Global Dietary Supplements Market By Type (Vitamins, Botanicals, Proteins and Amino Acids Omega Fatty Acids, Others), By Form (Tablets, Capsules, Liquids, Others), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies, O), By Application (Energy and Weight Management, Bone and Joint Health, Cardiac Health, Immunity, Diabetes, Anti-cancer, Others), By End-user (Adults, Pregnant Women, Children), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

-

51515

-

February 2025

-

267

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

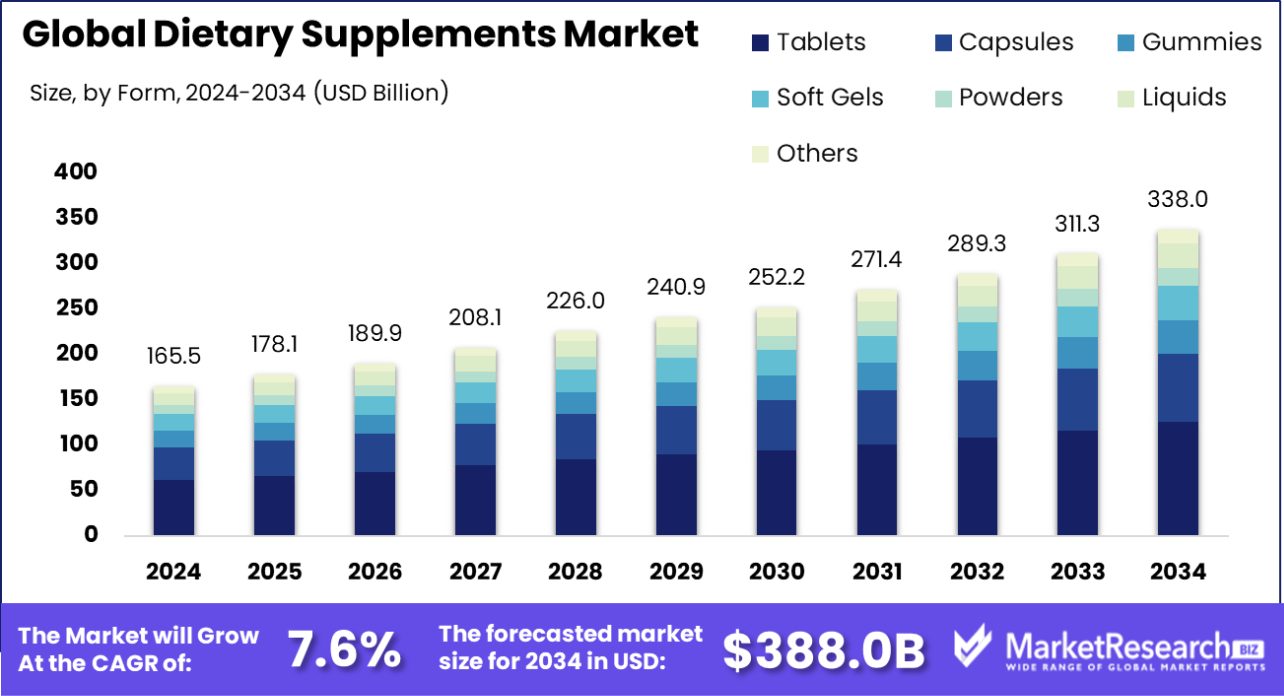

Global Dietary Supplements Market was valued at USD 165.5 billion in 2024. It is expected to reach USD 388.0 billion by 2034, with a CAGR of 7.6% during the forecast period from 2025 to 2034. North America dominates the dietary supplements market with 35.44%, USD 58.65 Bn.

Dietary supplements are products designed to augment the diet by providing nutrients that may be missing or insufficient in a person's diet. These supplements include vitamins, minerals, herbs, amino acids, fatty acids, enzymes, and other substances. They are available in various forms, such as pills, powders, liquids, and capsules, and are often used to improve overall health or target specific health concerns, like boosting immunity, supporting bone health, or enhancing energy levels.

