Connected Ship Market By Ship Type (Commercial, Defense), By Installation Type (On-board, Onshore), By Application (Vessel Traffic Management, Fleet Operations, Fleet Health Monitoring), By Fit (Line Fit, Retrofit), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46253

-

May 2024

-

136

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

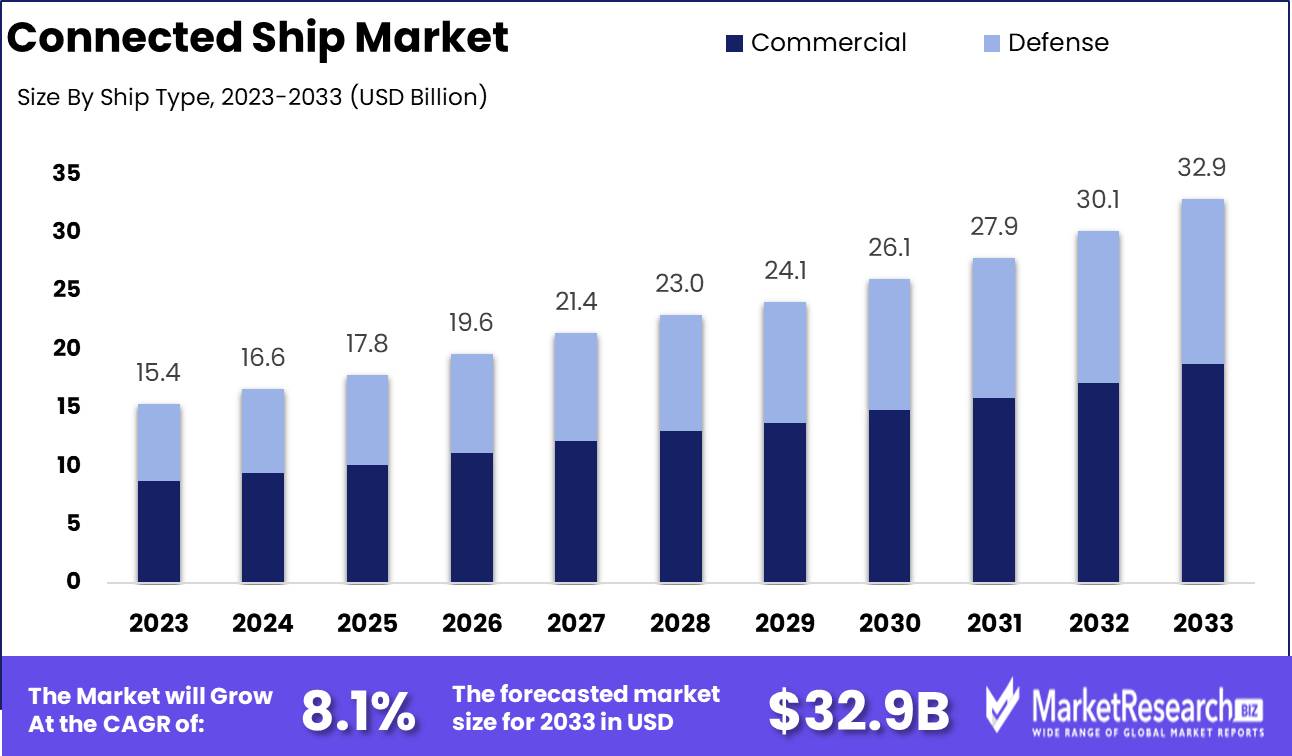

The Global Connected Ship Market was valued at USD 15.4 Bn in 2023. It is expected to reach USD 32.9 Bn by 2033, with a CAGR of 8.1% during the forecast period from 2024 to 2033.

The Connected Ship Market encompasses the rapidly evolving landscape of maritime technology, integrating advanced connectivity solutions to enhance vessel operations and management. It leverages Internet of Things (IoT) technologies to enable seamless data exchange between ship systems, shore-based facilities, and third-party platforms, fostering real-time monitoring, predictive maintenance, and operational optimization. With an emphasis on digitalization and automation, this market empowers maritime stakeholders to drive efficiency gains, reduce operational costs, and mitigate risks across the entire fleet.

The Connected Ship Market stands at the forefront of maritime innovation, poised to revolutionize the industry's operational landscape. By integrating sensors and communication technologies, connected ships offer unprecedented levels of data-driven insights and operational efficiency gains. Recent studies indicate that these advancements can potentially enhance operational efficiency by up to 20%, driving significant cost savings and performance improvements across fleets worldwide.

This paradigm shift is exemplified by the emergence of cutting-edge technologies such as the H-USV (Hybrid Unmanned Surface Vehicle), which embodies the next frontier of maritime connectivity and automation. Equipped with AI-based processing capabilities, modular design, and a robust payload capacity, the H-USV represents a transformative solution for streamlining maritime operations, reducing harbor-to-site transit times, and enhancing overall fleet agility.

Analysis underscores the immense transformative potential of the Connected Ship Market. From predictive maintenance to route optimization and environmental monitoring, connected ships offer a plethora of opportunities to drive efficiency gains and competitive differentiation in an increasingly dynamic and interconnected maritime ecosystem. As the industry navigates toward a future defined by digitalization and automation, the Connected Ship Market remains a cornerstone of strategic growth and innovation, reshaping the contours of maritime operations and ushering in a new era of sustainable, technology-driven competitiveness.

