End-Use segment of the Electric Construction Equipment Market. This leadership is attributed to the increasing demand for sustainable and efficient construction practices within commercial projects, including office buildings, retail spaces, and public infrastructure. The push for green building standards and the adoption of eco-friendly technologies further drive this segment's growth.

The Residential segment also experienced significant traction, driven by a surge in urbanization and the rising preference for smart, energy-efficient homes. The growing awareness of the environmental impact of traditional construction methods and the benefits of electric equipment contribute to the increasing adoption in residential projects.

Meanwhile, the Industrial segment is expanding steadily, fueled by the need for advanced equipment in large-scale infrastructure projects, manufacturing plants, and logistics hubs. The industrial sector's emphasis on reducing operational costs and improving sustainability aligns with the advantages offered by electric construction equipment, such as lower maintenance costs and reduced emissions.

Overall, the market dynamics indicate a robust growth trajectory across all segments, with the Commercial segment leading due to its significant impact on the overall market demand and development trends.

Key Market Segments

By Vehicle

- Forklift

- Excavator

- Loader

- Crane

- Roller

- Others

By Battery

- Lithium-Ion

- Lead Acid

- Others

By End-Use

- Residential

- Commercial

- Industrial

Growth Opportunity

Developing Hydrogen-Powered Construction Equipment

One of the most promising opportunities lies in the development of hydrogen-powered construction equipment. Hydrogen fuel cells offer a viable alternative to traditional batteries, providing longer operational times and quicker refueling. This technology is particularly advantageous for heavy-duty equipment used in large-scale construction projects where downtime can be costly. Companies investing in hydrogen technology are likely to benefit from early mover advantages, capturing market share as the technology matures and becomes more cost-effective.

Increased Adoption in Mining and Construction

The mining and construction sectors are witnessing a significant uptick in the adoption of electric equipment. This shift is driven by both environmental regulations and the operational efficiencies offered by electric machinery. In mining, electric equipment reduces the need for ventilation in underground operations, thereby lowering costs and improving safety. In construction, electric machinery offers quieter operation and lower emissions, aligning with urban construction requirements and sustainability goals. As these sectors continue to prioritize electric solutions, manufacturers with advanced, reliable electric equipment will find substantial growth opportunities.

Latest Trends

Shift Towards Quieter and Eco-Friendly Machinery

The electric construction equipment market is experiencing a pronounced shift towards quieter and more eco-friendly machinery. This trend is driven by increasing regulatory pressures and societal demands for sustainability in construction practices. Cities and municipalities, particularly in urban areas, are enforcing stricter noise pollution and emissions regulations. Electric construction equipment, known for its quieter operation and zero emissions, is becoming the preferred choice. This trend not only supports environmental goals but also enhances operational efficiency by allowing construction activities in noise-sensitive zones and during off-peak hours, thereby reducing project timelines and costs.

Increased Adoption of High-Power Electric Machinery

Another significant trend is the increased adoption of high-power electric machinery. Technological advancements have enabled the development of electric equipment with power capacities comparable to their diesel counterparts. This leap in capability is eliminating one of the last significant barriers to electric machinery adoption. High-power electric excavators, loaders, and cranes are now viable for heavy-duty applications, attracting interest from large construction firms focused on reducing their carbon footprint without compromising performance. This shift is further supported by investments in advanced battery technologies, which are extending operational hours and reducing charging times, making electric machinery a more practical and economically feasible option for large-scale projects.

Regional Analysis

Asia Pacific leads the electric construction equipment market, holding over 40% largest share.

The electric construction equipment market is experiencing robust growth globally, driven by increasing environmental regulations and advancements in battery technology. In North America, the market is bolstered by significant investments in sustainable infrastructure and stringent emissions standards. The U.S. and Canada are leading, with an estimated CAGR of 8.3% over the next five years. Europe follows closely, driven by the European Green Deal and substantial funding for green technologies. Germany, France, and the UK are key players, contributing to a market share of approximately 25%.

The Asia Pacific region dominates the market, accounting for over 40% of global revenue. Rapid urbanization, government initiatives promoting electric vehicles, and substantial infrastructure projects in China, Japan, and India fuel this growth. China, in particular, holds the largest market share, driven by aggressive policy support and the presence of leading manufacturers.

