Global Commercial Cleaning Market By Product (Surface Cleaners, Metal Surface Cleaners, Fabric Cleaners, Glass Cleaners, and Other Products), By Service (Floor & Carpet Cleaning, Upholstery Cleaning, Window Cleaning, Construction Cleaning, and Other Services), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

-

36282

-

April 2023

-

218

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

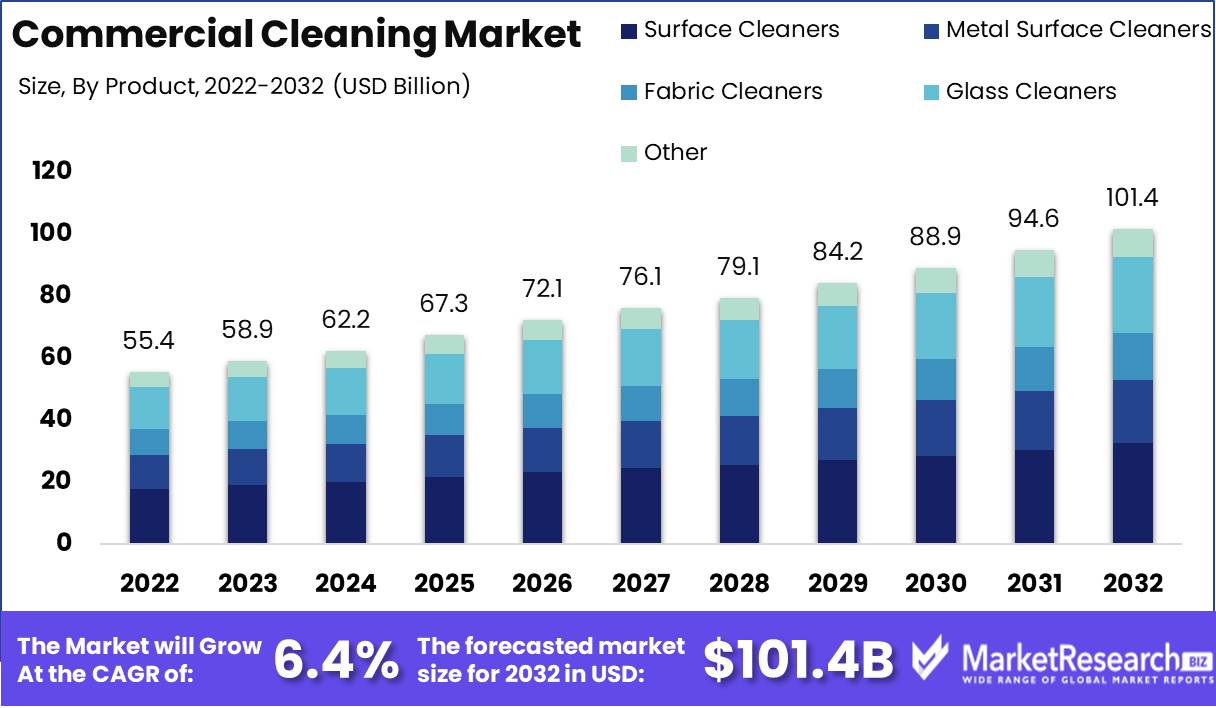

Commercial Cleaning Market size is expected to be worth around USD 101.4 Bn by 2032 from USD 55.4 Bn in 2022, growing at a CAGR of 6.4% during the forecast period from 2023 to 2032.

Commercial cleaning is described as cleaning undertaken by professional cleaners who are hired by an organization or companies such as offices, hotels, and leisure centers. They hire commercial cleaners to maintain hygiene and keep their area sanitized. The commercial cleaners are trained professionally in order to ensure the hygiene of the building. The commercial cleaning market expansion is likely to be influenced by the increasing focus on maintaining a clean and hygienic environment in commercial places. Moreover, it aids in relieving pressure from management and staff members of the organization or company, as well as, also maintains properties and prevents damage.

Market Scope

Product Analysis

The surface cleaners product segment dominated the global commercial cleaning market

Based on product, the market for commercial cleaning is segmented into surface cleaners, metal surface cleaners, fabric cleaners, glass cleaners, and other products. Among these products, the surface cleaners segment held the largest revenue share in 2022. This growth is highly attributed to its ease and convenient use for cleaning and disinfecting surfaces. In addition, there is an increase in demand from end-use industries such as food and beverages, commercial laundries, chemical processing industries, and industrial cleaning. Rising awareness among business owners regarding disinfection and cleaning practices for community and personal hygiene is also expected to surge the growth of this segment.

