Global E Scooter Sharing Market By Type(Free-Floating, Station-Bound), By Distribution Channel(Online, Offline), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

46245

-

May 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

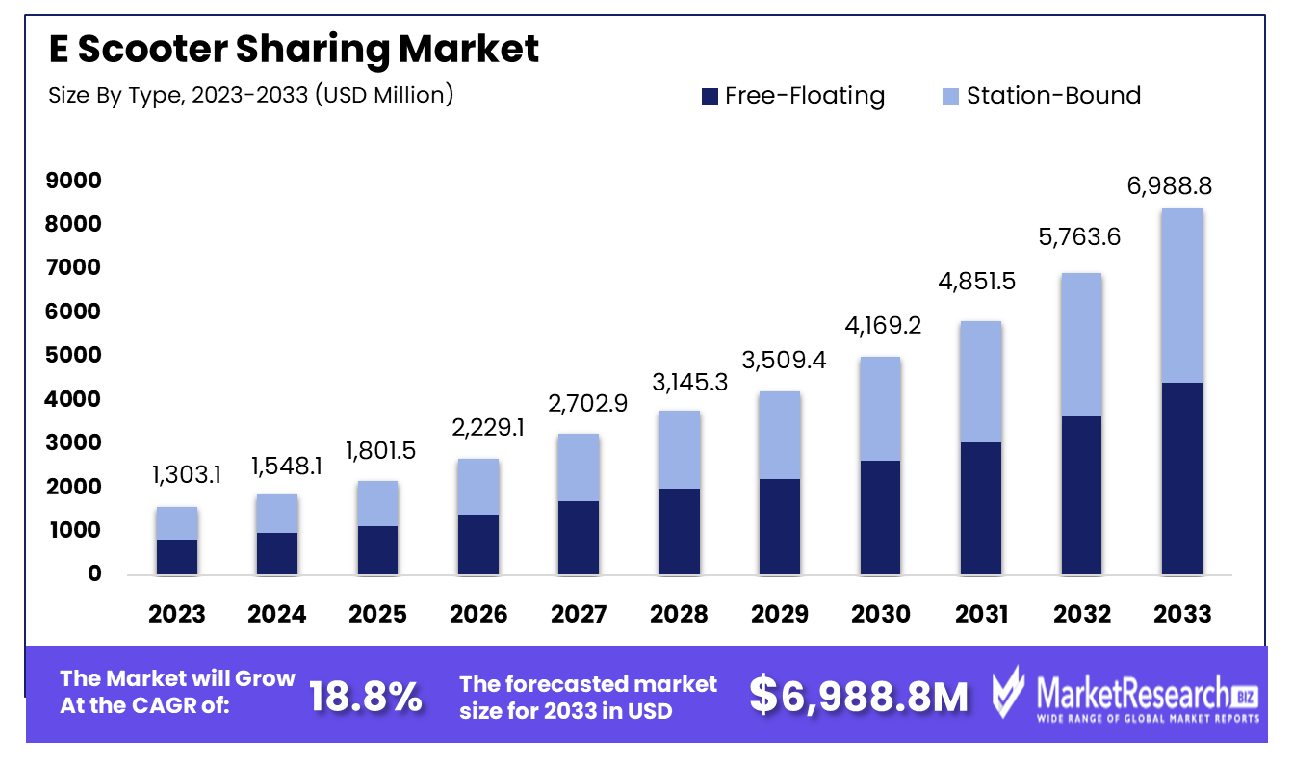

The Global E Scooter Sharing Market was valued at USD 1,303.1 million in 2023. It is expected to reach USD 6,988.8 million by 2033, with a CAGR of 18.8% during the forecast period from 2024 to 2033.

The E-Scooter Sharing Market encompasses a service-based model in which electric scooters are made available to individuals on a short-term basis. This market caters to the growing demand for cost-effective, eco-friendly transportation alternatives in urban areas. Typically accessed through smartphone applications, these services offer flexible pricing models, including pay-per-minute schemes.

They address the "last-mile" connectivity challenge, seamlessly integrating with other public transit systems. As cities worldwide strive to reduce carbon footprints and alleviate traffic congestion, the E-Scooter Sharing Market is positioned as a strategic, sustainable solution, appealing to urbanites seeking efficient and agile mobility options.

The E-Scooter Sharing Market is poised for significant growth, propelled by increasing urbanization and the collective shift towards sustainable transportation solutions. As cities become more congested, the demand for agile and eco-friendly mobility options is rising, positioning e-scooters as a viable solution for the "last-mile" transportation dilemma.

