Drug Device Combination Products Market By Product (Infusion Pumps, Orthopedic Combination Products, Photodynamic Therapy Devices, Transdermal Patches, Drug Eluting Stents, Wound Care Products, Inhalers, Antimicrobial Catheters, Others), By Therapeutic Use (Cardiovascular Disorders, Diabetes, Cancer, Other Indications), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48145

-

June 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

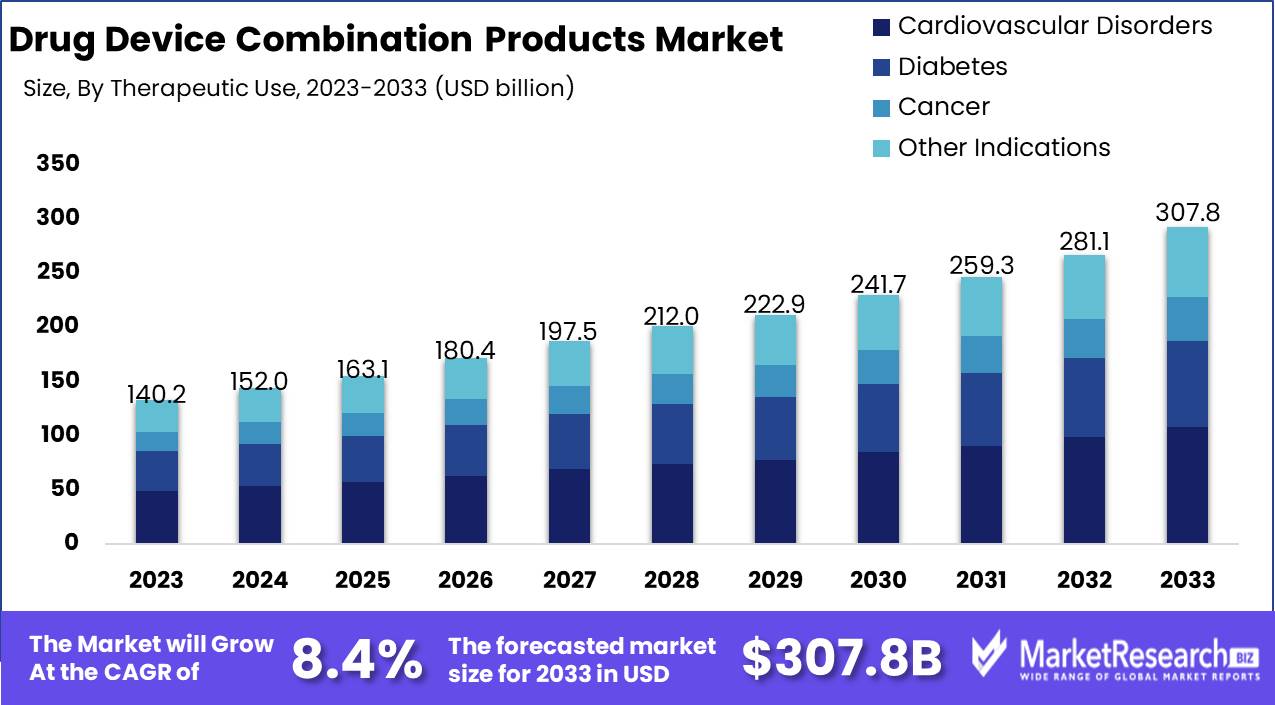

The Drug Device Combination Products Market was valued at USD 140.2 billion in 2023. It is expected to reach USD 307.8 billion by 2033, with a CAGR of 8.4% during the forecast period from 2024 to 2033.

The Drug-Device Combination Products Market encompasses a range of medical products that integrate drugs and medical devices to enhance therapeutic efficacy and patient outcomes. These products, which include drug-eluting stents, transdermal patches, and pre-filled syringes, combine the benefits of pharmaceuticals and device technology to provide innovative solutions for complex medical conditions. This market is driven by advancements in biotechnology, the growing prevalence of chronic diseases, and an increasing focus on personalized medicine. Regulatory harmonization and technological advancements further catalyze growth, positioning this market as a critical component in the evolving landscape of healthcare and medical innovation.

