DRAM Market By Type (Synchronous DRAM, BEDO (Burst Extended Data Output), EDO (Extended Data Output), Asynchronous DRAM, and FPM (Fast Page Mode)), By Technology (DDR4, DDR3, DDR5/GDDR5, and DDR2), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

-

40226

-

July 2023

-

137

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

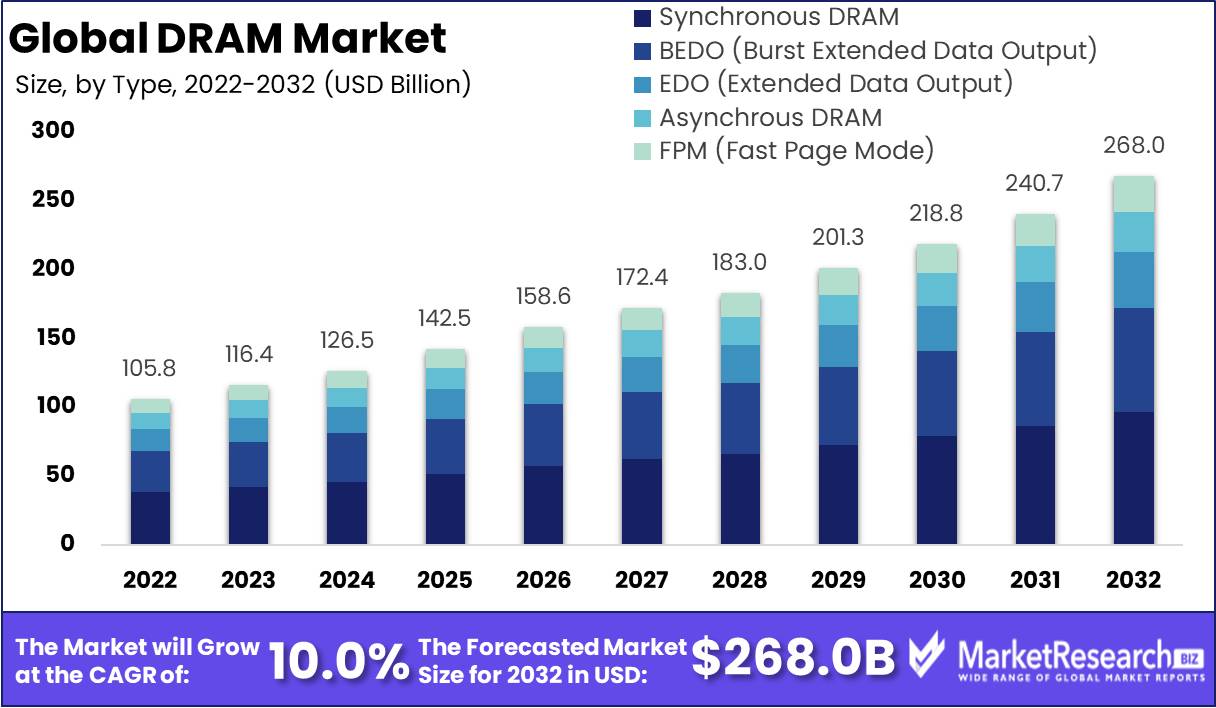

DRAM Market size is expected to be worth around USD 268.0 Bn by 2032 from USD 105.8 Bn in 2022, growing at a CAGR of 10.0% during the forecast period from 2023 to 2032.

The DRAM is a type of dynamic random-access memory that stores data in every bit arrangement on an individual capacitor. Static RAM (SRAM) includes stored data that remains secured using static memory. A DRAM can store more data as compared to an SRAM chip of the same size. DRAM stores the data effectively because it expects less physical space to store equal data compared to statically stored. The DRAM can be considered as external data output (EDO), asynchronous DRAM, synchronous DRAM (SDRAM), fast page mode (FPM), and burst extended data output (BEDO).

