Global Construction Robot Market By Type (Articulated Robots, Cartesian Robots, Other ), By Payload Capacity (Less Than 500 Kg, 500-3000 Kg, Other), By Automation (Fully Automated,Semi-Autonomous), By Function (Demolition, Structural Process, Material Handling, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

38166

-

June 2023

-

179

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

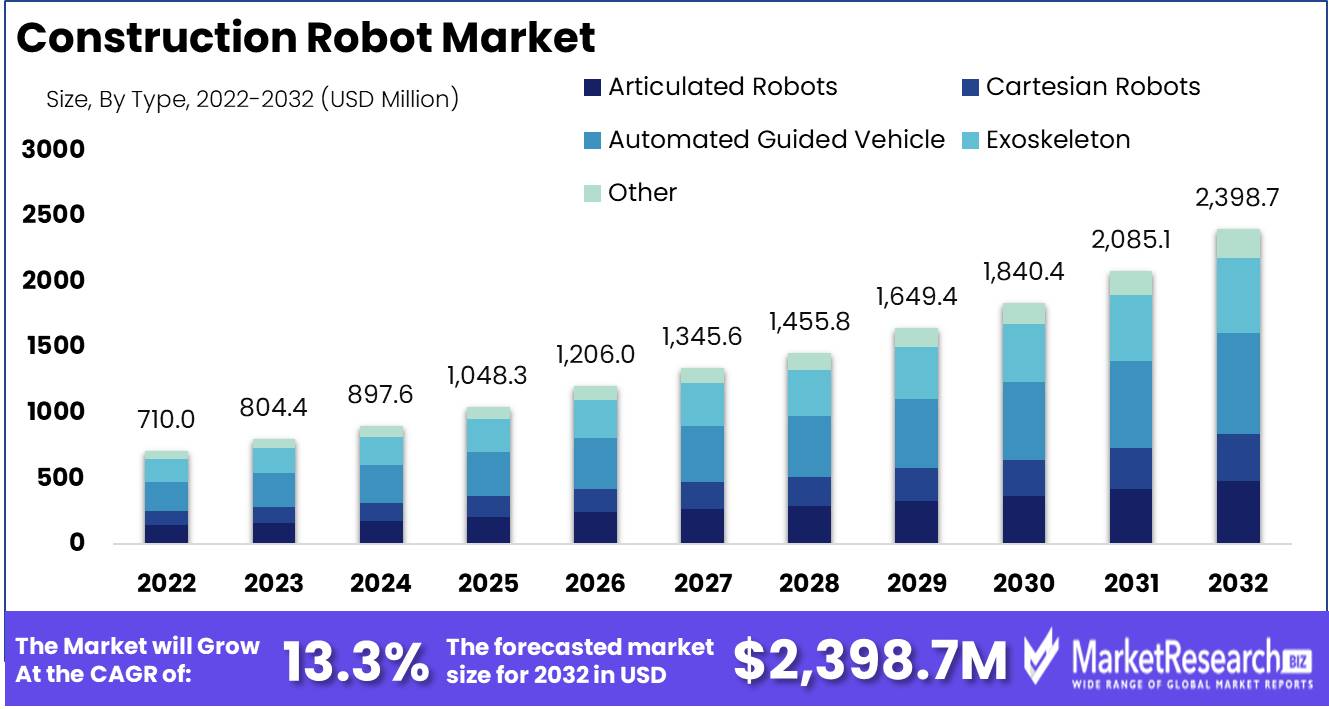

The Global Construction Robot Market size is expected to be worth around USD 2,398.7 Mn by 2032 from USD 710.0 Mn in 2022, growing at a CAGR of 13.3% during the forecast period from 2023 to 2032.

The expansive construction robot incorporates an amalgamation of cutting-edge technologies and artificial intelligence that have permeated the construction industry, orchestrating a complex symphony of tasks including bricklaying, welding, painting, and demolition. The primary objective of this technological marvel is to overcome the inefficiency, exorbitant costs, danger, and environmental degradation that have afflicted the construction industry.

