Confectionery Market Product Type(Chocolate, Fine Bakery Wares, Sugar), Distribution Channels (Supermarkets and hypermarkets, Convenience stores, Online store), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

5636

-

May 2023

-

150

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

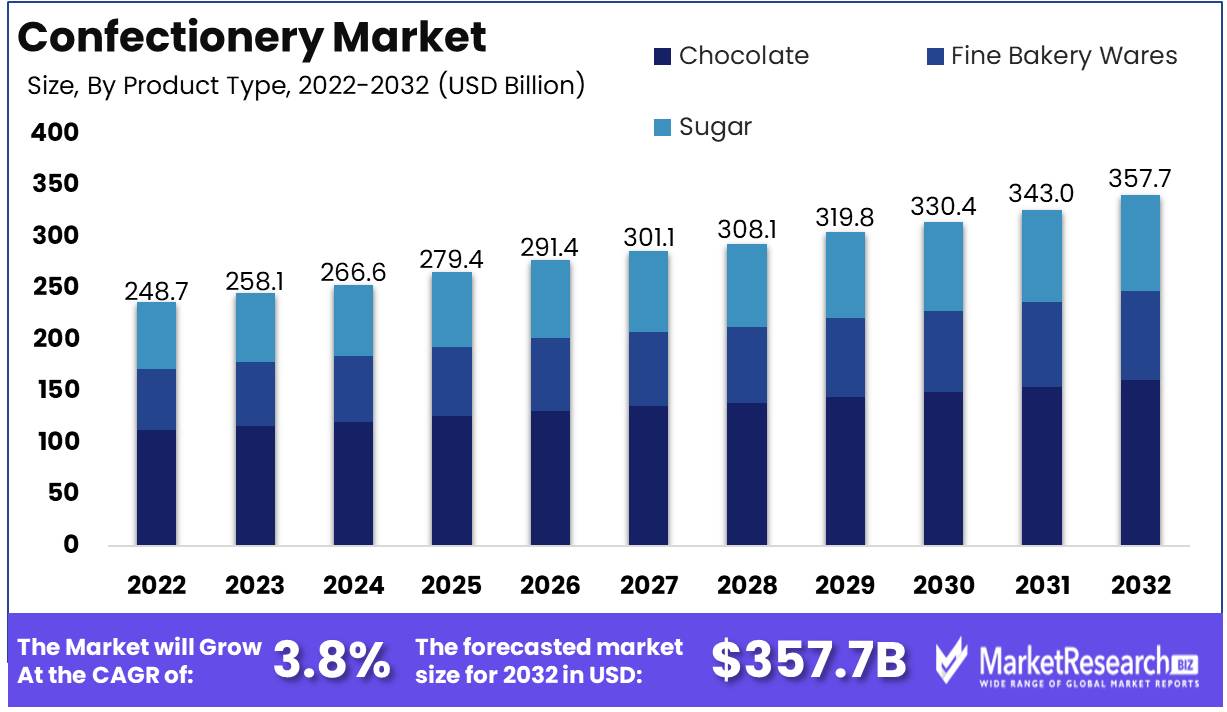

Confectionery Market size is expected to be worth around USD 357.7 Bn by 2032 from USD 248.7 Bn in 2022, growing at a CAGR of 3.8% during the forecast period from 2023 to 2032.

The confectionery industry, which includes manufacturers, distributors, and retailers of various sweet treats such as candy, chocolate, gum, and mints, is growing due to a number of factors. These include the rise in disposable income, the ever-changing preferences of consumers, and the introduction of novel products with innovative flavors and alluring packaging.

The confectionery market, an integral component of the vast food and beverage industry, offers a vast selection of products for consumers of all ages. Candy, chocolate, and gum are commonly regarded as scrumptious indulgences that bring immense pleasure and happiness into people's lives. Their scrumptious and enticing flavor is the primary reason for their worldwide fame.

The primary objective of the confectionery market is to provide consumers with premium, delectable delights that can be enjoyed at their discretion. This necessitates an unwavering commitment to churning out fresh and innovative products that correlate with consumers' ever-changing preferences and tastes. In addition, businesses in this industry endeavor ceaselessly to provide a vast selection of products that cater to various dietary restrictions and lifestyle preferences.

Driving Factors

Increasing Population

Because of the growing world population, the confectionery market is expanding at an exponential rate. As the population continues to grow, so too does the demand for confectionery products. More people means a larger consumer base, resulting in higher sales and market expansion. The expanding population, particularly in urban areas, provides confectionery manufacturers with a substantial client base to target.

Urbanization

With more people relocating to cities and urban areas, urbanization directly affects the confectionery market. With a greater prevalence of potential consumers in a smaller geographical area, urbanization causes changes in lifestyle and consumer preferences. The convenience and accessibility of urban areas make it simpler for consumers to obtain confectionery products, thereby increasing demand. In addition, consumers in urban areas typically have a higher disposable income, allowing them to indulge in confectionery products more frequently.

Growing Disposable Income

Globally rising levels of disposable income have played a crucial role in propelling the confectionery market. As people's financial circumstances improve, they are able to spend more on non-essential items such as confectionery. Increased discretionary income permits consumers to occasionally indulge in chocolates, confectionery, and other confections. This increased purchasing power drives the demand for confectionery products and encourages manufacturers to introduce new and innovative products to meet consumers' changing tastes.

Changing Lifestyle Preferences

Changes in lifestyle preferences have also contributed to the expansion of the market for confectionery. In order to satiate their cravings and experiment with various flavors and textures, consumers increasingly seek out novel and distinctive product varieties. They are searching for confectionery products that correspond to their dietary preferences, such as organic, natural, or gluten-free options. Manufacturers have responded to these shifting preferences by introducing a vast array of confectionery items that appeal to various dietary requirements and lifestyle preferences. This constant innovation and product diversification contributes to the expansion of the confectionery market by appealing to a larger consumer base.

