Defense Cybersecurity Market By Platform(Software & Service, Hardware), By Solution(Cyber Threat Protection, Threat Evaluation, Security and Vulnerability Management, Data loss Prevention Management, Enterprise Risk and Compliance, Content Security), OthersBy Type, (Critical Infrastructure Security & Resilience, Application Security, Cloud Security, Others), By End User(Land Force, Naval Force, Air Force) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43046

-

Jan 2024

-

176

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Driving Factors

- Restraining Factors

- Defence Cybersecurity Market Segmentation Analysis

- Defence Cybersecurity Industry Segments

- Growth Opportunities

- Regional Analysis

- Industry By Region

- Defence Cybersecurity Market Key Player Analysis

- Defence Cybersecurity Industry Key Players

- Recent Development

- Report Scope

Report Overview

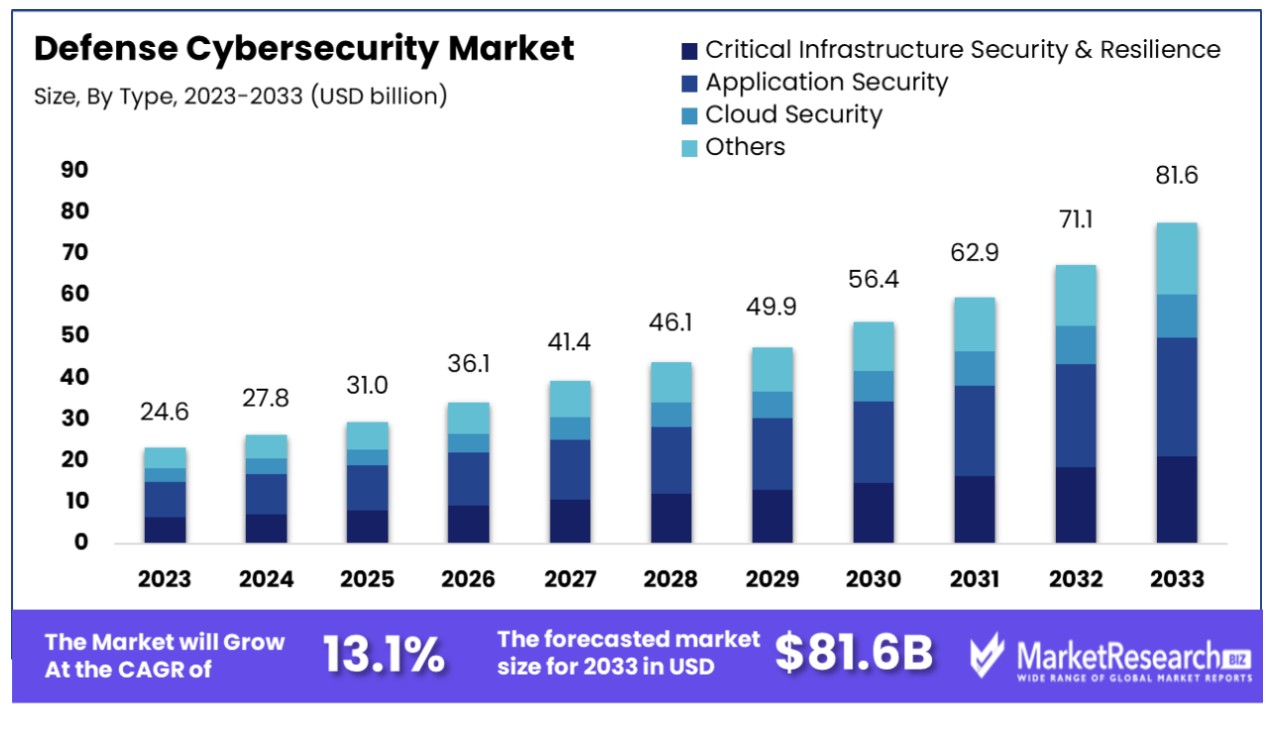

The defense cybersecurity market was valued at USD 24.56 billion in 2023. It is expected to reach USD 81.6 billion by 2033, with a CAGR of 13.1% during the forecast period from 2024 to 2033.

