Dental Adhesive Market By Product Type (Creams, Powder, Strips), By Technique (Generation Technique, Etching Technique), By Application (Dentures, Pits and Fissures, Restorative), By End User (Dental Clinics, Hospitals, Academic Institutes, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47798

-

June 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

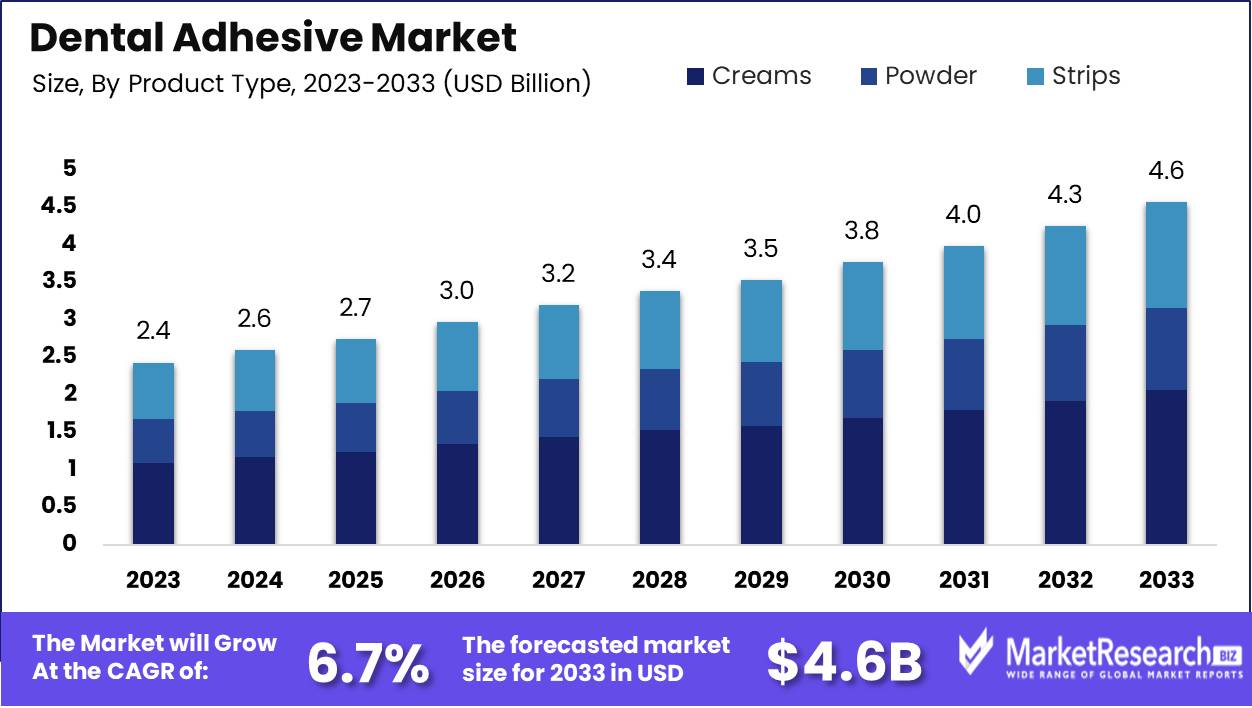

The Dental Adhesive Market was valued at USD 2.43 billion in 2023. It is expected to reach USD 4.06 billion by 2033, with a CAGR of 6.7% during the forecast period from 2024 to 2033.

The dental adhesive market encompasses products used to bond dental materials to tooth structures, crucial for restorative and orthodontic procedures. This market is driven by advancements in dental technologies, the increasing prevalence of dental disorders, and the rising demand for cosmetic dentistry. Dental adhesives, which include resin-based, glass ionomer, and polycarboxylate adhesives, ensure durable and effective bonding, enhancing the longevity and performance of dental restorations.

Innovations such as nanotechnology and bioactive materials are further propelling market growth. As dental health awareness rises globally, the demand for high-quality, reliable dental adhesives continues to expand, fostering competitive dynamics and continual product enhancement.