In the Middle East & Africa, growth is more moderate but steadily rising due to increasing awareness and gradual adoption of sustainable practices. The UAE and South Africa are notable contributors. Latin America shows potential, particularly in Brazil and Mexico, where government incentives are starting to take shape.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global electric construction equipment market is poised for substantial growth, driven by advancements in technology, increasing environmental regulations, and the pursuit of sustainability.

Volvo Construction Equipment is a pioneer in electric construction machinery, offering a broad portfolio of electric compact excavators and wheel loaders. Their strategic focus on sustainability and innovation positions them as a leader in the market. Similarly, Komatsu Ltd. has been aggressively developing electric and hybrid construction equipment, integrating smart technologies to enhance efficiency and reduce emissions.

Caterpillar, known for its robust and versatile machinery, is expanding its electric offerings, particularly in heavy-duty applications. Their strategic investments in battery technology and electric drivetrain systems are critical for maintaining competitive advantage.

John Deere (Deere & Company) and Honda are also notable players, with John Deere emphasizing the electrification of its construction and agricultural equipment, and Honda leveraging its expertise in electric motors to diversify its product offerings.

Companies like Cummins, traditionally known for diesel engines, are pivoting towards electrification by developing electric powertrain solutions. Meanwhile, XCMG Group and Sany Group, major Chinese manufacturers, are rapidly scaling up their electric construction equipment portfolios, driven by strong domestic demand and supportive government policies.

Hitachi Construction Machinery Co. Ltd and Liebherr are integrating advanced battery technologies and autonomous systems into their electric machinery, enhancing operational efficiency. JCB and Doosan Infracore are expanding their electric equipment lines to meet the growing demand for sustainable construction solutions.

Hyundai Construction Equipment and Kobelco Construction Machinery are focusing on innovation and collaboration to advance their electric machinery offerings. These companies are investing in R&D to develop cutting-edge technologies that meet evolving industry standards.

Overall, the competition among these key players is intensifying, fostering innovation and accelerating the transition towards a more sustainable construction industry.

Market Key Players

- Volvo Construction Equipment

- Komatsu Ltd.

- Caterpillar

- John Deere (Deere & Company)

- Honda

- Cummins

- Wacker Neuson SE

- XCMG Group

- Hitachi Construction Machinery Co. Ltd.

- Liebherr

- JCB

- Doosan Infracore

- Hyundai Construction Equipment

- Kobelco Construction Machinery

- Sany Group

Recent Development

- In March 2024, Hitachi Construction Machinery Co., Ltd. launched a new electric dump truck designed for large-scale mining operations. This vehicle is part of Hitachi's broader strategy to promote sustainability in heavy industries through advanced electric technologies.

- In February 2024, Volvo Construction Equipment announced an expansion of its electric construction machinery portfolio. The new range includes electric compact excavators and wheel loaders to reduce carbon emissions and enhance operational efficiency on construction sites.

- In January 2024, Caterpillar Inc. expanded its electric construction equipment lineup with the development of new electric track loaders. These loaders are designed to offer enhanced maneuverability and stability, making them ideal for a variety of construction applications.

Report Scope

Report Features Description Market Value (2023) USD 13.4 Billion Forecast Revenue (2033) USD 72.1 Billion CAGR (2024-2032) 18.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Vehicle (Forklift, Excavator, Loader, Crane, Roller, Others), By Battery (Lithium-Ion, Lead Acid, Others), By End-Use (Residential, Commercial, Industrial) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Volvo Construction Equipment, Komatsu Ltd., Caterpillar, John Deere (Deere & Company), Honda, Cummins, Wacker Neuson SE, XCMG Group, Hitachi Construction Machinery Co. Ltd., Liebherr, JCB, Doosan Infracore, Hyundai Construction Equipment, Kobelco Construction Machinery, Sany Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Electric Construction Equipment Market Overview

- 2.1. Electric Construction Equipment Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Electric Construction Equipment Market Dynamics

- 3. Global Electric Construction Equipment Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Electric Construction Equipment Market Analysis, 2016-2021

- 3.2. Global Electric Construction Equipment Market Opportunity and Forecast, 2023-2032

- 3.3. Global Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Vehicle, 2016-2032

- 3.3.1. Global Electric Construction Equipment Market Analysis by Vehicle: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vehicle, 2016-2032

- 3.3.3. Forklift

- 3.3.4. Excavator

- 3.3.5. Loader

- 3.3.6. Crane

- 3.3.7. Roller

- 3.3.8. Others

- 3.4. Global Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Battery, 2016-2032

