Cybersecurity and Data Privacy Market By Security Type (Network Security, Cloud Security, Application Security, Data Security, Others), By Deployment Mode (On-premises, Cloud-based), By Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises), By Industry Vertical (BFSI, Healthcare, IT and Telecom, Retail, Government, Energy and Utilities, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

51272

-

September 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

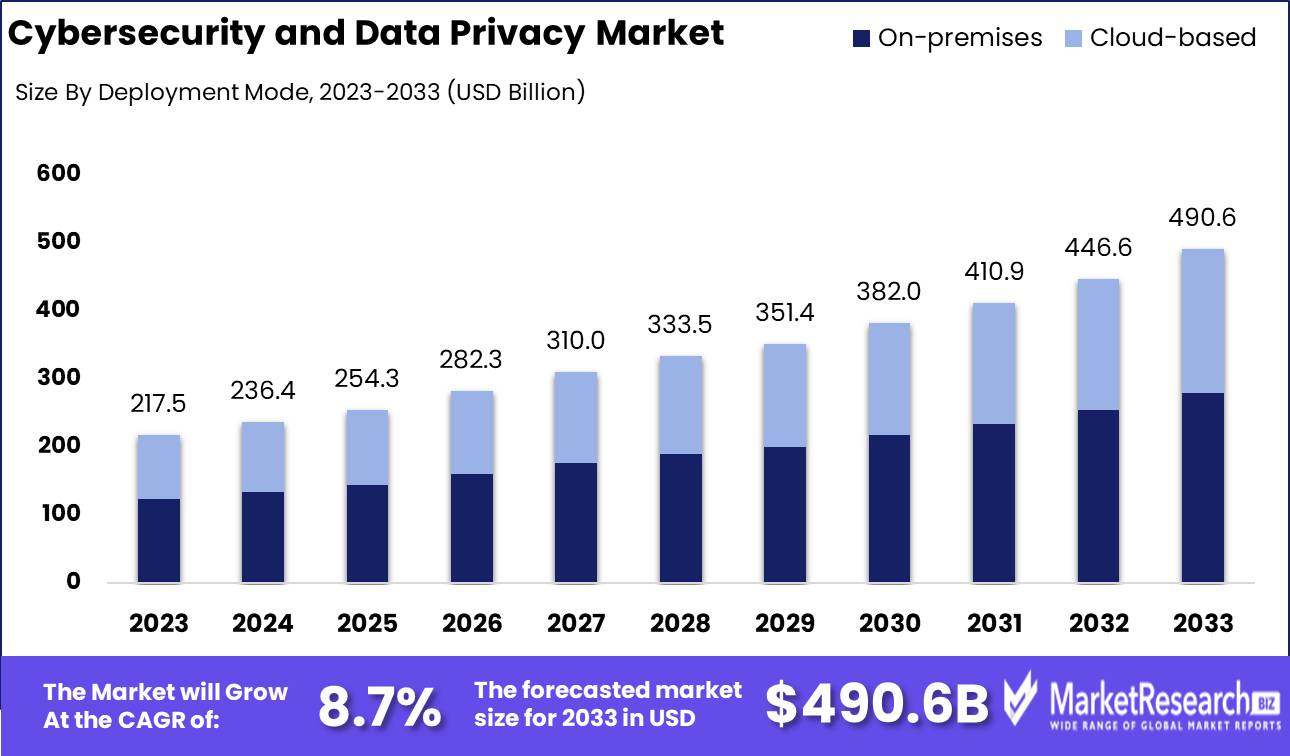

The Cybersecurity and Data Privacy Market was valued at USD 217.5 billion in 2023. It is expected to reach USD 490.6 billion by 2033, with a CAGR of 8.7% during the forecast period from 2024 to 2033.