Key Takeaways

- Market Growth: The Global Connected Ship Market was valued at USD 15.4 Bn in 2023. It is expected to reach USD 32.9 Bn by 2033, with a CAGR of 8.1% during the forecast period from 2024 to 2033.

- By Ship Type: Commercial ships dominate the connected ship market with approximately 75% market share.

- By Installation Type: On-board installations lead the market with around 65% share.

- By Application: Fleet Operations is the top application in the connected ship market with a 50% market share.

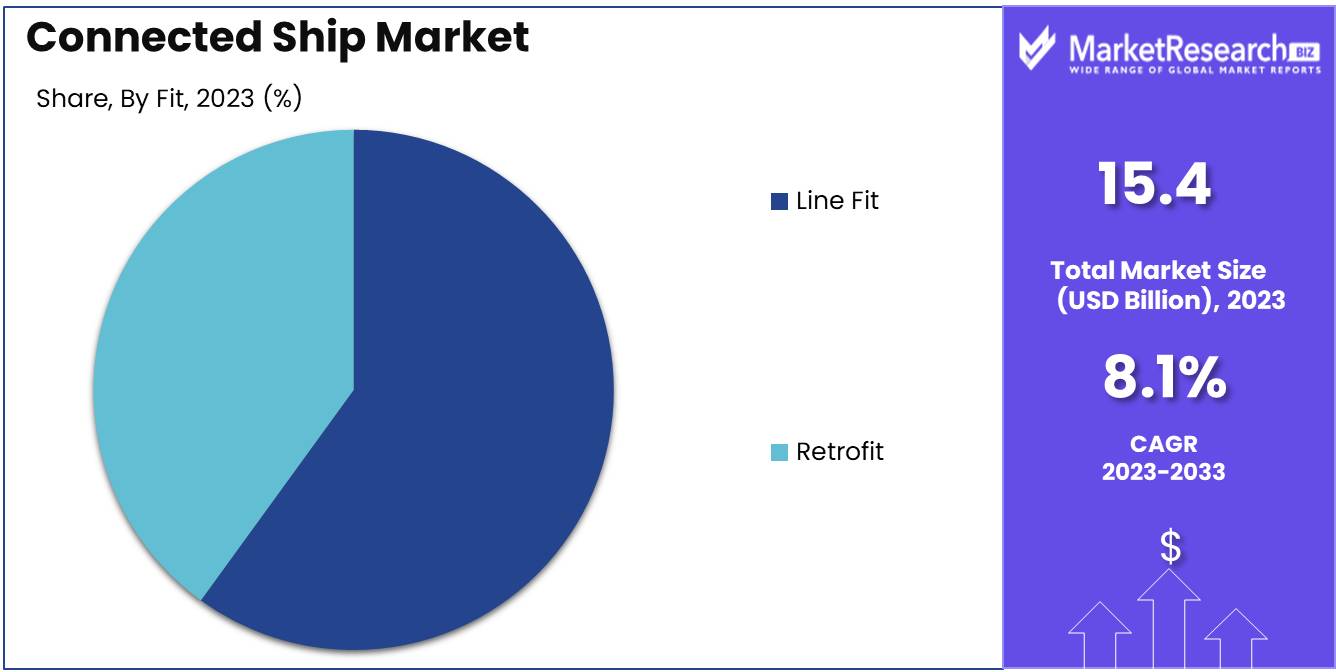

- By Fit: Line Fit holds the largest share in the connected ship market at about 60%.

