Digestive Health Products Market Research Report By Product (Prebiotics, Probiotics, Multi-Vitamins, Lactase Nutritional Supplements, Digestive Nutritional Supplements), By Delivery Format (Capsules, Tablets, Chewable, Drops, Caplets, Sticks), By Application (Functional Foods, Functional Beverages, Breakfast Cereals, Supplements), By Distribution Channel (Supermarkets & Hypermarkets, Pharmacy Stores, E-commerce, and Others) and By Region Global Market Analysis and Forecast, 2023-2032

-

9082

-

May 2023

-

174

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

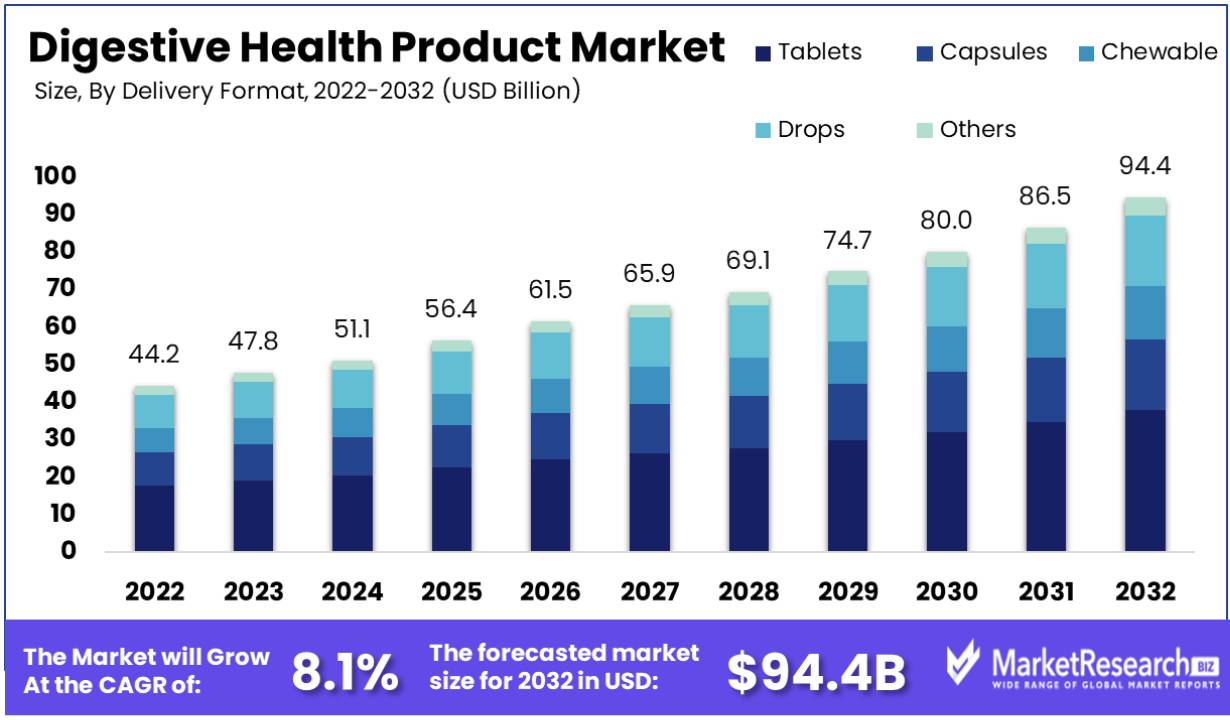

Marketresearch.biz reports that the global digestive health products market was valued at USD 44.2 billion in 2022. It is projected to reach approximately USD 94.4 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.1% from 2023 to 2032.

The market for digestive health products is being driven by various factors. One key driver is the fact that these products are effective in treating gastrointestinal issues without causing any negative side effects. This has led to a growing popularity of digestive health products, as consumers are increasingly seeking safe and affordable solutions for their digestive health needs.

Additionally, the increased utilization of these products in the field of medicine and for the management of specific medical conditions is also contributing to the growth of the market. These are just a few examples of the market drivers fuelling the expansion of the digestive health products market.

