Drip Irrigation Systems Market By Component (Emitters, Pressure Gauge, Drip Tube, Valves, Filters, Fittings & Accessories), By Crop Type (Cereals & Pulses, Fruits & Vegetables, Oilseeds & Pulses, Turf & Ornamentals, Others Crops), By Application (Agriculture, Landscape, Greenhouse, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

29

-

July 2024

-

150

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

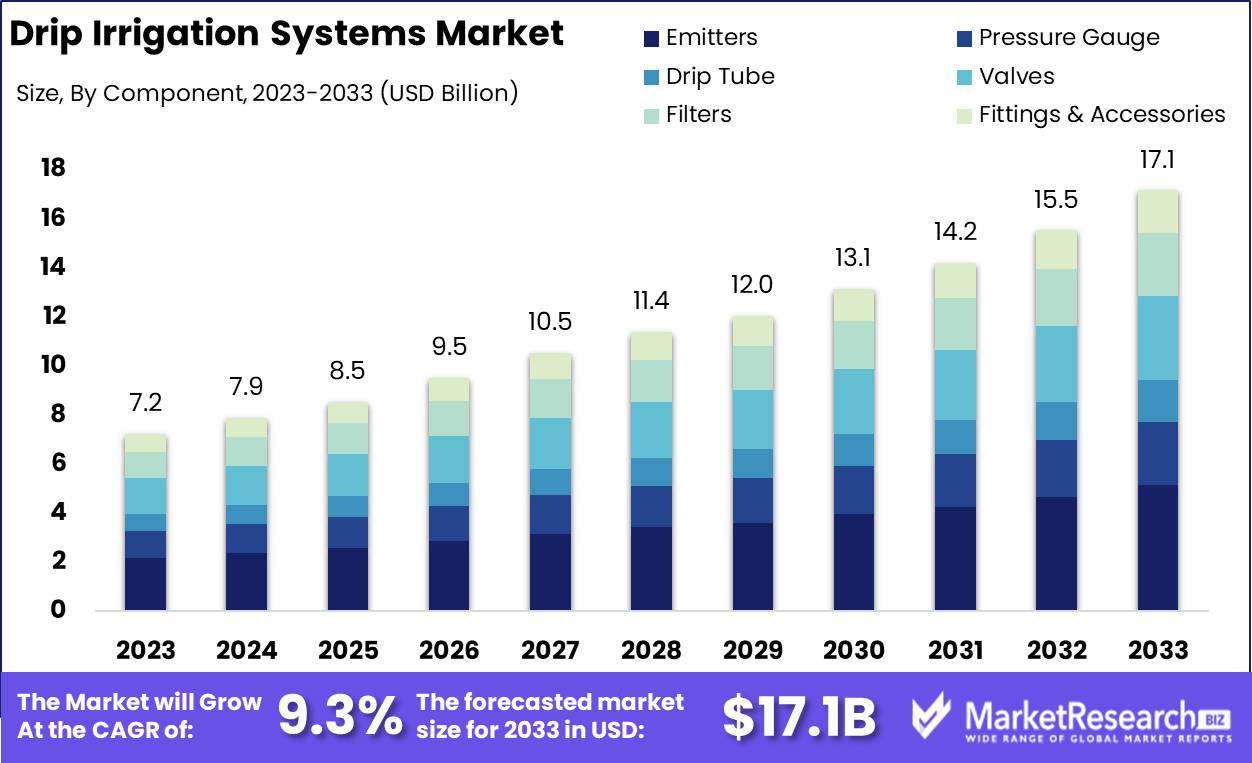

The Global Drip Irrigation Systems Market was valued at USD 7.2 Bn in 2023. It is expected to reach USD 17.1 Bn by 2033, with a CAGR of 9.3% during the forecast period from 2024 to 2033.

