Color Concentrate Market By Form (Solid Color Concentrate, Liquid Color Concentrate), By End-User (Packaging, Building & Construction, Consumer Goods, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

49136

-

July 2024

-

137

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

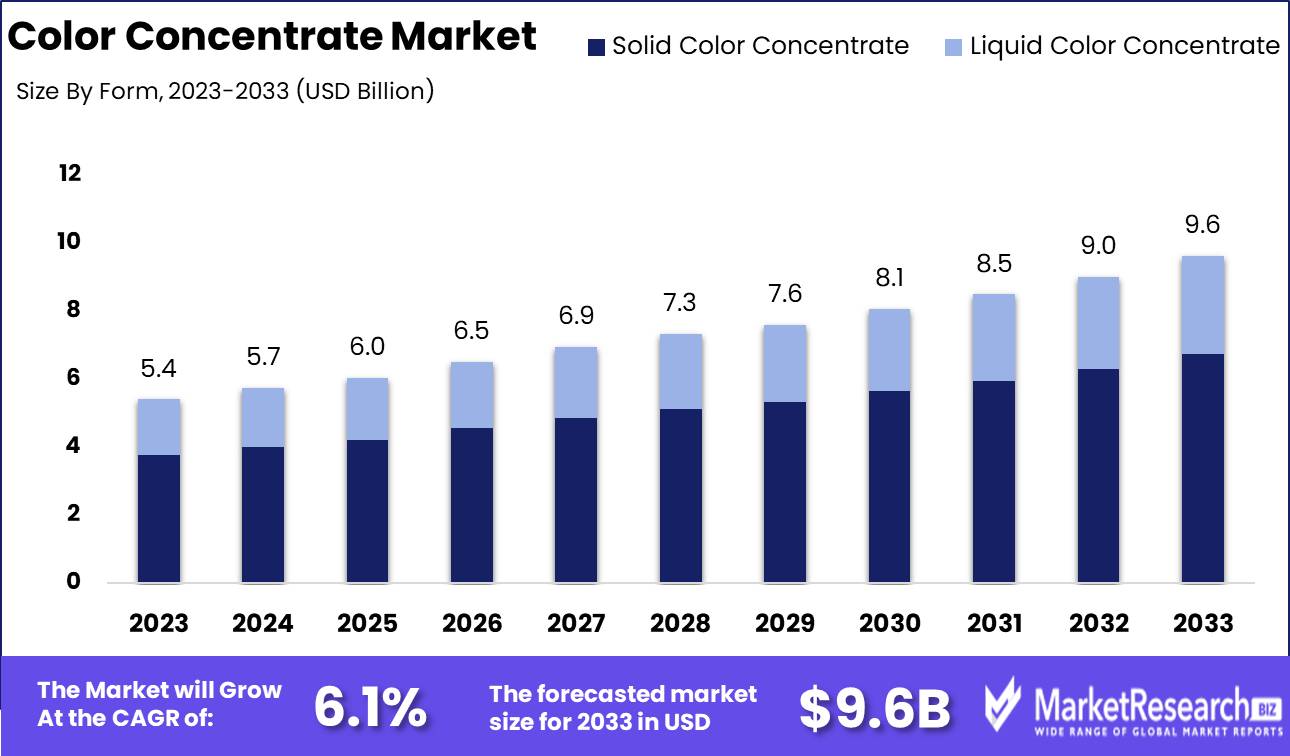

The Global Color Concentrate Market was valued at USD 5.4 Bn in 2023. It is expected to reach USD 9.4 Bn by 2033, with a CAGR of 6.1% during the forecast period from 2024 to 2033.

The Color Concentrate Market encompasses the production, distribution, and application of color concentrates—highly concentrated pigments or dyes dispersed in a carrier resin. These concentrates are used to color plastic products, offering manufacturers the flexibility to produce custom-colored plastics without the need to stock extensive inventories of pre-colored resins. This market is driven by the increasing demand for colored plastics in various industries such as packaging, automotive, consumer goods, and construction, where aesthetic appeal and brand differentiation are critical. The market also benefits from advancements in polymer technology and the growing trend towards sustainable and eco-friendly products.