The surge in demand in the military and the rise of cybersecurity attacks are some of the main key driving factors for the defense cybersecurity market. Cybersecurity is the group of practices, techniques, and advanced technologies that have been constructed to protect systems, information, and computer programs from any kind of loss, damage, and unauthorized access. Cybersecurity in general terms, is the fortification of personal data and secrets. Defense is quite similar to any other organizations that depend upon cybersecurity for protection as they utilize these systems and networks for operations.

According to a report published by IBM in 2023, highlights that there are more than 550 companies that were hit by data breaches. Moreover, the global average expenditure of a data breach in 2023 was USD 4.45 million which is a 15% increase over the last 3 years. More than 51% of the companies are preparing to up-surge security funding due to breach that comprises of incident response planning, employee training, and threat detection with response equipment.

The important data is to protect that comprises social security and the country’s highest secrets. This type of information should be kept protected and confidential from all unauthorized users, susceptibilities, and attackers who want to disclose or exploit them. Defense has created cyber potentialities to support them in combating the battlefields and to safeguard their systems from cyber attackers during peacetime. The defense has a major role in offering its country with utmost national signal intelligence daily. As defense is always in mission-oriented nature, they are also a valuable asset as compared to other arms of the government. The defence is structured properly to provide an accurate obligatory and high cyber defence. The cyber defense must now apply strict actions towards cyber-attacks and hackers.

Governments and defense entities recognize the gravity of cyber threats and are actively implementing defensive measures to enhance cybersecurity. A significant stride in this direction involves the formulation of regulatory frameworks by governments, mandating cybersecurity measures for businesses and companies. Numerous nations have established cybersecurity agencies tasked with coordinating cybersecurity efforts across various sectors. For instance, the US Cyber Command assumes responsibility for the defense's cyberspace operations, collaborating with a global team of proficient cyber experts to oversee and safeguard the defense network. Governments and defense entities are undertaking various initiatives to secure vital infrastructure and sensitive information, encompassing efforts to ensure confidentiality, elevate cybersecurity data protection standards, and implement robust encryption measures. The demand for defense cybersecurity is poised to rise, driven by its imperative role in military and defense applications, contributing to market expansion in the foreseeable future.

Driving Factors

Escalating Cyber Threats Propel Defense Cybersecurity Market

The rising frequency and sophistication of cyberattacks on government entities significantly bolster the defense cybersecurity market. Verizon's 2021 Data Breach Investigations Report highlighted 3,236 attacks (11%) targeting the public sector, a figure that excludes numerous nation-state attacks. High-profile incidents like the 2022 Canadian Revenue Agency's credential stuffing attack affecting 48,500 accounts and the 2023 breach of U.S. federal agencies by Russian hackers underscore the urgency for advanced cybersecurity solutions. These threats necessitate substantial investment in cybersecurity tools and services, emphasizing the market's growth driven by the need to safeguard sensitive government and military data against increasingly complex cyber threats.

Government Budgetary Support Accelerates Market Growth

Governmental financial commitments towards military and defense cybersecurity underpin market expansion. For instance, the U.S. Department of Defense earmarked $7.4 billion for cyberspace operations in its 2024 fiscal year budget, including a significant allocation for the U.S. Cyber Command (CYBERCOM). Additionally, the Defense Threat Reduction Agency (DTRA) increased its cyber capabilities budget by $19.3 million in 2023. These budgetary allocations reflect the strategic importance of cybersecurity in national defense strategies, providing a substantial boost to the defense cybersecurity market. Data Loss Prevention is pivotal in fortifying the Defense Cybersecurity Market, shielding sensitive information from potential threats and breaches.

Emerging Attack Vectors Intensify Cybersecurity Demands

The proliferation of Internet of Things (IoT) devices, cloud computing, and the advent of 5G networks have expanded potential cyberattack vectors. This evolution has exposed new vulnerabilities, necessitating robust and sophisticated cybersecurity measures. The defense sector, in particular, faces unique challenges in protecting these emerging technologies from cyber threats. The imperative for market growth in the defense sector is fueled by the development and deployment of advanced cybersecurity solutions, crucial for shielding against continuously evolving threats.

