Data Discovery Market Covid-19 Impact Analysis, Drivers, Restraints, Opportunities, Threats, Trends, Applications, And Growth Forecast To 2031

-

24951

-

March 2023

-

173

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

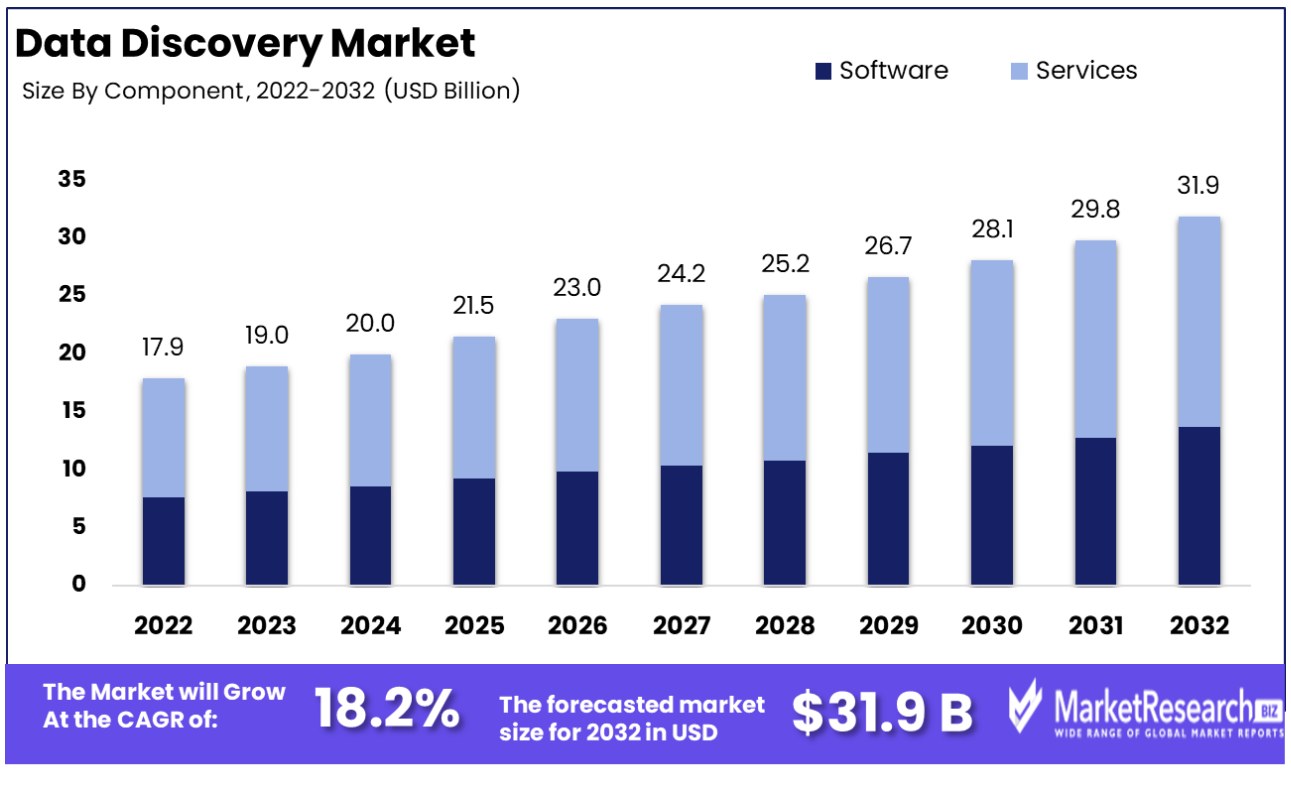

The data discovery market was valued at USD 17.9 billion in 2022. It is expected to reach USD 31.9 billion in 2032, at a CAGR of 18.2% during the forecast period from 2023 to 2032.