The global market for construction robots has witnessed an unprecedented surge in technological progress, which has unfolded like a vibrant tapestry of development. The advent of autonomous mobile robots (AMRs) with the ability to navigate construction sites without human intervention is a game-changing innovation that has propelled this market into uncharted territory; it represents a quantum leap in the history of automation. In addition, robotic exoskeletons and drones equipped with lidar sensors have emerged as safety pioneers, revolutionizing worker safety and site inspections through a combination of mechanical precision and technological prowess.

Diverse industries, including construction, agriculture, infrastructure, and mining, have embarked on an audacious investment frenzy, channeling their capital into the dynamic global construction robot market. These industries are integrating the synergistic marvels of robotics and artificial intelligence into their daily operations, transforming the landscape of productivity, cost reduction, and safety into a kaleidoscope of possibilities.

However, like a double-edged weapon, this emerging technology unleashes a whirlwind of ethical concerns, casting a pall over the construction industry. The unsettling displacement of human laborers, which echoes the ominous prospect of job losses and an ever-widening gulf between skilled and menial labor, exemplifies the need to strike a delicate balance. In addition, fears reverberate through the corridors of privacy and safety, enveloping the deployment of autonomous robots on construction sites in a shroud of apprehension.

To assuage these ethical concerns, a resounding clarion call for transparency, clarification, and accountability has emerged, permeating the development and implementation of construction robots. Companies are obligated to reveal the intricate nuances of their robotic endeavors so that stakeholders can holistically evaluate their effects on laborers, communities, and the fragile ecosystem we inhabit.

The global construction robot market, a kaleidoscope of countless opportunities, possesses a bewildering array of business applications. From the enhancement of productivity to the reduction of expenses and the bolstering of site safety and health, these robotic marvels create an unmatched model of progress. Moreover, these indomitable construction robots operate as eco-warriors, engaging in the noble pursuit of sustainability by assiduously reducing waste and energy consumption, thereby harmonizing human aspirations with the preservation of our priceless planet.

Driving factors

Increasing Interest in Construction Automation

In the future years, the global market for construction robots is anticipated to expand significantly, driven by the rising demand for automation and productivity. A shortage of skilled labor is one of the greatest challenges confronting the construction industry, driving the need for construction automation. The use of robots in construction can help alleviate the labor shortage while also addressing the industry's other significant challenges.

Robotic Construction Technology Advances

The advancements in robotics technology are revolutionizing the construction industry, and construction robots are becoming more intelligent and capable. From automated bricklaying to 3D printing of concrete, these robots are used in a variety of construction applications, making work more efficient and quicker.

Increased Construction Robot Safety

Safety concerns, which are always a top priority in any construction endeavor, are another crucial factor. Construction robots are designed to operate in hazardous environments, substantially reducing the risk of accidents and injuries. In addition, the use of these robots reduces the need for human workers in hazardous environments and frees them up to perform more important duties requiring human intervention.

Impact of Regulation on Construction Robots

As governments become more aware of the advantages of automation, changes to regulations also have an impact on the construction robot market. The implementation of regulations ensures that these robots are safe, efficient, and compliant with environmental standards.

The Impact of AI and IoT on Construction Robots

Emerging technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) may have a substantial impact on the market for construction robots. The incorporation of AI into these robots could make them more intelligent and capable, whereas IoT technology could improve the robots' communication and data sharing with other machinery.

Technology Disruptors in Construction Robotics

The rise of 3D printing and the development of drones, which could potentially supplant some construction robots, are potential market-altering factors that could impact the competitive landscape of this market. Emerging trends, such as the growing demand for green and sustainable construction, may have an impact on the market for construction robots, as builders and contractors seek to make their operations more environmentally benign and sustainable.

Restraining Factors

Construction Robot Market Growth Is Hampered by High Costs

Construction robots are the future of the construction industry because they increase productivity, reduce costs, and improve labor safety. However, there are still a number of factors preventing the global construction robot market from reaching its maximum potential. The high initial costs associated with these robots are one of the largest factors inhibiting the expansion of the global construction robot market. The development, design, and manufacturing of Construction Robots are expensive.