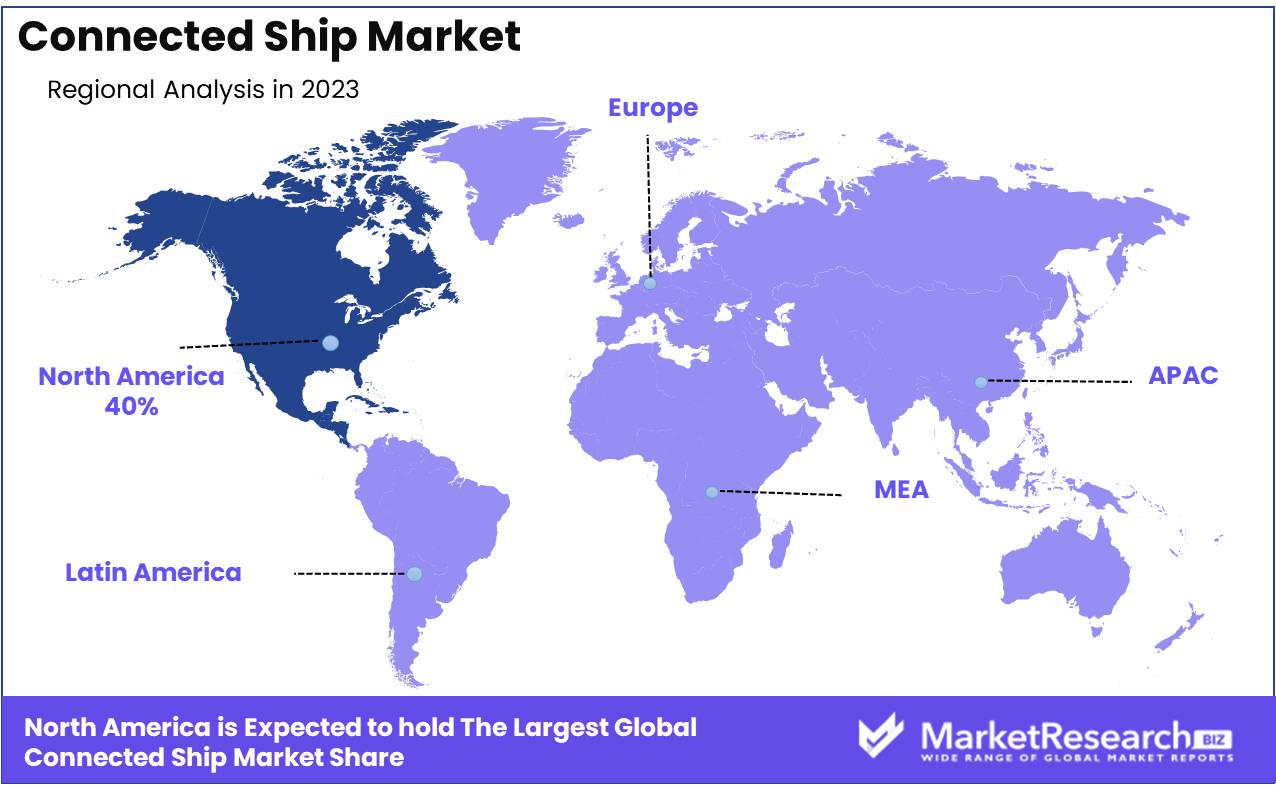

- Regional Dominance: In the connected ship market, North America dominates with approximately 40% market share

- Growth Opportunity: A significant growth opportunity lies in expanding connected ship technologies to enhance maritime safety and efficiency worldwide.

Driving factors

Adoption of IoT and AI Technologies

The integration of Internet of Things (IoT) and Artificial Intelligence (AI) technologies is fundamentally transforming the maritime industry, driving the growth of the Connected Ship Market. IoT enables real-time data collection from various shipboard systems and sensors, facilitating enhanced monitoring and management of ship operations. AI processes this vast amount of data to provide predictive analytics, optimize routes, improve fuel efficiency, and reduce operational costs.

The advent of these technologies is creating new avenues for innovation in ship design and functionality. Autonomous ships, which leverage AI for navigation and IoT for continuous connectivity and monitoring, are becoming a reality, promising further advancements in safety and efficiency. According to market reports, the global connected ship market is expected to grow substantially as ship owners and operators increasingly recognize the value of integrating IoT and AI into their operations. The continuous improvement and adoption of these technologies are setting new standards in maritime operations, propelling the industry towards a more connected and intelligent future.

Demand for Operational Efficiency and Cost Savings

The growing demand for operational efficiency and cost savings is a major catalyst for the expansion of the Connected Ship Market. Shipping companies are under constant pressure to reduce operational costs amidst fluctuating fuel prices and stringent environmental regulations. Connected ship technologies provide solutions by optimizing fuel consumption, reducing emissions, and enhancing route planning through advanced data analytics. For example, real-time monitoring systems can track fuel usage and engine performance, allowing for adjustments that lead to significant cost reductions.

The drive for cost savings extends to maintenance and repair operations. Predictive maintenance, powered by IoT and AI technologies, enables ship operators to foresee and address potential issues before they escalate into expensive repairs or cause operational disruptions. By minimizing unexpected downtime and extending the lifespan of ship components, these technologies help in achieving substantial savings. The emphasis on efficiency and cost-effectiveness is thus a powerful motivator for the adoption of connected ship solutions, ensuring sustained growth in the market as shipping companies strive to maintain competitive edges and improve their bottom lines.

Emphasis on Safety and Compliance

Safety and compliance are paramount concerns in the maritime industry, and they significantly influence the growth of the Connected Ship Market. Connected ship technologies enhance safety by providing real-time data and analytics that improve decision-making and operational awareness. Advanced navigation systems and real-time weather data integration help in avoiding hazardous conditions and optimizing voyage planning, thereby reducing the risk of accidents.

Compliance with international maritime regulations is another critical driver for the adoption of connected ship technologies. Regulatory bodies such as the International Maritime Organization (IMO) have stringent requirements regarding emissions, safety standards, and environmental protection. Connected ship solutions facilitate compliance by providing detailed reporting and analytics capabilities, ensuring that ships meet these regulatory standards efficiently. This not only helps in avoiding hefty fines and penalties but also enhances the reputation of shipping companies as responsible and compliant operators.

Restraining Factors

High Investment and Maintenance

High investment and maintenance costs pose significant challenges to the growth of the Connected Ship Market. The initial implementation of advanced IoT and AI technologies requires substantial capital investment. Ship owners and operators must invest in modernizing their fleets with sophisticated sensors, communication systems, and data analytics platforms. These technologies, while offering long-term benefits in terms of efficiency and operational savings, can represent a considerable financial burden upfront.