The Cybersecurity and Data Privacy market encompasses solutions, services, and technologies designed to protect sensitive data, networks, and systems from unauthorized access, breaches, and cyberattacks. As global digital transformation accelerates, businesses face increasing regulatory pressures and evolving cyber threats, driving demand for robust security frameworks. This market includes encryption technologies, identity management, threat detection, and compliance services, all aimed at safeguarding information integrity and ensuring privacy across sectors.

The cybersecurity and data privacy market is poised for sustained growth, driven by an evolving threat landscape, increased cloud adoption, and the growing complexity of security infrastructures. As cyberattacks become more sophisticated, organizations are facing unprecedented challenges in safeguarding sensitive data. This has led to heightened investments in advanced security solutions, with a particular focus on Zero Trust Architecture (ZTA) as a foundational model for securing digital assets. ZTA’s assumption that no entity, inside or outside an organization, is inherently trustworthy has been gaining traction, especially as the workforce becomes more distributed and reliant on remote access.

Moreover, the adoption of cloud services is accelerating, compelling companies to rethink their security frameworks. The cloud’s scalability and flexibility offer significant benefits but also introduce new vulnerabilities, necessitating a shift toward more robust cybersecurity measures. In this context, AI and machine learning are playing pivotal roles by enabling predictive threat detection and automated response mechanisms, thereby enhancing the resilience of security systems. The increasing reliance on these technologies, coupled with the growing complexity of managing security across hybrid environments, underscores the need for integrated solutions that can manage risk in real time. As a result, the cybersecurity and data privacy market is expected to see strong demand, with enterprises focusing on proactive, rather than reactive, strategies to mitigate risks. This shift will further accelerate as regulatory scrutiny around data privacy intensifies, compelling organizations to enhance both their defensive and compliance capabilities in a rapidly evolving digital ecosystem.

Key Takeaways

- Market Growth: The Cybersecurity and Data Privacy Market was valued at USD 217.5 billion in 2023. It is expected to reach USD 490.6 billion by 2033, with a CAGR of 8.7% during the forecast period from 2024 to 2033.

- By Security Type: Network Security dominated diverse cybersecurity segments amid rising threats.

- By Deployment Mode: On-premises solutions dominated the cybersecurity and data privacy market.

- By Organization Size: SMEs dominated the Cybersecurity and Data Privacy Market.

- By Industry Vertical: BFSI dominated cybersecurity demand, followed by healthcare and others.

- Regional Dominance: North America leads the global cybersecurity market with a 40% market share.

- Growth Opportunity: The global cybersecurity market will see significant growth driven by AI integration and increased demand for cybersecurity training programs to mitigate risks and enhance threat detection capabilities.

Driving factors

Increasing Cyber Threats Drive Urgent Demand for Enhanced Cybersecurity Solutions

The rising frequency and sophistication of cyber threats, including data breaches, ransomware, and phishing attacks, are among the most significant drivers of the cybersecurity and data privacy market. The growing reliance on digital systems for critical business operations, combined with the increasing value of sensitive data, has created lucrative opportunities for cybercriminals. As a result, organizations across industries are prioritizing investment in cybersecurity solutions to mitigate these risks.

According to industry data, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, up from $3 trillion in 2015. This dramatic rise reflects the escalating volume and severity of attacks, compelling businesses to strengthen their defenses. The surge in cyberattacks has catalyzed the adoption of advanced security measures such as endpoint protection, firewalls, intrusion detection systems (IDS), and encryption technologies. Additionally, the expansion of remote work during and after the COVID-19 pandemic has heightened vulnerabilities, further intensifying the demand for robust cybersecurity infrastructures.

Proliferation of IoT Devices Expands the Cybersecurity Threat Landscape

The rapid expansion of the Internet of Things (IoT) ecosystem, marked by billions of connected devices, has significantly increased the surface area for cyberattacks. IoT devices, ranging from smart home appliances to industrial sensors, often have limited security features, making them vulnerable to cyber threats. With the number of IoT devices expected to reach 30.9 billion by 2025, this proliferation represents a critical risk factor.

