Construction Aggregates Market By Product Type (Crushed stone, Sand, Gravel, Other aggregates), By Application (Commercial, Residential, Industrial, Infrastructure), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

2344

-

June 2024

-

128

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

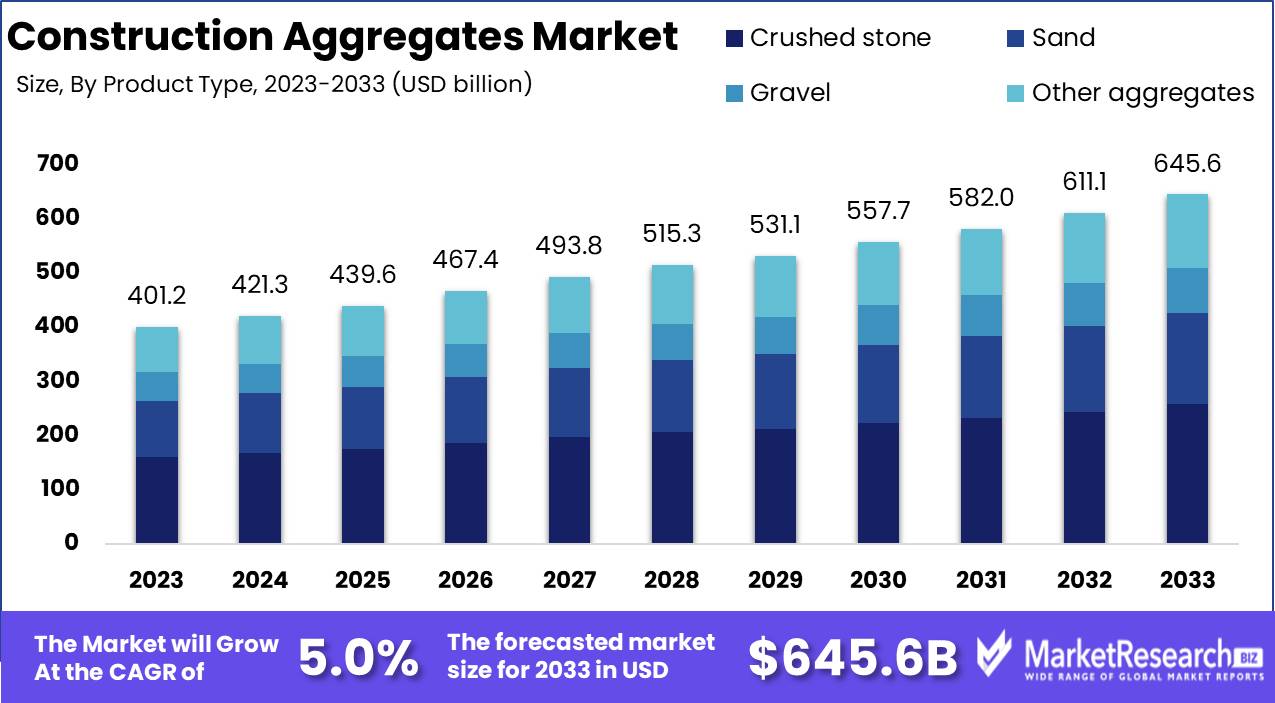

The Global Construction Aggregates Market was valued at USD 401.2 Bn in 2023. It is expected to reach USD 645.6 Bn by 2033, with a CAGR of 5% during the forecast period from 2024 to 2033.

The Construction Aggregates Market encompasses the global production, distribution, and utilization of crushed stone, sand, gravel, and other aggregates used in construction. These materials are fundamental components in the creation of concrete, asphalt, and other building materials, supporting infrastructure development and urbanization. Market growth is driven by rising construction activities, particularly in emerging economies, and the ongoing expansion of residential, commercial, and industrial projects. Technological advancements in aggregate production and sustainable practices are enhancing efficiency and environmental performance.