Maintenance costs are another critical factor. The advanced technologies involved in connected ships require regular updates, calibration, and technical support to ensure optimal performance and reliability. This ongoing maintenance can be expensive, especially for smaller shipping companies with limited budgets. The need for continuous system upgrades to keep pace with technological advancements also adds to the financial burden. Despite these challenges, the long-term benefits in operational efficiency, cost savings, and compliance.

Cybersecurity and Data Privacy Concerns

Cybersecurity and data privacy concerns are increasingly significant as the maritime industry becomes more digitally connected. Connected ships, relying heavily on IoT and AI technologies, generate and transmit vast amounts of data, which can be vulnerable to cyber-attacks. The maritime sector has seen a rise in cyber threats, with potential risks including the hacking of navigation systems, unauthorized access to sensitive data, and disruption of operational systems. Ensuring robust cybersecurity measures is thus crucial to protect against these threats, requiring ongoing investment in advanced security protocols and technologies.

Data privacy is another critical issue. With the increased collection and transmission of data from connected ships, there is a heightened risk of data breaches and unauthorized access to personal and operational information. Compliance with data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe, is essential to safeguard this information and maintain the trust of stakeholders. Shipping companies must implement comprehensive data privacy policies and practices to protect sensitive information and comply with legal requirements.

By Ship Type Analysis

Commercial ships command 75% of the connected ship market.

In 2023, Commercial held a dominant market position in the By Ship Type segment of Connected Ship Market, capturing more than a 75% share. This segmental dominance underscores the pivotal role commercial vessels play in driving the adoption of connected ship technologies. With a majority share, Commercial ships are at the forefront of integrating advanced connectivity solutions to optimize operations, enhance safety, and improve overall efficiency.

Commercial vessels, ranging from container ships to bulk carriers, have been actively embracing connected ship technologies to streamline communication, monitor vessel performance, and comply with stringent regulations. The robust presence of Commercial entities in this segment signifies a concerted effort towards modernizing maritime operations and staying competitive in an increasingly digitalized industry landscape.

Defense, while holding a notable market share, is characterized by its distinct operational requirements and regulatory frameworks. While not as dominant as the Commercial segment, Defense vessels exhibit a growing interest in leveraging connected ship technologies to bolster naval capabilities, enhance situational awareness, and ensure mission success.

By Installation Type Analysis

On-board installations lead with a 65% share.

In 2023, On-board held a dominant market position in the By Installation Type segment of the Connected Ship Market, capturing more than a 65% share. This substantial market dominance underscores the preference for on-board installation solutions among shipowners and operators seeking seamless integration of connectivity technologies directly onto vessels.

On-board installations offer numerous advantages, including real-time data access, improved operational efficiency, and enhanced crew communication, making them the preferred choice for many stakeholders within the maritime industry. With the majority of installations occurring directly on vessels, On-board solutions cater to the evolving needs of modern ships across various sectors, from cargo and tanker vessels to passenger liners and offshore platforms.

Onshore installations, while accounting for a significant portion of the market, primarily serve as complementary solutions to on-board installations. These installations often support back-end operations, such as shore-based monitoring and data analytics, augmenting the capabilities of on-board systems.

By Application Analysis

Fleet Operations holds the top spot in applications, capturing 50% of the market.

In 2023, Fleet Operations held a dominant market position in the By Application segment of the Connected Ship Market, capturing more than a 50% share. This significant market share underscores the critical role of Fleet Operations applications in optimizing vessel performance, enhancing safety, and maximizing operational efficiency across the maritime industry.

Vessel Traffic Management, as a subset of Fleet Operations, focuses on improving navigational safety, reducing congestion, and optimizing route planning through advanced traffic monitoring and management systems. While contributing to the overall connected ship ecosystem, Vessel Traffic Management applications accounted for a smaller share compared to Fleet Operations. However, they remain instrumental in ensuring smooth and secure maritime traffic flow in busy waterways and ports.

Fleet Health Monitoring, another key application within the Fleet Operations segment, offers predictive maintenance capabilities, remote diagnostics, and real-time health monitoring of critical onboard systems and machinery. By proactively identifying potential issues and minimizing downtime, Fleet Health Monitoring applications help shipowners and operators optimize maintenance schedules, reduce operational costs, and enhance asset reliability.

By Fit Analysis

Line Fit dominates fitting solutions with a 60% share.

In 2023, Line Fit held a dominant market position in the By Fit segment of the Connected Ship Market, capturing more than a 60% share. This substantial market share underscores the preference for Line Fit solutions, which are integrated directly into vessels during their initial construction phase, ensuring seamless connectivity from the outset of operations.

Line Fit installations are favored by shipbuilders and original equipment manufacturers (OEMs) for their ability to incorporate connectivity features into vessel designs from the ground up. By integrating connectivity solutions during the construction process, Line Fit installations offer numerous advantages, including optimized space utilization, reduced installation complexities, and enhanced system reliability.

