Dandruff Treatment Market By Treatment (Fluocinolone Shampoos, Ketoconazole Shampoos, Other), By Type (Fungal Dandruff, Dry Skin-Related Dandruff, Other), By End-Users (Hospitals, Specialty Clinics, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

38229

-

June 2023

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

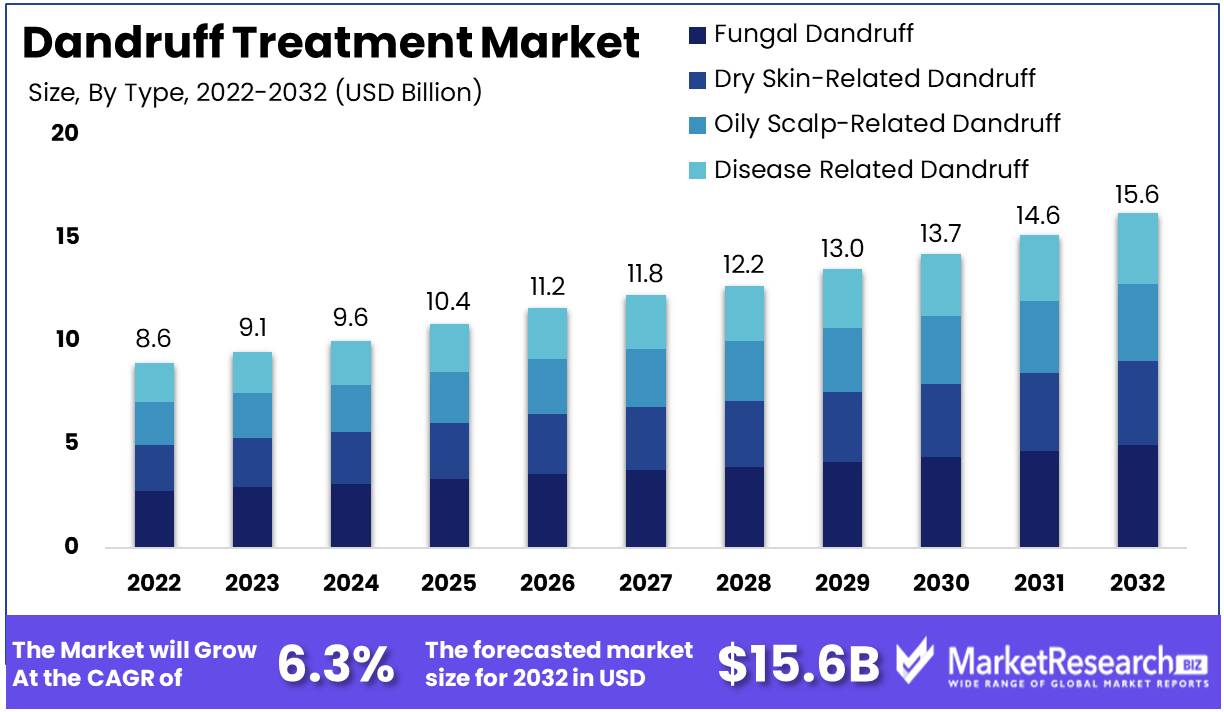

The global Dandruff Treatment Market size is expected to be worth around USD 15.6 Bn by 2032 from USD 8.6 Bn in 2022, growing at a CAGR of 6.3% during the forecast period from 2023 to 2032.

The dynamic and ever-changing global dandruff treatment market is driven by a multiplicity of complex factors that interweave to create a complex landscape. At its core is the rising prevalence of dandruff among the general population, which drives an insatiable demand for effective and quick treatments. This burgeoning market features a vast array of products, including shampoos, conditioners, hair lubricants, and specialized medicated treatments, each with its own advantages and disadvantages.

Dandruff, a condition that affects millions of people worldwide, manifests in the form of unsightly white granules that disfigure and irritate the scalp. As a holistic endeavor, the global dandruff treatment market seeks to mitigate this problem by providing a vast array of products and services that are meticulously designed to alleviate dandruff and revive scalp vitality.

The primary objective of the global dandruff treatment solutions market is to provide superior remedies to dandruff-stricken individuals. These multifaceted solutions cover a broad spectrum, comprising diverse treatments and products that have been meticulously designed to combat dandruff. As a means of ensuring socioeconomic equality, the market seeks to provide a diverse array of options, accommodating diverse consumer budgets and promoting widespread accessibility.