Restraining Factors

Health Concerns Regarding the High Sugar and Fat Content in Confectionery Products

Health concerns, including the high sugar and fat content of many confectionery products, are one of the primary reasons consumers are transitioning away from these items. Today's consumers are highly concerned with their health and well-being, and the demand for healthy refreshment alternatives is soaring. To combat this problem, numerous confectionery companies are introducing low-sugar, low-fat, nutrient-rich options that pander to this new health-conscious consumer.

The availability of healthy snack alternatives

While the confectionery industry struggles to adapt to shifting consumer preferences, the healthy refreshment industry has been thriving. With increasing awareness of the health advantages of wholesome and nutrient-dense refreshment options, a growing number of consumers now choose healthier alternatives over traditional confectionery items. Confectionery manufacturers are also entering the healthy snack market to combat this trend by launching their own lines of nutritious treats to meet consumer demand.

Profit margins are impacted by fluctuating raw material costs.

The fluctuating prices of basic materials are one of the most significant obstacles encountered by the confectionery industry. As a consequence, profit margins are under constant pressure, which can impact product quality. Due to these market pressures, it is essential for companies to keep a close watch on raw material prices and implement the necessary strategies to maintain their margins while delivering confectionery products of the highest quality.

Stringent government regulations and taxation policies

The confectionery industry is heavily influenced by government regulations and taxation policies. Excessive regulations and taxes make it difficult for businesses to operate efficiently and can have a negative effect on their profitability. Therefore, in order to avoid any legal or financial repercussions, it is essential for companies to remain apprised of any new policies that emerge and ensure compliance.

Product Type Analysis

Chocolate Segment Dominates Confectionery Market. From a primary component in confectionery, desserts, and bakery goods to a basic material for the production of ice creams, beverages, and candies. The chocolate segment has been a formidable force in the confectionery industry. The expansion of the chocolate segment of the confectionery market can be attributed to the rising demand for premium chocolates, which appeal to consumers seeking higher-quality products.

Emerging societies around the world are experiencing unprecedented economic expansion, which is driving the demand for chocolate products. Rising prosperity has increased the purchasing power of individuals, allowing them to indulge in premium chocolate products. This trend is especially evident in the Asia-Pacific region, where the middle-class population has increased, thereby driving up demand for premium products such as chocolate.

Today's consumers are increasingly concerned about their health and well-being, which has resulted in an increase in demand for chocolate products that are healthier and more natural. Chocolates with functional benefits such as enhancing cardiac health, facilitating weight management, and boosting the immune system are appealing to consumers. In recent years, the trend of giving chocolates as gifts to loved ones on special occasions has grown in prominence, contributing to the expansion of the chocolate segment of the confectionery market.

Distribution Channel Analysis

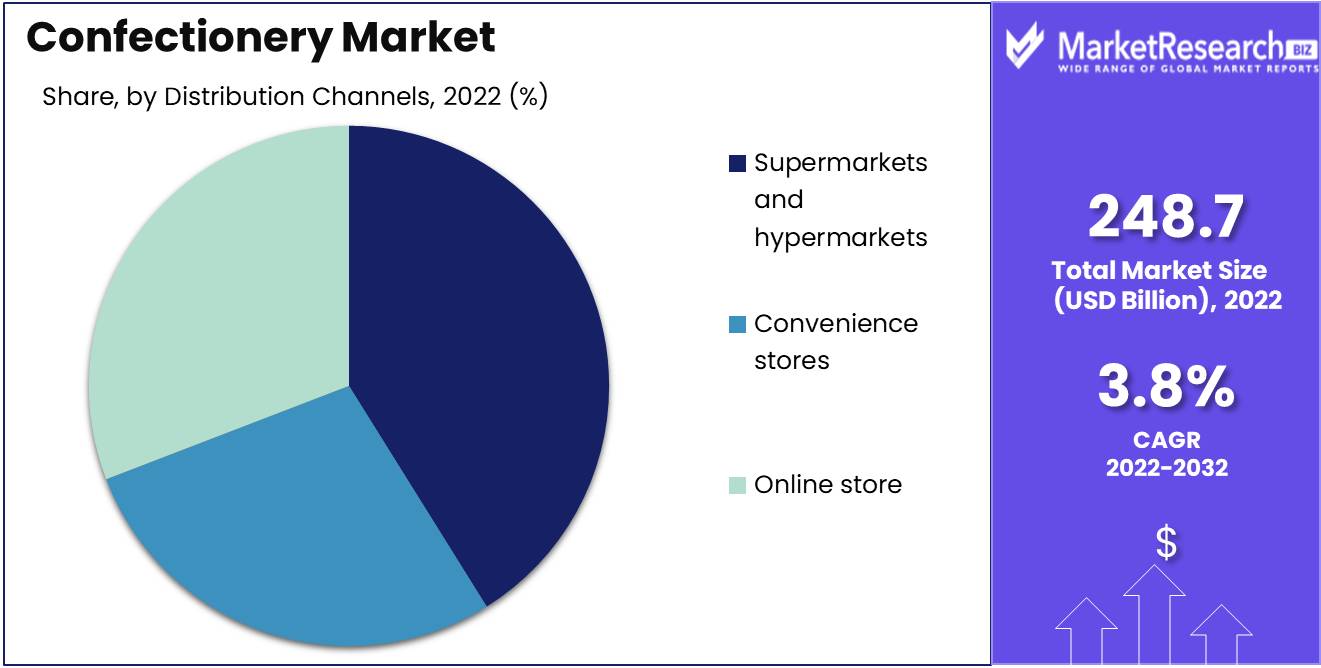

The convenience of purchasing goods from supermarkets and hypermarkets has dominated the Confectionery Market, leading to a growing preference for the channel over traditional markets. Due to their capacity to offer a wide variety of products under one roof, supermarkets and hypermarkets have become dominant distribution channels in the confectionery market, including popular chocolate products.