The Drip Irrigation Systems Market involves the production and distribution of irrigation systems that deliver water directly to the roots of plants through a network of valves, pipes, tubing, and emitters. These systems are designed to optimize water usage, reduce wastage, and enhance crop yields by providing precise moisture levels. Market growth is driven by increasing water scarcity, the need for sustainable agricultural practices, and advancements in irrigation technology. Drip irrigation systems are widely adopted in agriculture, horticulture, and landscaping, promoting efficient water management and contributing to the overall sustainability of water resources in various regions.

The Drip Irrigation Systems Market is poised for significant expansion, driven by the imperative to enhance agricultural productivity and water efficiency amid increasing global water scarcity and population growth. Drip irrigation systems deliver water directly to plant roots, optimizing usage and minimizing wastage. This method supports 100% land utilization, ensuring uniform irrigation across diverse topographies and soil types. With typical static pressures required for these systems ranging from 20-70 psi, drip irrigation is adaptable and efficient.

By 2050, the global population is projected to reach 10 billion, exacerbating the challenge of feeding more people with 20% less arable land per person. This demographic pressure, combined with escalating water scarcity, underscores the critical need for sustainable agricultural practices. Drip irrigation systems address these challenges by significantly boosting crop yields and resource efficiency.

Technological advancements are further propelling market growth, as innovations in materials and system design enhance the durability, efficiency, and ease of installation of drip irrigation systems. Governments and international bodies are increasingly recognizing the importance of water conservation, leading to supportive policies and subsidies that encourage the adoption of drip irrigation.'

Key Takeaways

- Market Growth: The Global Drip Irrigation Systems Market was valued at USD 7.2 Bn in 2023. It is expected to reach USD 17.1 Bn by 2033, with a CAGR of 9.3% during the forecast period from 2024 to 2033.

- By Component: Emitters are a crucial component, accounting for 30% of the market, critical for delivering water directly to the plant roots efficiently.

- By Crop Type: Fruits & Vegetables are the largest beneficiaries, making up 35% of the market, due to their high water needs and value per acre.