The dietary supplements market has experienced significant growth, driven by rising health awareness, a growing aging population, and increasing consumer preference for preventive healthcare. The global market includes a wide range of product categories, from vitamins and minerals to probiotics, protein powders, and specialized supplements for fitness and beauty. This sector has also seen a surge in demand from health-conscious consumers, fueling innovation and diversification in the types of supplements available.

One of the primary growth factors in the dietary supplements market is the increasing awareness about personal health and wellness food. As more consumers focus on preventive measures, the demand for products that support overall health, such as multivitamins, omega-3 fatty acids, and probiotics, has risen. Additionally, the growth in e-commerce and online retail platforms has made these products more accessible to a wider range of consumers.

Consumer demand for dietary supplements is driven by the growing focus on fitness, weight management, and natural health solutions. Millennials and Gen Z, in particular, are increasingly seeking products that promote mental clarity, improve immune function, and enhance physical performance. The rise of plant-based and organic supplements is also a significant trend, as people become more mindful of the ingredients and ethical implications of their purchases.

The expanding opportunity for dietary supplements lies in the growing trend of personalized nutrition. With advancements in genetic testing and AI-driven health diagnostics, consumers are increasingly looking for tailored supplement regimens based on their individual health needs. Companies that can offer customizable or data-driven supplement solutions are well-positioned to capture a larger share of the market in the coming years.

In December 2024, Power Gummies, a D2C nutraceutical brand, raised INR 10 Cr ($1.2 million) in bridge funding. The Office of Dietary Supplements (ODS) at NIH had a $28.5 million budget for FY2024, with $20.4 million allocated to research projects. Meanwhile, Bioniq, an AI-driven personalized supplements company, raised $15 million in Series B funding, reaching a $75 million valuation.

Key Takeaways

- Global Dietary Supplements Market was valued at USD 165.5 billion in 2024. It is expected to reach USD 388.0 billion by 2034, with a CAGR of 7.6% during the forecast period from 2025 to 2034.

- Vitamins account for 38.42% of the dietary supplements market, offering essential nutrients for overall health.

- Tablets dominate the market at 37.49%, providing a convenient and widely preferred form for supplements.