The market is set to expand as user penetration increases, from 1.3% in 2024 to 1.8% by 2028, with users expected to reach 143.50 million. This growth is supported by a substantial increase in the global electric scooter market, which was valued at $37.07 billion in 2023 and is forecasted to nearly double to $78.65 billion by 2030, growing at a CAGR of 9.9%.

The United States is anticipated to be a significant revenue contributor, with projections reaching $768,400K in 2024. This revenue surge is indicative of the market’s capacity to integrate with other forms of public transport, providing a seamless solution for urban mobility. Furthermore, the electric scooter segment itself is expected to see the fastest growth within the broader market, with a projected CAGR of 7.8% through the forecast period.

These factors collectively underscore the market’s robust potential and its critical role in shaping sustainable urban transportation infrastructures. For stakeholders, including VPs, CEOs, CMOs, and Product Managers, the strategic implications are profound, offering numerous opportunities for investment and expansion in urban markets globally.

Key Takeaways

- Market Growth: The Global E Scooter Sharing Market was valued at USD 1,303.1 million in 2023. It is expected to reach USD 6,988.8 million by 2033, with a CAGR of 18.8% during the forecast period from 2024 to 2033.

- By Type: Free-floating dominated with a 95% market share.

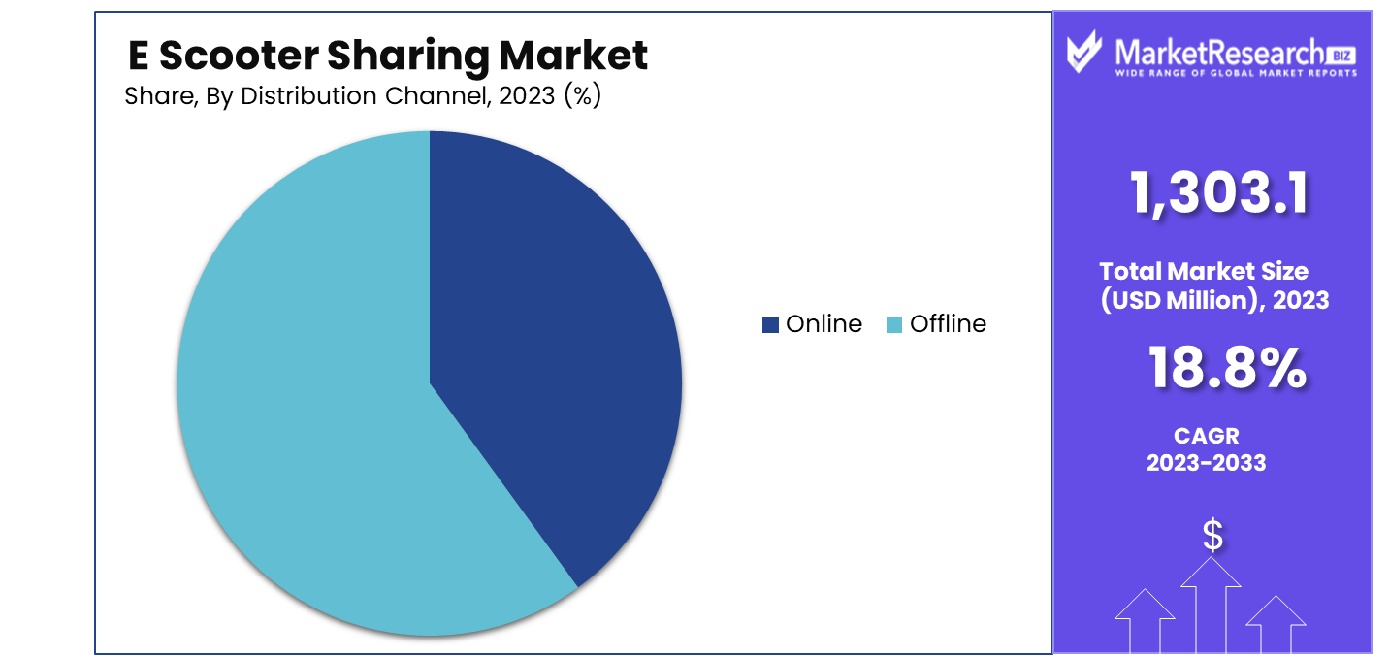

- By Distribution Channel: Offline held a minimal 5% dominance.

