Data Center Storage Market By Deployment (Storage Area Network (SAN) System, Network-attached storage (NAS) System, Direct-Attached Storage (DAS) System)), By End-User (IT & Telecommunications, BFSI, Government, Healthcare, Other End-Users), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

40528

-

Aug 2023

-

195

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

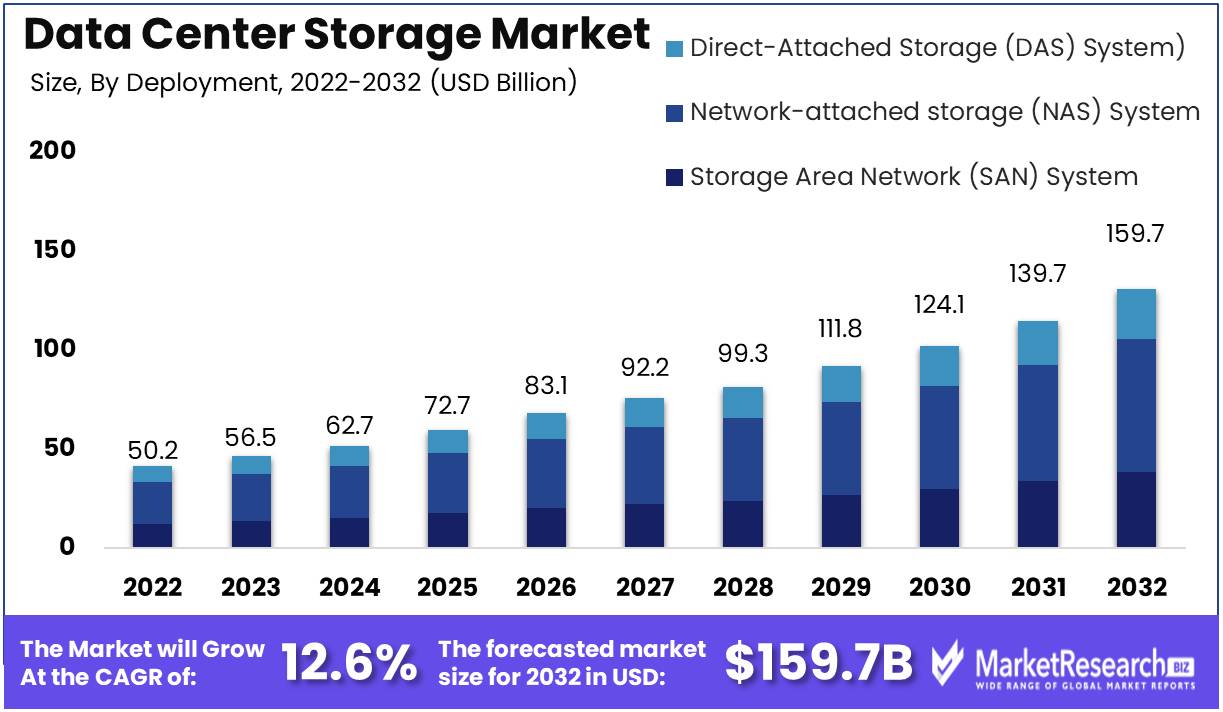

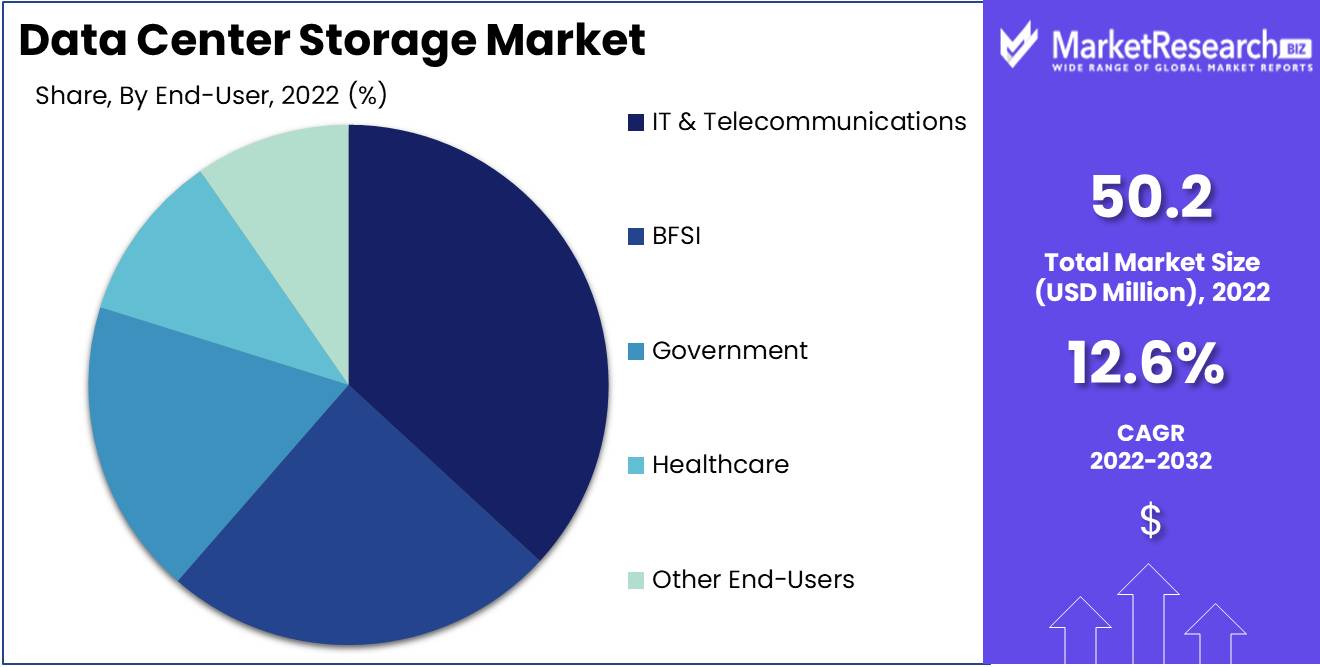

Data Center Storage Market size is expected to be worth around USD 159.7 Bn by 2032 from USD 50.2 Bn in 2022, growing at a CAGR of 12.6% during the forecast period from 2023 to 2032.

The data center storage market has seen significant growth in recent years, with companies and organizations increasingly relying on data storage solutions to manage their ever-expanding data needs. The data center storage market, highlights its definition, goals, importance, advantages, notable innovations, major investments, growth and applications, industries investing in this market, major drivers, ethical concerns, and responsible data center storage practices.

