Global Dried Fruits Market By Product(Apricots, Dates, Raisins, Figs, Berries, Others), By Distribution Channel(Supermarkets & Hypermarkets, Convenience Stores, Online), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

49862

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

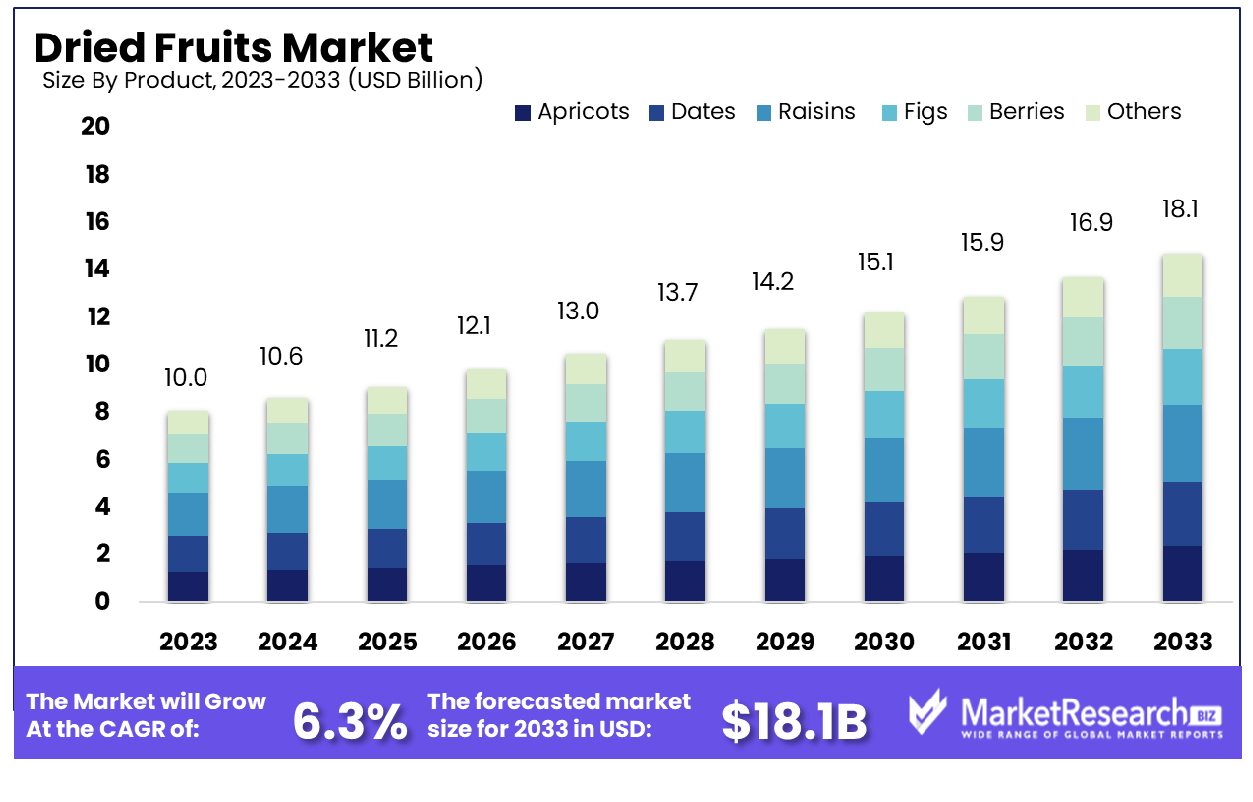

The Global Dried Fruits Market was valued at USD 10.0 billion in 2023. It is expected to reach USD 18.1 billion by 2033, with a CAGR of 6.3% during the forecast period from 2024 to 2033.

The Dried Fruits Market encompasses the global trade and distribution of dehydrated fruits, which have undergone moisture removal processes to extend shelf life and enhance flavor concentration. This market caters to a variety of sectors including retail, culinary, and nutraceuticals, offering products like raisins, dates, apricots, and berries.

The appeal of dried fruits lies in their convenience, nutritional benefits, and diverse applications in dietary supplements, snacks, and culinary ingredients. Strategic market players focus on innovative packaging, organic product offerings, and expanded distribution channels to capitalize on the growing health-conscious consumer base and emerging market economies.