The economic growth of emergent nations has also contributed to the expansion of supermarkets and hypermarkets in the market for confectionery. As individuals increase in wealth, they desire convenience and premium products that are readily available in supermarkets and hypermarkets.

Due to the convenience afforded by supermarkets and hypermarkets, consumers prefer purchasing through these channels. In addition, the ability of supermarkets and hypermarkets to purchase products in volume at discounted prices is also contributing to their expansion in the confectionery market. Consumers' high level of impulsivity, complexity, originality, and human-like behavior toward supermarkets/hypermarkets is anticipated to continue propelling the expansion of this market segment.

Key Market Segments

By product type:

- Chocolate

- Dark

- Milk

- White

- Fine Bakery Wares

- Sugar

- Caramel and Toffee

- Jelly and Gum

- Mint

- Hard-Boiled Sweets

By distribution channels:

- Supermarkets and hypermarkets

- Convenience stores

- Online store

Growth Opportunity

Introduction of New and Exotic Flavors and Product Innovations

The introduction of novel and exotic flavors has revolutionized the confectionery industry. Manufacturers are currently experimenting with exotic flavors and ingredients such as ginger, matcha, and exotic fruits in order to appeal to the evolving tastes of consumers. This trend has also spawned product innovations such as nut-based confectionery and non-dairy chocolate that accommodate to consumers with specific dietary needs.

Growing Demand for Sugar-Free and Low-Calorie Treats

As the number of health-conscious consumers rises, so has the demand for sugar-free and low-calorie confectionery. In response, manufacturers have developed products that appeal to this expanding trend. Some manufacturers, for instance, have begun manufacturing sugar-free and low-calorie versions of popular candy bars and other confectionery items. This trend toward healthful products has also resulted in an increase in the popularity of nut-based treats and confectionery made with natural sweeteners.

Increasing Adoption of E-commerce and Online Retail Channels

The pandemic has accelerated the transition to online retail channels and e-commerce, which includes the confectionery market. Favorite confectionery items are progressively purchased via online channels. This has resulted in the development of new online retailers and the incorporation of e-commerce platforms by established manufacturers. In addition, e-commerce provides consumers with the convenience of ordering their preferred confectionery items from the comfort of their own residences and receiving door-to-door delivery.

The Growing Preference for Organic and Natural Confectionery Products

Consumers are progressively making informed decisions regarding the products they purchase, including confectionery. There is a growing preference for organic and natural confectionery produced with ingredients that are not only beneficial to health but also have a low environmental impact. Manufacturers have responded to this trend by creating products such as organic chocolate bars and all-natural gummy bears made with real fruit liquid.

Expanding Product Portfolio to Cater to a Diverse Customer Base

Now, confectionery manufacturers are diversifying their product offerings to appeal to a wide range of customers. This diversification is a result of consumer demand for non-traditional confectionery options. To accommodate consumer preferences, manufacturers may offer gluten-free, vegan, and kosher-certified products. In addition, manufacturers are now diversifying their product lines to accommodate various occasions, including holidays, nuptials, and other celebrations.

Latest Trends

Vegan and gluten-free confectionery is becoming more and more popular.

Demand for vegan and gluten-free confectionery products has increased significantly over the past few years. This trend can be ascribed to consumers' growing awareness of health and environmental issues. As more individuals adopt plant-based diets, demand for vegan confectionery has skyrocketed. Additionally, consumers with gluten allergies or intolerances prefer gluten-free confectionery.

To meet this growing demand, a number of confectionery manufacturers have begun offering vegan and gluten-free alternatives to their traditional products. These products are manufactured with premium ingredients and have the same excellent flavor and texture as their conventional counterparts. In the future years, it is anticipated that the growing popularity of vegan and gluten-free confectionery will persist.

Escalating demand for confectionery with added nutritional value

Consumers are becoming increasingly health-conscious, and there is a growing demand for functional confectionery products that provide additional nutritional benefits. Functional confectionery products are those that are intended to offer additional health benefits beyond their fundamental nutrition. These products contain vitamins, minerals, and other nutrients that promote health and wellness.

Energy bars, protein bars, and vitamin-enhanced gummies are some examples of functional confectionery products. These products provide a convenient and delicious means of supplementing daily nutrition and achieving health objectives. The increasing demand for functional confectionery products with added nutritional benefits is anticipated to stimulate innovation in the confectionery market.

Increasing demand for premium and luxury confectionery

Consumers are willing to pay a premium for distinctive and opulent confectionery products of superior quality. Premium and luxury confectionery items are those constructed with the finest ingredients and meticulous attention to every detail.

These items are marketed as decadent delights that convey a sense of exclusivity and luxury. From artisanal chocolates to handcrafted caramels, premium and luxury confectionery caters to consumers in search of the utmost indulgence. In response to the growing demand for luxury confectionery products, many confectionery firms are expanding their product lines.

Increasing emphasis on eco-friendly and sustainable packaging options

There has been a growing emphasis on sustainable and eco-friendly packaging solutions in the confectionery market as consumers become more aware of their impact on the environment. The packaging of confectionery products is crucial for ensuring their safety and freshness. Traditional packaging materials, such as plastic, can have a substantial impact on the environment.

