Cool Roof Coatings Market By Material Type (Elastomeric Plastic, Metal, Silicon, Tiles), By Roof Type (Low-slope, Steep-slope), By Technology (Water-based, Solvent-based), By End-use (Residential, Commercial, Healthcare, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

49040

-

July 2024

-

136

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

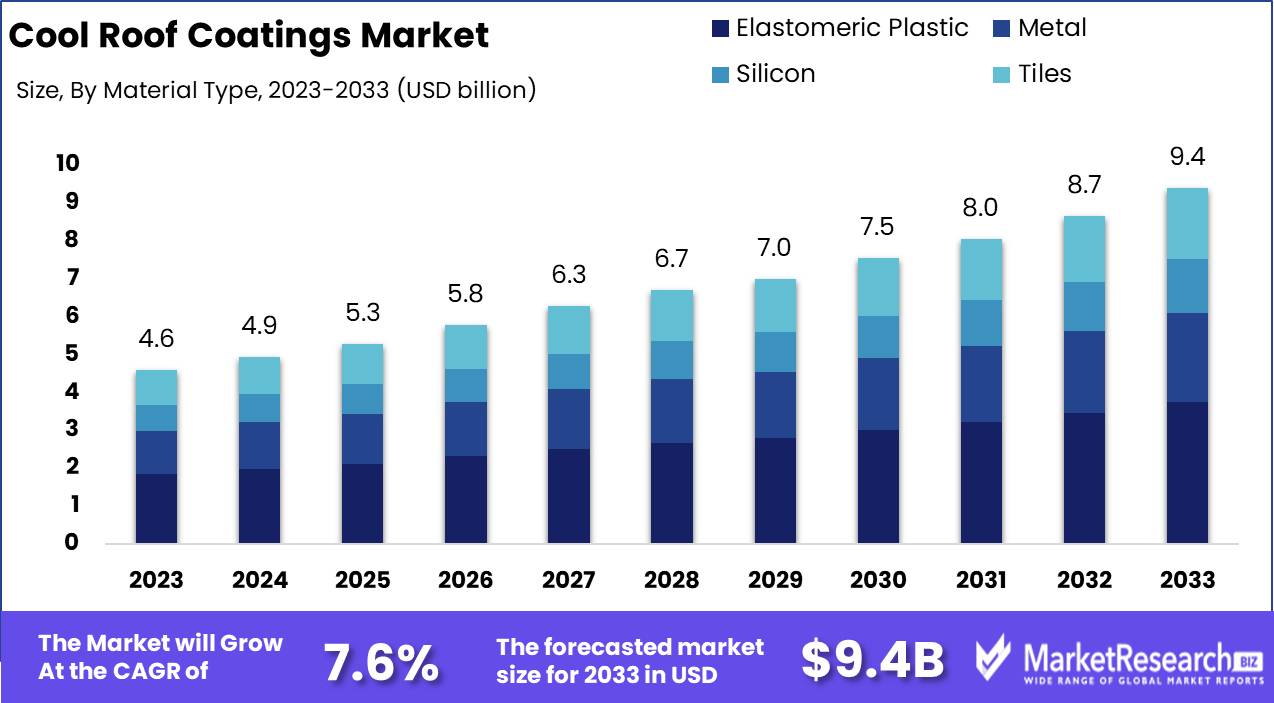

The Global Cool Roof Coatings Market was valued at USD 4.6 Bn in 2023. It is expected to reach USD 9.4 Bn by 2033, with a CAGR of 7.6% during the forecast period from 2024 to 2033.

The Cool Roof Coatings Market encompasses the sector dedicated to the production and distribution of specialized coatings designed to reflect more sunlight and absorb less heat than standard roofs. These coatings, typically applied to existing or new roofs, significantly enhance energy efficiency by reducing cooling costs and mitigating urban heat islands.

The market includes a variety of products, such as elastomeric, silicone, acrylic, and polyurethane coatings, tailored to diverse roofing materials and climates. Driven by regulatory incentives, rising environmental awareness, and advancements in material science, the market is poised for substantial growth, fostering sustainability and operational cost savings across residential, commercial, and industrial sectors.

The market includes a variety of products, such as elastomeric, silicone, acrylic, and polyurethane coatings, tailored to diverse roofing materials and climates. Driven by regulatory incentives, rising environmental awareness, and advancements in material science, the market is poised for substantial growth, fostering sustainability and operational cost savings across residential, commercial, and industrial sectors.The Cool Roof Coatings Market is experiencing robust growth, driven by the increasing emphasis on energy efficiency and sustainability in the built environment. These coatings, which can reflect sunlight and release absorbed heat, significantly lower roof surface temperatures by 20°C or more compared to traditional roofing materials. This substantial temperature reduction translates to lower cooling loads and energy consumption, potentially saving building owners 20-30% on their air conditioning costs.

Additionally, advancements in material science have led to the development of durable coatings, with typical warranties of 10 years for coatings applied at a 20mil thickness, and up to 18 years for those at a 30mil thickness. This longevity, coupled with the financial savings from reduced energy costs, presents a compelling value proposition for commercial, residential, and industrial sectors alike.