This dynamic and ever-evolving field is a hive of innovation, perpetually spawning ground-breaking solutions. Notable pioneering efforts include the creation of medicated shampoos and conditioners infused with scalp exfoliators, as well as hair oils enriched with essential oils boasting anti-inflammatory and antibacterial properties. These innovative formulations aim to effectively combat dandruff while nourishing and revitalizing the delicate scalp ecosystem.

Frontrunners in the personal care industry make significant investments in the global dandruff treatment market, channeling resources toward the incorporation of dandruff-fighting ingredients into their products and driving the search for novel solutions. Procter & Gamble, Johnson & Johnson, Unilever, and L'Oreal are examples of prominent stakeholders in this prospering industry.

It is crucial to comprehend the ramifications of the global dandruff treatment market, which reverberate across diverse industries such as personal care, cosmetics, and healthcare. Each industry offers a unique perspective that provides invaluable insight into the diverse preferences and needs of discriminating consumers.

Embracing a steadfast commitment to ethical and responsible business conduct, the global dandruff treatment market emphasizes the importance of transparency, explicability, and accountability in all operational aspects. Providing consumers with the ability to have confidence in the products and services they purchase and holding corporations accountable for their actions and practices remain central tenets of industry standards.

Driving factors

Advancements Boost Dandruff Market

The ongoing development of anti-dandruff formulations is another significant factor propelling the growth of the dandruff treatment market. Companies are investing significantly in research and development to develop more effective dandruff treatments that provide lasting relief. These innovations are likely to increase the overall efficacy of dandruff treatments, thereby making them more alluring to consumers and driving market sales growth.

Impact of Regulation on Dandruff Treatments

While the current regulatory environment for dandruff treatments is generally favorable, market-impacting changes are always possible. The formulation or marketing of dandruff treatments may be influenced by the introduction of new guidelines or requirements by regulatory bodies. Businesses operating in this market must closely monitor regulatory changes and adjust their strategies accordingly.

Technology and Natural Ingredients Transform the Dandruff Market

Several emerging technologies may also have an impact on the market for dandruff treatments. For instance, some companies are investigating the use of artificial intelligence and machine learning algorithms to develop more personalized remedies for individuals with specific scalp conditions. In addition, there is a growing interest in the use of natural or plant-based constituents in dandruff treatments, which could pose a threat to the market share of conventional anti-dandruff products.

Disruptors Challenge Dandruff Industry

As the market for dandruff treatments continues to expand, new competitors may emerge to challenge the status quo. New entrants may enter the market with innovative products or ingenious marketing strategies that radically alter the competitive landscape. To maintain their market share, incumbents must be able to acclimate to these changes and take action

Restraining Factors

Market Constraints for Dandruff Saturation, Adverse Effects, and Competition

Dandruff is one of the most common scalp conditions, affecting millions of people all over the globe. It is an aggravating and embarrassing condition that causes white flakes and itchiness on the scalp. The market for dandruff treatments is dynamic and competitive, with products ranging from anti-dandruff shampoos to natural remedies and at-home remedies. Several factors, including market saturation with existing treatments, potential side effects of anti-dandruff products, and fierce competition from natural and home remedies, are restraining the market's growth.

Saturation of the Market and Dandruff Treatments

Market saturation is a significant factor restraining the growth of the global dandruff treatment market. There is presently an abundance of anti-dandruff shampoos and scalp care products on the market, making it difficult for new entrants to gain market share. It is becoming increasingly difficult to make a new product stand out in a market already saturated with options. The market is dominated by well-established companies such as Head & Shoulders, Dove, and Neutrogena, leaving little space for innovative new companies.

Impact of Side Effects on the Dandruff Market

Potential side effects of anti-dandruff products are an additional factor restraining the global dandruff treatment market. Most anti-dandruff shampoos on the market contain sulfates and parabens as active constituents. These chemicals can cause skin irritation, dehydration, and allergic reactions. Consumers are becoming increasingly health-conscious and searching for natural alternatives devoid of harmful chemicals. This shift in consumer preferences is placing pressure on manufacturers to reduce the use of chemicals in their products and find natural alternatives.