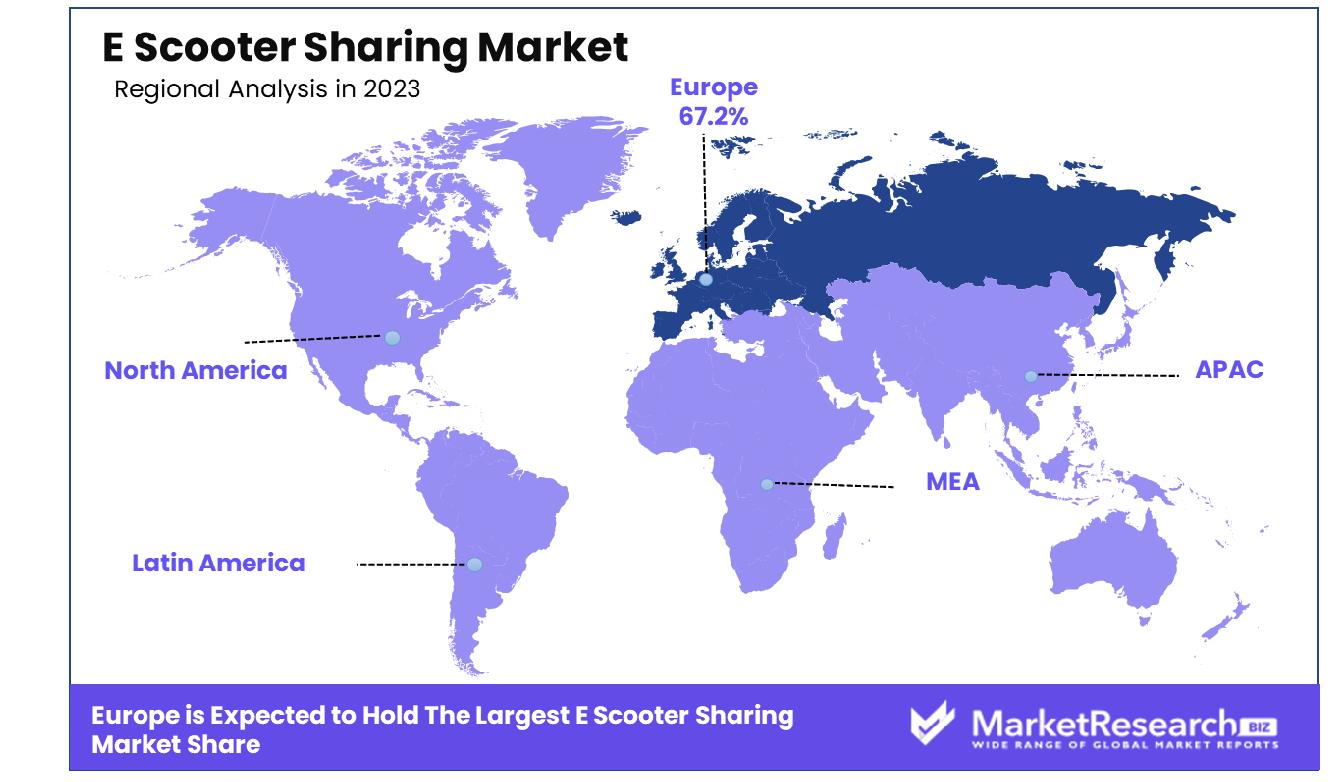

- Regional Dominance: Europe holds 67.2% of the global e-scooter sharing market.

- Growth Opportunity: In 2023, the global E-Scooter Sharing Market is driven by the popularity of flexible, dockless services and significant growth opportunities in emerging markets like India.

Driving factors

Environmental Benefits with No Carbon Emissions

The rising global awareness of environmental sustainability is a crucial driver for the E-Scooter Sharing Market. E-scooters offer a clean, efficient mode of transportation that contributes to reduced carbon emissions, positioning them as a viable alternative to conventional vehicles, especially in urban settings. The appeal of e-scooters is enhanced by their ability to alleviate traffic congestion and reduce air pollution, key concerns in densely populated cities.

As more consumers and policymakers recognize the environmental benefits of e-scooters, their adoption is expected to rise, propelling market growth. The push towards greener cities globally further bolsters this trend, with many urban planners integrating e-scooter sharing systems into their public transportation networks to complement their sustainability goals.