The rise in demand for structured and unstructured information is the main driving factor of the data discovery market. Structure data includes the names, addresses, and dates that can be searched easily by comparison.

Whereas, unstructured data includes everything starting from social media posts to video & audio files, emails, and images. Unstructured data generates about 90% of all information globally. Though structured data contributes a small amount of percentage to existing data, it is still considered more valuable as it is much easier to handle and extract the information.

Structure data in the data discovery market plays an important role in various industries from business and finance to healthcare and education. It is used in data analysis to help organizations get valuable insights from their information.

This information is used to make decision-making processes, enhance operations, and predict market trends. For example, in the healthcare sector, structured data helps in maintaining patient health records that allow medical experts to access the information and standardize it. It also improves patient safety and helps in diagnosis and other medical research.

Moreover, in the retail business, it helps to maintain inventory records. In many businesses structured data helps to track product sales, and consumer preferences and improve the shopping experience. Whereas, banks depend on these structured data to keep accurate records of customer’s money, and transactions and control regulatory compliance.

Additionally, data discovery does not require the creation of complex models by the business users. Several businesses depend upon data discovery for their business intelligence software, which provides them with a complete overview of their business in a visual pattern.

It helps the business to understand the market trends and other sorts of information and also data discovery uses structural diagrams, text, and visual storytelling methods to analyze the business. Non-IT individuals can decode multiple amounts of information and obtain the data they want instantly. By following this method data discovery can democratize data analysis for all the working employees in the organization. This market is rapidly expanding and is likely to surge during the forecast period.

Driving Factors

Growing Need to Discover Sensitive Structured and Unstructured Data Drives Market Growth

The growing need to discover sensitive structured and unstructured data is a primary driver for the expansion of the data discovery market. In the digital age, organizations are inundated with vast volumes of data, both in traditional databases and unstructured formats like emails, documents, and social media. Identifying and managing sensitive information within this data is crucial for compliance, risk management, and decision-making.

As businesses recognize the importance of understanding what data they possess and its potential risks or values, the demand for data discovery tools that can efficiently scan, categorize, and analyze this information grows. This trend is likely to persist, driven by the increasing complexity and volume of data generated, necessitating advanced solutions for data discovery and management.

Increasing Investments in Data Privacy with Evolving Regulations Boosts Market

Increasing investments in data privacy, spurred by evolving global regulations like GDPR, are significantly boosting the data discovery market. Compliance with these regulations requires organizations to have a clear understanding and control over the data they hold, particularly personal and sensitive information. This has led to increased demand for data discovery tools that enable businesses to locate, classify, and monitor data in line with regulatory requirements.

The emphasis on data privacy and security is not just a compliance issue but also a matter of corporate responsibility and trust. As regulations continue to evolve and more regions implement their data protection laws, the necessity for robust data discovery solutions becomes more pronounced, promising continued market growth.

Growing Adoption of AI and Machine Learning Propels Market Innovation

The growing adoption of artificial intelligence (AI) and machine learning (ML) is propelling the data discovery market to new heights. AI and ML technologies enhance the capabilities of data discovery tools by enabling more efficient processing, pattern recognition, and predictive analytics. This integration allows for more sophisticated analysis and understanding of large data sets, making the discovery process faster and more insightful.

The incorporation of AI and ML in data discovery tools is not just an enhancement but a transformation, shifting the market towards more intelligent and autonomous solutions. This trend is anticipated to continue, with AI and ML driving innovation and expanding the possibilities of what data discovery platforms can achieve.

Growing Adoption of Big Data Analytics Enhances Market Scope

The growing adoption of big data analytics is significantly enhancing the scope of the data discovery market. As organizations increasingly leverage big data for strategic insights, the need to efficiently navigate and make sense of this data becomes critical. Data discovery tools play a vital role in this context, providing the means to extract actionable insights from vast and varied data sources.