Regulatory incentives and building codes increasingly favor sustainable building practices, further propelling market adoption. Moreover, as urbanization intensifies, the need to combat urban heat islands becomes critical, positioning cool roof coatings as an effective solution.

Key Takeaways

- Market Growth: The Global Cool Roof Coatings Market was valued at USD 4.6 Bn in 2023. It is expected to reach USD 9.4 Bn by 2033, with a CAGR of 7.6% during the forecast period from 2024 to 2033.

- By Material Type: Elastomeric Plastic coatings lead with a 40% market share, favored for their durability and ability to reflect sunlight, reducing cooling costs.

- By Roof Type: Low-slope roofs are predominantly coated, making up 70% of the market, as they benefit significantly from reflective coatings in reducing heat absorption.

- By Technology: Water-based technologies dominate with a 60% share, preferred for their environmental safety and ease of application.

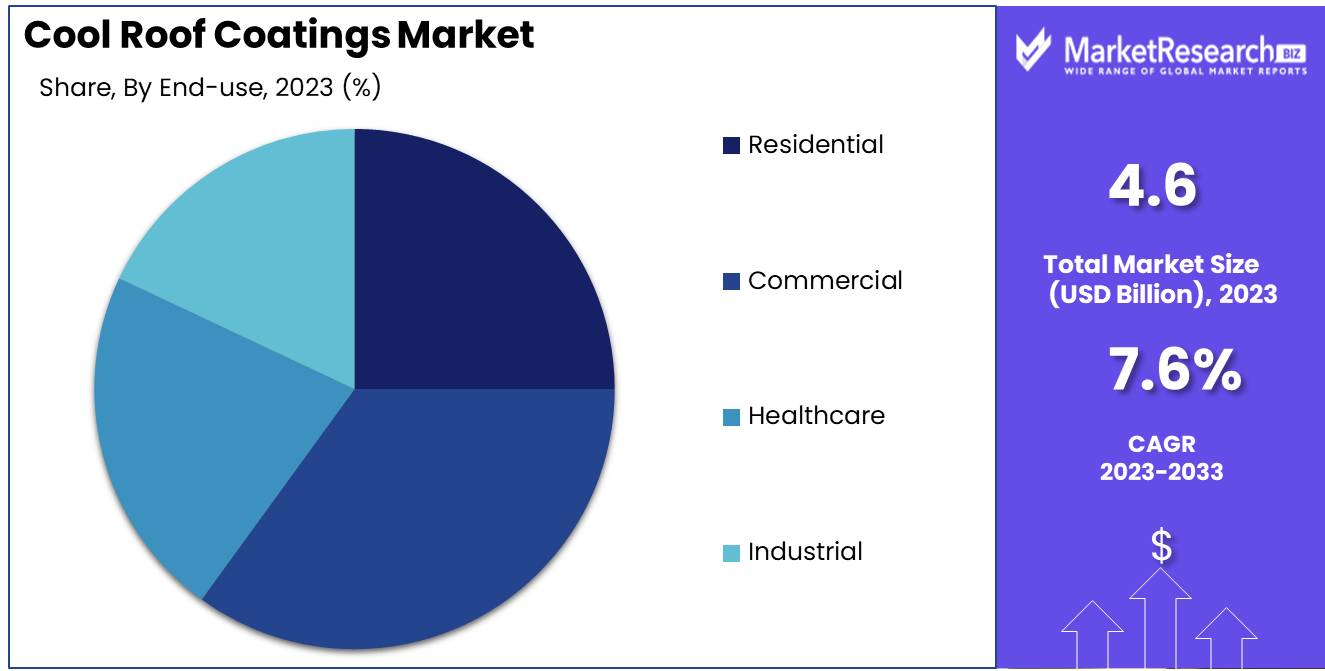

- By End-use: The Commercial sector is the primary end-user, accounting for 35% of the market, driven by the need to reduce energy costs in commercial buildings.