Natural Remedies Challenge Dandruff Market

Competition from natural and home remedies is a significant factor restraining the global dandruff treatment market's growth. Because they are perceived to be safer and milder on the scalp, many consumers prefer natural remedies such as tea tree oil, apple cider vinegar, and aloe vera gel. Also acquiring popularity are home remedies such as baking soda paste, coconut oil, and lemon juice. These remedies are not only simple to prepare, but they are also inexpensive, making them a popular option among consumers.

Treatment Analysis

The Ketoconazole shampoo segment dominates the global dandruff treatment market, according to the latest market research. It accounts for most market share and is expected to continue its dominance. The market for shampoos is expected to grow at a significant rate over the next few years due to many factors such as economic development, consumer trends, and changing lifestyles.

Emerging economies are slowly seeing a rise in the use of Ketoconazole shampoos due to economic growth. Countries such as China, India, and Brazil are leading the way in terms of economic growth, and there is a growing demand for personal care products. In these economies, the market for Ketoconazole shampoos is expanding. As the global economy recovers from the recession, this trend is expected to continue.

Dandruff is a typical scalp issue for consumers. Thus, consumers are using Ketoconazole shampoos to treat dandruff. There is a growing trend toward natural and organic products without toxic ingredients. Such products are popular because they treat dandruff naturally without harming the scalp. The Ketoconazole shampoo segment's growth is due to its large choice of organic and chemical-free products.

The Ketoconazole shampoo segment is expected to grow the fastest. This growth can be ascribed to an increase in awareness of the benefits of Ketoconazole shampoos, a rise in disposable incomes among consumers, changing consumer preferences, and new product releases by Ketoconazole firms. As more companies enter the market, competition will increase, leading to product innovation, higher quality, and cheaper pricing, further driving this segment's growth.

Type Analysis

The fungal dandruff segment dominates the global dandruff treatment market. Fungus-induced dandruff is more severe. It accounts for a large market share and is expected to sustain dominance.

The introduction of new economies with rising disposable incomes is a growth factor for the fungal dandruff segment. These economies are seeing a rise in the number of consumers who can afford fungal dandruff shampoo. This trend is expected to continue, driving segment growth.

Consumers are becoming more aware of the seriousness of fungal dandruff and how it can lead to other scalp concerns. Thus, consumers seek specific shampoos to address the issue. The growth of the fungal dandruff segment is being driven by this trend and the rising desire for natural and organic products.

The fungal dandruff segment is expected to grow the fastest in the coming years because to factors such as a rise in disposable incomes, increasing consumer awareness, and product innovation. The segment is expected to gain from medical advances that will lead to better fungal dandruff treatment choices.

Distribution Channel Analysis

In terms of distribution channels, the retail pharmacy market segment dominates the global dandruff treatment market. Retail pharmacies offer many dandruff treatments. As a result, consumers choose to buy shampoos from retail pharmacies, leading to the segment's growth.

In emerging economies like China, India, and Brazil, where disposable incomes are rising, retail pharmacies are expanding their presence. This trend is driving the retail pharmacy segment of the dandruff treatment market.

Due to their accessibility and extensive selection of dandruff treatment products, consumers prefer to buy them from retail pharmacies. Retail pharmacists also advise consumers about products. Thus, the retail pharmacy segment is expected to grow.

The retail pharmacy segment is anticipated to grow at the fastest rate in the next years due to a rise in disposable incomes, an increase in the number of retail pharmacies in emerging economies, and a shift in customer behavior toward convenience and accessibility.