The data center storage market caters to organizations seeking efficient and scalable solutions for data storage and access. It plays a vital role in modern businesses, as data drives decision-making, enhances customer experiences, and boosts operational efficiency. Innovations like SSDs, flash storage, and SDS have improved performance and reliability.

Technology giants like Amazon, Google, and Microsoft have heavily invested in the market by integrating storage solutions into their cloud services. This integration offers flexibility and cost-effectiveness to organizations for managing their data. The data center storage market's growth is fueled by cloud adoption, mobile device proliferation, big data analytics, and the demand from emerging industries like AI and IoT.

Industries such as healthcare, finance, retail, manufacturing, and telecommunications are increasingly adopting data center storage solutions to drive innovation and gain a competitive edge. However, this growth has raised ethical concerns about data privacy and responsible data storage practices. Ensuring transparency, accountability, and compliance with data protection regulations is essential.

Apart from addressing ethical considerations, data center storage solutions find diverse business applications. They support data-intensive tasks like big data analytics, AI, and machine learning, enabling organizations to gain valuable insights and drive business growth. Responsible data governance frameworks and robust security measures are crucial to protect data and uphold ethical standards in the market.

Driving Factors

Increasing Data Volumes and Storage Needs

In the digital era, data explosion has become undeniable, fueled by smartphones, social media, and internet-enabled devices. The data center storage market experiences soaring demand as businesses seek efficient solutions for managing and analyzing ever-increasing data volumes. Coping with this immense influx necessitates robust storage infrastructures.

Growth of Cloud Computing and Big Data Analytics

Cloud computing has revolutionized data storage by offering unlimited resources and scalable solutions. It empowers organizations to manage data efficiently, avoiding high infrastructure expenses. With off-site storage and processing, businesses gain flexibility and agility to meet their storage needs. Big data analytics is now a crucial part of strategies, enabling data-driven decisions. Success hinges on reliable and efficient data center storage solutions.

Expansion of Data-Intensive Applications

Artificial Intelligence (AI) and the Internet of Things (IoT) have transformed technology interactions, ushering in a data-driven era with significant business impacts. These data-intensive applications require robust storage solutions to manage the immense amount of data they produce. For AI, powerful data centers are essential for learning, analysis, and accurate predictions. Similarly, the IoT's real-time data from interconnected devices demand reliable data center storage to optimize operations and enhance customer experiences.

Advancements in Storage Technologies and Architectures

As data volumes surge, storage technologies evolve to meet modern business needs. Traditional solutions are insufficient, driving significant advancements. Cutting-edge data center storage now features SSDs, SDS, and hyper-converged infrastructure, offering superior performance, scalability, and reliability, while ensuring data integrity and resilience.

Rising Demand for Data Backup and Disaster Recovery Solutions

Businesses understand the disastrous impact of data loss or disruption. Therefore, they now prioritize reliable data backup and disaster recovery solutions. This trend has led to a surge in demand for secure data center storage, ensuring confidence in protecting valuable information from unforeseen events and minimizing downtime.

Restraining Factors

Potential Data Security and Privacy Concerns in Data Center Storage Market

Data security and privacy concerns are critical restraining factors in the data center storage market. Organizations must protect sensitive information from cyberattacks and unauthorized access to avoid legal consequences and loss of customer trust. To instill confidence, data center storage providers must implement robust security measures like advanced encryption algorithms, access controls, and regular security audits.

Potential Complexity in Data Migration and Management

Another significant restraint faced by the data center storage market is the potential complexity in data migration and management. As businesses grow and evolve, they often face the daunting task of transferring their data to a new storage solution or platform. This process requires meticulous planning, extensive coordination, and advanced data migration tools to ensure a smooth transition without any loss or corruption of valuable data. Moreover, managing and organizing vast amounts of data can be an intricate and time-consuming process, necessitating efficient data management systems and practices.

Potential Energy and Cooling Challenges in Data Centers

With the exponential increase in data generation, energy consumption in data centers has become a pressing concern. The immense power requirements of data storage systems can strain existing power infrastructures, leading to potential energy shortages and increased operational costs. Additionally, the heat generated by the hardware and servers within data centers requires efficient cooling mechanisms to prevent overheating and equipment failure. Data center storage providers must implement energy-efficient technologies, such as server virtualization, efficient cooling systems, and renewable energy sources, to mitigate these challenges and promote sustainable practices.

Potential Compatibility Issues with Legacy Systems of the Data Center Storage Market

The data center storage market also faces potential compatibility issues with legacy systems. Many organizations still rely on outdated infrastructure and legacy storage systems that may not seamlessly integrate with modern data center solutions. To ensure compatibility and avoid disruptions, data center storage providers must offer robust integration capabilities and provide extensive support to assist businesses with the migration from legacy systems to more advanced storage solutions. Adapting to the requirements of legacy systems helps organizations smoothly transition into newer data center storage technologies, thereby enhancing their operational efficiency and competitiveness.

Covid-19 Impact on Data Center Storage Market

The COVID-19 pandemic had a profound impact on the global data center storage market. Lockdowns and remote work spurred a surge in demand for secure data centers. Providers quickly expanded to meet new requirements and invested in cutting-edge technology to support increased online activities like e-commerce and video streaming.

Remote work necessitated robust data center storage to facilitate cloud-based applications and virtual meetings. Businesses had to scale up data centers to ensure seamless connectivity for remote employees. This shift to remote work also accelerated digital transformation, with companies adopting cloud computing and data analytics at an unprecedented pace, driving demand for scalable data center solutions.

Security and privacy concerns heightened as more sensitive data was stored in data centers. Organizations sought providers with robust security measures and compliance with regulations to protect against cyber threats and data breaches. Meeting these concerns effectively could boost search engine rankings for data center providers.

Despite the challenges, the data center storage market found opportunities in innovation and adaptability. Providers offered hybrid cloud infrastructure and scalable storage options to optimize strategies and improve operational efficiency. As remote work and digital transformation persist, data center providers offering flexible, secure solutions will have a competitive edge and higher search engine rankings.

Deployment Analysis

The deployment analysis of the network-attached storage (NAS) system segment in the data center storage market reveals its dominant position in the industry. NAS systems have gained immense popularity due to their efficiency, scalability, and cost-effectiveness. These systems provide a centralized storage solution that is easily accessible by multiple clients, making them the preferred choice for various organizations.