The Dried Fruits Market presents a compelling opportunity within the global food industry, as consumer preferences shift towards healthier and more convenient dietary choices. Analysis indicates that dried fruit consumption correlates positively with improved dietary quality. For instance, data extracted from the National Health and Nutrition Examination Survey (2007-2016) reveal that individuals consuming dried fruits attain a mean Healthy Eating Index score of 60.6, substantially higher than the 52.6 scored by non-consumers. This underscores dried fruits' role in promoting better eating habits.

Furthermore, the consumption of dried fruits, though associated with an incremental daily caloric intake of approximately 208-215 kcal, presents significant health benefits. A pertinent study published in BMC Nutrition & Metabolism highlights a notable finding: a modest increase in dried fruit intake, about 1.3 pieces daily, can reduce the risk of type 2 diabetes by up to 60%. This statistic is particularly relevant for health-conscious consumers and underscores the potential of dried fruits as a strategic component in preventative health diets.

Key Takeaways

- Market Growth: The Global Dried Fruits Market was valued at USD 10.0 billion in 2023. It is expected to reach USD 18.1 billion by 2033, with a CAGR of 6.3% during the forecast period from 2024 to 2033.

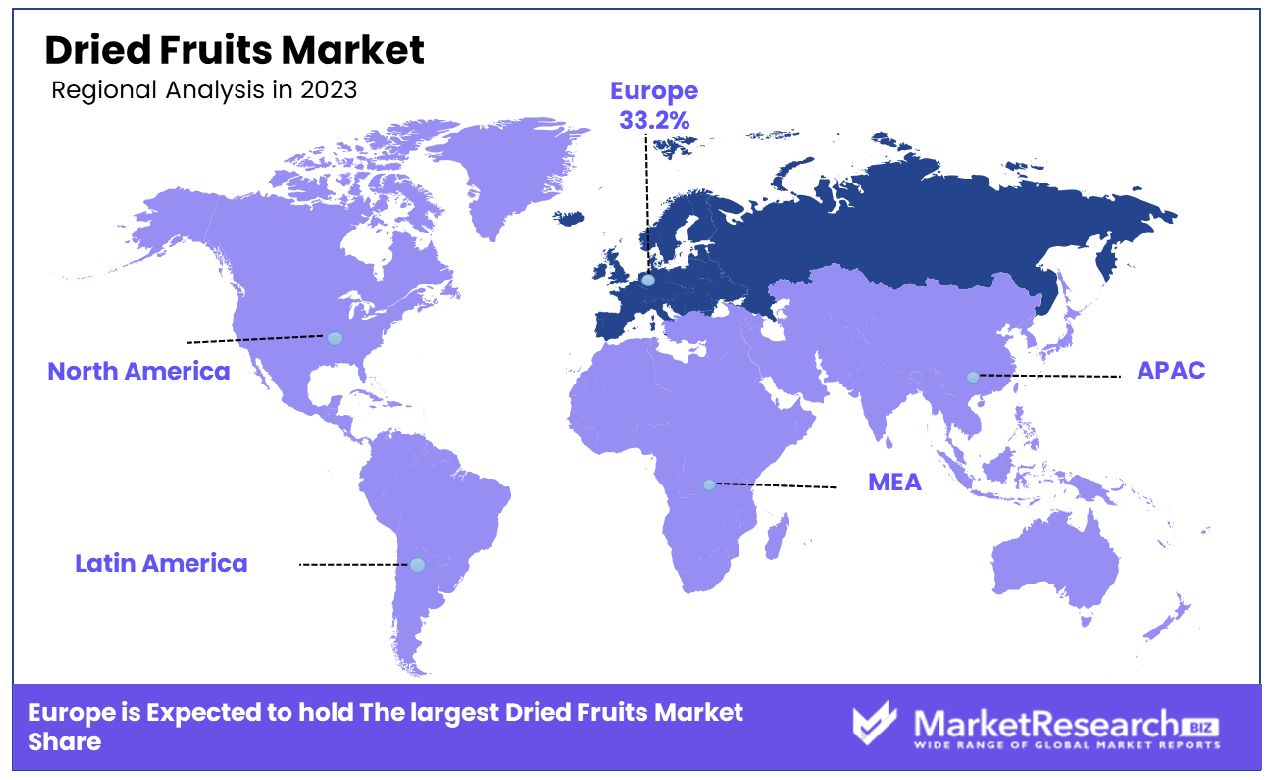

- Regional Dominance: Europe holds a 33.2% share in the global Dried Fruits Market, leading significantly.