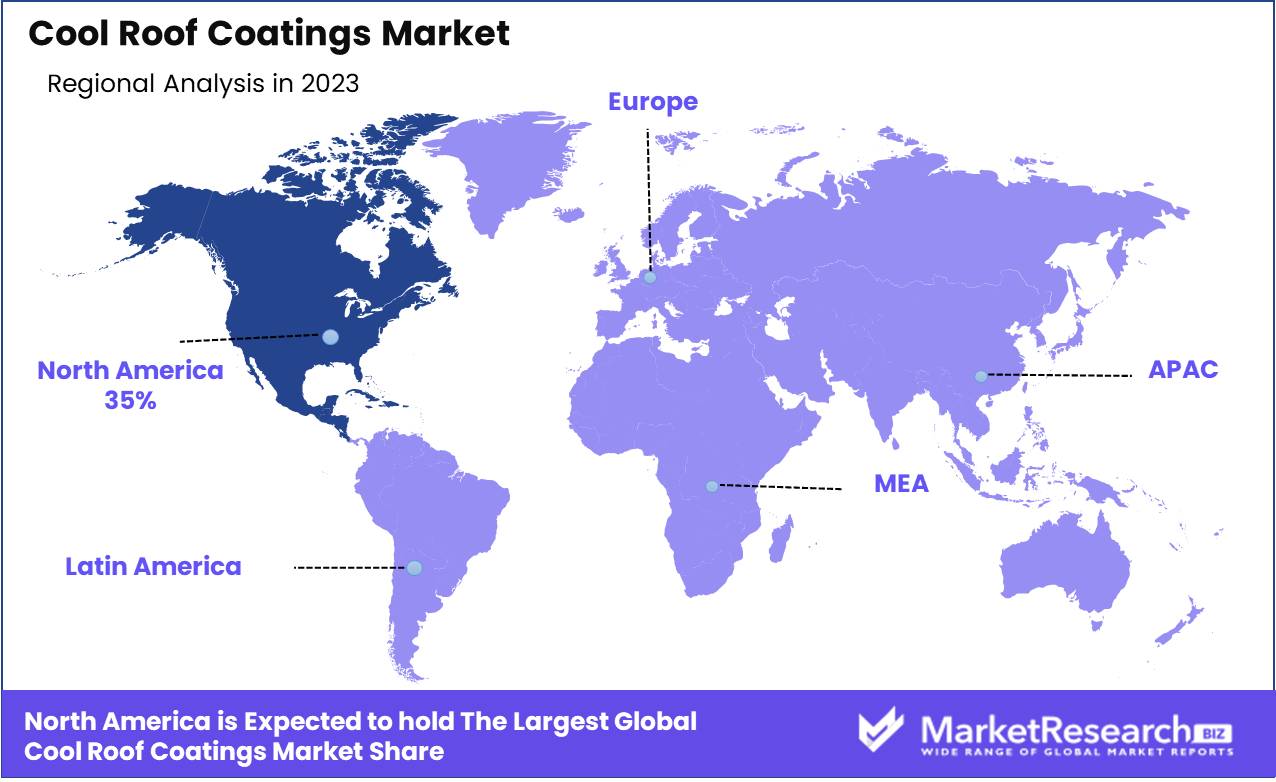

- Regional Dominance: North America holds a 35% share, influenced by growing regulatory support and the adoption of green building standards.

- Growth Opportunity: Expansion into beauty and wellness e-commerce platforms can significantly increase market reach and consumer adoption.

Driving factors

Growing Emphasis on Energy Efficiency

The rising importance of energy efficiency is a pivotal driver for the Cool Roof Coatings Market. Governments, businesses, and homeowners are increasingly prioritizing energy conservation to reduce utility costs and minimize environmental impact. Cool roof coatings, which reflect more sunlight and absorb less heat than standard roofing materials, play a critical role in reducing building cooling loads.

This results in significant energy management systems, particularly in regions with hot climates. Furthermore, energy-efficient buildings are often eligible for incentives and rebates from utility companies and government programs, further boosting the adoption of cool roof coatings. As energy efficiency standards become more stringent globally, the demand for solutions like cool roof coatings is expected to continue its upward trajectory.

Increasing Adoption of Green Building Standards

The widespread adoption of green building standards is another significant factor driving the Cool Roof Coatings Market. Certification systems such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) emphasize sustainable building practices, including the use of cool roof coatings to reduce the heat island effect and improve overall energy efficiency.

Buildings that achieve these certifications not only benefit from lower operational costs but also gain a competitive advantage in the market, attracting environmentally conscious tenants and buyers. As awareness of the environmental impact of construction grows, and as regulations become more stringent, the incorporation of cool roof coatings into new and existing buildings is likely to increase, supporting market growth.

Rising Urbanization and Construction Activities

Urbanization and the resultant boom in construction activities significantly contribute to the expansion of the Cool Roof Coatings Market. As urban areas expand, there is a heightened demand for new residential, commercial, and industrial buildings. Cool roof coatings are increasingly being specified in new construction projects due to their benefits in improving building energy efficiency and contributing to sustainable urban development.

The renovation and retrofitting of existing buildings to enhance energy performance and comply with updated building codes further drive market demand. The synergy between urbanization and the need for sustainable construction practices creates a robust growth environment for the cool roof coatings market.

Restraining Factors

High Initial Application Costs

The high initial application costs of cool roof coatings represent a significant challenge to market growth. Despite their long-term benefits in terms of energy savings and reduced maintenance costs, the upfront investment required for cool roof coatings can be a barrier for many potential users, particularly in residential and smaller commercial projects.

This is especially true in regions where budget constraints are a major consideration for building owners and developers. Consequently, while the long-term financial and environmental benefits are well-documented, the need for substantial initial capital can deter adoption, slowing the market's expansion.

Limited Awareness in Some Regions

Limited awareness of the benefits and availability of cool roof coatings in certain regions also hampers market growth. In areas where the advantages of cool roof technology are not well-known, building owners and developers may be less likely to consider these solutions. This lack of awareness can be due to insufficient marketing efforts, lack of education on energy efficiency measures, or limited exposure to green building practices.