Product Improvements and Custom-Designed Vehicles

Innovation in product design and functionality significantly boosts the E-Scooter Sharing Market. Manufacturers are continuously introducing advanced models that enhance user experience through increased battery life, improved safety features, and smartphone integration. The development of custom-designed vehicles tailored for sharing systems ensures higher durability and lower maintenance costs, making them more attractive for both operators and users.

These improvements not only enhance consumer satisfaction but also expand market reach by making e-scooter sharing more accessible and appealing to a broader audience, including those previously hesitant due to safety concerns or usability issues.

Government Incentives and Regulations Supporting E-Scooter Sharing

Government policies play a pivotal role in shaping the E-Scooter Sharing Market. Various incentives such as grants, subsidies, and tax exemptions are designed to promote the adoption of eco-friendly transportation alternatives. Additionally, regulatory frameworks that support the operation and integration of e-scooter sharing systems within city infrastructures further encourage market growth.

These regulations often include provisions for dedicated lanes and parking zones, which improve the visibility and accessibility of e-scooter sharing services. By fostering a supportive legal and financial environment, governments not only enhance the market viability of e-scooters but also contribute to broader goals of sustainable urban mobility.

Restraining Factors

Safety Concerns Related to Accidents and Injuries Involving E-Scooters

Safety concerns represent a significant barrier to the growth of the E-Scooter Sharing Market. Data indicating a rise in accidents and injuries associated with e-scooter usage can deter potential users and prompt regulatory bodies to impose stricter controls or limitations on e-scooter sharing services. These safety issues primarily stem from factors such as inadequate rider training, poorly maintained vehicles, and the mingling of e-scooters with larger traffic on busy streets.

Public hesitancy increases when the perceived risk of injury overshadows the convenience offered by e-scooters, thereby restraining market growth. Addressing these concerns through improved safety measures, rider education, and enhanced vehicle technology is essential for sustaining market expansion.

Lack of Charging Infrastructure Hindering Market Expansion

The inadequate availability of charging stations is a critical impediment to the scalability of the E-Scooter Sharing Market. Efficient and widespread charging infrastructure is crucial for maintaining the operational readiness of e-scooters, which in turn affects user satisfaction and service reliability. Without sufficient charging facilities, the operational scope of e-scooter-sharing systems is limited, restricting their adoption to smaller or more densely populated urban areas where shorter trips are common.

Expanding this infrastructure would enable broader geographic coverage and longer usage times, directly impacting market growth by making e-scooter sharing more practical and appealing to a larger population base. Integrating these solutions, alongside addressing safety concerns, is pivotal for overcoming barriers and enhancing the growth trajectory of the E-Scooter Sharing Market.

By Type Analysis

Free-floating accounted for 95% of the market, dominating other categories significantly.

In 2023, Free-Floating held a dominant market position in the "By Type" segment of the E-Scooter Sharing Market, capturing more than a 95% share. This type of sharing model has been increasingly favored due to its flexibility and convenience, allowing users to pick up and drop off scooters anywhere within a designated operational zone, rather than at fixed stations. This model contrasts sharply with the Station-Bound type, which accounted for less than 5% of the market share, where users are required to return the scooters to specific docking stations.

The overwhelming preference for Free-Floating models can be attributed to the enhanced user experience it offers, particularly in urban environments where demand for quick and accessible transportation options is high. This model reduces the time and effort spent by users in locating a docking station, thereby enhancing customer satisfaction and increasing usage rates. Additionally, the operational costs for providers are somewhat reduced as they do not need to invest heavily in station infrastructure.

However, the dominance of the Free-Floating model also presents challenges, such as the need for advanced technology solutions to manage fleet distribution and ensure balanced availability across service areas. Companies operating in this segment have increasingly invested in sophisticated data analytics and machine learning algorithms to optimize their services and maintain competitive advantages.

Overall, while the Station-Bound model still presents opportunities in areas where controlled parking is necessary, the future growth of the E-Scooter Sharing Market is likely to be driven by the scalability and user-centric advantages of the Free-Floating model.

By Distribution Channel Analysis

Offline channels held a mere 5%, showing minimal dominance in the market.

In 2023, Offline held a dominant market position in the "By Distribution Channel" segment of the E-Scooter Sharing Market, capturing more than a 5% share. Despite the pervasive trend towards digital platforms, the offline channel has carved out a significant niche. This segment typically includes kiosk-based bookings where users can rent scooters directly from physical locations. This approach contrasts with the Online distribution channel, which dominates the market with a 95% share, allowing users to book scooters via apps or websites.