The Color Concentrate Market is poised for significant growth, driven by the increasing demand for customized plastic products across various industries, including packaging, automotive, consumer goods, and construction. As manufacturers strive for greater flexibility and efficiency in production, the use of color concentrates presents a cost-effective and versatile solution. Color concentrates are typically added at low levels, around 2-5% by weight, which substantially reduces inventory and storage requirements compared to pre-colored resins. This efficiency in usage not only lowers operational costs but also aligns with the broader industry trends towards lean manufacturing and sustainable practices.

The Color Concentrate Market is poised for significant growth, driven by the increasing demand for customized plastic products across various industries, including packaging, automotive, consumer goods, and construction. As manufacturers strive for greater flexibility and efficiency in production, the use of color concentrates presents a cost-effective and versatile solution. Color concentrates are typically added at low levels, around 2-5% by weight, which substantially reduces inventory and storage requirements compared to pre-colored resins. This efficiency in usage not only lowers operational costs but also aligns with the broader industry trends towards lean manufacturing and sustainable practices.The market's growth is further propelled by the rising consumer preference for aesthetically appealing and differentiated products. Brands like Matrix Color Insider have capitalized on this trend by offering a diverse range of color concentrates, available at major retailers such as Walmart. These products are priced competitively between $16 and $24 per unit, making them accessible to a wide consumer base. Additionally, advancements in polymer technology have enhanced the quality and performance of color concentrates, making them suitable for a broader range of applications.

The automotive industry, in particular, is a significant contributor to the demand for color concentrates, as vehicle manufacturers seek to enhance the visual appeal and brand identity of their products. Similarly, the packaging industry benefits from the use of color concentrates to create attractive and distinctive packaging solutions that stand out on the shelves. As sustainability becomes a key focus across industries, the market is also seeing a shift towards eco-friendly color concentrates that minimize environmental impact while maintaining high performance.

The Color Concentrate Market is expected to experience robust growth, supported by the need for cost-effective, flexible, and sustainable coloring solutions across multiple industries. The market's ability to cater to the evolving demands of manufacturers and consumers alike positions it as a vital component of the global plastics industry.

Key Takeaways

- Market Growth: The Global Color Concentrate Market was valued at USD 5.4 Bn in 2023. It is expected to reach USD 9.4 Bn by 2033, with a CAGR of 6.1% during the forecast period from 2024 to 2033.

- By Form: Solid Color Concentrate dominates the market with a 70% share, preferred for its stability and ease of use in various manufacturing processes.