The Drug-Device Combination Products Market is poised for substantial growth, driven by the increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer. This surge in chronic conditions necessitates more effective and efficient treatment options, positioning drug-device combination products as a crucial solution in the healthcare landscape. Technological advancements are catalyzing the development of innovative products that integrate drugs and devices seamlessly, enhancing therapeutic efficacy and patient compliance. Additionally, the growing preference for minimally invasive surgeries is amplifying the demand for these combination products, as they often enable less invasive treatment modalities with quicker recovery times and reduced complication risks.

However, the market's expansion is tempered by stringent regulatory requirements and complex approval processes, which can pose significant challenges for market entrants and existing players alike. Navigating these regulatory landscapes necessitates robust compliance strategies and significant investment in R&D.

Concurrently, the increasing integration of digital health technologies with drug-device combination products is emerging as a transformative trend. This integration not only augments the functionality and patient monitoring capabilities of these products but also aligns with the broader shift towards personalized medicine and telehealth. As a result, stakeholders must strategically align their operations and innovations to leverage these growth drivers while mitigating regulatory hurdles to maintain a competitive edge in this dynamic market.

Key Takeaways

- Market Growth: The Drug Device Combination Products Market was valued at USD 140.2 billion in 2023. It is expected to reach USD 307.8 billion by 2033, with a CAGR of 8.4% during the forecast period from 2024 to 2033.

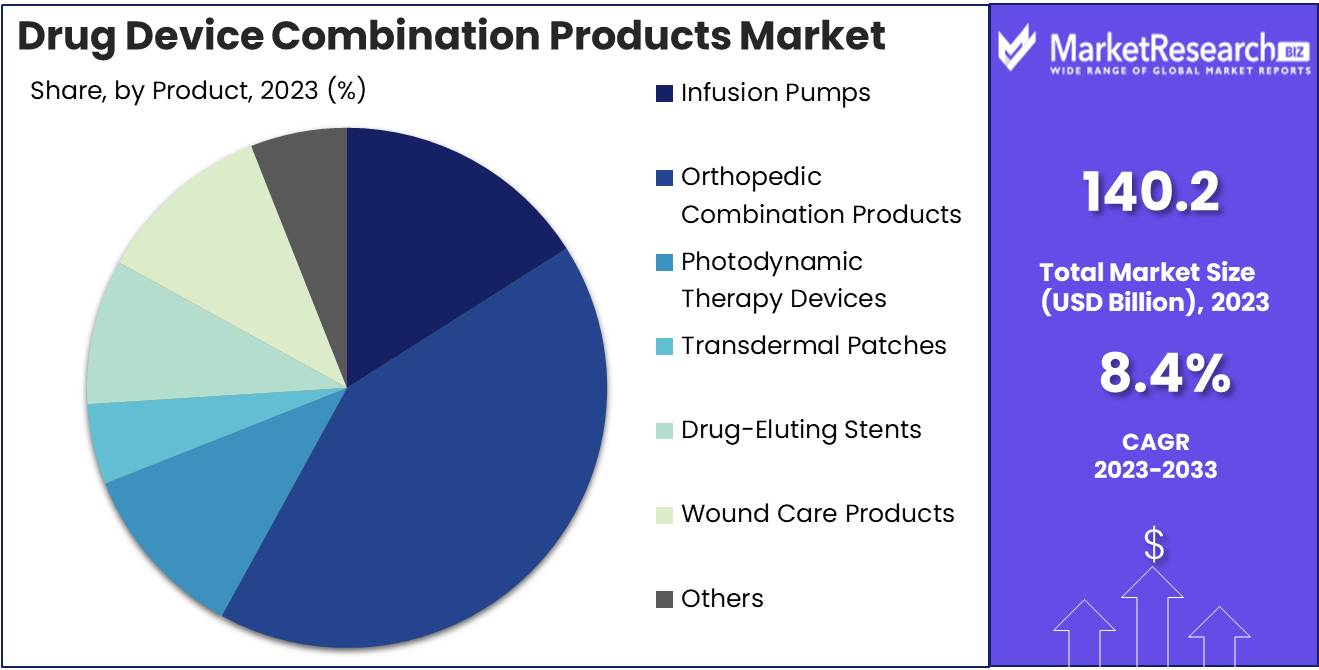

- By Product: Orthopedic Combination Products dominated the diverse Drug-Device Combination Products Market.

- By Therapeutic Use: Cardiovascular Disorders dominated the Drug-Device Combination Products Market.