The resilience of the Offline distribution channel can be primarily attributed to consumer preferences in specific regions where digital penetration is lower or where consumers show a predilection for face-to-face interactions due to trust and usability concerns. Moreover, tourists or infrequent users who may not wish to download an app for short-term use often find offline services more accessible and convenient.

Despite its smaller market share, the Offline channel plays a critical role in enhancing the accessibility of e-scooter sharing services. It serves as a vital touchpoint for reaching demographics less familiar with or skeptical about digital transactions. Furthermore, these offline points can also act as service hubs, providing maintenance and customer support, thus ensuring higher levels of service reliability and scooter uptime.

While the Online channel continues to facilitate rapid growth in the E-Scooter Sharing Market through scalability and lower operational costs, the Offline channel remains a crucial component, ensuring comprehensive market coverage and accessibility to all user segments.

Key Market Segments

By Type

- Free-Floating

- Station-Bound

By Distribution Channel

- Online

- Offline

Growth Opportunity

Flexibility and Convenience in Urban Mobility

The growth of the global E-Scooter Sharing Market in 2023 can be largely attributed to the increasing preference for dockless, free-floating e-scooter sharing services. These services provide an essential solution to urban congestion by offering a flexible and convenient transportation alternative.

The ability of users to pick up and drop off scooters anywhere within a designated area enhances the appeal of e-scooters, especially in densely populated cities. This model not only reduces the need for fixed docking stations, thereby lowering operational costs but also increases user accessibility and convenience, factors that are critical in driving user adoption and market expansion.

Emerging Market Potential: Focus on India

India emerges as a significant growth opportunity for the E-Scooter Sharing Market in 2023. With one of the largest shares of the global e-scooter fleet, India presents a burgeoning market characterized by rapid urbanization and an increasing focus on sustainable transportation solutions. The market is poised for expansion as adoption rates climb, driven by the growing awareness of environmental issues and the need for cost-effective transportation alternatives.

The regulatory environment in India is also evolving to support the adoption of e-scooters, further facilitating market penetration and growth. This trend underscores the potential for e-scooter sharing services to make substantial inroads in emerging markets, where the demand for innovative and sustainable mobility solutions is particularly pronounced.

Latest Trends

Growing Popularity of Shared Mobility

The surge in shared mobility has significantly influenced the global e-scooter sharing market in 2023. This trend can be attributed to the increasing consumer preference for cost-effective and environmentally friendly transportation options. Urban populations are gravitating towards shared mobility solutions as a means to reduce personal vehicle ownership, thereby decreasing urban congestion and lowering emissions.

E-scooter sharing, in particular, has emerged as a popular choice due to its ease of access and flexibility, facilitating long-distance travel efficiently. This shift is supported by the expansion of digital platforms that enhance user access through seamless mobile applications, contributing to the robust growth of this market segment.

Increasing Demand for Last-Mile Mobility

The demand for efficient last-mile mobility solutions has become a critical driver for the e-scooter sharing market. As cities expand and the distance between public transit stations and final destinations grows, e-scooters offer a practical solution for covering these short spans quickly and conveniently. This is particularly relevant in densely populated cities where traditional transportation can be slow due to traffic congestion.

Additionally, the integration of e-scooters with public transport systems as a feeder service enhances the overall efficiency of urban transport networks, encouraging more commuters to opt for public transportation options, knowing they have a reliable and quick option for the last segment of their journey. These factors collectively fuel the adoption of e-scooter sharing services, positioning them as a pivotal element of urban mobility strategies.

Regional Analysis

The e-scooter sharing market in Europe commands a significant 67.2% share of the global market.

The global e-scooter sharing market exhibits diverse dynamics across different regions, reflecting varying levels of market penetration and growth potential. Europe emerges as the dominating region, commanding a substantial 67.2% share of the market. This predominance is supported by robust urban mobility policies, significant investments in sustainable transport solutions, and high consumer readiness to adopt eco-friendly travel options. European cities have been pioneers in integrating e-scooters into their public transport systems, enhancing the accessibility and convenience of last-mile connectivity.

In North America, the market is characterized by rapid adoption in major cities like San Francisco, New York, and Chicago, driven by the growing demand for quick and flexible urban transport solutions. Although the region does not match Europe in terms of market share, it is expected to see considerable growth, encouraged by supportive regulations and increasing environmental awareness among consumers.

Asia Pacific is witnessing a steady rise in the e-scooter sharing market, fueled by escalating urbanization and the need to address traffic congestion in mega-cities. Countries like China and South Korea are leading in terms of adoption, leveraging extensive manufacturing capabilities and technological innovations to boost market growth.