The dental adhesive market is poised for substantial growth driven by a confluence of demographic and behavioral factors. One primary driver is the aging global population, leading to an increased prevalence of dental conditions that require adhesive solutions, such as dentures. As life expectancy rises, so does the demand for dental care among elderly individuals, underpinning the market’s expansion.

Additionally, the heightened awareness and adoption of dental hygiene practices across various age groups have significantly boosted the utilization of dental adhesives. Public health initiatives and educational campaigns emphasizing the importance of oral health are contributing to this trend, fostering a proactive approach to dental care and maintenance.

These dynamics underscore a nuanced landscape for stakeholders in the dental adhesive market. Companies must navigate the dual forces of rising demand and cost-related limitations. Strategic emphasis on innovation and cost-efficiency will be crucial in capturing market share and addressing affordability issues. Furthermore, regional strategies tailored to economic conditions and healthcare infrastructure will be pivotal. For instance, enhancing the accessibility of cost-effective adhesive solutions in price-sensitive markets could unlock significant growth potential.

Overall, while the dental adhesive market benefits from strong underlying demand drivers, success will hinge on the ability to balance innovation with affordability, ensuring broad-based access to essential dental care solutions.

Key Takeaways

- Market Growth: The Dental Adhesive Market was valued at USD 2.43 billion in 2023. It is expected to reach USD 4.06 billion by 2033, with a CAGR of 6.7% during the forecast period from 2024 to 2033.

- By Product Type: Creams dominated the dental adhesive market due to versatility.

- By Technique: Generation Technique dominated the Dental Adhesive Market segments.

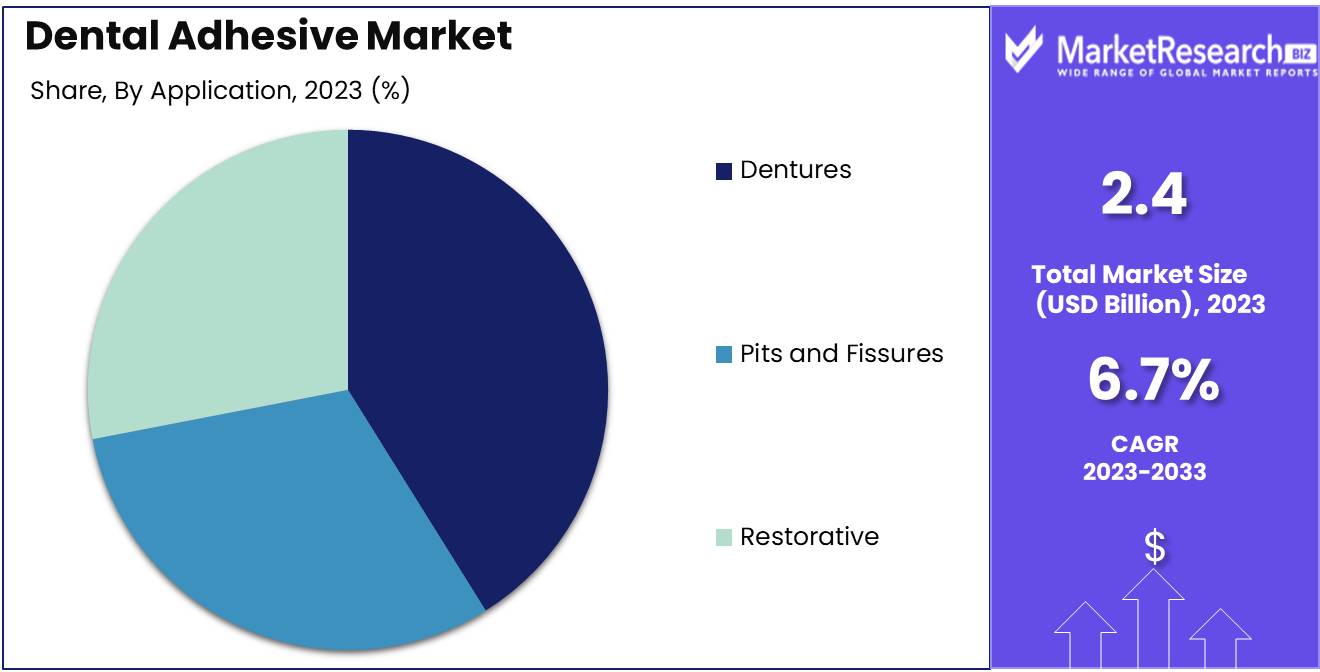

- By Application: The dentures segment dominated the Dental Adhesive Market by application.