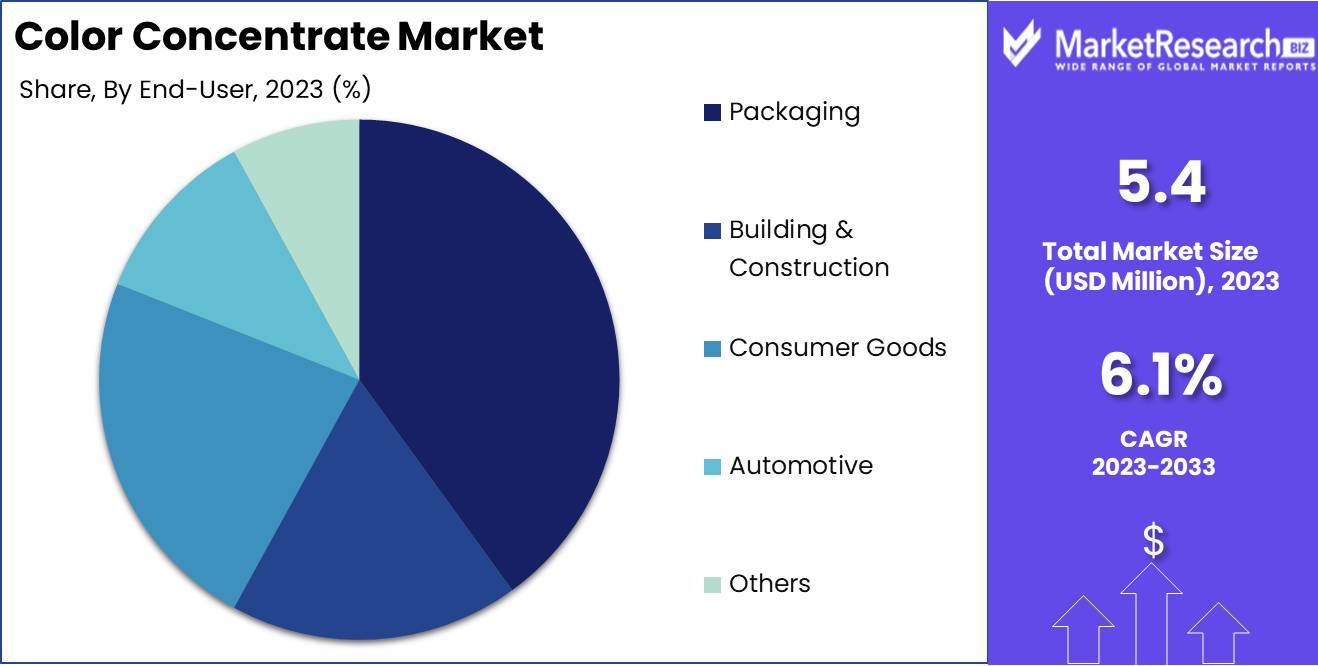

- By End-User: The Packaging sector is the primary market, utilizing 40% of color concentrates for enhancing visual appeal and brand recognition.