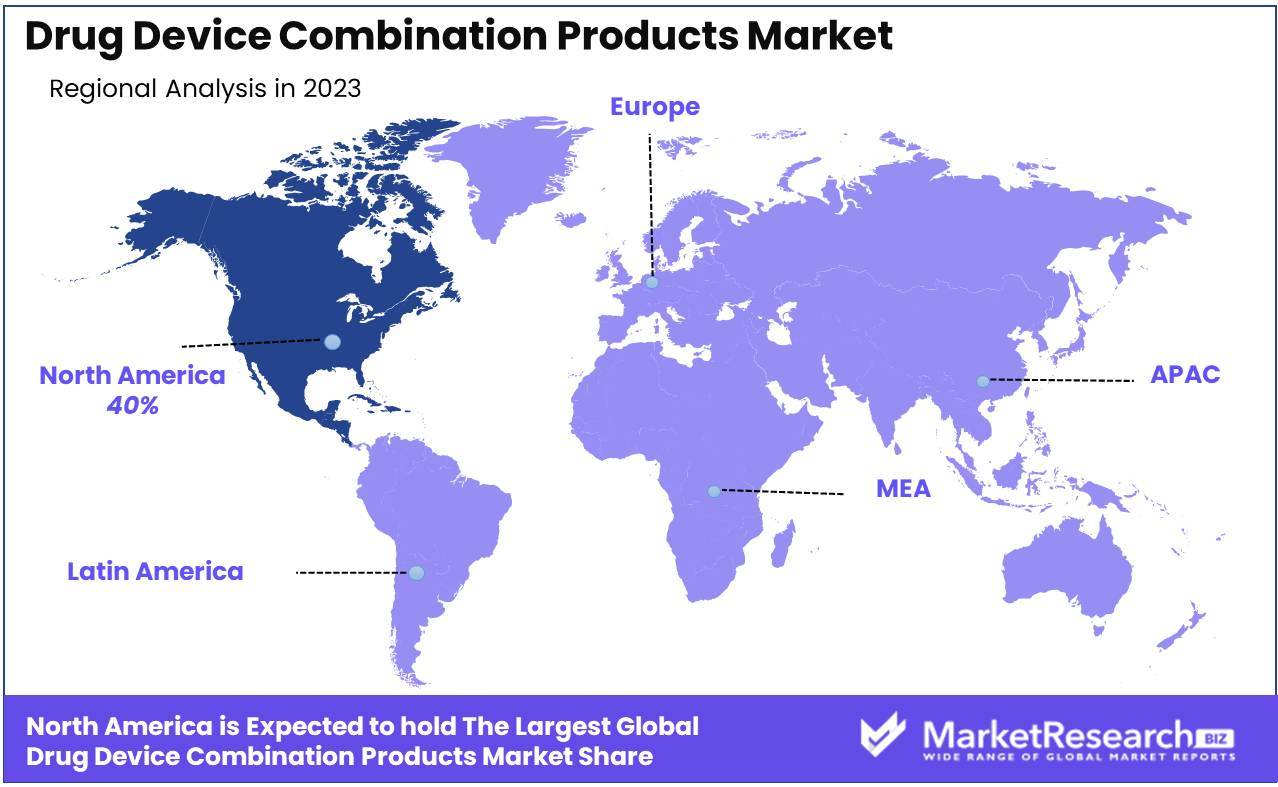

- Regional Dominance: North America dominates the growing drug-device combination market with a 40% share.

- Growth Opportunity: The global drug-device combination products market growth is driven by home-based healthcare expansion and strategic outsourcing opportunities.

Driving factors

Growing Prevalence of Chronic Diseases: A Catalyst for Market Expansion

The increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and respiratory disorders is a primary driver for the growth of the drug-device combination products market. According to the World Health Organization (WHO), chronic diseases are responsible for 71% of all deaths globally, emphasizing the critical need for effective management and treatment solutions. Drug device combination products, such as insulin pens, inhalers, and drug-eluting stents, offer integrated approaches that enhance therapeutic outcomes and simplify disease management for patients. This rise in chronic conditions directly correlates with an upsurge in demand for these innovative products, as they provide targeted, efficient, and often more comfortable treatment options compared to traditional methods.

Demand for Minimally Invasive Treatments: Enhancing Adoption Rates

The healthcare industry's shift towards minimally invasive treatments is significantly driving the adoption of drug-device combination products. Minimally invasive procedures typically result in reduced patient trauma, shorter recovery times, and lower overall healthcare costs. Drug device combination products like transdermal patches, prefilled syringes, and micro-needle arrays are at the forefront of this trend, offering less invasive alternatives to conventional drug delivery methods. This growth underscores the increasing preference for minimally invasive options, which are often facilitated by drug-device combination products, further propelling the market growth.