- By End User: Dental Clinics dominated the dental adhesive market landscape.

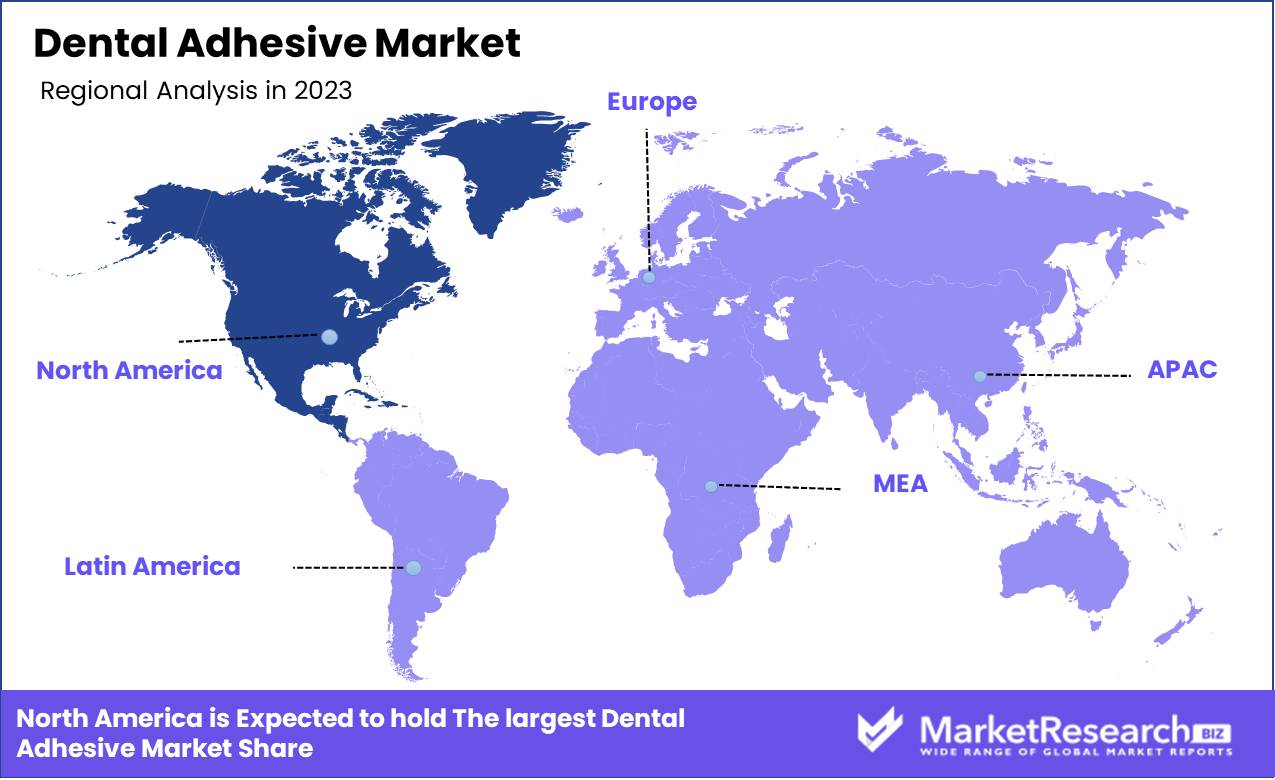

- Regional Dominance: North America leads the dental adhesive market, holding a 35% share.

- Growth Opportunity: The global dental adhesive market is set for robust growth, driven by rising dental restoration needs and technological advancements.