The Construction Aggregates Market is integral to the infrastructure and construction sectors, underpinning the development of residential, commercial, and industrial projects. The market is experiencing robust growth, driven by increased construction activities globally, particularly in emerging economies where urbanization and industrialization are rapidly advancing. In 2006, the U.S. produced 1.32 billion tonnes of sand and gravel worth $8.54 billion, with 264 million tonnes valued at $1.92 billion specifically used as concrete aggregates, highlighting the significant scale and economic impact of this market segment.

The Construction Aggregates Market is integral to the infrastructure and construction sectors, underpinning the development of residential, commercial, and industrial projects. The market is experiencing robust growth, driven by increased construction activities globally, particularly in emerging economies where urbanization and industrialization are rapidly advancing. In 2006, the U.S. produced 1.32 billion tonnes of sand and gravel worth $8.54 billion, with 264 million tonnes valued at $1.92 billion specifically used as concrete aggregates, highlighting the significant scale and economic impact of this market segment.A notable trend in the market is the adoption of sustainable and innovative aggregate solutions. For instance, Ring Industrial Group's EZflow product lines are produced using geosynthetic aggregate pieces made from more than 99.9% recycled polystyrene. This shift towards sustainable practices not only addresses environmental concerns but also aligns with global regulatory standards and the increasing demand for eco-friendly construction materials.

Technological advancements in aggregate production processes are enhancing efficiency, reducing waste, and improving the quality of the end products. Companies are investing in cutting-edge technologies to optimize resource utilization and minimize environmental impact. Additionally, strategic partnerships and mergers and acquisitions are shaping the competitive landscape, enabling market players to expand their product portfolios and geographical reach.

The construction aggregates market's growth trajectory is expected to remain positive, driven by ongoing infrastructure investments and the need for high-quality building materials. As urban centers continue to expand and new projects emerge, the demand for construction aggregates will persist, reinforcing its critical role in the construction industry. The focus on sustainability and innovation will further propel market growth, ensuring long-term viability and environmental stewardship.

Key Takeaways

- Market Value: The Global Construction Aggregates Market was valued at USD 401.2 Bn in 2023. It is expected to reach USD 645.6 Bn by 2033, with a CAGR of 5% during the forecast period from 2024 to 2033.

- By Product Type: Crushed Stone dominates the market, accounting for approximately 40% of the total share, due to its extensive use in construction and infrastructure projects.

- By Application: Residential construction accounts for approximately 30% of the market, fueled by housing developments and urbanization.

- Regional Dominance: The Asia-Pacific region dominates the construction aggregates market, accounting for around 38% of the market share.

- Growth Opportunity: The growing infrastructure development and urbanization in emerging economies drive growth opportunities in the construction aggregates market.

Driving factors

Infrastructure Development

Infrastructure development is a primary driver of the construction aggregates market, as the sector forms the backbone of any thriving economy. Major infrastructure projects, such as highways, bridges, railways, and airports, necessitate vast quantities of construction aggregates, including sand, gravel, and crushed stone. Governments worldwide are investing heavily in infrastructure to boost economic growth and improve connectivity. The United States has unveiled plans for a $2 trillion infrastructure package, while China continues to expand its Belt and Road Initiative, both of which are projected to significantly increase the demand for construction aggregates.

Infrastructure development projects often have a long-term horizon, ensuring sustained demand for aggregates over several years. This consistent demand supports stable market growth and encourages investment in aggregate production facilities. With advancements in construction technology and techniques, the efficiency and scope of infrastructure projects are expanding, further driving the need for high-quality construction aggregates.

Urbanization and Population Growth

Urbanization and population growth are critical factors contributing to the rise in demand for construction aggregates. As more people move to urban areas, the need for residential, commercial, and industrial construction intensifies. According to the United Nations, 68% of the world's population is expected to live in urban areas by 2050, up from 55% in 2018. This massive urban migration necessitates the development of housing, roads, utilities, and other urban infrastructure, all of which rely heavily on construction aggregates.