Service Analysis

The floor & carpet segment leads the global commercial cleaning market

By service, the market is further divided into floor & carpet cleaning, upholstery cleaning, window cleaning, construction cleaning, and other services. In 2022, the floor & carpet cleaning segment held the largest revenue share. Floor & carpet cleansing is a time-consuming and tedious task as the floor area is relatively large in manufacturing facilities, corporate offices, and other commercial places. Hence, the charge for this service by the service contractors is higher in comparison to other services such as window cleaning and upholstery. In addition, the cost for these services varies depending on the factors such as area, frequency, time, and complexity. Furthermore, floor cleansing is a pre-requisite for any industrial and commercial establishment and is therefore mostly outsourced to skilled contractors.

End-User Analysis

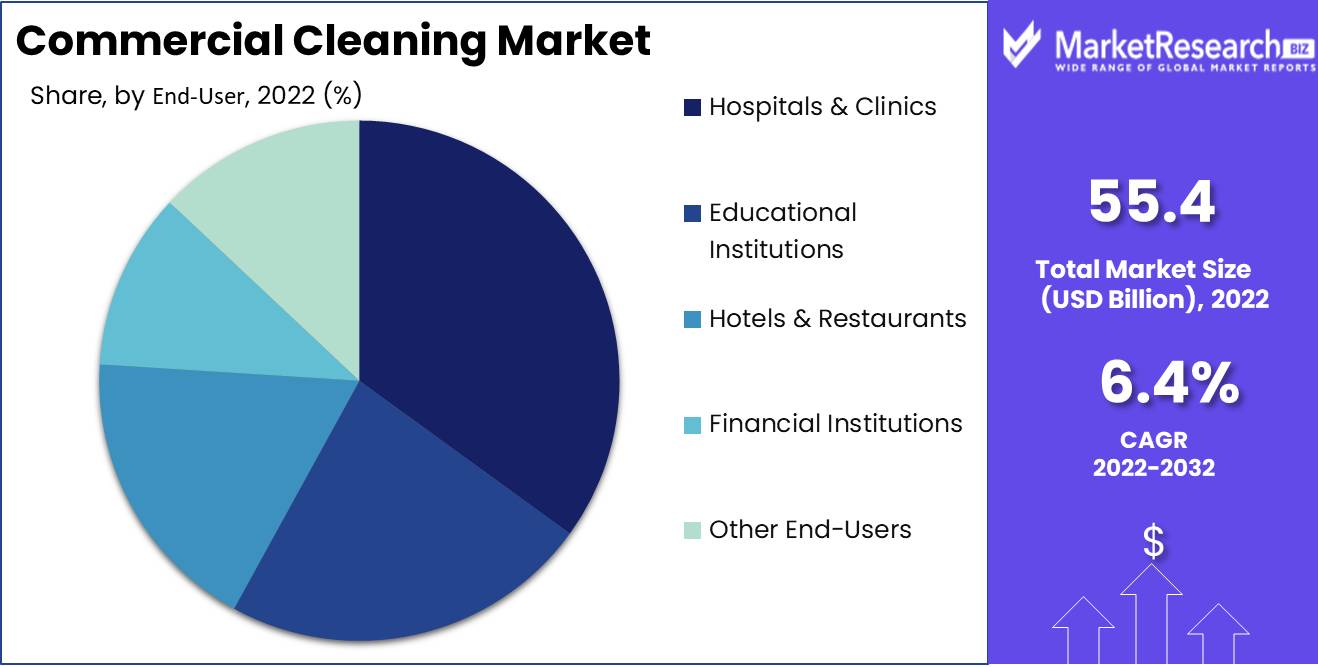

The hospitals & clinics segment is accounted to register the highest revenue during the forecast period

Based on end-user, the market is segmented into hospitals & clinics, educational institutions, hotels & restaurants, financial institutions, and other end-users. Hospitals & clinics are expected to dominate the global commercial cleaning market over the forecast period. The rising awareness regarding hospital-acquired infection seeks the need of maintaining hygiene to avoid further consequences. As a result, it is anticipated to drive the segment growth. Moreover, the hotel's segment is accounted to experience noteworthy growth during the forecast period. The higher adoption of commercial cleaning services and products by the hotels in order to improve the customer experience is likely to enhance the market growth.