The synergy between big data analytics and data discovery is creating new opportunities for market growth. As big data technologies evolve, so does the need for advanced data discovery solutions capable of handling the complexity and scale of big data.

Restraining Factors

Lack of Awareness About Data Discovery Tools Restrains Market Growth

The growth of the data discovery market is hindered by a general lack of awareness about these tools and their benefits. Many organizations, especially small to medium-sized businesses, may not fully understand how data discovery solutions can enhance decision-making and operational efficiency. This lack of awareness results in slow adoption rates as potential users may not recognize the value these tools bring or how they could be integrated into their existing systems. Increasing awareness and demonstrating the tangible benefits of data discovery tools are crucial to expanding their market presence.

High Implementation Costs of Data Discovery Solutions Restrain Market Growth

High implementation costs significantly limit the expansion of the data discovery market. The development, deployment, and maintenance of effective data discovery solutions often require substantial investment, particularly for comprehensive and advanced systems. This financial barrier can be prohibitive for smaller organizations or those with limited IT budgets, leading them to opt for more basic, less costly alternatives. Overcoming cost concerns, possibly through scalable solutions or as-a-service models, is essential for broader market adoption.

Data Discovery Market Segment Analysis

By Component

The software segment dominates the data discovery market. This predominance is attributed to the increasing need for organizations to gain insights from large volumes of data. Data discovery software provides tools for data aggregation, processing, visualization, and analysis, helping businesses make informed decisions. The growth is propelled by advancements in AI and machine learning, enabling more sophisticated and automated data analysis.

While services are less dominant, they play a crucial role in supporting the software segment. Services include consulting, implementation, and ongoing support, which are essential for the successful deployment and utilization of data discovery solutions.