Construction Robot Adoption Is Hampered by Lack of Awareness

In addition, there is a lack of understanding regarding the long-term advantages of construction robots. Due to the high initial cost, many organizations are hesitant to invest in this technology because they are uncertain of the return on investment. This lack of knowledge results in industry resistance, which in turn delays the global construction robot market's growth.

Customizing Robots for Diverse Construction Settings

With a variety of terrains, heights, weather patterns, and materials, construction sites can be extremely complex environments. The design and functionality of construction robots may be affected by the aforementioned factors. For example, robots employed in the construction of high-rise structures require more sophisticated technology than robots employed in excavation and leveling.

Robots Adaptable to Diverse Construction Projects

In addition, the robot's configuration and design must correspond with the type of construction project. Construction robots must be adaptable to a variety of construction locations in order to maximize their productivity and justify their investment cost. However, the tasks associated with each construction project vary, necessitating the development of unique robots for each form of construction project.

Regulatory Obstacles Hinder Market for Construction Robots

Regulations can also hinder the expansion of the global market for construction robots. The use of robots in construction projects is governed by stringent regulations in a number of countries. In some countries, these regulations may prevent the adoption of construction robots or increase the costs associated with their implementation.

Change Resistance Restrains Construction Robot Adoption

Construction is one of the world's oldest and most traditional industries, and there is resistance to change. Many construction companies have utilized the same methods and techniques for decades, and some may be reluctant to invest in new technology such as construction robots. This reluctance is frequently caused by a lack of understanding regarding the advantages of utilizing construction robots.

Type Analysis

The global construction robot market is growing rapidly and is expected to register a CAGR of over during the forecast period. This growth is linked to the adoption of automation and robots in the construction industry. The automated Guided Vehicle (AGV) segment dominates the construction robot market.

AGVs are self-driving robots. Construction sites employ them to move huge loads. Due to its ability to boost production, lower operational costs, and improve logistical efficiency, the AGV segment is growing.

AGV segment adoption is driven by economic development in emerging markets including India, China, and South Korea. These countries are rapidly urbanizing, and modern construction solutions to meet population needs are in high demand.

In India, the government launched Smart Cities Mission and Homes for All to provide affordable homes. China is urbanizing quickly, thus there is a high demand for modern construction solutions that can keep up with development.

The construction industry has embraced robots, and customer trends and behavior toward the AGV segment are becoming more positive. Consumers already know the benefits of AGVs and are expecting smart construction solutions that boost efficiency and production.

The AGV segment is expected to register the fastest growth rate in the next years. First, the construction industry is automating and demanding robots to boost efficiency and productivity. Second, the AGV segment is highly adaptable and can be employed in factories and warehouses. Finally, manufacturers are investing extensively in research and development to increase AGV capabilities, which is expected to drive their adoption in the future years.

Analysis of Payload Capacity

When picking construction robots, payload capacity is crucial. The 500 - 3000 Kg segment is dominating the global construction robot market and is expected to do so for the foreseeable future.

This segment is growing because of its ability to transport big amounts of construction materials and equipment. Construction of high routes, bridges, and tunnels benefits from it.

The development of the 500 - 3000 Kg segment in the construction robot market is being driven by growing nations like India and China. These countries are rapidly urbanizing, and modern construction technologies that efficiently move huge volumes of materials are in high demand.

In India, the government has launched various infrastructure projects, including the Bharatmala Project and the Sagarmala Project, which are expected to drive high demand for construction robots with high payload capacity.

As construction businesses grasp the benefits of robots with high payload capacity, customer trends and behavior towards the 500-3000 Kg segment are becoming more positive. They can finish tasks faster and under budget using such robots.

The 500 - 3000 Kg segment is anticipated to register the fastest growth rate in the next years. First, the construction industry is automating and demanding high-payload robots. Second, the 500-3000 Kg segment's adaptability allows it to be used in many construction contexts, which is expected to drive global adoption. The increasing focus on infrastructure development in emerging nations is expected to drive demand for robots with high payload capacities.