Retrofit, while constituting a significant portion of the market, involves the installation of connectivity solutions onto existing vessels after their initial construction. Retrofit installations cater to shipowners and operators seeking to modernize their fleets with advanced connectivity capabilities, enabling them to harness the benefits of digitalization without requiring new vessel acquisitions.

While Retrofit solutions address the growing demand for connectivity among existing vessels, Line Fit installations remain the preferred choice for many stakeholders due to their inherent advantages in terms of integration, reliability, and long-term cost-effectiveness.

Key Market Segments

By Ship Type

- Commercial

- Defense

By Installation Type

- On-board

- Onshore

By Application

- Vessel Traffic Management

- Fleet Operations

- Fleet Health Monitoring

By Fit

- Line Fit

- Retrofit

Growth Opportunity

Technological Advancements

The year 2024 presents substantial growth opportunities for the global Connected Ship Market, largely driven by technological advancements in 5G infrastructure and satellite communication. The deployment of 5G technology offers unprecedented speed and reliability, enabling real-time data transmission and enhanced connectivity even in remote maritime environments. This advancement significantly improves operational efficiency by facilitating seamless communication between ship components and shore-based control centers.

Modern satellite communication technologies ensure that ships remain connected across vast oceanic expanses, providing critical data for navigation, weather updates, and operational monitoring. These technological innovations are pivotal in overcoming previous connectivity limitations, thus boosting the market's growth potential.

Government Policies Supporting Digitalization

Supportive government policies are also a major factor contributing to the growth opportunities in the Connected Ship Market. Many governments worldwide are recognizing the strategic importance of maritime digitalization and are implementing policies and incentives to promote the adoption of connected technologies.

Regulatory frameworks mandating digital reporting and compliance with environmental standards are driving shipping companies to invest in connected ship technologies. Government initiatives aimed at enhancing maritime safety and efficiency further bolster market growth, as they provide financial support and resources for the digital transformation of the maritime industry.

Latest Trends

Development of Autonomous and Unmanned Surface Vehicles

In 2024, one of the most significant trends in the Connected Ship Market is the development of autonomous and unmanned surface vehicles (USVs). These advanced vessels utilize cutting-edge technologies such as AI, IoT, and advanced sensors to operate with minimal human intervention. The push towards autonomy is driven by the desire to improve operational efficiency, reduce human error, and enhance safety.

The deployment of USVs is expected to revolutionize various maritime operations, including cargo transport, surveillance, and research. As the technology matures, the adoption of autonomous ships will likely accelerate, offering substantial cost savings and operational benefits to shipping companies.

Integration of Renewable Energy Sources

Another critical trend is the integration of renewable energy sources into connected ships. With increasing environmental regulations and a growing emphasis on sustainability, shipping companies are exploring alternative energy solutions such as solar, wind, and hybrid propulsion systems. Renewable energy integration not only helps in reducing greenhouse gas emissions but also contributes to significant cost savings on fuel.

The use of renewable energy is expected to become more prevalent as technological advancements make these solutions more viable and cost-effective. This trend aligns with global efforts to decarbonize the maritime industry and will play a crucial role in shaping the future of connected ships.

Use of Big Data Analytics and Machine Learning

Big data analytics and machine learning are becoming integral to the connected ship ecosystem. In 2024, the use of these technologies will continue to grow, enabling more sophisticated data analysis and decision-making processes. Big data analytics allows for the comprehensive monitoring and optimization of ship operations, while machine learning algorithms can predict maintenance needs, optimize fuel consumption, and enhance route planning.

These technologies provide valuable insights that help shipping companies improve efficiency, reduce operational costs, and enhance safety. The ongoing advancements in big data and machine learning are set to drive significant improvements in the connected ship market, making maritime operations more intelligent and data-driven.

Regional Analysis

North America reigns supreme in regional dominance, claiming 40% of the connected ship market.

North America commands a dominant position in the connected ship market, accounting for approximately 40% of the global market share. This is primarily attributed to the significant technological advancements, robust maritime infrastructure, and the presence of key players in the region. The United States, in particular, stands out as a major contributor to the market growth, owing to its extensive investment in maritime connectivity solutions.

Europe holds a significant share in the connected ship market, driven by the region's emphasis on maritime safety regulations and initiatives promoting digitalization in the shipping industry. Countries such as Germany, the UK, and Norway are at the forefront of adopting connected ship technologies, owing to their strong maritime traditions and advanced technological capabilities.

Asia Pacific emerges as a key region in the connected ship market, supported by the region's thriving maritime trade activities and increasing investments in maritime infrastructure development. Countries like China, Japan, and South Korea are leading contributors to market growth, driven by their prominent shipbuilding industries and growing adoption of digitalization initiatives.

The Middle East & Africa region is witnessing a gradual uptake of connected ship technologies, supported by the region's strategic location along major shipping routes and increasing investments in port infrastructure development. Countries like the UAE, Saudi Arabia, and South Africa are investing in advanced maritime communication systems and IoT-based solutions to enhance port operations and maritime security.

Latin America is emerging as a promising market for connected ship technologies, propelled by the region's growing maritime trade activities and efforts to modernize its shipping infrastructure.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global connected ship market is poised for significant growth, driven by the increasing adoption of advanced technologies in the maritime industry. Among the key players shaping this landscape, several stand out for their innovative solutions and market influence.