The expansion of urban centers also spurs the development of new towns and cities, creating a cycle of ongoing construction activity. This trend is particularly pronounced in emerging economies in Asia, Africa, and Latin America, where urbanization rates are accelerating. For example, India's Smart Cities Mission aims to develop 100 smart cities, significantly boosting the demand for construction aggregates in the region.

Economic Growth

Economic growth directly influences the construction aggregates market by enabling higher levels of investment in infrastructure and construction projects. As economies grow, governments and private sectors have more resources to allocate towards building and upgrading infrastructure. This economic expansion fuels the demand for construction aggregates needed for a wide range of projects, from residential developments to large-scale public works.

The correlation between GDP growth and construction activity is well-documented. For instance, China's rapid economic growth over the past few decades has been accompanied by substantial investment in construction, driving its status as the largest consumer of construction aggregates globally. Similarly, as countries in Africa and Southeast Asia experience economic growth, their construction sectors are expanding, increasing the demand for aggregates.

Restraining Factors

Stringent Mining Laws

Stringent mining laws have a profound impact on the construction aggregates market, often creating challenges that require market adaptation. Regulations aimed at environmental protection, land use, and sustainable mining practices can limit the availability of raw materials. These laws typically impose restrictions on where and how mining operations can be conducted, mandate reclamation projects, and enforce strict environmental standards to minimize the ecological footprint of mining activities.

The United States and Canada have comprehensive mining regulations that include extensive permitting processes, environmental impact assessments, and community engagement requirements. While these regulations are crucial for sustainable development, they can increase operational costs and slow down the approval of new mining projects. This, in turn, can lead to supply constraints and higher prices for construction aggregates.

Trade Protectionist Policies

Trade protectionist policies significantly influence the construction aggregates market by shaping global supply chains and market dynamics. These policies, which include tariffs, import quotas, and trade restrictions, are designed to protect domestic industries from foreign competition. While they can stimulate local production, they also have the potential to disrupt international trade and create volatility in the market.

Tariffs on imported aggregates or raw materials can lead to increased costs for construction projects, as domestic producers may not always be able to meet the demand or offer competitive pricing. This can result in higher prices for consumers and potentially slow down construction activity. Countries that rely on imports to supplement their aggregate supplies may face shortages or price hikes due to protectionist measures.

By Product Type Analysis

Leading with over 40% market share, Crushed Stone remains the preferred type of construction aggregate.

In 2023, Crushed Stone held a dominant market position in the By Product Type segment of the Construction Aggregates Market, capturing more than a 40% share. This significant market share highlights the crucial role of crushed stone in construction activities, driven by its widespread use in infrastructure development and building projects. The growth of this product type is attributed to its versatility, durability, and the increasing demand for high-quality construction materials. Its dominance is supported by its extensive use in road construction, concrete production, and building foundations.

The Sand segment also holds a substantial share in the construction aggregates market. Sand is a critical component in concrete, mortar, and asphalt mixtures. The growth in urbanization and the ongoing construction of residential and commercial buildings have driven the demand for sand. Additionally, the use of sand in land reclamation projects and landscaping further supports its market presence.

Gravel is another significant segment in the construction aggregates market. It is widely used in road construction, railway ballast, and as a drainage material. The increasing construction of roads and highways, along with the expansion of railway networks, has fueled the demand for gravel. Its easy availability and cost-effectiveness make it a favored choice for various construction applications.

Other Aggregates, including materials like recycled concrete, slag, and other by-products, have also shown growth. These materials are gaining popularity due to their environmental benefits and cost savings. The growing emphasis on sustainable construction practices and the recycling of construction waste have positively impacted the demand for other aggregates.

By Application Analysis

Residential segment is the primary driver of demand for construction aggregates leading with over 30% market share.

In 2023, Residential held a dominant market position in the By Application segment of the Construction Aggregates Market, capturing more than a 30% share. This substantial market share underscores the critical role of residential construction in driving the demand for construction aggregates, supported by the ongoing urbanization and population growth. The growth in this application segment is attributed to the increasing number of housing projects and renovations, coupled with government initiatives to promote affordable housing.