Restraining Factors

Legacy Systems Impede Modernization in the Defense Cybersecurity Market

Legacy systems within defense organizations significantly limit the growth of the defense cybersecurity market. These older systems are often challenging to update and secure, rendering them vulnerable to cyber threats. The U.S. Government Accountability Office continues to identify legacy IT as a major security risk, highlighting the difficulty of integrating these systems with contemporary cybersecurity tools. This situation creates a significant obstacle in modernizing defense cybersecurity infrastructure, as the integration process is fraught with complexities and potential security loopholes, thereby slowing down the adoption of advanced cybersecurity solutions in the defense sector.

Regulatory Lag Restrains Defense Cybersecurity Market Evolution

The lag in the development and implementation of cybersecurity regulations and compliance standards tailored to the defense sector acts as a barrier to market growth. The defense industry faces a landscape of unclear or inconsistent regulations, which can deter investment and hinder the adoption of new cybersecurity technologies. The U.S. Department of Defense's Cybersecurity Maturity Model Certification (CMMC) program, which aims to standardize cybersecurity regulations, is a step towards addressing this issue. However, until these regulations are fully developed and uniformly implemented, the uncertainty and inconsistency in regulatory frameworks continue to pose challenges for stakeholders in the defense cybersecurity market.

Defence Cybersecurity Market Segmentation Analysis

By Platform:

The primary force driving the defense cybersecurity market is the Software & Services segment. The indispensability of software and services arises from the growing intricacy of cyber threats, requiring constant monitoring and updating of security measures. Encompassing solutions such as firewalls, antivirus software, intrusion detection systems, and cybersecurity services, this segment plays a pivotal role in the effective identification, mitigation, and response to cyber threats. The continuous evolution of cyber threats mandates regular software updates and professional services, solidifying the preeminence of this segment.

Hardware, while also crucial, typically involves a one-time investment and lacks the dynamic adaptability offered by software and services. It includes physical devices like secure servers, routers, and hardware firewalls.

By Solution:

Cyber Threat Protection stands out as the predominant solution in the defense cybersecurity market. This segment covers a wide range of cybersecurity measures focused on protecting defense networks and systems from cyber threats, such as malware, phishing, and advanced persistent threats. The increasing sophistication of cyberattacks targeted at defense entities makes threat protection a top priority.

Other solutions like Threat Evaluation, Security and Vulnerability Management, Data Loss Prevention Management, Enterprise Risk and Compliance, and Content Security are also key components of the defense cybersecurity ecosystem. Each plays a vital role in providing a comprehensive defense against various cyber threats. Cyber Threat Protection takes center stage in the market due to its fundamental significance in safeguarding critical defense information and infrastructure.

By Type:

Application Security holds a dominant position as the primary type in the defense cybersecurity market. This segment focuses on securing software applications from external threats. As defense organizations increasingly rely on various applications for operations and communication, securing these applications against cyber espionage, data breaches, and other cyber threats is crucial.

Critical Infrastructure Security & Resilience and Cloud Security are also significant segments, addressing the security needs of defense infrastructure and cloud-based systems, respectively. However, the pivotal role of Application Security in protecting the software that underpins defense operations underscores its market dominance.