Driving factors

Growing Intrest in Cloud Computing and High-Speed Communication

The rising demand for DRAM, principally in data center infrastructures, is anticipated to cause rising interest in cloud computing and the need for high-speed communication. Dynamic Random Access Memory is a high-density, less-power memory technology that manages cloud services' coolings, high-speed data transfers, and backup needs. In addition, growing smartphone, laptop/PC, tablet, digital camera, and other device sellings are anticipated to support the DRAM market. The revenue share of the DRAM market is also rising as a result of the growing demand for processing technologies with more processing capability and decreasing power consumption.

Restraining Factors

High Cost Can be a Restrain for the DRAM Market

The constant market growth is restrained by the high cost of Dynamic Random Access Memory chips, which have a harmful effect on DRAM sales and usage during the forecast period. Due to more individuals working from home caused by the COVID-19 pandemic, manufacturers are concentrating on improving manufacturing abilities to fulfill with demand for mobile PCs. Dynamic Random Access Memory consumes more power than Static Random Access Memory due to its capacitors requiring to be recharged frequently to maintain their charge. Extensive power consumption is a major element that is anticipated to present substantial obstacles to the growth of the Dynamic Random Access Memory market.

Type Analysis

The synchronous DRAM dominated the type segment of the global DRAM market.

Based on type, the market for Dynamic RAM (DRAM) is segmented into, Synchronous DRAM, Asynchronous DRAM, FPM (Fast Page Mode), and BEDO (Burst Extended Data Output). The memory whose workings are simultaneous with the microprocessor’s clock speed is recognized as Synchronous DRAM (SDRAM). The Synchronous DRAM is projected to witness significant growth during the forecast period. SDRAMs speed is calculated in MHz and needs continuous refreshes to maintain the data. Synchronous DRAM utilizes an externally supplied clock signal to coordinate the control of its external pin supply. Synchronous DRAM is faster and operates more efficiently than Asynchronous DRAM.