Key Market Segments

Based on Product

- Surface Cleaners

- Metal Surface Cleaners

- Fabric Cleaners

- Glass Cleaners

- Other Products

Based on Service

- Floor & Carpet Cleaning

- Upholstery Cleaning

- Window Cleaning

- Construction Cleaning

- Other Services

Based on End-User

- Hospitals & Clinics

- Educational Institutions

- Hotels & Restaurants

- Financial Institutions

- Other End-Users

Market Dynamics

Drivers

Awareness regarding hygiene and cleanliness to drive the market growth

Higher prominence toward workplace hygiene and cleanliness due to better productivity and corporate performance is expected to drive market expansion. A hygienic and clean work environment aids the workers to be healthier and happier, which decreases the germs spread, and limits the absence of workers due to illnesses. Moreover, the researchers at Syracuse and Harvard Universities state that an improvement on just the air quality of the workplace can influence the overall performance of employees positively. The increase in the number of hotels, restaurants, and hospitals across regions has been considerably supporting the demand for commercial cleaning products and services in order to maintain a hygienic and clean environment. The expansion in the food service industry such as new restaurant establishments is anticipated to surge the market growth.

Restraints

High cost associated with commercial cleaning to restrict the market growth

In less developed countries price is the key factor that affects the demand for any product or service existing in the market. Owing to the use of expensive chemicals in production the cost of cleaning products is high. Also, the strict regulations imposed by the government of various nations for the use of various chemicals have left no other option for the manufacturers instead of spending more capital on certain chemicals that increase the overall cost of the product. Similarly, the regular improvement in offering quality commercial cleaning services has led to an increase in cost. As a result, the market for commercial cleaning is likely to hamper the market growth during the forecast period.

Opportunity

The adoption of sophisticated tools and technologies from the fundamental cleaning tools has led the market to evolve with technology, thereby impacting the growth of the commercial cleaning market and bringing noteworthy progress in cleaning efficiency. The implementation of tools such as steam cleaners, low-noise vacuum cleaners, as well as high-quality cleaning agents and supplies has led to efficient as well as better-quality services, thereby offering numerous growth opportunities.

Trends

Rising demand for green cleaning products

Increasing awareness regarding green cleaning products is recognized as one of the major trends in the commercial cleaning market that highly contributes to market growth. Allergens and carcinogens are chemicals present in cleaning products that are harmful to the environment and individuals. Constant exposure to these chemicals is also connected to symptoms ranging from allergies, rashes, and headaches to reduced fertility rates or cancer. According to the American Association of Poison Control Centers, cleaning products are major substances involved in reported toxic exposures. Hence, green cleaning products are gaining high popularity as they promote sustainability and protect the environment.