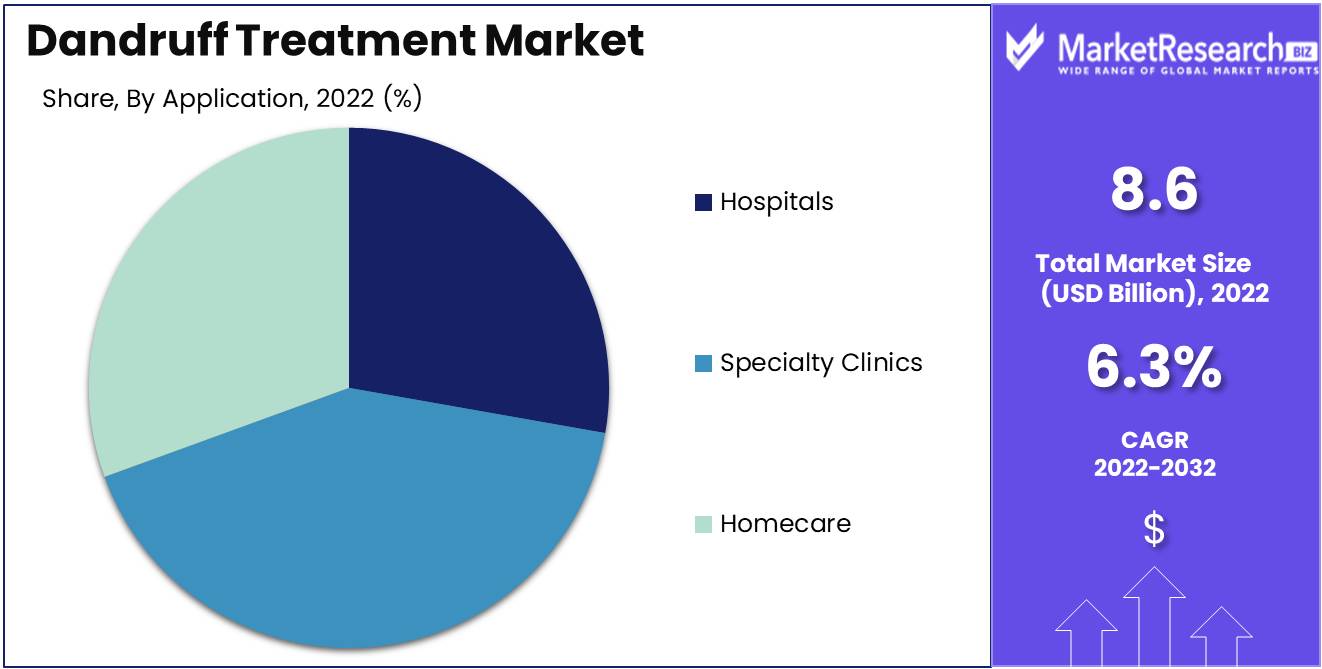

End-Users Analysis

The specialty clinics segment dominates the global dandruff treatment market in terms of end-users. For severe dandruff, specialty clinics offer treatment and medical advice. Patients prefer specialty clinics for treatment, leading to the segment's growth.

In growing economies with rising demand for specialist medical services, specialty clinics are extending their presence. This segment is driving the growth of the specialty market segment in the driving dandruff market.

The specialty clinics segment is anticipated to grow the fastest in the next years due to the rise in disposable incomes, the desire for specialized medical treatments, and advancements in medical technology and treatment alternatives.

Key Market Segments

By Treatment

- Fluocinolone shampoos

- Ketoconazole shampoos

- Selenium sulfide shampoos

- Shampoos containing salicylic acid

- Tar-based shampoos

- Pyrithione zinc shampoos

By Type

- Fungal Dandruff

- Dry Skin-Related Dandruff

- Oily Scalp-Related Dandruff

- Disease Related Dandruff

By Product

- Non-Medicated

- Medicated

By Drug Type

- Branded

- Generics

By Mode of Prescription

- Over-the-counter (OTC)

- Prescription

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Other Distribution Channel

By End-Users

- Hospitals

- Specialty Clinics

- Homecare

- Other End-Users

Growth Opportunity

The Global Dandruff Treatment Market is Expanding and Innovating

The Opportunity presents a growth opportunity for the global dandruff treatment market. Collaboration between dermatologists and product manufacturers for the creation of innovative and effective anti-dandruff remedies, expansion into emerging markets, and targeted marketing campaigns.

Market Expansion is Driven by Rising Demand for Effective Dandruff Treatments

As the world evolves, people tend to pay more attention to their personal hygiene and are becoming more aware of the significance of maintaining clean skin and hair. Dandruff is a common problem around the globe, and there is a growing demand for its treatment.

Emerging Markets Drive Dandruff Treatment Market Expansion

The development of innovative and effective anti-dandruff treatments is the key factor propelling the growth of the dandruff treatment market. Manufacturers are introducing new products to the market to meet the requirements of consumers thanks to technological advancements, research and development, and rising demand. Some brands, for instance, have introduced shampoos that are sulfate-free and infused with natural constituents such as tea tree oil, neem, aloe vera, etc., which aid in preventing dandruff without damaging the hair.