The market for digestive health products is expected to experience significant growth over the forecast period. This can be attributed to multiple factors. Firstly, the inclusion of digestive ingredients like probiotics in popular products such as fish oil and yogurt has contributed to reducing the risk of gut health issues. This trend is expected to drive the expansion of the market.

The digestive health products market appears poised for strong growth in the coming years driven by rising consumer awareness and demand. As highlighted by recent surveys and campaigns, digestive issues are incredibly common, affecting nearly 40% of Americans to the point of disrupting daily living according to the American Gastroenterological Association (AGA).

Additionally, the Centers for Disease Control and Prevention (CDC) reports that the number of adults with diagnosed ulcers in the U.S. is 14.8 million, which represents 5.9% of adults.

In light of these statistics, efforts are being made to encourage more transparent dialogue around digestive health, such as the AGA's "Trust Your Gut" initiative. By reducing the stigma, more consumers may be inclined to seek information and solutions for their digestive troubles.

This is likely to spur further growth for the broader consumer health market, especially probiotics, digestive enzymes, herbal supplements, and other products targeting improved gastrointestinal function. Brands and manufacturers stand to benefit, as they can position their offerings as trusted and effective aids for the millions struggling with disruptive bowel symptoms.

The presence of various enzymes in digestive health products, such as lipase, amylases, and lactase, plays a crucial role in improving digestion and maintaining stomach acid levels. This has led to an increased demand for nutritional food additives and supplements, further fuelling market growth.

The dairy industry is also expected to contribute to the market growth, as digestive health products are increasingly used in various dairy products. The use of probiotics and food enzymes in infant formula and the growing health concerns among adults are driving the demand for digestive health products in this industry.

Despite the initial impact of the COVID-19 pandemic on global industrial production, digestive health products have gained popularity due to their perceived benefits for gut health and immunity. This has led to an increased demand for supplements and dairy products, further bolstering the market growth.

Growth Drivers

Customer education and awareness regarding diet and health play a crucial role in driving the demand for digestive products, leading to an expansion of market share. Additionally, this creates opportunities for key market players to invest in research and development (R&D) initiatives. By doing so, these players can introduce new and profitable ideas to further enhance the market and promote overall growth.

The holistic approach to health has gained significant popularity in Western countries, with a specific focus on gut health. Due to the rising prevalence of obesity and diseases associated with unhealthy eating habits, such as the consumption of ready-to-eat food, the United States is witnessing a continuous surge in the demand for digestive health products.

Restraining Factors

In the digestive health market, the manufacturing of products is subject to stringent rules and regulations, particularly when it comes to the development of new probiotics. The introduction of new products is often hindered by the strict regulations imposed by manufacturers of vitamins and supplements.

In 1994, the Dietary Supplements Health and Education Act was implemented, which mandates manufacturers to ensure the safety of their products. All claims made about these products must align with published information. This means that manufacturers must adhere to strict guidelines and regulations to produce and distribute dietary supplements that are deemed safe for consumption.

Market Key Segments

By Product

- The dairy products segment held the highest revenue share of approximately 74% in 2022 due to the increasing consumer interest in preventive healthcare and the development of efficient probiotic strains for dairy products.

- Functional beverages like relaxation drinks, sports drinks, and kombucha have gained popularity, leading to an increased incorporation of prebiotics and probiotics in non-alcoholic beverages.

- Unhealthy food habits and sedentary lifestyles have contributed to the demand for digestive dairy products as consumers seek to improve their health and well-being.

- Manufacturers are introducing innovative products with digestive health benefits, such as Biocatalysts Ltd.'s enzyme Lipomod 4MDP, which enhances flavor profiles in dairy products.

- The supplement segment is expected to grow steadily due to the positive outlook towards nutrition and health, driven by awareness about the benefits of an active lifestyle and nutritional supplements.

- The aging population and concerns about gut health are driving increased demand for digestive health products.

- Consumer spending on products that improve intestinal health is projected to further drive demand for digestive health products.

By Delivery Format

- Capsules were the dominant delivery format in the digestive health market in 2022, capturing approximately 40% of the total market revenue.

- The hectic lifestyle of consumers has led to unhealthy food habits, with a higher consumption of fast foods.

- Due to the lack of necessary nutrients in their diets, consumers are opting for digestive health capsules to fulfill their fiber requirements.