IoT devices generate vast amounts of data, much of which is sensitive and requires secure storage and transmission. The lack of uniform security standards across IoT devices and networks exacerbates these risks. Consequently, the cybersecurity market has experienced growth in specialized solutions designed to secure IoT ecosystems. These include IoT-specific encryption technologies, threat detection systems, and network security tools that protect the integrity of data flows between devices. The growing concern over IoT vulnerabilities has prompted governments and regulatory bodies to implement stricter data privacy laws, which further stimulates market growth by driving demand for compliance solutions.

Digital Transformation Initiatives Amplify the Need for Comprehensive Cybersecurity

The global push for digital transformation, accelerated by technological advancements such as cloud computing, artificial intelligence, and big data analytics, has led to a fundamental shift in how businesses operate. While these initiatives offer numerous benefits, including operational efficiency, scalability, and enhanced customer experiences, they also introduce new security challenges that increase the demand for cybersecurity solutions.

As organizations embrace cloud-based services, mobile platforms, and digital infrastructures, they expose themselves to new risks, particularly around data breaches, insider threats, and regulatory non-compliance. The global digital transformation market is expected to grow at a compound annual growth rate (CAGR) of 23.1% between 2020 and 2027, illustrating the pace at which companies are adopting these technologies. However, the accompanying cybersecurity risks are also rising, leading companies to prioritize security in their digital transformation strategies. Cloud security, identity and access management (IAM), and zero-trust architectures are becoming essential components of modern digital infrastructures.

Moreover, regulatory requirements like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) have intensified the focus on data privacy. Compliance with these regulations requires companies to implement stringent cybersecurity measures, which further propels market growth as organizations seek to avoid hefty fines and reputational damage. The convergence of digital transformation and regulatory pressure ensures that cybersecurity and data privacy will remain central to business strategies in the coming years.

Restraining Factors

Integration of New Technologies Creates Complex Security Challenges

The rapid integration of new and emerging technologies in industries worldwide has significantly impacted the growth of the cybersecurity and data privacy market. While advancements such as cloud computing, artificial intelligence (AI), the Internet of Things (IoT), and 5G networks drive operational efficiency, they also introduce vulnerabilities that must be addressed. Each new technology comes with its own set of risks that cybercriminals can exploit. For instance, AI can be leveraged to automate both attacks and defenses, but it also requires sophisticated, real-time threat detection systems to ensure data integrity.

Cloud computing adoption has surged in recent years, with global spending projected to exceed $1 trillion by 2030. This shift, while improving scalability, also creates a more distributed environment, increasing the attack surface for cyber threats. IoT, with 75 billion devices expected to be connected by 2025, further complicates cybersecurity by creating numerous entry points for attacks. Each connected device potentially serves as a vulnerability, increasing the need for robust security frameworks.

Despite the demand for cybersecurity solutions, the market growth is somewhat restrained by the complexity and cost of securing these integrated systems. Many companies struggle with deploying security protocols that can keep up with the speed of technological change, particularly in sectors that rely heavily on legacy systems. These integration challenges create growth opportunities, but they also place pressure on organizations to continuously update and refine their cybersecurity strategies.

User Awareness and Training Deficiencies Contribute to Increased Cybersecurity Threats

A major restraining factor in the cybersecurity and data privacy market is the lack of user awareness and adequate training. Human error remains one of the leading causes of data breaches, with research indicating that 95% of cybersecurity incidents are due to human error. Despite significant investment in cybersecurity infrastructure, companies often overlook the importance of educating employees about proper data handling and the detection of phishing attempts, malware, and other social engineering attacks.

The rapid digital transformation across industries means employees are frequently exposed to new systems and tools without proper security training. Small and medium-sized enterprises (SMEs), in particular, are vulnerable, as they typically lack the resources to implement extensive training programs. This knowledge gap increases the risk of successful cyber-attacks, which, in turn, constrains the overall market growth, as breaches damage organizational trust and can result in costly regulatory fines.