Potential customers in these regions may continue to use traditional roofing materials that do not offer the same energy-saving benefits. Addressing this issue through targeted awareness campaigns and education initiatives is crucial for unlocking the market's full potential and driving wider adoption of cool roof coatings.

By Material Type Analysis

Elastomeric Plastic dominated the By Material Type segment of the Cool Roof Coatings Market in 2023, capturing more than a 40% share.

In 2023, Elastomeric Plastic held a dominant market position in the By Material Type segment of the Cool Roof Coatings Market, capturing more than a 40% share. The significant market share of elastomeric plastic coatings is attributed to their superior flexibility, durability, and ability to provide excellent waterproofing and UV resistance. These coatings are highly effective in reflecting solar power radiation, thereby reducing the heat absorption of buildings and enhancing energy efficiency. The ease of application and compatibility with various roofing materials make elastomeric plastic coatings a preferred choice for both residential and commercial buildings.

Metal roof coatings, while offering excellent durability and reflective properties, are generally used in specific industrial and commercial applications where long-term performance and resistance to extreme weather conditions are critical.

Silicon coating are renowned for their outstanding weather resistance and longevity. They are particularly effective in providing protection against extreme temperatures and UV radiation.

Tiles, as a traditional roofing material, are increasingly being incorporated with cool roof technologies. Cool roof tiles offer excellent thermal performance and durability, making them a popular choice in regions with high temperatures.

By Roof Type Analysis

Low-slope dominated the By Roof Type segment of the Cool Roof Coatings Market in 2023, capturing more than a 70% share.

In 2023, Low-slope held a dominant market position in the By Roof Type segment of the Cool Roof Coatings Market, capturing more than a 70% share. This dominance is driven by the widespread application of cool roof coatings on low-slope roofs, which are common in commercial, industrial, and multifamily residential buildings. Low-slope roofs benefit significantly from cool roof coatings due to their larger surface area exposed to direct sunlight, leading to substantial energy savings and improved indoor comfort.

Steep-slope roofs, typically found in single-family homes and smaller residential buildings, also benefit from cool roof coatings, although their market share is smaller compared to low-slope roofs. The application of cool roof coatings on steep-slope roofs helps in reducing heat transfer into the buildings, thereby enhancing energy efficiency and extending the roof's lifespan.

By Technology Analysis

Water-based dominated the By Technology segment of the Cool Roof Coatings Market in 2023, capturing more than a 60% share.

In 2023, Water-based held a dominant market position in the By Technology segment of the Cool Roof Coatings Market, capturing more than a 60% share. The significant market share of water-based cool roof coatings is driven by their environmental friendliness, low VOC emissions, and ease of application. These coatings are preferred for their ability to provide excellent reflectivity and durability while being safe for applicators and the environment. The growing emphasis on sustainable building practices and regulatory requirements for eco-friendly materials have further bolstered the adoption of water-based technologies in the cool roof coatings market.

Solvent-based cool roof coatings, while offering strong adhesion and durability, hold a smaller market share due to their higher VOC emissions and environmental concerns. Despite their effectiveness in certain applications, the stringent environmental regulations and increasing preference for green building materials limit their growth.

By End-use Analysis

Commercial dominated the By End-use segment of the Cool Roof Coatings Market in 2023, capturing more than a 35% share.

In 2023, Commercial held a dominant market position in the By End-use segment of the Cool Roof Coatings Market, capturing more than a 35% share. This significant market presence is attributed to the extensive adoption of cool roof coatings in commercial buildings, which include office spaces, retail centers, and warehouses. The large roof areas of commercial structures make them prime candidates for cool roof technologies, leading to substantial energy savings and improved indoor comfort.

Residential applications of cool roof coatings are also growing, driven by increasing awareness of energy efficiency and the desire to reduce cooling costs. Homeowners are increasingly adopting these coatings to improve their homes' thermal performance and comfort.

Healthcare facilities, which require strict temperature control and energy efficiency, also benefit from cool roof coatings. Hospitals and clinics use these coatings to maintain a comfortable environment for patients and staff while reducing energy consumption.

Industrial applications of cool roof coatings include factories, manufacturing plants, and storage facilities. These buildings often have large roof surfaces and benefit significantly from reduced cooling loads and extended roof life provided by cool roof coatings.

Key Market Segments

By Material Type

- Elastomeric Plastic

- Metal

- Silicon

- Tiles

By Roof Type

- Low-slope

- Steep-slope

By Technology

- Water-based

- Solvent-based

By End-use

- Residential

- Commercial

- Healthcare

- Industrial

Growth Opportunity

Technological Advancements Driving Market Growth

The development of advanced, high-performance cool roof coatings presents a significant growth opportunity for the market in 2024. Innovations in materials science are leading to the creation of coatings that offer superior reflectivity, durability, and application ease.