Driving factors

Increasing Prevalence of Oral Diseases: Driving Demand for Dental Adhesives

The rising incidence of oral diseases, such as dental caries, periodontal disease, and tooth decay, significantly fuels the growth of the dental adhesive market. According to the World Health Organization (WHO), nearly 3.5 billion people worldwide suffer from oral diseases, making it a critical public health issue.

The high prevalence of these conditions necessitates more frequent dental treatments, including the use of dental adhesives for restorative procedures. Dental adhesives are essential in the bonding process of restorative materials to the natural tooth structure, ensuring durability and longevity of treatments. As the global burden of oral diseases continues to increase, the demand for effective and reliable dental adhesives is expected to rise correspondingly, driving market growth.

Growing Aging Population: Expanding the Market for Dental Restorative Solutions

The demographic shift towards an aging population is another crucial factor contributing to the growth of the dental adhesive market. The United Nations estimates that by 2050, the global population aged 60 years and older will reach 2.1 billion. Older adults are more susceptible to oral health issues such as tooth loss, dental caries, and gum diseases, which require restorative dental procedures. The need for dental adhesives is particularly pronounced in this age group, as they often undergo procedures like fillings, crowns, bridges, and dentures that rely heavily on adhesives for stability and effectiveness. This growing segment of the population will continue to drive the demand for dental adhesives, as maintaining oral health becomes increasingly important with age.

Rising Demand for Cosmetic Dentistry: Boosting Innovation and Adoption

Cosmetic dentistry has seen a substantial rise in popularity, driven by increasing consumer awareness and desire for aesthetic dental improvements. The American Academy of Cosmetic Dentistry (AACD) reports that the demand for cosmetic procedures, such as teeth whitening, veneers, and bonding, has been steadily increasing. Dental adhesives play a pivotal role in cosmetic dentistry, providing the necessary bonding strength and aesthetic quality required for these procedures. Advances in adhesive technology have improved the effectiveness and appeal of cosmetic dental treatments, encouraging more patients to seek these services. The rising demand for cosmetic dentistry not only stimulates the market for dental adhesives but also fosters innovation, leading to the development of advanced adhesive products that enhance patient outcomes and satisfaction.

Restraining Factors

Stringent FDA Regulations Hamper Market Expansion

The dental adhesive market faces significant challenges due to the increasing stringency of regulations imposed by the U.S. Food and Drug Administration (FDA). These regulations are designed to ensure the safety and efficacy of dental products, necessitating extensive testing, compliance with rigorous standards, and often prolonged approval processes. For instance, new dental adhesives must undergo pre-market approval (PMA) or meet the standards of 510(k) clearance, both of which are time-consuming and costly.

This regulatory landscape creates barriers to entry, particularly for smaller companies and startups that may lack the resources to navigate these complex requirements. Larger firms, while better equipped to handle compliance costs, still face delays that can impact their time-to-market and innovation cycles. As a result, the pace of introducing new products slows down, stifling the overall growth of the dental adhesive market.

Environmental Sustainability Concerns Drive Market Constraints

Environmental sustainability concerns are increasingly influencing the dental adhesive market, imposing both ethical and regulatory pressures on manufacturers. With growing awareness of environmental issues, there is a rising demand for eco-friendly dental products. This shift necessitates substantial changes in manufacturing processes, sourcing of raw materials, and product lifecycle management.

Manufacturers are compelled to invest in research and development to create sustainable dental adhesives, which often involve higher costs and longer development times. For instance, the use of bio-based or recyclable materials in dental adhesives can lead to increased production expenses. These costs can be prohibitive, especially for smaller companies, limiting their ability to compete and innovate.

Additionally, environmental regulations at national and international levels are becoming more stringent, compelling manufacturers to adopt greener practices. Compliance with these regulations can incur significant costs, including investment in new technologies and processes to reduce carbon footprints, manage waste, and ensure the sustainability of supply chains.

By Product Type Analysis

In 2023, Creams dominated the dental adhesive market due to versatility.