Improving Patient Compliance: Driving Market Adoption

Patient compliance is a critical factor in the success of therapeutic regimens, and drug-device combination products significantly enhance this aspect. These products are designed to simplify the administration process, thereby reducing the burden on patients and improving adherence to prescribed treatments. For example, smart inhalers equipped with sensors can track usage and provide reminders, ensuring patients take their medication as required. Studies have shown that medication adherence rates can increase by up to 60% with the use of such smart devices. This improved compliance not only enhances patient outcomes but also drives the market demand for drug-device combination products, as healthcare providers and patients increasingly recognize their benefits in achieving optimal therapeutic results.

Restraining Factors

Stringent Regulatory Approval Process: A Barrier to Market Expansion

The stringent regulatory approval process for drug-device combination products significantly hampers market growth. Regulatory agencies, including the FDA and EMA, impose rigorous standards to ensure patient safety and product efficacy. These standards require extensive clinical trials, thorough documentation, and long-term safety data, which can delay product launches and increase development costs.

For instance, the FDA's Premarket Approval (PMA) process for combination products can extend over several years, demanding substantial financial and time investments from manufacturers. The need for dual compliance addressing both drug and device regulations adds further complexity. Consequently, smaller companies, in particular, may find it challenging to navigate these regulations due to limited resources, leading to reduced market entry and slower innovation.

Product Recalls and Safety Concerns: Undermining Consumer Trust and Market Stability

Product recalls and safety concerns present another significant restraint on the drug-device combination products market. Recalls, often triggered by defects or adverse events, not only disrupt supply chains but also damage the reputation of the companies involved. This leads to a loss of consumer trust and can result in substantial financial losses due to lawsuits, compensation, and corrective actions.

For example, the FDA recalled numerous drug-device combination products, citing issues ranging from contamination to malfunctioning components. Such recalls highlight potential vulnerabilities in product design and manufacturing processes, prompting stricter scrutiny and regulatory oversight. The increased frequency of recalls also fosters a conservative market environment where companies might be hesitant to innovate, fearing potential future recalls and associated costs.

By Product Analysis

In 2023, Orthopedic Combination Products dominated the diverse Drug-Device Combination Products Market.

In 2023, Orthopedic Combination Products held a dominant market position in the By Product segment of the Drug Device Combination Products Market. This sector includes a diverse range of products that integrate drugs with medical devices to enhance therapeutic outcomes. Infusion Pumps, critical for delivering precise medication dosages, remain pivotal in chronic disease management. Orthopedic Combination Products, encompassing bone graft substitutes and antibiotic-loaded bone cement, are vital in orthopedic surgeries, driving their market dominance.

Photodynamic Therapy Devices, employing light-activated drugs to treat conditions like cancer, continue to show promising growth due to their non-invasive nature. Transdermal Patches, offering controlled drug release through the skin, cater to patients seeking pain management and hormone therapies. Drug Eluting Stents, crucial in preventing arterial blockages post-surgery, are essential in cardiovascular treatments. Wound Care Products, incorporating antimicrobial agents, address the rising demand for advanced wound healing solutions.

Inhalers, designed for respiratory conditions such as asthma, remain integral to respiratory care. Antimicrobial Catheters, minimizing infection risks, are increasingly adopted in hospital settings. Lastly, the 'Others' category, including innovative products like drug-loaded contact lenses, reflects the expanding scope and innovation within the market. The versatility and effectiveness of these combination products underscore their critical role in advancing patient care and treatment outcomes.

By Therapeutic Use Analysis

In 2023, Cardiovascular Disorders dominated the Drug Device Combination Products Market.

In 2023, Cardiovascular Disorders held a dominant market position in the "By Therapeutic Use" segment of the Drug Device Combination Products Market. This dominance can be attributed to the high prevalence of cardiovascular diseases globally, necessitating advanced therapeutic solutions. Drug device combination products, such as drug-eluting stents and transcatheter heart valves, have proven crucial in managing these conditions, offering enhanced efficacy and safety.

Diabetes followed as a significant segment, driven by the increasing incidence of diabetes worldwide. Innovative products like insulin pumps and continuous glucose monitoring systems have revolutionized diabetes management, improving patient outcomes and quality of life.