These advancements are not only enhancing the energy efficiency benefits of cool roof coatings but also reducing long-term maintenance costs, making them more attractive to a broader range of customers. As these high-performance products become more widely available, they are expected to drive increased adoption across residential, commercial, and industrial sectors.

Government Incentives and Rebates Boost Adoption

Increased government incentives and rebates are poised to play a critical role in accelerating the growth of the cool roof coatings market in 2024. Various government initiatives aimed at promoting energy efficiency and reducing carbon footprints are offering financial incentives to building owners who opt for cool roof solutions.

These incentives significantly offset the initial application costs, making cool roof coatings a more viable option for many. Such policies not only encourage new installations but also support the retrofit market, further expanding the potential customer base and driving overall market growth.'

Latest Trends

Adoption of Reflective and Nanotechnology-Based Coatings

In 2024, the adoption of reflective and nanotechnology-based coatings is set to be a significant trend in the cool roof coatings market. Reflective coatings, which enhance the albedo effect by reflecting a higher percentage of solar radiation, are becoming increasingly popular for their superior energy-saving capabilities.

Nanotechnology-based coatings further elevate this trend by offering enhanced performance characteristics such as increased durability, self-cleaning properties, and superior thermal resistance. These advanced coatings not only improve energy efficiency but also extend the lifespan of roofs, making them a compelling choice for both new constructions and retrofits.

Integration with Smart Building Technologies

The integration of cool roof coatings with smart building technologies represents another transformative trend for 2024. As buildings become more interconnected and intelligent, cool roof coatings can be integrated into broader energy management systems to optimize building performance.

Smart sensors and IoT-enabled systems can monitor roof temperatures and weather conditions in real-time, adjusting cooling systems to maximize energy savings dynamically. This synergy between cool roof coatings and smart technologies enhances building efficiency, reduces operational costs, and supports the overall sustainability objectives of modern smart buildings.

Regional Analysis

Cool Roof Coatings Market by Region: North America, Europe, Asia Pacific, Middle East & Africa, Latin America

In 2023, North America dominated the Cool Roof Coatings Market, capturing a substantial 35% share. This dominance is attributed to stringent building energy efficiency regulations, high awareness about energy conservation, and substantial investment in green building technologies. The United States, in particular, has seen widespread adoption of cool roof coatings in both residential and commercial sectors, driven by incentives and rebate programs aimed at reducing energy consumption and urban heat islands.

Europe is another significant market, driven by the European Union’s regulations on energy performance in buildings and the increasing focus on sustainable construction practices. However, Europe’s market share is slightly smaller compared to North America due to regional climatic differences and varying levels of adoption.

Asia Pacific is experiencing rapid growth in the cool roof coatings market, propelled by the expanding construction sector and increasing urbanization. The region’s efforts to combat high temperatures and improve energy efficiency in buildings are driving the demand for cool roof coatings. Despite the fast-paced growth, Asia Pacific’s market share is still developing compared to the more mature markets of North America and Europe.

Middle East & Africa shows promising potential, supported by the need to mitigate extreme heat and improve energy efficiency in buildings. The adoption of cool roof coatings is particularly relevant in this region due to the high temperatures and intense sunlight. However, the overall market share remains relatively modest due to economic constraints and limited awareness in some areas.

Latin America is emerging as a potential market for cool roof coatings, with Brazil and Mexico leading the demand. The region benefits from a growing focus on energy-efficient building solutions and efforts to reduce cooling costs. While the market share is expanding, it remains smaller compared to dominant regions due to economic variability and slower adoption of new building technologies.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Cool Roof Coatings Market is witnessing significant contributions from several major players, each bringing distinct technological advancements and strategic initiatives to the forefront. Among these key players, companies like Nutech Paint Pty Ltd., The Valspar Corporation, and Nippon Paint (M) Sdn. Bhd. continue to lead with innovative solutions.

Nutech Paint Pty Ltd., recognized for its specialized coatings, remains a frontrunner through its emphasis on sustainability and energy efficiency. Its products are tailored to reflect more sunlight and absorb less heat, contributing to the reduction of urban heat islands and lowering energy costs in buildings.

The Valspar Corporation, with its global reach, enhances the market through extensive R&D, focusing on durability and performance in diverse climates. Valspar’s commitment to innovation is evident in its latest product lines that offer advanced UV protection and longer lifespan for roof coatings.

Nippon Paint (M) Sdn. Bhd. stands out in the Asia Pacific region, leveraging its strong local presence to meet the rising demand for eco-friendly and high-performing cool roof solutions. The company’s strategies to expand its product portfolio and improve customer service significantly boost its market position.

Companies like Sika AG and BASF SE are also pivotal, driving growth through their comprehensive range of cool roof coatings that cater to both commercial and residential sectors. Their focus on eco-friendly products and the adoption of green building standards are aligning with global sustainability trends.

Market Key Players

- Nutech Paint Pty Ltd.

- The Valspar Corporation

- Nippon Paint (M) Sdn. Bhd.