- 3.4.1. Global Electric Construction Equipment Market Analysis by Battery: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Battery, 2016-2032

- 3.4.3. Lithium-Ion

- 3.4.4. Lead Acid

- 3.4.5. Others

- 3.5. Global Electric Construction Equipment Market Analysis, Opportunity and Forecast, By End-Use, 2016-2032

- 3.5.1. Global Electric Construction Equipment Market Analysis by End-Use: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-Use, 2016-2032

- 3.5.3. Residential

- 3.5.4. Commercial

- 3.5.5. Industrial

- 4. North America Electric Construction Equipment Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Electric Construction Equipment Market Analysis, 2016-2021

- 4.2. North America Electric Construction Equipment Market Opportunity and Forecast, 2023-2032

- 4.3. North America Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Vehicle, 2016-2032

- 4.3.1. North America Electric Construction Equipment Market Analysis by Vehicle: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vehicle, 2016-2032

- 4.3.3. Forklift

- 4.3.4. Excavator

- 4.3.5. Loader

- 4.3.6. Crane

- 4.3.7. Roller

- 4.3.8. Others

- 4.4. North America Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Battery, 2016-2032

- 4.4.1. North America Electric Construction Equipment Market Analysis by Battery: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Battery, 2016-2032

- 4.4.3. Lithium-Ion

- 4.4.4. Lead Acid

- 4.4.5. Others

- 4.5. North America Electric Construction Equipment Market Analysis, Opportunity and Forecast, By End-Use, 2016-2032

- 4.5.1. North America Electric Construction Equipment Market Analysis by End-Use: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-Use, 2016-2032

- 4.5.3. Residential

- 4.5.4. Commercial

- 4.5.5. Industrial

- 4.6. North America Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Electric Construction Equipment Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Electric Construction Equipment Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Electric Construction Equipment Market Analysis, 2016-2021

- 5.2. Western Europe Electric Construction Equipment Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Vehicle, 2016-2032

- 5.3.1. Western Europe Electric Construction Equipment Market Analysis by Vehicle: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vehicle, 2016-2032

- 5.3.3. Forklift

- 5.3.4. Excavator

- 5.3.5. Loader

- 5.3.6. Crane

- 5.3.7. Roller

- 5.3.8. Others

- 5.4. Western Europe Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Battery, 2016-2032

- 5.4.1. Western Europe Electric Construction Equipment Market Analysis by Battery: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Battery, 2016-2032

- 5.4.3. Lithium-Ion

- 5.4.4. Lead Acid

- 5.4.5. Others

- 5.5. Western Europe Electric Construction Equipment Market Analysis, Opportunity and Forecast, By End-Use, 2016-2032

- 5.5.1. Western Europe Electric Construction Equipment Market Analysis by End-Use: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-Use, 2016-2032

- 5.5.3. Residential

- 5.5.4. Commercial

- 5.5.5. Industrial

- 5.6. Western Europe Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Electric Construction Equipment Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Electric Construction Equipment Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Electric Construction Equipment Market Analysis, 2016-2021

- 6.2. Eastern Europe Electric Construction Equipment Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Vehicle, 2016-2032

- 6.3.1. Eastern Europe Electric Construction Equipment Market Analysis by Vehicle: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vehicle, 2016-2032

- 6.3.3. Forklift

- 6.3.4. Excavator

- 6.3.5. Loader

- 6.3.6. Crane

- 6.3.7. Roller

- 6.3.8. Others

- 6.4. Eastern Europe Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Battery, 2016-2032

- 6.4.1. Eastern Europe Electric Construction Equipment Market Analysis by Battery: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Battery, 2016-2032

- 6.4.3. Lithium-Ion

- 6.4.4. Lead Acid

- 6.4.5. Others

- 6.5. Eastern Europe Electric Construction Equipment Market Analysis, Opportunity and Forecast, By End-Use, 2016-2032

- 6.5.1. Eastern Europe Electric Construction Equipment Market Analysis by End-Use: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-Use, 2016-2032

- 6.5.3. Residential

- 6.5.4. Commercial

- 6.5.5. Industrial

- 6.6. Eastern Europe Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Electric Construction Equipment Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Electric Construction Equipment Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Electric Construction Equipment Market Analysis, 2016-2021

- 7.2. APAC Electric Construction Equipment Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Vehicle, 2016-2032

- 7.3.1. APAC Electric Construction Equipment Market Analysis by Vehicle: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vehicle, 2016-2032