Technology Analysis

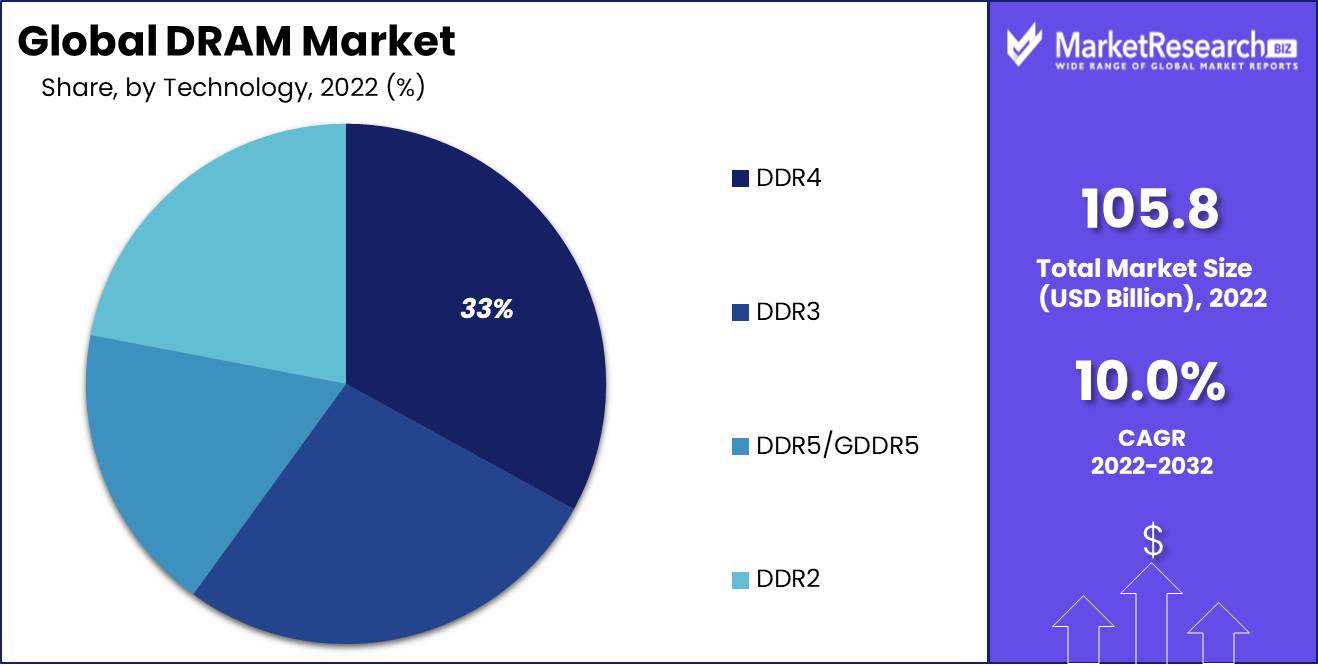

DDR4 technology conquered the technological segment of the DRAM market

Based on technologies, the DRAM market is segregated into DDR3, DDR4, DDR5/GDDR5, and DDR2. DDR4 is expected to record the largest share of the global Dynamic RAM (DRAM) market. DDR4 was initially launched in 2014 with the fluctuating bus clock speed from 800 to 1600 MHz. Its storage capacity ranges from 4 to 128 GB per DIMM. DDR4 advances a broader range of timings and clock rates, uses less power, and has lower downtime overall than DDR3 segments, which is one of the major advantages. The DDR4 advances long-term system strength since it processes more data concurrently than former RAM alternatives. It is also a secure alternative for overclocking experiments because it deals with more data without becoming overburdened. At last, it releases the burden on the entire computer system.

DDR4 effectively works on 1.2 V, whereas DDR3 controls in the wide range of 1.5 to 1.65 V. DDR4 memory segments are available in DIMM and SO-DIMM. SO-DIMM is created for all-in-one desktop computers and laptops. DDR4 DIMMs are invented with curved edge technology, which helps to make it easier to remove and put them from the slots. DDR4 memory aids data transfer speeds fluctuating from 1600 Mbps to 3200 Mbps.

Application Analysis

The PC and laptops segment is anticipated to record the maximum CAGR over the forecast period.

Based on application, the DRAM market is separated into PC/Laptops, Mobile Phones, Gaming Consoles, and Networking Devices. The PC and laptops segment is anticipated to record the maximum CAGR over the forecast period. The major advantage of a laptop as compared to a desktop computer is its lightness. The laptop's internal battery, small size, and light weight make it easy to move from one place to another. Multiple versions are normally used in public venues, such as cafes, parks, or being transported in vehicles. The laptop may be used efficiently without other accessories. Everything is built-in technology, including speakers, a built-in mouse, a touchpad, a keyboard, a camera, and a microphone in multiple laptops.

DDR3, DDR4, and DDR5 memories have exchanged DDR2 in PCs and laptops. These memory chips are used in PCs and laptops to run applications and operating systems smoothly and quickly. DDR4 and DDR3 are the most popular and high-end DRAMs crucial for image editing, HD video editing, graphic designs, gaming, multitasking & manipulating, and processing enormous amounts of data. The implementation of DDR5 DRAM is still in progress for PC and laptop applications. DDR5 DRAM is anticipated to dominate the DRAM market during the forecast period. PCs/Laptops will consume less power that can extend the battery life with the help of DDR5 DRAM.

Key Market Segments

Based on Type

- Synchronous DRAM

- BEDO (Burst Extended Data Output)

- EDO (Extended Data Output)

- Asynchronous DRAM

- FPM (Fast Page Mode)

Based on Technology

- DDR4

- DDR3

- DDR5/GDDR5

- DDR2

Based on Application

- PC/Laptops

- Mobile Phones

- Gaming Consoles

- Networking Devices

Growth Opportunity

Introduction of 5G Processors, Which Power New Smartphones, Increases Sales

The DRAM market is anticipating the launch of 5G processors, which will be able to power new smartphones, increasing sales of mobile application microprocessors. The mass 5G processors are built using cutting-edge, more costly 5nm process technology. Dynamic Random Access Memory sales grow extensively compared to other communications-related IC product sectors, consequently due to the sophisticated and rapid 5G smartphone market growth.