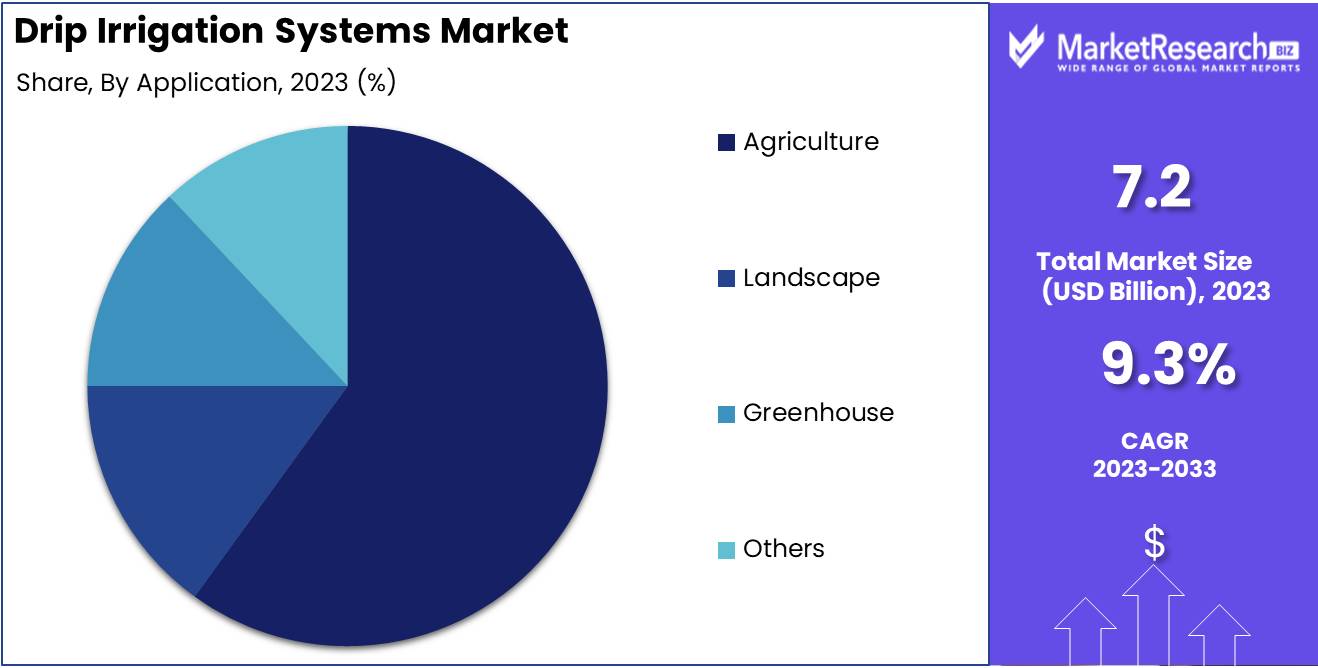

- By Application: Agriculture is the primary application area, with 60% usage, highlighting its importance in enhancing crop yields and water conservation.

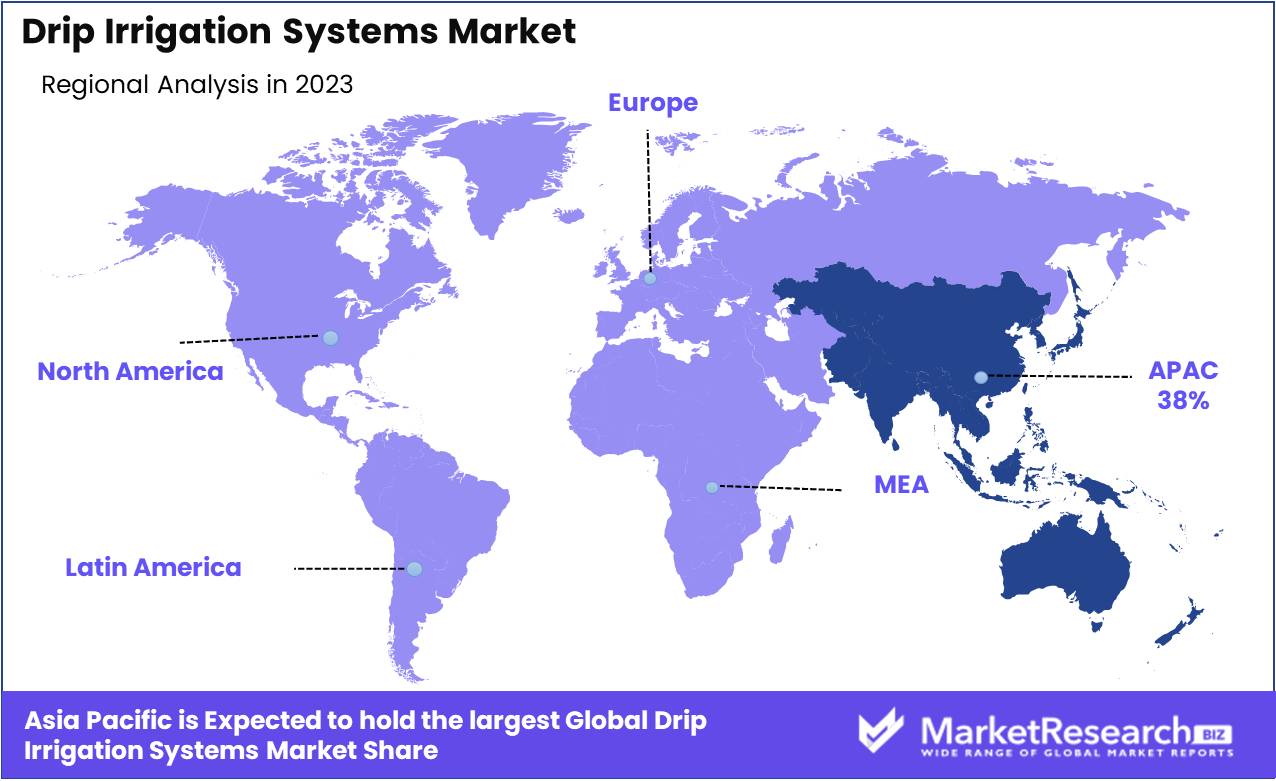

- Regional Dominance: Asia Pacific holds a 38% share, propelled by the increasing adoption of efficient irrigation techniques to meet the growing food demand in the region.