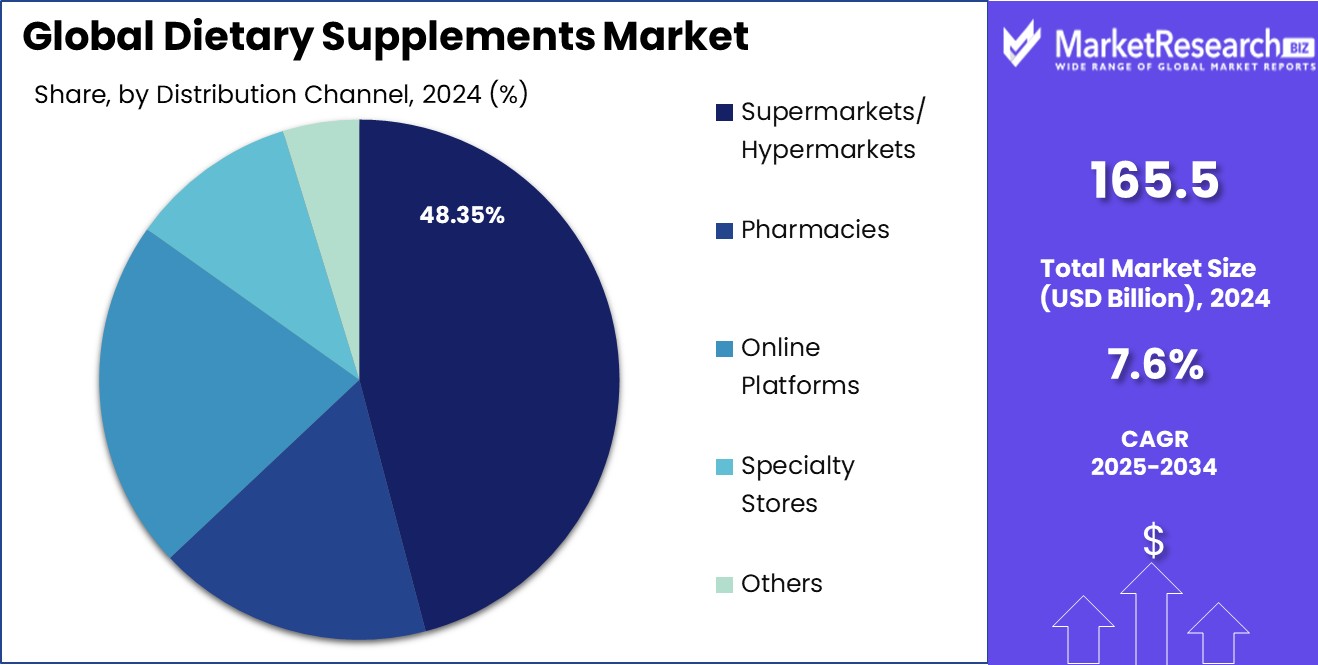

- Supermarkets/Hypermarkets lead distribution channels at 48.35%, offering a broad range of dietary supplements for consumers.

- Energy and weight management applications represent 33.43%, reflecting the growing demand for supplements promoting active lifestyles.

- Adults make up 47.35% of the dietary supplements market, driven by health-conscious consumers seeking preventative care.