The data center storage market is witnessing the ascendance of network-attached storage (NAS) systems as the leading player. Their reliability and efficiency attract organizations of all sizes, thanks to centralized storage allowing simultaneous data access and sharing. The sought-after flexibility and scalability of NAS systems are particularly appealing amid the increasing demand for integration with cloud computing and virtualization technologies. Moreover, these systems deliver high-speed data transfer rates, ensuring quick and efficient access to stored data.

The growth of emerging economies has spurred NAS system adoption as organizations expand operations, necessitating scalable storage solutions. With rising SMEs in these economies seeking affordable storage, NAS systems provide cost-effective options without compromising performance. This fosters economic development while meeting storage needs.

In recent years, consumer trends have shown a positive inclination towards NAS systems, driven by the surge in digital data and multimedia usage. Reliability and data security are paramount for consumers, making NAS systems an ideal choice. Moreover, the growing demand is fueled by remote work and collaboration needs, as these systems enable easy access and sharing of data from any location, boosting productivity. Additionally, consumers seek seamless integration with smartphones and tablets, which NAS systems efficiently provide.

End User Analysis

The IT & Telecommunications segment dominates the data center storage market due to its data-intensive operations. Telecommunication companies handle vast voice and data traffic, while IT firms manage storage for various applications. The rise of cloud computing and content delivery services has further increased their demand for data centers and storage solutions. Additionally, the mobile data boom, IoT applications, and big data analytics contribute to their significant reliance on data center storage.

As service providers, IT & Telecommunications companies must meet diverse client needs, driving investment in robust data center infrastructures. They also embrace virtualization and software-defined storage technologies for enhanced efficiency and flexibility. The competitive nature of the industry prompts continuous investments to maintain a competitive edge. However, the market dynamics may change over time as other sectors experience data growth and seek data center storage solutions.

While the IT & Telecommunications segment currently dominates the data center storage market, other industries may catch up due to their increasing data demands. As more sectors adopt cloud computing and digitization, data center storage will become crucial across various domains. Ongoing advancements and the ever-changing landscape will shape the future of the data center storage market.

Key Market Segments

By Deployment

- Storage Area Network (SAN) System

- Network-attached storage (NAS) System

- Direct-Attached Storage (DAS) System)

By End-User

- IT & Telecommunications

- BFSI

- Government

- Healthcare

- Other End-Users

Growth Opportunity

Expanding into Emerging Markets with Digital Transformation Initiatives

One of the significant growth opportunities in the data center storage market lies in expanding into emerging markets. As businesses worldwide are undergoing digital transformation, markets that were once untapped are now rich with potential. Countries in Asia, Africa, and Latin America are witnessing rapid advancements in technology adoption and digital infrastructure. By strategically entering these markets, organizations can tap into new customer bases and fuel their growth.

Collaboration with Cloud Service Providers and Data Center Operators

Collaboration with cloud service providers and data center operators is another pivotal opportunity for participants in the data center storage market. Cloud computing has revolutionized the way businesses operate, offering scalability, flexibility, and cost-efficiency. Data center storage providers can form partnerships with cloud service providers and data center operators to offer comprehensive and integrated storage solutions, catering to the evolving needs of businesses. Such collaborations enable seamless data management across both on-premises and cloud environments, enhancing efficiency and data accessibility.

Adoption of Software-Defined Storage and Hyperconverged Infrastructure

Software-defined storage (SDS) and hyper-converged infrastructure (HCI) have transformed the data center storage landscape. SDS allows organizations to separate storage hardware from software, streamlining management through a centralized interface. This flexibility optimizes storage usage, reduces costs, and boosts agility. Similarly, HCI consolidates storage, computing, and virtualization into a single platform, simplifying management and ensuring scalability. Embracing SDS and HCI offers data center storage providers the chance to offer customers scalable, agile, and cost-effective solutions for their needs.

Focus on Data Center Efficiency and Green Storage Solutions

In response to mounting concerns over energy consumption and environmental sustainability, the focus on data center efficiency and eco-friendly storage solutions has intensified. The energy-intensive operations and carbon footprint associated with data centers have sparked the need for innovative cooling technologies, optimized energy usage, and eco-conscious practices. By providing energy-efficient storage solutions that offer high capacity and performance, while consuming less power and space, data center storage providers empower organizations to achieve sustainability objectives without sacrificing storage needs. This emphasis on green storage solutions and data center efficiency is poised to foster growth and pave the way for a greener, more sustainable future.

Latest Trends

Growth of Solid-State Drives (SSDs) and Flash Storage

The data center storage market witnesses a notable trend - the rapid rise of solid-state drives (SSDs) and flash storage solutions. SSDs offer faster data transfer, higher IOPS, and lower latency than traditional HDDs, making them the favored storage for mission-critical applications and high-performance data centers. Beyond speed, SSDs boast superior reliability, lower power consumption, and reduced physical space, prompting organizations to transition from HDD to SSD-based infrastructure for improved system performance and data center efficiency across industries.

Utilization of Data Deduplication and Compression Technologies

Data center administrators face growing challenges with data volume, storage capacity, and management. To overcome this, data deduplication and compression have emerged as vital solutions, optimizing storage efficiency and cost reduction. Deduplication stores unique data instances, saving significant space, is ideal for repetitive data like virtual machine images, backups, and archives. Additionally, compression encodes data in a compact format, further optimizing storage usage.

Rise of Software-Defined Storage and Storage Virtualization

Software-defined storage (SDS) marks a paradigm shift in storage infrastructure provisioning and management. Decoupling software from hardware enhances flexibility, scalability, and cost-efficiency, enabling organizations to leverage commodity hardware, automate provisioning, and allocate resources dynamically based on demand. SDS's key component, storage virtualization, unifies storage devices into a pool, offering centralized management, simplified provisioning, and seamless scalability. Embracing SDS and storage virtualization empowers data centers with increased agility, reduced hardware expenses, and enhanced data protection.

Adoption of Hybrid and Multi-Cloud Storage Architectures

As organizations embrace cloud computing's benefits, hybrid and multi-cloud storage architectures gain traction. Hybrid storage combines on-premises and cloud advantages, leveraging scalability and cost-effectiveness while retaining data control. Multi-cloud storage uses multiple providers for redundancy, risk mitigation, and performance optimization, ensuring resilience and cost efficiency based on workload requirements.