- By Product: Raisins dominated the product segment with a 36.3% market share.

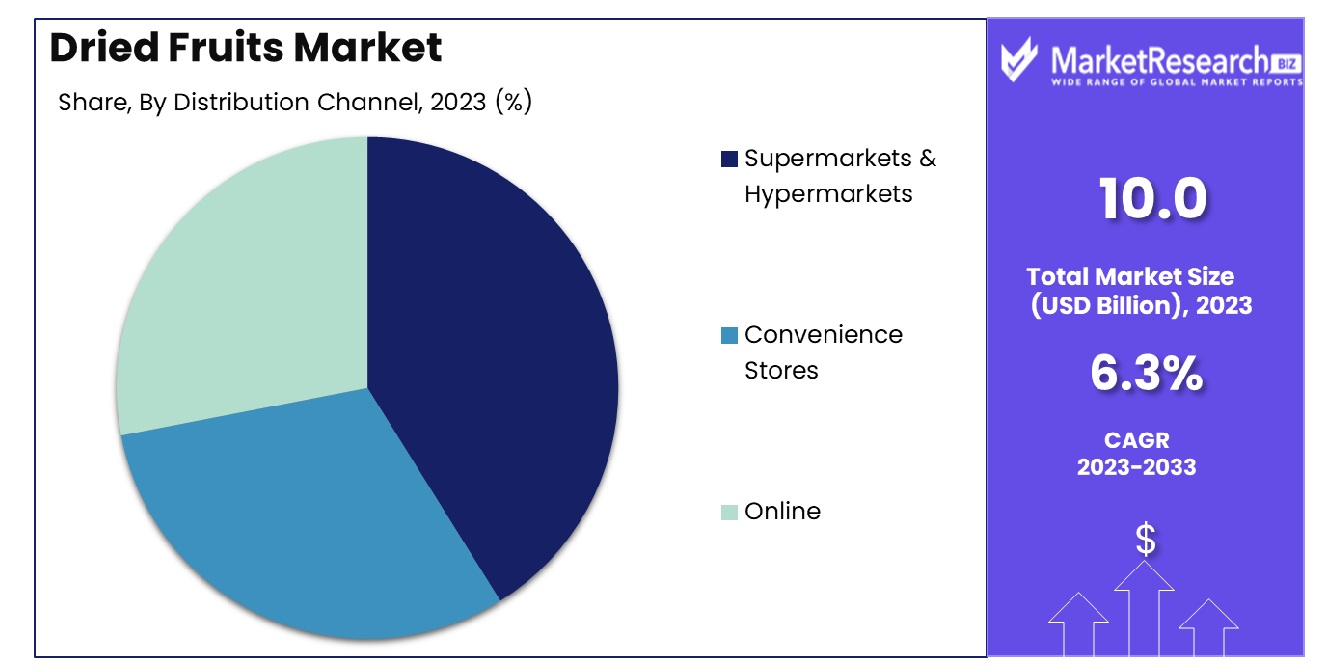

- By Distribution Channel: Supermarkets & hypermarkets led distribution channels, holding 52.3% of sales.

Driving factors

Enhanced Consumer Health Awareness Boosts Demand

The increasing consumer awareness about the health benefits associated with dried fruits is significantly driving market growth. Recent studies, such as those leveraging data from the National Health and Nutrition Examination Survey, reveal that dried fruit consumers typically achieve higher Healthy Eating Index scores compared to non-consumers (60.6 versus 52.6).

This association with improved dietary quality fuels consumer interest and demand, as more individuals seek nutritious food choices that support a healthy lifestyle. Enhanced awareness has positioned dried fruits not only as a standalone snack but also as a desirable component in health-oriented diets, influencing purchase behaviors across diverse demographics.