- 7.3.3. Forklift

- 7.3.4. Excavator

- 7.3.5. Loader

- 7.3.6. Crane

- 7.3.7. Roller

- 7.3.8. Others

- 7.4. APAC Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Battery, 2016-2032

- 7.4.1. APAC Electric Construction Equipment Market Analysis by Battery: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Battery, 2016-2032

- 7.4.3. Lithium-Ion

- 7.4.4. Lead Acid

- 7.4.5. Others

- 7.5. APAC Electric Construction Equipment Market Analysis, Opportunity and Forecast, By End-Use, 2016-2032

- 7.5.1. APAC Electric Construction Equipment Market Analysis by End-Use: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-Use, 2016-2032

- 7.5.3. Residential

- 7.5.4. Commercial

- 7.5.5. Industrial

- 7.6. APAC Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Electric Construction Equipment Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Electric Construction Equipment Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Electric Construction Equipment Market Analysis, 2016-2021

- 8.2. Latin America Electric Construction Equipment Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Vehicle, 2016-2032

- 8.3.1. Latin America Electric Construction Equipment Market Analysis by Vehicle: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vehicle, 2016-2032

- 8.3.3. Forklift

- 8.3.4. Excavator

- 8.3.5. Loader

- 8.3.6. Crane

- 8.3.7. Roller

- 8.3.8. Others

- 8.4. Latin America Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Battery, 2016-2032

- 8.4.1. Latin America Electric Construction Equipment Market Analysis by Battery: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Battery, 2016-2032

- 8.4.3. Lithium-Ion

- 8.4.4. Lead Acid

- 8.4.5. Others

- 8.5. Latin America Electric Construction Equipment Market Analysis, Opportunity and Forecast, By End-Use, 2016-2032

- 8.5.1. Latin America Electric Construction Equipment Market Analysis by End-Use: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-Use, 2016-2032

- 8.5.3. Residential

- 8.5.4. Commercial

- 8.5.5. Industrial

- 8.6. Latin America Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Electric Construction Equipment Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Electric Construction Equipment Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Electric Construction Equipment Market Analysis, 2016-2021

- 9.2. Middle East & Africa Electric Construction Equipment Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Vehicle, 2016-2032

- 9.3.1. Middle East & Africa Electric Construction Equipment Market Analysis by Vehicle: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vehicle, 2016-2032

- 9.3.3. Forklift

- 9.3.4. Excavator

- 9.3.5. Loader

- 9.3.6. Crane

- 9.3.7. Roller

- 9.3.8. Others

- 9.4. Middle East & Africa Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Battery, 2016-2032

- 9.4.1. Middle East & Africa Electric Construction Equipment Market Analysis by Battery: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Battery, 2016-2032

- 9.4.3. Lithium-Ion

- 9.4.4. Lead Acid

- 9.4.5. Others

- 9.5. Middle East & Africa Electric Construction Equipment Market Analysis, Opportunity and Forecast, By End-Use, 2016-2032

- 9.5.1. Middle East & Africa Electric Construction Equipment Market Analysis by End-Use: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-Use, 2016-2032

- 9.5.3. Residential

- 9.5.4. Commercial

- 9.5.5. Industrial

- 9.6. Middle East & Africa Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Electric Construction Equipment Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Electric Construction Equipment Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Electric Construction Equipment Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Electric Construction Equipment Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Volvo Construction Equipment

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Komatsu Ltd.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Caterpillar

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. John Deere (Deere & Company)

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Honda

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Cummins

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Wacker Neuson SE

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. XCMG Group

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Hitachi Construction Machinery Co. Ltd.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Liebherr

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. JCB

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Hyundai Construction Equipment

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Kobelco Construction Machinery

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Sany Group

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Vehicle in 2022

- Figure 2: Global Electric Construction Equipment Market Market Attractiveness Analysis by Vehicle, 2016-2032

- Figure 3: Global Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Batteryin 2022

- Figure 4: Global Electric Construction Equipment Market Market Attractiveness Analysis by Battery, 2016-2032

- Figure 5: Global Electric Construction Equipment Market Revenue (US$ Mn) Market Share by End-Usein 2022

- Figure 6: Global Electric Construction Equipment Market Market Attractiveness Analysis by End-Use, 2016-2032

- Figure 7: Global Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Electric Construction Equipment Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Electric Construction Equipment Market Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Vehicle (2016-2032)

- Figure 12: Global Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Battery (2016-2032)