- Growth Opportunity: The shift towards precision agriculture practices offers substantial growth potential for targeted liquid fertilizer solutions.

Driving factors

Increasing Need for Water Conservation

The increasing need for water conservation is a significant driver for the growth of the Drip Irrigation Systems Market. With global water resources under intense pressure from population growth, climate change, and unsustainable agricultural practices, efficient water use has become paramount. Drip irrigation systems, which deliver water directly to the root zone of plants, significantly reduce water wastage by minimizing evaporation and runoff compared to traditional irrigation methods.

This method can achieve up to 90% water-use efficiency, making it an essential technology for regions facing water scarcity. As water conservation becomes a critical priority worldwide, the adoption of drip irrigation systems is expected to surge, driving market growth.

Growing Adoption of Precision Agriculture

The growing adoption of precision agriculture is another major factor propelling the Drip Irrigation Systems Market. Precision agriculture involves using advanced technologies to optimize field-level management regarding crop farming. Drip irrigation systems are integral to this approach as they allow for precise control over water and nutrient delivery, enhancing crop yield and quality while reducing resource use.

The integration of drip irrigation with sensors, GPS, and data analytics enables farmers to monitor soil moisture levels, weather conditions, and crop health in real-time, making informed irrigation decisions. This technological synergy not only improves efficiency and productivity but also supports sustainable farming practices, further driving the market for drip irrigation systems.

Rising Global Food Demand

Rising global food demand is a critical factor contributing to the expansion of the Drip Irrigation Systems Market. The global population is projected to reach nearly 10 billion by 2050, requiring a substantial increase in food production. Drip irrigation systems play a crucial role in meeting this demand by enabling higher crop yields on the same or even reduced acreage.

By ensuring that water and nutrients are delivered directly to the plant roots, these systems enhance growth rates and productivity, particularly in arid and semi-arid regions where traditional farming is less viable. This efficiency in resource use helps address food security challenges, making drip irrigation systems indispensable in modern agriculture.

Restraining Factors

High Initial Setup Costs

High initial setup costs are a significant barrier to the growth of the Drip Irrigation Systems Market. The installation of drip irrigation systems involves substantial upfront investments in equipment, including emitters, pipes, filters, and control systems. Additionally, the need for skilled labor to design and install these systems correctly can further escalate costs.

These financial barriers can be particularly challenging for small-scale farmers and those in developing regions with limited access to capital. Although the long-term benefits of drip irrigation, such as water savings and increased crop yields, can offset these initial expenses, the high upfront costs can deter potential adopters and slow market growth.

Maintenance Challenges and Clogging Issues

Maintenance challenges and clogging issues also pose significant hurdles to the widespread adoption of drip irrigation systems. These systems require regular maintenance to ensure optimal performance and longevity. Clogging of emitters, caused by debris, mineral deposits, or algae, is a common problem that can reduce the efficiency of water distribution and lead to uneven crop growth.

Addressing these issues often involves additional labor and costs for cleaning and repairs. Farmers need to invest in filtration systems and periodic maintenance to prevent and mitigate clogging, which can be both time-consuming and costly. These maintenance challenges can discourage farmers from adopting drip irrigation systems, particularly in regions where technical support and maintenance services are scarce.

By Component Analysis

Emitters dominated the By Component segment of the Drip Irrigation Systems Market in 2023, capturing more than a 30% share.

In 2023, Emitters held a dominant market position in the By Component segment of the Drip Irrigation Systems Market, capturing more than a 30% share. The prominence of emitters is due to their critical role in delivering precise amounts of water directly to the plant roots, ensuring efficient water use and promoting optimal plant growth. Emitters are essential for maintaining uniform water distribution across diverse agricultural fields, which is crucial for maximizing crop yield and conserving water resources.