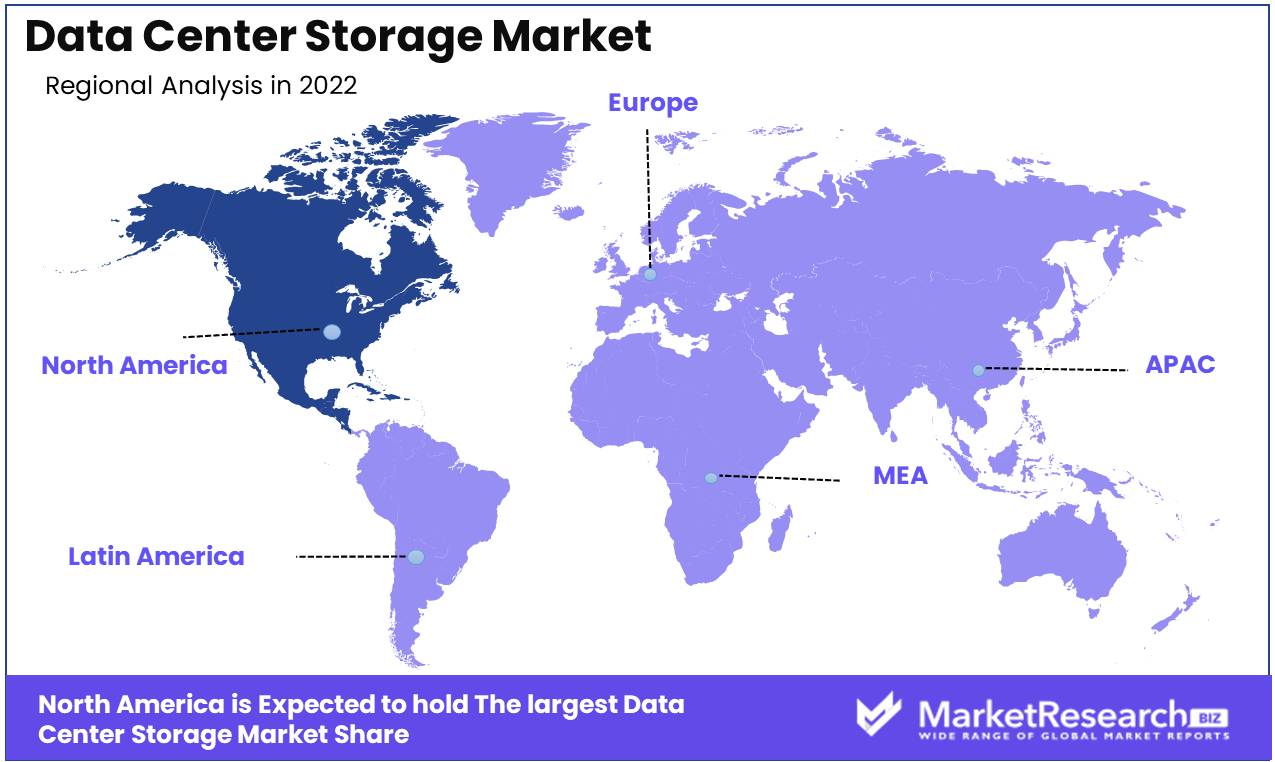

Regional Analysis

The Data Center Storage Market is Predominated by North America. In the fast-paced world of technology, data storage is crucial for businesses around the world to maintain high-performance operations. As businesses increase their digital footprint and adopt innovations such as cloud computing and big data analytics, the demand for dependable data center storage solutions soars. North America emerges as a dominant force among the main players in this dynamic market, driving innovation and capturing a significant market share.

The market for data center storage in North America is dominated by its advanced infrastructure, technological expertise, and favorable business environment. The region's extensive network of state-of-the-art data centers ensures dependability, scalability, and security, processing vast data volumes at lightning-fast speeds to satisfy businesses' ever-increasing storage requirements.

Its robust digital economy and flourishing business landscape also contribute to the region's dominance. North America fosters a favorable environment for both new and established businesses, luring investment and fostering entrepreneurship. A plethora of venture capital and an innovation-friendly ecosystem enables businesses to develop disruptive technologies and acquire a competitive edge in the global marketplace. Combined with a strong emphasis on digital transformation, this business-friendly environment has positioned North America as a prominent hub for data center storage solutions.

In terms of market share, North America dominates the global data center storage market, holding a sizeable share. The region's strong presence is evidenced by its lucrative partnerships, strategic alliances, and major storage providers' capacity expansions. As more businesses adopt hybrid and multi-cloud strategies, the demand for efficient and scalable data center storage solutions continues to increase. With its well-established infrastructure and technological prowess, North America is perfectly positioned to meet and exceed these demands.

North America recognizes the importance of staying ahead of the curve in order to maintain its dominance. Focusing on emerging technologies such as artificial intelligence, machine learning, and edge computing, the region invests significantly in research and development. By harnessing the power of these disruptive technologies, North America hopes not only to improve the performance of data center storage, but also to investigate new growth and innovation opportunities.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Lenovo, a Chinese multinational technology corporation, has become a major participant in the data center storage market. Lenovo satisfies the diverse requirements of businesses in a variety of industries by providing a robust portfolio of high-performance storage solutions. Lenovo's offerings include all-flash arrays, software-defined storage solutions, and scalable storage systems, which increase their clients' efficiency and agility.

Oracle Corporation, a software and hardware industry titan, extends its expertise to the data center storage market. Oracle enables organizations to effectively leverage the power of data by providing a comprehensive array of storage solutions, including hybrid storage systems and cloud-based storage services. Their emphasis on assuring data security, scalability, and seamless integration has made them a globally trusted option for businesses.

IBM, a technological pioneer, has solidified its position as a major player in the data center storage market. IBM offers a variety of storage solutions for organizations of all sizes, drawing on its extensive industry experience. From software-defined storage to high-performance flash systems, IBM's products are renowned for their dependability, scalability, and advanced data management capabilities.

Hitachi, a multinational conglomerate, has made substantial contributions to the data center storage market with its extensive selection of solutions. Hitachi's storage portfolio includes virtualization, unified storage, and data protection, among other features. Their dedication to innovation combined with their extensive knowledge of storage technologies positions them as a market leader.

Top Key Players in Data Center Storage Market

- Hewlett Packard Enterprise Development LP (U.S.)

- Dell Inc(U.S.)

- Lenovo (China)

- Orcale (U.S.)

- IBM (U.S.)

- Hitachi (Japan)

- Fujitsu (Japan)

- Silicon Graphics International Corp. (U.S.)

- NEC Corporation (Japan)

- Huawei Technologies Co. Ltd. (China)

- Intel Corporation (U.S.)

- AVADirect Custom Computers (U.S.)

- Schneider Electric (France)

- Trend Micro Incorporated (U.S.)

- Egenera Inc (U.S.)

- Western Digital Corporation (U.S.)

- Toshiba CORPORATION (Japan)

- AmZetta Technologies (U.S.)