- Sika AG

- Monarch Industrial Products (I) Private Limited

- Excel Coatings

- Indian Insulation & Engineering

- KST Coatings

- Dow Inc.

- GAF Materials Corporation

- Huntsman Corporation

- PPG Industries, Inc.

- RPM International Inc.

- Akzo Nobel N.V.

- BASF SE

- Hempel A/S

- Graco Inc.

- Owens Corning

- H.B. Fuller Company

- Compagnie de Saint-Gobain S.A.

- Kraton Performance Polymers, Inc.

Recent Development

- In June 2024, self-healing roof coatings by RenoTec, which prevent dirt, grime, and moss from adhering to shingles, enhancing durability and reducing maintenance needs.

- In October 2023, BaSO4-based cool roof coating by Purdue University, reflecting over 98% of solar radiation, enhancing passive cooling, and reducing energy consumption for buildings.

Report Scope

Report Features Description Market Value (2023) USD 4.6 Bn Forecast Revenue (2033) USD 9.4 Bn CAGR (2024-2033) 7.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Elastomeric Plastic, Metal, Silicon, Tiles), By Roof Type (Low-slope, Steep-slope), By Technology (Water-based, Solvent-based), By End-use (Residential, Commercial, Healthcare, Industrial) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Nutech Paint Pty Ltd., The Valspar Corporation, Nippon Paint (M) Sdn. Bhd., Sika AG, Monarch Industrial Products (I) Private Limited, Excel Coatings, Indian Insulation & Engineering, KST Coatings, Dow Inc., GAF Materials Corporation, Huntsman Corporation, PPG Industries, Inc., RPM International Inc., Akzo Nobel N.V., BASF SE, Hempel A/S, Graco Inc., Owens Corning, H.B. Fuller Company, Compagnie de Saint-Gobain S.A., Kraton Performance Polymers, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Cool Roof Coatings Market Overview

- 2.1. Cool Roof Coatings Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Cool Roof Coatings Market Dynamics

- 3. Global Cool Roof Coatings Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Cool Roof Coatings Market Analysis, 2016-2021

- 3.2. Global Cool Roof Coatings Market Opportunity and Forecast, 2023-2032

- 3.3. Global Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Material Type, 2016-2032

- 3.3.1. Global Cool Roof Coatings Market Analysis by By Material Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material Type, 2016-2032

- 3.3.3. Elastomeric Plastic

- 3.3.4. Metal

- 3.3.5. Silicon

- 3.3.6. Tiles

- 3.4. Global Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Roof Type, 2016-2032

- 3.4.1. Global Cool Roof Coatings Market Analysis by By Roof Type: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Roof Type, 2016-2032

- 3.4.3. Low-slope

- 3.4.4. Steep-slope

- 3.5. Global Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 3.5.1. Global Cool Roof Coatings Market Analysis by By Technology: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 3.5.3. Water-based

- 3.5.4. Solvent-based

- 3.6. Global Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 3.6.1. Global Cool Roof Coatings Market Analysis by By End-use: Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 3.6.3. Residential

- 3.6.4. Commercial

- 3.6.5. Healthcare

- 3.6.6. Industrial

- 4. North America Cool Roof Coatings Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Cool Roof Coatings Market Analysis, 2016-2021

- 4.2. North America Cool Roof Coatings Market Opportunity and Forecast, 2023-2032

- 4.3. North America Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Material Type, 2016-2032

- 4.3.1. North America Cool Roof Coatings Market Analysis by By Material Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material Type, 2016-2032

- 4.3.3. Elastomeric Plastic

- 4.3.4. Metal

- 4.3.5. Silicon

- 4.3.6. Tiles

- 4.4. North America Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Roof Type, 2016-2032

- 4.4.1. North America Cool Roof Coatings Market Analysis by By Roof Type: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Roof Type, 2016-2032

- 4.4.3. Low-slope

- 4.4.4. Steep-slope

- 4.5. North America Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 4.5.1. North America Cool Roof Coatings Market Analysis by By Technology: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 4.5.3. Water-based

- 4.5.4. Solvent-based

- 4.6. North America Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 4.6.1. North America Cool Roof Coatings Market Analysis by By End-use: Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 4.6.3. Residential

- 4.6.4. Commercial

- 4.6.5. Healthcare

- 4.6.6. Industrial

- 4.7. North America Cool Roof Coatings Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.7.1. North America Cool Roof Coatings Market Analysis by Country : Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.7.2.1. The US

- 4.7.2.2. Canada

- 4.7.2.3. Mexico

- 5. Western Europe Cool Roof Coatings Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Cool Roof Coatings Market Analysis, 2016-2021

- 5.2. Western Europe Cool Roof Coatings Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Material Type, 2016-2032

- 5.3.1. Western Europe Cool Roof Coatings Market Analysis by By Material Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material Type, 2016-2032

- 5.3.3. Elastomeric Plastic

- 5.3.4. Metal

- 5.3.5. Silicon

- 5.3.6. Tiles

- 5.4. Western Europe Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Roof Type, 2016-2032

