Cooking Oil Market By Distribution Channel Analysis (Hypermarket/Supermarket, Independent Retail Store, Business To Business, Online Sales Channel), By End-Use Analysis (Residential, Food Services, Food Processing), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

4455

-

May 2023

-

176

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

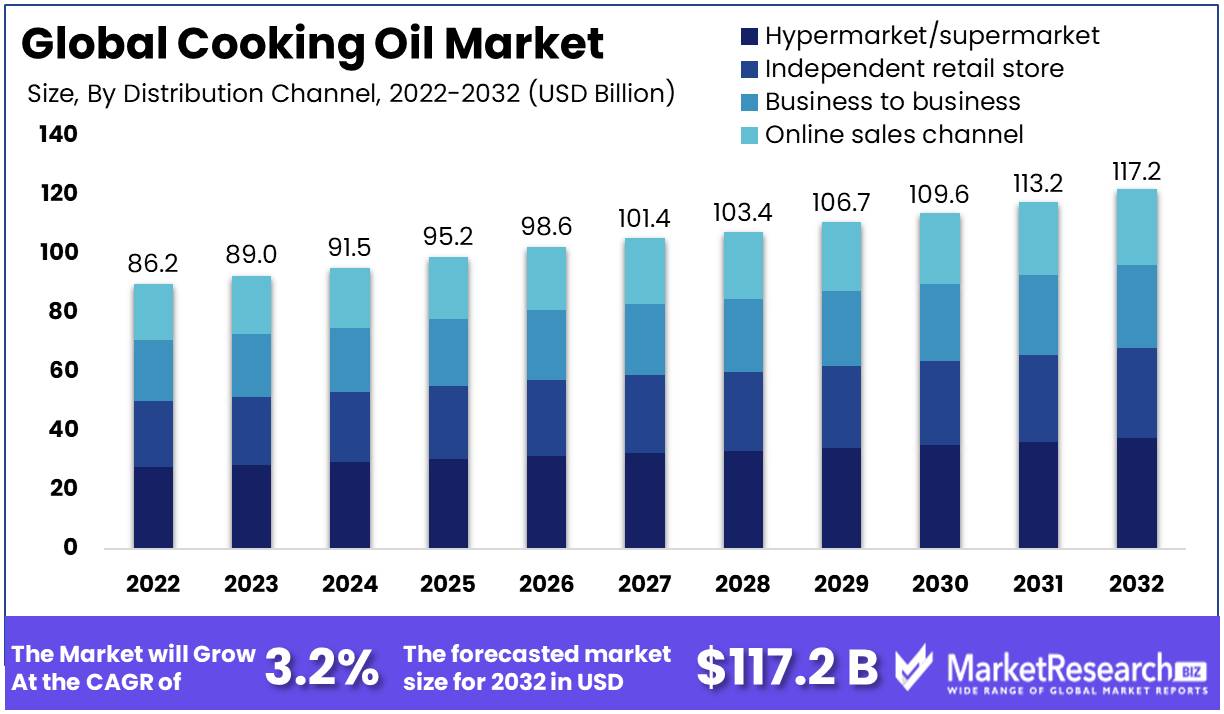

Cooking Oil Market size is expected to be worth around USD 117.2 Bn by 2032 from USD 86.2 Bn in 2022, growing at a CAGR of 3.2% during the forecast period from 2023 to 2032.

The cooking oil market has grown continuously over time. Since ancient times, humans have consumed a variety of cooking oils, but industrialization has expanded this market to include a wide range of oil products that meet a wide range of purposes.

The cooking oil market produces, distributes, and sells a variety of oils for cooking, frying, and baking. Sunflower, vegetable, olive, canola, and soybean oils dominate this market. However, animal-based oils like lard and tallow participate in this flavorful dance. The cooking oil market's major goal is to deliver high-quality oils that meet consumers' nutritional and health needs.

The cooking oil market has seen an increase in novel formulations to address concerns about saturated fats, trans fats, and cholesterol as people seek healthier culinary options. High-oleic canola oil, a monounsaturated fat elixir without saturated fats, is one such breakthrough.