By Deployment

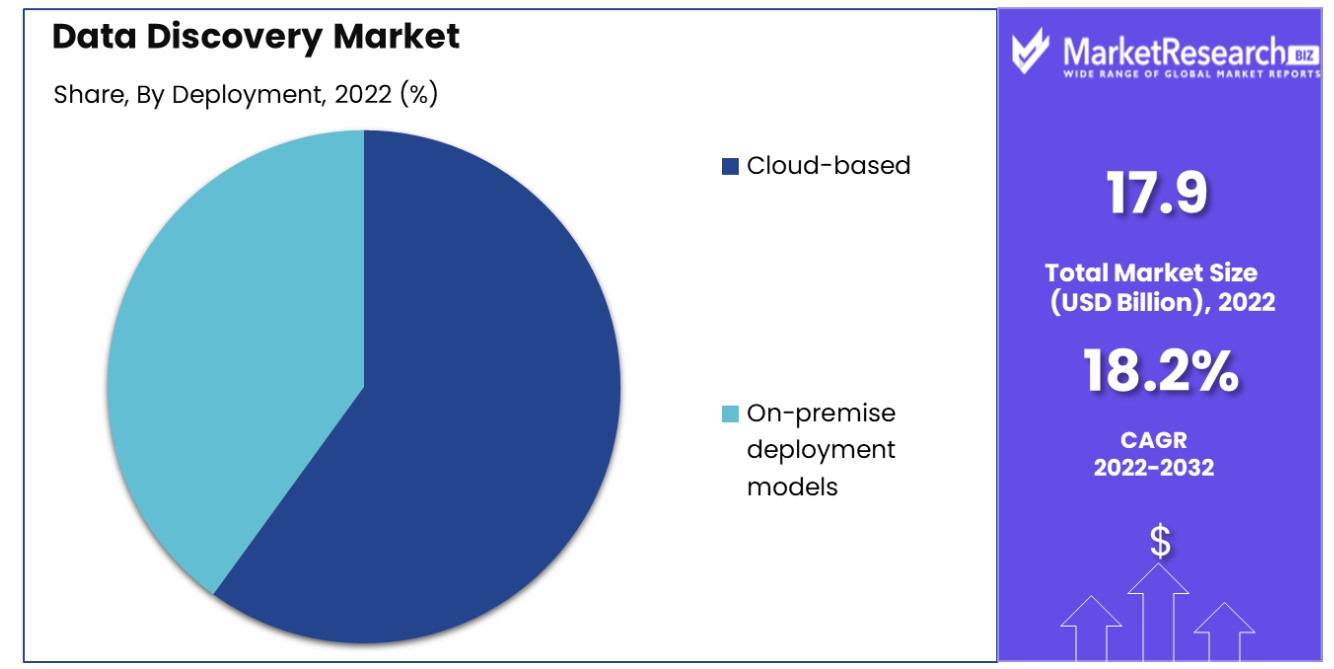

Cloud-based deployment leads the market, offering scalability, flexibility, and cost-effectiveness. The growth of cloud computing has made data discovery tools more accessible to a broader range of businesses, including SMEs. Cloud deployment also facilitates real-time data analysis and collaboration across locations.

On-premise solutions, while not as prevalent, are important for organizations requiring enhanced data security and control, particularly in sectors like BFSI and government.

By Organization Size

SMEs are increasingly adopting data discovery tools to remain competitive and data-driven. Cloud-based solutions have lowered the entry barrier, enabling SMEs to leverage advanced data analysis capabilities.

Large enterprises have been traditional users of data discovery tools, utilizing them for complex data analysis and strategic decision-making across various departments.

By Functionality

Visual data discovery is at the forefront due to its user-friendly approach to data analysis, enabling users to interact with data visually. This functionality is key for driving user adoption and facilitating quicker insights.

Augmented data discovery incorporates AI and machine learning for more advanced analysis. Search-based discovery allows users to find data using natural language queries. Self-service data preparation tools enable users to clean and organize data independently.

By Application

In the realm of applications, security, and risk management take precedence. Data discovery tools are crucial in identifying and mitigating risks, ensuring compliance, and enhancing overall security posture.

Sales and marketing use data discovery for customer insights and market trends analysis. Asset and supply chain management applications focus on optimizing operations and reducing inefficiencies.

By Vertical

Each vertical presents unique opportunities and requirements for data discovery. BFSI focuses on risk analysis and customer data management, healthcare on patient data and research, retail on consumer behavior, and manufacturing on process optimization. Media and entertainment, telecommunications and IT, and energy and utilities use data discovery for various operational, customer-related, and innovation-driven purposes.

The data discovery market is driven by the increasing demand for software that enables comprehensive data analysis, with a significant shift towards cloud-based solutions. Visual data discovery is leading in functionality due to its accessibility and effectiveness. Security and risk management applications are paramount, reflecting the growing need for data-driven decision-making in mitigating risks. The market's expansion across different organization sizes and industry verticals indicates its broadening scope and relevance in the modern data-centric business environment.

Component:

- Software

- Services

Deployment:

- Cloud-based

- On-premise deployment models

Organization size:

- Small and medium-sized enterprises (SMEs)

- Large enterprises

Functionality:

- Visual data discovery

- Augmented data discovery

- Search-based data discovery

- Self-service data preparation

Application:

- Security and risk management

- Sales and marketing management

- Asset management

- Supply chain management

Vertical:

- BFSI

- Government

- Healthcare and life sciences

- Retail

- Manufacturing

- Media and entertainment

- Telecommunications and IT

- Energy and utilities

Growth Opportunities

Growing Trends in Self-Service Business Intelligence (BI) Tools Drive Market Opportunities in Data Discovery

The proliferation of self-service business intelligence (BI) tools is a significant driver of growth in the data discovery market. As businesses increasingly empower non-technical users to access and analyze data independently, the demand for intuitive data discovery solutions rises. These tools enable users to explore and visualize data, fostering better decision-making and insights. Vendors specializing in user-friendly data discovery platforms are well-positioned for expansion, catering to the growing need for accessible and agile data exploration, thereby contributing to the overall growth of the data discovery market.