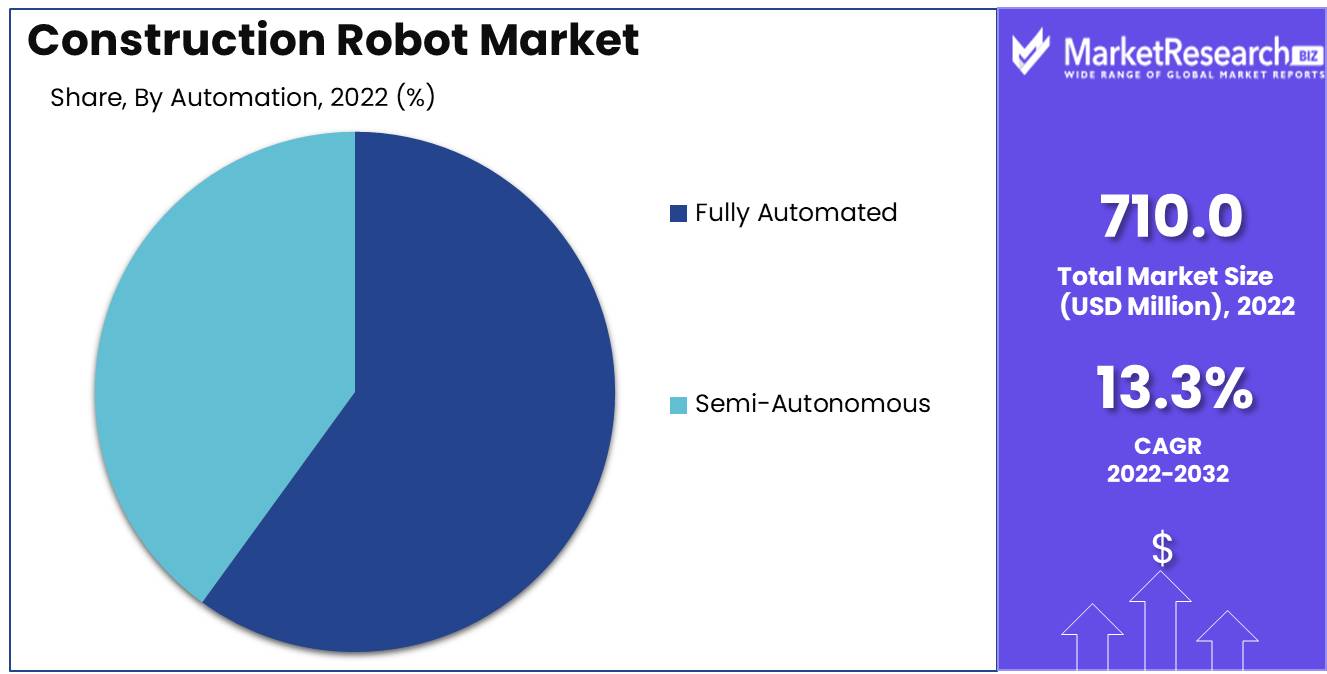

Automation Analysis

The construction robot industry is rapidly automating, and the Fully Automated Segment is dominating the market. Due to its ability to do sophisticated, high-precision procedures, this segment is growing.

The adoption of fully automated systems in the construction robot market is driven by rising economies' economic development. These countries are rapidly urbanizing, and modern construction solutions to meet population needs are in high demand. Construction businesses can finish projects faster and within budget thanks to the integration of fully automated systems.

As construction organizations continue to implement automation to boost efficiency and productivity, the consumer trend and behavior toward completely automated systems in the industry are becoming increasingly positive. These technologies can work without human assistance, reducing construction site accidents.

In the future years, the completely automated segment is anticipated to register the fastest growth rate. First, the construction industry is automating and demanding superior robots. Second, the integration of modern technologies like AI, ML, and CV in fully automated systems makes them work well, which is expected to drive their global adoption. Finally, emerging economies' focus on infrastructure development is expected to drive the construction industry's demand for fully automated systems.