Cancer, another vital segment, has seen growth due to the rising cancer burden and the need for targeted, efficient treatment modalities. Drug-device combinations, including implantable drug delivery systems and smart inhalers, have shown promise in providing localized and controlled drug release, minimizing side effects, and enhancing therapeutic effectiveness.

Other indications, comprising a range of chronic and acute conditions, also contribute to market expansion. Products designed for pain management, neurological disorders, and infectious diseases exemplify the diverse applications of drug device combinations. This segment's growth is fueled by ongoing research and development, aiming to address unmet medical needs across various therapeutic areas.

Key Market Segments

By Product

- Infusion Pumps

- Orthopedic Combination Products

- Photodynamic Therapy Devices

- Transdermal Patches

- Drug-Eluting Stents

- Wound Care Products

- Inhalers

- Antimicrobial Catheters

- Others

By Therapeutic Use

- Cardiovascular Disorders

- Diabetes

- Cancer

- Other Indications

Growth Opportunity

Expansion of Home-Based Healthcare Fuels Growth

The global drug-device combination products market is poised for significant expansion, driven by the burgeoning trend of home-based healthcare. With the increasing prevalence of chronic diseases and the aging population, there is a growing demand for healthcare solutions that allow patients to manage their conditions in the comfort of their homes. Drug device combination products, which integrate medical devices with pharmaceutical treatments, are ideally suited for this purpose. These products offer the convenience of self-administration, reducing the need for frequent hospital visits and enhancing patient compliance.

The shift towards home-based care is further supported by advancements in telehealth and remote monitoring technologies, which facilitate seamless patient-provider interactions and ensure timely intervention. As healthcare systems worldwide strive to reduce costs and improve patient outcomes, the adoption of drug-device combination products in home-based settings is expected to accelerate, presenting a substantial growth opportunity for market players.

Outsourcing Opportunities Enhance Market Competitiveness

Outsourcing presents another significant growth avenue for the drug-device combination products market. By leveraging the expertise of contract manufacturing organizations (CMOs) and contract research organizations (CROs), companies can streamline their operations, reduce time-to-market, and focus on core competencies such as R&D and marketing. This strategic move not only enhances operational efficiency but also allows for greater flexibility in scaling production to meet market demand.

The global outsourcing market for pharmaceutical and medical device manufacturing is expanding rapidly, driven by cost containment pressures and the need for specialized skills and technologies. Companies that effectively utilize outsourcing can achieve significant cost savings, improve product quality, and accelerate regulatory approvals. As the market for drug device combination products becomes increasingly competitive, the ability to innovate and bring products to market swiftly will be a critical success factor.

Latest Trends

Technological Advancements Enabling Controlled and Targeted Drug Delivery

The drug-device combination products market is set to witness significant growth driven by technological advancements in controlled and targeted drug delivery systems. Innovations in microelectronics, nanotechnology, and biotechnology are enabling the development of devices that offer precise drug administration, reducing side effects and improving patient outcomes. For instance, smart inhalers and injectable devices equipped with sensors and connectivity features are becoming increasingly prevalent. These devices not only ensure accurate dosing but also facilitate real-time monitoring of patient adherence and response, allowing for personalized treatment plans. Furthermore, the integration of AI and machine learning algorithms in these devices is expected to enhance predictive analytics capabilities, further optimizing drug delivery processes.

Expanding Service Provider Landscape

The expanding service provider landscape is another critical trend shaping the market. As the demand for drug-device combination products grows, a broader array of service providers, including contract manufacturing organizations (CMOs) and contract research organizations (CROs), are entering the market. These providers offer specialized services ranging from product development and regulatory consulting to manufacturing and distribution. This trend is driven by pharmaceutical companies' need to streamline operations and reduce time-to-market. The increased competition among service providers is likely to spur innovation and drive down costs, benefiting both manufacturers and end-users. Moreover, partnerships between pharmaceutical companies and service providers are becoming more strategic, focusing on leveraging each party's strengths to enhance product quality and market reach.

Regional Analysis

North America dominates the growing drug-device combination market with a 40% share.

The global market for drug-device combination products is experiencing robust growth, driven by innovations in medical technology and increasing demand for advanced healthcare solutions. North America holds a dominating position, capturing approximately 40% of the largest market share. This leadership is attributed to the region's strong healthcare infrastructure, high investment in R&D, and favorable regulatory environment. The United States, in particular, is a key driver due to its large patient population and the presence of leading pharmaceutical and medical device companies.