- Figure 13: Global Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by End-Use (2016-2032)

- Figure 14: Global Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Vehicle (2016-2032)

- Figure 16: Global Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Battery (2016-2032)

- Figure 17: Global Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by End-Use (2016-2032)

- Figure 18: Global Electric Construction Equipment Market Market Share Comparison by Region (2016-2032)

- Figure 19: Global Electric Construction Equipment Market Market Share Comparison by Vehicle (2016-2032)

- Figure 20: Global Electric Construction Equipment Market Market Share Comparison by Battery (2016-2032)

- Figure 21: Global Electric Construction Equipment Market Market Share Comparison by End-Use (2016-2032)

- Figure 22: North America Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Vehiclein 2022

- Figure 23: North America Electric Construction Equipment Market Market Attractiveness Analysis by Vehicle, 2016-2032

- Figure 24: North America Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Batteryin 2022

- Figure 25: North America Electric Construction Equipment Market Market Attractiveness Analysis by Battery, 2016-2032

- Figure 26: North America Electric Construction Equipment Market Revenue (US$ Mn) Market Share by End-Usein 2022

- Figure 27: North America Electric Construction Equipment Market Market Attractiveness Analysis by End-Use, 2016-2032

- Figure 28: North America Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Electric Construction Equipment Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Electric Construction Equipment Market Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Vehicle (2016-2032)

- Figure 33: North America Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Battery (2016-2032)

- Figure 34: North America Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by End-Use (2016-2032)

- Figure 35: North America Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Vehicle (2016-2032)

- Figure 37: North America Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Battery (2016-2032)

- Figure 38: North America Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by End-Use (2016-2032)

- Figure 39: North America Electric Construction Equipment Market Market Share Comparison by Country (2016-2032)

- Figure 40: North America Electric Construction Equipment Market Market Share Comparison by Vehicle (2016-2032)

- Figure 41: North America Electric Construction Equipment Market Market Share Comparison by Battery (2016-2032)

- Figure 42: North America Electric Construction Equipment Market Market Share Comparison by End-Use (2016-2032)

- Figure 43: Western Europe Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Vehiclein 2022

- Figure 44: Western Europe Electric Construction Equipment Market Market Attractiveness Analysis by Vehicle, 2016-2032

- Figure 45: Western Europe Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Batteryin 2022

- Figure 46: Western Europe Electric Construction Equipment Market Market Attractiveness Analysis by Battery, 2016-2032

- Figure 47: Western Europe Electric Construction Equipment Market Revenue (US$ Mn) Market Share by End-Usein 2022

- Figure 48: Western Europe Electric Construction Equipment Market Market Attractiveness Analysis by End-Use, 2016-2032

- Figure 49: Western Europe Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Electric Construction Equipment Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Electric Construction Equipment Market Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Vehicle (2016-2032)

- Figure 54: Western Europe Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Battery (2016-2032)

- Figure 55: Western Europe Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by End-Use (2016-2032)

- Figure 56: Western Europe Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Vehicle (2016-2032)

- Figure 58: Western Europe Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Battery (2016-2032)

- Figure 59: Western Europe Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by End-Use (2016-2032)

- Figure 60: Western Europe Electric Construction Equipment Market Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Electric Construction Equipment Market Market Share Comparison by Vehicle (2016-2032)

- Figure 62: Western Europe Electric Construction Equipment Market Market Share Comparison by Battery (2016-2032)

- Figure 63: Western Europe Electric Construction Equipment Market Market Share Comparison by End-Use (2016-2032)

- Figure 64: Eastern Europe Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Vehiclein 2022

- Figure 65: Eastern Europe Electric Construction Equipment Market Market Attractiveness Analysis by Vehicle, 2016-2032

- Figure 66: Eastern Europe Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Batteryin 2022

- Figure 67: Eastern Europe Electric Construction Equipment Market Market Attractiveness Analysis by Battery, 2016-2032

- Figure 68: Eastern Europe Electric Construction Equipment Market Revenue (US$ Mn) Market Share by End-Usein 2022

- Figure 69: Eastern Europe Electric Construction Equipment Market Market Attractiveness Analysis by End-Use, 2016-2032

- Figure 70: Eastern Europe Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Electric Construction Equipment Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Electric Construction Equipment Market Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Vehicle (2016-2032)

- Figure 75: Eastern Europe Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Battery (2016-2032)

- Figure 76: Eastern Europe Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by End-Use (2016-2032)

- Figure 77: Eastern Europe Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Vehicle (2016-2032)