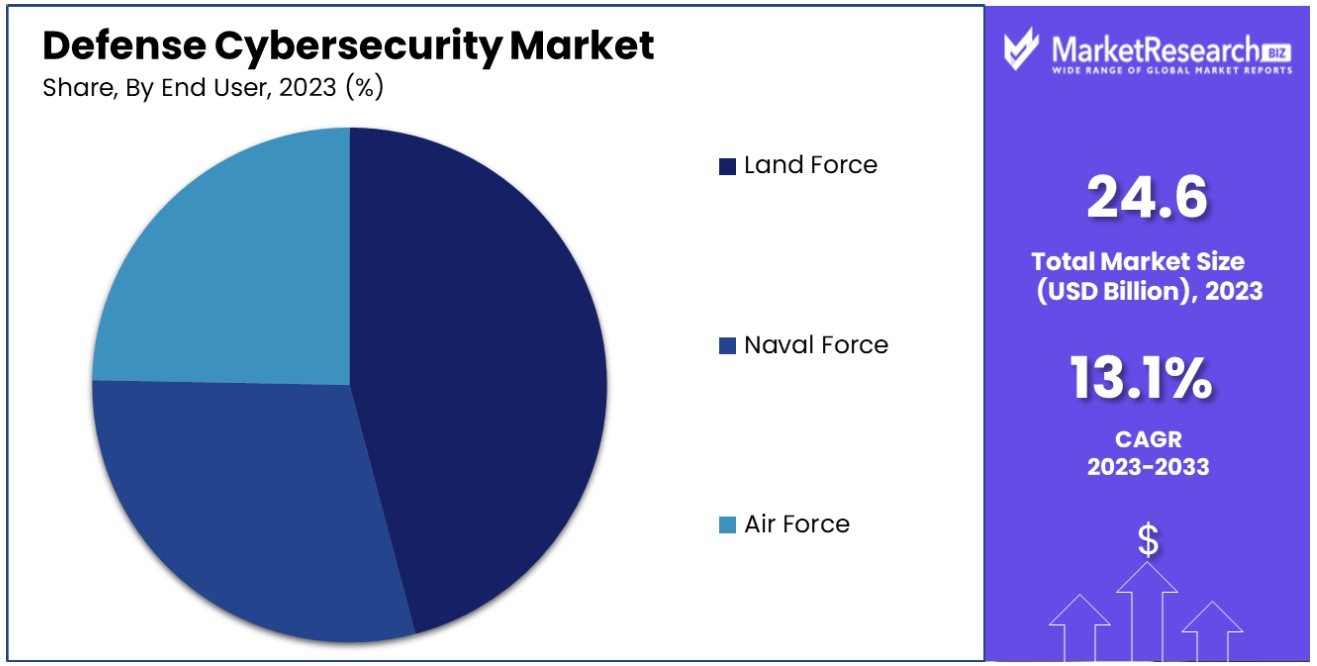

By End User

Land Force is the dominant end user in the defense cybersecurity market. Land forces, comprising army and ground defense units, require robust cybersecurity solutions due to their extensive use of digital and communication technologies in operations. The protection of data and communication networks is vital for maintaining operational effectiveness and security.

Naval Force and Air Force also represent significant segments, with each branch having unique cybersecurity requirements for their respective platforms and systems. However, the breadth and scope of digital technologies used by land forces make them the primary market for defense cybersecurity solutions.

Defence Cybersecurity Industry Segments

By Platform

- Software & Service

- Hardware

By Solution

- Cyber Threat Protection

- Threat Evaluation

- Security and Vulnerability Management

- Data loss Prevention Management

- Enterprise Risk and Compliance

- Content Security

- Others

By Type

- Critical Infrastructure Security & Resilience

- Application Security

- Cloud Security

- Others

By End User

- Land Force

- Naval Force

- Air Force

Growth Opportunities

Cloud Computing Adoption Opens New Avenues in the Defense Cybersecurity Market

The incorporation of cloud-based systems within defense agencies presents a significant growth opportunity for the defense cybersecurity market. Cloud computing offers several security advantages, such as centralization, automation, and scalability, essential for defense applications. However, this shift also exposes new vulnerabilities, creating a demand for specialized cloud security tools and services. As defense agencies increasingly adopt cloud computing for their operations, the need for robust cybersecurity measures to protect these cloud environments becomes paramount. Providers of cloud security solutions are thus positioned to address these emerging challenges, leading to market growth and innovation in defense cybersecurity.