Growing Importance of Data-Driven Decision-Making Propels Market Growth in Data Discovery

The increasing importance of data-driven decision-making is a pivotal factor fueling market growth in the data discovery industry. Organizations across sectors recognize that data insights are essential for competitive advantage and operational efficiency. Data discovery solutions play a critical role in this transformation, enabling users to uncover valuable insights from data. Vendors providing robust data discovery platforms that facilitate informed and data-backed decision-making are well-positioned to capitalize on this trend. The alignment with the broader shift towards data-driven strategies enhances the overall market potential and expansion prospects.

Increasing Demand for Predictive Analytics Spurs Opportunities in Data Discovery Market

The rising demand for predictive analytics is a key driver of market opportunities in the data discovery sector. Predictive analytics empowers businesses to anticipate future trends, behaviors, and outcomes based on historical data. Data discovery tools that integrate predictive capabilities offer added value to organizations seeking proactive insights. Companies specializing in data discovery solutions that facilitate predictive modeling and forecasting are positioned for growth. This trend reflects the growing appetite for data-driven foresight and strategy formulation, contributing to the expansion of the data discovery market as a whole.

Regional Analysis

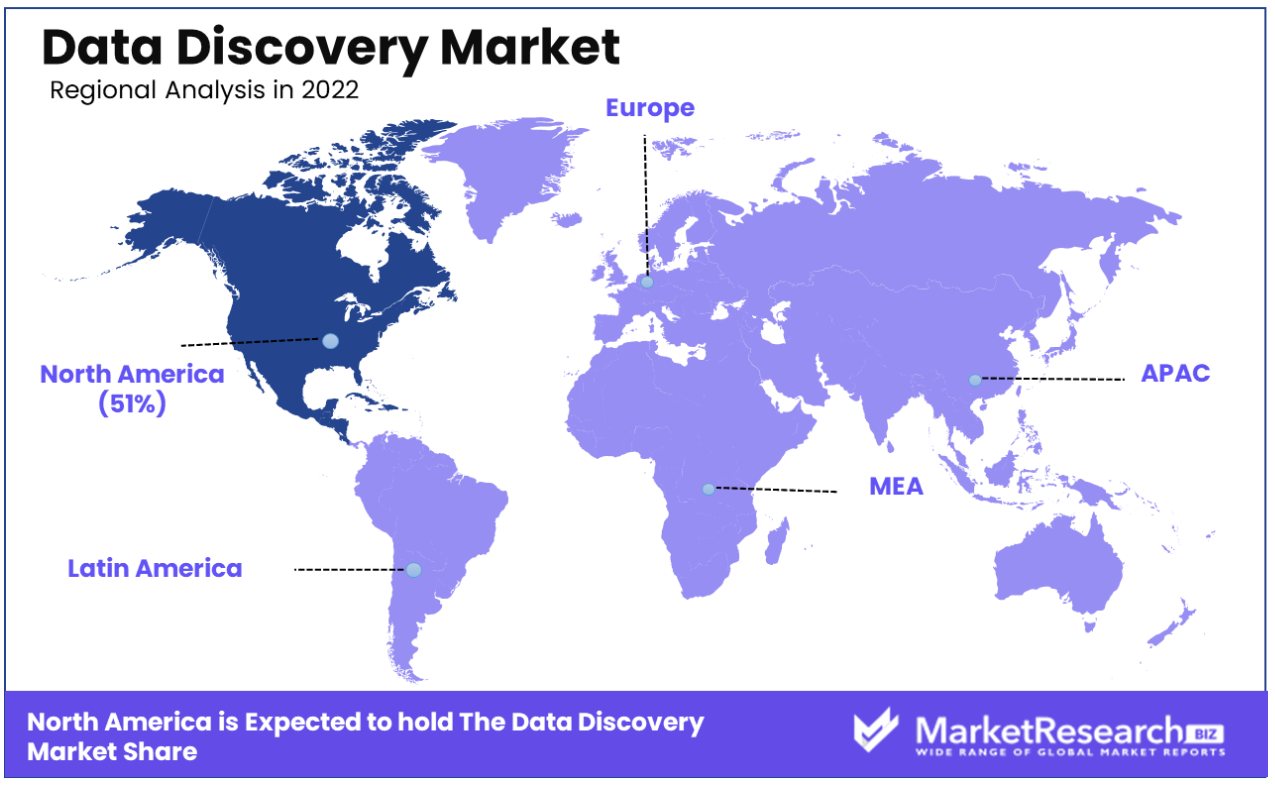

North America Dominates with 51% Market Share in the Data Discovery Market

North America leads the data discovery market with a commanding 51% share. This dominance is primarily driven by the region's advanced technological infrastructure, the presence of major global technology companies, and a strong culture of data-driven decision-making in business operations. The United States, in particular, has been a pioneer in developing and adopting new technologies in data analytics and business intelligence.

The market dynamics in North America are further influenced by high investments in big data and analytics, a robust startup ecosystem constantly innovating in the data discovery space, and stringent data governance and compliance regulations that necessitate effective data management tools.

Forecast implications suggest that North America will continue to be a key player in the data discovery market. The growing emphasis on data privacy and security, coupled with the increasing adoption of cloud-based technologies and machine learning, is expected to further drive market growth. Additionally, the expansion of industries such as healthcare, retail, and finance that heavily rely on data analytics will contribute to sustaining the region's market dominance.

Europe:

Europe's data discovery market is growing steadily, propelled by the increasing adoption of GDPR (General Data Protection Regulation) and other data protection laws, which necessitate advanced data management solutions. The market benefits from a strong focus on data privacy and security, driving demand for sophisticated data discovery tools.

The European market is expected to continue its growth trajectory, with increasing investments in digital transformation initiatives across various industries, and the rising need for data compliance and governance.

Asia-Pacific:

The Asia-Pacific region is rapidly emerging as a significant market for data discovery, driven by digitalization and economic growth in countries like China, India, and Japan. The region's expanding IT sector, coupled with the increasing adoption of analytics and business intelligence tools in SMEs and large enterprises, is fueling this growth.

The future of the data discovery market in Asia-Pacific looks promising, with potential growth driven by the region's burgeoning e-commerce, manufacturing, and healthcare sectors. Moreover, the growing focus on data-driven decision-making in the business sector is likely to further boost demand for data discovery solutions.

Data Discovery Industry by Region

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Key Player Overview: Data Discovery Market

The data discovery market is characterized by the presence of established technology giants and specialized data analytics firms, each contributing significantly to the industry's evolution. IBM Corporation, Microsoft, Oracle Corporation, and SAP are notable for their comprehensive analytics solutions, extensive enterprise software portfolios, and global market presence. Their strategic positioning emphasizes advanced analytics, AI integration, and cloud computing, setting industry benchmarks.

Salesforce.com, inc., SAS Institute Inc., and Google bring to the market a strong focus on customer relationship management and digital analytics, capitalizing on their expertise in cloud-based solutions and AI-driven analytics. Amazon Web Services, Inc. and HP Enterprise are pivotal in providing robust cloud infrastructure and services, supporting the data discovery needs of various organizations.

Micro Focus and Thales offer unique solutions in data security and governance, aligning with increasing concerns about data privacy and compliance. Cloudera, Inc., Databricks, and Tibco Software Inc. specialize in big data analytics and data integration, catering to the demand for processing large and complex data sets.

Alteryx, Inc., Qlik Technologies, Inc., and Tableau Software LLC stand out for their user-friendly data discovery tools, making analytics accessible to a broader range of business users. MicroStrategy, Inc. and Panorama Software focus on BI and analytics platforms, enhancing decision-making capabilities in businesses.