Targeted Advertising Promotes Market Expansion for Dandruff Treatments

The expansion into emerging markets is another factor fueling the growth of the market for dandruff treatments. In Asia-Pacific, Latin America, and Africa, where personal hygiene awareness is on the rise, there is a vast underserved market. The demand for anti-dandruff products is rising due to increased awareness, a rising incidence of dandruff, and a shift in lifestyle. Consequently, product manufacturers are increasing their presence in these markets and attracting a larger customer base.

Collaboration Among Dermatologists Drives the Dandruff Treatment Market

Any product's success depends on how well it is marketed to its intended market. In response to the increasing competition in the market for dandruff treatments, manufacturers are employing targeted marketing campaigns to build brand recognition, educate consumers, and attract new customers. Social media platforms, online advertising, and influencer marketing are some of the most widely used marketing strategies for promoting products.

Latest Trends

Competitive Innovations Dandruff Treatment Market

The global Dandruff Treatment Market is a substantial market for the treatment of dandruff, a common scalp condition. The market is extremely competitive, and the main players strive to gain a competitive edge by introducing new and innovative products that meet consumers' changing needs.

Growing Demand Scalp Health Products

In recent years, consumers have taken a greater interest in their scalp health. They now prefer products that not only address dandruff symptoms but also maintain the health of their scalp. As a result, the market has witnessed a surge in demand for products focused on scalp health. These products contain soothing and nourishing ingredients for the scalp. They prevent the formation of dandruff and stimulate hair growth. Various types of shampoos, conditioners, and serums are available as products aimed at scalp health.

Natural Revolution Organic Dandruff Treatments

The shift towards natural and organic anti-dandruff formulations is another significant market trend in the global dandruff treatment market. Consumers are becoming increasingly health-conscious and are beginning to favor products without hazardous chemicals. They now prefer plant-based ingredients with anti-inflammatory and antimicrobial properties, such as tea tree oil, aloe vera oil, and lavender oil. Natural and organic dandruff treatments are also mild on the scalp, making them ideal for those with sensitive skin.

Tech Integration Personalized Dandruff Solutions

Technology advancements have led to the incorporation of technology into dandruff treatment options. The use of wearable devices and apps has resulted in a more personalized approach to dandruff treatment. These devices and apps enable individuals to monitor their scalp health and receive individualized treatment. For example, a wearable device can monitor the pH levels of the scalp and recommend products that are suitable for the individual.

Tailored Treatment Individualized Dandruff Care

The global dandruff treatment market is shifting from a one-size-fits-all approach to a more personalized and tailored treatment option. Consumers now desire products that appeal to their specific requirements. Customers desire products that address their specific scalp condition, hair type, and lifestyle. This trend has led to the development of personalized treatment options.