Recent Development

- In 2023, Seagate officially announced the launch of its highly anticipated line of data center storage drives, engineered with a focus on energy efficiency. Set to revolutionize the market, these new drives are expected to deliver substantial power savings while maintaining exceptional performance and reliability. Seagate's commitment to sustainability and environmental consciousness promises to elevate the efficiency standards of data center storage solutions.

- In 2022, Western Digital made a strategic move to bolster its data center storage presence by expanding its production capacity in China. This expansion signals the company's dedication to meeting the growing demand for advanced storage solutions in one of the world's largest markets. By enhancing its manufacturing capabilities, Western Digital aims to offer an increased range of cutting-edge storage products catering to the evolving needs of data centers.

- In 2021, Micron Technology entered into a pivotal partnership with Google to develop innovative data center storage technologies. This alliance combines Micron's expertise in memory and storage solutions with Google's extensive research and development capabilities. The two industry giants aim to enhance the performance, reliability, and scalability of data center storage systems, anticipating groundbreaking breakthroughs for the industry as a whole.

- In 2020, Intel's acquisition of Habana Labs showcased its commitment to revolutionizing the data center storage landscape. Habana Labs stands out for its expertise in developing cutting-edge storage chips, enabling enhanced throughput, improved acceleration capabilities, and superior overall performance. Intel's strategic move to incorporate these advanced storage technologies emphasizes its determination to drive innovation within the data center sector.

Report Scope

Report Features Description Market Value (2022) USD 50.2 Bn Forecast Revenue (2032) USD 159.7 Bn CAGR (2023-2032) 12.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment (Storage Area Network (SAN) System, Network-attached storage (NAS) System, Direct-Attached Storage (DAS) System))

By End-User (IT & Telecommunications, BFSI, Government, Healthcare, Other End-Users)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Hewlett Packard Enterprise Development LP (U.S.), Dell Inc(U.S.), Lenovo (China), Orcale (U.S.), IBM (U.S.), Hitachi (Japan), Fujitsu (Japan), Silicon Graphics International Corp. (U.S.), NEC Corporation (Japan), Huawei Technologies Co. Ltd. (China), Intel Corporation (U.S.), AVADirect Custom Computers (U.S.), Schneider Electric (France), Trend Micro Incorporated (U.S.), Egenera Inc (U.S.), Western Digital Corporation (U.S.), Toshiba CORPORATION (Japan), AmZetta Technologies (U.S.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Data Center Storage Market Overview

- 2.1. Data Center Storage Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Data Center Storage Market Dynamics

- 3. Global Data Center Storage Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Data Center Storage Market Analysis, 2016-2021

- 3.2. Global Data Center Storage Market Opportunity and Forecast, 2023-2032

- 3.3. Global Data Center Storage Market Analysis, Opportunity and Forecast, By Deployment, 2016-2032

- 3.3.1. Global Data Center Storage Market Analysis By Deployment: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Deployment, 2016-2032

- 3.3.3. Storage Area Network (SAN) System

- 3.3.4. Network-attached storage (NAS) System

- 3.3.5. Direct-Attached Storage (DAS) System)

- 3.4. Global Data Center Storage Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 3.4.1. Global Data Center Storage Market Analysis By End-User: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 3.4.3. IT & Telecommunications

- 3.4.4. BFSI

- 3.4.5. Government

- 3.4.6. Healthcare

- 3.4.7. Other End-Users

- 4. North America Data Center Storage Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Data Center Storage Market Analysis, 2016-2021

- 4.2. North America Data Center Storage Market Opportunity and Forecast, 2023-2032

- 4.3. North America Data Center Storage Market Analysis, Opportunity and Forecast, By Deployment, 2016-2032

- 4.3.1. North America Data Center Storage Market Analysis By Deployment: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Deployment, 2016-2032

- 4.3.3. Storage Area Network (SAN) System

- 4.3.4. Network-attached storage (NAS) System

- 4.3.5. Direct-Attached Storage (DAS) System)

- 4.4. North America Data Center Storage Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 4.4.1. North America Data Center Storage Market Analysis By End-User: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 4.4.3. IT & Telecommunications

- 4.4.4. BFSI

- 4.4.5. Government

- 4.4.6. Healthcare

- 4.4.7. Other End-Users

- 4.5. North America Data Center Storage Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Data Center Storage Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Data Center Storage Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Data Center Storage Market Analysis, 2016-2021

- 5.2. Western Europe Data Center Storage Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Data Center Storage Market Analysis, Opportunity and Forecast, By Deployment, 2016-2032

- 5.3.1. Western Europe Data Center Storage Market Analysis By Deployment: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Deployment, 2016-2032

- 5.3.3. Storage Area Network (SAN) System

- 5.3.4. Network-attached storage (NAS) System

- 5.3.5. Direct-Attached Storage (DAS) System)

- 5.4. Western Europe Data Center Storage Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 5.4.1. Western Europe Data Center Storage Market Analysis By End-User: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 5.4.3. IT & Telecommunications

- 5.4.4. BFSI

- 5.4.5. Government

- 5.4.6. Healthcare

- 5.4.7. Other End-Users

- 5.5. Western Europe Data Center Storage Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Data Center Storage Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Data Center Storage Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Data Center Storage Market Analysis, 2016-2021

- 6.2. Eastern Europe Data Center Storage Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Data Center Storage Market Analysis, Opportunity and Forecast, By Deployment, 2016-2032

- 6.3.1. Eastern Europe Data Center Storage Market Analysis By Deployment: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Deployment, 2016-2032

- 6.3.3. Storage Area Network (SAN) System

- 6.3.4. Network-attached storage (NAS) System

- 6.3.5. Direct-Attached Storage (DAS) System)

- 6.4. Eastern Europe Data Center Storage Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 6.4.1. Eastern Europe Data Center Storage Market Analysis By End-User: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 6.4.3. IT & Telecommunications

- 6.4.4. BFSI

- 6.4.5. Government

- 6.4.6. Healthcare

- 6.4.7. Other End-Users

- 6.5. Eastern Europe Data Center Storage Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Data Center Storage Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Data Center Storage Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Data Center Storage Market Analysis, 2016-2021

- 7.2. APAC Data Center Storage Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Data Center Storage Market Analysis, Opportunity and Forecast, By Deployment, 2016-2032

- 7.3.1. APAC Data Center Storage Market Analysis By Deployment: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Deployment, 2016-2032

- 7.3.3. Storage Area Network (SAN) System

- 7.3.4. Network-attached storage (NAS) System

- 7.3.5. Direct-Attached Storage (DAS) System)