In 2023, Creams held a dominant market position in the By Product Type segment of the Dental Adhesive Market. The convenience and ease of application associated with creams have driven their widespread adoption among both dental professionals and patients. Creams provide strong, long-lasting adhesion, which enhances user comfort and denture stability. Additionally, the extensive availability of creams in various formulations caters to diverse consumer needs, such as sensitivity and taste preferences, further solidifying their market dominance.

Powders also captured a significant share, valued for their customizable adhesive strength. Users can control the amount of powder applied, offering a tailored fit that appeals to those seeking precision. However, powders are often perceived as less convenient compared to creams, impacting their overall market share.

Strips, while innovative and offering ease of use, have a smaller market presence. Their pre-measured format ensures consistent application, appealing to new users and those seeking simplicity. Despite this, higher costs and limited adhesive strength compared to creams and powders have constrained their growth.

By Technique Analysis

In 2023, Generation Technique dominated the Dental Adhesive Market segments.

In 2023, The Generation Technique held a dominant market position in the By Technique segment of the Dental Adhesive Market. The Generation Technique encompasses several subcategories, including the 4th, 5th, 6th, and 7th generation dental adhesives, each offering varying degrees of bond strength, application ease, and moisture tolerance. The 4th and 5th generation adhesives are known for their high bond strength and reliable performance, particularly in wet conditions, making them a preferred choice for complex dental restorations. The 6th and 7th generation adhesives simplify the bonding process by reducing the number of steps required, enhancing user convenience without significantly compromising bond efficacy.

Similarly, the Etching Technique, divided into Total-etch, Self-etch, and Selective-etch categories, plays a crucial role. The Total-etch technique, involving separate etching and rinsing steps, offers strong bond durability but requires precise moisture control. Self-etch adhesives integrate etching into the adhesive application, simplifying the procedure and reducing sensitivity issues, albeit with a slight trade-off in bond strength. Selective-etch, combining the benefits of both techniques by selectively etching enamel while self-etching dentin, strikes a balance between bond strength and simplicity. The dominance of these techniques in the market is driven by their ability to cater to diverse clinical needs, ensuring optimal outcomes for various dental restorative procedures.

By Application Analysis

In 2023, The Dentures Segment dominated the Dental Adhesive Market by application.

In 2023, The Dentures Segment held a dominant market position in the By Application segment of the Dental Adhesive Market. This dominance can be attributed to the increasing global geriatric population, which has led to a higher prevalence of edentulism. As more individuals require dentures, the demand for dental adhesives to secure these prosthetics has surged. Furthermore, advancements in denture adhesive formulations, which offer improved comfort and longer-lasting hold, have contributed to this segment's growth.

In the Pits and Fissures segment, the rising incidence of dental caries among children and adolescents has driven market demand. Dental adhesives are crucial in sealing pits and fissures to prevent cavities, making them a staple in preventive dental care.

The Restorative segment has also experienced significant growth, driven by the increasing emphasis on aesthetic dentistry and the rising number of dental restoration procedures such as fillings, crowns, and bridges. Innovations in adhesive technologies that ensure better bonding strength and durability have further bolstered this segment. Collectively, these segments reflect the diverse applications of dental adhesives and underscore the market's expansion driven by demographic trends and technological advancements.

By End User Analysis

In 2023, Dental Clinics dominated the dental adhesive market landscape.

In 2023, Dental Clinics held a dominant market position in the "By End User" segment of the Dental Adhesive Market. This can be attributed to the high patient footfall and the increasing preference for professional dental care services. Dental clinics offer specialized services and advanced treatments, making them a primary choice for dental adhesive applications.

Hospitals, while significant, accounted for a smaller market share compared to dental clinics. They provide comprehensive dental services as part of broader healthcare offerings but often lack the specialized focus found in dedicated dental clinics.

Academic institutes play a critical role in the market through research and training, driving innovations in dental adhesives. Their market share, though limited in direct consumer services, is pivotal in shaping future market trends and product development.

The "Others" category encompasses small private practices, mobile dental units, and community health centers. While their individual market shares are relatively minor, collectively, they contribute to market diversity and accessibility, especially in underserved regions. Together, these segments reflect a dynamic and multifaceted market landscape for dental adhesives.