Key Market Segments

By Type

- Articulated Robots

- Cartesian Robots

- Automated Guided Vehicle

- Exoskeleton

- Other Types

By Payload Capacity

- Less Than 500 Kg

- 500-3000 Kg

- 3001 Kg & Above

By Automation

- Fully Automated

- Semi-Autonomous

By Function

- Demolition

- Structural Process

- Material Handling

- Finishing Processes

- Fabrication & Assembly

- 3d Printing

- Quality Inspection

- Layout

- Other Functions

By Vertical

- Commercial & Residential Building

- Energy & Utilities

- Public Infrastructure

- Other Verticals

Growth Opportunity

Construction Efficiency Is Boosted by Specialized Robots

Specialized construction robots accelerate market growth. These robots perform specific tasks including bricklaying, painting, and welding. These robots boost production and save labor expenses for construction companies. These robots can perform repetitive tasks without tiring, which can lead to higher quality.

Construction Robotics Collaboration

While robots can perform some tasks better than humans, they lack human adaptability and problem-solving. In construction, robots and humans must work together. Humans and robots can balance each other out by working together. A human worker can supervise a robot's work and make key choices, while a robot can perform heavy lifting tasks.

Modular Construction Promotes Robotics

Modular building is another factor driving the construction robot market growth. This construction approach involves factory-prefabricated building components and on-site assembly. Construction companies can reduce time and labor expenses by employing modular construction. Robots can assemble pre-fabricated parts, saving money and time.

Partnerships Grow Construction Robots

Finally, construction companies' partnerships with robotics manufacturers are propelling the construction robot market growth. By working together, these companies can create construction-specific technology and solutions. These partnerships can lead to enhanced robot and BIM integration.

Latest Trends

Construction Robot Market Growth Driven by Innovation

Significant market trends, including autonomous and collaborative robots, robotic assembly, drones in construction, and hazardous task automation, are shaping the global construction robot market. This market is expanding at an unprecedented rate, and the future of construction robots appears more promising than ever with the advent of sophisticated technology and innovative designs.

Construction-Revolutionizing Autonomous Robots Ascend

The construction industry is revolutionizing with autonomous and collaborative robots. These robots are capable of working more quickly and precisely than humans, reducing the need for human labor and boosting productivity. These robots are capable of a vast array of duties, including painting, plastering, bricklaying, and welding. As these robots continue to improve, their use and adoption in the construction industry will increase dramatically.

Construction Efficiency Is Driven by Robotic Assembly

The new era of automated assembly has arrived, and robots are at the forefront. In the construction industry, robotic assembly is being used in a variety of methods, including prefabrication and modular construction. The construction process can be accelerated, and robotic assembly can help improve accuracy and safety.

Transformation of Construction Site Surveillance by Drones

Drones are gaining popularity in the construction industry because they enable more precise surveying and mapping of construction sites. Additionally, they can be used to monitor construction progress and ensure that everything is operating efficiently. Drones can reduce expenses, improve safety, and boost productivity. We can expect to see more businesses incorporating drones into their construction processes as this technology continues to improve.

Enhancing Robot Safety Automate Hazardous Tasks

Safety is always a top priority on construction sites due to the numerous dangers. In the construction industry, automation of hazardous tasks is becoming increasingly prevalent. This includes the use of robots to perform hazardous activities like demolition and excavation. By utilizing robots for these duties, we can reduce the risk of injury to human workers and improve construction site safety overall.

Innovative Trends Fuel Construction Robot Market Growth

The rise of autonomous and collaborative robots, robotic assembly, construction drones, and hazardous task automation is shaping the global market for construction robots. These developments are revolutionizing our approach to construction by making it quicker, safer, and more precise. We can expect to see even more growth in the construction robot market as this technology continues to evolve and improve.