Regional Analysis

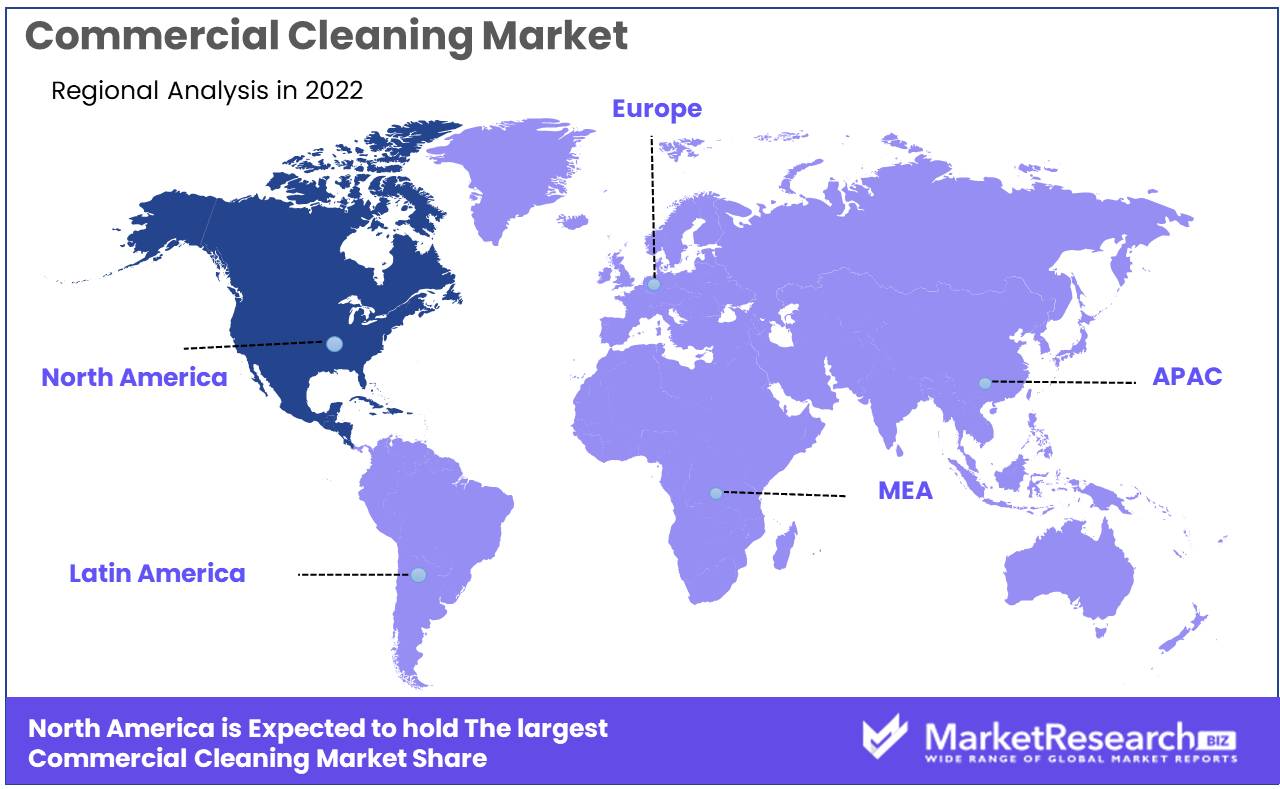

North America dominated the global commercial cleaning market in 2022

Based on region, the global commercial cleaning market is divided into North America, Europe, Latin America, and Middle East & Africa. Among these regions, North America accounted for the highest revenue share in 2022 and is also expected to maintain its dominance during the forecast period. The region is categorized by a higher number of service providers, particularly in the United States. Additionally, most commercial establishments have contractual service agreements with service providers to provide their employees with a sanitized and clean working environment. Rapid growth is observed in the commercial sector, especially in terms of the rapidly increasing number of restaurants and cafes across this region. This is likely to fuel the demand for commercial cleaning products.

The market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. This growth is mainly influenced by the various large organizations that are heavily investing in lucrative regions as well as setting up new plants and offices in developing countries like India, China, and Singapore.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis:

Major market players are concentrated on the implementation of various strategic policies in order to develop their portfolios and expand their respective businesses in foreign markets. Several commercial cleaning companies are focused on expanding their existing operations and research and development activities. Additionally, companies in the market are developing new products and improving their services to improve the customer experience. In addition, they are involved in investments, collaborations, partnerships, mergers & acquisitions, as well as competitive pricing. In addition, several key players are now focusing on different marketing strategies such as spreading awareness regarding their services and products. These strategies by key players are likely to propel the market growth.

Listed below are some of the most prominent commercial cleaning industry players.

Market Key Players

- ABM Industries Inc.

- ISS A/S

- Jani-King International, Inc.

- Anago Cleaning Systems, Inc.

- Diversey Holdings, Ltd.

- Sodexo Group

- Ecolab Inc.

- 3M

- Medline Industries, Inc.

- The Procter & Gamble Company

- Johnson & Son Inc.

- Other Key Players

Recent Developments

- In October 2022, With a deal of five years, SBFM has planned to provide a wide range of commercial cleaning services to PureGym (the largest gym operator) in the UK. The contract was signed on 1 September 2022, and SBFM and PureGym have their main offices in Leeds. PureGym's venues are generally open with 1.7 million members spread across 525 clubs, mainly in the UK and Europe, Recently, the group recently publicized its ambitions to increase the number of clubs worldwide by 2030.

- In Feb-2021, Diversey partnered with Solenis, a US-based chemical manufacturer. This partnership would increase the company’s Prosumer Solution category and provide the company’s partners with an expanded portfolio of cleaning products and trusted brands.

Report Scope

Report Features Description Market Value (2022) USD 55.4 Bn Forecast Revenue (2032) USD 101.4 Bn CAGR (2023-2032) 6.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product - Surface Cleaners, Metal Surface Cleaners, Fabric Cleaners, Glass Cleaners, and Other Products; By Service - Floor & Carpet Cleaning, Upholstery Cleaning, Window Cleaning, Construction Cleaning, and Other Services; By End-User Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ABM Industries Inc., ISS A/S, Jani-King International, Inc., Anago Cleaning Systems, Inc., Diversey Holdings, Ltd., Sodexo Group, Ecolab Inc., 3M, Medline Industries, Inc., The Procter & Gamble Company, Johnson & Son Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- ABM Industries Inc.

- ISS A/S

- Jani-King International, Inc.

- Anago Cleaning Systems, Inc.

- Diversey Holdings, Ltd.

- Sodexo Group

- Ecolab Inc.

- 3M

- Medline Industries, Inc.

- The Procter & Gamble Company

- Johnson & Son Inc.

- Other Key Players