To address this issue, there is a growing demand for cybersecurity awareness training solutions. However, the market's expansion is tempered by the reluctance of organizations to invest in comprehensive user education, despite the clear need for such measures to protect their systems. Inadequate training increases the likelihood of internal breaches, making it one of the critical factors restraining the pace of cybersecurity advancements. Yet, it also creates an opportunity for market participants to develop more user-centric training solutions that are easier to deploy and scale across organizations.

By Security Type Analysis

In 2023, Network Security dominated diverse cybersecurity segments amid rising threats.

In 2023, Network Security held a dominant market position in the "By Security Type" segment of the Cybersecurity and Data Privacy Market, driven by the increasing sophistication of cyberattacks targeting network infrastructures. As organizations prioritized safeguarding internal and external communications, network security solutions, such as firewalls, intrusion detection systems (IDS), and virtual private networks (VPNs), saw widespread adoption.

The Cloud Security segment also experienced significant growth, as enterprises continued their migration to cloud platforms, requiring robust solutions to secure cloud environments and mitigate data breaches.

Application Security emerged as a crucial focus, addressing vulnerabilities within software and web applications to prevent unauthorized access and data leakage.

The Data Security segment gained traction, largely fueled by stringent regulatory requirements like GDPR and CCPA, compelling organizations to implement encryption and access control measures.

Lastly, the Others category, encompassing endpoint security, identity and access management (IAM), and zero-trust architectures, supported broader cybersecurity strategies. The diverse adoption of these security types underlined the growing complexity and demand for integrated solutions in a continuously evolving threat landscape.

By Deployment Mode Analysis

In 2023, On-premises solutions dominated the cybersecurity and data privacy market.

In 2023, On-premises held a dominant market position in the by-deployment mode segment of the cybersecurity and data privacy market. This can be attributed to the increased preference for in-house data security solutions, particularly among large enterprises with critical infrastructure. Organizations with stringent compliance requirements, such as those in financial services, healthcare, and government sectors, continue to rely on on-premises solutions due to their perceived greater control over sensitive data and infrastructure. The ability to customize security protocols and maintain data sovereignty further strengthens the on-premises preference.

However, the cloud-based segment is experiencing significant growth as businesses increasingly migrate to cloud environments. The flexibility, scalability, and cost-effectiveness of cloud solutions make them attractive to small and medium enterprises (SMEs) and businesses seeking agility in their security frameworks. Advancements in cloud security, encryption technologies, and multi-cloud management systems are also reducing concerns over data breaches, driving the expansion of cloud-based deployments.