Overall, these key players, through their varied strategic approaches, from comprehensive enterprise solutions to specialized analytics tools, drive the data discovery market, catering to a wide range of business needs and advancing their capabilities in data analysis and insights generation.

Major Companies in the Data Discovery Market

- IBM Corporation (US)

- Microsoft (US)

- Oracle (US)

- Salesforce.com, inc. (US)

- SAS Institute Inc. (US)

- Google (US)

- Amazon Web Services, Inc. (US)

- Micro Focus (UK)

- Thales (US)

- Cloudera, Inc. (US)

- Alteryx, Inc. (US)

- PKWARE, Inc. (US)

- Spirion, LLC. (US)

- Egnyte, Inc. (US)

- Oracle Corporation

- SAP

- MicroStrategy, Inc.

- Qlik Technologies, Inc.

- Tibco Software Inc.

- Platform

- Datameer Inc.

- Tableau Software LLC

- Systems, Applications & Products in Data Processing

- ClearStory Data Inc.

- Cloudera Inc.

- Databricks

- Panorama Software

- HP Enterprise

- Aegis Softtech

- Crest Infosystems Pvt. Ltd.

Recent Developments

- In September 2022, Alation Inc. raised $123 million in funding to expand its data intelligence platform capabilities in data discovery, governance, and cataloging.

- Microsoft added new data discovery features to Azure Purview in 2022, including integration with Microsoft Power BI to find sensitive data faster.

- Data discovery vendor Collibra acquired OwlDQ, a data quality start-up, in March 2022 to integrate automated data quality checks into its platform.

Report Features Description Market Value (2022) USD 17.9 billion Forecast Revenue (2032) USD 31.9 billion CAGR (2023-2032) 18.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Deployment:(Cloud-based, On-premise deployment models), Organization size:(Small and medium-sized enterprises (SMEs), Large enterprises), Functionality:Visual data discovery, Augmented data discovery, Search-based data discovery, Self-service data preparation), Application:(Security and risk management, Sales and marketing management, , Supply chain management), Vertical:(BFSI, Government, Healthcare and life sciences, , Manufacturing, , Energy and utilities) Regional Analysis North America - The US, Canada, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape IBM Corporation (US), Microsoft (US), Oracle (US), Salesforce, com, inc, (US), SAS Institute Inc., (US), Google (US), Amazon Web Services, Inc., (US), Micro Focus (UK), Thales (US), Cloudera, Inc, (US), Alteryx, Inc, (US), PKWARE, Inc, (US), Spirion, LLC, (US), Egnyte, Inc, (US), Oracle Corporation, SAP, MicroStrategy, Inc, Qlik Technologies, Inc, Tibco Software Inc, Platform, Datameer Inc, Tableau Software LLC, Systems, Applications & Products in Data Processing, ClearStory Data Inc, Cloudera Inc, Databricks, Panorama Software, HP Enterprise, Aegis Softtech, Crest Infosystems Pvt Ltd, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- IBM Corporation (US)

- Microsoft (US)

- Oracle (US)

- Salesforce.com, inc. (US)

- SAS Institute Inc. (US)

- Google (US)

- Amazon Web Services, Inc. (US)

- Micro Focus (UK)

- Thales (US)

- Cloudera, Inc. (US)

- Alteryx, Inc. (US)

- PKWARE, Inc. (US)

- Spirion, LLC. (US)

- Egnyte, Inc. (US)

- Oracle Corporation

- SAP

- MicroStrategy, Inc.

- Qlik Technologies, Inc.

- Tibco Software Inc.

- Platform

- Datameer Inc.

- Tableau Software LLC

- Systems, Applications & Products in Data Processing

- ClearStory Data Inc.

- Cloudera Inc.

- Databricks

- Panorama Software

- HP Enterprise

- Aegis Softtech

- Crest Infosystems Pvt. Ltd.