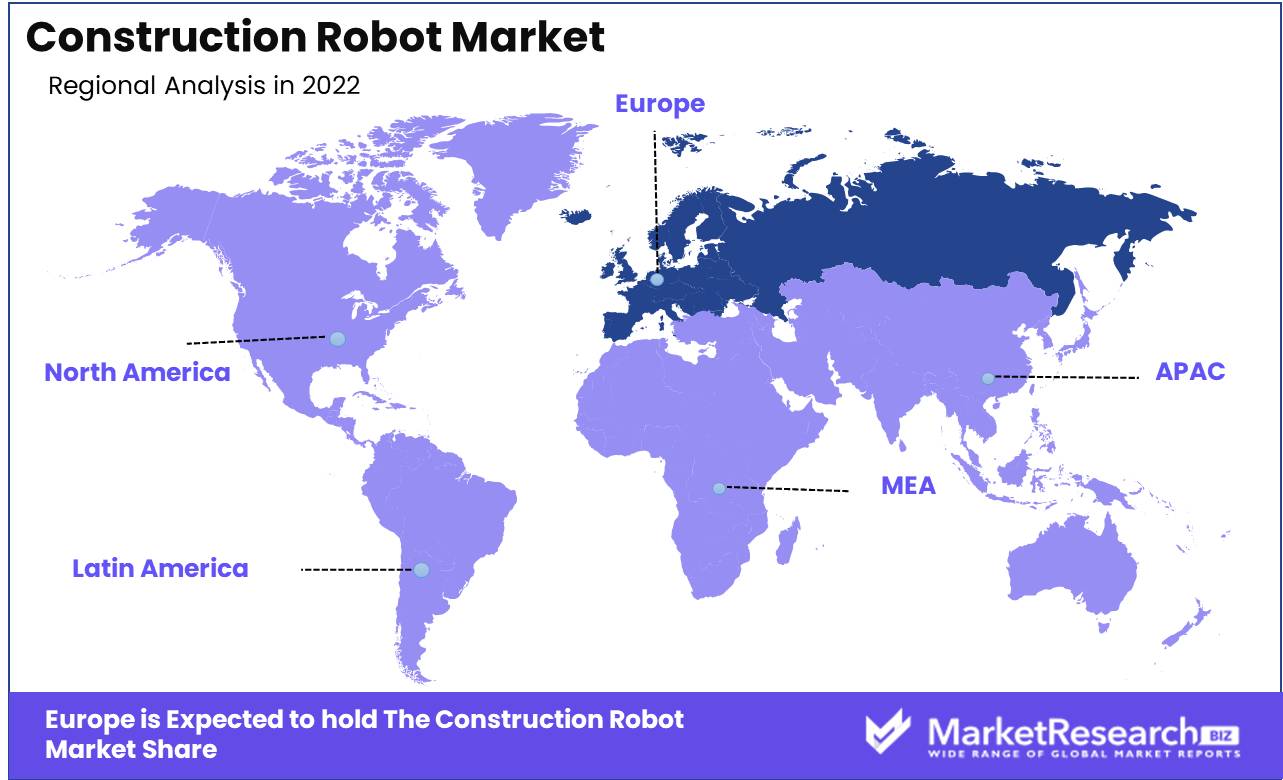

Regional Analysis

The construction industry has rapidly adopted construction robots in Europe, which dominates the market. Construction robots undertake demolition, excavation, and transportation operations in the construction industry. Europe dominates the construction robots market, which has been growing rapidly.

Innovation and technology are why Europe dominates the construction robot market. ABB, KUKA, and FANUC are leading European robotics companies. These companies pioneered construction industry-specific robots. They have substantially invested in research and development to create safe, efficient, and trustworthy robots. Since many European construction companies use these robots, Europe dominates the market.

Sustainability is another reason Europe leads the construction robot market. Europe has traditionally been a leader in supporting sustainable development, including in the construction industry. Efficiency and waste reduction from construction robots could lessen the industry's environmental effects. Many nations in Europe have implemented rigorous environmental restrictions, increasing the demand for sustainable construction. Construction robots suit this ethos, solidifying Europe's market leadership.