- The preference for digestive health capsules as a convenient and efficient way to support digestive health is a significant driver for the growth of this segment.

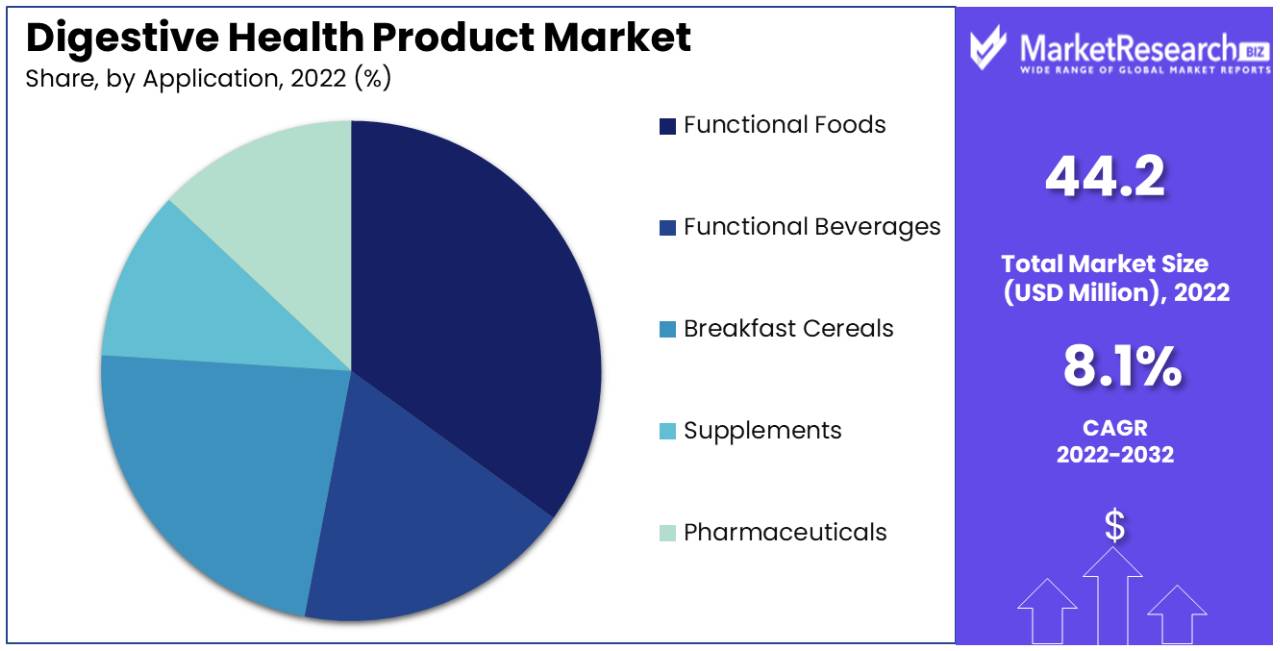

By Application

- The Digestive Health Products market is segmented based on application, including functional foods, functional beverages, breakfast cereals, supplements, and pharmaceuticals.

- In 2022, the functional beverages segment held the largest share of the digestive health products market.

- The growing consumer preference for preventive healthcare and the development of effective probiotic strains for dairy products are driving market growth.

- Functional beverages like kombucha, sports drinks, and relaxation drinks have gained significant popularity due to their unique flavors and health benefits.

- The increasing demand for functional beverages is expected to drive the incorporation of functional ingredients like prebiotics and probiotics in non-alcoholic drinks, further fuelling market expansion.

By Distribution Channel

- In 2022, pharmacy stores had the largest market share of around 63% in terms of revenue in the digestive health products market. The dominance of pharmacy stores is attributed to the high demand for capsules and tablets of digestive health products.

- The sedentary lifestyle of consumers has driven the growth of this segment, as people look for convenient ways to fulfill their nutritional and fiber needs. The lack of time for maintaining a proper diet has led consumers to opt for the fastest and most convenient option, which is often in the form of tablets and capsules.

- The easy availability of digestive health capsules in pharmacy stores has contributed to the growth of this distribution channel segment.