ABB Ltd., a pioneering multinational corporation in power and automation technologies, is expected to continue its strong presence in the connected ship market. With its expertise in electrical systems, automation, and digital solutions, ABB is well-positioned to offer integrated solutions that enhance vessel performance, safety, and efficiency.

Inmarsat Plc, a leading provider of global mobile satellite communications, plays a crucial role in enabling connectivity at sea. Its satellite communication services ensure seamless data exchange and enable remote monitoring and management, making it a key player in the connected ship ecosystem.

Marlink AS is another prominent player, offering end-to-end communication solutions tailored to maritime needs. With a focus on reliability, scalability, and cybersecurity, Marlink empowers shipping companies to optimize operations and stay connected even in remote areas.

Siemens AG brings its expertise in electrification, automation, and digitalization to various industries, enhancing efficiency, sustainability, and innovation across sectors such as energy, healthcare, and infrastructure.

gitalization to the maritime sector, offering solutions that improve energy efficiency, reduce emissions, and enhance safety on board ships.

Emerson Electric, with its diverse portfolio of automation technologies, is positioned to address the evolving needs of the connected ship market. Its solutions for predictive maintenance, asset optimization, and remote monitoring contribute to operational excellence and cost savings for ship operators.

Northrop Grumman Corporation's expertise in defense and aerospace technologies translates into innovative solutions for maritime connectivity and security. Its offerings include advanced communication systems, cybersecurity solutions, and unmanned systems, catering to the evolving needs of connected vessels.

Schneider Electric, General Electric, RH Marine, Rockwell Automation, Wartsila Corporation, Ulstein Group ASA, and Kongsberg Gruppen are also key players contributing to the growth of the connected ship market, each bringing unique capabilities and solutions to address the industry's challenges and opportunities. As the maritime sector continues to embrace digitalization and connectivity, these companies are well-positioned to drive innovation and shape the future of shipping.

Market Key Players

- ABB Ltd.

- Inmarsat Plc

- Marlink AS

- Siemens AG

- Emerson Electric

- Northrop Grumman Corporation

- Schneider Electric

- General Electric

- RH Marine

- Rockwell Automation

- Wartsila Corporation

- Ulstein Group ASA

- Kongsberg Gruppen

Recent Development

- In May 2024, Mitsui & Co. has invested in Navigare Capital Partners' $650 million maritime fund, focusing on sustainable shipping. This aligns with Mitsui's commitment to reducing the shipping industry's carbon footprint.

- In May 2024, India signs a 10-year agreement with Iran for India Ports Global (IPGL) to operate Chabahar Port, aiming to boost trade with Afghanistan and Central Asia, overcoming logistical challenges.

Report Scope

Report Features Description Market Value (2023) USD 15.4 Bn Forecast Revenue (2033) USD 32.9 Bn CAGR (2024-2033) 8.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Ship Type (Commercial, Defense), By Installation Type (On-board, Onshore), By Application (Vessel Traffic Management, Fleet Operations, Fleet Health Monitoring), By Fit (Line Fit, Retrofit) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ABB Ltd., Inmarsat Plc, Marlink AS, Siemens AG, Emerson Electric, Northrop Grumman Corporation, Schneider Electric, General Electric, RH Marine, Rockwell Automation, Wartsila Corporation, Ulstein Group ASA, Kongsberg Gruppen Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Connected Ship Market Overview

- 2.1. Connected Ship Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Connected Ship Market Dynamics

- 3. Global Connected Ship Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Connected Ship Market Analysis, 2016-2021

- 3.2. Global Connected Ship Market Opportunity and Forecast, 2023-2032

- 3.3. Global Connected Ship Market Analysis, Opportunity and Forecast, By By Ship Type, 2016-2032

- 3.3.1. Global Connected Ship Market Analysis by By Ship Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Ship Type, 2016-2032

- 3.3.3. Commercial

- 3.3.4. Defense

- 3.4. Global Connected Ship Market Analysis, Opportunity and Forecast, By By Installation Type, 2016-2032

- 3.4.1. Global Connected Ship Market Analysis by By Installation Type: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Installation Type, 2016-2032

- 3.4.3. On-board

- 3.4.4. Onshore

- 3.5. Global Connected Ship Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.5.1. Global Connected Ship Market Analysis by By Application: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.5.3. Vessel Traffic Management

- 3.5.4. Fleet Operations

- 3.5.5. Fleet Health Monitoring

- 3.6. Global Connected Ship Market Analysis, Opportunity and Forecast, By By Fit, 2016-2032

- 3.6.1. Global Connected Ship Market Analysis by By Fit: Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Fit, 2016-2032

- 3.6.3. Line Fit

- 3.6.4. Retrofit

- 4. North America Connected Ship Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Connected Ship Market Analysis, 2016-2021

- 4.2. North America Connected Ship Market Opportunity and Forecast, 2023-2032

- 4.3. North America Connected Ship Market Analysis, Opportunity and Forecast, By By Ship Type, 2016-2032

- 4.3.1. North America Connected Ship Market Analysis by By Ship Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Ship Type, 2016-2032