The cooking oil market has grown into the food industry's lifeblood. It pushes the boundaries of culinary excellence in the realms of conventional frying, baking, sautéing, and marinades. Companies have unveiled their magnificent tapestry of low-fat and organic solutions to satiate the growing demand for healthier options. With the rise of vegan and vegetarian diets, the market has welcomed an array of plant-based oils, including delicious olive oil and adaptable coconut oil.

Beyond gastronomy, the cooking oil market has attracted numerous industries, including food and beverage, health and wellness, and cosmetics. In order to meet a variety of nutritional needs, companies have cleverly included cooking oils in their recipes. In the hallowed corridors of the health and wellness sector, these oils have made their way into the essence of products like supplements and vitamins, capturing the imagination of health enthusiasts worldwide.

The emergence of vegan and vegetarian lifestyles has surely played a significant influence in this ever-changing landscape, inspiring individuals to investigate plant-based alternatives to their animal-derived equivalents. The exponential development of the worldwide population has created an insatiable need for cooking oils as individuals seek a variety of culinary options to satiate their discriminating preferences.

Driving Factors

Increasing Health Awareness Fuels Cooking Oil Market

The cooking oil market has experienced tremendous growth, which is anticipated to continue in the future years. The increasing health consciousness and demand for cooking oil are one of the factors propelling the market. Consumers are increasingly health-conscious and prefer cooking oils that are low in cholesterol and trans fat. This trend has led to the emergence of new types of cooking oils containing healthier constituents, such as olive, canola, and sunflower oil.

Convenience Foods Drive the Growth of the Cooking Oil Market

The rising demand for convenience goods and the food service industry is another factor fueling the growth of the cooking oil market. As consumers become increasingly time-crunched, they seek meal options that require minimal or no cooking. This has led to a rise in the utilization of cooking oils in processed foods and the food service industry. Increasing populations and disposable incomes in emerging economies have also led to the growth of the cooking oil market.

Expansion of Retail and Technological Developments Boost Cooking Oil Market

The expansion of retail chains and online platforms for the sale of cooking oils has facilitated consumers' access to a greater variety of cooking oils. Technological advances in oil extraction and refining have also contributed significantly to the growth of the cooking oil market. These developments have contributed to the enhancement of the quality and efficacy of cooking oil production.

Organic and Gourmet Cooking Oils are in High Demand

The increasing prominence of plant-based and vegan diets has led to an increase in the demand for organic and non-GMO cooking oils. Consumers seek healthier and environmentally favorable alternatives. The demand for ethnic and gourmet foods has also contributed to the growth of the cooking oil market. Consumers are seeking high-quality and premium cooking oils to enhance the flavor of their food as they become more adventurous in their culinary preferences.

Healthy Cooking Oil Market Supported by Government Initiatives

Government initiatives to promote healthful cooking practices have also had a positive impact on the market for cooking oil. Health campaigns and regulations aimed at reducing trans fats and encouraging healthier cooking practices have led to an increase in demand for healthier cooking oils. The elimination of trans fats in food products is one of the potential regulatory changes that could affect the cooking oil market.

New Technologies and Tendencies Transform the Cooking Oil Market

Emerging technologies that may have an impact on the market for cooking oils include novel oil extraction and processing techniques that are more efficient and yield higher-quality oils. The emergence of alternative plant-based oils, such as algae or hemp oil, may have a significant impact on the competitive landscape of the cooking oil market. Emerging trends and changes in consumer behavior that may have an impact on the cooking oil market impact include the continued trend toward healthier and environmentally favorable options, as well as the increasing demand for locally sourced and sustainable products.

Restraining Factors

Cooking Oil Market Challenges Fluctuations and Competition

For years, cooking oil market restraints have plagued the industry. The factors include fluctuations in raw material availability and prices, high competition from alternative cooking mediums such as butter, margarine, and cooking sprays, strict government regulations and quality standards, health risks associated with the consumption of certain types of cooking oils, and the negative impact of cooking oils on the environment.

Raw Materials Cooking Oil Market Suffers

The availability and prices of raw materials affect the cooking oil market. For manufacturers in the cooking oil industry, price fluctuations in raw materials including soybeans, palm oil, and rapeseed can lead to higher production costs. If raw material prices rise, cooking oil demand will fall as customers turn to other cooking mediums.