Pressure Gauges are vital for monitoring and maintaining the correct pressure levels within drip irrigation systems, ensuring consistent water flow and system efficiency. Despite their importance, the market share of pressure gauges is smaller compared to emitters, as they are supplementary components rather than direct water delivery mechanisms.

Drip Tubes are integral to the infrastructure of drip irrigation systems, transporting water from the source to the emitters. While crucial for the overall system functionality, their market share is overshadowed by emitters due to the primary role emitters play in water delivery and efficiency.

Valves are essential for controlling water flow within drip irrigation systems, allowing for precise regulation and distribution of water. Their role in enhancing system efficiency and flexibility is significant, yet their market share is less compared to emitters due to their supporting function within the system.

Filters are critical for preventing clogging and ensuring the longevity of drip irrigation systems by removing particulates and impurities from the water supply. Although essential for system maintenance and efficiency, their market share is smaller compared to emitters because they do not directly influence water distribution to plants.

Fittings & Accessories include various components that connect and support the drip irrigation system, such as connectors, adapters, and stakes. These components are necessary for system setup and maintenance but hold a smaller market share due to their auxiliary role in the system’s overall operation.

By Crop Type Analysis

Fruits & Vegetables dominated the By Crop Type segment of the Drip Irrigation Systems Market in 2023, capturing more than a 35% share.

In 2023, Fruits & Vegetables held a dominant market position in the By Crop Type segment of the Drip Irrigation Systems Market, capturing more than a 35% share. This dominance is driven by the high value and water-sensitive nature of these crops, which require precise and efficient irrigation methods to ensure optimal growth and yield. Drip irrigation systems are particularly effective for fruits and vegetables as they deliver water directly to the root zone, minimizing water waste and reducing the risk of disease and nutrient leaching.

Cereals & Pulses, which include staple crops such as wheat, rice, and beans, also benefit from drip irrigation, especially in regions facing water scarcity. However, the market share for cereals and pulses is smaller compared to fruits and vegetables due to the traditionally lower profit margins and the larger-scale farming operations that may rely on other irrigation methods.

Oilseeds & Pulses, including crops like soybeans, sunflowers, and lentils, require efficient water management to maximize oil content and yield. While drip irrigation is beneficial for these crops, their market share is less than that of fruits and vegetables due to similar economic and operational factors affecting cereals and pulses.

Turf & Ornamentals represent a significant segment for drip irrigation systems, particularly in landscaping, golf courses, and nurseries. The precise water delivery and conservation benefits of drip irrigation are highly valued in these applications. Despite this, the overall market share remains smaller compared to the high-value and high-demand fruits and vegetables segment.

Other Crops encompass a variety of agricultural products that benefit from drip irrigation, including herbs, spices, and medicinal plants.

By Application Analysis

Agriculture dominated the By Application segment of the Drip Irrigation Systems Market in 2023, capturing more than a 60% share.

In 2023, Agriculture held a dominant market position in the By Application segment of the Drip Irrigation Systems Market, capturing more than a 60% share. This leading position is driven by the widespread adoption of drip irrigation systems in agricultural practices to enhance water efficiency, crop yield, and sustainability. Drip irrigation is particularly effective in regions facing water scarcity, as it delivers water directly to the plant roots, minimizing evaporation and runoff. The agricultural sector's focus on optimizing resource use and improving productivity to meet the growing global food demand has significantly contributed to the dominance of this segment.

Landscape applications, including residential lawns, public parks, and commercial landscaping projects, also benefit from drip irrigation systems. These systems provide precise water delivery, reducing waste and promoting healthy plant growth in various landscaping environments.

Greenhouse applications leverage drip irrigation to maintain controlled growing environments, ensuring consistent water supply and nutrient delivery to plants. The ability of drip irrigation to provide precise and uniform watering is crucial for optimizing growth conditions in greenhouses.