Key Market Segments

Growth Opportunity

Rise in Dental Restoration and Prosthetics

The global dental adhesive market is poised for significant growth, driven by an increasing demand for dental restoration and prosthetics. As populations age and the prevalence of dental issues rises, there is a growing need for restorative dental procedures. This trend is especially pronounced in developed regions with older demographics and in developing countries where dental care access is improving.

According to recent industry reports, the dental prosthetics market is expected to grow at a CAGR of over 6% from 2023 to 2028, directly influencing the demand for dental adhesives. This surge is bolstered by the expanding awareness of oral health and the increasing disposable income, allowing more individuals to opt for advanced dental treatments.

Advancements in Dental Materials and Technology

Technological advancements are revolutionizing the dental adhesive landscape, creating lucrative opportunities. Innovations in dental materials, such as improved biocompatibility and enhanced bonding strength, are setting new standards in dental care. These advancements not only improve patient outcomes but also drive market growth by enabling more effective and longer-lasting dental restorations. The integration of digital dentistry, including CAD/CAM systems, is also enhancing the precision and efficiency of dental adhesive applications. The adoption of these technologies is expected to accelerate, supported by continuous R&D investments and the professional training of dental practitioners in advanced adhesive techniques.

Latest Trends

Expansion of Dental Clinics and Hospitals

The dental adhesive market is poised for significant growth, driven largely by the expansion of dental clinics and hospitals worldwide. This trend is particularly pronounced in emerging markets, where increasing dental health awareness and rising disposable incomes are fueling the demand for advanced dental care. The establishment of new facilities, coupled with the modernization of existing ones, necessitates a higher intake of state-of-the-art dental materials, including adhesives. As healthcare infrastructure continues to evolve, manufacturers are expected to align their product development strategies to meet the growing needs of these institutions, ensuring that their offerings are compatible with the latest dental technologies and treatment protocols.

Focus on Sustainable and Eco-Friendly Products

In response to global environmental concerns, there is a notable shift towards sustainability in the dental adhesive market. Consumers and dental professionals are increasingly prioritizing environmentally friendly products, prompting manufacturers to innovate and develop adhesives with reduced environmental impact. This includes the use of biodegradable components, reducing volatile organic compounds (VOCs), and enhancing the recyclability of packaging materials. Regulatory bodies are also tightening standards around the environmental footprint of dental products, further accelerating this trend. Companies that integrate sustainability into their product lines are not only enhancing their market appeal but are also positioning themselves as leaders in corporate social responsibility, thereby gaining a competitive edge in a market that is progressively valuing eco-friendly practices.

Regional Analysis

North America leads the dental adhesive market, holding a 35% share.

The global dental adhesive market exhibits significant regional variations, each influenced by distinct factors such as economic development, healthcare infrastructure, and consumer preferences. North America dominates the market, accounting for approximately 35% of the global share, driven by advanced dental care facilities, high patient awareness, and substantial healthcare expenditure. The U.S., a major contributor in this region, benefits from a robust insurance framework and a high prevalence of cosmetic dentistry practices.

In Europe, the market is propelled by countries like Germany, France, and the UK, with a strong emphasis on oral health and technological advancements in dental care. The region holds about 30% of the market share, reflecting its mature healthcare systems and increasing geriatric population, which boosts demand for dental adhesives.

The Asia Pacific region is experiencing rapid growth, capturing around 25% of the market. This is attributed to rising disposable incomes, improving healthcare infrastructure, and growing awareness about dental hygiene. Countries such as China, India, and Japan are key players, with significant investments in healthcare services and a burgeoning middle class.

In the Middle East & Africa, the market is in a nascent stage but showing promising growth, particularly in affluent countries like the UAE and Saudi Arabia, due to increasing healthcare investments and a growing expatriate population seeking quality dental care.