Pressure Cooking Oil Market

The availability of raw resources like palm oil and soybeans has also been a problem. Climate change and other environmental issues have influenced raw material availability, which has led to a drop in production. Reduced availability has raised raw material prices, which raises cooking oil production costs.

Cooking Oil Regulations

Competition from other cooking mediums including butter, margarine, and cooking sprays is another constraint. Butter and margarine replace cooking oil, and cooking sprays are becoming more common. With healthier cooking oil options, consumers are switching. To address competition, the cooking oil industry has focused on healthier cooking by lowering trans-fats and employing olive, sunflower, and canola oils.

Cooking Oil Market Risks

Government regulations and quality requirements also impact the cooking oil industry. Global regulations demand manufacturers to meet quality requirements. Therefore, manufacturers must regularly inspect and comply with these regulatory authorities. Noncompliance with regulations can lead to fines, recalls, and reputational damage.

Environment Impacts Cooking Oil Market

The cooking oil market has been concerned about the health implications of some types of cooking oils, such as palm oil, soybean oil, and canola oil. Saturated fats in these oils can raise the risk of cardiovascular disease over time. Health concerns have led people to choose olive and sunflower oils. By lowering trans-fats and employing healthier oils, manufacturers have also focused on making better cooking oils.

Sustainable Cooking Oil Industry

Finally, cooking oils' environmental impact restrains the market. The production of cooking oils causes habitat degradation, greenhouse gas emissions, and water contamination. The cooking oil industry has adopted ecologically friendly production methods to address these concerns. Sustainable palm oil production, renewable energy, and greenhouse gas reduction are examples.

Distribution Channel Analysis

The dominant distribution channels for the cooking oil market are supermarkets and hypermarkets. Due to their convenience and affordability, these segments are expected to continue to expand rapidly over the future years.

Due to their extensive selection of products and competitive pricing, supermarkets and hypermarkets are the most popular distribution channels for the cooking oil market.

As economic development continues to improve the standard of living for millions of people, emergent economies are increasingly adopting retail options that are both convenient and cost-effective, such as supermarkets and hypermarkets.

When it comes to the purchase of cooking oils, consumers prioritize convenience and affordability. Supermarkets and hypermarkets are favored by consumers because they provide a vast selection of products at reasonable prices.

Due to their convenience and affordability, as well as the rising number of supermarkets and hypermarkets opening in emerging economies, supermarkets and hypermarkets are expected to experience the fastest growth rate in the coming years.