By Organization Size Analysis

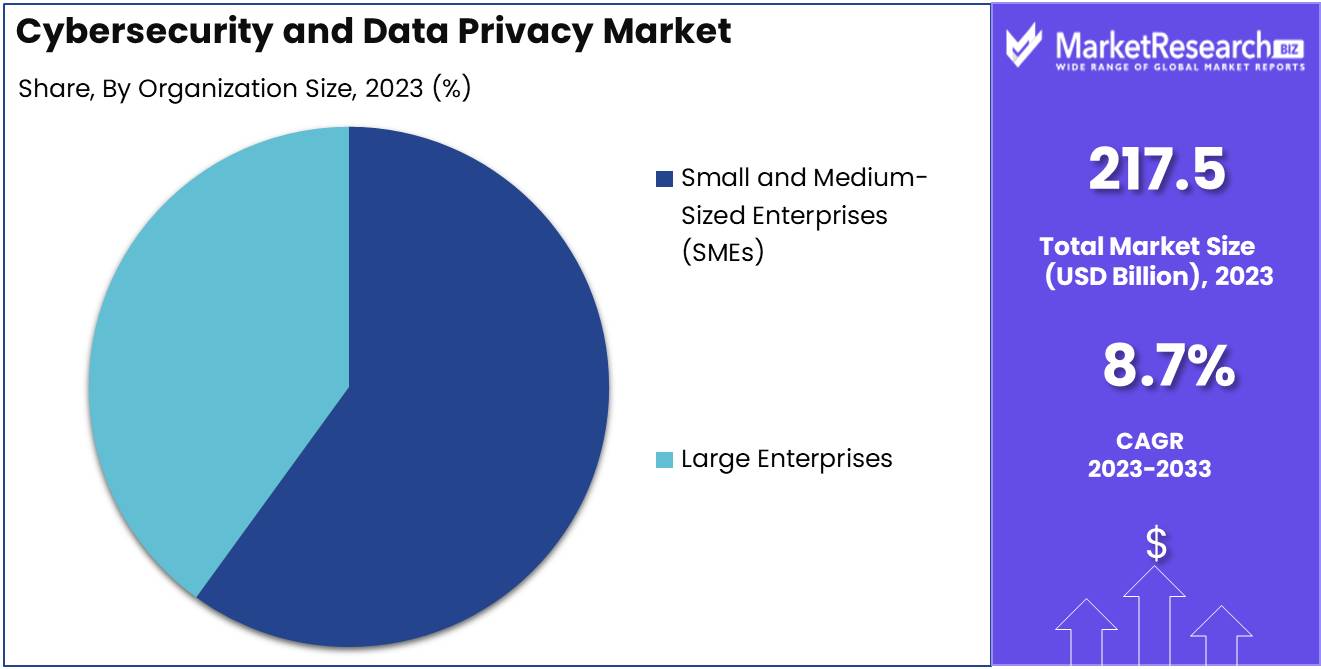

In 2023, SMEs dominated the Cybersecurity and Data Privacy Market.

In 2023, Small and Medium Enterprises (SMEs) held a dominant market position in the By Organization Size segment of the Cybersecurity and Data Privacy Market. This can be attributed to the rising awareness among SMEs about the growing cyber threats and the increasing need to protect sensitive data. As SMEs are increasingly adopting digital platforms and cloud-based solutions, they have become more vulnerable to cyberattacks, driving the demand for comprehensive cybersecurity solutions. Additionally, SMEs are more likely to invest in cost-effective, scalable, and customizable security solutions that cater to their specific business needs, further contributing to market growth.

Large Enterprises are also a significant segment in the cybersecurity market, often implementing robust and advanced security systems due to their vast data repositories and complex IT infrastructure. However, SMEs are growing faster in this sector due to their digital transformation efforts and the regulatory pressures to comply with data privacy laws such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). The increasing need for affordable cybersecurity solutions positions SMEs as key players in this market.

By Industry Vertical Analysis

In 2023, BFSI dominated cybersecurity demand, followed by healthcare and others.

In 2023, BFSI (Banking, Financial Services, and Insurance) held a dominant market position in the by-industry vertical segment of the Cybersecurity and Data Privacy Market, driven by the heightened need for secure financial transactions and stringent regulatory compliance. The BFSI sector's adoption of cybersecurity measures has been propelled by the increasing sophistication of cyber-attacks targeting financial institutions and the critical nature of safeguarding sensitive customer data.

Following BFSI, the Healthcare sector exhibited substantial growth due to the digitization of health records and the subsequent need to protect sensitive patient information. The IT and Telecom industry also played a significant role, with increased vulnerability to cyber threats due to the expansion of digital infrastructure and cloud services.

The Retail sector showed growing adoption of cybersecurity, driven by the surge in e-commerce and the growing threat of payment fraud. Meanwhile, the Government sector focused on national security concerns, pushing for enhanced cybersecurity measures.

In the Energy and Utilities sector, the critical infrastructure posed a high risk of cyber-attacks, prompting increased investments in data protection. Lastly, Others, including education and manufacturing, demonstrated increasing adoption of cybersecurity solutions as part of a broader digital transformation strategy across industries.