The Commercial segment also holds a significant share in the construction aggregates market. This segment encompasses office buildings, retail spaces, hotels, and other commercial properties. The expansion of urban areas, rising investments in commercial real estate, and the growing demand for modern office spaces and retail complexes have fueled the need for construction aggregates in commercial applications.

The Industrial segment includes factories, warehouses, and production facilities. The growth of manufacturing and logistics sectors has led to increased construction activities in industrial applications. The need for durable and reliable construction materials to support large-scale industrial projects has driven the demand for construction aggregates in this segment.

The Infrastructure segment, encompassing roads, bridges, airports, and other public works, remains a vital part of the construction aggregates market. Significant investments in infrastructure development, particularly in emerging economies, have bolstered the demand for aggregates.

Key Market Segments

By Product Type

- Crushed stone

- Sand

- Gravel

- Other aggregates

By Application

- Commercial

- Residential

- Industrial

- Infrastructure

Growth Opportunity

Sustainable Construction Practices

Sustainable construction practices are becoming a cornerstone of the construction industry, driven by regulatory requirements and consumer preferences for eco-friendly buildings. The shift towards green construction materials, such as recycled aggregates and eco-friendly binders, is creating new opportunities for market players.

Adopting sustainable practices not only addresses environmental concerns but also offers cost benefits through improved resource efficiency and waste reduction. Companies investing in sustainable aggregate production technologies, such as advanced recycling methods and low-emission processing techniques, are well-positioned to capitalize on this growing trend.

Smart City Initiatives

Smart city initiatives represent a significant growth driver for the construction aggregates market. With urbanization accelerating, governments and municipalities worldwide are investing in smart infrastructure to enhance urban living. Smart cities focus on integrating advanced technologies into urban infrastructure, including transportation networks, energy systems, and public services.

These projects necessitate durable and high-quality construction materials, driving demand for aggregates. Companies that align their product offerings with the specific requirements of smart city projects, such as providing high-performance and versatile aggregates, can tap into this burgeoning market segment.

Latest Trends

Mergers and Acquisitions

The trend of mergers and acquisitions (M&A) is expected to accelerate in the construction aggregates market in 2024. As regulatory pressures and operational costs rise, companies are increasingly seeking to consolidate to enhance their competitive edge and achieve economies of scale. M&A activities allow firms to expand their geographic footprint, access new markets, and integrate advanced technologies.

For instance, the acquisition of regional producers by larger firms helps in diversifying product portfolios and strengthening supply chains. The aggregate value of global M&A deals in the construction sector reached $123 billion in 2022, indicating a robust appetite for consolidation. This trend is likely to continue, fostering a more competitive and resilient market landscape.

Dominance of Sand and Gravel

Sand and gravel remain the most dominant types of construction aggregates, driven by their essential role in various construction applications. These materials are integral to concrete production, road building, and infrastructure projects. According to the US Geological Survey, sand and gravel accounted for over 70% of total aggregates production in 2022, a trend that is expected to persist.

The abundance and versatility of sand and gravel make them indispensable, particularly as urbanization and infrastructure development projects proliferate. In regions experiencing rapid urban growth, such as Asia-Pacific and Africa, the demand for these core materials continues to soar. Companies focusing on efficient extraction and processing of sand and gravel are well-positioned to benefit from this sustained demand.

Regional Analysis

Asia-Pacific leads the global construction aggregates market with a 38% share,

The global construction aggregates market displays varied regional trends, with Asia-Pacific leading the charge, holding a significant 38% market share. This dominance is primarily driven by rapid urbanization, substantial infrastructure development, and extensive construction activities in countries like China, India, and Indonesia. The region's burgeoning population and governmental investments in large-scale infrastructure projects, such as China's Belt and Road Initiative, further bolster demand for construction aggregates.

In North America, the market is fueled by steady growth in residential and commercial construction. The U.S. and Canada are key contributors, benefiting from ongoing urban redevelopment and infrastructure modernization efforts. The presence of advanced construction technologies and the implementation of sustainable building practices also support market expansion in this region.