- 7.4. APAC Data Center Storage Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 7.4.1. APAC Data Center Storage Market Analysis By End-User: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 7.4.3. IT & Telecommunications

- 7.4.4. BFSI

- 7.4.5. Government

- 7.4.6. Healthcare

- 7.4.7. Other End-Users

- 7.5. APAC Data Center Storage Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Data Center Storage Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Data Center Storage Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Data Center Storage Market Analysis, 2016-2021

- 8.2. Latin America Data Center Storage Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Data Center Storage Market Analysis, Opportunity and Forecast, By Deployment, 2016-2032

- 8.3.1. Latin America Data Center Storage Market Analysis By Deployment: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Deployment, 2016-2032

- 8.3.3. Storage Area Network (SAN) System

- 8.3.4. Network-attached storage (NAS) System

- 8.3.5. Direct-Attached Storage (DAS) System)

- 8.4. Latin America Data Center Storage Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 8.4.1. Latin America Data Center Storage Market Analysis By End-User: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 8.4.3. IT & Telecommunications

- 8.4.4. BFSI

- 8.4.5. Government

- 8.4.6. Healthcare

- 8.4.7. Other End-Users

- 8.5. Latin America Data Center Storage Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Data Center Storage Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Data Center Storage Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Data Center Storage Market Analysis, 2016-2021

- 9.2. Middle East & Africa Data Center Storage Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Data Center Storage Market Analysis, Opportunity and Forecast, By Deployment, 2016-2032

- 9.3.1. Middle East & Africa Data Center Storage Market Analysis By Deployment: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Deployment, 2016-2032

- 9.3.3. Storage Area Network (SAN) System

- 9.3.4. Network-attached storage (NAS) System

- 9.3.5. Direct-Attached Storage (DAS) System)

- 9.4. Middle East & Africa Data Center Storage Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 9.4.1. Middle East & Africa Data Center Storage Market Analysis By End-User: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 9.4.3. IT & Telecommunications

- 9.4.4. BFSI

- 9.4.5. Government

- 9.4.6. Healthcare

- 9.4.7. Other End-Users

- 9.5. Middle East & Africa Data Center Storage Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Data Center Storage Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Data Center Storage Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Data Center Storage Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Data Center Storage Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Hewlett Packard Enterprise Development LP (U.S.)

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Dell Inc(U.S.)

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Lenovo (China)

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Orcale (U.S.)

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. IBM (U.S.)

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Hitachi (Japan)

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Fujitsu (Japan)

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Silicon Graphics International Corp. (U.S.)

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. NEC Corporation (Japan)

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Huawei Technologies Co. Ltd. (China)

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13. Intel Corporation (U.S.)

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. AVADirect Custom Computers (U.S.)

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Schneider Electric (France)

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Trend Micro Incorporated (U.S.)

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Egenera Inc (U.S.)

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 11.18. Western Digital Corporation (U.S.)

- 11.18.1. Company Overview

- 11.18.2. Financial Highlights

- 11.18.3. Product Portfolio

- 11.18.4. SWOT Analysis

- 11.18.5. Key Strategies and Developments

- 11.19. Toshiba CORPORATION (Japan)

- 11.19.1. Company Overview

- 11.19.2. Financial Highlights

- 11.19.3. Product Portfolio

- 11.19.4. SWOT Analysis

- 11.19.5. Key Strategies and Developments

- 11.20. AmZetta Technologies (U.S.)

- 11.20.1. Company Overview

- 11.20.2. Financial Highlights

- 11.20.3. Product Portfolio

- 11.20.4. SWOT Analysis

- 11.20.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

List of Figures

- Figure 1: Global Data Center Storage Market Revenue (US$ Mn) Market Share By Deployment in 2022

- Figure 2: Global Data Center Storage Market Attractiveness Analysis By Deployment, 2016-2032

- Figure 3: Global Data Center Storage Market Revenue (US$ Mn) Market Share By End-Userin 2022

- Figure 4: Global Data Center Storage Market Attractiveness Analysis By End-User, 2016-2032

- Figure 5: Global Data Center Storage Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Data Center Storage Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Data Center Storage Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Data Center Storage Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Data Center Storage Market Revenue (US$ Mn) Comparison By Deployment (2016-2032)

- Figure 10: Global Data Center Storage Market Revenue (US$ Mn) Comparison By End-User (2016-2032)

- Figure 11: Global Data Center Storage Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Data Center Storage Market Y-o-Y Growth Rate Comparison By Deployment (2016-2032)

- Figure 13: Global Data Center Storage Market Y-o-Y Growth Rate Comparison By End-User (2016-2032)

- Figure 14: Global Data Center Storage Market Share Comparison by Region (2016-2032)

- Figure 15: Global Data Center Storage Market Share Comparison By Deployment (2016-2032)

- Figure 16: Global Data Center Storage Market Share Comparison By End-User (2016-2032)

- Figure 17: North America Data Center Storage Market Revenue (US$ Mn) Market Share By Deploymentin 2022

- Figure 18: North America Data Center Storage Market Attractiveness Analysis By Deployment, 2016-2032

- Figure 19: North America Data Center Storage Market Revenue (US$ Mn) Market Share By End-Userin 2022

- Figure 20: North America Data Center Storage Market Attractiveness Analysis By End-User, 2016-2032

- Figure 21: North America Data Center Storage Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Data Center Storage Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Data Center Storage Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Data Center Storage Market Revenue (US$ Mn) Comparison By Deployment (2016-2032)

- Figure 26: North America Data Center Storage Market Revenue (US$ Mn) Comparison By End-User (2016-2032)

- Figure 27: North America Data Center Storage Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Data Center Storage Market Y-o-Y Growth Rate Comparison By Deployment (2016-2032)

- Figure 29: North America Data Center Storage Market Y-o-Y Growth Rate Comparison By End-User (2016-2032)

- Figure 30: North America Data Center Storage Market Share Comparison by Country (2016-2032)

- Figure 31: North America Data Center Storage Market Share Comparison By Deployment (2016-2032)

- Figure 32: North America Data Center Storage Market Share Comparison By End-User (2016-2032)

- Figure 33: Western Europe Data Center Storage Market Revenue (US$ Mn) Market Share By Deploymentin 2022

- Figure 34: Western Europe Data Center Storage Market Attractiveness Analysis By Deployment, 2016-2032

- Figure 35: Western Europe Data Center Storage Market Revenue (US$ Mn) Market Share By End-Userin 2022

- Figure 36: Western Europe Data Center Storage Market Attractiveness Analysis By End-User, 2016-2032