Snacking Trends Propel Market Expansion

Parallel to the health wave, the expansion of the snack food industry and the rising demand for convenient, yet healthy snack options, are pivotal in driving the dried fruits market. The evolving lifestyle of consumers, marked by busyness and a propensity for on-the-go eating, has elevated the demand for healthy snacks that offer both convenience and nutritional value.

Dried fruits, with their extended shelf life and portability, fit perfectly into this niche. Their natural sweetness and variety also make them an appealing choice for consumers looking to substitute traditional high-calorie snacks with healthier alternatives.

Culinary Applications Enrich Market Versatility

The expanding use of dried fruits in culinary applications further enriches their market appeal. From baking ingredients to components in gourmet dishes, dried fruits are increasingly favored for their ability to enhance flavor profiles with natural sweetness and texture.

Chefs and home cooks alike are integrating dried fruits into a variety of recipes, promoting their usage beyond traditional snacking. This versatility not only opens new market segments but also reinforces the position of dried fruits as a staple in modern, health-conscious kitchens.

Restraining Factors

Health Concerns Over Sugar Content Impede Market Growth

The high sugar content of certain dried fruits poses a significant restraint on the growth of the Dried Fruits Market. While dried fruits are praised for their health benefits, the concentration of natural sugars resulting from the dehydration process can lead to health concerns, particularly for consumers with diabetes or those monitoring calorie intake.

This factor can deter a segment of health-conscious consumers who prioritize low-sugar diets, thus limiting the potential consumer base. To mitigate this, market players may need to innovate in processing techniques that maintain the nutritional benefits of dried fruits while addressing concerns over high sugar levels.

Supply Chain Volatility Affects Market Stability

Fluctuations in the availability and price of fresh fruits for drying also play a crucial role in restraining the Dried Fruits Market. The quality and economic viability of producing dried fruits are directly tied to the supply of fresh fruits, which can be affected by factors such as climatic conditions, agricultural practices, and geopolitical issues. These fluctuations can lead to inconsistent product quality and pricing instability in the dried fruits market, challenging producers to maintain a steady supply chain and pricing strategy.

This volatility not only affects producers but also impacts retailers and consumers, potentially leading to reduced market growth during periods of supply shortage or significant price hikes. Integrating these supply chain challenges with consumer concerns over sugar content presents a complex landscape for market players, requiring strategic planning and adaptation to maintain and grow market share.

By Product Analysis

Raisins lead the Dried Fruits Market by product, holding a dominant share of 36.3%.

In 2023, Raisins held a dominant market position in the by-product segment of the Dried Fruits Market, capturing more than a 36.3% share. This prominence is closely followed by dates, which accounted for approximately 23.7% of the market. Apricots and figs also maintained significant shares, with 14.2% and 12.6% respectively, while berries and other dried fruits collectively accounted for the remaining 13.2%.

The market's affinity for raisins can be attributed to their widespread application in both culinary and commercial food production sectors, where they are prized for their natural sweetness and preservative-free attributes. This has bolstered their consumption globally, especially in regions with a strong tradition of dried fruit consumption such as North America and the Middle East.

Dates continue to see robust growth, driven by an increasing awareness of health benefits associated with their consumption, such as high fiber content and essential nutrients. This has been complemented by rising vegan and health-conscious populations who favor dates as a natural sweetener.

The apricot segment benefits from its versatility in various culinary applications, from baking to snacking, which has sustained its market presence. Meanwhile, the demand for figs has been buoyed by their growing inclusion in exotic and health-related food products, reflecting a broader consumer trend towards foods with perceived health benefits.

Berries, encompassing varieties such as cranberries and blueberries, have carved out a niche in the market through their use in dietary supplements and health foods, tapping into consumer demand for superfoods rich in antioxidants.

By Distribution Channel Analysis

Supermarkets & hypermarkets are the leading distribution channels, commanding a significant 52.3% market share.

In 2023, Supermarkets & Hypermarkets held a dominant market position in the By Distribution Channel segment of the Dried Fruits Market, capturing more than a 52.3% share. Convenience stores accounted for 29.5% of the market, while online sales channels made up the remaining 18.2%.

The substantial market share held by supermarkets and hypermarkets can be largely attributed to their ability to offer a wide variety of dried fruits under one roof, coupled with the benefit of immediate product accessibility. These outlets benefit from high foot traffic and the consumer preference for tactile, see-before-you-buy shopping experiences, which are crucial for food products.