- 4.3.3. Commercial

- 4.3.4. Defense

- 4.4. North America Connected Ship Market Analysis, Opportunity and Forecast, By By Installation Type, 2016-2032

- 4.4.1. North America Connected Ship Market Analysis by By Installation Type: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Installation Type, 2016-2032

- 4.4.3. On-board

- 4.4.4. Onshore

- 4.5. North America Connected Ship Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.5.1. North America Connected Ship Market Analysis by By Application: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.5.3. Vessel Traffic Management

- 4.5.4. Fleet Operations

- 4.5.5. Fleet Health Monitoring

- 4.6. North America Connected Ship Market Analysis, Opportunity and Forecast, By By Fit, 2016-2032

- 4.6.1. North America Connected Ship Market Analysis by By Fit: Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Fit, 2016-2032

- 4.6.3. Line Fit

- 4.6.4. Retrofit

- 4.7. North America Connected Ship Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.7.1. North America Connected Ship Market Analysis by Country : Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.7.2.1. The US

- 4.7.2.2. Canada

- 4.7.2.3. Mexico

- 5. Western Europe Connected Ship Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Connected Ship Market Analysis, 2016-2021

- 5.2. Western Europe Connected Ship Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Connected Ship Market Analysis, Opportunity and Forecast, By By Ship Type, 2016-2032

- 5.3.1. Western Europe Connected Ship Market Analysis by By Ship Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Ship Type, 2016-2032

- 5.3.3. Commercial

- 5.3.4. Defense

- 5.4. Western Europe Connected Ship Market Analysis, Opportunity and Forecast, By By Installation Type, 2016-2032

- 5.4.1. Western Europe Connected Ship Market Analysis by By Installation Type: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Installation Type, 2016-2032

- 5.4.3. On-board

- 5.4.4. Onshore

- 5.5. Western Europe Connected Ship Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.5.1. Western Europe Connected Ship Market Analysis by By Application: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.5.3. Vessel Traffic Management

- 5.5.4. Fleet Operations

- 5.5.5. Fleet Health Monitoring

- 5.6. Western Europe Connected Ship Market Analysis, Opportunity and Forecast, By By Fit, 2016-2032

- 5.6.1. Western Europe Connected Ship Market Analysis by By Fit: Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Fit, 2016-2032

- 5.6.3. Line Fit

- 5.6.4. Retrofit

- 5.7. Western Europe Connected Ship Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.7.1. Western Europe Connected Ship Market Analysis by Country : Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.7.2.1. Germany

- 5.7.2.2. France

- 5.7.2.3. The UK

- 5.7.2.4. Spain

- 5.7.2.5. Italy

- 5.7.2.6. Portugal

- 5.7.2.7. Ireland

- 5.7.2.8. Austria

- 5.7.2.9. Switzerland

- 5.7.2.10. Benelux

- 5.7.2.11. Nordic

- 5.7.2.12. Rest of Western Europe

- 6. Eastern Europe Connected Ship Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Connected Ship Market Analysis, 2016-2021

- 6.2. Eastern Europe Connected Ship Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Connected Ship Market Analysis, Opportunity and Forecast, By By Ship Type, 2016-2032

- 6.3.1. Eastern Europe Connected Ship Market Analysis by By Ship Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Ship Type, 2016-2032

- 6.3.3. Commercial

- 6.3.4. Defense

- 6.4. Eastern Europe Connected Ship Market Analysis, Opportunity and Forecast, By By Installation Type, 2016-2032

- 6.4.1. Eastern Europe Connected Ship Market Analysis by By Installation Type: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Installation Type, 2016-2032

- 6.4.3. On-board

- 6.4.4. Onshore

- 6.5. Eastern Europe Connected Ship Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.5.1. Eastern Europe Connected Ship Market Analysis by By Application: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.5.3. Vessel Traffic Management

- 6.5.4. Fleet Operations

- 6.5.5. Fleet Health Monitoring

- 6.6. Eastern Europe Connected Ship Market Analysis, Opportunity and Forecast, By By Fit, 2016-2032

- 6.6.1. Eastern Europe Connected Ship Market Analysis by By Fit: Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Fit, 2016-2032

- 6.6.3. Line Fit

- 6.6.4. Retrofit

- 6.7. Eastern Europe Connected Ship Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.7.1. Eastern Europe Connected Ship Market Analysis by Country : Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.7.2.1. Russia

- 6.7.2.2. Poland

- 6.7.2.3. The Czech Republic

- 6.7.2.4. Greece

- 6.7.2.5. Rest of Eastern Europe

- 7. APAC Connected Ship Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Connected Ship Market Analysis, 2016-2021

- 7.2. APAC Connected Ship Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Connected Ship Market Analysis, Opportunity and Forecast, By By Ship Type, 2016-2032

- 7.3.1. APAC Connected Ship Market Analysis by By Ship Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Ship Type, 2016-2032

- 7.3.3. Commercial

- 7.3.4. Defense

- 7.4. APAC Connected Ship Market Analysis, Opportunity and Forecast, By By Installation Type, 2016-2032

- 7.4.1. APAC Connected Ship Market Analysis by By Installation Type: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Installation Type, 2016-2032