- Figure 37: Western Europe Data Center Storage Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Data Center Storage Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Data Center Storage Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Data Center Storage Market Revenue (US$ Mn) Comparison By Deployment (2016-2032)

- Figure 42: Western Europe Data Center Storage Market Revenue (US$ Mn) Comparison By End-User (2016-2032)

- Figure 43: Western Europe Data Center Storage Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Data Center Storage Market Y-o-Y Growth Rate Comparison By Deployment (2016-2032)

- Figure 45: Western Europe Data Center Storage Market Y-o-Y Growth Rate Comparison By End-User (2016-2032)

- Figure 46: Western Europe Data Center Storage Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Data Center Storage Market Share Comparison By Deployment (2016-2032)

- Figure 48: Western Europe Data Center Storage Market Share Comparison By End-User (2016-2032)

- Figure 49: Eastern Europe Data Center Storage Market Revenue (US$ Mn) Market Share By Deploymentin 2022

- Figure 50: Eastern Europe Data Center Storage Market Attractiveness Analysis By Deployment, 2016-2032

- Figure 51: Eastern Europe Data Center Storage Market Revenue (US$ Mn) Market Share By End-Userin 2022

- Figure 52: Eastern Europe Data Center Storage Market Attractiveness Analysis By End-User, 2016-2032

- Figure 53: Eastern Europe Data Center Storage Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Data Center Storage Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Data Center Storage Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Data Center Storage Market Revenue (US$ Mn) Comparison By Deployment (2016-2032)

- Figure 58: Eastern Europe Data Center Storage Market Revenue (US$ Mn) Comparison By End-User (2016-2032)

- Figure 59: Eastern Europe Data Center Storage Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Data Center Storage Market Y-o-Y Growth Rate Comparison By Deployment (2016-2032)

- Figure 61: Eastern Europe Data Center Storage Market Y-o-Y Growth Rate Comparison By End-User (2016-2032)

- Figure 62: Eastern Europe Data Center Storage Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Data Center Storage Market Share Comparison By Deployment (2016-2032)

- Figure 64: Eastern Europe Data Center Storage Market Share Comparison By End-User (2016-2032)

- Figure 65: APAC Data Center Storage Market Revenue (US$ Mn) Market Share By Deploymentin 2022

- Figure 66: APAC Data Center Storage Market Attractiveness Analysis By Deployment, 2016-2032

- Figure 67: APAC Data Center Storage Market Revenue (US$ Mn) Market Share By End-Userin 2022

- Figure 68: APAC Data Center Storage Market Attractiveness Analysis By End-User, 2016-2032

- Figure 69: APAC Data Center Storage Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Data Center Storage Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Data Center Storage Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Data Center Storage Market Revenue (US$ Mn) Comparison By Deployment (2016-2032)

- Figure 74: APAC Data Center Storage Market Revenue (US$ Mn) Comparison By End-User (2016-2032)

- Figure 75: APAC Data Center Storage Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Data Center Storage Market Y-o-Y Growth Rate Comparison By Deployment (2016-2032)

- Figure 77: APAC Data Center Storage Market Y-o-Y Growth Rate Comparison By End-User (2016-2032)

- Figure 78: APAC Data Center Storage Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Data Center Storage Market Share Comparison By Deployment (2016-2032)

- Figure 80: APAC Data Center Storage Market Share Comparison By End-User (2016-2032)

- Figure 81: Latin America Data Center Storage Market Revenue (US$ Mn) Market Share By Deploymentin 2022

- Figure 82: Latin America Data Center Storage Market Attractiveness Analysis By Deployment, 2016-2032

- Figure 83: Latin America Data Center Storage Market Revenue (US$ Mn) Market Share By End-Userin 2022

- Figure 84: Latin America Data Center Storage Market Attractiveness Analysis By End-User, 2016-2032

- Figure 85: Latin America Data Center Storage Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Data Center Storage Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Data Center Storage Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Data Center Storage Market Revenue (US$ Mn) Comparison By Deployment (2016-2032)

- Figure 90: Latin America Data Center Storage Market Revenue (US$ Mn) Comparison By End-User (2016-2032)

- Figure 91: Latin America Data Center Storage Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Data Center Storage Market Y-o-Y Growth Rate Comparison By Deployment (2016-2032)

- Figure 93: Latin America Data Center Storage Market Y-o-Y Growth Rate Comparison By End-User (2016-2032)

- Figure 94: Latin America Data Center Storage Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Data Center Storage Market Share Comparison By Deployment (2016-2032)

- Figure 96: Latin America Data Center Storage Market Share Comparison By End-User (2016-2032)

- Figure 97: Middle East & Africa Data Center Storage Market Revenue (US$ Mn) Market Share By Deploymentin 2022

- Figure 98: Middle East & Africa Data Center Storage Market Attractiveness Analysis By Deployment, 2016-2032

- Figure 99: Middle East & Africa Data Center Storage Market Revenue (US$ Mn) Market Share By End-Userin 2022

- Figure 100: Middle East & Africa Data Center Storage Market Attractiveness Analysis By End-User, 2016-2032

- Figure 101: Middle East & Africa Data Center Storage Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Data Center Storage Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Data Center Storage Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Data Center Storage Market Revenue (US$ Mn) Comparison By Deployment (2016-2032)

- Figure 106: Middle East & Africa Data Center Storage Market Revenue (US$ Mn) Comparison By End-User (2016-2032)

- Figure 107: Middle East & Africa Data Center Storage Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Data Center Storage Market Y-o-Y Growth Rate Comparison By Deployment (2016-2032)

- Figure 109: Middle East & Africa Data Center Storage Market Y-o-Y Growth Rate Comparison By End-User (2016-2032)

- Figure 110: Middle East & Africa Data Center Storage Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Data Center Storage Market Share Comparison By Deployment (2016-2032)

- Figure 112: Middle East & Africa Data Center Storage Market Share Comparison By End-User (2016-2032)

List of Tables

- Table 1: Global Data Center Storage Market Comparison By Deployment (2016-2032)

- Table 2: Global Data Center Storage Market Comparison By End-User (2016-2032)

- Table 3: Global Data Center Storage Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Data Center Storage Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Data Center Storage Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Data Center Storage Market Revenue (US$ Mn) Comparison By Deployment (2016-2032)

- Table 7: Global Data Center Storage Market Revenue (US$ Mn) Comparison By End-User (2016-2032)

- Table 8: Global Data Center Storage Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Data Center Storage Market Y-o-Y Growth Rate Comparison By Deployment (2016-2032)

- Table 10: Global Data Center Storage Market Y-o-Y Growth Rate Comparison By End-User (2016-2032)

- Table 11: Global Data Center Storage Market Share Comparison by Region (2016-2032)