- 5.4.1. Western Europe Cool Roof Coatings Market Analysis by By Roof Type: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Roof Type, 2016-2032

- 5.4.3. Low-slope

- 5.4.4. Steep-slope

- 5.5. Western Europe Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 5.5.1. Western Europe Cool Roof Coatings Market Analysis by By Technology: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 5.5.3. Water-based

- 5.5.4. Solvent-based

- 5.6. Western Europe Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 5.6.1. Western Europe Cool Roof Coatings Market Analysis by By End-use: Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 5.6.3. Residential

- 5.6.4. Commercial

- 5.6.5. Healthcare

- 5.6.6. Industrial

- 5.7. Western Europe Cool Roof Coatings Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.7.1. Western Europe Cool Roof Coatings Market Analysis by Country : Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.7.2.1. Germany

- 5.7.2.2. France

- 5.7.2.3. The UK

- 5.7.2.4. Spain

- 5.7.2.5. Italy

- 5.7.2.6. Portugal

- 5.7.2.7. Ireland

- 5.7.2.8. Austria

- 5.7.2.9. Switzerland

- 5.7.2.10. Benelux

- 5.7.2.11. Nordic

- 5.7.2.12. Rest of Western Europe

- 6. Eastern Europe Cool Roof Coatings Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Cool Roof Coatings Market Analysis, 2016-2021

- 6.2. Eastern Europe Cool Roof Coatings Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Material Type, 2016-2032

- 6.3.1. Eastern Europe Cool Roof Coatings Market Analysis by By Material Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material Type, 2016-2032

- 6.3.3. Elastomeric Plastic

- 6.3.4. Metal

- 6.3.5. Silicon

- 6.3.6. Tiles

- 6.4. Eastern Europe Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Roof Type, 2016-2032

- 6.4.1. Eastern Europe Cool Roof Coatings Market Analysis by By Roof Type: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Roof Type, 2016-2032

- 6.4.3. Low-slope

- 6.4.4. Steep-slope

- 6.5. Eastern Europe Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 6.5.1. Eastern Europe Cool Roof Coatings Market Analysis by By Technology: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 6.5.3. Water-based

- 6.5.4. Solvent-based

- 6.6. Eastern Europe Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 6.6.1. Eastern Europe Cool Roof Coatings Market Analysis by By End-use: Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 6.6.3. Residential

- 6.6.4. Commercial

- 6.6.5. Healthcare

- 6.6.6. Industrial

- 6.7. Eastern Europe Cool Roof Coatings Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.7.1. Eastern Europe Cool Roof Coatings Market Analysis by Country : Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.7.2.1. Russia

- 6.7.2.2. Poland

- 6.7.2.3. The Czech Republic

- 6.7.2.4. Greece

- 6.7.2.5. Rest of Eastern Europe

- 7. APAC Cool Roof Coatings Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Cool Roof Coatings Market Analysis, 2016-2021

- 7.2. APAC Cool Roof Coatings Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Material Type, 2016-2032

- 7.3.1. APAC Cool Roof Coatings Market Analysis by By Material Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material Type, 2016-2032

- 7.3.3. Elastomeric Plastic

- 7.3.4. Metal

- 7.3.5. Silicon

- 7.3.6. Tiles

- 7.4. APAC Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Roof Type, 2016-2032

- 7.4.1. APAC Cool Roof Coatings Market Analysis by By Roof Type: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Roof Type, 2016-2032

- 7.4.3. Low-slope

- 7.4.4. Steep-slope

- 7.5. APAC Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 7.5.1. APAC Cool Roof Coatings Market Analysis by By Technology: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 7.5.3. Water-based

- 7.5.4. Solvent-based

- 7.6. APAC Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 7.6.1. APAC Cool Roof Coatings Market Analysis by By End-use: Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 7.6.3. Residential

- 7.6.4. Commercial

- 7.6.5. Healthcare

- 7.6.6. Industrial

- 7.7. APAC Cool Roof Coatings Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.7.1. APAC Cool Roof Coatings Market Analysis by Country : Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.7.2.1. China

- 7.7.2.2. Japan

- 7.7.2.3. South Korea

- 7.7.2.4. India

- 7.7.2.5. Australia & New Zeland

- 7.7.2.6. Indonesia

- 7.7.2.7. Malaysia

- 7.7.2.8. Philippines

- 7.7.2.9. Singapore

- 7.7.2.10. Thailand

- 7.7.2.11. Vietnam

- 7.7.2.12. Rest of APAC

- 8. Latin America Cool Roof Coatings Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Cool Roof Coatings Market Analysis, 2016-2021

- 8.2. Latin America Cool Roof Coatings Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Material Type, 2016-2032

- 8.3.1. Latin America Cool Roof Coatings Market Analysis by By Material Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material Type, 2016-2032

- 8.3.3. Elastomeric Plastic

- 8.3.4. Metal

- 8.3.5. Silicon

- 8.3.6. Tiles

- 8.4. Latin America Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Roof Type, 2016-2032

- 8.4.1. Latin America Cool Roof Coatings Market Analysis by By Roof Type: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Roof Type, 2016-2032