To address this issue, a number of confectionery companies are investigating sustainable and eco-friendly packaging alternatives, such as biodegradable materials, recycled materials, and reusable containers. As consumers become more environmentally conscious and demand sustainable packaging solutions, this trend is likely to continue.

Personalization of gifts and confectionery items is a growing trend.

Personalization and customization are gaining importance in the market for confectionery. Consumers are interested in receiving presents that reflect their personalities and passions. Customized confectionery items, such as chocolates, mints, and lollipops, are a fun and memorable way to commemorate special occasions and events.

This trend is especially popular among newer generations who place a premium on experiences and individualization over material possessions. As a result, numerous confectionery brands are investigating methods to provide customized products and experiences to meet this demand.

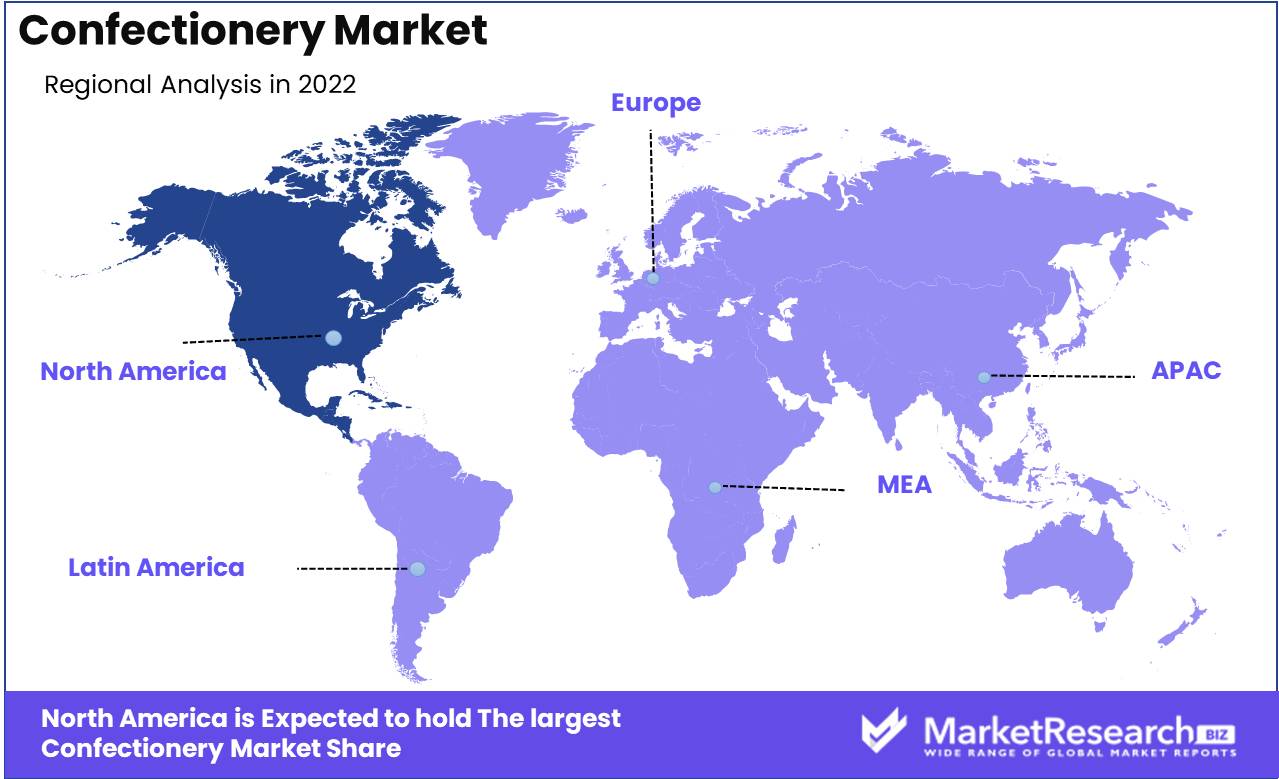

Regional Analysis

As the world evolves toward a more conscious and sustainable lifestyle, the demand for premium and organic products has increased, as has the confectionery industry. In North America, consumers are increasingly selecting organic alternatives to conventional candies and chocolates. This change in consumer behavior has been prompted by an increased awareness of the negative health effects of consuming low-quality, high-sugar confectionery products, as well as a growing concern for eco-friendliness and sustainability.

In the vanguard of this shift are premium confectionery brands that provide healthier and environmentally favorable options. Instead of using manufactured sweeteners, artificial flavors, and preservatives, these brands have opted to sweeten their products with natural ingredients such as coconut sugar, honey, and agave syrup. In addition, they have incorporated organic and non-GMO ingredients into their recipes, providing consumers with a healthful option for nibbling. These premium brands have taken sustainable packaging a step further, reducing their carbon footprint and plastic waste.

The demand for premium confectionery is not restricted to organic options but also extends to products that offer a novel and elevated nibbling experience. Brands are currently stretching the envelope in terms of flavor and texture by combining unorthodox ingredients to create innovative and thrilling confectionery products. These include chocolates infused with herbs and seasonings, gummies made from real fruit liquids, and chocolate bars with added nut butter or sea salt.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Nestle is a well-known Swiss multinational food and beverage corporation renowned for its chocolate products. With well-known brands like KitKat, Smarties, and Aero, the corporation has a significant presence in the global confectionery market. Mars, on the other hand, is an American multinational corporation whose M&MaEUR(TM), Snickers, and Twix brands are well-known.