- Figure 79: Eastern Europe Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Battery (2016-2032)

- Figure 80: Eastern Europe Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by End-Use (2016-2032)

- Figure 81: Eastern Europe Electric Construction Equipment Market Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Electric Construction Equipment Market Market Share Comparison by Vehicle (2016-2032)

- Figure 83: Eastern Europe Electric Construction Equipment Market Market Share Comparison by Battery (2016-2032)

- Figure 84: Eastern Europe Electric Construction Equipment Market Market Share Comparison by End-Use (2016-2032)

- Figure 85: APAC Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Vehiclein 2022

- Figure 86: APAC Electric Construction Equipment Market Market Attractiveness Analysis by Vehicle, 2016-2032

- Figure 87: APAC Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Batteryin 2022

- Figure 88: APAC Electric Construction Equipment Market Market Attractiveness Analysis by Battery, 2016-2032

- Figure 89: APAC Electric Construction Equipment Market Revenue (US$ Mn) Market Share by End-Usein 2022

- Figure 90: APAC Electric Construction Equipment Market Market Attractiveness Analysis by End-Use, 2016-2032

- Figure 91: APAC Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Electric Construction Equipment Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Electric Construction Equipment Market Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Vehicle (2016-2032)

- Figure 96: APAC Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Battery (2016-2032)

- Figure 97: APAC Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by End-Use (2016-2032)

- Figure 98: APAC Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Vehicle (2016-2032)

- Figure 100: APAC Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Battery (2016-2032)

- Figure 101: APAC Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by End-Use (2016-2032)

- Figure 102: APAC Electric Construction Equipment Market Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Electric Construction Equipment Market Market Share Comparison by Vehicle (2016-2032)

- Figure 104: APAC Electric Construction Equipment Market Market Share Comparison by Battery (2016-2032)

- Figure 105: APAC Electric Construction Equipment Market Market Share Comparison by End-Use (2016-2032)

- Figure 106: Latin America Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Vehiclein 2022

- Figure 107: Latin America Electric Construction Equipment Market Market Attractiveness Analysis by Vehicle, 2016-2032

- Figure 108: Latin America Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Batteryin 2022

- Figure 109: Latin America Electric Construction Equipment Market Market Attractiveness Analysis by Battery, 2016-2032

- Figure 110: Latin America Electric Construction Equipment Market Revenue (US$ Mn) Market Share by End-Usein 2022

- Figure 111: Latin America Electric Construction Equipment Market Market Attractiveness Analysis by End-Use, 2016-2032

- Figure 112: Latin America Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Electric Construction Equipment Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Electric Construction Equipment Market Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Vehicle (2016-2032)

- Figure 117: Latin America Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Battery (2016-2032)

- Figure 118: Latin America Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by End-Use (2016-2032)

- Figure 119: Latin America Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Vehicle (2016-2032)

- Figure 121: Latin America Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Battery (2016-2032)

- Figure 122: Latin America Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by End-Use (2016-2032)

- Figure 123: Latin America Electric Construction Equipment Market Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Electric Construction Equipment Market Market Share Comparison by Vehicle (2016-2032)

- Figure 125: Latin America Electric Construction Equipment Market Market Share Comparison by Battery (2016-2032)

- Figure 126: Latin America Electric Construction Equipment Market Market Share Comparison by End-Use (2016-2032)

- Figure 127: Middle East & Africa Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Vehiclein 2022

- Figure 128: Middle East & Africa Electric Construction Equipment Market Market Attractiveness Analysis by Vehicle, 2016-2032

- Figure 129: Middle East & Africa Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Batteryin 2022

- Figure 130: Middle East & Africa Electric Construction Equipment Market Market Attractiveness Analysis by Battery, 2016-2032

- Figure 131: Middle East & Africa Electric Construction Equipment Market Revenue (US$ Mn) Market Share by End-Usein 2022

- Figure 132: Middle East & Africa Electric Construction Equipment Market Market Attractiveness Analysis by End-Use, 2016-2032

- Figure 133: Middle East & Africa Electric Construction Equipment Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Electric Construction Equipment Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Electric Construction Equipment Market Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Vehicle (2016-2032)

- Figure 138: Middle East & Africa Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Battery (2016-2032)

- Figure 139: Middle East & Africa Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by End-Use (2016-2032)

- Figure 140: Middle East & Africa Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Vehicle (2016-2032)

- Figure 142: Middle East & Africa Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Battery (2016-2032)