- 8.4.3. Low-slope

- 8.4.4. Steep-slope

- 8.5. Latin America Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 8.5.1. Latin America Cool Roof Coatings Market Analysis by By Technology: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 8.5.3. Water-based

- 8.5.4. Solvent-based

- 8.6. Latin America Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 8.6.1. Latin America Cool Roof Coatings Market Analysis by By End-use: Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 8.6.3. Residential

- 8.6.4. Commercial

- 8.6.5. Healthcare

- 8.6.6. Industrial

- 8.7. Latin America Cool Roof Coatings Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.7.1. Latin America Cool Roof Coatings Market Analysis by Country : Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.7.2.1. Brazil

- 8.7.2.2. Colombia

- 8.7.2.3. Chile

- 8.7.2.4. Argentina

- 8.7.2.5. Costa Rica

- 8.7.2.6. Rest of Latin America

- 9. Middle East & Africa Cool Roof Coatings Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Cool Roof Coatings Market Analysis, 2016-2021

- 9.2. Middle East & Africa Cool Roof Coatings Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Material Type, 2016-2032

- 9.3.1. Middle East & Africa Cool Roof Coatings Market Analysis by By Material Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material Type, 2016-2032

- 9.3.3. Elastomeric Plastic

- 9.3.4. Metal

- 9.3.5. Silicon

- 9.3.6. Tiles

- 9.4. Middle East & Africa Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Roof Type, 2016-2032

- 9.4.1. Middle East & Africa Cool Roof Coatings Market Analysis by By Roof Type: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Roof Type, 2016-2032

- 9.4.3. Low-slope

- 9.4.4. Steep-slope

- 9.5. Middle East & Africa Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 9.5.1. Middle East & Africa Cool Roof Coatings Market Analysis by By Technology: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 9.5.3. Water-based

- 9.5.4. Solvent-based

- 9.6. Middle East & Africa Cool Roof Coatings Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 9.6.1. Middle East & Africa Cool Roof Coatings Market Analysis by By End-use: Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 9.6.3. Residential

- 9.6.4. Commercial

- 9.6.5. Healthcare

- 9.6.6. Industrial

- 9.7. Middle East & Africa Cool Roof Coatings Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.7.1. Middle East & Africa Cool Roof Coatings Market Analysis by Country : Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.7.2.1. Algeria

- 9.7.2.2. Egypt

- 9.7.2.3. Israel

- 9.7.2.4. Kuwait

- 9.7.2.5. Nigeria

- 9.7.2.6. Saudi Arabia

- 9.7.2.7. South Africa

- 9.7.2.8. Turkey

- 9.7.2.9. The UAE

- 9.7.2.10. Rest of MEA

- 10. Global Cool Roof Coatings Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Cool Roof Coatings Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Cool Roof Coatings Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Nutech Paint Pty Ltd.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. The Valspar Corporation

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Nippon Paint (M) Sdn. Bhd.

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Sika AG

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Monarch Industrial Products (I) Private Limited

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Excel Coatings

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Indian Insulation & Engineering

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. KST Coatings

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Dow Inc.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. GAF Materials Corporation

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Huntsman Corporation

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. RPM International Inc.

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Akzo Nobel N.V.

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. BASF SE

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 11.18. Hempel A/S

- 11.18.1. Company Overview

- 11.18.2. Financial Highlights

- 11.18.3. Product Portfolio

- 11.18.4. SWOT Analysis

- 11.18.5. Key Strategies and Developments

- 11.19. Graco Inc.

- 11.19.1. Company Overview

- 11.19.2. Financial Highlights

- 11.19.3. Product Portfolio

- 11.19.4. SWOT Analysis

- 11.19.5. Key Strategies and Developments

- 11.20. Owens Corning

- 11.20.1. Company Overview

- 11.20.2. Financial Highlights

- 11.20.3. Product Portfolio

- 11.20.4. SWOT Analysis

- 11.20.5. Key Strategies and Developments

- 11.21. H.B. Fuller Company

- 11.21.1. Company Overview

- 11.21.2. Financial Highlights

- 11.21.3. Product Portfolio

- 11.21.4. SWOT Analysis

- 11.21.5. Key Strategies and Developments

- 11.22. Compagnie de Saint-Gobain S.A.

- 11.22.1. Company Overview

- 11.22.2. Financial Highlights

- 11.22.3. Product Portfolio

- 11.22.4. SWOT Analysis

- 11.22.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- Nutech Paint Pty Ltd.

- The Valspar Corporation

- Nippon Paint (M) Sdn. Bhd.

- Sika AG

- Monarch Industrial Products (I) Private Limited

- Excel Coatings

- Indian Insulation & Engineering

- KST Coatings

- Dow Inc.

- GAF Materials Corporation

- Huntsman Corporation

- PPG Industries, Inc.

- RPM International Inc.

- Akzo Nobel N.V.

- BASF SE

- Hempel A/S

- Graco Inc.

- Owens Corning

- H.B. Fuller Company

- Compagnie de Saint-Gobain S.A.

- Kraton Performance Polymers, Inc.