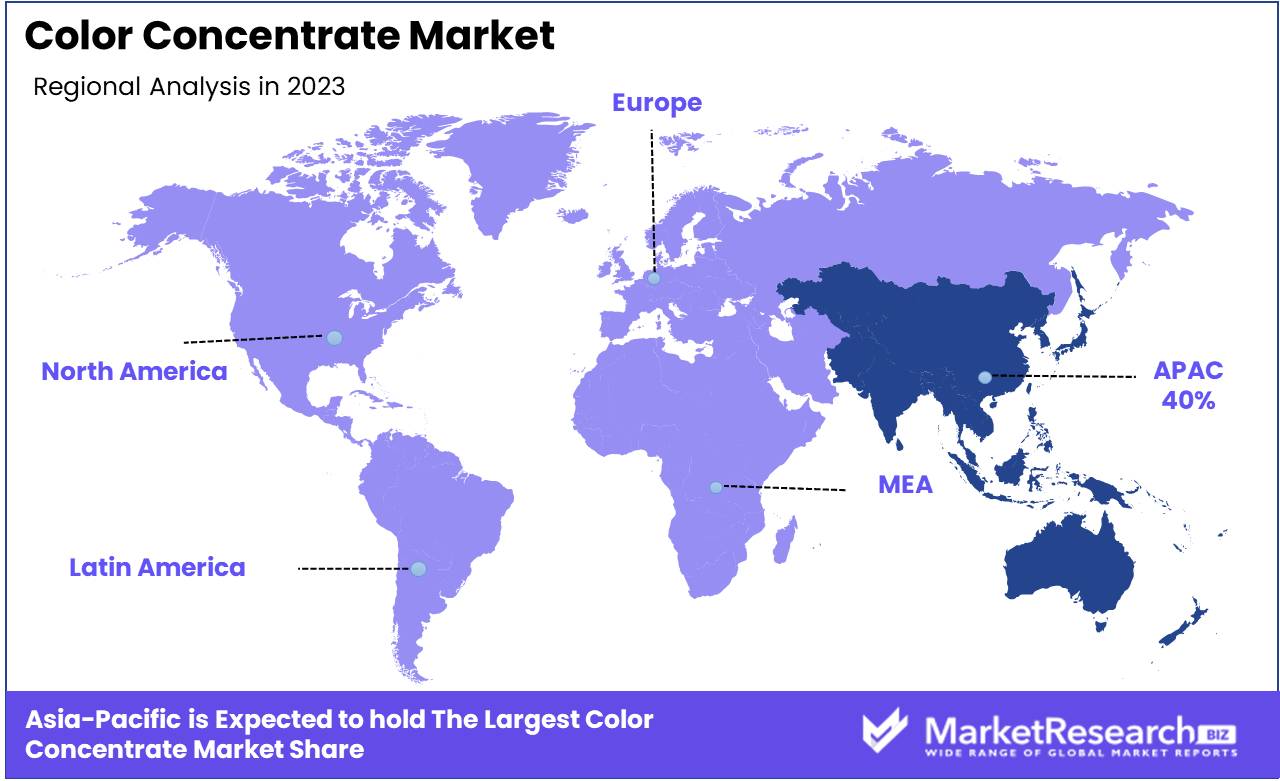

- Regional Dominance: Asia Pacific holds a 40% market share, driven by rapid industrial growth and increasing consumer goods production.

- Growth Opportunity: Expanding applications in biodegradable plastics and environmentally friendly packaging materials offer significant growth prospects.

Driving factors

Growing Demand for Plastics in Various Industries

The burgeoning demand for plastics across multiple industries, including automotive, construction, and consumer goods, is a primary driver for the color concentrate market. Plastics are preferred for their versatility, durability, and cost-effectiveness, necessitating the use of color concentrates to enhance aesthetic appeal and meet specific industry requirements. This increasing demand for high-quality and visually appealing plastic products significantly boosts the color concentrate market.

Increasing Use of Color Concentrates in Packaging

The packaging industry is a significant consumer of color concentrates, driven by the need for visually striking and brand-distinctive packaging solutions. As consumer preferences shift towards aesthetically pleasing and innovative packaging, manufacturers are increasingly incorporating color concentrates to differentiate their products on retail shelves. The growing trend of e-commerce further amplifies the demand for attractive packaging, propelling the color concentrate market.

Advancements in Polymer Technologies

Technological advancements in polymer science have led to the development of innovative and high-performance color concentrates. These advancements allow for better dispersion, enhanced color strength, and improved stability of colorants within polymers. Consequently, industries can achieve more vibrant and consistent colors in their plastic products, driving the adoption of advanced color concentrates. This technological progress supports the expansion of the color concentrate market by providing superior product solutions.

Restraining Factors

Volatility in Raw Material Prices

The volatility in raw material prices poses a significant challenge to the growth of the color concentrate market. Fluctuating costs of pigments, dyes, and resins can impact the overall production costs, leading to price instability for end-users. Manufacturers need to develop strategies to manage these cost variations, which could otherwise hinder market growth.

Environmental Regulations

Stringent environmental regulations related to the production and disposal of plastics and color concentrates also act as a restraining factor. Regulations aimed at reducing environmental impact and promoting sustainability require manufacturers to innovate and comply with eco-friendly standards. While this can increase production costs and complicate compliance, it also drives innovation towards more sustainable solutions in the color concentrate market.

By Form Analysis

Solid Color Concentrate dominated the By Form segment of the Color Concentrate Market in 2023, capturing more than a 70% share.

In 2023, Solid Color Concentrate held a dominant market position in the By Form segment of the Color Concentrate Market, capturing more than a 70% share. This significant market share is primarily due to the extensive use of solid color concentrates in various industries such as plastics, packaging, and automotive. Solid color concentrates are preferred for their ease of handling, storage stability, and consistent color dispersion. These factors contribute to their widespread adoption in manufacturing processes, where uniformity and color precision are crucial. Additionally, the cost-effectiveness of solid color concentrates compared to liquid forms further supports their dominance in the market.

Liquid Color Concentrate also plays an important role in the color concentrate market, particularly in applications requiring quick color changes and lower production volumes. Liquid concentrates offer advantages such as faster color adjustments and reduced dust generation during processing. However, their market share remains smaller compared to solid color concentrates due to challenges related to storage, handling, and potential issues with color consistency over time.