- Figure 143: Middle East & Africa Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by End-Use (2016-2032)

- Figure 144: Middle East & Africa Electric Construction Equipment Market Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Electric Construction Equipment Market Market Share Comparison by Vehicle (2016-2032)

- Figure 146: Middle East & Africa Electric Construction Equipment Market Market Share Comparison by Battery (2016-2032)

- Figure 147: Middle East & Africa Electric Construction Equipment Market Market Share Comparison by End-Use (2016-2032)

"

- List of Tables

- "

- Table 1: Global Electric Construction Equipment Market Market Comparison by Vehicle (2016-2032)

- Table 2: Global Electric Construction Equipment Market Market Comparison by Battery (2016-2032)

- Table 3: Global Electric Construction Equipment Market Market Comparison by End-Use (2016-2032)

- Table 4: Global Electric Construction Equipment Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Electric Construction Equipment Market Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Vehicle (2016-2032)

- Table 8: Global Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Battery (2016-2032)

- Table 9: Global Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by End-Use (2016-2032)

- Table 10: Global Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Vehicle (2016-2032)

- Table 12: Global Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Battery (2016-2032)

- Table 13: Global Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by End-Use (2016-2032)

- Table 14: Global Electric Construction Equipment Market Market Share Comparison by Region (2016-2032)

- Table 15: Global Electric Construction Equipment Market Market Share Comparison by Vehicle (2016-2032)

- Table 16: Global Electric Construction Equipment Market Market Share Comparison by Battery (2016-2032)

- Table 17: Global Electric Construction Equipment Market Market Share Comparison by End-Use (2016-2032)

- Table 18: North America Electric Construction Equipment Market Market Comparison by Battery (2016-2032)

- Table 19: North America Electric Construction Equipment Market Market Comparison by End-Use (2016-2032)

- Table 20: North America Electric Construction Equipment Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Electric Construction Equipment Market Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Vehicle (2016-2032)

- Table 24: North America Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Battery (2016-2032)

- Table 25: North America Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by End-Use (2016-2032)

- Table 26: North America Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Vehicle (2016-2032)

- Table 28: North America Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Battery (2016-2032)

- Table 29: North America Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by End-Use (2016-2032)

- Table 30: North America Electric Construction Equipment Market Market Share Comparison by Country (2016-2032)

- Table 31: North America Electric Construction Equipment Market Market Share Comparison by Vehicle (2016-2032)

- Table 32: North America Electric Construction Equipment Market Market Share Comparison by Battery (2016-2032)

- Table 33: North America Electric Construction Equipment Market Market Share Comparison by End-Use (2016-2032)

- Table 34: Western Europe Electric Construction Equipment Market Market Comparison by Vehicle (2016-2032)

- Table 35: Western Europe Electric Construction Equipment Market Market Comparison by Battery (2016-2032)

- Table 36: Western Europe Electric Construction Equipment Market Market Comparison by End-Use (2016-2032)

- Table 37: Western Europe Electric Construction Equipment Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Electric Construction Equipment Market Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Vehicle (2016-2032)

- Table 41: Western Europe Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Battery (2016-2032)

- Table 42: Western Europe Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by End-Use (2016-2032)

- Table 43: Western Europe Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Vehicle (2016-2032)

- Table 45: Western Europe Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Battery (2016-2032)

- Table 46: Western Europe Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by End-Use (2016-2032)

- Table 47: Western Europe Electric Construction Equipment Market Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Electric Construction Equipment Market Market Share Comparison by Vehicle (2016-2032)

- Table 49: Western Europe Electric Construction Equipment Market Market Share Comparison by Battery (2016-2032)

- Table 50: Western Europe Electric Construction Equipment Market Market Share Comparison by End-Use (2016-2032)

- Table 51: Eastern Europe Electric Construction Equipment Market Market Comparison by Vehicle (2016-2032)

- Table 52: Eastern Europe Electric Construction Equipment Market Market Comparison by Battery (2016-2032)

- Table 53: Eastern Europe Electric Construction Equipment Market Market Comparison by End-Use (2016-2032)

- Table 54: Eastern Europe Electric Construction Equipment Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Electric Construction Equipment Market Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Vehicle (2016-2032)

- Table 58: Eastern Europe Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Battery (2016-2032)

- Table 59: Eastern Europe Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by End-Use (2016-2032)

- Table 60: Eastern Europe Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Vehicle (2016-2032)

- Table 62: Eastern Europe Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Battery (2016-2032)