AI and Machine Learning Integration Bolsters Defense Cybersecurity Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) in defense cybersecurity is still in its nascent stages but offers immense potential for market expansion. These technologies are being adopted for critical tasks like threat detection, intelligence gathering, and predictive analytics. With ongoing improvements in algorithms and computational capabilities, AI and ML are poised to significantly enhance cybersecurity defenses. The U.S. Air Force's 2021 pilot of an AI-based predictive maintenance system exemplifies this trend. As these technologies evolve and prove their efficacy, their adoption in defense cybersecurity will likely increase, driving market growth and transforming cybersecurity strategies in defense sectors.

Regional Analysis

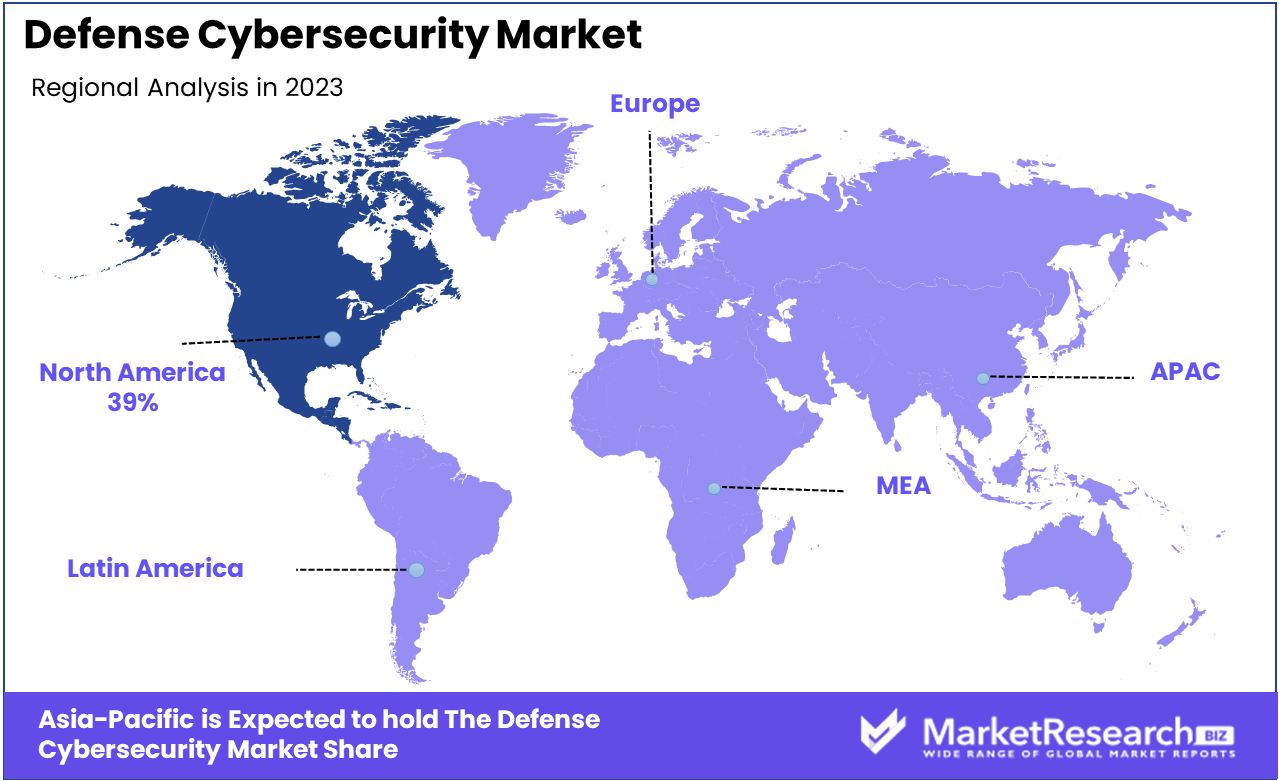

North America Dominates with 39% Market Share in the Defense Cybersecurity Market

North America’s 39% share of the global defense cybersecurity market is largely driven by the United States’ significant investment in national security and defense infrastructure. The region's market dominance is bolstered by the presence of major defense contractors and cybersecurity firms, like Lockheed Martin and Northrop Grumman, which are heavily invested in developing advanced cybersecurity solutions for defense applications. High government spending on defense, coupled with increasing awareness of cyber threats to national security, fuels the market’s growth.