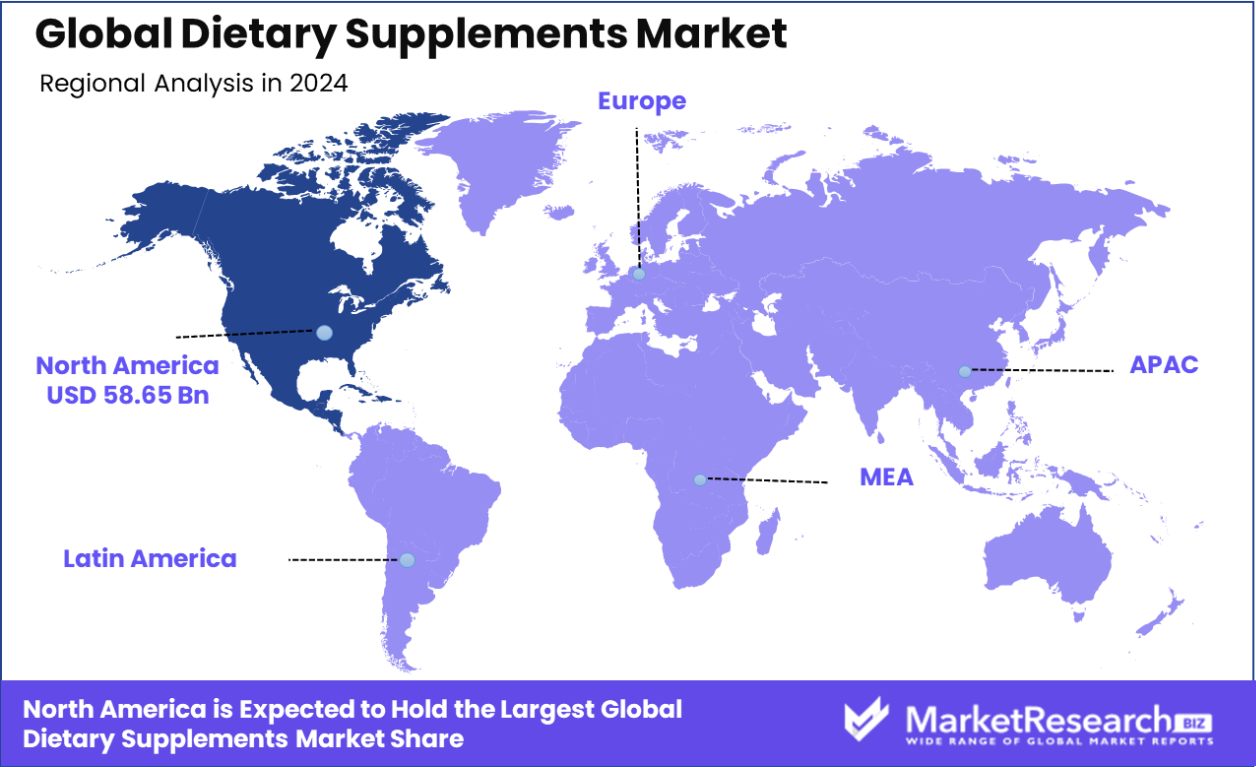

- North America dominates the Dietary Supplements Market with a 35.44% share, valued at USD 58.65 billion.

By Type Analysis

Vitamins hold the largest market share in the dietary supplements sector, 38.42%.

In 2024, Vitamins held a dominant market position in the By Type segment of the Dietary Supplements Market, accounting for 38.42% of the total market share. This significant share is primarily attributed to the widespread consumer awareness regarding the importance of vitamins in supporting overall health and well-being.

Vitamins, particularly those in the form of multivitamins, Vitamin D, Vitamin C, and B-complex vitamins, continue to be popular due to their essential role in immune function, energy production, and overall vitality.

The strong market presence of vitamins can be attributed to their proven benefits in preventing deficiencies and enhancing immunity, especially in aging populations and health-conscious consumers. Additionally, the growing prevalence of chronic diseases, coupled with the increasing adoption of preventive healthcare measures, has further bolstered the demand for vitamin supplements.

Furthermore, continuous innovations in vitamin formulations, such as plant-based and targeted supplements, have expanded their appeal to a broader range of consumers. E-commerce platforms have also played a crucial role in making these products more accessible, driving their popularity among a tech-savvy, health-focused demographic.

By Form Analysis

Tablets dominate the form of dietary supplements, accounting for 37.49% market share.

In 2024, Tablets held a dominant market position in the By Form segment of the Dietary Supplements Market, accounting for 37.49% of the total market share. The popularity of tablets in the dietary supplement industry can be attributed to their convenience, long shelf life, and widespread consumer familiarity. Tablets are widely available and offer a precise dosage of active ingredients, making them a preferred option for individuals seeking targeted health benefits.

One of the key drivers behind the strong performance of tablets is their ease of use and portability, which appeals to busy, on-the-go consumers. Moreover, tablets allow for a variety of formulations, including slow-release and multi-layered tablets, which enhance their appeal in the market. This format is particularly favored for daily wellness routines, with products targeting immune support, energy levels, and overall health being especially popular.

The tablet segment has also benefited from the growing trend of self-care and preventive health measures, with consumers increasingly looking for ways to boost their nutrition and support long-term health. With the rise of online retail and e-commerce, tablets have become more accessible to a global consumer base, further reinforcing their leading position.

By Distribution Channel Analysis

Supermarkets and hypermarkets are key distribution channels, representing 48.35% market share.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Dietary Supplements Market, accounting for 48.35% of the total market share. This strong market presence can be attributed to the widespread availability and accessibility of dietary supplements through large retail chains.

Supermarkets and hypermarkets are favored by consumers due to their convenience, extensive product selection, and competitive pricing, making them a one-stop destination for health and wellness products.

The significant market share of supermarkets and hypermarkets is also supported by their ability to offer a variety of dietary supplements, including popular brands and private-label products, all under one roof.