Europe's construction robot market has also benefited from government incentives. Many governments in Europe have implemented robot programs to boost robot use in construction. The European Union funds robotics research and development. To encourage construction companies to utilize robots, various countries have implemented tax cuts and other incentives. These policies have boosted the European construction robot market.

Europe's construction industry has highly skilled personnel. Engineering, robotics, and other technical training have prepared many professionals to operate and maintain construction robots. This experience has helped European construction companies use robots faster and more successfully than their counterparts.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global construction robot market is a quickly growing industry that is expected to grow over the next few years. Labor costs, safety concerns, and construction efficiency are driving the industry. With the growing automation trend in the construction industry, there is a growing demand for construction robots, which are designed to help with demolition, excavation, and masonry tasks.

The global construction robot market has several key players. These companies are creating cutting-edge robots with advanced capabilities designed to tackle various construction tasks with more efficiency, accuracy, and safety. Komatsu, Husqvarna, TopTec Spezialmaschinen, Brokk AB, Construction Robotics, Giant Hydraulic Tech, Fujita Corporation, and Alpine are key competitors in the global construction robot market. These firms are investing considerably in research and development to create sophisticated construction robots that can operate in difficult settings and execute complex tasks.

The development of autonomous construction robots is a key trend in the global construction robot market. These robots are designed to perform without human assistance, which can increase safety and lower labor expenses. Autonomous construction robots speed up operations and reduce downtime. Artificial intelligence and virtual and augmented reality are other key trends in the global construction robot market. The global construction robot market is expected to continue growing due to the rising demand for construction robots and the construction industry's drive toward automation.

Top Key Players in Construction Robot Market

- ABB

- Husqvarna AB

- Komatsu Ltd.

- Fujita Corporation

- FBR Ltd

- Conjet

- Contour Crafting Corporation

- MX3D

- CyBe Construction

- KEWAZO BROKK GLOBAL

- RobotWorx

- Built Robotics

- ICON Technology Inc.

- Dusty Robotics

- MUDBOTS 3D CONCRETE PRINTING LLC

- Other Key Players

Recent Development

- In 2023, 3D Printing Construction Robots In the construction industry, 3D printing technology has made significant strides in recent years.

- In 2022, Robotic Demolition Equipment will be available. In 2022, robotic precision demolition equipment became more prevalent.

- In 2021, Drones for Monitoring Construction Sites Construction site monitoring and surveying has become increasingly dependent on drones.

- 2020, Robotic exoskeletons for construction workers are expected to be available in 2020. robotic exoskeletons became increasingly prevalent in the construction industry.

- In 2019, Several companies introduced autonomous bricklaying robots that are capable of laying bricks with precision and efficiency.

Report Scope:

Report Features Description Market Value (2022) USD 710 Mn Forecast Revenue (2032) USD 2,398.7 Mn CAGR (2023-2032) 13.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Articulated Robots, Cartesian Robots, Automated Guided Vehicle, , Other Types), By Automation (Fully Automated,Semi-Autonomous), By Function (Demolition, Structural Process, Material Handling, Finsihing Processes, Fabrication & Assembly, 3d , Printing, Quality Inspection, Layout, Other Functions), By Vertical (Commercial & Residential Building, Energy & Utilities, Public Infrastructure, Other Verticals) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ABB, Husqvarna AB, Komatsu Ltd., Fujita Corporation, FBR Ltd, Conjet, Contour Crafting Corporation, MX3D, CyBe Construction, KEWAZO BROKK GLOBAL, RobotWorx, Built Robotics, ICON Technology inc., Dusty Robotics, MUDBOTS 3D CONCRETE PRINTING LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- ABB

- Husqvarna AB

- Komatsu Ltd.

- Fujita Corporation

- FBR Ltd

- Conjet

- Contour Crafting Corporation

- MX3D

- CyBe Construction

- KEWAZO BROKK GLOBAL

- RobotWorx

- Built Robotics

- ICON Technology Inc.

- Dusty Robotics

- MUDBOTS 3D CONCRETE PRINTING LLC

- Other Key Players