Key Market Segments

By Product

- Dairy Products

- Cereals

- Non-Alcoholic Beverages

- Probiotics

- Multi-Vitamins

- Lactase Nutritional Supplements

- Digestive Nutritional Supplements

- Others

By Delivery Format

- Tablets

- Capsules

- Chewable

- Drops

- Others

By Application

- Functional Foods

- Functional Beverages

- Breakfast Cereals

- Supplements

- Pharmaceuticals

By Distribution Channel

- Supermarkets & Hypermarkets

- Pharmacy Stores

- E-commerce

- Others

Opportunities

The aging population is experiencing an increase in digestive health issues, leading to greater awareness and concern for gut health. With over 40% of the population affected by gastrointestinal disorders, there is a growing demand for safe and effective digestive products. Food enzymes like lipase (lactase) and amylases play a vital role in improving digestion and maintaining proper acidity levels in these products.

The demand for food additives and supplements is also rising, and advancements in technology are driving innovation and development in the market. This presents promising opportunities for market players in the forecast period of 2023 to 2032.

Latest Trends

- Microbiome-targeted Products: There is a growing focus on developing digestive health products that specifically target and support a healthy gut microbiome. These products aim to balance and optimize the microbial composition in the digestive system for improved overall health.

- Growing Demand and Wellness Focus: The demand for digestive health products is on the rise, driven by increasing awareness of gut health issues and a focus on overall wellness. Consumers are prioritizing conditions such as joint health, mental health, eye health, and metabolic health, leading to the development of products that cater to these specific needs.

- Personalized Nutrition: With advancements in technology, there is a rise in personalized nutrition solutions for digestive health. Companies are leveraging data and analytics to provide tailored recommendations and customized products based on an individual's unique digestive needs.

- Functional Foods and Beverages: The market is witnessing an increase in the development of functional foods and beverages that promote digestive health. These products are fortified with specific ingredients such as probiotics, prebiotics, fiber, and digestive enzymes to support optimal gut function and overall digestive well-being.