Dynamic Random Access Memory has been the dominating revenue-generating IC sector, and it is estimated that it will remain dominant in the IC industry during the forecast period. Computer systems underwent modifications as consumers and businesses shifted to work-from-home-based online activities. In addition, a surge in the shipment of servers for data centers that process and store data will benefit sales of DRAM. The rise in smartphone application microprocessor sales in the forecast period has been mostly recognized as the sale of more costly 5G chipset processors in the forecast period.

Latest Trends

The rising number of social media networking platforms, IoT devices, and other devices has caused the generation of large volumes of data that have led to an increase in the launch of various data center facilities across the globe. In addition, the rising requirement for cloud computing has grown the data centers' economic impact and overall size. In North America, investments in data center construction involve some of the key service providers, namely Amazon, Google, Facebook, and Microsoft.

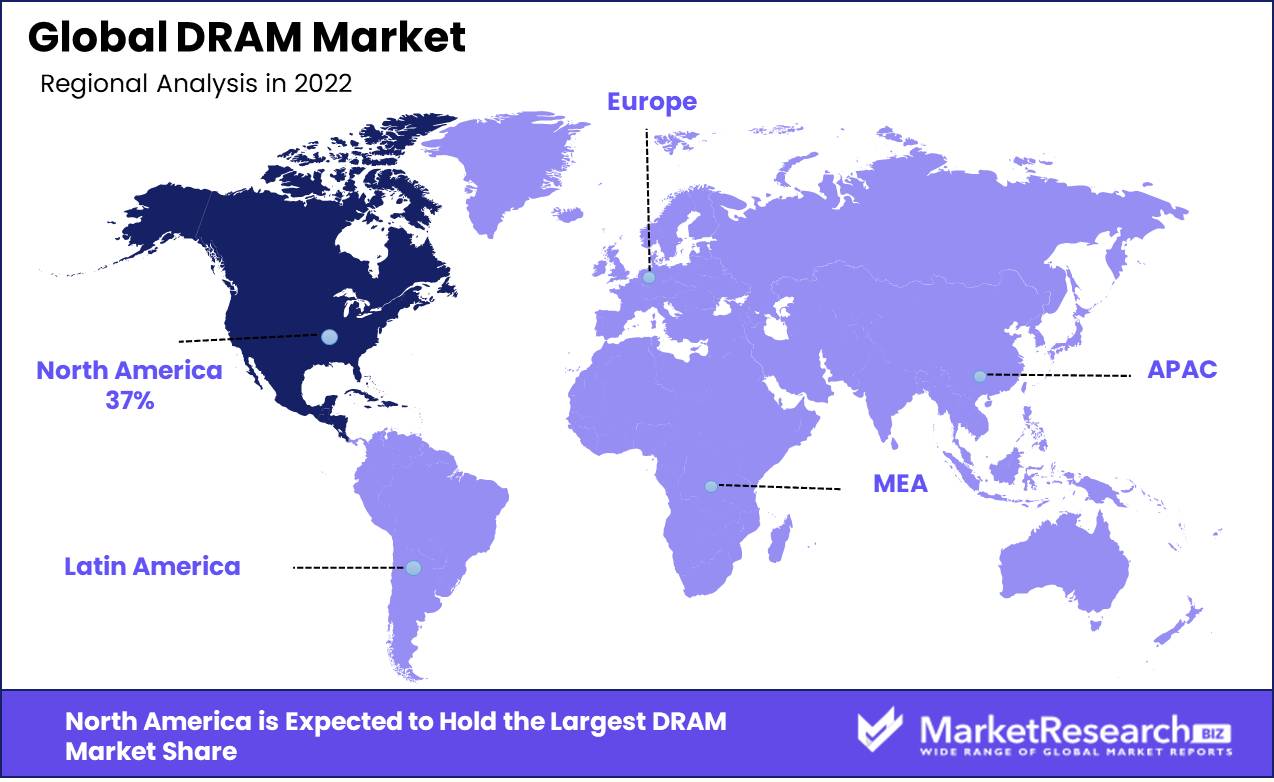

Regional Analysis

Based on the region, the market in North America holds the major DRAM market share of 37% and the largest growth rate and is anticipated to maintain its position in the forecast period. Green energy is growing in residential, industrial, and consumer verticals in North America. After building and home automation, transportation and industrial are the key applications using energy harvesting systems.

The market size of Asia Pacific is estimated to dominate the market in the projected period due to the rapid industrialization in countries such as China and India. Energy harvesting is reliant on the rapidly increasing renovation and industrialization growing in the Asia Pacific region. Major players are also moving their production facilities to Asia Pacific. This region is expected to dominate the DRAM market during the forecast period due to the quick increase tech-savvy population and population in general.

The market of North America is expected to grow rapidly in the forecast period due to the early acceptance of technological advancements. North America has a huge consumer base for applications that are dependent on harvested energy. The energy harvesting market is expected to record a significant CAGR in the anticipated period due to the previously established large energy market.