Key Market Segments

By Security Type

- Network Security

- Cloud Security

- Application Security

- Data Security

- Others

By Deployment Mode

- On-premises

- Cloud-based

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Government

- Energy and Utilities

- Others

Growth Opportunity

Integration of AI and Machine Learning

The integration of AI and machine learning (ML) technologies is projected to be a key driver for the global cybersecurity market in 2024. AI-enabled cybersecurity solutions enhance the ability to detect and respond to cyber threats in real-time, allowing for automated threat identification and mitigation. Machine learning algorithms can analyze vast amounts of data, identifying patterns and anomalies that may indicate a cyberattack, reducing the time taken to detect breaches and minimizing the impact. According to industry estimates, the global market for AI-driven cybersecurity solutions is expected to grow at a CAGR of 24.5% through 2024, demonstrating the increasing reliance on AI for advanced threat detection and response.

Cybersecurity Training and Awareness Programs

Another critical opportunity lies in the increasing emphasis on cybersecurity training and awareness programs. With the growing number of cyberattacks targeting both individuals and organizations, human error remains one of the most significant vulnerabilities. As businesses and governments prioritize cybersecurity training, the demand for awareness programs is expected to rise significantly. In fact, spending on cybersecurity training programs is forecasted to grow by 14.8% in 2024 as more organizations recognize the need to enhance employee capabilities in preventing breaches. This trend opens up a lucrative avenue for cybersecurity service providers to offer comprehensive training solutions to mitigate risks.

Latest Trends

Growing Importance of IoT Security

The proliferation of Internet of Things (IoT) devices continues to pose significant cybersecurity challenges. As more organizations integrate IoT technologies, vulnerabilities in these interconnected devices become increasingly apparent. The focus on IoT security is expected to intensify, driven by the rising incidence of cyberattacks targeting these devices. Companies are anticipated to allocate greater resources toward developing robust security frameworks and protocols to safeguard IoT ecosystems. Consequently, the market for IoT security solutions is projected to experience substantial growth, fostering innovation in areas such as device authentication, network segmentation, and data encryption.

Expansion of Remote Work

The enduring shift toward remote work arrangements has fundamentally altered the cybersecurity landscape. As organizations embrace hybrid work models, the need for comprehensive data privacy measures is more critical than ever. The businesses are likely to invest heavily in secure remote access solutions, cloud security, and employee training programs focused on cybersecurity awareness. The expansion of remote work not only necessitates enhanced security measures but also presents opportunities for vendors to offer innovative solutions tailored to this evolving work environment. The integration of zero-trust architectures and endpoint security measures will further drive the demand for effective cybersecurity strategies in remote work settings.