- Table 12: Global Data Center Storage Market Share Comparison By Deployment (2016-2032)

- Table 13: Global Data Center Storage Market Share Comparison By End-User (2016-2032)

- Table 14: North America Data Center Storage Market Comparison By End-User (2016-2032)

- Table 15: North America Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Data Center Storage Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Data Center Storage Market Revenue (US$ Mn) Comparison By Deployment (2016-2032)

- Table 19: North America Data Center Storage Market Revenue (US$ Mn) Comparison By End-User (2016-2032)

- Table 20: North America Data Center Storage Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Data Center Storage Market Y-o-Y Growth Rate Comparison By Deployment (2016-2032)

- Table 22: North America Data Center Storage Market Y-o-Y Growth Rate Comparison By End-User (2016-2032)

- Table 23: North America Data Center Storage Market Share Comparison by Country (2016-2032)

- Table 24: North America Data Center Storage Market Share Comparison By Deployment (2016-2032)

- Table 25: North America Data Center Storage Market Share Comparison By End-User (2016-2032)

- Table 26: Western Europe Data Center Storage Market Comparison By Deployment (2016-2032)

- Table 27: Western Europe Data Center Storage Market Comparison By End-User (2016-2032)

- Table 28: Western Europe Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Data Center Storage Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Data Center Storage Market Revenue (US$ Mn) Comparison By Deployment (2016-2032)

- Table 32: Western Europe Data Center Storage Market Revenue (US$ Mn) Comparison By End-User (2016-2032)

- Table 33: Western Europe Data Center Storage Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Data Center Storage Market Y-o-Y Growth Rate Comparison By Deployment (2016-2032)

- Table 35: Western Europe Data Center Storage Market Y-o-Y Growth Rate Comparison By End-User (2016-2032)

- Table 36: Western Europe Data Center Storage Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Data Center Storage Market Share Comparison By Deployment (2016-2032)

- Table 38: Western Europe Data Center Storage Market Share Comparison By End-User (2016-2032)

- Table 39: Eastern Europe Data Center Storage Market Comparison By Deployment (2016-2032)

- Table 40: Eastern Europe Data Center Storage Market Comparison By End-User (2016-2032)

- Table 41: Eastern Europe Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Data Center Storage Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Data Center Storage Market Revenue (US$ Mn) Comparison By Deployment (2016-2032)

- Table 45: Eastern Europe Data Center Storage Market Revenue (US$ Mn) Comparison By End-User (2016-2032)

- Table 46: Eastern Europe Data Center Storage Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Data Center Storage Market Y-o-Y Growth Rate Comparison By Deployment (2016-2032)

- Table 48: Eastern Europe Data Center Storage Market Y-o-Y Growth Rate Comparison By End-User (2016-2032)

- Table 49: Eastern Europe Data Center Storage Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Data Center Storage Market Share Comparison By Deployment (2016-2032)

- Table 51: Eastern Europe Data Center Storage Market Share Comparison By End-User (2016-2032)

- Table 52: APAC Data Center Storage Market Comparison By Deployment (2016-2032)

- Table 53: APAC Data Center Storage Market Comparison By End-User (2016-2032)

- Table 54: APAC Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Data Center Storage Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Data Center Storage Market Revenue (US$ Mn) Comparison By Deployment (2016-2032)

- Table 58: APAC Data Center Storage Market Revenue (US$ Mn) Comparison By End-User (2016-2032)

- Table 59: APAC Data Center Storage Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Data Center Storage Market Y-o-Y Growth Rate Comparison By Deployment (2016-2032)

- Table 61: APAC Data Center Storage Market Y-o-Y Growth Rate Comparison By End-User (2016-2032)

- Table 62: APAC Data Center Storage Market Share Comparison by Country (2016-2032)

- Table 63: APAC Data Center Storage Market Share Comparison By Deployment (2016-2032)

- Table 64: APAC Data Center Storage Market Share Comparison By End-User (2016-2032)

- Table 65: Latin America Data Center Storage Market Comparison By Deployment (2016-2032)

- Table 66: Latin America Data Center Storage Market Comparison By End-User (2016-2032)

- Table 67: Latin America Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Data Center Storage Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Data Center Storage Market Revenue (US$ Mn) Comparison By Deployment (2016-2032)

- Table 71: Latin America Data Center Storage Market Revenue (US$ Mn) Comparison By End-User (2016-2032)

- Table 72: Latin America Data Center Storage Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Data Center Storage Market Y-o-Y Growth Rate Comparison By Deployment (2016-2032)

- Table 74: Latin America Data Center Storage Market Y-o-Y Growth Rate Comparison By End-User (2016-2032)

- Table 75: Latin America Data Center Storage Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Data Center Storage Market Share Comparison By Deployment (2016-2032)

- Table 77: Latin America Data Center Storage Market Share Comparison By End-User (2016-2032)

- Table 78: Middle East & Africa Data Center Storage Market Comparison By Deployment (2016-2032)

- Table 79: Middle East & Africa Data Center Storage Market Comparison By End-User (2016-2032)

- Table 80: Middle East & Africa Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Data Center Storage Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Data Center Storage Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Data Center Storage Market Revenue (US$ Mn) Comparison By Deployment (2016-2032)

- Table 84: Middle East & Africa Data Center Storage Market Revenue (US$ Mn) Comparison By End-User (2016-2032)

- Table 85: Middle East & Africa Data Center Storage Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Data Center Storage Market Y-o-Y Growth Rate Comparison By Deployment (2016-2032)

- Table 87: Middle East & Africa Data Center Storage Market Y-o-Y Growth Rate Comparison By End-User (2016-2032)

- Table 88: Middle East & Africa Data Center Storage Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Data Center Storage Market Share Comparison By Deployment (2016-2032)

- Table 90: Middle East & Africa Data Center Storage Market Share Comparison By End-User (2016-2032)

- 1. Executive Summary

-

- Hewlett Packard Enterprise Development LP (U.S.)

- Dell Inc(U.S.)

- Lenovo (China)

- Orcale (U.S.)

- IBM (U.S.)

- Hitachi (Japan)

- Fujitsu (Japan)

- Silicon Graphics International Corp. (U.S.)

- NEC Corporation (Japan)

- Huawei Technologies Co. Ltd. (China)

- Intel Corporation (U.S.)

- AVADirect Custom Computers (U.S.)

- Schneider Electric (France)

- Trend Micro Incorporated (U.S.)

- Egenera Inc (U.S.)

- Western Digital Corporation (U.S.)

- Toshiba CORPORATION (Japan)

- AmZetta Technologies (U.S.)