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The DRAM market shows an oligopolistic expenditure, with some suppliers and a high level of price competition. Multiple key market players are competing to get a competitive advantage by leveraging innovative processing technology to decrease unit costs. For instance, Samsung Electronics inaugurated mass production of DRAM in March 2014 by using the 20nm process technology. Such technology allows the company to produce DDR3 memory at better energy efficiency and cheap manufacturing costs.

Top Key Players in DRAM Market

- ABB Ltd

- Fujitsu

- Cypress Semiconductor Corp.

- Green Peak Technologies

- Honeywell International Inc.

- Levant Power Corporation

- Marlow Industries

- Microcheap Technology Inc.

- G24 Innopvations Ltd.

- SolarEdge Technologies Inc.

- Micron Technology Inc.

- Other Key Players

Recent Development

- In February 2023, A team of 100 engineers, with an average age of 28 to 30 years, developed a chip – a 12GB LPDDR4 (low power double data rate) DRAM – that can operate at a bandwidth of 4266 Mbps with 1.1v input supply. Micron says this chip will be the primary choice for automotive applications globally through 2030.

- In December 2022, Samsung Electronics announced the development of the industry’s first DDR5 RAM based on the 12nm-class process technology. The company confirmed that the compatibility evaluation with AMD on its ‘Zen’ products have also been completed.

Report Scope:

Report Features Description Market Value (2022) USD 105.8 Bn Forecast Revenue (2032) USD 268.0 Bn CAGR (2023-2032) 10.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Synchronous DRAM, BEDO (Burst Extended Data Output), EDO (Extended Data Output), Asynchronous DRAM, and FPM (Fast Page Mode); By Technology- DDR4, DDR3, DDR5/GDDR5, and DDR2; By Application- PC/Laptops, Mobile Phones, Gaming Consoles, and Networking Devices Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ABB Ltd, Fujitsu, Cypress Semiconductor Corp., Green Peak Technologies, Honeywell International Inc., Levant Power Corporation, Marlow Industries, Microcheap Technology Inc., G24 Innovations Ltd., SolarEdge Technologies Inc., Micron Technology Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- ABB Ltd

- Fujitsu

- Cypress Semiconductor Corp.

- Green Peak Technologies

- Honeywell International Inc.

- Levant Power Corporation

- Marlow Industries

- Microcheap Technology Inc.

- G24 Innopvations Ltd.

- SolarEdge Technologies Inc.

- Micron Technology Inc.

- Other Key Players