Mondelez International is another significant participant in the confectionery market, with well-known brands including Cadbury, Toblerone, and Milka. The Italian confectionery manufacturer Ferrero Group is renowned for its Ferrero Rocher, Nutella, and Kinder trademarks. With its renowned Hershey's Kisses and Reese's trademarks, the American company Hershey's also has a substantial presence in the confectionery market.

Lindt & Sprungli, a Swiss chocolate manufacturer, offers a variety of premium chocolates, including Lindor and Excellence. With their iconic brands and high-quality products, these key actors dominate the global confectionery market.

Top Key Players in Confectionery Market

- Delfi Limited

- Ezaki Glico Co., Ltd.

- Ferrero S.p.A.

- Chocoladefabriken Lindt & Sprüngli AG

- Lotte Confectionery Co. Ltd.

- Mars, Incorporated

- Mondelēz International, Inc.

- Nestlé S.A.

- The Hershey Company

- Wrigley Jr. Company

Recent Development

- In February 2022, Nestle most recent product line, introduced, is causing a stir in the confectionery market. Two new confections, KitKat Biscoff Giant Egg and Aero Melts, were introduced to satiate consumers' sweet tooth cravings. The KitKat Biscoff Giant Egg is a decadent confection composed of layers of chocolate custard and speculoos biscuit texture. Aero Melts, meanwhile, are effervescent, bite-sized chocolates available in three flavors: milk chocolate, white chocolate, and dark chocolate.

- In September 2021, UK-based manufacturer of healthy snack bars KIND recently added a new hazelnut dark chocolate flavor to its protein bar product line. The bars are composed of all-natural constituents, such as whole grains, fruits, and seeds, and are high in protein and fiber. The flavor of hazelnut dark chocolate lends a hint of decadence to this healthy snack.

- In July 2021, Nature Valley from General Mills Inc. adopted the snack bar trend with the release of Full Mix snack bars. These bars are prepared with a delectable combination of berries, seeds, peanuts, oats made from whole grains, and peanut butter. They are ideal for those seeking a nutritious and satisfying snack that is also delicious. Available in the United Kingdom, the Full Mix snack bars from Nature Valley are acquiring popularity among health-conscious consumers.

Report Scope:

Report Features Description Market Value (2022) USD 248.7 Bn Forecast Revenue (2032) USD 357.7 Bn CAGR (2023-2032) 3.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Type(Chocolate, Fine Bakery Wares, Sugar), Distribution Channels (Supermarkets and hypermarkets, Convenience stores, Online store) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Delfi Limited, Ezaki Glico Co., Ltd., Ferrero S.p.A., Chocoladefabriken Lindt & Sprüngli AG, Lotte Confectionery Co. Ltd., Mars, Incorporated, Mondelēz International, Inc., Nestlé S.A., The Hershey Company, Wrigley Jr. Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) - Chocolate

-

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Confectionery Market Overview

- 2.1. Confectionery Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Confectionery Market Dynamics

- 3. Global Confectionery Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Confectionery Market Analysis, 2016-2021

- 3.2. Global Confectionery Market Opportunity and Forecast, 2023-2032

- 3.3. Global Confectionery Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 3.3.1. Global Confectionery Market Analysis by By Product Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 3.3.3. Chocolate

- 3.3.3.1. Dark

- 3.3.3.2. Milk

- 3.3.3.3. White

- 3.3.4. Fine Bakery Wares

- 3.3.5. Sugar

- 3.3.5.1. Caramel and Toffee

- 3.3.5.2. Jelly and Gum

- 3.3.5.3. Mint

- 3.3.5.4. Hard-Boiled Sweets

- 3.4. Global Confectionery Market Analysis, Opportunity and Forecast, By Distribution Channels, 2016-2032

- 3.4.1. Global Confectionery Market Analysis by Distribution Channels: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channels, 2016-2032

- 3.4.3. Supermarkets and hypermarkets

- 3.4.4. Convenience stores

- 3.4.5. Online store

- 4. North America Confectionery Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Confectionery Market Analysis, 2016-2021

- 4.2. North America Confectionery Market Opportunity and Forecast, 2023-2032

- 4.3. North America Confectionery Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 4.3.1. North America Confectionery Market Analysis by By Product Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 4.3.3. Chocolate

- 4.3.3.1. Dark

- 4.3.3.2. Milk

- 4.3.3.3. White

- 4.3.4. Fine Bakery Wares

- 4.3.5. Sugar

- 4.3.5.1. Caramel and Toffee

- 4.3.5.2. Jelly and Gum

- 4.3.5.3. Mint

- 4.3.5.4. Hard-Boiled Sweets

- 4.4. North America Confectionery Market Analysis, Opportunity and Forecast, By Distribution Channels, 2016-2032

- 4.4.1. North America Confectionery Market Analysis by Distribution Channels: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channels, 2016-2032

- 4.4.3. Supermarkets and hypermarkets

- 4.4.4. Convenience stores

- 4.4.5. Online store

- 4.5. North America Confectionery Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Confectionery Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Confectionery Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Confectionery Market Analysis, 2016-2021

- 5.2. Western Europe Confectionery Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Confectionery Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 5.3.1. Western Europe Confectionery Market Analysis by By Product Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 5.3.3. Chocolate

- 5.3.3.1. Dark

- 5.3.3.2. Milk

- 5.3.3.3. White

- 5.3.4. Fine Bakery Wares

- 5.3.5. Sugar

- 5.3.5.1. Caramel and Toffee

- 5.3.5.2. Jelly and Gum

- 5.3.5.3. Mint

- 5.3.5.4. Hard-Boiled Sweets

- 5.4. Western Europe Confectionery Market Analysis, Opportunity and Forecast, By Distribution Channels, 2016-2032