Regional Analysis

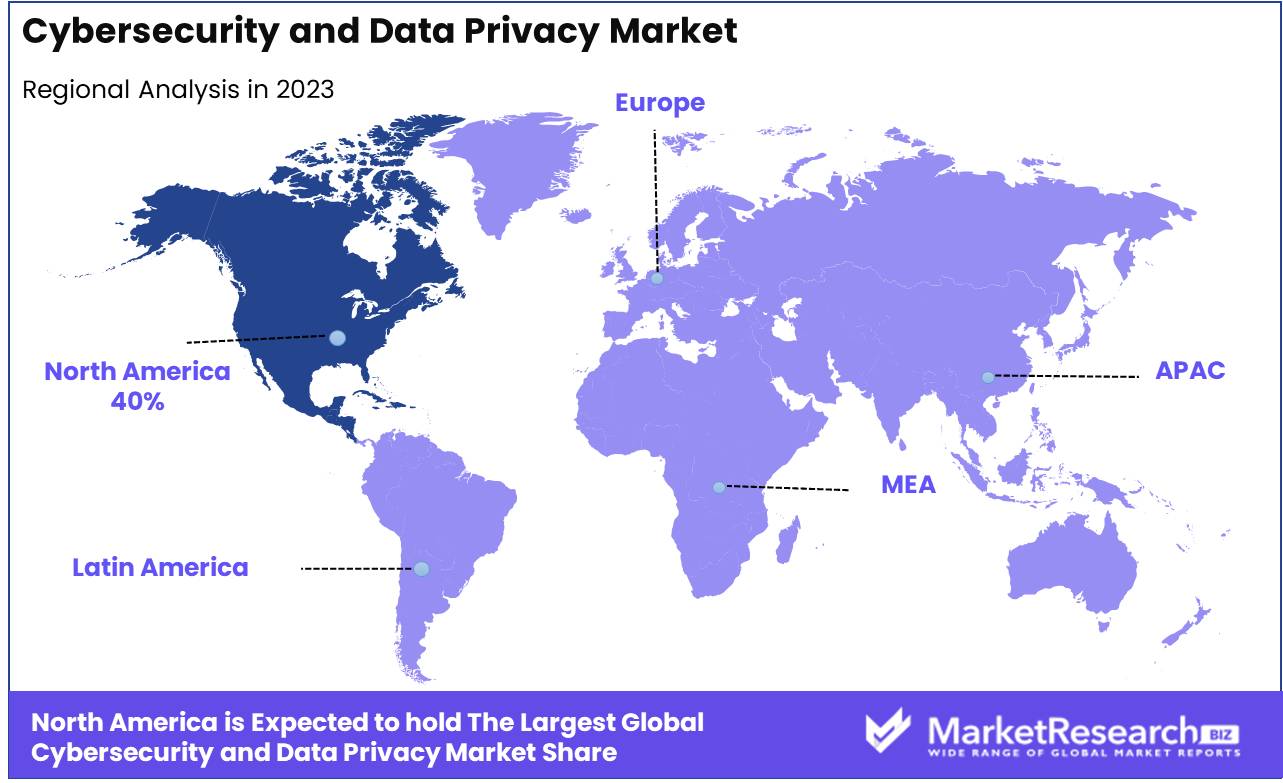

North America leads the global cybersecurity market with a 40% market share.

The Cybersecurity and Data Privacy market is witnessing significant growth across all major regions, driven by increasing digital transformation, rising cyber threats, and stringent data protection regulations. North America dominates the market, holding the largest share, accounting for approximately 40% of the global cybersecurity and data privacy market. The region's dominance can be attributed to robust investments in advanced cybersecurity infrastructure, high adoption of cloud-based services, and the presence of key market players such as IBM, Cisco, and Palo Alto Networks. The United States leads in cybersecurity spending, fueled by increased concerns over data breaches and compliance with regulations like GDPR and CCPA.

Europe follows closely, driven by stringent data privacy regulations like the General Data Protection Regulation (GDPR) and heightened awareness of cybersecurity risks among businesses. The European market represents approximately 25% of the global market share, with countries such as Germany, the UK, and France leading in adoption and innovation.

In the Asia Pacific, rapid digitalization, the proliferation of IoT devices, and increasing incidents of cyberattacks are driving growth. The region accounts for about 20% of the global market, with significant contributions from China, Japan, and India.

Latin America and the Middle East & Africa are emerging markets, experiencing moderate growth as businesses prioritize cybersecurity investments. Together, these regions contribute around 15% of the global market. Despite lower overall spending, countries like Brazil and South Africa are witnessing accelerated adoption due to increasing cyber threats and evolving regulatory frameworks.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global cybersecurity and data privacy market will continue to be shaped by several key players, each bringing unique strengths and solutions to the growing demand for robust digital protection. Cisco Systems, Inc. remains a critical player, leveraging its extensive networking expertise to deliver comprehensive cybersecurity solutions that integrate with its hardware offerings. IBM Corporation's leadership in AI-driven security, particularly through its IBM Security division, positions it as a frontrunner in offering advanced threat intelligence and incident response services.

Palo Alto Networks, Inc. continues to strengthen its portfolio with cloud-native security platforms, focusing on zero-trust architecture and automation. Similarly, Check Point Software Technologies is capitalizing on its cloud security solutions and advanced threat prevention services, catering to enterprises' evolving needs. Fortinet, Inc. distinguishes itself through its Security Fabric platform, offering integrated and automated cybersecurity solutions across the digital attack surface.