The Middle East & Africa, and Latin America regions are relatively nascent in the e-scooter sharing market but are anticipated to grow as urban populations increase and governments look towards sustainable transport infrastructures. These regions offer significant growth opportunities due to increasing internet penetration and the young demographic's openness to adopting new mobility solutions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global E-Scooter Sharing Market has seen varied contributions from several key players, each bringing unique strengths to the sector.

Gogoro Inc. has established itself as a leader in the Taiwanese market, leveraging its innovative battery recycling swapping technology to enhance the convenience and operational efficiency of e-scooter sharing systems. Terra Motors Corporation has made significant inroads in Japan by adapting to local market needs and focusing on robust, cost-effective scooter designs.

Vmoto Limited continues to expand its footprint outside Australia, targeting European markets with stylish and environmentally friendly models. Meanwhile, Jiangsu Xinri Electric Vehicle Co. Ltd. remains a dominant force in China, capitalizing on vast manufacturing capabilities and competitive pricing strategies.

In the United States, NYCe Wheels and Mahindra GenZe have focused on integrating advanced telematics systems to improve user experience and fleet management. GOVECS GmbH stands out in Germany for its premium e-scooters that emphasize durability and performance, appealing to a more discerning European customer base.

Ampere Vehicles Pvt. Ltd. and Hero Electric Vehicles Pvt. Ltd. have been pivotal in India, driving the adoption of e-scooter sharing through affordable and locally manufactured models suited to dense urban environments. Amego Electric Vehicles Inc. in Canada and Kumpan Electric in Germany are enhancing their market presence by focusing on eco-friendly transportation solutions and sleek designs.

Torrot Group in Spain has been innovating with connectivity and smart mobility solutions, aiming to integrate e-scooters more seamlessly into urban transport networks.

Collectively, these companies are driving the global expansion of the e-scooter sharing market by adapting to regional demands, focusing on sustainability, and leveraging technology to enhance user experiences. Their efforts are crucial in shaping the future dynamics of urban mobility.

Market Key Players

- Gogoro Inc. (Taiwan)

- Terra Motors Corporation (Japan)

- Vmoto Limited (Australia)

- Jiangsu Xinri Electric Vehicle Co. Ltd. (China)

- NYCe Wheels (U.S.)

- GOVECS GmbH (Germany)

- Ampere Vehicles Pvt. Ltd. (India)

- Amego Electric Vehicles Inc. (Canada)

- Hero Electric Vehicles Pvt. Ltd. (India)

- Kumpan Electric (Germany)

- Torrot Group (Spain)

- Mahindra GenZe (U.S.)

Recent Development

- In April 2024, Tech-infused electric scooters offer affordable, eco-friendly, and space-saving urban mobility. With projected market growth, they're poised to dominate transportation. E-scooter-sharing revenue in Australia could reach $51.73 million by 2024.

- In April 2024, Mobec Innovation advances micro-mobility with its innovative charging scooter, enhancing accessibility for electric vehicles. Their beta activities have resulted in 1.5 lakh green kilometers, emphasizing environmental stewardship.

Report Scope

Report Features Description Market Value (2023) USD 1,303.1 Million Forecast Revenue (2033) USD 6,988.8 Million CAGR (2024-2032) 18.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Free-Floating, Station-Bound), By Distribution Channel(Online, Offline) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Gogoro Inc. (Taiwan), Terra Motors Corporation (Japan), Vmoto Limited (Australia), Jiangsu Xinri Electric Vehicle Co. Ltd. (China), NYCe Wheels (U.S.), GOVECS GmbH (Germany), Ampere Vehicles Pvt. Ltd. (India), Amego Electric Vehicles Inc. (Canada), Hero Electric Vehicles Pvt. Ltd. (India), Kumpan Electric (Germany), Torrot Group (Spain), Mahindra GenZe (U.S.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Gogoro Inc. (Taiwan)

- Terra Motors Corporation (Japan)

- Vmoto Limited (Australia)

- Jiangsu Xinri Electric Vehicle Co. Ltd. (China)

- NYCe Wheels (U.S.)

- GOVECS GmbH (Germany)

- Ampere Vehicles Pvt. Ltd. (India)

- Amego Electric Vehicles Inc. (Canada)

- Hero Electric Vehicles Pvt. Ltd. (India)

- Kumpan Electric (Germany)

- Torrot Group (Spain)

- Mahindra GenZe (U.S.)