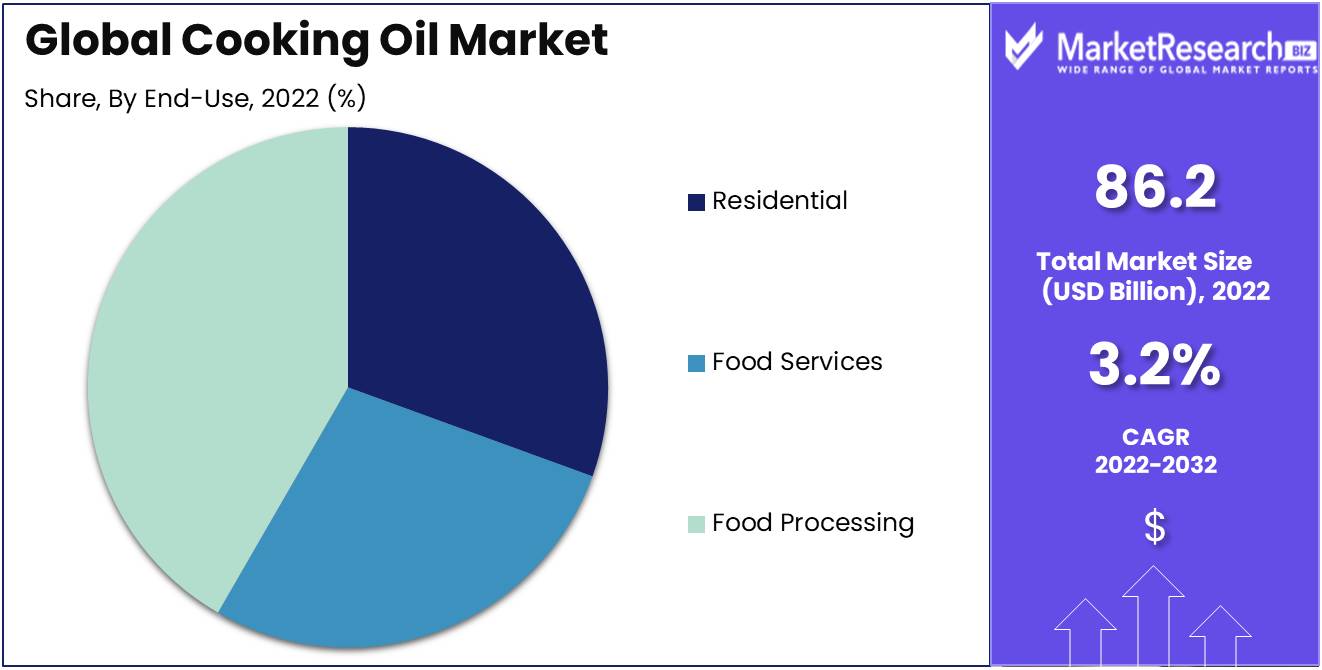

End-Use Analysis

In the cooking oil market, food processing is the dominant end-use segment. Due to the growing demand for processed food products, this segment is expected to continue to expand rapidly in the future years. Food processors account for the greatest portion of the cooking oil market.

As economic development continues to improve the standard of living for millions of people, an increasing number of individuals are adopting a Western-style diet consisting of processed food products.

When it comes to the purchase of food products, consumers prioritize convenience. Cooking oil is used to make processed food products, which offer convenience, affordability, and a variety of flavors.

Due to the rising demand for processed food products, the segment of food processing is expected to continue to expand rapidly in the future years. This is primarily driven by the convenience factor and the rise of food processors in emerging economies.

Key Market Segments

By Distribution Channel Analysis

- Hypermarket/supermarket

- Independent retail store

- Business to business

- Online sales channel

By End-Use Analysis

- Residential

- Food Services

- Food processing

Growth Opportunity

Cooking Oil Market Potential Rises

The cooking oil market growth potential is powered by Opportunity Development of innovative, value-added products Distribution and market penetration, Investment in cooking oil and sustainable cooking oil development, Mergers and acquisitions for market share and diversity, and Strategic partnerships with food service providers and manufacturers.

Innovations Grow the Cooking Oil Market

The market for cooking oil is expected to develop significantly in the future years as demand for cooking oil continues to rise globally. The development of innovative and value-added products, expansion of product distribution and penetration into untapped markets, investment in research and development of sustainable and environmentally friendly cooking oils, mergers and acquisitions for market share and diversification, and strategic partnerships with food manufacturers and foodservice providers drive the cooking oil market's growth.

Distribution Increases Cooking Oil Market

The development of innovative and value-added products drives the cooking oil market growth. Health-conscious consumers want flavorful, cheap cooking oils with health benefits. New cooking oils with omega-3 fatty acids, antioxidants, and reduced saturated and trans fats are being developed by manufacturers in response to this demand.

Sustainable Oils Grow Markets

The expansion of product distribution and penetration into unexplored regions are key factors driving growth in the cooking oil market. With the rise of e-commerce and online buying, manufacturers can reach new customers in locations where their products may not have been available before. Younger consumers are more willing to test new cooking oil products, therefore manufacturers are investing in new marketing methods.

Cooking Oil Market Satisfies Consumers

Finally, partnerships between food manufacturers and cooking oil service providers are becoming more and more vital for the cooking oil market. Manufacturers can create new products suited to certain customers and offer them in restaurants and specialty stores by cooperating with food manufacturers and food service providers.

Latest Trends

Altering Trends

Due to many market factors, the cooking oil industry is constantly changing. Food manufacturers, retailers, and consumers adjust to new, healthier ingredients. The popularity of organic and non-GMO cooking oils, the growth of e-commerce and online sales channels, the adoption of healthier cooking oils like avocado and grapeseed oil, the introduction of flavored and infused oils, and the shift toward sustainable and environmentally friendly packaging are just a few of these factors.

E-commerce Boom

Consumers are looking for healthier cooking oils. Organic and non-GMO cooking oils are an alternative. Non-GMO and organic cooking oils are made from crops farmed without synthetic pesticides or fertilizers. As more consumers learn about the health and environmental benefits of organic and non-GMO products, this trend is projected to continue.