The defense cybersecurity market in North America is characterized by rapid technological advancements and a strong emphasis on securing defense networks and communication systems. The U.S. Department of Defense (DoD) allocates a substantial portion of its budget to cybersecurity, focusing on protecting critical infrastructure and countering increasing cyber threats. The region also benefits from collaborative efforts between government agencies and private sector companies to enhance cybersecurity measures. The presence of cutting-edge research facilities and the adoption of emerging technologies like AI and machine learning in cybersecurity further drive market growth.

Europe: Strong Focus on Cybersecurity Collaboration

Europe's defense cybersecurity market is driven by a strong focus on collaboration among member countries for cybersecurity. The European Defense Fund and initiatives like the Permanent Structured Cooperation (PESCO) project underline the region's commitment to enhancing cybersecurity capabilities. Countries like the UK, France, and Germany are leading in this space.

Asia-Pacific: Rising Investments in Defense and Cybersecurity

The defense cybersecurity market in the Asia-Pacific region is undergoing notable growth, propelled by rising geopolitical tensions and a substantial surge in investments in defense capabilities Countries like China, India, and Japan are channeling considerable resources into reinforcing their cybersecurity infrastructure, intending to fortify protection against cyber threats. This collective commitment is a primary catalyst for the robust growth observed in the market within the region.

Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Defence Cybersecurity Market Key Player Analysis

In the realm of the Defense Cybersecurity Market, a domain crucial for national security, the listed companies assume a pivotal role in fortifying defense systems against cyber threats. Leading the charge are industry giants such as Lockheed Martin Corporation and BAE Systems, offering advanced cybersecurity solutions customized to meet the specific requirements of defense. Their strategic emphasis on innovative technologies and robust cybersecurity frameworks holds substantial influence in enhancing the sector's resilience against the ever-evolving landscape of cyber threats.

Accenture and IBM Corporation bring their extensive expertise in IT and cybersecurity to the defense sector, offering a blend of cutting-edge technologies and strategic consulting services. Their positioning emphasizes the integration of cybersecurity into broader defense strategies.

Defence Cybersecurity Industry Key Players

- Accenture (Ireland)

- DXC Technology Company

- BAE Systems

- Lockheed Martin Corporation

- Cisco Systems, Inc.

- Leidos Holding Inc. (US)

- AT&T

- Boeing

- EclecticIQ B.V.

- IBM Corporation (US)

Recent Development

- December 2023 - SimSpace, a US-based market leader in military-grade cybersecurity, today announced that it has closed a $45 million equity raise led by L2 Point Management, a private investment firm specializing in flexible capital solutions for growth companies. This investment brings the total capital raised by SimSpace over the past year to $70 million and will support the company’s continued growth trajectory, including its expansion into new geographies.

- In 2023 Managed cybersecurity services provider BlueVoyant Inc. announced today that it has acquired cyber defense company Conquest Cyber LLC and raised $140 million in new funding to accompany the acquisition

- April 2023 The first few months of 2023 witnessed a tremendous number of mergers and acquisitions (M&A) and capital placement activity in the cybersecurity segment. Highlighted below are 22 transactions, which are a representative sample of transactions that occurred in the cybersecurity market.

Report Scope

Report Features Description Market Value (2023) USD 24.56 Billion Forecast Revenue (2033) USD 81.6 Billion CAGR (2024-2032) 13.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Platform(Software & Service, Hardware), By Solution(Cyber Threat Protection, Threat Evaluation, Security and Vulnerability Management, Data loss Prevention Management, Enterprise Risk and Compliance, Content Security, Others) By Type(Critical Infrastructure Security & Resilience, Application Security, Cloud Security, Others), By End User(Land Force, Naval Force, Air Force) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Accenture (Ireland), DXC Technology Company, BAE Systems, Lockheed Martin Corporation, Cisco Systems, Inc., Leidos Holding Inc. (US), AT&T, Boeing, EclecticIQ B.V., IBM Corporation (US) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-