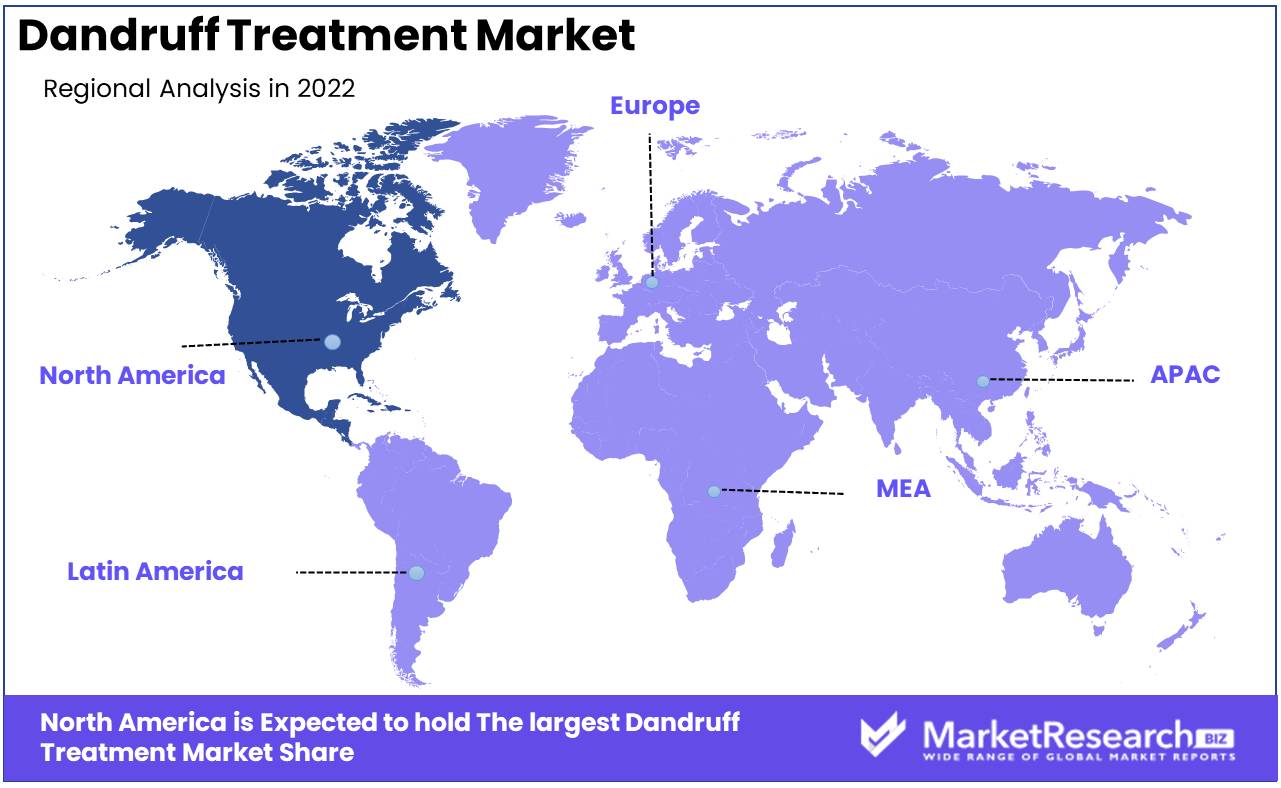

Regional Analysis

The global dandruff treatment market in North America is on the rise, and the dandruff treatment market is dominating. Scalp treatment products are becoming a highly sought-after commodity due to the rising awareness of scalp health and the proliferation of hair care brands in the market.

The prevalence of scalp issues in North America drives the dandruff treatment market. Dandruff is caused by severe weather, hair styling products, and poor lifestyles. The increased awareness of scalp health and the demand for efficient treatment alternatives have also driven market expansion.

The region's top players also help the market dominate. These companies offer new and effective solutions to consumers thanks to their significant research and development and strategic relationships.

In North America's dandruff treatment market, P&G, Unilever, and Johnson & Johnson are top players. These companies offer shampoos, conditioners, scalp treatments, and serums. These companies dominate the regional market due to their strong brand reputation and vast distribution channels.

Selsun Blue, Neutrogena, Maple Holistics, and Kamedis are also market players. These companies provide natural and organic solutions that appeal to consumers that seek chemical-free products.

Product innovation has driven dandruff treatment market growth. Companies are creating new solutions employing plant-based components and essential oils to meet the rise in demand for natural and organic products. Maple Holistics' dandruff Control contains calming and cleaning tea tree oil and rosemary.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Dandruff is a widespread scalp disorder that affects millions of individuals worldwide. The global dandruff treatment market is estimated to be worth billions of dollars, and the key players in this market are constantly innovating and developing new products to meet consumer demand.

Procter & Gamble is one of the prominent players in the global dandruff treatment market. Head & Shoulders is one of the most well-known dandruff cleanser brands in the world and has been a market leader for over 50 years. Procter & Gamble is constantly innovating and developing new products to meet consumers' evolving demands.

Johnson & Johnson is another prominent player in the global dandruff treatment market. The company's Neutrogena T/Gel brand offers a variety of extremely effective shampoos and treatments for dandruff control. Johnson & Johnson is well-known for its research and development in the field of dermatology, and the company is constantly developing new dandruff treatments.

In addition to Unilever, L'Oreal, and Kao Corporation, other major players in the global dandruff treatment market are Unilever, L'Oreal, and the Kao Corporation. In many parts of the globe, Unilever's Clear brand is a popular dandruff treatment, while L'Oreal's Kérastase line offers specialized treatments for dandruff and other scalp conditions. Bioré is a well-known brand of dandruff treatments produced by the Kao Corporation.