In Europe, the market is propelled by the rising incidence of chronic diseases and the region's significant healthcare expenditure. Countries such as Germany, France, and the UK are at the forefront, benefiting from established healthcare systems and strong support for medical research.

Asia Pacific is the fastest-growing region, with countries like China, India, and Japan leading the expansion. The growth is fueled by increasing healthcare awareness, a rising middle-class population, and substantial government investments in healthcare infrastructure. Moreover, the region is becoming a hub for clinical trials and manufacturing due to cost advantages.

The Middle East & Africa and Latin America regions are witnessing gradual growth, supported by improving healthcare facilities and increasing foreign investments. Brazil and South Africa are notable contributors within these regions, demonstrating steady advancements in healthcare services.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global Drug Device Combination Products Market is poised for significant growth, driven by innovations and strategic maneuvers from key industry players. Abbott remains a dominant force, leveraging its robust R&D capabilities to advance drug-eluting stents and diagnostic devices, thus enhancing patient outcomes. Terumo Corporation continues to expand its portfolio with cutting-edge cardiovascular solutions, capitalizing on its expertise in minimally invasive treatments.

Stryker Corporation's focus on orthopedic and neurosurgical products positions it as a leader in integrating drug delivery mechanisms with implantable devices, offering comprehensive solutions for complex medical conditions. Mylan N.V. (now part of Viatris) emphasizes affordability and accessibility in its combination products, particularly in respiratory and oncology sectors, aligning with global healthcare needs.

Medtronic's extensive range of combination products, particularly in diabetes management and cardiac care, underscores its commitment to patient-centric innovation. Allergan plc, now part of AbbVie, leverages its strengths in aesthetics and eye care, expanding its portfolio to include combination products that address chronic conditions.

Boston Scientific Corporation and Novartis AG continue to push boundaries with their respective advancements in interventional cardiology and personalized medicine, while C.R. Bard (part of BD) focuses on vascular and urology segments, providing integrated solutions that enhance therapeutic efficacy.

Teleflex Incorporated and W. L. Gore & Associates Inc. excel in developing novel delivery systems and bioengineered solutions, addressing unmet clinical needs. These companies, along with other emerging players, are set to drive market expansion through technological innovation, strategic partnerships, and a keen focus on improving patient outcomes and beyond.

Market Key Players

- Abbott

- Terumo Corporation

- Stryker Corporation

- Mylan N.V.

- Medtronic

- Allergan plc

- Boston Scientific Corporation

- Novartis AG

- C.R. Bard

- Teleflex Incorporated

- W. L. Gore & Associates Inc.

- Other Key Players

Recent Development

- In March 2024, Abbott received FDA approval for their innovative drug-device combination targeting cardiovascular patients. The product integrates a stent delivery system with an anti-restenosis drug, aimed at improving long-term outcomes for patients undergoing angioplasty.

- In January 2024, Kindeva Drug Delivery announced the acquisition of Summit Biosciences. This strategic move aims to enhance Kindeva's capabilities in the nasal drug delivery sector, strengthening its position as a leader in innovative drug delivery solutions.

- In June 2023, Evonik announced a $220 million expansion of its pharmaceutical lipid production facility in Indiana, USA. This expansion, supported by the U.S. government's Biomedical Advanced Research and Development Authority (BARDA), aims to bolster the production of lipids critical for mRNA vaccines and other nucleic acid therapies.

Report Scope

Report Features Description Market Value (2023) USD 140.2 Billion Forecast Revenue (2033) USD 307.8 Billion CAGR (2024-2032) 8.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Infusion Pumps, Orthopedic Combination Products, Photodynamic Therapy Devices, Transdermal Patches, Drug Eluting Stents, Wound Care Products, Inhalers, Antimicrobial Catheters, Others), By Therapeutic Use (Cardiovascular Disorders, Diabetes, Cancer, Other Indications) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Abbott, Terumo Corporation, Stryker Corporation, Mylan N.V., Medtronic, Allergan plc, Boston Scientific Corporation, Novartis AG, C.R. Bard, Teleflex Incorporated, W. L. Gore & Associates Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Abbott

- Terumo Corporation

- Stryker Corporation

- Mylan N.V.

- Medtronic

- Allergan plc

- Boston Scientific Corporation

- Novartis AG

- C.R. Bard

- Teleflex Incorporated

- W. L. Gore & Associates Inc.

- Other Key Players