Healthier Options

Online buying has transformed the cooking oil market. The growth of e-commerce has increased competition within the industry and given consumers more product, flavor, and packaging options than ever before. Online marketplaces like Amazon or specialized e-commerce platforms help retailers and manufacturers access new customers.

Green Revolution

Cooking oil is now used for more than just cooking. By creating flavored and infused oils, the oil industry has adapted to shifting consumer tastes. Flavored oils can be used to flavor food or dip bread. In contrast, infusing oils with herbs or spices can increase taste and health. Flavored and infused oils are becoming increasingly popular in the market, and manufacturers are inventing varied flavors to appeal to customer preferences.

Health and Environment Unite

The demand for sustainable packaging is rising in the cooking oil market. Eco-friendly packaging is growing increasingly popular as consumers become more environmentally conscious. Customers and environmental standards both require change. Thus, eco-conscious consumers favor cardboard, paperboard, and glass packaging.

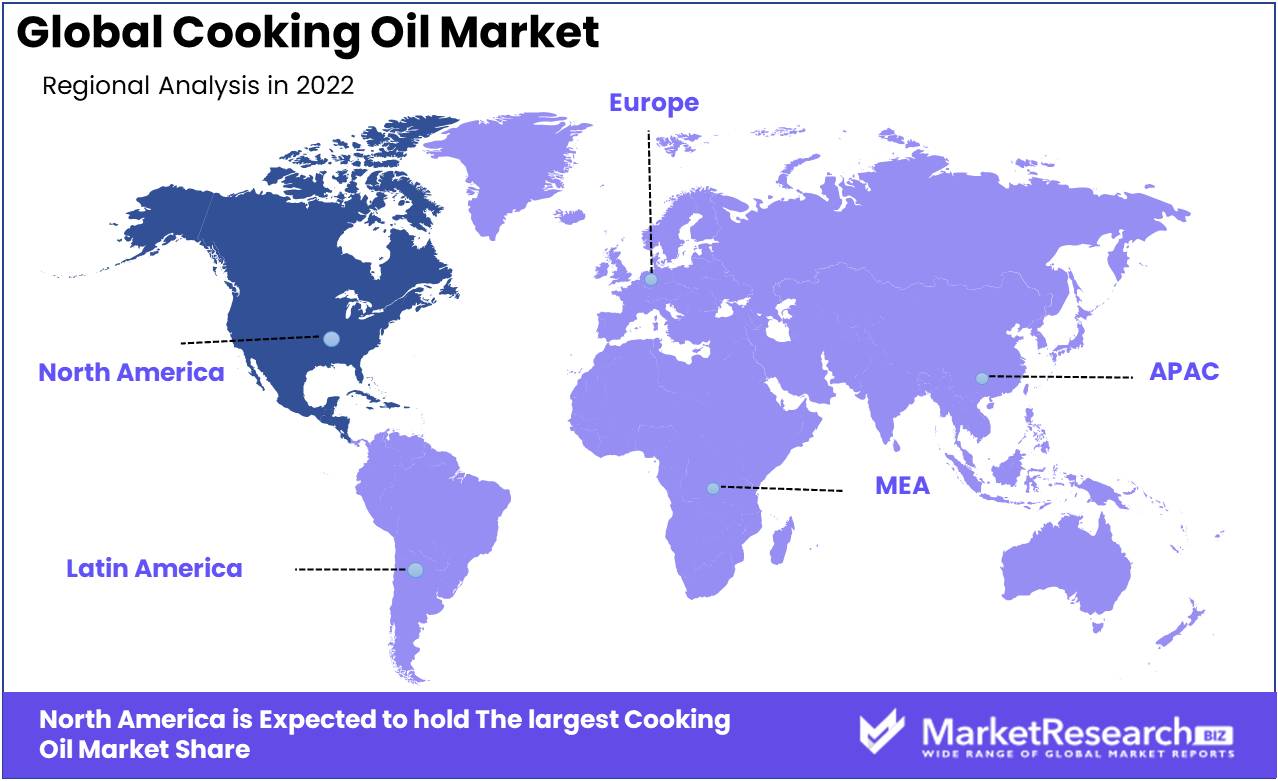

Regional Analysis

Plant-based diets and healthier cooking oils are rising across North America. More individuals are switching to healthier cooking oils that promote sustainable living as they learn about the health risks of bad oils.