- 5.4.1. Western Europe Confectionery Market Analysis by Distribution Channels: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channels, 2016-2032

- 5.4.3. Supermarkets and hypermarkets

- 5.4.4. Convenience stores

- 5.4.5. Online store

- 5.5. Western Europe Confectionery Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Confectionery Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Confectionery Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Confectionery Market Analysis, 2016-2021

- 6.2. Eastern Europe Confectionery Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Confectionery Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 6.3.1. Eastern Europe Confectionery Market Analysis by By Product Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 6.3.3. Chocolate

- 6.3.3.1. Dark

- 6.3.3.2. Milk

- 6.3.3.3. White

- 6.3.4. Fine Bakery Wares

- 6.3.5. Sugar

- 6.3.5.1. Caramel and Toffee

- 6.3.5.2. Jelly and Gum

- 6.3.5.3. Mint

- 6.3.5.4. Hard-Boiled Sweets

- 6.4. Eastern Europe Confectionery Market Analysis, Opportunity and Forecast, By Distribution Channels, 2016-2032

- 6.4.1. Eastern Europe Confectionery Market Analysis by Distribution Channels: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channels, 2016-2032

- 6.4.3. Supermarkets and hypermarkets

- 6.4.4. Convenience stores

- 6.4.5. Online store

- 6.5. Eastern Europe Confectionery Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Confectionery Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Confectionery Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Confectionery Market Analysis, 2016-2021

- 7.2. APAC Confectionery Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Confectionery Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 7.3.1. APAC Confectionery Market Analysis by By Product Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 7.3.3. Chocolate

- 7.3.3.1. Dark

- 7.3.3.2. Milk

- 7.3.3.3. White

- 7.3.4. Fine Bakery Wares

- 7.3.5. Sugar

- 7.3.5.1. Caramel and Toffee

- 7.3.5.2. Jelly and Gum

- 7.3.5.3. Mint

- 7.3.5.4. Hard-Boiled Sweets

- 7.4. APAC Confectionery Market Analysis, Opportunity and Forecast, By Distribution Channels, 2016-2032

- 7.4.1. APAC Confectionery Market Analysis by Distribution Channels: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channels, 2016-2032

- 7.4.3. Supermarkets and hypermarkets

- 7.4.4. Convenience stores

- 7.4.5. Online store

- 7.5. APAC Confectionery Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Confectionery Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Confectionery Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Confectionery Market Analysis, 2016-2021

- 8.2. Latin America Confectionery Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Confectionery Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 8.3.1. Latin America Confectionery Market Analysis by By Product Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 8.3.3. Chocolate

- 8.3.3.1. Dark

- 8.3.3.2. Milk

- 8.3.3.3. White

- 8.3.4. Fine Bakery Wares

- 8.3.5. Sugar

- 8.3.5.1. Caramel and Toffee

- 8.3.5.2. Jelly and Gum

- 8.3.5.3. Mint

- 8.3.5.4. Hard-Boiled Sweets

- 8.4. Latin America Confectionery Market Analysis, Opportunity and Forecast, By Distribution Channels, 2016-2032

- 8.4.1. Latin America Confectionery Market Analysis by Distribution Channels: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channels, 2016-2032

- 8.4.3. Supermarkets and hypermarkets

- 8.4.4. Convenience stores

- 8.4.5. Online store

- 8.5. Latin America Confectionery Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Confectionery Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Confectionery Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Confectionery Market Analysis, 2016-2021

- 9.2. Middle East & Africa Confectionery Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Confectionery Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 9.3.1. Middle East & Africa Confectionery Market Analysis by By Product Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 9.3.3. Chocolate

- 9.3.3.1. Dark

- 9.3.3.2. Milk

- 9.3.3.3. White

- 9.3.4. Fine Bakery Wares

- 9.3.5. Sugar

- 9.3.5.1. Caramel and Toffee

- 9.3.5.2. Jelly and Gum

- 9.3.5.3. Mint

- 9.3.5.4. Hard-Boiled Sweets

- 9.4. Middle East & Africa Confectionery Market Analysis, Opportunity and Forecast, By Distribution Channels, 2016-2032

- 9.4.1. Middle East & Africa Confectionery Market Analysis by Distribution Channels: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channels, 2016-2032

- 9.4.3. Supermarkets and hypermarkets

- 9.4.4. Convenience stores

- 9.4.5. Online store

- 9.5. Middle East & Africa Confectionery Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Confectionery Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Confectionery Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Confectionery Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Confectionery Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Delfi Limited

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Ezaki Glico Co., Ltd.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Ferrero S.p.A.

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Chocoladefabriken Lindt & Sprüngli AG

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Lotte Confectionery Co. Ltd.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Mars, Incorporated

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Mondelēz International, Inc.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Nestlé S.A.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. The Hershey Company

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Wrigley Jr. Company

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

List of Figures

- Figure 1: Global Confectionery Market Revenue (US$ Mn) Market Share by By Product Type in 2022

- Figure 2: Global Confectionery Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 3: Global Confectionery Market Revenue (US$ Mn) Market Share by Distribution Channelsin 2022

- Figure 4: Global Confectionery Market Attractiveness Analysis by Distribution Channels, 2016-2032

- Figure 5: Global Confectionery Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Confectionery Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Confectionery Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Confectionery Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Confectionery Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 10: Global Confectionery Market Revenue (US$ Mn) Comparison by Distribution Channels (2016-2032)

- Figure 11: Global Confectionery Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Confectionery Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 13: Global Confectionery Market Y-o-Y Growth Rate Comparison by Distribution Channels (2016-2032)

- Figure 14: Global Confectionery Market Share Comparison by Region (2016-2032)

- Figure 15: Global Confectionery Market Share Comparison by By Product Type (2016-2032)