Convenience stores have also capitalized on the growing demand for on-the-go eating options. Their strategic locations, extended hours, and rapid transaction capabilities cater effectively to busy consumers who seek quick and easy snack solutions, thereby driving the segment’s growth.

Meanwhile, the online segment has shown significant growth, driven by the shift in consumer purchasing behaviors towards digital platforms. This channel's expansion is bolstered by the convenience of home deliveries and the availability of diverse product options, often including premium and organic products not available in traditional outlets. Additionally, online platforms offer the advantage of customer reviews and competitive pricing, enhancing their appeal.

Key Market Segments

By Product

- Apricots

- Dates

- Raisins

- Figs

- Berries

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

Growth Opportunity

Technological Advancements Propel Nutritional and Flavor Enhancements

In 2023, the Dried Fruits Market is set to benefit significantly from innovations in drying technologies that aim to better preserve nutrients and enhance the natural flavors of the fruits. Modern drying techniques, such as freeze-drying and vacuum drying, are increasingly adopted by manufacturers to maintain a higher content of vitamins and antioxidants in dried fruits compared to traditional methods.

These technological advancements not only improve product quality but also appeal to health-conscious consumers who prioritize nutritional value in their snacking choices. By retaining more nutrients and improving taste, these innovations are likely to drive consumer preference and expand market share, positioning dried fruits as both a healthy and flavorful option in the global snack food arena.

Strategic Market Expansion and Targeted Marketing Drive Growth

Furthermore, 2023 presents ample opportunities for market growth through strategic expansions into new geographical markets and targeted marketing campaigns. By focusing on health-conscious consumers, especially in emerging economies where awareness of nutritional food choices is increasing, companies can tap into new consumer segments. Tailored marketing strategies that highlight the health benefits of dried fruits, such as low-fat content and high fiber, alongside their role in preventing various health conditions, can effectively attract a broader audience.

Moreover, leveraging digital marketing and social media platforms to reach these target demographics can enhance consumer engagement and drive sales, particularly among younger populations who value both convenience and health in their dietary choices. These strategic initiatives are crucial for capturing new markets and sustaining long-term growth in the global Dried Fruits Market.

Latest Trends

Organic and Natural Processing Trends Enhance Market Appeal

In 2023, the global Dried Fruits Market is witnessing a significant shift towards the consumption of organic and naturally processed products. This trend is fueled by growing consumer awareness of the health and environmental benefits associated with organic farming and natural processing methods. Organic dried fruits, free from synthetic pesticides and fertilizers, are gaining traction among health-conscious consumers who are increasingly mindful of the ecological footprint of their food choices.

The demand for these products is not only driving premium pricing in the market but also compelling manufacturers to obtain organic certifications and adopt more sustainable agricultural practices. This shift towards organic and natural products is reshaping consumer preferences and is expected to stimulate market growth by aligning with the broader trend of clean eating.

Functional Foods and Dietary Supplements Market Integration

Another prominent trend in 2023 is the incorporation of dried fruits into functional foods and dietary supplements. As consumers increasingly look for food products that offer specific health benefits beyond basic nutrition, dried fruits are being recognized for their potential to enhance health outcomes. Rich in vitamins, minerals, and antioxidants, dried fruits are being integrated into various functional foods aimed at improving digestive health, boosting immune function, and reducing the risk of chronic diseases.

Additionally, the use of dried fruits in dietary supplements is expanding, as they provide a concentrated source of nutrients in a convenient form. This integration not only broadens the application spectrum of dried fruits but also opens new avenues for market expansion, catering to the burgeoning sector of health-oriented food products.

Regional Analysis

Europe holds a commanding 33.2% share of the global Dried Fruits Market, driven by robust consumer health awareness.

In the global landscape of the Dried Fruits Market, regional dynamics display varied growth patterns and consumer preferences that influence market behavior. Europe stands as the dominant region, accounting for 33.2% of the market share. The European market benefits from high consumer awareness about dietary health and a robust demand for organic and naturally processed foods. European consumers' preference for nutritious snack alternatives, coupled with strong regulatory support for food safety and organic farming, drives substantial market growth in this region.