Others include applications such as nurseries, horticulture, and sports facilities where efficient water management is essential. These areas benefit from the precision and conservation advantages of drip irrigation systems, but their collective market share is relatively small compared to the dominant agriculture segment.

Key Market Segments

By Component

- Emitters

- Pressure Gauge

- Drip Tube

- Valves

- Filters

- Fittings & Accessories

By Crop Type

- Cereals & Pulses

- Fruits & Vegetables

- Oilseeds & Pulses

- Turf & Ornamentals

- Others

By Application

- Agriculture

- Landscape

- Greenhouse

- Others

Growth Opportunity

Technological Advancements in Irrigation Systems

Technological advancements in irrigation systems are set to create significant opportunities for the Drip Irrigation Systems Market in 2024. Innovations such as smart irrigation controllers, soil moisture sensors, and automated systems are enhancing the efficiency and effectiveness of drip irrigation. These technologies allow for real-time monitoring and precise water delivery, optimizing water use and improving crop yields. For instance, the integration of IoT and AI can help farmers make data-driven decisions, adjusting irrigation schedules based on weather forecasts and soil conditions.

These advancements not only improve the performance of drip irrigation systems but also reduce maintenance challenges and operational costs, making them more accessible to a broader range of users. As technology continues to evolve, the adoption of advanced irrigation solutions is expected to drive substantial growth in the market.

Government Subsidies and Incentives for Sustainable Agriculture

Government subsidies and incentives for sustainable agriculture present another critical growth opportunity for the Drip Irrigation Systems Market in 2024. Recognizing the importance of water conservation and sustainable farming practices, many governments are offering financial support to encourage the adoption of efficient irrigation technologies. These subsidies can significantly offset the high initial setup costs associated with drip irrigation systems, making them more affordable for farmers. Programs that provide grants, tax breaks, or low-interest loans for the purchase and installation of drip irrigation systems are particularly impactful.

Such initiatives not only promote the adoption of drip irrigation but also support broader environmental and agricultural sustainability goals. As more countries implement and expand these incentives, the market for drip irrigation systems is poised for accelerated growth.

Latest Trends

Integration with IoT and Smart Farming Technologies

The integration of IoT and smart farming technologies is a significant trend that will shape the Drip Irrigation Systems Market in 2024. IoT-enabled drip irrigation systems provide real-time data on soil moisture levels, weather conditions, and crop health, allowing farmers to make informed decisions and optimize water usage.

These smart systems can automatically adjust irrigation schedules based on real-time data, ensuring that crops receive the right amount of water at the right time. This precision not only conserves water but also enhances crop yields and reduces labor costs. As the adoption of smart farming technologies increases, the demand for IoT-integrated drip irrigation systems is expected to rise, driving market growth and innovation.

Development of Solar-Powered Drip Irrigation Systems

The development of solar-powered drip irrigation systems represents another transformative trend for 2024. Solar-powered systems offer a sustainable and cost-effective solution for irrigation, especially in regions with limited access to electricity. These systems harness solar energy to power the pumps and controllers needed for drip irrigation, reducing reliance on traditional energy sources and lowering operational costs.

Solar-powered drip irrigation is particularly beneficial for small-scale and remote farmers who struggle with high energy costs and unreliable power supplies. By providing a reliable and eco-friendly irrigation solution, solar-powered systems can significantly expand the reach and adoption of drip irrigation technologies, contributing to market growth.

Regional Analysis

Drip Irrigation Systems Market by Region: North America, Europe, Asia Pacific, Middle East & Africa, Latin America

In 2023, Asia Pacific dominated the Drip Irrigation Systems Market, capturing a significant 38% share. This leadership is driven by the region's large agricultural sector and the increasing adoption of efficient irrigation technologies to address water scarcity and improve crop yields. Countries such as China, India, and Australia are at the forefront, with government initiatives and subsidies promoting the use of drip irrigation systems. The growing awareness among farmers about the benefits of water-efficient irrigation methods, coupled with the need to enhance food security for a large population, further bolsters the market's dominance in this region.