By End-User Analysis

Packaging dominated the By End-User segment of the Color Concentrate Market in 2023, capturing more than a 40% share.

In 2023, Packaging held a dominant market position in the By End-User segment of the Color Concentrate Market, capturing more than a 40% share. This leadership is driven by the extensive use of color concentrates in the packaging industry to enhance product aesthetics, brand differentiation, and consumer appeal. The growing demand for attractive and customized packaging solutions, particularly in the food and beverage, personal care, and consumer goods sectors, significantly contributes to this dominance.

Building & Construction is another significant end-user segment, utilizing color concentrates for applications in pipes, fittings, sidings, and roofing materials. The need for durable and aesthetically pleasing construction materials drives the demand in this sector.

Consumer Goods, including household items, toys, and electronics, also represent a substantial segment for color concentrates. The emphasis on product differentiation and the appeal of vibrant, consistent colors to attract consumers contribute to the steady demand in this market.

Automotive applications for color concentrates include interior and exterior components such as dashboards, trims, and bumpers. The automotive industry's focus on enhancing vehicle aesthetics and personalizing customer options supports the use of color concentrates.

Others include various industries such as textiles, agriculture, and medical devices, where color concentrates are used for functional and aesthetic purposes. These applications, while important, contribute a smaller overall share to the market compared to the dominant packaging segment due to their niche and specialized nature.

Key Market Segments

By Form

- Solid Color Concentrate

- Liquid Color Concentrate

By End-User

- Packaging

- Building & Construction

- Consumer Goods

- Automotive

- Others

Growth Opportunity

Development of Bio-Based Color Concentrates

The development of bio-based color concentrates presents a significant growth opportunity for the color concentrate market in 2024. As industries and consumers increasingly prioritize sustainability, there is a rising demand for eco-friendly and biodegradable color solutions. Bio-based color concentrates, derived from renewable resources, offer a sustainable alternative to conventional petroleum-based products. This shift towards green solutions can enhance brand reputation and meet regulatory requirements, driving market expansion.

Customization and Product Differentiation

Customization and product differentiation offer substantial opportunities for growth in the color concentrate market. Manufacturers are increasingly seeking tailored color solutions to meet specific brand aesthetics and functional requirements. The ability to provide customized color concentrates allows companies to differentiate their products and enhance consumer appeal. This trend towards personalization and unique product offerings is expected to drive demand in the color concentrate market, as businesses strive to stand out in competitive markets.

Latest Trends

Adoption of Sustainable and Eco-Friendly Concentrates

The adoption of sustainable and eco-friendly color concentrates is a key trend shaping the market in 2024. As environmental concerns and regulatory pressures mount, manufacturers are shifting towards greener alternatives that reduce ecological impact. Sustainable color concentrates, including those made from recycled materials or biodegradable components, are gaining traction. This trend aligns with global sustainability goals and consumer preferences for eco-friendly products, driving innovation and growth in the color concentrate market.

Enhanced Color Performance and Stability

Another significant trend in 2024 is the focus on enhanced color performance and stability. Advances in color concentrate formulations are leading to products that offer superior color consistency, durability, and resistance to environmental factors such as UV light and chemicals. These enhancements are crucial for applications in industries like automotive, packaging, and consumer goods, where high-performance color solutions are essential. The demand for concentrates that maintain vibrant colors over time is expected to propel market growth as industries seek to meet stringent quality standards and consumer expectations.

Regional Analysis

Asia Pacific led the Color Concentrate Market, securing a substantial 40% share.

In 2023, Asia Pacific dominated the Color Concentrate Market, capturing a significant 40% share. This dominance is driven by the region's robust manufacturing sector, particularly in countries like China, India, and Japan. The increasing demand for plastic products across various industries, such as packaging, automotive, and consumer goods, fuels the growth of color concentrates. The rapid industrialization and urbanization in Asia Pacific further boost market demand, alongside favorable government policies encouraging foreign investments in the manufacturing sector.