North America also represents a significant portion of the dried fruits market, characterized by a surge in demand for convenient, health-oriented foods. The market here is propelled by the trend towards functional foods and a growing preference for snacks that offer health benefits beyond basic nutrition, such as enhanced immunity and improved digestive health.

In Asia Pacific, the market is expanding rapidly due to increasing urbanization and the rising affluence of the middle class. Consumers in this region are becoming more health-conscious and are incorporating dried fruits into their diets as a source of essential nutrients. The region's vast agricultural sector supports local availability, making dried fruits an affordable and popular choice.

The Middle East & Africa, and Latin America are emerging markets with potential for growth. These regions experience increasing demand driven by rising health awareness and changes in dietary patterns. Local tastes and the traditional use of dried fruits in regional cuisines also play a significant role in expanding the market footprint in these areas.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the landscape of the global Dried Fruits Market is significantly shaped by the strategic movements and innovations of key players. Among them, companies like Kiantama Oy and Paradise Fruits are distinguishing themselves in the European market by focusing on organic and sustainably sourced products, aligning with the region’s stringent quality and environmental standards.

In the United States, industry stalwarts such as National Raisin Company, Traina Foods, and Dole Food Company Inc. continue to lead with their expansive product ranges and robust distribution networks. These companies capitalize on advanced drying technologies that preserve nutritional value and enhance flavor, catering to the health-conscious American consumer. Their commitment to quality and innovation helps them maintain a competitive edge in a crowded market.

Sun-Maid Growers of California, known for their iconic raisins, are leveraging their brand reputation to expand into new varieties and product offerings, thus broadening their market appeal. Similarly, Lion Raisins Inc., Red River Foods Incorporated, and Bergin Fruit and Nut Company Inc. are exploring new market segments by integrating dried fruits into functional foods and dietary supplements, tapping into the growing trend towards health and wellness.

In Australia, Sunbeam Foods Pty Ltd is capitalizing on the Asia-Pacific region’s burgeoning demand for healthy snack options by exporting premium quality dried fruits that meet the high safety and quality standards expected by consumers in this region.

Market Key Players

- Kiantama Oy (Finland)

- National Raisin Company (US)

- Traina Foods (US)

- Red River Foods Incorporated (US)

- Dole Food Company Inc (US)

- Sunbeam Foods Pty Ltd (Australia)

- Lion Raisins Inc (US)

- Sun-Maid Growers of California (US)

- Bergin Fruit and Nut Company Inc. (US)

- Paradise Fruits (Germany)

Recent Development

- In June 2024, Kiantama Oy launched a new product line of organic dried blueberries. This launch aims to cater to the increasing consumer demand for organic and healthy snack options, projecting a 25% increase in their organic product sales by the end of 2025.

- In April 2024, Red River Foods Incorporated secured a $20 million investment in April 2024 to expand their international distribution network. This investment will facilitate the export of their dried fruits to new markets in Europe and Asia, aiming to boost their global market presence by 20% over the next three years.

- In March 2024, Traina Foods introduced a new packaging design that extends the shelf life of its dried fruits by 30%. This innovation is part of their commitment to reducing food waste and providing fresher products to their customers.

Report Scope

Report Features Description Market Value (2023) USD 10.0 Billion Forecast Revenue (2033) USD 18.1 Billion CAGR (2024-2032) 6.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Apricots, Dates, Raisins, Figs, Berries, Others), By Distribution Channel(Supermarkets & Hypermarkets, Convenience Stores, Online) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Kiantama Oy (Finland), National Raisin Company (US), Traina Foods (US), Red River Foods Incorporated (US), Dole Food Company Inc (US), Sunbeam Foods Pty Ltd (Australia), Lion Raisins Inc (US), Sun-Maid Growers of California (US), Bergin Fruit and Nut Company Inc. (US), Paradise Fruits (Germany) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Kiantama Oy (Finland)

- National Raisin Company (US)

- Traina Foods (US)

- Red River Foods Incorporated (US)

- Dole Food Company Inc (US)

- Sunbeam Foods Pty Ltd (Australia)

- Lion Raisins Inc (US)

- Sun-Maid Growers of California (US)

- Bergin Fruit and Nut Company Inc. (US)

- Paradise Fruits (Germany)