This variety ensures that consumers can find a wide range of products to meet their specific needs, whether for general health, fitness, or targeted nutritional support. Additionally, in-store promotions, discounts, and loyalty programs further attract customers to purchase dietary supplements from these retail outlets.

The large-scale reach of supermarkets and hypermarkets, combined with their strategic locations in both urban and suburban areas, has contributed to their dominance in the distribution of dietary supplements. Moreover, the increasing trend of health-conscious consumers seeking convenience and value-driven purchases positions supermarkets and hypermarkets to maintain their leading role in the dietary supplements market over the forecast period.

By Application Analysis

Energy and weight management applications drive significant demand in the supplement market.

In 2024, Energy and Weight Management held a dominant market position in the By Application segment of the Dietary Supplements Market, accounting for 33.43% of the total market share. This dominance is driven by the increasing consumer focus on weight management, energy enhancement, and overall fitness, particularly among health-conscious individuals and those leading active lifestyles.

The growing trend of weight management, coupled with rising concerns about obesity and sedentary behavior, has significantly fueled the demand for supplements targeting weight loss and appetite control. Products designed to boost metabolism, support fat burning, and increase energy levels are becoming more popular, especially among millennials and Gen Z consumers. Additionally, the increasing emphasis on fitness and workout regimens has led to a surge in the use of energy-boosting supplements, including pre-workout and post-workout formulations.

The energy and weight management segment's growth is also supported by a rise in consumer awareness of the importance of balanced nutrition, along with an increasing preference for natural and plant-based supplements.

The accessibility of such products through various retail channels, including online platforms, has further expanded their market reach. As demand for functional and performance-enhancing supplements continues to rise, the energy and weight management category is expected to maintain its prominent position in the dietary supplements market.

By End-user Analysis

Adults represent the largest end-user demographic, comprising 47.35% of dietary supplement consumption.

In 2024, Adults held a dominant market position in the By End-user segment of the Dietary Supplements Market, capturing 47.35% of the total market share. This substantial share reflects the increasing focus of adult consumers on maintaining health and wellness through preventative measures, such as dietary supplementation.

Adults, particularly those aged 25-55, are driving the demand for supplements that support various health goals, from improving energy levels and boosting immunity to enhancing mental clarity and promoting joint health.

The rising awareness of the importance of nutrition, especially among working professionals, has led to a surge in the consumption of supplements designed to support active lifestyles, weight management, and stress reduction. The aging population of adults is also a contributing factor, as older adults seek supplements that address issues such as bone health, heart health, and cognitive function.

Additionally, the growing popularity of personalized nutrition, where adults select supplements based on individual needs, has further propelled this segment. The accessibility of dietary supplements through both traditional retail outlets and e-commerce platforms has made it easier for adults to incorporate these products into their daily routines.

Key Market Segments

By Type

- Vitamins

- Botanicals

- Proteins and Amino Acids

- Minerals

- Fibers and Specialty Carbohydrates

- Prebiotics and Probiotics

- Omega Fatty Acids

- Others

By Form

- Tablets

- Capsules

- Gummies

- Soft Gels

- Powders

- Liquids

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Pharmacies

- Online Platforms

- Specialty Stores

- Others

By Application

- Energy and Weight Management

- General Health

- Bone and Joint Health

- Cardiac Health

- Gastrointestinal Health

- Immunity

- Diabetes

- Anti-cancer

- Others

By End-user

- Adults

- Geriatric

- Infants

- Pregnant Women

- Children

Driving Factors

Rising Health Awareness Drives Dietary Supplements Market Growth

The increasing health consciousness among consumers is a primary driving factor for the dietary supplements market. As people become more proactive about their well-being, they are turning to supplements to fill nutritional gaps and support specific health goals.

This trend has been accelerated by the COVID-19 pandemic, which heightened focus on immune health and overall wellness. Consumers are now more educated about the benefits of various nutrients and are seeking personalized solutions to address their individual health needs.