Europe represents a mature market with stable demand driven by renovation activities and infrastructure upgrades. Germany, the UK, and France are major markets where the focus is on enhancing existing structures and promoting sustainable construction. Stringent environmental regulations and the European Union's emphasis on recycling and resource efficiency play a pivotal role in shaping the market dynamics.

The Middle East & Africa region is experiencing robust growth in the construction aggregates market, driven by rapid urbanization and ambitious infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries. The UAE, Saudi Arabia, and Qatar are leading markets, with significant investments in smart cities and mega-projects such as Saudi Arabia's NEOM city.

Latin America is witnessing gradual market growth, with Brazil and Mexico being key players. Economic recovery and increasing foreign investments in infrastructure development are driving demand for construction aggregates. The region's focus on improving transportation networks and urban infrastructure further supports market growth.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global construction aggregates market is driven by key players such as Heidelberg Cement AG, Martin Marietta Materials, Inc., and LafargeHolcim Ltd., who are leading the industry through strategic expansions, technological advancements, and a focus on sustainability. Heidelberg Cement AG stands out with its extensive global presence and strong focus on innovation and environmental stewardship. The company's initiatives in reducing carbon emissions and utilizing alternative materials align with the growing demand for sustainable construction practices.

Martin Marietta Materials, Inc. continues to be a dominant force in North America, benefiting from a strong portfolio of construction aggregates and significant investments in infrastructure projects across the United States. Their strategic acquisitions and emphasis on high-quality materials ensure a robust market position.

LafargeHolcim Ltd., with its vast international footprint, remains a key player by leveraging its advanced R&D capabilities to develop sustainable and high-performance construction materials. The company's commitment to circular economy principles and green building solutions positions it favorably in the market.

CEMEX S.A.B. de C.V. and Vulcan Materials Company are crucial players, particularly in the Americas. CEMEX's integrated supply chain and diversified product offerings cater to a broad range of construction needs, while Vulcan's strong distribution network and focus on operational efficiency drive its market growth.

CRH plc. and EUROCEMENT Holding AG are significant in Europe, with CRH's diverse product portfolio and strategic acquisitions enhancing its market position. EUROCEMENT's dominance in the Russian market and focus on modernizing production facilities contribute to its competitive edge.

Adelaide Brighton Ltd. plays a vital role in the Asia-Pacific region, particularly in Australia. The company's strategic partnerships and investments in expanding production capacity support its market growth.

Market Key Players

- Heidelberg Cement AG.

- Martin Marietta Materials, Inc.

- LSR Group PJSC.

- LafargeHolcim Ltd.

- CEMEX S.A.B. de C.V.

- Vulcan Materials Company

- CRH plc.

- EUROCEMENT Holding AG.

- ADELAIDE BRIGHTON LTD.

Recent Development

- In January 2024, HeidelbergCement AG announced a significant investment in its North American operations to enhance production capacity and improve sustainability.

- In November 2023, Martin Marietta Materials, Inc. invested $1.6 billion to acquire Lehigh Hanson’s West Region business, expanding its aggregate and cement production footprint

Report Scope

Report Features Description Market Value (2023) USD 401.2 Bn Forecast Revenue (2033) USD 645.6 Bn CAGR (2024-2033) 5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Crushed stone, Sand, Gravel, Other aggregates), By Application (Commercial, Residential, Industrial, Infrastructure) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Heidelberg Cement AG., Martin Marietta Materials, Inc., LSR Group PJSC., LafargeHolcim Ltd., CEMEX S.A.B. de C.V., Vulcan Materials Company, CRH plc., EUROCEMENT Holding AG., ADELAIDE BRIGHTON LTD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Heidelberg Cement AG.

- Martin Marietta Materials, Inc.

- LSR Group PJSC.

- LafargeHolcim Ltd.

- CEMEX S.A.B. de C.V.

- Vulcan Materials Company

- CRH plc.

- EUROCEMENT Holding AG.

- ADELAIDE BRIGHTON LTD.