Avocado oil, rich in monounsaturated fats and high in smoke point, is one of the most popular healthier cooking oils. It can resist high temperatures without decomposing and generating toxic toxins. Antioxidants in avocado oil neutralize free radicals that cause aging and disease.

Coconut oil is another North American healthy cooking oil market. Coconut oil's medium-chain fatty acids provide fast energy. It's rich in lauric acid, which boosts the immune system with antiviral and antibacterial characteristics.

Plant-based diets can get the same nutrition from a variety of healthful alternatives to animal products. Legumes are versatile and nutrient-dense. Legumes like chickpeas, lentils, and beans are high in protein, fiber, and complex carbs that regulate blood sugar and promote fullness.

Plant-based diets also favor almond, soy, and oat milk. These non-dairy milks are enriched with vitamins and minerals, making them a good substitute for cow's milk. They're lower in calories and fat than cow's milk, making them a good choice for dieters.

Tofu, tempeh, and seitan are popular plant-based proteins. Tofu is made from soybeans and is high in protein and calcium, making it a good meat substitute. Tempeh is rich in probiotics, which promote intestinal health and is made from fermented soybeans. Seitan, commonly known as wheat meat, is made from wheat gluten and can be used in a variety of cuisines.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Key competitors are always fighting for market dominance in the highly competitive global cooking oil market. Several international corporations, including Cargill, Wilmar International, Archer Daniels Midland Company, Bunge Limited, and Conagra Brands, dominate the market. These businesses, which have vast distribution networks, diverse product offerings, and well-known brands, are key players in the global cooking oil market.

With a roughly 17% share of the cooking oil market, Cargill dominates the industry. The business sells a variety of cooking oils, such as canola, soybean, and sunflower oils. Other significant competitors in the market are Wilmar International and Archer Daniels Midland Company, which are both well-established in North America and Asia Pacific, respectively.

Bunge Limited, which offers a wide range of goods including palm oil, soybean oil, and corn oil, is the fourth-largest player in the cooking oil market. The business is well-established in Latin America and has been growing in the Asia Pacific region.

Conagra Brands, another significant competitor in the cooking oil market, holds a market share of roughly 2.5%. Vegetable oil, canola oil, and corn oil are just a few of the many cooking oils that the company sells. It also has a robust distribution system throughout North America.

Top Key Players in Cooking Oil Market

- Unilever Plc

- Cargill, Inc.

- International Foodstuff Company Limited

- United Plantation Berhad

- Wilmar International Limited

- Archer Daniels Midland Company

- Associated British Foods Plc

- Bunge Limited

- Ajinomoto Co., Inc.

- Congra Foods Inc.

Recent Development

- In 2023, Sustainability has grown to be a significant issue in the food industry, especially the cooking oil industry.

- In 2022, There has been a drive for more traceability and transparency in the cooking oil sector due to rising customer knowledge of the origin and quality of food goods.

- In 2021, Worries about heart health and the detrimental effects of saturated fats on cholesterol levels have sparked the creation of cooking oils with lower saturated fat contents.

- In 2020, There was a significant uptick in the popularity of plant-based cooking oils due to the plant-based food movement.

- In 2019, A greater demand for healthier cooking oils has emerged in recent years.

Report Scope:

Report Features Description Market Value (2022) USD 86.2 Bn Forecast Revenue (2032) USD 117.2 B CAGR (2023-2032) 3.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Distribution Channel Analysis (Hypermarket/supermarket, Independent retail store, Business to business, Online sales channel), By End-Use Analysis (Residential, Food Services, Food processing) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Unilever Plc, Cargill, Inc., International Foodstuff Company Limited, United Plantation Berhad, Wilmar International Limited, Archer Daniels Midland Company, Associated British Foods Plc, Bunge Limited, Ajinomoto Co., Inc., Congra Foods Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Unilever Plc

- Cargill, Inc.

- International Foodstuff Company Limited

- United Plantation Berhad

- Wilmar International Limited

- Archer Daniels Midland Company

- Associated British Foods Plc

- Bunge Limited

- Ajinomoto Co., Inc.

- Congra Foods Inc.