Latin America, encompassing markets such as Brazil and Mexico, contributes approximately 10% to the global market. The region's growth is spurred by improving economic conditions, expanding healthcare services, and increasing adoption of advanced dental treatments.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global dental adhesive market in 2024 is poised for significant advancements, driven by the innovations and competitive strategies of key players such as New World Imports, 3M, Ultradent Products, Inc., Dentsply Sirona Inc., and others. Each company brings unique strengths to the market, contributing to a dynamic competitive landscape.

3M remains a leader through its continued investment in R&D and broad product portfolio, leveraging its expertise in materials science to enhance product efficacy and patient outcomes. Dentsply Sirona Inc. complements this with a robust focus on integrating dental adhesives into comprehensive digital dentistry solutions, enhancing procedural efficiency and precision.

Procter & Gamble Co. and GlaxoSmithKline PLC are leveraging their strong consumer healthcare brands to expand their market share, promoting dental adhesives through well-established channels and consumer trust. Johnson & Johnson Services Inc. and Colgate-Palmolive Company similarly capitalize on their extensive healthcare portfolios to introduce innovative dental care products.

Henkel AG & Co. KGaA and Mitsui Chemicals Inc. bring advanced chemical engineering capabilities to the fore, driving innovations in adhesive formulations that promise improved performance and durability. Meanwhile, companies like Ivoclar Vivadent AG and Tokuyama Dental Corporation Inc. emphasize quality and technological advancements, catering to both professional and consumer markets with specialized products.

As these key players navigate regulatory landscapes, invest in new technologies, and expand their product lines, the dental adhesive market is expected to experience robust growth, marked by enhanced product quality, expanded applications, and increased consumer awareness. This competitive interplay will likely spur further innovation, benefitting both dental professionals and patients globally.

Market Key Players

- New World Imports

- 3M

- Ultradent Products, Inc.

- Dentsply Sirona Inc.

- Procter & Gamble Co.

- GlaxoSmithKline PLC

- Johnson & Johnson Services Inc.

- Henkel AG & Co. KGaA

- Colgate-Palmolive Company

- Mitsui Chemicals Inc.

- Tokuyama Dental Corporation Inc.

- Prime Dental Manufacturing

- Den-Mat Holdings LLC.

- Ivoclar Vivadent AG

Recent Development

- In May 2024, Ivoclar Vivadent launched Adhese Universal DC, a dual-cure adhesive that caters to a wide range of restorative procedures. This new product aims to provide dental professionals with greater flexibility and efficiency, reducing the time required for procedures.

- In March 2024, Dentsply Sirona released Prime&Bond Universal™, a versatile dental adhesive system that simplifies the bonding process while ensuring high bond strength and reliability. The product is designed to be compatible with both direct and indirect restorations.

- In January 2024, 3M introduced a new dental adhesive designed to offer enhanced bonding strength and durability. This next-generation adhesive aims to improve clinical outcomes and patient satisfaction by providing superior adhesion to various dental substrates.

Report Scope

Report Features Description Market Value (2023) USD 2.43 Billion Forecast Revenue (2033) USD 4.06 Billion CAGR (2024-2032) 6.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Creams, Powder, Strips), By Technique (Generation Technique, Etching Technique), By Application (Dentures, Pits and Fissures, Restorative), By End User (Dental Clinics, Hospitals, Academic Institutes, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape New World Imports, 3M, Ultradent Products, Inc., Dentsply Sirona Inc., Procter & Gamble Co., GlaxoSmithKline PLC, Johnson & Johnson Services Inc., Henkel AG & Co. KGaA, Colgate-Palmolive Company, Mitsui Chemicals Inc., Tokuyama Dental Corporation Inc., Prime Dental Manufacturing, Den-Mat Holdings LLC., Ivoclar Vivadent AG Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- New World Imports

- 3M

- Ultradent Products, Inc.

- Dentsply Sirona Inc.

- Procter & Gamble Co.

- GlaxoSmithKline PLC

- Johnson & Johnson Services Inc.

- Henkel AG & Co. KGaA

- Colgate-Palmolive Company

- Mitsui Chemicals Inc.

- Tokuyama Dental Corporation Inc.

- Prime Dental Manufacturing

- Den-Mat Holdings LLC.

- Ivoclar Vivadent AG