The growing prevalence of chronic diseases and the rising costs of healthcare have also contributed to this shift, as many view supplements as a preventive measure. Additionally, the aging population, particularly in developed countries, is driving demand for products that support healthy aging and address age-related health concerns.

Restraining Factors

Regulatory Challenges Impacting Market Growth

One of the primary restraining factors for the Dietary Supplements Market is the regulatory challenges that govern the production, sale, and marketing of supplements. Different countries have varying standards and regulations regarding the approval and quality control of dietary supplements, which can create uncertainty and limit market access.

In some regions, stringent regulations can delay product launches and increase compliance costs for manufacturers. Additionally, concerns about the safety and efficacy of certain ingredients have led to increased scrutiny from regulatory authorities.

As a result, companies may face difficulties in navigating these complex regulatory landscapes, potentially impacting their ability to innovate or expand. These challenges may also hinder consumer trust in certain products, further limiting market growth.

Growth Opportunity

Rise in E-commerce Expanding Market Reach

A major growth opportunity for the Dietary Supplements Market lies in the continued expansion of e-commerce platforms. As more consumers turn to online shopping for convenience, dietary supplements have become more accessible through various online retail channels.

E-commerce offers a broad range of products from local and international brands, allowing consumers to easily compare prices, read reviews, and find products tailored to their specific needs. This digital shift has allowed smaller brands to reach a global audience, bypassing the limitations of physical retail space.

Additionally, targeted online marketing and personalized recommendations based on consumer behavior have further driven sales in the sector. As the trend of online health shopping continues to grow, the dietary supplements market stands to benefit significantly, with increasing consumer demand for convenience and variety.

Latest Trends

Shift Towards Plant-Based and Natural Supplements

One of the latest trends in the Dietary Supplements Market is the growing consumer preference for plant-based and natural supplements. With a rising awareness of health and environmental concerns, many consumers are now opting for supplements made from natural, organic, and plant-derived ingredients.

This shift is driven by the increasing desire for clean-label products free from synthetic additives, preservatives, and artificial colors. Herbal supplements, plant-based proteins, and natural vitamins are gaining popularity due to their perceived benefits for both personal health and sustainability.

Additionally, the rising demand for vegan and vegetarian products has influenced this trend, with more consumers seeking alternatives to animal-derived ingredients. As a result, the market is seeing a surge in innovation, with brands introducing plant-based formulations to cater to this evolving consumer preference.

Regional Analysis

North America holds 35.44% of the Dietary Supplements Market, valued at USD 58.65 billion in 2024.

In 2024, North America led the Dietary Supplements Market, holding a dominant share of 35.44%, valued at USD 58.65 billion. This strong position is driven by increasing health awareness, the widespread adoption of preventive healthcare, and the presence of key market players. The region’s robust retail and online distribution channels, along with a high demand for products targeting energy, weight management, and overall wellness, further fuel market growth.

Europe also holds a significant share of the market, with consumers increasingly seeking natural, plant-based supplements due to growing health and environmental concerns. The rise in demand for personalized nutrition and supplements targeting specific health issues like immunity and aging is driving growth in this region.

In the Asia Pacific region, rapid economic growth, a large population base, and an increasing focus on health are contributing to a surge in demand for dietary supplements. This market is witnessing strong growth, particularly in countries like China and India, where the rising middle class is becoming more health-conscious.

Middle East & Africa and Latin America are also emerging markets for dietary supplements, with steady growth driven by increasing disposable incomes and a growing awareness of preventive health. However, these regions remain smaller compared to North America and Europe in terms of market share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Dietary Supplements Market continues to be shaped by a diverse set of key players, each contributing to the market's growth through innovation, strategic acquisitions, and strong distribution networks. Amway Corporation, a dominant player in the market, maintains its leadership through its extensive product portfolio and a strong direct-selling business model. Similarly, Abbott Laboratories leverages its deep expertise in healthcare and nutrition to offer a broad range of supplements, particularly focusing on health needs across various age groups.