- Figure 16: Global Confectionery Market Share Comparison by Distribution Channels (2016-2032)

- Figure 17: North America Confectionery Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 18: North America Confectionery Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 19: North America Confectionery Market Revenue (US$ Mn) Market Share by Distribution Channelsin 2022

- Figure 20: North America Confectionery Market Attractiveness Analysis by Distribution Channels, 2016-2032

- Figure 21: North America Confectionery Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Confectionery Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Confectionery Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Confectionery Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 26: North America Confectionery Market Revenue (US$ Mn) Comparison by Distribution Channels (2016-2032)

- Figure 27: North America Confectionery Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Confectionery Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 29: North America Confectionery Market Y-o-Y Growth Rate Comparison by Distribution Channels (2016-2032)

- Figure 30: North America Confectionery Market Share Comparison by Country (2016-2032)

- Figure 31: North America Confectionery Market Share Comparison by By Product Type (2016-2032)

- Figure 32: North America Confectionery Market Share Comparison by Distribution Channels (2016-2032)

- Figure 33: Western Europe Confectionery Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 34: Western Europe Confectionery Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 35: Western Europe Confectionery Market Revenue (US$ Mn) Market Share by Distribution Channelsin 2022

- Figure 36: Western Europe Confectionery Market Attractiveness Analysis by Distribution Channels, 2016-2032

- Figure 37: Western Europe Confectionery Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Confectionery Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Confectionery Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Confectionery Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 42: Western Europe Confectionery Market Revenue (US$ Mn) Comparison by Distribution Channels (2016-2032)

- Figure 43: Western Europe Confectionery Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Confectionery Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 45: Western Europe Confectionery Market Y-o-Y Growth Rate Comparison by Distribution Channels (2016-2032)

- Figure 46: Western Europe Confectionery Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Confectionery Market Share Comparison by By Product Type (2016-2032)

- Figure 48: Western Europe Confectionery Market Share Comparison by Distribution Channels (2016-2032)

- Figure 49: Eastern Europe Confectionery Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 50: Eastern Europe Confectionery Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 51: Eastern Europe Confectionery Market Revenue (US$ Mn) Market Share by Distribution Channelsin 2022

- Figure 52: Eastern Europe Confectionery Market Attractiveness Analysis by Distribution Channels, 2016-2032

- Figure 53: Eastern Europe Confectionery Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Confectionery Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Confectionery Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Confectionery Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 58: Eastern Europe Confectionery Market Revenue (US$ Mn) Comparison by Distribution Channels (2016-2032)

- Figure 59: Eastern Europe Confectionery Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Confectionery Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 61: Eastern Europe Confectionery Market Y-o-Y Growth Rate Comparison by Distribution Channels (2016-2032)

- Figure 62: Eastern Europe Confectionery Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Confectionery Market Share Comparison by By Product Type (2016-2032)

- Figure 64: Eastern Europe Confectionery Market Share Comparison by Distribution Channels (2016-2032)

- Figure 65: APAC Confectionery Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 66: APAC Confectionery Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 67: APAC Confectionery Market Revenue (US$ Mn) Market Share by Distribution Channelsin 2022

- Figure 68: APAC Confectionery Market Attractiveness Analysis by Distribution Channels, 2016-2032

- Figure 69: APAC Confectionery Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Confectionery Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Confectionery Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Confectionery Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 74: APAC Confectionery Market Revenue (US$ Mn) Comparison by Distribution Channels (2016-2032)

- Figure 75: APAC Confectionery Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Confectionery Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 77: APAC Confectionery Market Y-o-Y Growth Rate Comparison by Distribution Channels (2016-2032)

- Figure 78: APAC Confectionery Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Confectionery Market Share Comparison by By Product Type (2016-2032)

- Figure 80: APAC Confectionery Market Share Comparison by Distribution Channels (2016-2032)

- Figure 81: Latin America Confectionery Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 82: Latin America Confectionery Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 83: Latin America Confectionery Market Revenue (US$ Mn) Market Share by Distribution Channelsin 2022

- Figure 84: Latin America Confectionery Market Attractiveness Analysis by Distribution Channels, 2016-2032

- Figure 85: Latin America Confectionery Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Confectionery Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Confectionery Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Confectionery Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 90: Latin America Confectionery Market Revenue (US$ Mn) Comparison by Distribution Channels (2016-2032)

- Figure 91: Latin America Confectionery Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Confectionery Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 93: Latin America Confectionery Market Y-o-Y Growth Rate Comparison by Distribution Channels (2016-2032)

- Figure 94: Latin America Confectionery Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Confectionery Market Share Comparison by By Product Type (2016-2032)

- Figure 96: Latin America Confectionery Market Share Comparison by Distribution Channels (2016-2032)

- Figure 97: Middle East & Africa Confectionery Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 98: Middle East & Africa Confectionery Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 99: Middle East & Africa Confectionery Market Revenue (US$ Mn) Market Share by Distribution Channelsin 2022

- Figure 100: Middle East & Africa Confectionery Market Attractiveness Analysis by Distribution Channels, 2016-2032

- Figure 101: Middle East & Africa Confectionery Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Confectionery Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Confectionery Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Confectionery Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 106: Middle East & Africa Confectionery Market Revenue (US$ Mn) Comparison by Distribution Channels (2016-2032)

- Figure 107: Middle East & Africa Confectionery Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Confectionery Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 109: Middle East & Africa Confectionery Market Y-o-Y Growth Rate Comparison by Distribution Channels (2016-2032)

- Figure 110: Middle East & Africa Confectionery Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Confectionery Market Share Comparison by By Product Type (2016-2032)

- Figure 112: Middle East & Africa Confectionery Market Share Comparison by Distribution Channels (2016-2032)

List of Tables

- Table 1: Global Confectionery Market Comparison by By Product Type (2016-2032)