In addition, McAfee Corp. and Trend Micro Incorporated remain dominant in endpoint security, with McAfee’s focus on consumer markets and Trend Micro's emphasis on cloud security. Broadcom Inc. (Symantec) continues to be a formidable player in enterprise security following its acquisition of Symantec, while CrowdStrike Holdings, Inc. stands out in endpoint detection and response, leveraging AI and machine learning to combat sophisticated threats.

Innovators like Zscaler, Inc. and Tenable, Inc. are carving a niche in cloud-based security and vulnerability management, respectively. Furthermore, Splunk Inc. and FireEye, Inc. remain pivotal in security analytics and incident response, while Microsoft Corporation and Sophos Ltd. are bolstering their positions through integrated cloud security services and AI-powered threat detection. These companies collectively drive the market's growth, addressing evolving cybersecurity challenges.

Market Key Players

- Cisco Systems, Inc.

- IBM Corporation

- Palo Alto Networks, Inc.

- Check Point Software Technologies

- Fortinet, Inc.

- McAfee Corp.

- Trend Micro Incorporated

- Broadcom Inc. (Symantec)

- CrowdStrike Holdings, Inc.

- Zscaler, Inc.

- Tenable, Inc.

- Splunk Inc.

- FireEye, Inc.

- Microsoft Corporation

- Sophos Ltd.

Recent Development

- In March 2024, Washington State enacted the My Health My Data Act, which introduces stringent data privacy requirements for organizations handling health-related data not covered under HIPAA. This law includes provisions allowing consumers to file lawsuits in cases of non-compliance. The regulation expands the definition of health data and imposes obligations on entities to secure explicit consent before processing sensitive health information.

- In January 2024, The EU expanded the Network and Information Security Directive (NIS2) to enhance cybersecurity for essential sectors, including energy, healthcare, and transportation. The directive aims to improve incident response, risk management, and supply chain security for businesses, requiring increased transparency and stronger safeguards for critical infrastructure. This regulation extends to more entities across the EU and enforces stringent compliance measures for protecting against cyberattacks and data breaches.

- In December 2023, The U.S. Securities and Exchange Commission (SEC) introduced new cybersecurity disclosure rules requiring public companies to disclose material cybersecurity incidents within four business days. These rules also mandate that companies outline their processes for assessing and managing cybersecurity risks in their annual reports. The regulations are designed to enhance transparency and accountability, ensuring that cybersecurity risks are integrated into the overall governance of organizations.

Report Scope

Report Features Description Market Value (2023) USD 217.5 Billion Forecast Revenue (2033) USD 490.6 Billion CAGR (2024-2032) 8.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Security Type (Network Security, Cloud Security, Application Security, Data Security, Others), By Deployment Mode (On-premises, Cloud-based), By Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises), By Industry Vertical (BFSI, Healthcare, IT and Telecom, Retail, Government, Energy and Utilities, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Cisco Systems, Inc., IBM Corporation, Palo Alto Networks, Inc., Check Point Software Technologies, Fortinet, Inc., McAfee Corp., Trend Micro Incorporated, Broadcom Inc. (Symantec), CrowdStrike Holdings, Inc., Zscaler, Inc., Tenable, Inc., Splunk Inc., FireEye, Inc., Microsoft Corporation, Sophos Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Cisco Systems, Inc.

- IBM Corporation

- Palo Alto Networks, Inc.

- Check Point Software Technologies

- Fortinet, Inc.

- McAfee Corp.

- Trend Micro Incorporated

- Broadcom Inc. (Symantec)

- CrowdStrike Holdings, Inc.

- Zscaler, Inc.

- Tenable, Inc.

- Splunk Inc.

- FireEye, Inc.

- Microsoft Corporation

- Sophos Ltd.