- 7.4.3. On-board

- 7.4.4. Onshore

- 7.5. APAC Connected Ship Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.5.1. APAC Connected Ship Market Analysis by By Application: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.5.3. Vessel Traffic Management

- 7.5.4. Fleet Operations

- 7.5.5. Fleet Health Monitoring

- 7.6. APAC Connected Ship Market Analysis, Opportunity and Forecast, By By Fit, 2016-2032

- 7.6.1. APAC Connected Ship Market Analysis by By Fit: Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Fit, 2016-2032

- 7.6.3. Line Fit

- 7.6.4. Retrofit

- 7.7. APAC Connected Ship Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.7.1. APAC Connected Ship Market Analysis by Country : Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.7.2.1. China

- 7.7.2.2. Japan

- 7.7.2.3. South Korea

- 7.7.2.4. India

- 7.7.2.5. Australia & New Zeland

- 7.7.2.6. Indonesia

- 7.7.2.7. Malaysia

- 7.7.2.8. Philippines

- 7.7.2.9. Singapore

- 7.7.2.10. Thailand

- 7.7.2.11. Vietnam

- 7.7.2.12. Rest of APAC

- 8. Latin America Connected Ship Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Connected Ship Market Analysis, 2016-2021

- 8.2. Latin America Connected Ship Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Connected Ship Market Analysis, Opportunity and Forecast, By By Ship Type, 2016-2032

- 8.3.1. Latin America Connected Ship Market Analysis by By Ship Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Ship Type, 2016-2032

- 8.3.3. Commercial

- 8.3.4. Defense

- 8.4. Latin America Connected Ship Market Analysis, Opportunity and Forecast, By By Installation Type, 2016-2032

- 8.4.1. Latin America Connected Ship Market Analysis by By Installation Type: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Installation Type, 2016-2032

- 8.4.3. On-board

- 8.4.4. Onshore

- 8.5. Latin America Connected Ship Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.5.1. Latin America Connected Ship Market Analysis by By Application: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.5.3. Vessel Traffic Management

- 8.5.4. Fleet Operations

- 8.5.5. Fleet Health Monitoring

- 8.6. Latin America Connected Ship Market Analysis, Opportunity and Forecast, By By Fit, 2016-2032

- 8.6.1. Latin America Connected Ship Market Analysis by By Fit: Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Fit, 2016-2032

- 8.6.3. Line Fit

- 8.6.4. Retrofit

- 8.7. Latin America Connected Ship Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.7.1. Latin America Connected Ship Market Analysis by Country : Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.7.2.1. Brazil

- 8.7.2.2. Colombia

- 8.7.2.3. Chile

- 8.7.2.4. Argentina

- 8.7.2.5. Costa Rica

- 8.7.2.6. Rest of Latin America

- 9. Middle East & Africa Connected Ship Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Connected Ship Market Analysis, 2016-2021

- 9.2. Middle East & Africa Connected Ship Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Connected Ship Market Analysis, Opportunity and Forecast, By By Ship Type, 2016-2032

- 9.3.1. Middle East & Africa Connected Ship Market Analysis by By Ship Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Ship Type, 2016-2032

- 9.3.3. Commercial

- 9.3.4. Defense

- 9.4. Middle East & Africa Connected Ship Market Analysis, Opportunity and Forecast, By By Installation Type, 2016-2032

- 9.4.1. Middle East & Africa Connected Ship Market Analysis by By Installation Type: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Installation Type, 2016-2032

- 9.4.3. On-board

- 9.4.4. Onshore

- 9.5. Middle East & Africa Connected Ship Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.5.1. Middle East & Africa Connected Ship Market Analysis by By Application: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.5.3. Vessel Traffic Management

- 9.5.4. Fleet Operations

- 9.5.5. Fleet Health Monitoring

- 9.6. Middle East & Africa Connected Ship Market Analysis, Opportunity and Forecast, By By Fit, 2016-2032

- 9.6.1. Middle East & Africa Connected Ship Market Analysis by By Fit: Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Fit, 2016-2032

- 9.6.3. Line Fit

- 9.6.4. Retrofit

- 9.7. Middle East & Africa Connected Ship Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.7.1. Middle East & Africa Connected Ship Market Analysis by Country : Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.7.2.1. Algeria

- 9.7.2.2. Egypt

- 9.7.2.3. Israel

- 9.7.2.4. Kuwait

- 9.7.2.5. Nigeria

- 9.7.2.6. Saudi Arabia

- 9.7.2.7. South Africa

- 9.7.2.8. Turkey

- 9.7.2.9. The UAE

- 9.7.2.10. Rest of MEA

- 10. Global Connected Ship Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Connected Ship Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Connected Ship Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. ABB Ltd.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Inmarsat Plc

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Marlink AS

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Siemens AG

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Emerson Electric

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Northrop Grumman Corporation

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Schneider Electric

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. General Electric

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. RH Marine

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Rockwell Automation

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Wartsila Corporation

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Kongsberg Gruppen

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- ABB Ltd.

- Inmarsat Plc

- Marlink AS

- Siemens AG

- Emerson Electric

- Northrop Grumman Corporation

- Schneider Electric

- General Electric

- RH Marine

- Rockwell Automation

- Wartsila Corporation

- Ulstein Group ASA

- Kongsberg Gruppen