Nestlé S.A., with its well-established presence in the global nutrition sector, is increasingly focusing on plant-based and natural supplements to meet rising consumer demand for clean-label products. In parallel, ADM and Pfizer Inc. continue to make significant strides by investing in research and development, advancing innovations in personalized nutrition, and expanding their product offerings in vitamins and minerals.

Companies like Herbalife and Nu Skin Enterprises dominate the direct-to-consumer channel, capitalizing on personalized nutrition and lifestyle-based products that appeal to health-conscious consumers. NOW Foods and Nature’s Sunshine focus on high-quality natural products, gaining a strong following among consumers seeking organic and plant-based options.

Meanwhile, global conglomerates such as Procter & Gamble, Koninklijke DSM N.V., and Bayer AG maintain solid market positions by incorporating dietary supplements into their broader health and wellness strategies.

Companies like Glanbia PLC and Sabinsa Corporation stand out for their focus on functional ingredients and global supply chains, while Sanofi S.A. focuses on expanding its footprint in the wellness and nutritional sectors. Collectively, these companies represent the dynamic and competitive landscape of the dietary supplements market.

Top Key Players in the Market

- Amway Corporation

- Abbott Laboratories

- Nestlé S.A.

- ADM

- Pfizer Inc.

- Herbalife International of America, Inc.

- Nu Skin Enterprises, Inc.

- Nature’s Sunshine Products, Inc.

- NOW Foods

- Procter & Gamble

- Koninklijke DSM N.V.

- Bayer AG

- Glanbia PLC

- Sabinsa Corporation

- Sanofi S.A.

- Other Key Players

Recent Developments

- In January 2025, Sanofi reported strong sales growth in Q4 2024, with a 10.3% increase at constant exchange rates. The company also announced plans for a €5 billion share buyback program in 2025.

- In October 2024, Nu Skin introduced MYND360, a new line of clinically proven nutritional formulas for cognitive well-being, including products for sleep, stress management, focus, and memory support.

- In August 2024, Nature's Sunshine showcased new product innovations at the Newtopia Now event, including their Power line of supplements and new flavors of powdered chlorophyll.

- In April 2024, Bayer expanded its Age Factor product line beyond dietary supplements, creating a full "ecosystem" of offerings focused on healthy aging.

Report Scope

Report Features Description Market Value (2024) USD 165.5 Billion Forecast Revenue (2034) USD 388.0 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Vitamins, Botanicals, Proteins and Amino Acids, Minerals, Fibers and Specialty Carbohydrates, Prebiotics and Probiotics, Omega Fatty Acids, Others), By Form (Tablets, Capsules, Gummies, Soft Gels, Powders, Liquids, Others), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies, Online Platforms, Specialty Stores, Others), By Application (Energy and Weight Management, General Health, Bone and Joint Health, Cardiac Health, Gastrointestinal Health, Immunity, Diabetes, Anti-cancer, Others), By End-user (Adults, Geriatric, Infants, Pregnant Women, Children) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amway Corporation, Abbott Laboratories, Nestlé S.A., ADM, Pfizer Inc., Herbalife International of America, Inc., Nu Skin Enterprises, Inc., Nature’s Sunshine Products, Inc., NOW Foods, Procter & Gamble, Koninklijke DSM N.V., Bayer AG, Glanbia PLC, Sabinsa Corporation, Sanofi S.A., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Amway Corporation

- Abbott Laboratories

- Nestlé S.A.

- ADM

- Pfizer Inc.

- Herbalife International of America, Inc.

- Nu Skin Enterprises, Inc.

- Nature’s Sunshine Products, Inc.

- NOW Foods

- Procter & Gamble

- Koninklijke DSM N.V.

- Bayer AG

- Glanbia PLC

- Sabinsa Corporation

- Sanofi S.A.

- Other Key Players