North America holds a substantial share in the color concentrate market due to its well-established plastics industry and high consumption of colored plastics in sectors like automotive, construction, and packaging. The presence of major market players and ongoing innovations in color concentrate formulations support the market growth in this region.

Europe is a significant market for color concentrates, driven by stringent regulations regarding the use of plastic additives and a strong focus on sustainable and eco-friendly products.

Middle East & Africa show promising potential for growth in the color concentrate market, supported by the expanding packaging and construction industries. The increasing urbanization and infrastructure development in the region drive the demand for colored plastics, despite the relatively smaller market share compared to other regions.

Latin America is emerging as a growing market for color concentrates, with Brazil and Mexico leading the demand. The region benefits from the growth of the automotive and consumer goods sectors, which drives the need for high-quality color concentrates.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global color concentrate market is poised for significant growth in 2024, driven by advancements in plastic manufacturing and increasing demand across diverse end-use industries. Key players such as Clariant, A. Schulman, Inc., and Cabot Corporation are at the forefront of this market, leveraging their robust R&D capabilities and extensive product portfolios.

Clariant continues to lead with its innovative solutions and sustainable product offerings, focusing on eco-friendly color concentrates. Their commitment to sustainability and circular economy practices sets them apart, making them a preferred choice among environmentally conscious manufacturers.

A. Schulman, Inc. and PolyOne Corporation (now Avient Corporation post-merger) have enhanced their market presence through strategic acquisitions and expansions. Their comprehensive range of color and additive concentrates, coupled with customized solutions, cater to various industry needs, ensuring a competitive edge.

Cabot Corporation and BASF SE are leveraging their strong technological foundations to develop high-performance color concentrates that meet stringent regulatory requirements. Their focus on advanced materials and specialty chemicals ensures they remain pivotal in addressing industry challenges.

Ampacet Corporation and Colorant Chromatics continue to innovate in the niche markets of medical and electronics, offering specialized concentrates that cater to high-performance requirements. Meanwhile, regional players like Far East Plastic Colours and Guangzhou Bosi are expanding their footprint in the Asia-Pacific region, capitalizing on the burgeoning demand in emerging economies.

Hudson Color Concentrates, Suzhou Pulaike, and Colortech Inc. are strengthening their market positions through innovative product development and strategic partnerships, enhancing their ability to serve diverse customer needs.

Market Key Players

- Clariant

- A. Schulman, Inc

- Cabot Corporation

- BASF SE

- PolyOne Corporation

- Ampacet Corporation

- A. Schulman

- Colorant Chromatics

- Far East Plastic Colours

- Guangzhou Bosi

- Hudson Color Concentrates

- Suzhou Pulaike

- Colortech Inc.

- DIC Corporation

Recent Development

- In June 2024., Ampacet Corporation launched advanced black color concentrates with improved UV resistance for agricultural films.

- In April 2024, Cabot Corporation expanded its color concentrate production capacity in Europe to meet rising demand for sustainable solutions.

Report Scope

Report Features Description Market Value (2023) USD 5.4 Bn Forecast Revenue (2033) USD 9.4 Bn CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Solid Color Concentrate, Liquid Color Concentrate), By End-User (Packaging, Building & Construction, Consumer Goods, Automotive, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Clariant, A. Schulman, Inc, Cabot Corporation, BASF SE, PolyOne Corporation, Ampacet Corporation, A. Schulman, Colorant Chromatics, Far East Plastic Colours, Guangzhou Bosi, Hudson Color Concentrates, Suzhou Pulaike, Colortech Inc., DIC Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Clariant

- A. Schulman, Inc

- Cabot Corporation

- BASF SE

- PolyOne Corporation

- Ampacet Corporation

- A. Schulman

- Colorant Chromatics

- Far East Plastic Colours

- Guangzhou Bosi

- Hudson Color Concentrates

- Suzhou Pulaike

- Colortech Inc.

- DIC Corporation