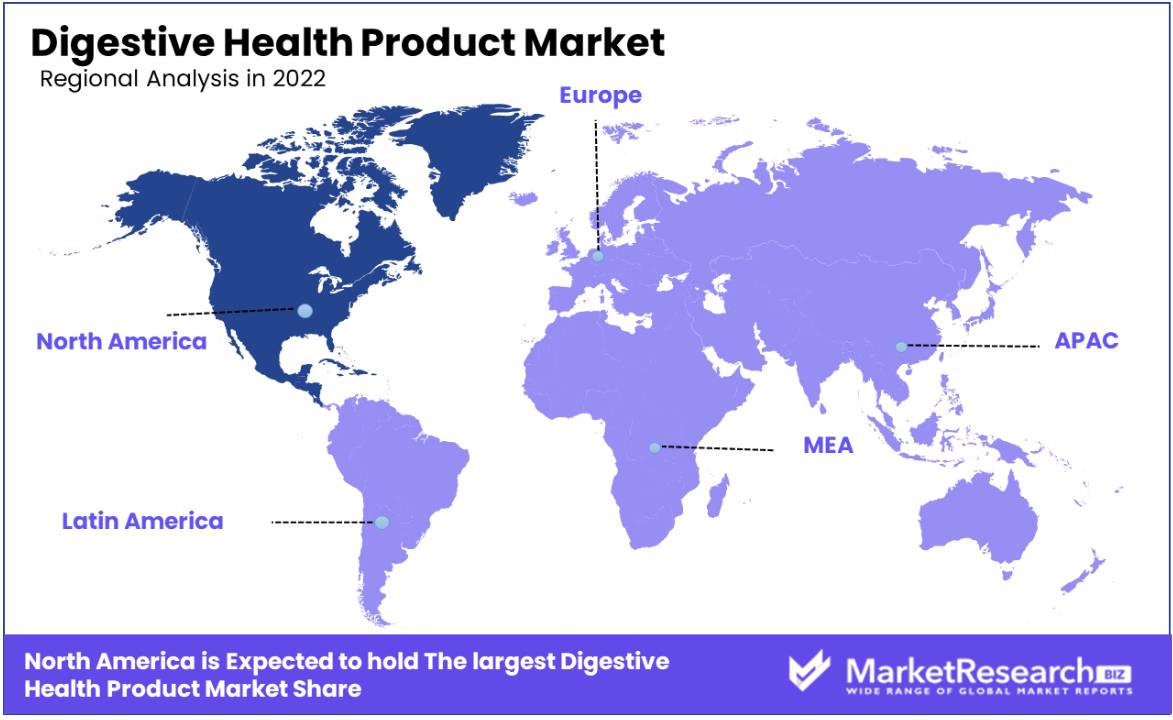

Regional Analysis

North America held the largest market share of 33.5% in the digestive health products market in 2022. This can be attributed to the presence of numerous digestive health product producers and increased consumer awareness about the availability of a wide range of digestive health products. Additionally, advancements in technology, product innovations, and efficient doorstep delivery have further contributed to the growth of the market in North America.

On the other hand, the Asia Pacific region is expected to experience the fastest growth in the digestive health products market in the coming years. This growth is driven by the increasing adoption of various health products by producers in major economies such as China, Japan, and India. Furthermore, the region benefits from a large consumer base, rising disposable income, rapid urbanization, and a growing working population, all of which contribute to the expansion of the market in Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Market Share and Key Players Analysis

The global market for digestive health products is expected to become highly competitive as numerous companies vie for market share. Key players in the industry are particularly focused on capturing the Southeast Asian market, which offers a target consumer base. To meet the growing demand for digestive health products across various application industries, manufacturers are expanding their production capacities and investing in research and development. They are also launching new products to cater to changing consumer preferences.

For example, in March 2023, BASF and Cargill (Provimi) strengthened their existing partnership by expanding their agreement for developing and distributing feed enzymes in South Korea. By leveraging BASF's expertise in enzyme research and development and Cargill's application knowledge and extensive market coverage, the two companies aim to establish a collaborative innovation pipeline for animal protein producers in South Korea. This initiative reflects the industry's commitment to meeting the evolving needs of consumers and staying competitive in the market.

Top Key Players in the Digestive Health Product Market

- BASF SE

- Hansen Holding A/S

- Nestle SA

- International Flavors & Fragrances Inc.

- DuPont de Nemours, Inc.

- Bayer AG

- Danone

- Arla Foods Inc.

- Sanofi

- Cargill, Inc.

- PepsiCo, Inc.

- Yakult Honsha Co.

- AST Enzymes

Recent Development

- In February 2022, Organic India launched a line of daily pack supplements that are designed to be portable and contain whole herb formulas. These supplements are specifically formulated to target issues such as stress and mood swings, immunity, as well as cognitive and digestive health problems.

- In 2022, the European Commission and EPA jointly introduced a new regulation aimed at promoting the consumption of natural-derived materials to combat the rising levels of greenhouse gas emissions. This regulation has had a direct impact on the food and beverage industry, as companies in this sector are actively seeking to incorporate more naturally derived ingredients into their products. As a result, the market for natural and safe digestive health products in Europe is experiencing significant growth, with a growing number of consumers opting for these products.

Report Scope

Report Features Description Market Value (2022) US$ 44.18 Bn Forecast Revenue (2032) US$ 94.6 Bn CAGR (2023-2032) 8.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Prebiotics, Probiotics, Multi-Vitamins, Lactase Nutritional Supplements, Digestive Nutritional Supplements), By Delivery Format (Capsules, Tablets, Chewable, Drops, Caplets, Sticks), By Application (Functional Foods, Functional Beverages, Breakfast Cereals, Supplements), By Distribution Channel (Supermarkets & Hypermarkets, Pharmacy Stores, E-commerce, and Others) Regional Analysis North America – The US, Canada, Mexico, Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America, Eastern Europe – Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe, Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC, Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA Competitive Landscape BASF SE, Hansen Holding A/S, Nestle SA, International Flavors & Fragrances Inc., DuPont de Nemours, Inc., Bayer AG, Danone, Arla Foods Inc., Sanofi, Cargill, Inc., PepsiCo, Inc., Yakult Honsha Co., AST Enzymes Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

-

- BASF SE

- Hansen Holding A/S

- Nestle SA

- International Flavors & Fragrances Inc.

- DuPont de Nemours, Inc.

- Bayer AG

- Danone

- Arla Foods Inc.

- Sanofi

- Cargill, Inc.

- PepsiCo, Inc.

- Yakult Honsha Co.

- AST Enzymes

-