- Table 2: Global Confectionery Market Comparison by Distribution Channels (2016-2032)

- Table 3: Global Confectionery Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Confectionery Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Confectionery Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Confectionery Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 7: Global Confectionery Market Revenue (US$ Mn) Comparison by Distribution Channels (2016-2032)

- Table 8: Global Confectionery Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Confectionery Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 10: Global Confectionery Market Y-o-Y Growth Rate Comparison by Distribution Channels (2016-2032)

- Table 11: Global Confectionery Market Share Comparison by Region (2016-2032)

- Table 12: Global Confectionery Market Share Comparison by By Product Type (2016-2032)

- Table 13: Global Confectionery Market Share Comparison by Distribution Channels (2016-2032)

- Table 14: North America Confectionery Market Comparison by Distribution Channels (2016-2032)

- Table 15: North America Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Confectionery Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Confectionery Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 19: North America Confectionery Market Revenue (US$ Mn) Comparison by Distribution Channels (2016-2032)

- Table 20: North America Confectionery Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Confectionery Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 22: North America Confectionery Market Y-o-Y Growth Rate Comparison by Distribution Channels (2016-2032)

- Table 23: North America Confectionery Market Share Comparison by Country (2016-2032)

- Table 24: North America Confectionery Market Share Comparison by By Product Type (2016-2032)

- Table 25: North America Confectionery Market Share Comparison by Distribution Channels (2016-2032)

- Table 26: Western Europe Confectionery Market Comparison by By Product Type (2016-2032)

- Table 27: Western Europe Confectionery Market Comparison by Distribution Channels (2016-2032)

- Table 28: Western Europe Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Confectionery Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Confectionery Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 32: Western Europe Confectionery Market Revenue (US$ Mn) Comparison by Distribution Channels (2016-2032)

- Table 33: Western Europe Confectionery Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Confectionery Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 35: Western Europe Confectionery Market Y-o-Y Growth Rate Comparison by Distribution Channels (2016-2032)

- Table 36: Western Europe Confectionery Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Confectionery Market Share Comparison by By Product Type (2016-2032)

- Table 38: Western Europe Confectionery Market Share Comparison by Distribution Channels (2016-2032)

- Table 39: Eastern Europe Confectionery Market Comparison by By Product Type (2016-2032)

- Table 40: Eastern Europe Confectionery Market Comparison by Distribution Channels (2016-2032)

- Table 41: Eastern Europe Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Confectionery Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Confectionery Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 45: Eastern Europe Confectionery Market Revenue (US$ Mn) Comparison by Distribution Channels (2016-2032)

- Table 46: Eastern Europe Confectionery Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Confectionery Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 48: Eastern Europe Confectionery Market Y-o-Y Growth Rate Comparison by Distribution Channels (2016-2032)

- Table 49: Eastern Europe Confectionery Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Confectionery Market Share Comparison by By Product Type (2016-2032)

- Table 51: Eastern Europe Confectionery Market Share Comparison by Distribution Channels (2016-2032)

- Table 52: APAC Confectionery Market Comparison by By Product Type (2016-2032)

- Table 53: APAC Confectionery Market Comparison by Distribution Channels (2016-2032)

- Table 54: APAC Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Confectionery Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Confectionery Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 58: APAC Confectionery Market Revenue (US$ Mn) Comparison by Distribution Channels (2016-2032)

- Table 59: APAC Confectionery Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Confectionery Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 61: APAC Confectionery Market Y-o-Y Growth Rate Comparison by Distribution Channels (2016-2032)

- Table 62: APAC Confectionery Market Share Comparison by Country (2016-2032)

- Table 63: APAC Confectionery Market Share Comparison by By Product Type (2016-2032)

- Table 64: APAC Confectionery Market Share Comparison by Distribution Channels (2016-2032)

- Table 65: Latin America Confectionery Market Comparison by By Product Type (2016-2032)

- Table 66: Latin America Confectionery Market Comparison by Distribution Channels (2016-2032)

- Table 67: Latin America Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Confectionery Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Confectionery Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 71: Latin America Confectionery Market Revenue (US$ Mn) Comparison by Distribution Channels (2016-2032)

- Table 72: Latin America Confectionery Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Confectionery Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 74: Latin America Confectionery Market Y-o-Y Growth Rate Comparison by Distribution Channels (2016-2032)

- Table 75: Latin America Confectionery Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Confectionery Market Share Comparison by By Product Type (2016-2032)

- Table 77: Latin America Confectionery Market Share Comparison by Distribution Channels (2016-2032)

- Table 78: Middle East & Africa Confectionery Market Comparison by By Product Type (2016-2032)

- Table 79: Middle East & Africa Confectionery Market Comparison by Distribution Channels (2016-2032)

- Table 80: Middle East & Africa Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Confectionery Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Confectionery Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Confectionery Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 84: Middle East & Africa Confectionery Market Revenue (US$ Mn) Comparison by Distribution Channels (2016-2032)

- Table 85: Middle East & Africa Confectionery Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Confectionery Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 87: Middle East & Africa Confectionery Market Y-o-Y Growth Rate Comparison by Distribution Channels (2016-2032)

- Table 88: Middle East & Africa Confectionery Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Confectionery Market Share Comparison by By Product Type (2016-2032)

- Table 90: Middle East & Africa Confectionery Market Share Comparison by Distribution Channels (2016-2032)

- 1. Executive Summary

-

- Delfi Limited

- Ezaki Glico Co., Ltd.

- Ferrero S.p.A.

- Chocoladefabriken Lindt & Sprüngli AG

- Lotte Confectionery Co. Ltd.

- Mars, Incorporated

- Mondelēz International, Inc.

- Nestlé S.A.

- The Hershey Company

- Wrigley Jr. Company