North America holds a substantial share in the drip irrigation systems market, driven by the advanced agricultural practices and technological innovations. The region's focus on sustainable farming practices and water conservation supports the adoption of drip irrigation systems.

Europe also represents a significant market for drip irrigation systems. The emphasis on sustainable agriculture and stringent environmental regulations drive the demand for efficient irrigation technologies.

Middle East & Africa show promising potential for growth in the drip irrigation systems market, supported by the need to manage water resources efficiently in arid and semi-arid regions. Despite the growing adoption, the overall market share is relatively modest due to economic constraints and varying levels of infrastructure development.

Latin America is emerging as a growing market for drip irrigation systems, with Brazil and Mexico leading the demand. The region benefits from a strong agricultural sector and increasing focus on improving irrigation efficiency to boost crop yields.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global Drip Irrigation Systems Market in 2024 is witnessing a surge in demand, driven by increased awareness of sustainable agricultural practices and the need for water conservation. Leading the charge are companies like Netafim Limited, Jain Irrigation Systems Ltd., and Rivulis Irrigation Ltd., each playing a pivotal role in the evolution and expansion of this market.

Netafim Limited continues to set industry standards with its highly efficient and innovative drip irrigation solutions. Their technology is focused on maximizing crop yield and water efficiency, making it a favorite among farmers dealing with water scarcity. Netafim's commitment to research and development has also led to the introduction of smart drip irrigation systems, integrating IoT technologies for real-time field management.

Jain Irrigation Systems Ltd., another key player, emphasizes not only on the efficiency of irrigation but also on the affordability and accessibility of their systems for small to large scale farms. Their comprehensive product portfolio and strong distribution network have facilitated their dominance in emerging markets, particularly in Asia and Africa.

Rivulis Irrigation Ltd. has made significant strides in modular drip irrigation technology, which allows for customization based on specific geographical and climatic conditions. This adaptability has enhanced their market reach and customer base globally.

Market Key Players

- Netafim Limited

- Jain Irrigation Systems Ltd.

- Rivulis Irrigation Ltd.

- Lindsay Corporation

- The Toro Company

- Eurodrip S.A.

- Driptech, Inc.

- EPC Industrie Limited

- Hunter Industries Incorporated

- Microjet Irrigation Systems

- Cantel Medical Corporation

- Baxter International Inc.

- Asahi Kasei Corporation

- Amifrox Medical, Inc.

- Nipro Corporation

- Amniox Medical, Inc.

- Pall Corporation

Recent Development

Report Scope

Report Features Description Market Value (2023) USD 7.2 Bn Forecast Revenue (2033) USD 17.1 Bn CAGR (2024-2033) 9.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Emitters, Pressure Gauge, Drip Tube, Valves, Filters, Fittings & Accessories), By Crop Type (Cereals & Pulses, Fruits & Vegetables, Oilseeds & Pulses, Turf & Ornamentals, Others Crops), By Application (Agriculture, Landscape, Greenhouse, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Netafim Limited, Jain Irrigation Systems Ltd., Rivulis Irrigation Ltd., Lindsay Corporation, The Toro Company, Eurodrip S.A., Driptech, Inc., EPC Industrie Limited, Hunter Industries Incorporated, Microjet Irrigation Systems, Cantel Medical Corporation, Baxter International Inc., Asahi Kasei Corporation, Amifrox Medical, Inc., Nipro Corporation, Amniox Medical, Inc., Pall Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Netafim Limited

- Jain Irrigation Systems Ltd.

- Rivulis Irrigation Ltd.

- Lindsay Corporation

- The Toro Company

- Eurodrip S.A.

- Driptech, Inc.

- EPC Industrie Limited

- Hunter Industries Incorporated

- Microjet Irrigation Systems

- Cantel Medical Corporation

- Baxter International Inc.

- Asahi Kasei Corporation

- Amifrox Medical, Inc.

- Nipro Corporation

- Amniox Medical, Inc.

- Pall Corporation