- Table 63: Eastern Europe Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by End-Use (2016-2032)

- Table 64: Eastern Europe Electric Construction Equipment Market Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Electric Construction Equipment Market Market Share Comparison by Vehicle (2016-2032)

- Table 66: Eastern Europe Electric Construction Equipment Market Market Share Comparison by Battery (2016-2032)

- Table 67: Eastern Europe Electric Construction Equipment Market Market Share Comparison by End-Use (2016-2032)

- Table 68: APAC Electric Construction Equipment Market Market Comparison by Vehicle (2016-2032)

- Table 69: APAC Electric Construction Equipment Market Market Comparison by Battery (2016-2032)

- Table 70: APAC Electric Construction Equipment Market Market Comparison by End-Use (2016-2032)

- Table 71: APAC Electric Construction Equipment Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Electric Construction Equipment Market Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Vehicle (2016-2032)

- Table 75: APAC Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Battery (2016-2032)

- Table 76: APAC Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by End-Use (2016-2032)

- Table 77: APAC Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Vehicle (2016-2032)

- Table 79: APAC Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Battery (2016-2032)

- Table 80: APAC Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by End-Use (2016-2032)

- Table 81: APAC Electric Construction Equipment Market Market Share Comparison by Country (2016-2032)

- Table 82: APAC Electric Construction Equipment Market Market Share Comparison by Vehicle (2016-2032)

- Table 83: APAC Electric Construction Equipment Market Market Share Comparison by Battery (2016-2032)

- Table 84: APAC Electric Construction Equipment Market Market Share Comparison by End-Use (2016-2032)

- Table 85: Latin America Electric Construction Equipment Market Market Comparison by Vehicle (2016-2032)

- Table 86: Latin America Electric Construction Equipment Market Market Comparison by Battery (2016-2032)

- Table 87: Latin America Electric Construction Equipment Market Market Comparison by End-Use (2016-2032)

- Table 88: Latin America Electric Construction Equipment Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Electric Construction Equipment Market Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Vehicle (2016-2032)

- Table 92: Latin America Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Battery (2016-2032)

- Table 93: Latin America Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by End-Use (2016-2032)

- Table 94: Latin America Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Vehicle (2016-2032)

- Table 96: Latin America Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Battery (2016-2032)

- Table 97: Latin America Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by End-Use (2016-2032)

- Table 98: Latin America Electric Construction Equipment Market Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Electric Construction Equipment Market Market Share Comparison by Vehicle (2016-2032)

- Table 100: Latin America Electric Construction Equipment Market Market Share Comparison by Battery (2016-2032)

- Table 101: Latin America Electric Construction Equipment Market Market Share Comparison by End-Use (2016-2032)

- Table 102: Middle East & Africa Electric Construction Equipment Market Market Comparison by Vehicle (2016-2032)

- Table 103: Middle East & Africa Electric Construction Equipment Market Market Comparison by Battery (2016-2032)

- Table 104: Middle East & Africa Electric Construction Equipment Market Market Comparison by End-Use (2016-2032)

- Table 105: Middle East & Africa Electric Construction Equipment Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Electric Construction Equipment Market Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Vehicle (2016-2032)

- Table 109: Middle East & Africa Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by Battery (2016-2032)

- Table 110: Middle East & Africa Electric Construction Equipment Market Market Revenue (US$ Mn) Comparison by End-Use (2016-2032)

- Table 111: Middle East & Africa Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Vehicle (2016-2032)

- Table 113: Middle East & Africa Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by Battery (2016-2032)

- Table 114: Middle East & Africa Electric Construction Equipment Market Market Y-o-Y Growth Rate Comparison by End-Use (2016-2032)

- Table 115: Middle East & Africa Electric Construction Equipment Market Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Electric Construction Equipment Market Market Share Comparison by Vehicle (2016-2032)

- Table 117: Middle East & Africa Electric Construction Equipment Market Market Share Comparison by Battery (2016-2032)

- Table 118: Middle East & Africa Electric Construction Equipment Market Market Share Comparison by End-Use (2016-2032)

- 1. Executive Summary

-

- Volvo Construction Equipment

- Komatsu Ltd.

- Caterpillar

- John Deere (Deere & Company)

- Honda

- Cummins

- Wacker Neuson SE

- XCMG Group

- Hitachi Construction Machinery Co. Ltd.

- Liebherr

- JCB

- Doosan Infracore

- Hyundai Construction Equipment

- Kobelco Construction Machinery

- Sany Group