Top Key Players in Dandruff Treatment Market

- AstraZeneca (U.K.)

- Procter & Gamble

- Johnson & Johnson Private Limited (U.S.)

- Glenmark Pharmaceuticals Limited (India)

- Cipla Inc. (U.S.)

- L'Oreal (France)

- Procter & Gamble (U.S.)

- Unilever (U.K.)

- Alliance Pharma PLC (U.K.)

- Arcadia Consumer Healthcare (U.S.)

- Vyome Therapeutics Inc. (India)

- ACTION LIFE SCIENCES (India)

- JOHN PAUL MITCHELL SYSTEMS (U.S.)

- JASÖN Natural Products, Inc. (U.S.)

- Nikole Kozemetics (India)

- DABUR (India)

- Kao Corporation (Japan)

- Philip Kingsley Products Ltd. (U.K.)

- Henkel AG & Co. KGaA (Germany)

- Arion Healthcare (India)

- Other Key Players

Recent Development

- In 2023, There is a growing emphasis on personalized medication, and the same philosophy is applied to the treatment of dandruff.

- In 2022, laser therapy emerged as a prospective dandruff treatment. It was discovered that low-level laser therapy (LLLT) effectively inhibits the growth of Malassezia fungi and reduces inflammation on the scalp.

- In 2021, Topical treatments for dandruff made significant advancements. Researchers created new formulations containing active constituents including pyrithione zinc, salicylic acid, ketoconazole, and ciclopirox olamine to treat inflammation.

- In 2020, Researchers began investigating the function of the scalp microbiome in the development of dandruff. This led to the development of innovative treatments designed to restore a healthy scalp microbiome balance.

- In 2019, Researchers introduced new antifungal agents designed to specifically target dandruff-causing fungi, such as Malassezia species.

Report Scope:

Report Features Description Market Value (2022) USD 8.6 Bn Forecast Revenue (2032) USD 15.6 Bn CAGR (2023-2032) 6.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Treatment (Fluocinolone shampoos, Ketoconazole shampoos, Selenium sulfide shampoos, Shampoos containing salicylic acid, Tar-based shampoos, Pyrithione zinc shampoos), By Type (Fungal Dandruff, Dry Skin-Related Dandruff, Oily Scalp-Related Dandruff, Disease Related Dandruff), By Product (Non-Medicated, Medicated), By Drug Type (Branded, Generics), By Mode of Prescription (Over-the-counter (OTC), Prescription), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, Other Distribution Channel), By End-Users (Hospitals, Specialty Clinics, Homecare, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AstraZeneca (U.K.), Procter & Gamble, Johnson & Johnson Private Limited (U.S.), Glenmark Pharmaceuticals Limited (India), Cipla Inc. (U.S.), L'Oreal (France), Procter & Gamble (U.S.), Unilever (U.K.), Alliance Pharma PLC (U.K.), Arcadia Consumer Healthcare (U.S.), Vyome Therapeutics Inc. (India), ACTION LIFE SCIENCES (India), JOHN PAUL MITCHELL SYSTEMS (U.S.), JASÖN Natural Products, Inc. (U.S.), Nikole Kozemetics (India), DABUR (India), Kao Corporation (Japan), Philip Kingsley Products Ltd. (U.K.), Henkel AG & Co. KGaA (Germany), Arion Healthcare (India), Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- AstraZeneca (U.K.)

- Procter & Gamble

- Johnson & Johnson Private Limited (U.S.)

- Glenmark Pharmaceuticals Limited (India)

- Cipla Inc. (U.S.)

- L'Oreal (France)

- Procter & Gamble (U.S.)

- Unilever (U.K.)

- Alliance Pharma PLC (U.K.)

- Arcadia Consumer Healthcare (U.S.)

- Vyome Therapeutics Inc. (India)

- ACTICON LIFE SCIENCES (India)

- JOHN PAUL MITCHELL SYSTEMS (U.S.)

- JASÖN Natural Products, Inc. (U.S.)

- Nikole Kozemetics (India)

- DABUR (India)

- Kao Corporation (Japan)

- Philip Kingsley Products Ltd. (U.K.)

- Henkel AG & Co. KGaA (Germany)

- Arion Healthcare (India)

- Other Key Players